Butyric Acid Market by Type (Synthetic, Renewable), End-use (Animal Feed, Chemical Intermediates, Pharmaceuticals, Food & Flavors, Human Dietary Supplements), and Region (Asia Pacific, North America, Europe, Rest of the World) - Global Forecast to 2027

Butyric Acid Market

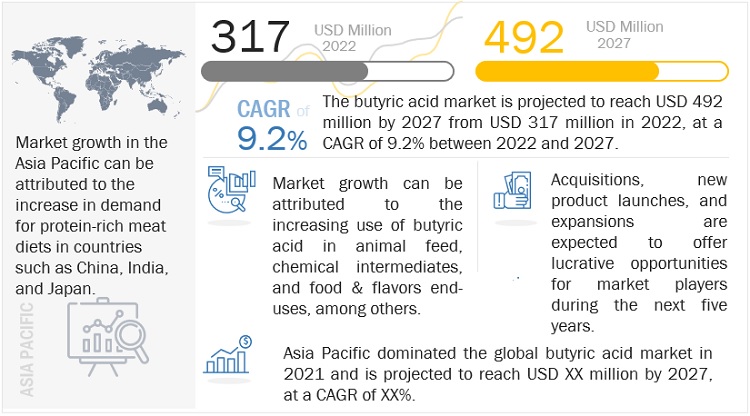

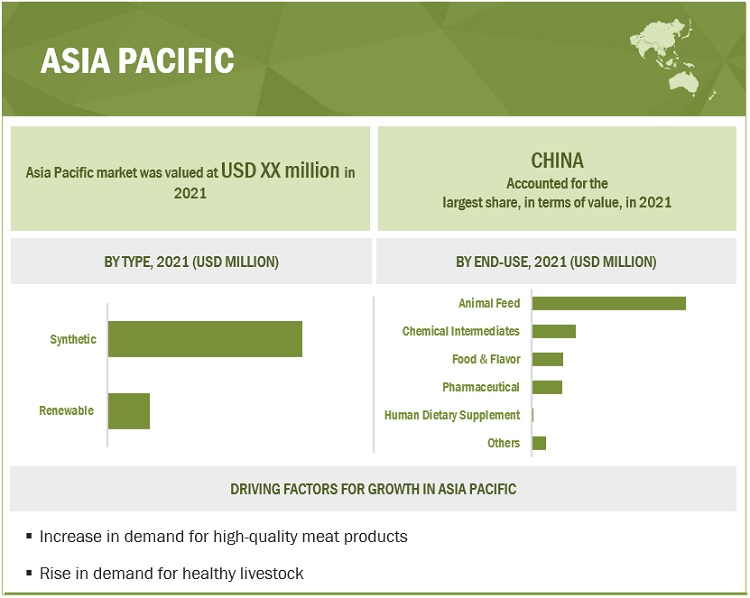

The global butyric acid market was valued at USD 317 million in 2022 and is projected to reach USD 492 million by 2027, growing at a cagr 9.2% from 2022 to 2027. The Asia Pacific region is one of the largest consumers of butyric acid, with China leading the regional market.

Attractive Opportunities in the Butyric Acid Market

To know about the assumptions considered for the study, Request for Free Sample Report

Butyric Acid Market Dynamics

Drivers: High demand from animal feed end-use

Butyric acid is used as a raw material in animal feed, especially for poultry and swine. It stands out among the short-chain fatty acids for its unique qualities. Butyric acid also stimulates the release of enzymes and stabilizes the microbiota, which improves the efficiency of nutrient digestion and colonization resistance. As a result, growth performance has improved, particularly in less-than-optimal circumstances. Because of this, butyric acid is a widely used feed addition for young animals all over the world.

Opportunity: Stringent regulations in use of antibiotics in animal feed

New regulations by the US Food and Drug Administration (FDA), which took effect on January 1, 2017, banned the addition of antibiotics to feed to promote the growth of livestock and poultry. Also, as the European Union banned the use of antibiotics in 2006, it was necessary to explore alternatives. Hence, such stringent regulations are expected to provide opportunities for butyric acid as an alternative for antibiotics in animal feed.

Based on type, the synthetic segment is expected to lead the butyric acid market in terms of volume from 2022 to 2027.

At the industrial level, butyric acid is mostly created chemically. This involves the oxidation of butyraldehyde, which is produced via oxo synthesis from propylene supplied from crude oil. This is generally preferred because it has low cost of production and raw materials are easily accessible.

Based on the end-use, the animal feed segment is expected to lead the butyric acid market in terms of volume from 2022 to 2027.

Butyric acid is known to play a role in the mucosal immune response and to have anti-inflammatory properties in animals. Given that it can affect gene expression and protein synthesis, it is also known to directly affect the proliferation, maturation, and differentiation of mucosal cells. Such characteristics increase in demand for animal feed.

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific butyric acid market is expected to lead during the forecast period in terms of volume. This growth is expected due to changes in dietary patterns have led to an increase in meat consumption in the region, which has led to the industrialization of meat production. This further increases the need for renewable based feed.

Butyric Acid Market Players

Perstorp Holding AB (Sweden), OQ Chemicals GmbH (Germany), Eastman Chemical Company (US), Palital Feed Additives B.V. (The Netherlands), Tokyo Chemical Industry Co., Ltd. (Japan), Snowco (China), Merck KGaA (Germany), Kemin Industries, Inc. (US), Hefei TNJ Chemical Industry Co., Ltd. (China), Kunshan Odowell Co., Ltd. (China), Yufeng International Group Co., Ltd. (China), Central Drug House (India), Spectrum Chemical (US). These companies have adopted product launches, acquisitions, partnerships, expansions, and merger & acquisition as growth strategies to enhance their position in the butyric acid market.

Butyric Acid Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 317 million |

|

Revenue Forecast in 2027 |

USD 492 million |

|

CAGR |

9.2% |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD) and Volume (Kiloton) |

|

Segments Covered |

Type, End-use, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Rest of the World |

|

Companies Covered |

Perstorp Holding AB (Sweden), OQ Chemicals GmbH (Germany), Eastman Chemical Company (US), Palital Feed Additives B.V. (The Netherlands), Tokyo Chemical Industry Co., Ltd. (Japan), Snowco (China), Merck KGaA (Germany), Kemin Industries, Inc. (US), Hefei TNJ Chemical Industry Co., Ltd. (China), Kunshan Odowell Co., Ltd. (China), Yufeng International Group Co., Ltd. (China), Central Drug House (India), Spectrum Chemical (US), other players. |

This research report categorizes the butyric acid market based on type, end-use, and region.

Based on Type, the butyric acid market has been segmented as follows:

- Synthetic

- Renewable

Based on End-use , the butyric acid market has been segmented as follows:

- Animal Feed

- Chemical Intermediates

- Food & Flavors

- Pharmaceuticals

- Human Dietary Supplements

- Others

Based on Region, the butyric acid market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Rest of the World

Recent Developments

- In April 2021, Eastman Chemical Company acquired 3F Feed & Food, a European pioneer in the technological and commercial advancement of additives for animal feed and human food.

- In July 2020, Kemin Industries has acquired a US patent application to manage African Swine Fever Virus (ASFv) in feed and feed ingredients employing Sal CURB Liquid Antimicrobial, a global disease control product produced by Kemin Industries.

Frequently Asked Questions (FAQ):

What is the current size of the global butyric acid market?

The butyric acid market is projected to grow from USD 317 million in 2022 to USD 492 million by 2027, at a CAGR of 9.2% from 2022 to 2027.

Who are the leading players in the global butyric acid market?

Some of the key players in this market are Perstorp Holding AB (Sweden), OQ Chemicals GmbH (Germany), Eastman Chemical Company (US), Palital Feed Additives B.V. (The Netherlands), Tokyo Chemical Industry Co., Ltd. (Japan), Snowco (China), Merck KGaA (Germany), Kemin Industries, Inc. (US), Hefei TNJ Chemical Industry Co., Ltd. (China), Kunshan Odowell Co., Ltd. (China), Yufeng International Group Co., Ltd. (China), Central Drug House (India), Spectrum Chemical (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 BUTYRIC ACID MARKET: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 BUTYRIC ACID MARKET SCOPE

FIGURE 1 BUTYRIC ACID MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 RESEARCH LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 BUTYRIC ACID MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Participating companies in primary research

2.1.2.3 Breakdown of primary interviews

2.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS

FIGURE 3 MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR BUTYRIC ACID

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF BUTYRIC ACID MARKET (1/2)

FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF BUTYRIC ACID MARKET (2/2)

2.3.3 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

2.3.4 FORECAST

2.3.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4 DATA TRIANGULATION

FIGURE 8 BUTYRIC ACID MARKET: DATA TRIANGULATION

2.4.1 KEY ASSUMPTIONS FOR CALCULATION OF DEMAND-SIDE MARKET SIZE

2.4.2 LIMITATIONS

2.4.3 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 37)

TABLE 2 BUTYRIC ACID MARKET

FIGURE 9 SYNTHETIC BUTYRIC ACID SEGMENT TO DOMINATE MARKET BETWEEN 2022 AND 2027

FIGURE 10 ANIMAL FEED SEGMENT TO LEAD MARKET BETWEEN 2022 AND 2027

FIGURE 11 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 SIGNIFICANT OPPORTUNITIES IN BUTYRIC ACID MARKET

FIGURE 12 MARKET TO WITNESS MODERATE GROWTH BETWEEN 2022 AND 2027

4.2 BUTYRIC ACID MARKET, BY REGION

FIGURE 13 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

4.3 ASIA PACIFIC BUTYRIC ACID MARKET, BY TYPE AND END-USE

FIGURE 14 ANIMAL FEED END-USE AND SYNTHETIC TYPE SEGMENTS LED ASIA PACIFIC MARKET IN 2021

4.4 BUTYRIC ACID MARKET, BY TYPE

FIGURE 15 SYNTHETIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.5 BUTYRIC ACID MARKET, BY END-USE

FIGURE 16 HUMAN DIETARY SUPPLEMENTS SEGMENT TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BUTYRIC ACID MARKET

5.2.1 DRIVERS

5.2.1.1 High demand from animal feed end-use segment

FIGURE 18 GLOBAL ANIMAL FEED PRODUCTION (MT), 2020

5.2.2 RESTRAINTS

5.2.2.1 Health concerns associated with handling butyric acid

5.2.3 OPPORTUNITIES

5.2.3.1 Stringent regulations on use of antibiotics in animal feed

5.2.3.2 Increasing R&D and usage of butyric acid as a precursor for producing biofuels

5.2.3.3 Demand for renewable butyric acid in food & flavors and pharmaceutical sectors

FIGURE 19 BREAKDOWN OF GLOBAL SALES OF PHARMACEUTICALS, 2020

5.2.4 CHALLENGES

5.2.4.1 High production cost

5.3 ECOSYSTEM

FIGURE 20 ECOSYSTEM MAP OF BUTYRIC ACID MARKET

TABLE 3 BUTYRIC ACID MARKET: ECOSYSTEM

5.4 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: HIGHEST VALUE ADDED DURING MANUFACTURING PHASE

5.5 PORTER'S FIVE FORCES ANALYSIS

FIGURE 22 BUTYRIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 4 BUTYRIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

5.5.1 BARGAINING POWER OF SUPPLIERS

5.5.2 BARGAINING POWER OF BUYERS

5.5.3 THREAT OF SUBSTITUTES

5.5.4 THREAT OF NEW ENTRANTS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 CASE STUDY ANALYSIS

5.6.1 INTRODUCTION OF GASTRIVIX AVI TO PROMOTE GROWTH PERFORMANCE IN BIRDS AND BOOST ANIMAL NUTRITION

5.6.1.1 Problem statement:

5.6.1.2 Solutions offered:

5.6.1.3 Outcome:

5.7 TECHNOLOGY ANALYSIS

5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 23 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE SEGMENTS

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE SEGMENTS (%)

5.8.2 BUYING CRITERIA

FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE END-USE SEGMENTS

TABLE 6 KEY BUYING CRITERIA FOR TOP THREE END-USE SEGMENTS

5.9 POLICIES AND REGULATIONS

5.9.1 REACH - REGISTRATION, EVALUATION, AUTHORISATION AND RESTRICTION OF CHEMICALS REGULATION

5.9.1.1 Dossier evaluation status

TABLE 7 DOSSIER EVALUATION STATUS OF BUTYRIC ACID

5.9.2 CLASSIFICATION, LABELLING AND PACKAGING (CLP)

5.9.3 ATMOSPHERIC STANDARDS

5.9.4 CLEAN WATER ACT REQUIREMENTS

5.9.5 FDA REQUIREMENTS

5.9.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10 PATENT ANALYSIS

FIGURE 25 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

FIGURE 26 PUBLICATION TRENDS - LAST 10 YEARS

5.10.1 INSIGHTS

FIGURE 27 LEGAL STATUS OF PATENTS

FIGURE 28 TOP JURISDICTION, BY DOCUMENT

FIGURE 29 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 12 LIST OF PATENTS BY NOVARTIS AG

TABLE 13 LIST OF PATENTS BY EVONIK DEGUSSA GMBH

TABLE 14 TOP 10 PATENT OWNERS DURING LAST 10 YEARS

5.11 PRICING ANALYSIS

FIGURE 30 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE END-USE SEGMENTS

5.11.1 AVERAGE SELLING PRICE TRENDS

FIGURE 31 BUTYRIC ACID MARKET: AVERAGE PRICE TRENDS FOR BUTYRIC ACID TYPES

5.12 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 15 BUTYRIC ACID MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 TRADE DATA

TABLE 16 IMPORT DATA FOR BUTYRIC ACID IN 2021

TABLE 17 EXPORT DATA FOR BUTYRIC ACID IN 2021

6 BUTYRIC ACID MARKET, BY TYPE (Page No. - 66)

6.1 INTRODUCTION

FIGURE 32 SYNTHETIC BUTYRIC ACID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 18 BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 19 BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 20 BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 21 BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

6.2 SYNTHETIC BUTYRIC ACID

6.2.1 LOW MANUFACTURING COST TO DRIVE SEGMENT

6.3 RENEWABLE BUTYRIC ACID

6.3.1 RISING INTEREST IN ORGANIC AND NATURAL PRODUCTS

7 BUTYRIC ACID MARKET, BY END-USE (Page No. - 69)

7.1 INTRODUCTION

FIGURE 33 ANIMAL FEED PROJECTED TO BE LARGEST END-USE SEGMENT DURING FORECAST PERIOD

TABLE 22 BUTYRIC ACID MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

TABLE 23 BUTYRIC ACID MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

TABLE 24 BUTYRIC ACID MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 25 BUTYRIC ACID MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

7.2 ANIMAL FEED

7.2.1 ENHANCING GUT HEALTH AND PERFORMANCE OF ANIMALS

7.3 CHEMICAL INTERMEDIATES

7.3.1 ESTERS AND PLASTICIZERS TO PROPEL DEMAND

7.4 FOOD & FLAVORS

7.4.1 DAIRY PRODUCTS AND ALCOHOLIC BEVERAGES TO LEAD SEGMENT

7.5 PHARMACEUTICALS

7.5.1 ANTICANCER CHARACTERISTICS TO FUEL MARKET GROWTH

7.6 HUMAN DIETARY SUPPLEMENTS

7.6.1 IMPROVING DIGESTIVE HEALTH CHARACTERISTICS TO PROPEL GROWTH

7.7 OTHERS

8 BUTYRIC ACID MARKET, BY REGION (Page No. - 75)

8.1 INTRODUCTION

FIGURE 34 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

TABLE 26 BUTYRIC ACID MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

TABLE 27 BUTYRIC ACID MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 28 BUTYRIC ACID MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 29 BUTYRIC ACID MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.2 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: BUTYRIC ACID MARKET SNAPSHOT

TABLE 30 ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 31 ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 32 ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 33 ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 34 ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 35 ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

TABLE 36 ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

TABLE 37 ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

TABLE 38 ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 39 ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 40 ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 41 ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

8.2.1 CHINA

8.2.1.1 Rise in consumption of meat and dairy products

TABLE 42 CHINA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 43 CHINA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 44 CHINA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 45 CHINA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.2.2 INDIA

8.2.2.1 Growth in consumption of poultry and milk products

TABLE 46 INDIA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 47 INDIA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 48 INDIA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 49 INDIA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.2.3 JAPAN

8.2.3.1 Growth in consumption of packaged food

TABLE 50 JAPAN: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 51 JAPAN: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 52 JAPAN: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 53 JAPAN: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.2.4 SOUTH KOREA

8.2.4.1 Growth of food and pharma sectors

TABLE 54 SOUTH KOREA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 55 SOUTH KOREA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 56 SOUTH KOREA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 57 SOUTH KOREA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.2.5 REST OF ASIA PACIFIC

TABLE 58 REST OF ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 59 REST OF ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 60 REST OF ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 61 REST OF ASIA PACIFIC: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.3 EUROPE

FIGURE 36 EUROPE: BUTYRIC ACID MARKET SNAPSHOT

TABLE 62 EUROPE: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 63 EUROPE: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 64 EUROPE: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 65 EUROPE: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 66 EUROPE: BUTYRIC ACID MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 67 EUROPE: BUTYRIC ACID MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

TABLE 68 EUROPE: BUTYRIC ACID MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

TABLE 69 EUROPE: BUTYRIC ACID MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

TABLE 70 EUROPE: BUTYRIC ACID MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 71 EUROPE: BUTYRIC ACID MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 72 EUROPE: BUTYRIC ACID MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 73 EUROPE: BUTYRIC ACID MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Growth of processed food and pharmaceutical sectors

TABLE 74 GERMANY: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 75 GERMANY: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 76 GERMANY: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 77 GERMANY: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.3.2 FRANCE

8.3.2.1 Growing market for poultry products

TABLE 78 FRANCE: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 79 FRANCE: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 80 FRANCE: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 81 FRANCE: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.3.3 ITALY

8.3.3.1 Growing consumption of processed and consumer-ready food

TABLE 82 ITALY: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 83 ITALY: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 84 ITALY: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 85 ITALY: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.3.4 UK

8.3.4.1 Pharmaceuticals to be major sector

TABLE 86 UK: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 87 UK: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 88 UK: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 89 UK: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.3.5 REST OF EUROPE

TABLE 90 REST OF EUROPE: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 91 REST OF EUROPE: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 92 REST OF EUROPE: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 93 REST OF EUROPE: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.4 NORTH AMERICA

FIGURE 37 NORTH AMERICA: BUTYRIC ACID MARKET SNAPSHOT

TABLE 94 NORTH AMERICA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 95 NORTH AMERICA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 96 NORTH AMERICA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 97 NORTH AMERICA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: BUTYRIC ACID MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 99 NORTH AMERICA: BUTYRIC ACID MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

TABLE 100 NORTH AMERICA: BUTYRIC ACID MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

TABLE 101 NORTH AMERICA: BUTYRIC ACID MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: BUTYRIC ACID MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 103 NORTH AMERICA: BUTYRIC ACID MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 104 NORTH AMERICA: BUTYRIC ACID MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 105 NORTH AMERICA: BUTYRIC ACID MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

8.4.1 US

8.4.1.1 Growth of feed industry and increase in poultry consumption

TABLE 106 US: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 107 US: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 108 US: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 109 US: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.4.2 CANADA

8.4.2.1 Increasing R&D activities in pharmaceutical sector

TABLE 110 CANADA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 111 CANADA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 112 CANADA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 113 CANADA: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.4.3 MEXICO

8.4.3.1 Growing food & flavor and beverage industries

TABLE 114 MEXICO: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 115 MEXICO: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 116 MEXICO: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 117 MEXICO: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

8.4.4 REST OF THE WORLD

TABLE 118 REST OF THE WORLD: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (KILOTON)

TABLE 119 REST OF THE WORLD: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

TABLE 120 REST OF THE WORLD: BUTYRIC ACID MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 121 REST OF THE WORLD: BUTYRIC ACID MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 122 REST OF THE WORLD: BUTYRIC ACID MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 123 REST OF THE WORLD: BUTYRIC ACID MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

TABLE 124 REST OF THE WORLD: BUTYRIC ACID MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

TABLE 125 REST OF THE WORLD: BUTYRIC ACID MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

TABLE 126 REST OF THE WORLD: BUTYRIC ACID MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

TABLE 127 REST OF THE WORLD: BUTYRIC ACID MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 128 REST OF THE WORLD: BUTYRIC ACID MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 129 REST OF THE WORLD: BUTYRIC ACID MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 112)

9.1 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 130 OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS

9.2 REVENUE ANALYSIS

FIGURE 38 REVENUE ANALYSIS FOR FIVE YEARS FOR KEY COMPANIES

9.3 MARKET SHARE ANALYSIS

FIGURE 39 BUTYRIC ACID MARKET: MARKET SHARE ANALYSIS

TABLE 131 BUTYRIC ACID MARKET: TYPE FOOTPRINT

TABLE 132 BUTYRIC ACID MARKET: END-USE FOOTPRINT

TABLE 133 BUTYRIC ACID MARKET: REGION FOOTPRINT

9.4 COMPANY EVALUATION MATRIX

9.4.1 STARS

9.4.2 EMERGING LEADERS

9.4.3 PERVASIVE PLAYERS

9.4.4 PARTICIPANTS

FIGURE 40 BUTYRIC ACID MARKET: COMPANY EVALUATION MATRIX, 2021

9.5 COMPETITIVE SCENARIO

TABLE 134 BUTYRIC ACID MARKET: PRODUCT LAUNCHES, 2019–2022

TABLE 135 BUTYRIC ACID MARKET: DEALS, 2019–2022

TABLE 136 BUTYRIC ACID MARKET: OTHER DEVELOPMENTS, 2019–2022

10 COMPANY PROFILES (Page No. - 124)

(Business Overview, Products/solutions/services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats)*

10.1 PERSTORP HOLDING AB

TABLE 137 PERSTORP HOLDING AB: COMPANY OVERVIEW

FIGURE 41 PERSTORP HOLDING AB: COMPANY SNAPSHOT

TABLE 138 PERSTORP HOLDING AB: PRODUCTS OFFERED

TABLE 139 PERSTORP HOLDING AB: PRODUCT LAUNCHES

TABLE 140 PERSTORP HOLDING AB: OTHERS

10.2 OQ CHEMICALS GMBH

TABLE 141 OQ CHEMICALS GMBH: COMPANY OVERVIEW

FIGURE 42 OQ CHEMICALS GMBH: COMPANY SNAPSHOT

TABLE 142 OQ CHEMICALS GMBH: PRODUCTS OFFERED

TABLE 143 OQ CHEMICALS GMBH: DEALS

TABLE 144 OQ CHEMICALS GMBH: OTHERS

10.3 EASTMAN CHEMICAL COMPANY

TABLE 145 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

FIGURE 43 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

TABLE 146 EASTMAN CHEMICAL COMPANY: PRODUCTS OFFERED

TABLE 147 EASTMAN CHEMICAL COMPANY: DEALS

10.4 KEMIN INDUSTRIES, INC.

TABLE 148 KEMIN INDUSTRIES, INC.: COMPANY OVERVIEW

TABLE 149 KEMIN INDUSTRIES, INC.: PRODUCTS OFFERED

TABLE 150 KEMIN INDUSTRIES, INC.: DEALS

TABLE 151 KEMIN INDUSTRIES, INC.: OTHERS

10.5 SNOWCO

TABLE 152 SNOWCO: COMPANY OVERVIEW

TABLE 153 SNOWCO: PRODUCTS OFFERED

TABLE 154 SNOWCO: OTHERS

10.6 TOKYO CHEMICAL INDUSTRY CO., LTD.

TABLE 155 TOKYO CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

TABLE 156 TOKYO CHEMICAL INDUSTRY CO., LTD.: PRODUCTS OFFERED

10.7 PALITAL FEED ADDITIVES B.V.

TABLE 157 PALITAL FEED ADDITIVES B.V.: COMPANY OVERVIEW

TABLE 158 PALITAL FEED ADDITIVES B.V.: PRODUCTS OFFERED

TABLE 159 PALITAL FEED ADDITIVES B.V.: DEALS

10.8 MERCK KGAA

TABLE 160 MERCK KGAA: COMPANY OVERVIEW

FIGURE 44 MERCK KGAA: COMPANY SNAPSHOT

TABLE 161 MERCK KGAA: PRODUCTS OFFERED

TABLE 162 MERCK KGAA: OTHERS

10.9 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

TABLE 163 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

TABLE 164 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.: PRODUCTS OFFERED

10.10 YUFENG INTERNATIONAL GROUP CO., LTD.

TABLE 165 YUFENG INTERNATIONAL GROUP CO., LTD.: COMPANY OVERVIEW

TABLE 166 YUFENG INTERNATIONAL GROUP CO., LTD.: PRODUCTS OFFERED

10.11 CENTRAL DRUG HOUSE

TABLE 167 CENTRAL DRUG HOUSE: COMPANY OVERVIEW

TABLE 168 CENTRAL DRUG HOUSE: PRODUCTS OFFERED

10.12 SPECTRUM CHEMICAL

TABLE 169 SPECTRUM CHEMICAL: COMPANY OVERVIEW

TABLE 170 SPECTRUM CHEMICAL: PRODUCTS OFFERED

10.13 ELAN CHEMICAL

TABLE 171 ELAN CHEMICAL: COMPANY OVERVIEW

TABLE 172 ELAN CHEMICAL: PRODUCTS OFFERED

10.14 SISCO RESEARCH LABORATORIES PVT. LTD.

TABLE 173 SISCO RESEARCH LABORATORIES PVT. LTD.: COMPANY OVERVIEW

TABLE 174 SISCO RESEARCH LABORATORIES PVT. LTD.: PRODUCTS OFFERED

10.15 WEN INTERNATIONAL, INC.

TABLE 175 WEN INTERNATIONAL, INC.: COMPANY OVERVIEW

TABLE 176 WEN INTERNATIONAL, INC.: PRODUCTS OFFERED

10.16 DAYANG CHEM (HANGZHOU) CO., LTD.

TABLE 177 DAYANG CHEM (HANGZHOU) CO., LTD.: COMPANY OVERVIEW

TABLE 178 DAYANG CHEM (HANGZHOU) CO., LTD.: PRODUCTS OFFERED

10.17 RXCHEMICALS

TABLE 179 RXCHEMICALS: COMPANY OVERVIEW

TABLE 180 RXCHEMICALS: PRODUCTS OFFERED

10.18 YANCHENG CITY CHUNZHU AROMA CO., LTD.

TABLE 181 YANCHENG CITY CHUNZHU AROMA CO., LTD.: COMPANY OVERVIEW

TABLE 182 YANCHENG CITY CHUNZHU AROMA CO., LTD.: PRODUCTS OFFERED

10.19 KUNSHAN ODOWELL CO., LTD.

TABLE 183 KUNSHAN ODOWELL CO., LTD.: COMPANY OVERVIEW

TABLE 184 KUNSHAN ODOWELL CO., LTD.: PRODUCTS OFFERED

*Details on Business Overview, Products/solutions/services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 157)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 CUSTOMIZATION OPTIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

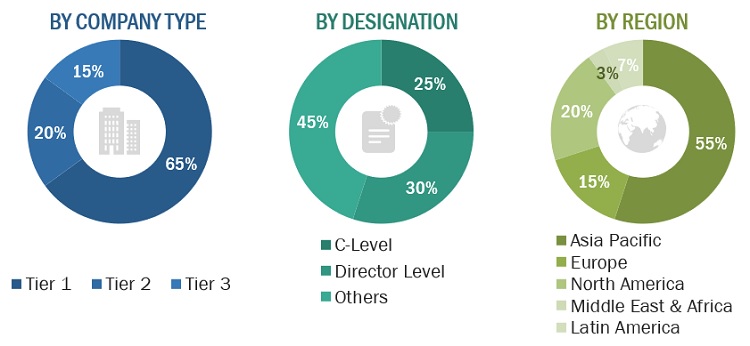

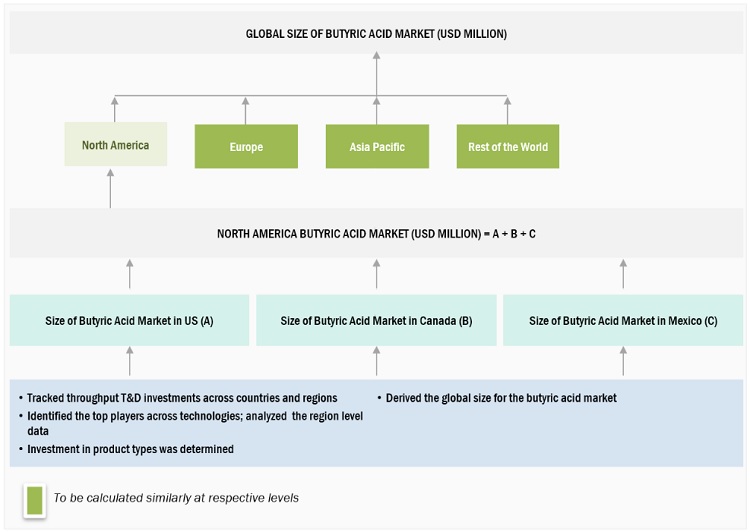

The study involved four major activities in estimating the current size of the butyric acid market. Exhaustive secondary research was done to collect information on the butyric acid market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the butyric acid value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments of the butyric acid market.

Secondary Research

As a part of the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain essential information about the supply chain of the industry, the monetary chain of the market, total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both the market and technology-oriented perspectives.

Primary Research

The butyric acid market comprises several stakeholders, such as butyric acid manufacturers, manufacturers in end-use industries, traders, distributors, and suppliers of butyric acids, regional manufacturer associations and butyric acid associations, and government and regional agencies, in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the butyric acid market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the butyric acid market. Primary sources from the demand side included directors, marketing heads, and purchase managers from multiple end-use industries.

Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the butyric acid market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

Global Butyric Acid Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the butyric acid market, in terms of value and volume

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To forecast the market size of butyric acids by type, end-use, and region

- To forecast the size of the market with respect to four main regions, namely, North America, Europe, Asia Pacific, Rest of the World

- To strategically analyze micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as new product launches, mergers & acquisitions, partnerships, and expansions in the butyric acid market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of the North America, Europe, and Asia Pacific butyric acid markets

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Organic Acid Market Analysis

Organic Acid Market Trends

Top Companies in Organic Acid Market

Organic Acid Market Impact on Different Industries

Speak to our Analyst today to know more about Organic Acid Market!

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Butyric Acid Market