Bus Seat Market by Component, Comfort Type (High comfort, Low Comfort), Seat type (Regular passenger Seat, Recliner Seat, Folding Seat, Driver Seat, Integrated Child Seat), Bus Type and Region - Global Forecast to 2027

Updated on : October 23, 2024

Bus Seat Market Size & Growth

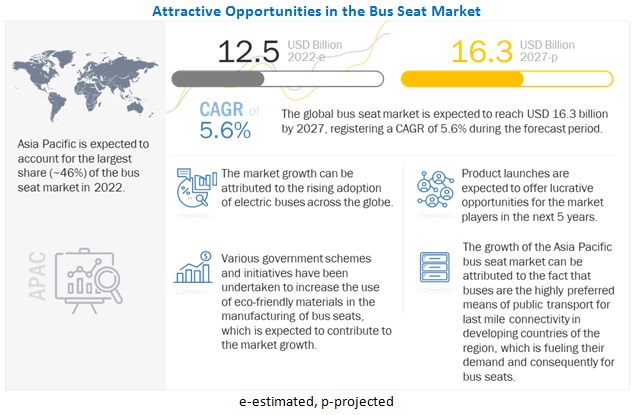

The Bus seat market size is expected to grow from USD 12.5 billion in 2022 to USD 16.3 billion by 2027, growing at a CAGR of 5.6% during the forecast period from 2022 to 2027.

The market growth can be attributed to several factors, such as increasing demand for bus seats due to rapid adoption of electric buses across the world.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Bus Seat Market

The Bus Seat market includes major Tier I, Tier II and Tier III suppliers such as GRAMMER AG (Germany), Faurecia (France), Magna International Inc. (Canada), Freedman Seating Company (US), Franz Keil GmbH (Germany), Adient (US), ISRINGHAUSEN GmbH (Germany), Lear Corporation (US), NHK Springs (Japan), Toyota Boshoku (Japan), Tachi-S (Japan), Minda Industries (India), Commercial Vehicle Group (US), Lazzerini SRL (Italy) and so on. These suppliers have their manufacturing facilities spread across various countries across North America, Europe, APAC, and RoW. COVID-19 has impacted their businesses as well. The outbreak of the COVID-19 pandemic has significantly impacted the bus seat market. Various regions worldwide are still moderately affected, and governments in these regions have responded to this pandemic accordingly by closing public transportation and manufacturing facilities and other public institutions to reduce the contamination of virus on the population. Due to the sudden outbreak of COVID-19, the market growth declined due to disruptions in the supply chain of automobiles. However, in the post-COVID-19 period, the market is expected to witness healthy growth, as traffic in metropolitan cities has returned to normal levels and people have started using public transport for commuting.

Bus Seat Market Trends:

Driver: Government-led programs to boost adoption of eco-friendly bus seat materials

The rapid growth of economy due to industrialization and adoption of modern technologies in the industrial sector, manufacturing activities are causing pollution and climate change. According to the United Nations report on climate change, the global temperature has increased by 1.1ºC due to industrial pollution and harmful processes and products to the environment. Regulatory authorities in countries such as US, France, Japan, and Germany are undertaking different measures and implementing policies for reducing carbon emissions from the transportation sector. The measures include the replacement of fossil fuels with alternative energy sources such as biofuel, fuel cells, and electric motors. These measures have increased the use of eco-friendly and recyclable materials in the manufacturing of seats and recycled metals in producing different parts and accessories for buses. Thus, governments are encouraging bus seat manufacturers to use eco-friendly biodegradable materials in the manufacturing of bus seats to reduce the carbon footprint of the transportation sector.

Restraint: High cost associated with retrofitting legacy buses with new seats

Buses are the main mode of transportation in several developing countries as they can reach remote locations inaccessible by other modes of transportation. Many buses that transport people to the remote sub-urban and village areas are operational even after more than 10 years of continuous use. Most seats in such buses are worn-out by regular usage and rough handling. Seat replacement in such buses is not a viable option for sustainable business operations as installing new seats requires special fittings and high costs, which may increase the operational costs of bus fleet companies. Thus, many bus fleet companies are reluctant to take contracts to change seats of legacy buses.

Opportunities: Increased safety for school bus seats

The school bus is a major segment of the bus seat industry. The safety of children is crucial in case of a road accident as they can be affected by severe injuries if not properly seated and can bounce and fall from the seat. This can be avoided by installing safety bus seats that reduce child-occupied seats’ damage. Governments do not mandate the installation of safety systems in school buses in developing countries. School bus seats can be integrated with motion sensors to detect accidents and release airbags before experiencing the impact of the collision. Such technology can help substantially reduced fatalities caused by school bus accidents across the world.

Challenge: High cost of eco-friendly raw materials

Eco-friendly materials are designed after extensive research and development (R&D). Hence, to accommodate the R&D costs, the selling prices of bus seats made with these advanced materials are incredibly high. These materials are expensive to produce as their manufacturing process may require establishing expensive plants and installing new machinery. Polyurethane foam is conventionally used to make legacy bus seats. However, biodegradable ABS material, which can be used as a substitute for polyurethane, is expensive to manufacture. Hence, these materials are normally used in luxury buses as manufacturers of such buses can afford the use of expensive seating materials. As of now, the penetration of these materials is low due to their high costs. However, the manufacturing of these materials will become cheaper over time due to production optimization.

Bus Seat Market Segmentation

Frames for bus seat to hold the largest share in component segment of Bus seat market during the forecast period

Frame of a bus seat is designed to function as a structure to support the weight of the seat and its occupant while providing strength and place to hold padding and other accessories into the bus seats. Frame are designed using material like steel, aluminum, and alloys with special metals properties. Thus, the frame of bus seat owns the huge cost on manufacturing as the metals used in seat frames are expensive. Seat frames are also designed to provide safety of the occupant in case of an accident, the frame ensure no damage or breaking of seats occur in an event of accident

Regular Passenger Seats to hold the largest share of bus seat market during the forecast period.

Regular Passenger Seats are used in almost all types of buses across the world. . These types of seats have their backrest in a fixed position and cannot be adjusted. These seats are designed either in bench style or in bucket style seats. Modern regular passenger bus seats are designed to utilize plastic shell body using environmentally friendly and recyclable material, it replaces the traditional seat frames and padding which allows for more compact, lightweight, and durable seats for transit bus applications. As the COVID-19 pandemic is subsiding and public bus transport is returing to normalcy in metropolitan cities, the demand for transit buses will increase, which will result in increasing demand for regular passenger seats.

Bus Seat Industry Regional Analysis

APAC to hold the largest share in bus seat market from 2022 to 2027.

Buses are the primary means of transportation in many countries in the APAC region. Almost all countries in APAC expect Japan and South Korea are still developing and make use of buses for last mile connectivity across urban, sub-urban and rural areas across the country. China and India has largest network of buses in the region. Recently, India has started inducting fleets of EV buses in Tier-I cities across the country. This has resulted in increased production of buses across the country thereby fueling the growth of bus seats.

To know about the assumptions considered for the study, download the pdf brochure

Top Bus Seat Companies - Key Market Players

Major players in the bus seat companies include

- Faurecia (France),

- GRAMMAR (Germany),

- Magna International (Canada),

- Freedman Seating Co (US),

- Franz Keil (Germany) and so on.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 12.5 billion in 2022 |

|

Expected Market Size |

USD 16.3 billion by 2027 |

|

Growth Rate |

CAGR of 5.6% |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Billion/Million) |

|

Segments covered |

By Components, By Comfort Type, By Seat Type, By Bus Type, and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

GRAMMER AG (Germany), Faurecia(France), Magna International Inc. (Canada), Freedman Seating Company (US), Franz Keil GmbH (Germany), Adient (US), ISRINGHAUSEN GmbH(Germany), Lear Corporation(US), NHK Springs (Japan), Toyota Boshoku (Japan), Tachi-S (Japan), Minda Industries (India), Commercial Vehicle Group(US), Lazzerini SRL (Italy) |

In this research report, the bus seat market has been segmented on the basis of Components ,Comfort type, Seat type, Bus type, and Region.

Bus Seat Market, by Components

- Frame

- Upholstery

- Other Accessories

Market, by Comfort type

- Low Comfort Seat

- High Comfort Seat

Market, by Seat Type

- Regular Passenger Seat

- Recliner Seat

- Folding Seat

- Bus Driver Seat

- Integrated Child Seat

Bus Seat Market,By Bus Type

- Transit bus

- Coach bus

- School Bus

- Transfer Bus

- Other

Region Analysis

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In September 2021, GRAMMAR launched its new the Ubility One product family consist of Ubility Light, Ubility Shift, and Ubility Air for seating in the buses. It features ultra-lightweight construction and innovative design and has the potential to reduce carbon emissions. This product line up had innovated the designs for passenger seats in public transportation.

- In March 2022, Toyota Boshoku, had agreed with Aisin Corporation and Shiroki Corp. on acquisition of Shiroki’s commercial rights for the automotive seat frame mechanism parts and Aisin’s seat frame manufacturing business segment.

Frequently Asked Questions (FAQ):

What is the current size of the global bus seat market?

The bus seat market is expected to grow from USD 12.5 billion in 2022 to USD 16.3 billion by 2027, at a CAGR of 5.6%

Who are the winners in the global bus seat market share?

Some of the key companies operating in the bus seat market are GRAMMER AG (Germany), Faurecia (France), Magna International Inc. (Canada), Freedman Seating Company (US), Franz Keil GmbH (Germany), Adient (US), ISRINGHAUSEN GmbH (Germany), Lear Corporation (US), NHK Springs (Japan), Toyota Boshoku (Japan), Tachi-S (Japan), Minda Industries (India), Commercial Vehicle Group (US), Lazzerini SRL (Italy), and so on. These players have adopted various growth strategies such as product launches, acquisitions, collaborations, agreements, and partnerships to expand their global presence and increase their share in the global market.

What are the major drivers for the bus seat market share?

The factors such as increasing demand for bus seats for electric buses, as the market for electric buses are rising.

Which major countries are considered in the European region?

The report includes an analysis of the Germany, UK, France, Italy and rest of European countries.

What are the impact of COVID-19 on the global bus seat market share?

COVID-19 pandemic has had a moderate impact on bus seat market as supply chains for buses across the world were disrupted leading to the scarcity of raw materials such as stainless steel and aluminum required for the manufacturing of bus and its components. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 BUS SEAT MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 VOLUME UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 BUS SEAT: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

TABLE 1 LIST OF SECONDARY SOURCES

2.1.2.1 Key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATION OF COMPANIES FROM SALE OF BUS SEATS

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size using top-down analysis

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—REVENUE GENERATED FROM SALE OF BUS SEATS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

TABLE 3 MARKET, BY UNIT SHIPMENT 2018–2021 (MILLION UNITS)

TABLE 4 MARKET BY UNIT SHIPMENT, 2022–2027 (MILLION UNITS)

TABLE 5 MARKET, 2018–2021 (USD BILLION)

TABLE 6 MARKET, 2022–2027 (USD BILLION)

FIGURE 8 IMPACT OF COVID-19 ON MARKET

3.2 POST-COVID-19 SCENARIO

TABLE 7 POST-COVID-19 SCENARIO: MARKET, 2022–2027 (USD BILLION)

3.3 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 8 OPTIMISTIC SCENARIO (POST-COVID-19): MARKET, 2022–2027 (USD BILLION)

3.4 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 9 PESSIMISTIC SCENARIO (POST-COVID-19): BUS SEAT MARKET, 2022–2027 (USD BILLION)

FIGURE 9 SCHOOL BUS SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2022 TO 2027

FIGURE 10 ASIA PACIFIC TO HOLD LARGEST SHARE OF MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 11 RISING ADOPTION OF ELECTRIC BUSES GLOBALLY TO FUEL DEMAND FOR BUS SEATS AND DRIVE MARKET GROWTH FROM 2022 TO 2027

4.2 MARKET, BY COMFORT TYPE

FIGURE 12 LOW COMFORT SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET FROM 2022 TO 2027

4.3 MARKET, BY COMPONENT AND REGION

FIGURE 13 FRAME SEGMENT AND ASIA PACIFIC TO HOLD LARGEST SHARES OF MARKET IN 2022

4.4 MARKET, BY COUNTRY

FIGURE 14 MARKET IN INDIA TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing demand for electric buses

5.2.1.2 Government-led programs to boost adoption of eco-friendly bus seat materials

5.2.1.3 Development of lightweight and biodegradable seating materials

FIGURE 16 MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High cost associated with retrofitting legacy buses with new seats

FIGURE 17 MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Improved ergonomics for driver and passenger seats in buses

5.2.3.2 Increased safety for school bus seats

5.2.3.2.1 Case study: Student detection system school bus motion sensor technology

FIGURE 18 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 High cost of eco-friendly raw materials

FIGURE 19 MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 BUS SEAT MARKET: VALUE CHAIN (2022)

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 IMPACT OF PORTER’S FIVE FORCES ON MARKET, 2022-2027

5.5 ECOSYSTEM ANALYSIS

FIGURE 21 MARKET: ECOSYSTEM

TABLE 11 MARKET: ECOSYSTEM

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

5.7 CASE STUDIES

5.7.1 CHILDPROOF BUS SEATS

5.7.2 ADVANCED POLYURETHANE-BASED BUS SEATS

5.7.3 ERGONOMIC BUS SEATS

5.8 TECHNOLOGY ANALYSIS

5.8.1 SMART SEAT OCCUPANCY DETECTION SYSTEM

5.8.2 SEAT TEMPERATURE-AIDED COMFORT

5.8.3 LIGHTWEIGHT MATERIALS IN SEAT MANUFACTURING

5.9 PRICING ANALYSIS

TABLE 12 AVERAGE SELLING PRICE (ASP) RANGE OF BUS SEATS, BY COMFORT TYPE, 2022–2027

5.9.1 AVERAGE SELLING PRICE (ASP) OF KEY PLAYER OFFERINGS, BY BUS SEAT

FIGURE 23 AVERAGE SELLING PRICES OF KEY PLAYER OFFERINGS, BY BUS SEAT

TABLE 13 AVERAGE SELLING PRICE (ASP) OF KEY PLAYER OFFERINGS, BY BUS SEAT (USD)

5.10 KEY CONFERENCES AND EVENTS BETWEEN 2022 AND 2024

TABLE 14 BUS SEAT MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.11 TRADE ANALYSIS

TABLE 15 IMPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

FIGURE 24 IMPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 16 EXPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

FIGURE 25 EXPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.11.1 PATENTS ANALYSIS

FIGURE 26 ANALYSIS OF PATENTS FOR MARKET (2011–2021)

TABLE 17 LIST OF FEW PATENTS IN MARKET, 2019–2021

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

TABLE 18 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS (%)

5.12.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 END USERS

TABLE 19 KEY BUYING CRITERIA FOR TOP 3 END USERS

5.12.3 REGULATIONS AND STANDARDS

5.12.3.1 Regulatory bodies, government agencies, and other organizations

TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 BUS SEAT MARKET, BY COMPONENT (Page No. - 67)

6.1 INTRODUCTION

FIGURE 29 MARKET, BY COMPONENT

TABLE 23 MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 24 MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

6.2 FRAME

6.2.1 BUS SEAT FRAMES PROVIDE STRUCTURAL SUPPORT AND ANCHORAGE TO SEAT AND ITS COMPONENTS

6.3 UPHOLSTERY

6.3.1 UPHOLSTERY PLAYS CRITICAL ROLE IN PROVIDING COMFORT TO OCCUPANTS DURING LONG-DISTANCE TRAVEL

6.3.2 CASE STUDY: MAGNA INTERNATIONAL DEVELOPS FREEFOAM SEAT TRIMS

6.4 OTHER ACCESSORIES

7 BUS SEAT MARKET, BY COMFORT TYPE (Page No. - 71)

7.1 INTRODUCTION

FIGURE 30 MARKET, BY COMFORT TYPE

TABLE 25 MARKET, BY COMFORT TYPE, 2018–2021 (USD BILLION)

TABLE 26 MARKET, BY COMFORT TYPE, 2022–2027 (USD BILLION)

7.2 LOW COMFORT

7.2.1 LOW COMFORT SEATS ARE DEPLOYED IN ALL BUS TYPES

7.3 HIGH COMFORT

7.3.1 HIGH COMFORT SEATS ARE HIGH IN DEMAND IN DEVELOPED COUNTRIES

8 BUS SEAT MARKET, BY SEAT TYPE (Page No. - 74)

8.1 INTRODUCTION

FIGURE 31 MARKET, BY SEAT TYPE

TABLE 27 MARKET, BY SEAT TYPE, 2018–2021 (USD BILLION)

TABLE 28 MARKET, BY SEAT TYPE, 2022–2027 (USD BILLION)

8.2 REGULAR PASSENGER SEAT

8.2.1 INCREASED ADOPTION OF ELECTRIC BUSES IN PUBLIC TRANSPORTATION TO FUEL DEMAND FOR REGULAR PASSENGER SEATS

8.3 RECLINER SEAT

8.3.1 RISING DEPLOYMENT OF RECLINER SEATS IN LONG-DISTANCE HAUL BUSES TO DRIVE MARKET GROWTH

9 BUS SEAT MARKET, BY BUS TYPE (Page No. - 77)

9.1 INTRODUCTION

FIGURE 32 MARKET, BY BUS TYPE

TABLE 29 MARKET, BY BUS TYPE, 2018–2021 (USD BILLION)

TABLE 30 MARKET, BY BUS TYPE, 2022–2027 (USD BILLION)

9.2 TRANSIT BUS

9.2.1 RISING DEMAND FOR TRANSIT BUSES WITH GROWING GLOBAL POPULATION

TABLE 31 MARKET FOR TRANSIT BUS, BY REGION, 2018–2021 (USD BILLION)

TABLE 32 MARKET FOR TRANSIT BUS, BY REGION, 2022–2027 (USD BILLION)

TABLE 33 MARKET FOR TRANSIT BUS, BY COMFORT TYPE, 2018–2021 (USD BILLION)

TABLE 34 MARKET FOR TRANSIT BUS, BY COMFORT TYPE, 2022–2027 (USD BILLION)

TABLE 35 MARKET FOR TRANSIT BUS, BY SEAT TYPE, 2018–2021 (USD BILLION)

TABLE 36 MARKET FOR TRANSIT BUS, BY SEAT TYPE, 2022–2027 (USD BILLION)

9.3 COACH BUS

9.3.1 INCREASING DEMAND FOR COACH BUSES WITH RISING DISPOSABLE INCOMES OF MIDDLE-CLASS POPULATION

TABLE 37 MARKET FOR COACH BUS, BY REGION, 2018–2021 (USD BILLION)

TABLE 38 MARKET FOR COACH BUS, BY REGION, 2022–2027 (USD BILLION)

TABLE 39 MARKET FOR COACH BUS, BY COMFORT TYPE, 2018–2021 (USD BILLION)

TABLE 40 MARKET FOR COACH BUS, BY COMFORT TYPE, 2022–2027 (USD BILLION)

TABLE 41 MARKET FOR COACH BUS, BY SEAT TYPE, 2018–2021 (USD BILLION)

TABLE 42 MARKET FOR COACH BUS, BY SEAT TYPE, 2022–2027 (USD BILLION)

9.4 SCHOOL BUS

9.4.1 GROWING DEMAND FOR SCHOOL BUSES FOR SAFE TRANSPORTATION OF CHILDREN

TABLE 43 BUS SEAT MARKET FOR SCHOOL BUS, BY REGION, 2018–2021 (USD BILLION)

TABLE 44 MARKET FOR SCHOOL BUS, BY REGION, 2022–2027 (USD BILLION)

TABLE 45 MARKET FOR SCHOOL BUS, BY COMFORT TYPE, 2018–2021 (USD BILLION)

TABLE 46 MARKET FOR SCHOOL BUS, BY COMFORT TYPE, 2022–2027 (USD BILLION)

TABLE 47 MARKET FOR SCHOOL BUS, BY SEAT TYPE, 2018–2021 (USD BILLION)

TABLE 48 MARKET FOR SCHOOL BUS, BY SEAT TYPE, 2022–2027 (USD BILLION)

9.5 TRANSFER BUS

9.5.1 TRANSFER BUSES ARE INCREASINGLY USED FOR COMMUTING WORKERS FROM OFFICE TO RESIDENCE

TABLE 49 MARKET FOR TRANSFER BUS, BY REGION, 2018–2021 (USD BILLION)

TABLE 50 MARKET FOR TRANSFER BUS, BY REGION, 2022–2027 (USD BILLION)

TABLE 51 MARKET FOR TRANSFER BUS, BY COMFORT TYPE, 2018–2021 (USD BILLION)

TABLE 52 MARKET FOR TRANSFER BUS, BY COMFORT TYPE, 2022–2027 (USD BILLION)

TABLE 53 MARKET FOR TRANSFER BUS, BY SEAT TYPE, 2018–2021 (USD BILLION)

TABLE 54 MARKET FOR TRANSFER BUS, BY SEAT TYPE, 2022–2027 (USD BILLION)

9.6 OTHERS

TABLE 55 MARKET FOR OTHERS, BY REGION, 2018–2021 (USD BILLION)

TABLE 56 MARKET FOR OTHERS, BY REGION, 2022–2027 (USD BILLION)

TABLE 57 MARKET FOR OTHERS, BY COMFORT TYPE, 2018–2021 (USD BILLION)

TABLE 58 MARKET FOR OTHERS, BY COMFORT TYPE, 2022–2027 (USD BILLION)

TABLE 59 MARKET FOR OTHERS, BY SEAT TYPE, 2018–2021 (USD BILLION)

TABLE 60 MARKET FOR OTHERS, BY SEAT TYPE, 2022–2027 (USD BILLION)

10 BUS SEAT MARKET, BY REGION (Page No. - 89)

10.1 INTRODUCTION

FIGURE 33 MARKET, BY REGION

TABLE 61 MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 62 MARKET, BY REGION, 2022–2027 (USD BILLION)

10.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA MARKET: SNAPSHOT

TABLE 63 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 64 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD BILLION)

10.2.1 US

10.2.1.1 Growing luxury seat and integrated child seat markets to drive US market growth

10.2.1.2 Use case: Recliner seat for coach bus

10.2.2 CANADA

10.2.2.1 Rising deployment of transit buses to fuel demand for bus seats

10.2.3 MEXICO

10.2.3.1 Growing demand for buses for intercity transport in post-COVID-19 period to drive market growth

10.2.3.2 Use case: Recliner seats for semi-luxury buses

10.3 EUROPE

FIGURE 35 EUROPE BUS SEAT MARKET: SNAPSHOT

TABLE 65 MARKET FOR EUROPE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 66 MARKET FOR EUROPE, BY COUNTRY, 2022–2027 (USD BILLION)

10.3.1 UK

10.3.1.1 Increasing demand for high comfort seats in luxury buses to drive market growth

10.3.1.2 Use case: Heated and ventilated recliner seat coach buses

10.3.2 GERMANY

10.3.2.1 Development of new technologies for bus seats to drive market growth

10.3.3 FRANCE

10.3.3.1 Improving ergonomics of bus seats used in public transit in France to drive market growth

10.3.4 ITALY

10.3.4.1 Growing demand for transit buses to fuel market growth

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC BUS SEAT MARKET: SNAPSHOT

TABLE 67 MARKET FOR ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 68 MARKET FOR ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD BILLION)

10.4.1 CHINA

10.4.1.1 Regular passenger bus seats to witness highest demand in China

10.4.1.2 Use case: Regular passenger seats in transfer buses

10.4.2 JAPAN

10.4.2.1 Rising demand for high comfort recliner seats for premium coach buses to drive market growth in Japan

10.4.3 SOUTH KOREA

10.4.3.1 Increasing use of public transit to fuel demand for seats in South Korea

10.4.4 INDIA

10.4.4.1 Demand for regular passenger seats to grow significantly in India

10.4.5 REST OF ASIA PACIFIC

10.5 REST OF WORLD

FIGURE 37 SNAPSHOT MARKET IN ROW

TABLE 69 MARKET FOR REST OF WORLD, BY REGION, 2018–2021 (USD BILLION)

TABLE 70 MARKET FOR REST OF WORLD, BY REGION, 2022–2027 (USD BILLION)

10.5.1 MIDDLE EAST

10.5.1.1 Replacement of urban bus transit with electric buses to fuel demand for bus seats

10.5.2 AFRICA

10.5.2.1 Rising demand for regular passenger seats to boost market growth

10.5.3 SOUTH AMERICA

10.5.3.1 Blooming tourism industry to drive the demand for bus seats in the region

11 COMPETITIVE LANDSCAPE (Page No. - 103)

11.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 71 KEY STRATEGIES ADOPTED BY TOP PLAYERS DURING LAST 5 YEARS

11.2 OVERVIEW

11.3 TOP FIVE COMPANY REVENUE ANALYSIS

FIGURE 38 MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019–2021

11.4 MARKET SHARE ANALYSIS, 2021

TABLE 72 MARKET: MARKET SHARE ANALYSIS (2021)

11.5 COMPETITIVE LEADERSHIP MAPPING

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 39 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

11.6 SMALL- AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX, 2021

11.6.1 PROGRESSIVE COMPANY

11.6.2 RESPONSIVE COMPANY

11.6.3 DYNAMIC COMPANY

11.6.4 STARTING BLOCK

FIGURE 40 BUS SEAT MARKET (GLOBAL), SME EVALUATION QUADRANT, 2021

11.7 STARTUP EVALUATION MATRIX

TABLE 73 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 74 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.8 MARKET: COMPANY FOOTPRINT

TABLE 75 COMPANY FOOTPRINT

TABLE 76 PRODUCT FOOTPRINT OF COMPANIES

TABLE 77 APPLICATION FOOTPRINT OF COMPANIES

TABLE 78 REGIONAL FOOTPRINT OF COMPANIES

11.9 COMPETITIVE SITUATIONS AND TRENDS

TABLE 79 MARKET: PRODUCT LAUNCHES, 2019–2022

TABLE 80 MARKET: DEALS, 2019–2022

12 COMPANY PROFILES (Page No. - 117)

(Business Overview, Products Offered, Recent Developments, and MnM View)*

12.1 KEY PLAYERS

12.1.1 FAURECIA

TABLE 81 FAURECIA.: BUSINESS OVERVIEW

FIGURE 41 FAURECIA: COMPANY SNAPSHOT

TABLE 82 FAURECIA: PRODUCT OFFERINGS

12.1.2 GRAMMER

TABLE 83 GRAMMER: BUSINESS OVERVIEW

FIGURE 42 GRAMMER: COMPANY SNAPSHOT

TABLE 84 GRAMMER: PRODUCT OFFERINGS

12.1.3 MAGNA INTERNATIONAL

TABLE 85 MAGNA INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 43 MAGNA INTERNATIONAL: COMPANY SNAPSHOT

TABLE 86 MAGNA INTERNATIONAL INC: PRODUCT OFFERINGS

12.1.4 FREEDMAN SEATING COMPANY

TABLE 87 FREEDMAN SEATING COMPANY: BUSINESS OVERVIEW

TABLE 88 FREEDMAN SEATING COMPANY: PRODUCT OFFERINGS

12.1.5 FRANZ KEIL

TABLE 89 FRANZ KEIL: BUSINESS OVERVIEW

TABLE 90 FRANZ KEIL: PRODUCT OFFERINGS

12.1.6 ADIENT

TABLE 91 ADIENT: BUSINESS OVERVIEW

FIGURE 44 ADIENT: COMPANY SNAPSHOT

TABLE 92 ADIENT: PRODUCT OFFERINGS

12.1.7 NHK SPRINGS

TABLE 93 NHK SPRINGS: BUSINESS OVERVIEW

FIGURE 45 NHK SPRINGS: COMPANY SNAPSHOT

TABLE 94 NHK SPRING CO. LTD.: PRODUCT OFFERINGS

12.1.8 TOYOTA BOSHOKU

TABLE 95 TOYOTA BOSHOKU CORPORATION: BUSINESS OVERVIEW

FIGURE 46 TOYOTA BOSHOKU: COMPANY SNAPSHOT

TABLE 96 TOYOTA BOSHOKU CORPORATION: PRODUCT OFFERINGS

12.1.9 IRINGHAUSEN GMBH

TABLE 97 ISRINHAUSEN GMBH: BUSINESS OVERVIEW

TABLE 98 ISRINGHAUSEN GMBH: PRODUCT OFFERINGS

12.1.10 TACHI-S

TABLE 99 TACHI-S: BUSINESS OVERVIEW

FIGURE 47 TACHI-S: COMPANY SNAPSHOT

TABLE 100 TACHI-S: PRODUCT OFFERINGS

12.1.11 LEAR CORPORATION

TABLE 101 LEAR CORPORATION: BUSINESS OVERVIEW

FIGURE 48 LEAR CORPORATION: COMPANY SNAPSHOT

TABLE 102 LEAR: PRODUCT OFFERINGS

12.2 OTHER PLAYERS

12.2.1 MINDA INDUSTRIES

TABLE 103 MINDA INDUSTRIES: COMPANY OVERVIEW

12.2.2 COMMERCIAL VEHICLE GROUP

TABLE 104 COMMERCIAL VEHICLE GORUP: COMPANY OVERVIEW

12.2.3 NINGBO JIFENG AUTO PARTS

TABLE 105 NINGBO JIFENG AUTOPARTS: COMPANY OVERVIEW

12.2.4 PINNACLE INDUSTRIES

TABLE 106 PINNACLE INDUSTRIES: COMPANY OVERVIEW

12.2.5 PRAKASH SEATING

TABLE 107 PRAKASH SEATING: COMPANY OVERVIEW

12.2.6 TATA AUTOCOMP SYSTEMS

TABLE 108 TATA AUTOCOMP SYSTEMS LTD: COMPANY OVERVIEW

12.2.7 RECARO AUTOMOTIVE

TABLE 109 RECARO AUTOMOTIVE: COMPANY OVERVIEW

12.2.8 LAZZERINI

TABLE 110 LAZZERINI SRL: COMPANY OVERVIEW

12.2.9 IMMI

TABLE 111 IMMI: COMPANY OVERVIEW

12.2.10 GUANGZHOU ONMUSE JINLI AUTOMOTIVE SEAT

TABLE 112 GUANGZHOU ONMUSE JINLI AUTOMOTIVE SEAT: COMPANY OVERVIEW

12.2.11 PHEONIX SEATING

TABLE 113 PHEONIX SEATING: COMPANY OVERVIEW

12.2.12 JIULONG AUTO SEAT

TABLE 114 JIULONG AUTO SEAT: COMPANY OVERVIEW

12.2.13 CHANGZHOU JINTAN YUANYUN IMPORT & EXPORT

TABLE 115 CHANGZHOU JINTAN YUANYUN IMPORT & EXPORT: COMPANY OVERVIEW

12.2.14 SEATS INC.

TABLE 116 SEATS INC.: COMPANY OVERVIEW

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 154)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

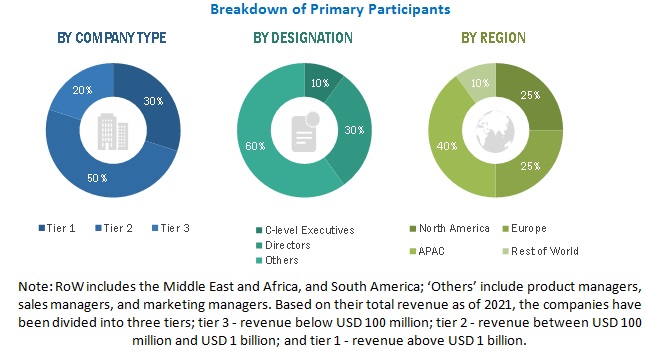

The study involved four major activities in estimating the size of the bus seat market. Extensive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

The secondary sources referred to for this research study include organizations such as Automotive Research Association of India, Society of India Automobile Manufacturer, National Highasy Traffic Safety Administration, Quality Association of Bus Comfort and so on; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, and business. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the bus seat market scenario through secondary research. In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related executives from various key companies and organizations operating in the bus seat market. After the complete market engineering (which includes calculations for the market statistics, market breakdown, data triangulation, market estimation, and market forecasting), extensive primary research has been conducted to gather information and verify and validate the critical numbers obtained.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the bus seat market. These methods were also extensively used to estimate the sizes of various market sub-segments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define and forecast the size of Bus Seat market based on components, comfort type, seat type, bus type, and region in terms of volume and value

- To describe and forecast the size of the Bus seat market in four key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the Bus Seat market

- To provide a detailed impact of COVID-19 on the Bus Seat market

- To provide the impact of COVID-19 on the market segments and players operating in the bus seat market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the bus seat market ecosystem

- To strategically profile the key players and comprehensively analyze their market position in terms of their ranking and core competencies2, and provide their detailed competitive landscape

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the bus seat market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bus Seat Market