Bone Cement & Glue Market by Bone Cement (PMMA, Calcium Phosphate), Bone Glue (Natural, Synthetic), Loading (Antibiotic Loaded), Application (Arthroplasty, Kyphoplasty, Vertebroplasty), End User (Hospitals, ASCS, Clinics) & Region - Global Forecast to 2028

Market Growth Outlook Summary

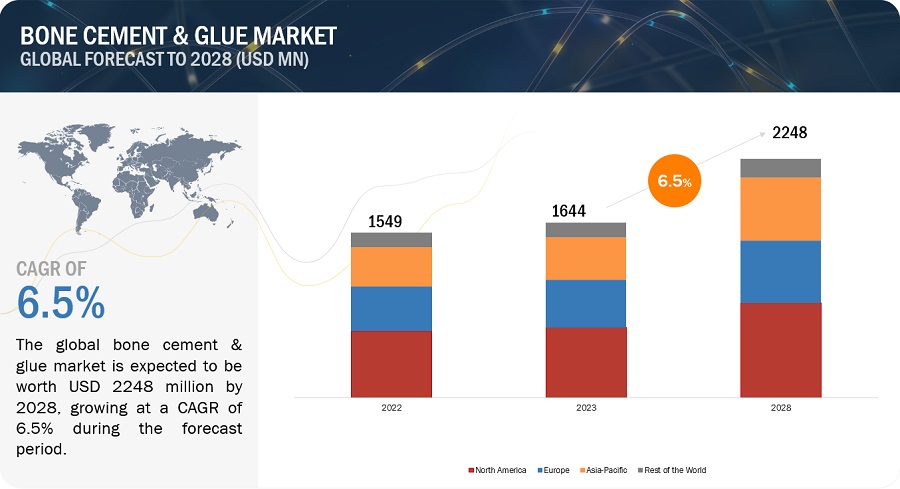

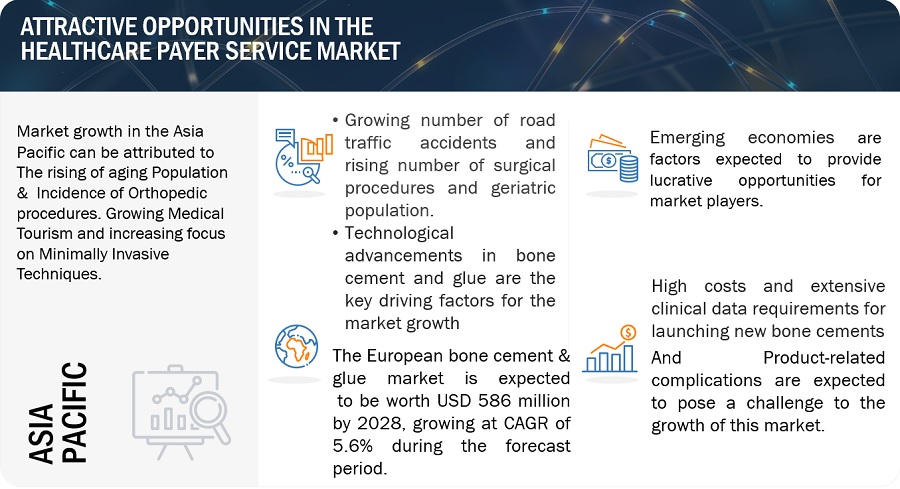

The global bone cement & glue market, valued at US$1,549 million in 2022, stood at US$1,644 million in 2023 and is projected to advance at a resilient CAGR of 6.5% from 2023 to 2028, culminating in a forecasted valuation of US$2,248 million by the end of the period. The growth of this market is majorly driven by growing number of road traffic accidents and rising number of surgical procedures However, extensive clinical data requirements for launching new bone cements may restrain the growth of this market.

Attractive Opportunities in the Bone Cement & Glue Market

To know about the assumptions considered for the study, Request for Free Sample Report

Bone Cement & Glue Market Dynamics

DRIVER: Growing incidences of sports injuries

Globally, the incidence of sports injuries has increased over the last few years primarily due to the growing participation in sports as well as active participation in fitness activities (because of the growing focus on leading healthy lifestyles), Intensity and competitiveness, Insufficient recovery, and rest. Some of the major statistics in this regard have been mentioned below:

According to The Johns Hopkins University 2023, In the U.S., about 30 million children and teens participate in some form of organized sports, and more than 3.5 million injuries each year. Sports and recreational activities contribute to approximately 21% of all traumatic brain injuries among American children. Similarly, almost 50% of head injuries sustained in sports or recreational activities occur during bicycling, skateboarding, or skating incidents. More than 775,000 children, ages 14 and younger, are treated in hospital emergency rooms for sports-related injuries each year.

- In 2021, the United States, the National Athletic Trainers' Association (NATA) reports that an estimated 2 million high school athletes suffer sports-related injuries and 30,000 hospitalizations each year.

- According to the Centers for Disease Control and Prevention (CDC), approximately 8.6 million sports-related injuries occur each year, with more than 2.6 million of those injuries requiring medical attention. The most reported injuries are sprains, strains, fractures, and contusions. In addition, traumatic brain injuries and concussions have become a major focus of research and prevention efforts.

- As per the New York CNN 2023, Pickleball is America’s fastest-growing sport and Pickleball injuries may cost Americans USD 377 million in health care costs this year which is driving up the cost burden.

- As per the Australian Institute of Health and Welfare 2023, Injuries related to physical activity cost USD 164 million in emergency departments and USD 600 million for admitted patients.

- As per The Athletic Media Company 2023, Big Five’ leagues in the 2021-22, European season, injury costs for clubs reached £513.23 million, (USD 547.86) a 29% rise compared to the previous campaign (2021).

Hip-, knee-, and shoulder-related injuries are the major sports injuries. These injuries often require the replacement of the affected joint with a synthetic (metal) implant (arthroplasty), supplemented with bone cement and bone graft substitutes. With the increasing participation in sports and subsequent growth in the incidence of sports injuries, the demand for bone cement and glue is expected to increase across the globe during the forecast period.

Restraints: High costs and extensive clinical data requirements for launching new bone cements

The development of bone cement is an extremely cost-intensive process. It takes significant investments in R&D to develop new products that effectively cater to market needs. The FDA approval process for surgical orthopedic cements is stringent and time-consuming, causing delays in bringing new bone cements to the market. The FDA demands more clinical data related to the safety and efficacy of the product, which results in tin additional R&D investments for companies. Despite the development of several advanced cements in the market, there is still a need for developing cost-effective bone cements with the appropriate clinical data required by regulatory authorities.

Owing to the abovementioned factors, many small firms and start-ups do not focus on launching new innovative products in the market. Such companies are pressured to reevaluate the timelines and budgets required in product development, which ultimately affects their market survival. Moreover, due to the presence of alternatives such as bone staples and orthopedic pins, the uptake of advanced bone cements is affected. This, in turn, is restraining the growth of the overall market.

Some of the prices of commercially available bone cements are as below:

DePuy SmartSet Bone Cement - SmartSet HV Bone Cement, 40G, High-Viscosity - USD 400-500, Spineplex - Bone Cement 20 g Twin Pack (One-Half Dose) – USD 700-800, Palacos Bone Mixing Cements by Heraeus Medica - USD 800-900

OPPORTUNITY: Rising awareness and demand for minimally invasive procedures

Minimally invasive surgeries offer benefits such as smaller incisions, reduced scarring, and faster recovery times. There is an increasing demand for minimally invasive orthopedic procedures, and bone cement and glue play a crucial role in these techniques. Opportunities exist for the development of specialized bone cement and glue products tailored for minimally invasive approaches. Minimally invasive procedures often result in reduced post-operative pain, shorter hospital stays, and faster rehabilitation compared to traditional open surgeries. This can lead to improved patient satisfaction and outcomes. The use of appropriate bone cement and glue products in these procedures contributes to the overall success and effectiveness of the treatment.

- As per the PubMed 2022, Ambulatory Minimally invasive surgeries MIS procedures showed an increasing trend across years, representing 16.9%, 17.4%, and 18%, respectively. Healthcare Cost and Utilization Project (HCUPNet) data revealed an increase in inpatient MIS cases from 529,811 (8.9%) in 1993 to 1,443,446 (20.7%) in 2014.

- As per the Intuitive Surgical Operations, Inc. 2023 (US), through more than 10 million surgeries, Intuitive has become a leader in surgical robotics, increasing the adoption of minimally invasive surgery.

Minimally invasive procedures can be cost-effective compared to traditional open surgeries. They may result in lower healthcare resource utilization, reduced hospitalization costs, and quicker return to daily activities and work. Bone cement and glue products that support minimally invasive approaches align with the cost-saving goals of healthcare systems and providers. For instance, As per the article published in musculoskeletal key 2020, health care costs were nearly 18% of the U.S. gross domestic product (GDP), with the cost of surgical care was approximately 7% of GDP. The patients with Minimally Invasive Transforaminal Lumbar Interbody Fusion (MIS-TLIF), the mean length of postoperative hospital stay was 3 days. The mean total in-hospitalization cost for these patients was USD 23,000. Each 1-day reduction in the length of stay results in a direct cost savings of USD 1,500. On the other hand, patients with open-TLIF, the mean length of postoperative hospital stay was 4 days. The mean total in-hospitalization cost for these patients was USD 25,000.Hence, the rising awareness and demand for minimally invasive procedures have a positive impact on the bone cement and glue market.

CHALLENGE: Product-related complications.

While bone cement and glue products are generally safe and effective, like any medical intervention, they can be associated with certain complications. Here are some potential complications associated with bone cement and glue:

- Infection: Infection is a possible complication following the use of bone cement and glue. Although efforts are made to maintain a sterile surgical environment, there is still a risk of bacterial contamination during the procedure or post-operatively. Infection can lead to implant loosening, prolonged healing, and the need for additional treatments or surgeries.

- Allergic reactions: Some individuals may experience allergic reactions to components of bone cement or glue, such as methacrylate monomers. Allergic reactions can manifest as localized inflammation, skin rashes, or more severe systemic reactions. Careful evaluation of patient history and selection of appropriate materials can help mitigate the risk of allergic reactions.

- Cement leakage: During the application of bone cement, there is a possibility of cement leakage into surrounding tissues or blood vessels. Cement leakage can lead to complications such as nerve impingement, embolism (if cement enters the bloodstream), or tissue damage. Proper surgical technique and monitoring can help reduce the risk of cement leakage.

- Implant loosening: Although bone cement is used to secure implants, there is still a possibility of implant loosening over time. Factors contributing to implant loosening include improper technique, poor bone quality, excessive weight-bearing, or inadequate cement fixation. Implant loosening may require revision surgery to address the instability and ensure long-term implant function.

- Adverse tissue reactions: Some individuals may experience adverse tissue reactions to bone cement or glue. These reactions can manifest as chronic inflammation, granuloma formation, or hypersensitivity reactions. The incidence of such reactions is relatively rare, but they can result in discomfort, implant failure, or the need for further interventions.

- Thermal necrosis: During the polymerization process of bone cement, heat is generated, which can potentially cause thermal necrosis (tissue damage due to excessive heat) in surrounding tissues. This risk is mitigated by proper cement handling, cooling techniques, and careful monitoring during the procedure.

Likewise, some of the Potential disadvantages of antibiotic-loaded bone cement are as below

- Alteration in the mechanical and structural properties of the bone cement

- Antibiotic resistance

- Allergic reactions

- Systemic toxicity

- Cost implications

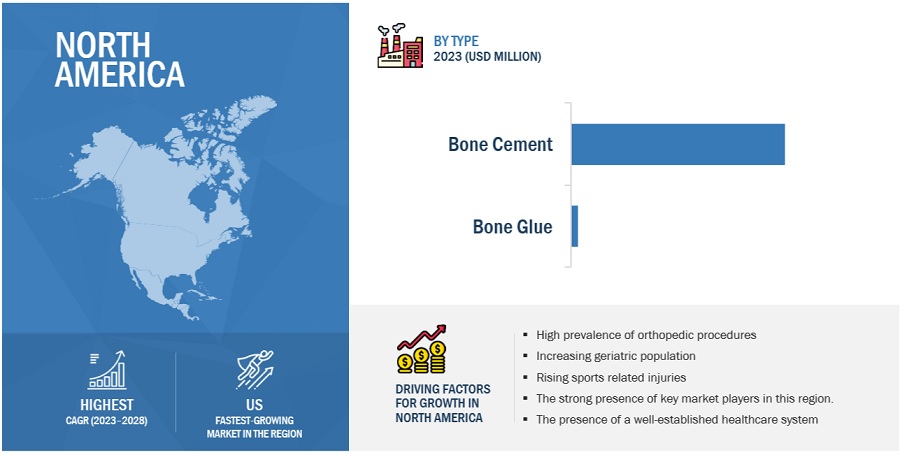

The Bone Cement segment is expected to account the largest shares during the forecast period.

Based on Type, the Bone Cement & Glue market is segmented into Bone Cement and Glue. The Bone Cement segment is expected to account the largest shares during the forecast period. The major factors contributing to the growth of this market are due it its wide applications, as Bone cement is widely used for in various orthopedic such as such as total hip arthroplasty (THA) and total knee arthroplasty (TKA), also to anchor prosthetic implants and trauma surgeries. Bone cement is a synthetic polymer-based material used primarily in joint replacement surgeries, while bone glue is a biological adhesive used to bond tissues and bones.

The PMMA (Polymethyl methacrylate Cement segment is projected to grow at the highest CAGR during the forecast period.

Based on Type, the Bone Cement market is segmented into PMMA (Polymethyl methacrylate Cement), CPC (Calcium Phosphate Cement), and GPC (Glass polyalkenoate cement). The PMMA (Polymethyl methacrylate Cement segment is projected to grow at the highest CAGR during the forecast period. The major factors contributing to the growth of this market are PMMA bone cements are widely used in various orthopedic procedures such as arthroplasty, kyphoplasty and vertebroplasty hence increasing demand of PMMA segment compared to other bone cements such as CPC and GPC.

The Natural bone glue segment is forecasted to grow at the highest CAGR during the forecast period.

Based on Type, the Bone Glue market is segmented into Natural bone glue and Synthetic bone glue. The Natural bone glue segment is forecasted to grow at the highest CAGR during. The major factors contributing to the growth of this market includes Natural bone glue’ Biocompatibility, Biodegradability, its ability to Reduced Foreign Body Response which can lead to faster healing and reduced inflammation around the adhesive site compared to synthetic materials.

The Antibiotic-loaded bone cement segment is anticipated to grow at the highest CAGR during the forecast period.

Based on Loading, the Bone Cement & Glue market is segmented into Antibiotic-loaded bone cement, and non-Antibiotic-loaded bone cement. The Antibiotic-loaded bone cement segment is anticipated to grow at the highest CAGR considering Antibiotic-loaded bone cement has been widely adopted in orthopedic surgeries due to its ability to provide localized antibiotic therapy, helping to prevent or treat infection in the surgical site. The addition of antibiotics such as gentamicin, vancomycin, and tobramycin to the bone cement allows for sustained release of the antibiotic agent over time, helping to reduce the risk of infection associated with orthopedic procedures.

The Arthroplasty segment is expected to dominate the market during the forecast period.

Based on the Application, the Bone Cement & Glue market is segmented into Arthroplasty (Total knee arthroplasty, Total hip arthroplasty, Total shoulder arthroplasty), kyphoplasty, Vertebroplasty and Other Applications. The Arthroplasty segment is expected to dominate the market during the forecast period due to the increasing number of knee, hip, and shoulder injuries, Increasing Prevalence of osteoarthritis, rising aging Population as people age, the wear and tear on their joints increase, and they may require joint replacement surgeries like total hip arthroplasty (THA) or total knee arthroplasty (TKA).

The Hospitals, & Ambulatory Surgical Centers is expected to dominate the market during the forecast period.

Based on the end user, the Bone Cement & Glue market is segmented into Hospitals, & Ambulatory Surgical Centers, and Clinics/Physician offices. The Hospitals, & Ambulatory Surgical Centers is expected to dominate the market during the forecast period due to the increasing number of orthopedic surgical procedures as patients with traumatic, surgical, receive specialized care from experts as an integral part of overall hospital care, as well as various cost-effective and convenient treatments provided by ASCs.

North America accounted for the largest share of the Bone Cement & Glue market.

Based on the region, the Bone Cement & Glue market is segmented into North America, Europe, Asia Pacific, and Rest of the World. In 2022, North America accounted for the largest share of the Bone Cement & Glue market. Growth in the North American market is mainly driven by the high prevalence of target diseases, increasing geriatric population, and rising awareness about advanced treatment options, the strong presence of key market players in this region. In addition, the presence of a well-established healthcare system and ongoing investments by hospitals to upgrade and expand their operating capabilities are other factors supporting the growth of the North American Bone Cement & Glue market.

To know about the assumptions considered for the study, download the pdf brochure

India registered the highest growth rate in Asia Pacific Bone cement & glue industry.

The APAC bone cement & glue market is segmented into Japan, China, India, and Rest of Apac. In 2022, India accounted for the highest growth rate of the Asian bone cement & glue market. The high growth rate of India can be attributed to the rising of a medical tourism in orthopedic surgery sector and the increasing geriatric population. An increase in the number of elderly people gives rise to various orthopedic and diseases which is highly susceptible to several procedures. Therefore, growth in this population segment will directly drive the demand for bone cement & glue products.

The Germany in European Bone cement & glue industry to witness the second highest growth rate during the forecast period.

The Europe bone cement & glue market is segmented into Germany, France, the UK, and the Rest of Europe. Germany is registered the highest growth rate during the forecast period. The major factors contributing to the growth of this market are the high prevalence ofold age population, rising in sport related injuries, orthopedic cases, increasing R&D activities, strategic developments by key players.

Some of the major players operating in this market are Stryker (US), Zimmer Biomet (US), Smith+Nephew. (UK), DePuy Synthes (a subsidiary of Johnson & Johnson - US) , Enovis (US) , Artivion, Inc (US), Cardinal Health. (US), Medtronic (Ireland), Globus Medical (US), and Heraeus Holding (Germany).

Bone Cement & Glue Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$1,644 million |

|

Projected Revenue by 2028 |

$2,248 million |

|

Revenue Rate |

Poised to Grow at a CAGR of 6.5% |

|

Market Driver |

Growing incidences of sports injuries |

|

Market Opportuniry |

Rising awareness and demand for minimally invasive procedures |

This research report categorizes the Bone cement & glue market into the following segments and subsegments:

By Type (Bone Cement)

- PMMA Cement

- Calcium Phosphate Cement

- Glass polyalkenoate cement

By Type (Bone Glue)

- Natural bone glue

- Synthetic bone glue

By Loading

- Non-antibiotic-loaded bone cement

- Antibiotic-loaded bone cement

By Application

- Arthroplasty

- Total knee arthroplasty

- Total hip arthroplasty

- Total shoulder arthroplasty

- Kyphoplasty

- Vertebroplasty

- Other Applications

By End User

- Hospitals & Ambulatory Surgical Centers

- Other End Users

By Region

- North America

- Europe

- APAC

- Rest of the World

Recent Developments of Bone Cement & Glue Market

- In 2021, The company Smith & Nephew (UK) acquired the Extremity Orthopedics business of Integra Life Sciences to expand its shoulder, upper, and lower extremities product portfolio.

- In 2021, Zimmer Biomet (US) Completed the spinoff of spine and dental businesses into a new public company, ZimVie Inc. (“ZimVie”). The transaction was intended to benefit its stockholders by enhancing the focus of both Zimmer Biomet and ZimVie to meet the needs of patients and customers

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global bone cement & glue market between 2023 and 2028?

The global bone cement & glue market is expected to grow from USD 1,644 million in 2023 to USD 2,248 million by 2028, at a CAGR of 6.5%, driven by the rising number of surgical procedures and increasing sports injuries.

What factors are driving the growth of the bone cement & glue market?

The market growth is driven by the increasing incidence of sports injuries, a growing elderly population, and the rising demand for minimally invasive procedures.

What are the main challenges faced by the bone cement & glue market?

The main challenges include the high cost of developing new bone cements and extensive clinical data requirements for regulatory approval, which slow down product launches.

Which segment is expected to dominate the bone cement & glue market?

The Bone Cement segment is expected to dominate the market, driven by its wide application in orthopedic surgeries, such as total hip and knee arthroplasties.

What are the complications associated with bone cement & glue products?

Complications include infection, allergic reactions, cement leakage, implant loosening, and adverse tissue reactions, which may require further treatments or surgeries.

Which bone cement type is expected to grow at the highest CAGR?

The PMMA (Polymethyl methacrylate) bone cement segment is expected to grow at the highest CAGR due to its widespread use in orthopedic procedures like arthroplasty, kyphoplasty, and vertebroplasty.

What opportunities exist in the bone cement & glue market?

Opportunities lie in the development of specialized bone cement and glue products for minimally invasive procedures, which offer faster recovery times and reduced scarring.

Which end-user segment is expected to dominate the market?

The Hospitals & Ambulatory Surgical Centers segment is expected to dominate, driven by the rising number of orthopedic surgeries and specialized care provided by these facilities.

What role does antibiotic-loaded bone cement play in the market?

Antibiotic-loaded bone cement is crucial for preventing and treating infections in orthopedic surgeries, providing localized antibiotic therapy to reduce post-surgical complications.

Which region is expected to dominate the bone cement & glue market?

North America is expected to dominate the market due to the high prevalence of target diseases, advanced healthcare infrastructure, and increased healthcare spending.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing incidence of sports injuries- Rapid growth in geriatric population- Developments in regenerative medicine- Growing number of road traffic accidents and other factors increasing surgery volumes- Technological advancementsRESTRAINTS- High costs and extensive clinical data requirements for launching new products- Alternatives to bone cement and glueOPPORTUNITIES- Growth opportunities in emerging economies- Rising awareness and demand for minimally invasive proceduresCHALLENGES- Development of novel biomaterials with high mechanical properties and adhesion strength- Product-related complications- Unfavorable reimbursement scenario

- 6.1 INTRODUCTION

-

6.2 BONE CEMENTBONE CEMENT MARKET, BY TYPE- PMMA cement- Calcium phosphate cement- Glass polyalkenoate cementBONE CEMENT MARKET, BY LOADING- Antibiotic-loaded bone cement- Non-antibiotic-loaded bone cement

-

6.3 BONE GLUENATURAL BONE GLUE- High biocompatibility to support greater adoptionSYNTHETIC BONE GLUE- Emerging medical applications indicate high potential of synthetic glue

- 7.1 INTRODUCTION

-

7.2 ARTHROPLASTYTOTAL KNEE ARTHROPLASTY- TKA to hold largest arthroplasty market shareTOTAL HIP ARTHROPLASTY- Growing geriatric population to boost procedural volumesTOTAL SHOULDER ARTHROPLASTY- Rising sports injury incidence to drive market

-

7.3 KYPHOPLASTYINCREASING INCIDENCE OF OSTEOPOROSIS TO DRIVE MARKET

-

7.4 VERTEBROPLASTYRISING INCIDENCE OF VERTEBRAL COMPRESSION FRACTURES TO SUPPORT MARKET GROWTH

- 7.5 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 HOSPITALS & ASCSHOSPITALS & ASCS TO DOMINATE END-USER MARKET

-

8.3 CLINICS & PHYSICIAN OFFICESRISING PREFERENCE FOR CLINICS AND COST-SAVING POTENTIAL TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Growing geriatric population and high prevalence of sports injuries to drive marketCANADA- Availability of government funding and growth in geriatric population to drive market

-

9.3 EUROPEEUROPE: RECESSION IMPACTFRANCE- Rising government support to drive demandGERMANY- Robust healthcare spending and advanced healthcare system to favor market growthUK- Presence of strong healthcare infrastructure and high burden of orthopedic casesREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- China to hold largest market share in APACINDIA- Rising medical tourism, improving healthcare infrastructure, and growing population to drive marketJAPAN- Large aging population and favorable government initiatives to drive marketREST OF ASIA PACIFIC

-

9.5 REST OF THE WORLDROW: RECESSION IMPACT

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS, 2022

- 10.4 REVENUE SHARE ANALYSIS, 2022

-

10.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPANY EVALUATION MATRIX FOR SMES/STARTUPS, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 10.7 COMPETITIVE BENCHMARKING

- 10.8 COMPANY FOOTPRINT ANALYSIS

-

10.9 COMPETITIVE SCENARIODEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSSTRYKER- Business overview- Products offered- Recent developments- MnM viewZIMMER BIOMET- Business overview- Products offered- Recent developments- MnM viewHERAEUS HOLDING- Business overview- Products offered- MnM viewSMITH+NEPHEW- Business overview- Products offered- Recent developmentsDEPUY SYNTHES (JOHNSON & JOHNSON)- Business overview- Products offeredENOVIS- Business overview- Products offered- Recent developmentsARTIVION, INC.- Business overview- Products offeredCARDINAL HEALTH- Business overview- Products offeredMEDTRONIC- Business overview- Products offeredGLOBUS MEDICAL- Business overview- Products offered- Recent developmentsEXACTECH, INC.- Business overview- Products offeredARTHREX, INC.- Business overview- Products offeredTEKNIMED- Business overview- Products offeredTECRES S.P.A.- Business overview- Products offeredBIOCERAMED S.A.- Business overview- Products offeredEVOLUTIS- Business overview- Products offered

-

11.2 OTHER PLAYERSNORMMED MEDICALLINACOL MEDICAL INC.BPB MEDICAIZI MEDICALADITUS MEDICALOSARTIS GMBHLD DAVISMILLIGAN & HIGGINSVHERN S.R.L.

- 12.1 INDUSTRY INSIGHTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 GERIATRIC POPULATION, BY REGION, 2015 VS. 2030 VS. 2050 (MILLION)

- TABLE 2 BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 3 CONSTITUENTS OF BONE CEMENT

- TABLE 4 BONE CEMENT MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 5 BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 6 PMMA CEMENT MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 7 CPC MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 8 GPC MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 9 BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 10 ANTIBIOTIC-LOADED BONE CEMENT MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 11 NON-ANTIBIOTIC-LOADED BONE CEMENT MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 12 BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 13 BONE GLUE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 NATURAL BONE GLUE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 SYNTHETIC BONE GLUE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 16 BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 17 BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 19 BONE CEMENT & GLUE MARKET FOR TOTAL KNEE ARTHROPLASTY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 BONE CEMENT & GLUE MARKET FOR TOTAL HIP ARTHROPLASTY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 BONE CEMENT & GLUE MARKET FOR TOTAL SHOULDER ARTHROPLASTY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 TOP TEN COUNTRIES IN KYPHOPLASTY RESEARCH

- TABLE 23 BONE CEMENT & GLUE MARKET FOR KYPHOPLASTY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 BONE CEMENT & GLUE MARKET FOR VERTEBROPLASTY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 BONE CEMENT & GLUE MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 27 BONE CEMENT & GLUE MARKET FOR HOSPITALS & ASCS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 BONE CEMENT & GLUE MARKET FOR CLINICS & PHYSICIAN OFFICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 BONE CEMENT & GLUE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: BONE CEMENT & GLUE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 38 US: KEY MACROINDICATORS

- TABLE 39 US: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 40 US: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 41 US: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 42 US: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 43 US: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 44 US: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 45 US: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 46 FUNDS FOR SPORTS ORGANIZATIONS, 2021/2022 (USD THOUSAND)

- TABLE 47 CANADA: KEY MACROINDICATORS

- TABLE 48 CANADA: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 49 CANADA: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 50 CANADA: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 51 CANADA: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 52 CANADA: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 53 CANADA: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 54 CANADA: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 55 EUROPE: BURDEN OF OSTEOPOROSIS (2021)

- TABLE 56 EUROPE: BONE CEMENT & GLUE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 EUROPE: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 59 EUROPE: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 60 EUROPE: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 EUROPE: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 62 EUROPE: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 63 EUROPE: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 64 FRANCE: KEY MACROINDICATORS

- TABLE 65 FRANCE: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 66 FRANCE: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 FRANCE: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 68 FRANCE: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 FRANCE: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 FRANCE: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 71 FRANCE: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 72 GERMANY: KEY MACROINDICATORS

- TABLE 73 GERMANY: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 GERMANY: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 75 GERMANY: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 76 GERMANY: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 GERMANY: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 GERMANY: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 GERMANY: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 80 UK: KEY MACROINDICATORS

- TABLE 81 UK: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 UK: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 UK: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 84 UK: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 85 UK: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 UK: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 UK: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 88 REST OF EUROPE: HEALTHCARE EXPENDITURE, BY COUNTRY, 2010 VS. 2021 (% OF GDP)

- TABLE 89 REST OF EUROPE: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 REST OF EUROPE: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 REST OF EUROPE: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 92 REST OF EUROPE: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 REST OF EUROPE: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 94 REST OF EUROPE: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 REST OF EUROPE: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: BONE CEMENT & GLUE MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 104 CHINA: KEY MACROINDICATORS

- TABLE 105 INCIDENCE OF OSTEOPOROTIC FRACTURES IN CHINA, 2015–2035

- TABLE 106 CHINA: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 CHINA: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 CHINA: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 109 CHINA: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 CHINA: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 111 CHINA: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 112 CHINA: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 113 INDIA: KEY MACROINDICATORS

- TABLE 114 INDIA: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 INDIA: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 116 INDIA: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 117 INDIA: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 INDIA: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 119 INDIA: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 120 INDIA: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 121 JAPAN: KEY MACROINDICATORS

- TABLE 122 JAPAN: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 123 JAPAN: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 JAPAN: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 125 JAPAN: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 JAPAN: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 127 JAPAN: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 128 JAPAN: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 136 US VS. MEXICO: AVERAGE COST COMPARISON (USD)

- TABLE 137 REST OF THE WORLD: BONE CEMENT & GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 REST OF THE WORLD: BONE CEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 139 REST OF THE WORLD: BONE CEMENT MARKET, BY LOADING, 2021–2028 (USD MILLION)

- TABLE 140 REST OF THE WORLD: BONE GLUE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 REST OF THE WORLD: BONE CEMENT & GLUE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 142 REST OF THE WORLD: BONE CEMENT & GLUE MARKET FOR ARTHROPLASTY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 REST OF THE WORLD: BONE CEMENT & GLUE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 144 OVERVIEW OF STRATEGIES ADOPTED BY KEY BONE CEMENT & GLUE MARKET PLAYERS

- TABLE 145 BONE CEMENT & GLUE MARKET: DEGREE OF COMPETITION (2022)

- TABLE 146 BONE CEMENT & GLUE MARKET: DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 147 COMPANY FOOTPRINT ANALYSIS

- TABLE 148 COMPANY PRODUCT FOOTPRINT

- TABLE 149 COMPANY REGIONAL FOOTPRINT

- TABLE 150 DEALS

- TABLE 151 OTHER DEVELOPMENTS

- TABLE 152 STRYKER: BUSINESS OVERVIEW

- TABLE 153 ZIMMER BIOMET: BUSINESS OVERVIEW

- TABLE 154 HERAEUS HOLDING: BUSINESS OVERVIEW

- TABLE 155 SMITH+NEPHEW: BUSINESS OVERVIEW

- TABLE 156 JOHNSON & JOHNSON: BUSINESS OVERVIEW

- TABLE 157 ENOVIS: BUSINESS OVERVIEW

- TABLE 158 ARTIVION, INC.: BUSINESS OVERVIEW

- TABLE 159 CARDINAL HEALTH: BUSINESS OVERVIEW

- TABLE 160 MEDTRONIC: BUSINESS OVERVIEW

- TABLE 161 GLOBUS MEDICAL: BUSINESS OVERVIEW

- TABLE 162 EXACTECH, INC.: BUSINESS OVERVIEW

- TABLE 163 ARTHREX, INC.: BUSINESS OVERVIEW

- TABLE 164 TEKNIMED: BUSINESS OVERVIEW

- TABLE 165 TECRES S.P.A.: BUSINESS OVERVIEW

- TABLE 166 BIOCERAMED, S.A.: BUSINESS OVERVIEW

- TABLE 167 EVOLUTIS: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 BOTTOM-UP APPROACH: PROCEDURE-BASED ANALYSIS

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 BONE CEMENT & GLUE MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 BONE CEMENT & GLUE MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 BONE CEMENT & GLUE MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 BONE CEMENT & GLUE MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 GROWING GERIATRIC POPULATION TO DRIVE MARKET

- FIGURE 13 PMMA CEMENT TO REGISTER HIGHER GROWTH OVER FORECAST PERIOD

- FIGURE 14 US ACCOUNTED FOR LARGEST MARKET SHARE IN NORTH AMERICA IN 2022

- FIGURE 15 INDIA AND CHINA TO REGISTER HIGHEST GROWTH OVER FORECAST PERIOD

- FIGURE 16 BONE CEMENT & GLUE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 NORTH AMERICA: BONE CEMENT & GLUE MARKET SNAPSHOT

- FIGURE 18 TOTAL ESTIMATED INJURIES BY SPORTS ACTIVITY IN 2021

- FIGURE 19 ASIA PACIFIC: BONE CEMENT & GLUE MARKET SNAPSHOT

- FIGURE 20 BONE CEMENT & GLUE MARKET SHARE ANALYSIS, 2022

- FIGURE 21 REVENUE ANALYSIS OF TOP FOUR MARKET PLAYERS (USD MILLION)

- FIGURE 22 BONE CEMENT & GLUE MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 23 BONE CEMENT & GLUE MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- FIGURE 24 STRYKER: COMPANY SNAPSHOT (2022)

- FIGURE 25 ZIMMER BIOMET: COMPANY SNAPSHOT (2022)

- FIGURE 26 SMITH & NEPHEW: COMPANY SNAPSHOT (2022)

- FIGURE 27 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2022)

- FIGURE 28 ENOVIS: COMPANY SNAPSHOT (2022)

- FIGURE 29 ARTIVION, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 30 CARDINAL HEALTH.: COMPANY SNAPSHOT (2022)

- FIGURE 31 MEDTRONIC: COMPANY SNAPSHOT (2022)

- FIGURE 32 GLOBUS MEDICAL: COMPANY SNAPSHOT (2022)

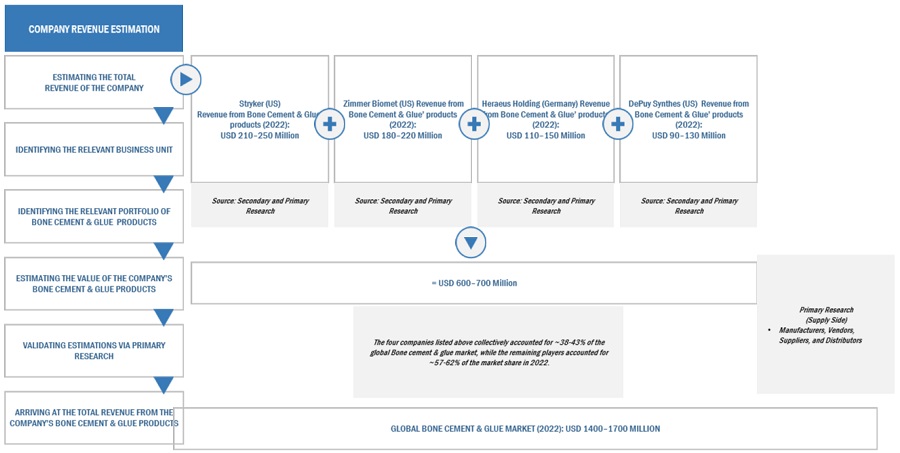

The study involved four major activities in estimating the current size of the Bone cement & glue market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

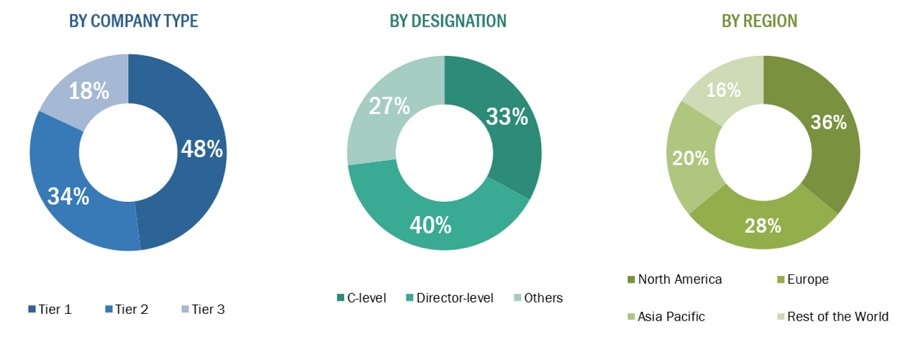

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (Physicians. Ophthalmologists, Orthopedic Surgeons) and supply sides (Bone cement & glue manufacturers and distributors).

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2. Tiers of companies are defined based on their total revenue. As of 2020: Tier 1 = >USD 5 billion, Tier 2 = USD 500 million to USD 5 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Bone cement & glue market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Bone cement & glue industry.

Market Definition

- Bone cement is a biocompatible material used to anchor implants, fill voids, or stabilize bone structures in orthopedic surgeries. It is commonly used in arthroplasty such as joint replacement surgeries, fracture fixations, vertebroplasty, and kyphoplasty, among other orthopedic procedures.

- Bone glue, also known as bone adhesive or bone sealant, offers strong and durable adhesion, promoting proper bone fixation and healing. It is utilized in procedures such as fracture fixation, joint replacements, dental implant placements, and vertebral augmentation.

Stakeholders

- Manufacturers and vendors of bone cement and glues

- Research associations related to bone related medical conditions

- Various research and consulting firms

- Distributors of bone cements and glues

- Contract research manufacturers of bone cements and glues

- Healthcare institutions

- Research institutes

Report Objectives

- To define, describe, and forecast the global Bone cement & glue market based on types, Loading, applications, end users, and region.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, challenges, Restraints)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific, Rest of the World.

- To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies3.

- To track and analyze competitive developments such as acquisitions, agreements, new product launches, and partnerships in the Bone cement & glue market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company.

- Geographic Analysis: Further breakdown of the European Bone cement & glue market into specific countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bone Cement & Glue Market