Brewing Ingredients Market by Source (Malt Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives), Brewery Size (Macro Brewery and Craft Brewery), Form (Dry and Liquid), and Region - Global Forecast to 2026

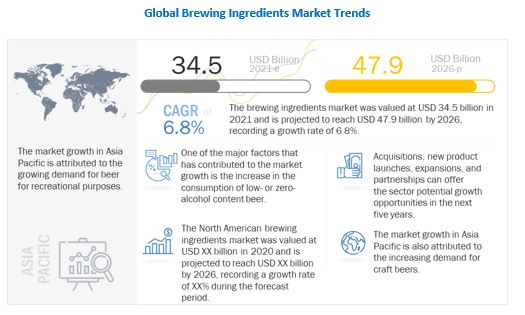

The global brewing ingredients market was valued 34.5 billion in 2021 and is projected to reach USD 47.9 billion by 2026, growing at a CAGR of 6.8% during the study period. The rise in demand for beers from all over the globe coupled with increasing consumption of craft beers will drive the market demand and growth of brewing ingredients globally.

To know about the assumptions considered for the study, Request for Free Sample Report

Various opportunities in near future such as introduction of new flavors in the beer market and increase in demand for organic beers will boost the demand of brewing ingredients market globally.

According to the Organic Trade Association, US organic beer sales increased more than tenfold since 2003, from USD 9 million to USD 92 million in 2014. Peak Organic Brewing Co. offers organic beers of different types, such as ale and pilsner. Consumer are becoming more aware about their intake which is resulting in the increasing in the demand for organic products and clean label food & beverages with maximum use of natural raw materials with information regarding the traceability of the raw materials used. The concern for traces of pesticides has also resulted in a rise in demand for organic beer, which provide a major opportunity to the brewing ingredients manufactures.

Brewing Ingredients Market Dynamics

Drivers: Increasing demand for low- or zero-alcohol content beer

With changing lifestyles, there is an increase in health awareness. This awareness has created a demand for healthier products in the food & beverage industry. Due to this, the demand for beer with low-alcohol content is increasing. According to the ADM survey, in 2020, a total of 51% of consumers are looking for items that contribute to their metabolic health to promote healthy weight. Low-alcohol products are no longer considered inferior ones. On the other hand, these products are more in demand, as they offer the taste and experience of alcohol - minus the guilt. Consumers are looking for beers with high protein and other nutritious content and reduced carb, sugar, and alcohol content.

The young population, in particular, is more health aware and looking for healthy beverages that won’t sabotage their health goals and commitments. Heineken USA conducted a survey of millennials in 2020, which showed that 52% of respondents had increased the consumption of alcohol-free beer and mocktails. Another major factor for the increase in demand for zero-alcohol content beer is that it allows consumers to drink in moderation and regularly. The survey also shows that 42% of respondents were likely to choose an alcohol-free beer because it allows them to drink regularly.

Restraint: Stringent regulations in the beer industry

Brewing ingredients such as malt, yeast, hops, and beer additives are used in different combinations to produce different beers with varying alcohol content. The beer industry faces many stringent regulations which limit its sale and consumption in different countries. In the US, several government agencies such as the US FDA, US TTB (Alcohol and Tobacco Tax and Trade Bureau), and the US EPA (Environmental Protection Agency) are responsible for stringent rules regarding the impact of beer packaging materials & emissions on the environment. Moreover, rules regarding the legal age for the consumption of alcoholic beverages limit the sale of beers. For example, Minimum Legal Drinking Age (MLDA) laws specify the legal age when an individual can purchase alcoholic beverages. The MLDA in the US is 21 years. This regulation has a hindering impact on sales and thus limits production. Thus, this negatively affects the brewing ingredients market.

Opportunity: Introduction of new flavors in beer

The increase in beverage consumption has led to intense competition amongst beer brands, resulting in the introduction of new flavors and increasing beer consumption. There is a growing popularity for craft beers as it offers various flavors besides the regular flavors offered by macro breweries. The introduction of new ingredients and innovative flavors, combining salty, fruity, and tart flavors, by craft beers, has found an increasing appeal among the millennial crowd globally. Some of the macro brewers are also acting on to respond to these changing demands from consumers. For example, Heineken USA, in 2021, launched Dos Equis Lime & Salt variety pack of lager beer. Similarly, Latambarcem Brewery (India), in 2020, launched a new craft beer brand called Maka di that currently serves four brews: Honey Ale, Belgian Tripel, Bavarian Keller, and Belgian Blanche. The introduction of these new flavors is projected to increase the sales and consumption of beer. Thus, this is anticipated to provide ample opportunities to players operating in the brewing ingredients market.

Challenge: Consumer shift to alternative beverages in North America

According to an article published in CNN, by author Jordan Valinsky, in 2019-December, beer consumers in the US are moving toward different and innovative alcoholic drinks for recreational purposes such as premium liquor, canned wine, spiked seltzers, and pre-made bottled cocktails. Consumers in the US are considering beer as an outdated recreational drink. According to the ISWR Drinks Market Analysis, in 2018, alcohol consumption in the US dropped for the third straight year. This drop was majorly due to a decline in beer sales, which dropped 1.5% in 2018 compared to 2017. Moreover, for the past five years, beer volume in the US has declined by 2.4%. Similarly, the consumption of beer in Canada is decreasing due to demographic shifts with the rising senior population. Also, changing consumer tastes, the overall high tax, and the price of the product have led to the decline in the consumption of beers in Canada. According to Statistics Canada, by volume, beer sales declined 0.3% from a year prior to 2,209 million liters in 2018/2019. This volume is equivalent to 4.1 bottles of beer sold per week per person over the legal drinking age in Canada (1 bottle = 341 ml, 5% alcohol content).

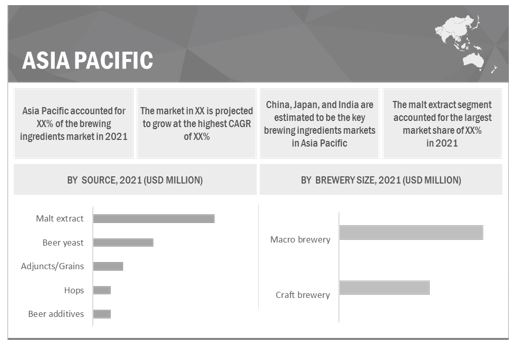

By source, the malt extract segment is estimated to hold the largest share in the brewing ingredients market

The market includes five major sources: malt extract, adjuncts/grains, hops, beer yeast, and beer additives. The malt extract segment is further bifurcated into standard malt and specialty malts. Brewing-grade malt extracts are made with the highest-quality brewing malts and get additional colors and flavors from using specialty malts. This gives beer the unique character and flavor desired for the particular style brew. These malts often have a longer time in the kiln, at higher temperatures, or get roasted to add depth, complexity, and flavor to the resulting beer. Specialty malts include less in the way of sugars but have a greater influence on the color of the beer. These malts are widely used in craft beers.

By brewery size, the craft brewery is estimated to grow at a higher growth rate in the brewing ingredients market.

According to the Brewers Association, an American craft brewer is a small and independent brewer, where small breweries have an annual production of 6 million barrels of beer or less. The craft brewing industry contributed USD 82.9 billion to the US economy in 2019, with more than 580,000 employees. The average alcohol by volume (ABV) content of a craft beer is 5% to 10%, but some of the most popular craft beers have an ABV of as high as 40%. On the other hand, beer produced in bulk by macro breweries has an ABV of 4% to 6% and as little as 2%. Craft breweries offer different flavors, which allow consumers with different tastes to cater to their preferences. These factors are driving the growth of the craft brewery segment in the global market.

By form, the dry segment is projected to grow at the fastest CAGR in the brewing ingredients market until 2026.

Dry brewing ingredients such as dry malt extract (DME) are produced the same way as liquid malt extract, except it goes through an additional dehydration step, which reduces the water content down to about 2%. Because of the lower water content, DME tends to have a better shelf life without the darkening issues of light malt extract. It offers more fermentable extract by weight. Thus less of it is required to achieve the target gravity. Moreover, as a powder, DME is easier to measure in precise increments. With a digital scale, it can be measured out in fractions of an ounce. This makes DME a great choice for priming, supplementing beer recipes, and for making gravity adjustments.

The increasing demand for beers in the Asia Pacific countries drives the region's growth rate at a higher pace.

The Asia Pacific region comprises two high-growth economies: India and China. The drinking preferences of the population in this region are gradually shifting toward alcoholic culture. The large, increasing population and the growing market mean that the demand for brewing ingredients is still promising. Another factor is the densely populated areas that are not completely tapped by beer manufacturing and brewing ingredient companies. Hence, beer produced in macro breweries and craft breweries still has a high-growth rate. Moreover, the increasing spending capacity of consumers has led to a surge in demand for craft beers. There has been an emergence of various craft breweries in countries such as India over the last few years.

The APAC region held the largest share in the brewing ingredients market. The demand for different beers with various flavors and different ABV is driven by economic growth, drinking culture in countries such as Vietnam and South Korea, urbanization, and the rise in the purchasing power of consumers.

Top Companies in the Brewing Ingredients Market

Key players in this market include major players such as Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK) . These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the report

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 34.5 billion |

|

Revenue Forecast in 2026 |

USD 47.9 billion |

|

Growth Rate |

CAGR of 6.8 % from 2021 to 2026 |

|

Forecast Period |

2021-2026 |

|

Historical Base Year |

2020 |

|

Segmentation |

|

|

Regional Scope |

|

|

Dominant Geography |

Asia Pacific |

|

Key companies profiled |

|

This research report categorizes the brewing ingredients market based on source, brewery size, form, and region.

On the basis of source, the market has been segmented as follows:

- Malt extract

- Adjuncts/Grains

- Hops

- Beer yeast

- Beer additives

On the basis of brewery size, the market has been segmented as follows:

- Macro brewery

- Craft brewery

On the basis of form, the market has been segmented as follows:

- Dry

- Liquid

On the basis of region, the market has been segmented as follows

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Key Features of the Brewing Ingredients Market

- Wide range of ingredients: The brewing ingredients market offers a diverse range of ingredients including grains, hops, yeast, adjuncts, and enzymes to suit the needs of different types of beer and brewing methods.

- Quality and consistency: To ensure consistent quality and taste, brewing ingredients are sourced from reputable suppliers and are often of the highest quality.

- Organic and natural options: As consumers become more health-conscious, there is a growing demand for organic and natural ingredients. Many brewing ingredient suppliers now offer these options.

- Innovative ingredients: The brewing ingredients market is constantly evolving, with new ingredients and technologies being developed to enhance the taste and quality of beer.

- Local sourcing: Many breweries are now sourcing ingredients from local suppliers to reduce transportation costs and support the local economy.

- Specialty ingredients: The brewing ingredients market also offers a range of specialty ingredients such as spices, fruits, and herbs, to create unique and flavored beers.

Brewing Ingredients Market Industry News

- In July 2020, Cargill Incorporated launched C?TruSweet 01795 to enable a 30% sugar and calorie reduction in beverages and other food applications via lower usage levels

- In May 2021, Angel Yeast Co. Ltd. plans to establish a green manufacturing project of yeast extracts with an annual output of 15,000 tons

- In April 2021, Boortmalt announced its plans to reopen its malting facility at Cavan, South Australia (SA), to increase the production of malt to meet the increasing demand

Frequently Asked Questions (FAQ):

What is the current size of the global brewing ingredients market?

The global brewing ingredients market was valued 34.5 billion in 2021 and is projected to reach USD 47.9 billion by 2026, growing at a CAGR of 6.8% during the study period.

Which are the major key players in the brewing ingredients market?

Key players in this market include major players such as Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK).

What are some emerging trends in the brewing ingredients market?

Emerging trends in the brewing ingredients market may include:

- Natural and organic ingredients: Consumers are looking for beers made with organic and natural ingredients.

- Adventurous flavors and functionality: Brewers are experimenting with new flavor combinations and ingredients that offer health benefits.

- Alternative grains: Gluten-free and other dietary needs are driving the use of grains like sorghum and quinoa in brewing.

- Sustainability: Brewers are focusing on reducing waste and using eco-friendly practices.

- Dry ingredients gain popularity: Dry malt extract (DME) is becoming a preferred choice due to its advantages over liquid malt extract.

Which region is projected to account for the largest share of the brewing ingredients market?

The APAC region held the largest share in the brewing ingredients market. The demand for different beers with various flavors and different ABV is driven by economic growth, drinking culture in countries such as Vietnam and South Korea, urbanization, and the rise in the purchasing power of consumers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 BREWING INGREDIENTS MARKET: REGIONS COVERED

1.4 INCLUSIONS & EXCLUSIONS

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2020

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 3 BREWING INGREDIENTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Brewing ingredients market: primary validations

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION – SUPPLY SIDE (1/2)

FIGURE 5 MARKET SIZE ESTIMATION – SUPPLY SIDE (2/2)

FIGURE 6 MARKET SIZE ESTIMATION – DEMAND SIDE

2.2.1 MARKET SIZE ESTIMATION NOTES

FIGURE 7 MARKET SIZE ESTIMATION – TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION – BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

FIGURE 10 SCENARIO-BASED MODELLING

2.6.1 COVID-19 HEALTH ASSESSMENT

FIGURE 11 COVID-19: GLOBAL PROPAGATION

FIGURE 12 COVID-19 PROPAGATION: SELECT COUNTRIES

2.7 COVID-19 ECONOMIC ASSESSMENT

FIGURE 13 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.7.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 14 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 15 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 16 BREWING INGREDIENTS MARKET, BY SOURCE, 2021 VS. 2026 (USD MILLION)

FIGURE 17 MARKET, BY BREWERY SIZE, 2021 VS. 2026 (USD MILLION)

FIGURE 18 MARKET SIZE, BY FORM, 2021 VS. 2026 (USD MILLION)

FIGURE 19 MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 BRIEF OVERVIEW OF THE BREWING INGREDIENTS MARKET

FIGURE 20 INCREASING DEMAND FOR CRAFT BEERS IS PROJECTED TO DRIVE THE BREWING INGREDIENTS MARKET

4.2 ASIA PACIFIC BREWING INGREDIENTS MARKET, BY SOURCE AND COUNTRY

FIGURE 21 MALT EXTRACT SEGMENT DOMINATED THE ASIA PACIFIC MARKET IN 2020

4.3 MARKET, BY BREWERY SIZE AND REGION

FIGURE 22 MACRO BREWERY SEGMENT DOMINATED THE MARKET ACROSS REGIONS IN 2020

4.4 MARKET, BY REGION

FIGURE 23 ASIA PACIFIC PROJECTED TO DOMINATE THE MARKET ACROSS REGIONS BY 2026 (USD MILLION)

4.5 MARKET, BY KEY COUNTRY

FIGURE 24 CHINA TO BE THE MOST LUCRATIVE MARKET FOR BREWING INGREDIENTS

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASING GLOBAL POPULATION

TABLE 2 POPULATION COMPARISON, 2009-2019

FIGURE 25 POPULATION GROWTH TREND, 1950–2050

5.2.2 RAPID URBANIZATION

TABLE 3 URBAN POPULATION PERCENTAGE, 2019

5.3 MARKET DYNAMICS

FIGURE 26 MARKET DYNAMICS: BREWING INGREDIENTS MARKET

5.3.1 DRIVERS

5.3.1.1 Rising beer consumption in emerging economies

FIGURE 27 PER CAPITA CONSUMPTION OF ALCOHOL, 2018 (LITERS)

FIGURE 28 CONSUMPTION OF BEER IN DIFFERENT COUNTRIES, 2018 (THOUSANDS OF KILO LITERS)

5.3.1.2 Increasing demand for low- or zero-alcohol content beer

TABLE 4 SURVEY ON LOW-ALCOHOL ALTERNATIVES, 2019

5.3.2 RESTRAINTS

5.3.2.1 Stringent regulations in the beer industry

5.3.3 OPPORTUNITIES

5.3.3.1 Introduction of new flavors in beer

TABLE 5 STUDY ON CONSUMER PREFERENCE FOR CRAFT BEER, 2018

5.3.3.2 Increase in demand for organic and clean label beers

5.3.4 CHALLENGES

5.3.4.1 Consumer shift to alternative beverages in North America

5.3.4.2 Fluctuations in the production of raw materials for brewing ingredients

5.4 IMPACT OF COVID-19 ON THE MARKET DYNAMICS

6 INDUSTRY TRENDS (Page No. - 56)

6.1 INTRODUCTION

6.2 YC-YCC SHIFT

FIGURE 29 YC-YCC SHIFT FOR THE MARKET

6.3 VALUE CHAIN ANALYSIS

FIGURE 30 BREWING INGREDIENTS MARKET: VALUE CHAIN ANALYSIS

6.4 ECOSYSTEM MAP

FIGURE 31 MARKET MAP

TABLE 6 MARKET ECOSYSTEM

6.4.1 RAW MATERIAL SUPPLIERS

6.4.2 MANUFACTURERS

6.4.3 END-USER COMPANIES

6.5 SUPPLY CHAIN ANALYSIS

FIGURE 32 BREWING INGREDIENT MANUFACTURERS (B2B PLAYERS): SUPPLY CHAIN

6.5.1 RAW MATERIAL SOURCING

6.5.2 MANUFACTURING

6.5.3 DISTRIBUTION, MARKETING & SALES

6.6 TRADE ANALYSIS OF THE BREWING INDUSTRY AS A COMMODITY ACROSS MAJOR COUNTRIES

TABLE 7 TRADE DATA (IMPORT) FOR MALT (ROASTED AND NOT ROASTED) FOR THE BREWING INDUSTRY (2020)

6.7 TECHNOLOGY ANALYSIS

6.7.1 DEVELOPMENT OF CAVITATION AS A BREWING PROCESS

6.7.2 USE OF ADVANCED CENTRIFUGE TECHNOLOGY

6.7.3 APPLICATION OF BOOM ALGAE FOR BREWING

6.7.4 ARTIFICIAL INTELLIGENCE IMBIBED REAL-TIME BREWING SYSTEM

6.8 PATENT ANALYSIS

FIGURE 33 LIST OF MAJOR PATENTS FOR BREWING INGREDIENTS

TABLE 8 KEY PATENTS FILED IN THE BREWING INGREDIENTS MARKET, 2018–2021

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 BREWING INGREDIENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.9.1 THREAT OF NEW ENTRANTS

6.9.2 THREAT OF SUBSTITUTES

6.9.3 BARGAINING POWER OF SUPPLIERS

6.9.4 BARGAINING POWER OF BUYERS

6.9.5 INTENSITY OF COMPETITIVE RIVALRY

6.10 PRICING ANALYSIS

FIGURE 34 AVERAGE SELLING PRICE TREND OF BREWING INGREDIENTS, 2016-2020

6.11 CASE STUDY ANALYSIS

TABLE 10 BOORTMALT: USE OF COMPUTERIZED MAINTENANCE MANAGEMENT SYSTEM (CMMS)

TABLE 11 MALTEUROP GROUPE: ADOPTION OF HIGH CORROSION RESISTANCE EQUIPMENT

TABLE 12 VIKING MALT: INSTALLATION OF SENSOR-EQUIPPED FANS

7 REGULATIONS (Page No. - 68)

7.1 NORTH AMERICA

7.1.1 US

7.1.2 CANADA

7.1.3 MEXICO

7.2 EUROPE

7.2.1 UK

7.2.2 FRANCE

7.2.3 RUSSIA

7.2.4 ITALY

7.3 ASIA PACIFIC

7.3.1 CHINA

7.3.2 JAPAN

7.3.3 INDIA

7.4 SOUTH AMERICA

7.4.1 BRAZIL

8 BREWING INGREDIENTS MARKET, BY SOURCE (Page No. - 72)

8.1 INTRODUCTION

FIGURE 35 MALT EXTRACT ACCOUNTED FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 13 BREWING INGREDIENTS MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

8.1.1 COVID-19 IMPACT ON THE BREWING INGREDIENTS MARKET, BY SOURCE

8.1.1.1 Realistic scenario

TABLE 14 REALISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

8.1.1.2 Optimistic scenario

TABLE 15 OPTIMISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

8.1.1.3 Pessimistic scenario

TABLE 16 PESSIMISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

8.2 MALT EXTRACTS

8.2.1 INCREASING USE OF SPECIALTY MALTS IS PROJECTED TO DRIVE THE GROWTH OF THE MALT EXTRACT SEGMENT

TABLE 17 MALT EXTRACT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.2.1.1 Standard Malt

8.2.1.2 Specialty Malt

TABLE 18 MALT EXTRACT: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

8.2.1.2.1 Crystal

8.2.1.2.2 Roasted

8.2.1.2.3 Dark

8.2.1.2.4 Other specialty malts

TABLE 19 SPECIALTY MALT EXTRACT: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

8.3 ADJUNCTS/GRAINS

8.3.1 INCREASE IN DEMAND FOR LESS-PROCESSED BEVERAGES TO FUELTHE DEMAND FOR ADJUNCTS/GRAINS

TABLE 20 ADJUNCTS/GRAINS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3.1.1 Flakes

8.3.1.2 Flours

8.3.1.3 Grits

8.3.1.4 Cereals

8.3.1.5 Starches

8.3.1.6 Other adjuncts/grains

TABLE 21 ADJUNCTS/GRAINS: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

8.4 HOPS

8.4.1 HOPS ADD FLAVOR TO BEER, WHICH IS ANTICIPATED TO DRIVE THE GROWTH OF THE SEGMENT

TABLE 22 HOPS: BREWING INGREDIENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.4.1.1 Amarillo

8.4.1.2 Cascade

8.4.1.3 Centennial

8.4.1.4 Chinook

8.4.1.5 Other hops

TABLE 23 HOPS: BREWING INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

8.5 BEER YEAST

8.5.1 THEY ARE WIDELY USED TO FERMENT BEER, WHICH IS PROJECTED TO SUPPORT THE GROWTH OF THE SEGMENT

TABLE 24 BEER YEAST: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.5.1.1 Active dry yeast

8.5.1.2 Liquid yeast

TABLE 25 BEER YEAST: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

8.6 BEER ADDITIVES

8.6.1 BEER ADDITIVES PERFORM DIFFERENT FUNCTIONS SUCH AS STABILIZING THE FLAVORS AND COLORS AND ARE VITAL FOR PERFECT BEER PRODUCTION

TABLE 26 BEER ADDITIVES: BREWING INGREDIENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.6.1.1 Enzymes

8.6.1.1.1 Amylase

8.6.1.1.2 Beta-glucanase

8.6.1.1.3 Protease

8.6.1.1.4 Xylanase

8.6.1.2 Flavors & Bitterness Suppressors

8.6.1.3 Stability Agents

8.6.1.4 Protein Ingredients

8.6.1.5 Colors

8.6.1.6 Other beer additives

TABLE 27 BEER ADDITIVES: BREWING INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

9 BREWING INGREDIENTS MARKET, BY BREWERY SIZE (Page No. - 86)

9.1 INTRODUCTION

FIGURE 36 MARKET SIZE, BY BREWERY SIZE, 2021 VS. 2026

TABLE 28 MARKET SIZE, BY BREWERY SIZE, 2019–2026 (USD MILLION)

9.1.1 COVID-19 IMPACT ON THE BREWING INGREDIENTS MARKET, BY BREWERY SIZE

9.1.1.1 Realistic scenario

TABLE 29 REALISTIC SCENARIO: MARKET SIZE, BY BREWERY SIZE, 2018–2021 (USD MILLION)

9.1.1.2 Optimistic scenario

TABLE 30 OPTIMISTIC SCENARIO: MARKET SIZE, BY BREWERY SIZE, 2018–2021 (USD MILLION)

9.1.1.3 Pessimistic scenario

TABLE 31 PESSIMISTIC SCENARIO: MARKET SIZE, BY BREWERY SIZE, 2018–2021 (USD MILLION)

9.2 MACRO BREWERY

9.2.1 LOW PRICE COMPARED TO CRAFT BEERS TO SUPPORT THE GROWTH OF THE MACRO BREWERY SEGMENT

TABLE 32 MACRO BREWERY: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.3 CRAFT BREWERY

9.3.1 INTENSE AND DIFFERENT FLAVORS OFFERED BY CRAFT BREWERIES TO DRIVE THE GROWTH OF THE CRAFT BREWERY SEGMENT

TABLE 33 CRAFT BREWERY: BREWING INGREDIENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10 BREWING INGREDIENTS MARKET, BY FORM (Page No. - 91)

10.1 INTRODUCTION

FIGURE 37 DRY SEGMENT TO ACCOUNT FOR A LARGER SHARE IN THE BREWING INGREDIENTS MARKET

TABLE 34 MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

10.1.1 COVID-19 IMPACT ON THE BREWING INGREDIENTS MARKET, BY FORM

10.1.1.1 Realistic scenario

TABLE 35 REALISTIC SCENARIO: MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

10.1.1.2 Optimistic scenario

TABLE 36 OPTIMISTIC SCENARIO: MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

10.1.1.3 Pessimistic scenario

TABLE 37 PESSIMISTIC SCENARIO: MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

10.2 DRY

10.2.1 INCREASED SHELF LIFE OF BREWING INGREDIENTS IN THE DRY FORM IS PROJECTED TO FOSTER THE GROWTH OF THE SEGMENT

TABLE 38 DRY: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.3 LIQUID

10.3.1 EASE IN THE USAGE OF LIQUID BREWING INGREDIENTS TO DRIVE THE GROWTH OF THE SEGMENT

TABLE 39 LIQUID: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11 BREWING INGREDIENTS MARKET, BY REGION (Page No. - 96)

11.1 INTRODUCTION

FIGURE 38 US HELD THE LARGEST SHARE IN THE MARKET, 2020

TABLE 40 MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 41 MARKET SIZE, BY REGION, 2019–2026 (KT)

11.1.1 COVID-19 IMPACT ON THE BREWING INGREDIENTS MARKET, BY REGION

11.1.1.1 Realistic Scenario

TABLE 42 REALISTIC SCENARIO: COVID-19 IMPACT ON THE BREWING INGREDIENTS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.1.1.2 Optimistic Scenario

TABLE 43 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE BREWING INGREDIENTS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.1.1.3 Pessimistic Scenario

TABLE 44 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE BREWING INGREDIENTS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.2 NORTH AMERICA

TABLE 45 NORTH AMERICA: BREWING INGREDIENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY MALT EXTRACT, 2019–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY SPECIALTY MALT EXTRACT, 2019–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY ADJUNCTS/GRAINS, 2019–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY HOPS, 2019–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY BEER YEAST, 2019–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY BEER ADDITIVES, 2019–2026 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY BREWERY SIZE, 2019–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

11.2.1 US

11.2.1.1 Increase in the consumption of craft beers to drive the growth of the market

FIGURE 39 PER CAPITA BEER CONSUMPTION BY STATES IN THE US, 2019 (IN GALLONS)

TABLE 55 US: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Increasing craft beer sales to encourage the growth of the brewing ingredients market

TABLE 56 CANADA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Increasing per capita beer consumption to fuel the growth of the brewing ingredients market in the country

TABLE 57 MEXICO: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.3 EUROPE

FIGURE 40 EUROPEAN MARKET SNAPSHOT – GERMANY IS THE MOST LUCRATIVE MARKET

TABLE 58 EUROPE: BREWING INGREDIENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY MALT EXTRACT, 2019–2026 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY SPECIALTY MALT EXTRACT, 2019–2026 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY ADJUNCTS/GRAINS, 2019–2026 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY HOPS, 2019–2026 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY BEER YEAST, 2019–2026 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY BEER ADDITIVES, 2019–2026 (USD MILLION)

TABLE 66 EUROPE: MARKET SIZE, BY BREWERY SIZE, 2019–2026 (USD MILLION)

TABLE 67 EUROPE: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 High per capita consumption of beer to support the growth of the market in the country

FIGURE 41 CONSUMPTION OF BEER IN GERMANY, 2015 - 2018 (IN MILLIONS OF HECTOLITERS)

FIGURE 42 CONSUMER SPENDING ON BEER IN GERMANY, 2015 - 2018 (EURO MILLION)

TABLE 68 GERMANY: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.3.2 UK

11.3.2.1 Large-scale production of barley used in beer production to encourage the growth of the market

TABLE 69 UK: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.3.3 POLAND

11.3.3.1 Large-scale production of beer to support the growth of the market

TABLE 70 POLAND: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.3.4 SPAIN

11.3.4.1 Rise in on-premises consumption of beer to support the growth of the market in the country

TABLE 71 SPAIN: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.3.5 BELGIUM

11.3.5.1 Increasing beer export is projected to encourage the brewing ingredients market growth in the country

TABLE 72 BELGIUM: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.3.6 NETHERLANDS

11.3.6.1 Large volumes of beer export projected to encourage the brewing ingredients market in the country

TABLE 73 NETHERLANDS: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.3.7 FRANCE

11.3.7.1 Increasing beer consumption projected to encourage the brewing ingredients market in the country

TABLE 74 FRANCE: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.3.8 RUSSIA

11.3.8.1 Stringent regulations on alcohol sales and promotion to limit the growth of the brewing ingredients market in the country

TABLE 75 RUSSIA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.3.9 REST OF EUROPE

11.3.9.1 Increasing demand for craft beers leading to steady growth in the brewing ingredients market in the region

TABLE 76 REST OF EUROPE: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 43 ASIA PACIFIC MARKET SNAPSHOT – CHINA IS THE MOST LUCRATIVE MARKET

TABLE 77 ASIA PACIFIC: BREWING INGREDIENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY MALT EXTRACT, 2019–2026 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY SPECIALTY MALT EXTRACT, 2019–2026 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY ADJUNCTS/GRAINS, 2019–2026 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY HOPS, 2019–2026 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY BEER YEAST, 2019–2026 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET SIZE, BY BEER ADDITIVES, 2019–2026 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET SIZE, BY BREWERY SIZE, 2019–2026 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Increase in the consumption of premium beer to drive the growth of the market

TABLE 87 CHINA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Rising preference for craft beers to encourage the growth of the market

TABLE 88 INDIA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Higher taxation on beers projected to restrain the market growth

TABLE 89 JAPAN: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.4.4 VIETNAM

11.4.4.1 High consumption of beer anticipated to propel the market growth

TABLE 90 VIETNAM: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.4.5 SOUTH KOREA

11.4.5.1 Increasing trend of solo drinking is projected to fuel the market growth

TABLE 91 SOUTH KOREA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

11.4.6.1 Increasing presence of beer manufacturers and changing lifestyles to fuel the market growth

TABLE 92 REST OF ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 93 SOUTH AMERICA: BREWING INGREDIENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 94 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 95 SOUTH AMERICA: MARKET SIZE, BY MALT EXTRACT, 2019–2026 (USD MILLION)

TABLE 96 SOUTH AMERICA: MARKET SIZE, BY SPECIALTY MALT EXTRACT, 2019–2026 (USD MILLION)

TABLE 97 SOUTH AMERICA: MARKET SIZE, BY ADJUNCTS/GRAINS, 2019–2026 (USD MILLION)

TABLE 98 SOUTH AMERICA: MARKET SIZE, BY HOPS, 2019–2026 (USD MILLION)

TABLE 99 SOUTH AMERICA: MARKET SIZE, BY BEER YEAST, 2019–2026 (USD MILLION)

TABLE 100 SOUTH AMERICA: MARKET SIZE, BY BEER ADDITIVES, 2019–2026 (USD MILLION)

TABLE 101 SOUTH AMERICA: MARKET SIZE, BY BREWERY SIZE, 2019–2026 (USD MILLION)

TABLE 102 SOUTH AMERICA: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Increasing demand for craft beers to support the growth of the market

TABLE 103 BRAZIL: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Rising demand for craft beers to encourage the market growth

TABLE 104 ARGENTINA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

11.5.3.1 Increasing disposable income and changing lifestyles to propel the market growth in the region

TABLE 105 REST OF SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.6 REST OF THE WORLD (ROW)

TABLE 106 ROW: BREWING INGREDIENTS MARKET SIZE, BY COUNTRY/REGION, 2019–2026 (USD MILLION)

TABLE 107 ROW: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 108 ROW: MARKET SIZE, BY MALT EXTRACT, 2019–2026 (USD MILLION)

TABLE 109 ROW: MARKET SIZE, BY SPECIALTY MALT EXTRACT, 2019–2026 (USD MILLION)

TABLE 110 ROW: MARKET SIZE, BY ADJUNCTS/GRAINS, 2019–2026 (USD MILLION)

TABLE 111 ROW: MARKET SIZE, BY HOPS, 2019–2026 (USD MILLION)

TABLE 112 ROW: MARKET SIZE, BY BEER YEAST, 2019–2026 (USD MILLION)

TABLE 113 ROW: MARKET SIZE, BY BEER ADDITIVES, 2019–2026 (USD MILLION)

TABLE 114 ROW: MARKET SIZE, BY BREWERY SIZE, 2019–2026 (USD MILLION)

TABLE 115 ROW: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

11.6.1 SOUTH AFRICA

11.6.1.1 Increasing number of craft breweries to drive the market growth

TABLE 116 SOUTH AFRICA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.6.2 NIGERIA

11.6.2.1 Beer, being the most preferred alcoholic beverage in the country, anticipated to drive the market growth

TABLE 117 NIGERIA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.6.3 KENYA

11.6.3.1 Developing economic conditions to drive the market growth

TABLE 118 KENYA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.6.4 REST OF AFRICA

11.6.4.1 Increasing disposable income anticipated to drive the market growth

TABLE 119 REST OF AFRICA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.6.5 MIDDLE EAST

11.6.5.1 Consumer preference for alcoholic beverages to propel the growth of the market

TABLE 120 MIDDLE EAST: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 144)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS OF THE BREWING INGREDIENT COMPANIES SUPPLYING INGREDIENTS TO BEVERAGE COMPANIES

TABLE 121 BREWING INGREDIENTS MARKET: DEGREE OF COMPETITION

12.3 RANKING OF THE MAJOR BEER COMPANIES

12.4 KEY PLAYER STRATEGIES

12.5 REVENUE ANALYSIS OF KEY PLAYERS SUPPLYING BREWING INGREDIENTS TO BEVERAGE COMPANIES, 2017-2020

FIGURE 44 REVENUE ANALYSIS, 2017–2020 (USD BILLION)

12.6 COVID-19-SPECIFIC COMPANY RESPONSE

12.6.1 CARGILL, INCORPORATED

12.6.2 ANGEL YEAST CO. LTD.

12.6.3 BOORTMALT

12.6.4 MALTEUROP GROUPE

12.6.5 RAHR CORPORATION

12.7 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.7.1 STARS

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE PLAYERS

12.7.4 PARTICIPANTS

FIGURE 45 BREWING INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

12.8 PRODUCT FOOTPRINT

TABLE 122 COMPANY FOOTPRINT, BY SOURCE

TABLE 123 COMPANY FOOTPRINT, BY REGION

12.9 COMPETITIVE EVALUATION QUADRANT (START-UP/SME)

12.9.1 PROGRESSIVE COMPANIES

12.9.2 RESPONSIVE COMPANIES

12.9.3 DYNAMIC COMPANIES

12.9.4 STARTING BLOCKS

FIGURE 46 BREWING INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2020 (OTHERS)

12.10 COMPETITIVE SCENARIO

12.10.1 NEW PRODUCT LAUNCHES

TABLE 124 BREWING INGREDIENTS MARKET: PRODUCT LAUNCHES, JULY 2017- MARCH 2021

12.10.2 DEALS

TABLE 125 BREWING INGREDIENTS MARKET: DEALS, AUGUST 2017– FEBRUARY 2021

12.10.3 OTHERS

TABLE 126 BREWING INGREDIENTS MARKET: OTHERS, MARCH 2018- MARCH 2021

13 COMPANY PROFILES (Page No. - 158)

(Business overview, Products offered, Recent developments & MnM View)*

13.1 KEY PLAYERS

13.1.1 CARGILL, INCORPORATED

TABLE 127 CARGILL, INCORPORATED: BUSINESS OVERVIEW

TABLE 128 CARGILL, INCORPORATED: PRODUCTS OFFERED

TABLE 129 CARGILL, INCORPORATED: NEW PRODUCT LAUNCHES

13.1.2 ANGEL YEAST CO. LTD.

TABLE 130 ANGEL YEAST CO. LTD.: BUSINESS OVERVIEW

FIGURE 48 ANGEL YEAST CO. LTD.: COMPANY SNAPSHOT

TABLE 131 ANGEL YEAST CO. LTD.: PRODUCTS OFFERED

TABLE 132 ANGEL YEAST CO. LTD.: OTHERS

13.1.3 BOORTMALT

TABLE 133 BOORTMALT: BUSINESS OVERVIEW

TABLE 134 BOORTMALT: PRODUCTS OFFERED

TABLE 135 BOORTMALT: DEALS

TABLE 136 BOORTMALT: OTHERS

13.1.4 MALTEUROP GROUPE

TABLE 137 MALTEUROP GROUPE: BUSINESS OVERVIEW

TABLE 138 MALTEUROP GROUPE: PRODUCTS OFFERED

TABLE 139 MALTEUROP GROUPE: OTHERS

13.1.5 RAHR CORPORATION

TABLE 140 RAHR CORPORATION: BUSINESS OVERVIEW

TABLE 141 RAHR CORPORATION: PRODUCTS OFFERED

TABLE 142 RAHR CORPORATION: OTHERS

13.1.6 LALLEMAND INC.

TABLE 143 LALLEMAND INC.: BUSINESS OVERVIEW

TABLE 144 LALLEMAND INC.: PRODUCTS OFFERED

TABLE 145 LALLEMAND INC.: NEW PRODUCT LAUNCHES

13.1.7 VIKING MALT

TABLE 146 VIKING MALT: BUSINESS OVERVIEW

TABLE 147 VIKING MALT: PRODUCTS OFFERED

TABLE 148 VIKING MALT: NEW PRODUCT LAUNCHES

TABLE 149 VIKING MALT: OTHERS

13.1.8 LESAFFRE

TABLE 150 LESAFFRE: BUSINESS OVERVIEW

TABLE 151 LESAFFRE: PRODUCTS OFFERED

TABLE 152 LESAFFRE: NEW PRODUCT LAUNCHES

13.1.9 MALTEXCO S.A.

TABLE 153 MALTEXCO S.A.: BUSINESS OVERVIEW

TABLE 154 MALTEXCO S.A.: PRODUCTS OFFERED

13.1.10 SIMPSONS MALT

TABLE 155 SIMPSONS MALT: BUSINESS OVERVIEW

TABLE 156 SIMPSONS MALT: PRODUCTS OFFERED

TABLE 157 SIMPSONS MALT: DEALS

TABLE 158 SIMPSONS MALT: OTHERS

13.2 OTHERS

13.2.1 PURE MALT PRODUCTS LTD

TABLE 159 PURE MALT PRODUCTS LTD: BUSINESS OVERVIEW

TABLE 160 PURE MALT PRODUCTS LTD: PRODUCTS OFFERED

13.2.2 IREKS GMBH

TABLE 161 IREKS GMBH: BUSINESS OVERVIEW

TABLE 162 IREKS GMBH: PRODUCTS OFFERED

TABLE 163 IREKS GMBH: OTHERS

13.2.3 LEIBER GMBH

TABLE 164 LEIBER GMBH: BUSINESS OVERVIEW

TABLE 165 LEIBER GMBH: PRODUCTS OFFERED

13.2.4 IMPERIAL MALTS LTD.

TABLE 166 IMPERIAL MALTS LTD.: BUSINESS OVERVIEW

TABLE 167 IMPERIAL MALTS LTD.: PRODUCTS OFFERED

13.2.5 HOLLAND MALT

TABLE 168 HOLLAND MALT: BUSINESS OVERVIEW

TABLE 169 HOLLAND MALT: PRODUCTS OFFERED

13.2.6 IMPERIAL YEAST

13.2.7 MAHALAXMI MALT PRODUCTS PRIVATE LIMITED

13.2.8 PMV MALTINGS PVT. LTD.

13.2.9 CEREAL AND MALT-EXTRACTS (PTY) LTD.

13.2.10 CEREAL FOOD MANUFACTURING COMPANY

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 191)

14.1 INTRODUCTION

TABLE 170 ADJACENT MARKETS FOR BREWING INGREDIENTS

14.2 LIMITATIONS

14.3 BEER PROCESSING MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.4 BEER PROCESSING MARKET, BY BEER TYPE

14.4.1 INTRODUCTION

TABLE 171 BEER MARKET SIZE, BY BEER TYPE, 2017–2025 (BILLION LITERS)

14.5 MALT EXTRACT AND INGREDIENTS MARKET

14.5.1 MARKET DEFINITION

14.5.2 MARKET OVERVIEW

14.5.3 MALT EXTRACT AND INGREDIENTS MARKET, BY PRODUCT

TABLE 172 MALT EXTRACT AND INGREDIENTS MARKET SIZE, BY PRODUCT, 2018-2025 (USD MILLION)

15 APPENDIX (Page No. - 195)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

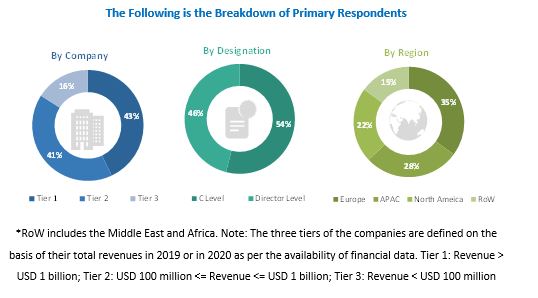

The study involves four major activities to estimate the current size for brewing ingredients market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. These findings, assumptions, and the market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, in order to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders such as manufacturers, importers & exporters, traders, distributors, suppliers of brewing ingredients; food safety authorities; food technologists; food product manufacturers; raw material suppliers; and regulatory bodies such as the Food and Agriculture Organization (FAO), the Environmental Protection Agency (EPA), the Food Safety Council (FSC), government and research organizations, and trade associations and industry bodies. The demand-side of this market is characterized by the rising awareness of shelf-life extension among beverage manufacturers. The supply-side is characterized by advancements in technology and increased convenience in packaging. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Brewing Ingredients Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the brewing ingredients market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The value chain and market size of the brewing ingredients market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for key opinions from leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives:

- To define, segment, and project the global market size for brewing ingredients

- To understand the structure of the brewing ingredients market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per a client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe, Rest of Asia Pacific, and Rest of South America.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Brewing Ingredients Market