Calcium Propionate Market by Application (Food (Bakery Products, Dairy & Frozen Desserts, Meat, Fish & Seafood Products), Feed), Form (Dry and Liquid), and Region (North America, Europe, Asia Pacific and RoW) - Global Forecast to 2023

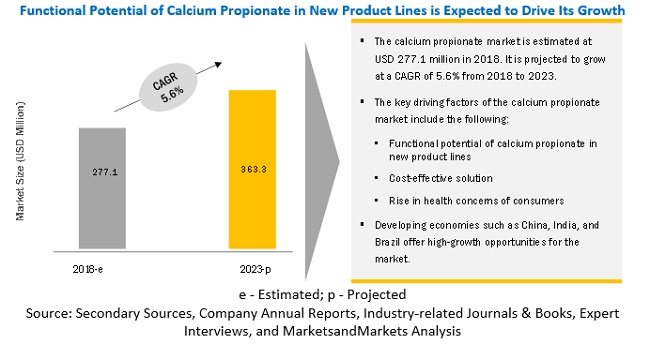

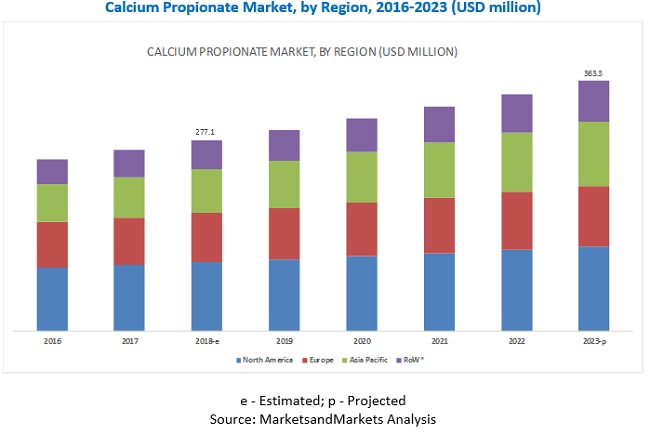

[110 Pages Report] The calcium propionate market size was estimated at USD 277.1 million in 2018 and is projected to reach USD 363.3 million by 2023, at a CAGR of 5.6%. The growth of the calcium propionate market is driven by factors such as an increase in demand for clean-label food products with extended shelf life and the cost-effectiveness of calcium propionate as compared to other preservatives. Stringent legislation and regulations with respect to food safety and shelf life have made it difficult for food and feed processing industries to getting the right formulation of ingredients along with preservatives without affecting the product quality, which acts as a major restraint for the calcium propionate market.

To know about the assumptions considered for the study, Request for Free Sample Report

See how this study impacted revenues for other players in Calcium Propionate Market

Client’s Problem Statement

Our client, an American food additive manufacturer, wanted to understand the different uses of calcium propionate in the food industry and related demand among target customers in the region.

MnM Approach

In its study, MNM provided a comprehensive understanding of the market potential of calcium propionate in terms of sub-applications such as bakery, dairy and frozen desserts, meat, and fish and seafood.

We also interviewed potential customers in end-use industries to ascertain their needs and demand for calcium propionate in different food products, as well as understand in what forms they prefer to add calcium propionate in different food applications.

Revenue Impact (RI)

Our findings helped the client analyze the regional market, upcoming application segments, and competitor strategies of different players. The study also allowed the client to devise its market penetration strategy and target new revenue sources, with projected revenue of USD 3–4 million in five years. The client was able to understand the key emerging applications of calcium propionate in the food industry and the potential market in the US.

“The demand for dry calcium propionate is exhibiting steady growth.”

On the basis of form, the dry segment is projected to exhibit a higher CAGR from 2018 to 2023. The dry segment led the market for calcium propionate. The growth of dry calcium propionate is attributed to factors such as ease of mixing and better dispersion throughout the food matrix; additionally, dry calcium propionate does not affect the leavening action of baking powder in bakery products.

“The food segment is set to dominate the calcium propionate market in 2018”.

On the basis of application, the food segment is estimated to dominate the calcium propionate market in 2018. Calcium propionate is highly used in bread in the food industry. The growth of the bread industry, especially in the developing economies, owing to high per capita bread consumption, fuels the demand for calcium propionate.

On the basis of form, the dry segment accounted for the largest market share due to factors such as ease of mixing and better dispersion throughout the food matrix. Additionally, dry calcium propionate does not affect the leavening action of baking powder in bakery products. Furthermore, dry form has a longer shelf life, facilitates better dispersion throughout the food matrix, and enhances flavor.

“Asia Pacific is projected to witness the highest growth rate during the forecast period.”

Asia Pacific is projected to be the fastest-growing market for calcium propionate during the forecast period. The consumption is driven by rapid urbanization, economic growth, and rise in purchasing power of the middle-class population, leading to increased bakery & convenience food purchases in the region. The region is an emerging market for calcium propionate, with investments from several multinational manufacturers, especially in countries such as China, India, Japan, Australia, and New Zealand.

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

“Increasing health concerns of consumers are driving the market for calcium propionates”

The calcium propionate market is driven by this rising demand for nutritional food and the increasing health consciousness among consumers. The preference of natural food additives over synthetic ones to eliminate health concerns also increases the demand for calcium propionate.

The food industry has begun using natural calcium propionate to make it as safe to consume as organic calcium salt of propionic acid, which is produced by fermentation with a selected strain of propionibacterium. The food industry also uses advanced technologies such as bacteriophages, MAP, and alternative preserving techniques combined with preservatives to maintain the quality and safety of food.

“Stringent regulations are a major restraint.”

Stringent legislations and regulations with respect to food safety and shelf life have meant that processing industries are keen on getting the right formulation to present the best food product to the consumer, and preservatives play a pivotal role in this aspect. Local and regional regulations are required to be checked for allowed applications and dosage levels. The stringent regulations pertaining to quality and food safety are projected to restrain the global calcium propionate market growth. For instance, in the US, the usage level of propionic acid and propionates is 0.1% to 0.4%. According to federal regulations, the addition of calcium propionate to a food product raises the pH by approximately 0.1 to 0.5 pH units depending on the amount, pH, and type of product. Also, federal regulations limit the maximum level for flour, white bread, and rolls at 0.32% based on the weight of the flour; for whole wheat products at 0.38% based on the weight of the flour; and for cheese products at 0.3%. Such stringent monitoring and regulations restrain the market growth.

“Untapped emerging markets are providing growth opportunities.”

The Middle Eastern & African countries are increasingly adopting calcium propionate due to changes in consumer lifestyles and increasing demand for fresh products. Asia Pacific is the second-largest market for calcium propionate after North America in 2023, owing to the increased awareness about calcium propionate and the benefits offered. It remains one of the important markets for calcium propionate manufacturers due to its size and its regulatory environment.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD Million) and Volume (KT) |

|

Segments covered |

Application, Form, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Niacet (US), Impextraco (Belgium), ADDCON (Germany), Kemin Industries (US), Macco Organiques (Canada), Bell Chem (US), Krishna Chemicals (India), AM Food Chemicals (China), Associated British Foods plc (ABF) (UK), Fine Organics (UK), Real S.A.S. (Columbia) |

On the basis of form, the calcium propionate market has been segmented as follows:

- Dry

- Liquid

On the basis of application, the calcium propionate market has been segmented as follows:

- Food

- Feed

- Others (Pharmaceuticals and agriculture)

On the basis of region, the calcium propionate market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (South America and the Middle East & Africa)

Break-up of Primaries:

- By Company Type: Tier 1 - 45 %, Tier 2 - 33%, and Tier 3 - 22%

- By Designation: C-level - 33%, D-level - 45%, and Others* - 22%

- By Region: North America - 11%, Europe - 11%, Asia Pacific - 45%, and RoW - 33%

*Others include sales managers, marketing managers, and product managers.

Recent Developments:

- In January 2018, Kemin Industries acquired its distributor Agri-Marketing Corp. (Canada) distributor for Kemin products in Canada. With this acquisition Kemin has expanded and established new location in Quebec, Canada. The development helped the company to further enhance their product portfolio and increase their production capacities.

- In October 2017, ADDCON expanded its facility at the site in Parsevalstraße, Germany to meet the increased demand and the associated requirements. As a part of the expansion, ADDCON upgraded the site in the Bitterfeld-Wolfen Chemical Park and relocated all operational functions into the new administration building at Parsevalstraße.

- In September 2017, ADDCON entered into a partnership with Blendtek Ingredients Inc. (Canada), a food ingredients and solutions company, for the distribution of ADDCON’s ammonium bicarbonate and calcium propionate. The primary focus of Blendtek was increasing the supply of ammonium bicarbonate to the North American market and calcium propionate in the Canadian market.

Key Questions addressed by the report

- What are the growth opportunities in the calcium propionate market?

- What are the major applications for calcium propionate?

- What are the key factors affecting market dynamics?

- What are some of the major challenges and restraints that the industry faces?

- Which are the key players operating in the market and what initiatives have they undertaken over the past few years?

Frequently Asked Questions (FAQ):

What is the leading application in the calcium propionate market?

The food segment was the highest revenue contributor to the market, with USD 143.6 million in 2017, and is estimated to reach USD 200.1 million by 2023, with a CAGR of 5.7%. The feed segment is estimated to reach USD 132.9 million by 2023, at a significant CAGR of 6.0% during the forecast period.

What is the estimated industry size of calcium propionate?

The global calcium propionate market was valued at USD 262.4 million in 2017, and is projected to reach USD 363.3 million by 2023, registering a CAGR of 5.6% from 2018 to 2023.

What is the leading form of calcium propionate market?

The dry segment was the highest revenue contributor to the market, with USD 241.9 million in 2017, and is estimated to reach USD 338.9 million by 2023, with a CAGR of 5.8%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Market Definition

1.2 Study Scope

1.3 Periodization Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the Calcium Propionate Market

4.2 Calcium Propionate Market, By Application

4.3 Calcium Propionate Market, By Application (KT)

4.4 North America: Market for Calcium Propionate, By Application & Country

4.5 Food: Market for Calcium Propionate, By Type & Region

4.6 Calcium Propionate Market, By Form & Region

4.7 Calcium Propionate Market, By Region

5 Market Overview (Page No. - 32)

5.1 Introduction

5.1.1 Key Features of Calcium Propionate

5.1.1.1 Acts as an Antimicrobial Agent

5.1.1.2 Acts as A Feed Supplement

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Functional Potential of Calcium Propionate in New Product Lines

5.2.1.2 Cost-Effective Preservation Solution

5.2.1.3 Increasing Health Concerns of Consumers in the Food Industry

5.2.2 Restraints

5.2.2.1 Increasing Demand for Food Products Devoid of Synthetic Preservatives

5.2.2.2 Stringent Regulations

5.2.3 Opportunities

5.2.3.1 Untapped Emerging Markets

5.2.3.2 Technological Advancements to Develop New Product Lines

5.2.3.3 R&D & Innovations to Strengthen Demand

5.2.4 Challenges

5.2.4.1 Competition From Substitutes

5.3 Supply Chain

5.4 Value Chain

5.5 Regulatory Framework

5.5.1 Food

5.5.1.1 The Delaney Clause

5.5.1.2 Food Preservatives Regulation By the Food and Agricultural Organization in the Us

5.5.1.3 Food Preservatives Regulation By the European Commission’s Scientific Committee

5.5.1.4 European Food Safety Authority (EFSA): Safety Evaluation of Additives in Europe

5.5.1.5 Codex Alimentarius Commission: Global Food Safety & Standard for World Trade

5.5.1.6 Amendment for Calcium Propionate

5.5.2 Feed

5.5.2.1 North America

5.5.2.1.1 US

5.5.2.1.2 Canada

5.5.2.2 Europe

5.5.2.3 South America

5.5.2.3.1 Brazil

5.5.2.4 Asia Pacific

5.5.2.4.1 Japan

5.5.2.4.2 China

5.5.2.5 South Africa

6 Market For Calcium Propionate, By Application (Page No. - 43)

6.1 Introduction

6.2 Food

6.2.1 Bakery Products

6.2.2 Dairy & Frozen Desserts

6.2.3 Meat, Fish, and Seafood Products

6.2.4 Others

6.3 Feed

6.4 Others

7 Calcium Propionate Market, By Form (Page No. - 50)

7.1 Introduction

7.2 Dry

7.3 Liquid

8 Calcium Propionate Market, By Region (Page No. - 55)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Italy

8.3.2 Spain

8.3.3 Netherlands

8.3.4 UK

8.3.5 France

8.3.6 Germany

8.3.7 Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.2 India

8.4.3 Japan

8.4.4 Australia & New Zealand

8.4.5 Rest of Asia Pacific

8.5 Rest of the World (RoW)

8.5.1 South America

8.5.2 Middle East & Africa

9 Company Landscape (Page No. - 82)

9.1 Introduction

9.2 Calcium Propionate Market Ranking, By Key Player, 2017

9.2.1 Expansions

9.2.2 Acquisitions

9.2.3 Certifications

9.2.4 Partnerships

10 Company Profiles (Page No. - 87)

(Business Overview, Products Offered, Recent Developments)*

10.1 Niacet (SK Capital)

10.2 Impextraco

10.3 Addcon

10.4 Kemin Industries

10.5 Macco Organiques

10.6 Real S.A.S.

10.7 Associated British Foods PLC (ABF)

10.8 Shandong Tong Tai Wei Run Chemical Co., Ltd. (TTWR)

10.9 Bell Chem

10.10 Krishna Chemicals

10.11 A.M Food Chemicals

10.12 Fine Organics

10.12.1 Business Overview

10.12.2 Products Offered

10.12.3 Recent Developments

*Business Overview, Products Offered, Recent Developments, Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 102)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (68 Tables)

Table 1 US Dollar Exchange Rate, 2014–2016

Table 2 Calcium Propionate: Physical & Chemical Properties

Table 3 Market Size For Calcium Propionate, By Application, 2016–2023 (USD Million)

Table 4 Market Size, By Application, 2016–2023 (KT)

Table 5 Food: Market Size For Calcium Propionate, By Region, 2016–2023 (USD Million)

Table 6 Food: Market Size For Calcium Propionate, By Region, 2016–2023 (KT)

Table 7 Market Size, By Food Application, 2016–2023 (USD Million)

Table 8 Feed: By Market Size, By Region, 2016–2023 (USD Million)

Table 9 Feed: Market Size, By Region, 2016–2023 (KT)

Table 10 Other Applications: By Market Size, By Region, 2016–2023 (USD Million)

Table 11 Other Applications: Market Size, By Region, 2016–2023 (KT)

Table 12 Market For Calcium Propionate Size, By Form, 2016–2023 (USD Million)

Table 13 Market Size, By Form, 2016–2023 (KT)

Table 14 Dry CP Market Size, By Region, 2016–2023 (USD Million)

Table 15 Dry CP Market Size, By Region, 2016–2023 (KT)

Table 16 Liquid CP Market Size, By Region, 2016–2023 (USD Million)

Table 17 Liquid CP Market Size, By Region, 2016–2023 (KT)

Table 18 Market For Calcium Propionate Size, By Region, 2016–2023 (USD Million)

Table 19 Market Size, By Region, 2016–2023 (KT)

Table 20 North America: By Market Size, By Country, 2016–2023 (USD Million)

Table 21 North America: Market Size, By Country, 2016–2023 (KT)

Table 22 North America: Market Size, By Application, 2016–2023 (USD Million)

Table 23 North America: Market Size, By Application, 2016–2023 (KT)

Table 24 North America: By Market Size for Food, By Type, 2016–2023 (USD Million)

Table 25 North America: Market Size, By Form, 2016–2023 (USD Million)

Table 26 North America: Market Size, By Form, 2016–2023 (KT)

Table 27 US: Calcium Propionate Market Size, By Application, 2016–2023 (USD Million)

Table 28 Canada: By Market Size, By Application, 2016–2023 (USD Million)

Table 29 Mexico: By Market Size, By Application, 2016–2023 (USD Million)

Table 30 Europe: By Market Size, By Country, 2016–2023 (USD Million)

Table 31 Europe: Market Size, By Country, 2016–2023 (KT)

Table 32 Europe: Market Size, By Application, 2016–2023 (USD Million)

Table 33 Europe: Market Size, By Application, 2016–2023 (KT)

Table 34 Europe: Market Size, By Type, 2016–2023 (USD Million)

Table 35 Europe: Market Size, By Form, 2016–2023 (USD Million)

Table 36 Europe: Market Size, By Form, 2016–2023 (KT)

Table 37 Italy: By Market Size, By Application, 2016–2023 (USD Million)

Table 38 Spain: Market Size, By Application, 2016–2023 (USD Million)

Table 39 Netherlands: By Market Size, By Application, 2016–2023 (USD Million)

Table 40 UK: By Market Size, By Application, 2016–2023 (USD Million)

Table 41 France: Market Size, By Application, 2016–2023 (USD Million)

Table 42 Germany: By Market Size, By Application, 2016–2023 (USD Million)

Table 43 Rest of Europe: Market Size, By Application, 2016–2023 (USD Million)

Table 44 Asia Pacific: By Market Size, By Country, 2016–2023 (USD Million)

Table 45 Asia Pacific: Market Size, By Country, 2016–2023 (KT)

Table 46 Asia Pacific: Market Size, By Application, 2016–2023 (USD Million)

Table 47 Asia Pacific: Market Size, By Application, 2016–2023 (KT)

Table 48 Asia Pacific: Market Size for Food, By Type, 2016–2023 (USD Million)

Table 49 Asia Pacific: Market Size, By Form, 2016–2023 (USD Million)

Table 50 Asia Pacific: Market Size, By Form, 2016–2023 (KT)

Table 51 China: By Market Size, By Application, 2016–2023 (USD Million)

Table 52 India: By Market Size, By Application, 2016–2023 (USD Million)

Table 53 Japan: Market Size, By Application, 2016–2023 (USD Million)

Table 54 Australia & New Zealand: Market Size, By Application, 2016–2023 (USD Million)

Table 55 Rest of Asia Pacific: Market Size, By Application, 2016–2023 (USD Million)

Table 56 RoW: Calcium Propionate Market Size, By Region, 2016–2023 (USD Million)

Table 57 RoW: Market Size, By Region, 2016–2023 (KT)

Table 58 RoW: Market Size, By Application, 2016–2023 (USD Million)

Table 59 RoW: Market Size, By Application, 2016–2023 (KT)

Table 60 RoW: Market Size for Food, By Type, 2016–2023 (USD Million)

Table 61 RoW: Market Size, By Form, 2016–2023 (USD Million)

Table 62 RoW: Market Size, By Form, 2016–2023 (KT)

Table 63 South America: Market Size, By Application, 2016–2023 (USD Million)

Table 64 Middle East & Africa: CP Market Size, By Application, 2016–2023 (USD Million)

Table 65 Expansions, 2015–2017

Table 66 Acquisitions, 2013–2018

Table 67 Certifications, 2014

Table 68 Partnerships, 2017

List of Figures (29 Figures)

Figure 1 Calcium Propionate Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Calcium Propionate Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Calcium Propionate Market Size, By Application, 2018 vs 2023

Figure 9 Bakery Products Subsegment to Grow at the Highest CAGR, 2018–2023

Figure 10 Dry Form Held A Larger Share of the Market in 2017

Figure 11 North America: Largest Market for Calcium Propionate in 2017

Figure 12 Functional Potential of Calcium Propionate in New Product Lines is Expected to Drive Its Growth

Figure 13 Feed Segment to Grow at the Highest CAGR From 2018 to 2023

Figure 14 Food Segment to Lead the Market From 2018 to 2023

Figure 15 Food Segment is Estimated to Dominate the North American Market in 2018

Figure 16 Bakery Products Segment is Estimated to Hold the Largest Share Across All Regions in 2018

Figure 17 Dry Segment is Estimated to Dominate the Market Across All Regions in 2018

Figure 18 North America to Dominate the Market for Calcium Propionate Through 2023

Figure 19 Market Dynamics: Calcium Propionate Market

Figure 20 Supply Chain of the Market

Figure 21 Value Chain of the Calcium Propionate Market

Figure 22 Food Segment to Dominate the Market Through 2023

Figure 23 Dry Segment to Dominate the Market Through 2023

Figure 24 Geographic Snapshot (2018–2023): Fast-Growing Markets are Emerging as New Hot Spots

Figure 25 North America: Market For Calcium Propionate Snapshot

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Key Developments By Calcium Propionate Companies in the Last Five Years

Figure 28 Expansions & Acquisitions: the Key Strategy, 2012 to January 2018

Figure 29 Associated British Foods PLC: Company Snapshot

Growth opportunities and latent adjacency in Calcium Propionate Market

In reference to application segment, I want to know if the bifurcation of food in various sub segments (Bakery/confectionery) is available or not?