Bonding Films Market by Type (Epoxy, Acrylic, Polyurethane), Technology (Thermally Cured, Pressure Cured), End-Use Industry (Electrical & Electronics, Transportation, Packaging), Region - Global Forecast to 2022

[142 Pages Report] Bonding Films Market was valued at USD 613.5 Million in 2016 and is projected to reach USD 985.5 Million by 2022, at a CAGR of 8.2% between 2017 and 2022. In this report, 2016 has been considered as the base year and the forecast period has been considered from 2017 to 2022.

The Objectives of this Study are:

- To define, describe, and analyze the bonding films market on the basis of type, technology, end-use industry, and region

- To forecast and analyze the size of the bonding films market (in terms of value) in five key regions, namely, Asia Pacific, Western Europe, Central & Eastern Europe, North America, and Rest of the World (RoW)

- To forecast and analyze the bonding films market at the country level in each region

- To strategically analyze each submarket with respect to individual growth trends and its contribution to the bonding films market

- To analyze opportunities in the bonding films market for the stakeholders by identifying high-growth segments of the market

- To identify the significant market trends and factors driving or inhibiting the growth of the bonding films market and its submarkets

- To analyze competitive developments such as expansions, joint ventures, new products launches, and acquisitions in the bonding films market

- To strategically profile the key players of the bonding films market and comprehensively analyze their growth strategies

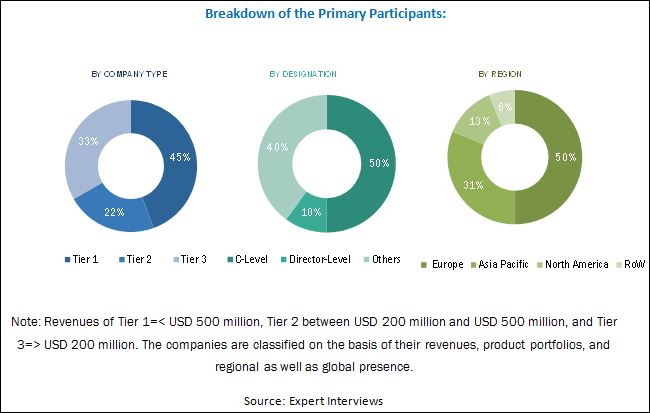

This research study involves the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the market for bonding films. The primary sources that have been considered mainly include several industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industrys supply chain. After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below illustrates the breakdown of the primary interviews based on company type, designation, and region conducted during this research study on the bonding films market:

To know about the assumptions considered for the study, download the pdf brochure

The bonding films value chain includes raw material manufacturers such as Nanya Plastics Corporation (Taiwan), 3M (US), Huntsman International LLC. (US), etc. that manufacture epoxy, acrylic, polyurethane, and other types of resins. These resins are used by manufacturers to develop various types of bonding films that are further used by various other companies such as Tokyo Electron Limited (Japan), Hexcel Corporation (US), etc. in various high-end applications.

The target audiences for the bonding films market report are as follows:

- Manufacturers of Bonding Films

- Suppliers of Bonding Films

- Raw Material Suppliers

- Service Providers

- Electrical & Electronics, Transportation, and Packaging End-use Industries

- Government Bodies

Scope of the Report

This report categorizes the bonding films market on the basis of type, technology, end-use industry, and region.

Bonding Films Market, by Type:

The bonding films market has been segmented on the basis of the type into:

- Epoxy

- Acrylic

- Polyurethane

- Others (Polyvinyl Acetate (PVA), Polyvinyl Butyral (PVB), Ethylene-vinyl Acetate (EVA), and phenolic)

Bonding Films Market, by Technology:

The bonding films market has been segmented on the basis of the technology into:

- Thermally Cured

- Pressure Cured

- Others (Chemically Cured and Light cured)

Bonding Films Market, by End-use Industry:

The bonding films market has been segmented on the basis of the end-use industry into:

- Electrical & Electronics

- Transportation

- Packaging

- Others (Medical and Textiles)

Bonding Films Market, by Region:

The bonding films market has been segmented on the basis of the region into:

- Asia Pacific

- North America

- Western Europe

- Central & Eastern Europe

- Rest of the World (The Middle East & Africa and South America)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region to the country level with additional applications and/or types

Country Information

- Additional country information (up to 3)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

The bonding films market was valued at USD 613.5 Million in 2016 and is projected to reach USD 985.5 Million by 2022, at a CAGR of 8.2% from 2017 to 2022. The increased demand for bonding films in the high-end applications of the electrical & electronics and transportation industries is expected to drive the growth of the bonding films market during the forecast period.

The bonding films market has been classified on the basis of type into epoxy, acrylic, polyurethane, and others. Among types, the epoxy segment of the bonding films market is projected to grow at the highest CAGR during the forecast period. The growth of this segment of the market can be attributed to the high bonding strength of epoxy bonding films and their ability to bond with various types of substrates. Moreover, these bonding films offer high bond strength and controlled bond line thickness control. They are capable of being cured at various temperatures.

On the basis of the end-use industry, the bonding films market has been classified into electrical & electronics, transportation, packaging, and others. The electrical & electronics end-use industry segment is projected to lead the bonding films market during the forecast period. The growth of this segment of the market can be attributed to the increasing use of bonding films in automotive, consumer, industrial, and defense & aerospace applications. The electrical & electronics end-use industry segment of the market for bonding films is projected to grow at the highest CAGR between 2017 and 2022.

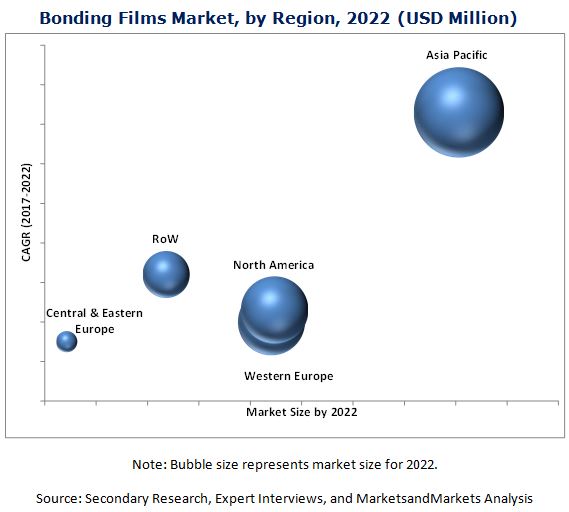

The Asia Pacific region is the largest market for bonding films across the globe. The Asia Pacific bonding films market is projected to grow at the highest CAGR between 2016 and 2022. The growth of the Asia Pacific bonding films can be attributed to the presence of various key manufacturers of bonding films in the region and increasing demand for bonding films from various end-use industries such as electrical & electronics and transportation of the countries such as China, South Korea, Japan, and Taiwan of the Asia Pacific region. Moreover, the easy availability of raw materials in the Asia Pacific region has attracted several global companies and investors to set up their production facilities in the region, thereby fueling the growth of the Asia Pacific bonding films market.

The major factors restraining the growth of the bonding films market across the globe are the high costs involved in the storage and transportation of bonding films, which make them preferable only for high-end applications in various industries as these applications demand high-quality bonding films at high costs.

Some of the key players operating in the bonding films market are Henkel AG & Co. KGaA (Germany), 3M (US), Cytec Solvay Group (Belgium), Hitachi Chemical Co., Ltd. (Japan), Arkema S.A. (France), H.B. Fuller (US), Hexcel Corporation (US), Gurit (Switzerland), DuPont (US), and Rogers Corporation (US). The competition among these players is high, and they mostly compete with each other on the prices and quality of the products, their product portfolios, after sale services, customized solutions, etc.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in Bonding Films Market

4.2 Bonding Films Market, By Type

4.3 Bonding Films Market Share, By Region and Type

4.4 Bonding Films Market Attractiveness

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Usage of Bonding Films in Transportation End-Use Industry

5.2.1.2 Preference Over Conventional Adhesives in High-End Aerospace Applications

5.2.2 Restraints

5.2.2.1 Time Consuming Processing Techniques and High Storage & Transportation Costs

5.2.3 Opportunities

5.2.3.1 Growing Demand in Smart Clothing and Wearable Technology

5.2.4 Challenges

5.2.4.1 Stringent Regulations Governing the Usage of Harmful Adhesive Systems

5.3 Porters Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

6 Bonding Films Market, By Type (Page No. - 40)

6.1 Introduction

6.2 Epoxy

6.3 Acrylic

6.4 Polyurethane

6.5 Others

7 Bonding Films Market, By Technology (Page No. - 47)

7.1 Introduction

7.2 Thermally Cured

7.3 Pressure Cured

7.4 Others

8 Bonding Films Market, By End-Use Industry (Page No. - 49)

8.1 Introduction

8.2 Electrical & Electronics

8.3 Transportation

8.4 Packaging

8.5 Others

9 Bonding Films Market, By Region (Page No. - 58)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 South Korea

9.2.3 Japan

9.2.4 Taiwan

9.2.5 Singapore

9.2.6 India

9.2.7 Rest of Asia-Pacific

9.3 Europe

9.3.1 Western Europe

9.3.1.1 Germany

9.3.1.2 France

9.3.1.3 U.K.

9.3.1.4 Italy

9.3.1.5 Belgium

9.3.1.6 Rest of Western Europe

9.3.2 Central & Eastern Europe

9.3.2.1 Russia

9.3.2.2 Turkey

9.3.2.3 Rest of Central & Eastern Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 RoW

9.5.1 Middle East & Africa

9.5.2 South America

10 Competitive Landscape (Page No. - 92)

10.1 Introduction

10.2 Competitive Leadership Mapping, 2016

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging Companies

10.3 Competitive Benchmarking

10.3.1 Strength of Product Portfolio (25 Players)

10.3.2 Business Strategy Excellence (25 Players)

10.4 Market Ranking of Key Players

10.4.1 Henkel AG & Co. KGaA (Germany)

10.4.2 3M (U.S.)

10.4.3 Cytec Solvay Group (Belgium)

10.4.4 Arkema S.A. (France)

10.4.5 Hitachi Chemical Co., Ltd. (Japan)

10.4.6 H.B. Fuller (U.S.)

11 Company Profiles (Page No. - 98)

(Overview, Strength of Product Portfolio , Business Strategy Excellence , Products Offering, Recent Developments, Business Strategy)*

11.1 Henkel AG & Co. KGaA

11.2 3M

11.3 Cytec Solvay Group

11.4 Hitachi Chemical Co., Ltd.

11.5 Arkema S.A.

11.6 H.B. Fuller

11.7 Hexcel Corporation

11.8 Dupont

11.9 Gurit

11.10 Koninklijke Ten Cate Bv

11.11 Master Bond Inc.

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Products Offering, Recent Developments, Business Strategy Might Not Be Captured in Case of Unlisted Companies.

12 Additional Company Profiles (Page No. - 130)

12.1 Rogers Corporation

12.2 Plitek, LLC

12.3 Pontacol AG

12.4 Formplast

12.5 Fastel Adhesives & Substrate Products

12.6 Dai Nippon Printing Co., Ltd.

12.7 Flextech Srl

12.8 Chemtech Co., Ltd.

12.9 Gluetex GmbH

12.10 HMT Manufacturing, Inc.

12.11 Optimum Plastics.

12.12 Nihon Matai Co., Ltd.

12.13 Everad Adhesives

12.14 Specialty Adhesive Film Co, Inc.

13 Appendix (Page No. - 133)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (66 Tables)

Table 1 Trends and Forecast of Per Capita GDP (USD)

Table 2 Bonding Films Market Size, By Type, 20152022 (USD Million)

Table 3 Epoxy Bonding Films Market Size, By Region, 20152022 (USD Million)

Table 4 Acrylic Bonding Films Market Size, By Region, 20152022 (USD Million)

Table 5 Polyurethane Bonding Films Market Size, By Region, 20152022 (USD Million)

Table 6 Other Bonding Films Market Size, By Region, 20152022 (USD Million)

Table 7 Bonding Films Market Size, By End-Use Industry, 20152022 (USD Million)

Table 8 Bonding Films Market Size in Electrical & Electronics Industry, By Region, 20152022 (USD Million)

Table 9 Bonding Films Market Size in Transportation Industry, By Region, 20152022 (USD Million)

Table 10 Bonding Films Market Size in Packaging Industry, By Type, 20152022 (USD Million)

Table 11 Bonding Films Market Size in Other Industries, By Type, 20152022 (USD Million)

Table 12 Bonding Films Market Size, By Region, 20152022 (USD Million)

Table 13 Asia-Pacific: Market Size, By Country, 20152022 (USD Million)

Table 14 Asia-Pacific: Market Size, By Type, 20152022 (USD Million)

Table 15 Asia-Pacific: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 16 China: Market Size, By Type, 20152022 (USD Million)

Table 17 China: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 18 South Korea: Market Size, By Type, 20152022 (USD Million)

Table 19 South Korea: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 20 Japan: Market Size, By Type, 20152022 (USD Million)

Table 21 Japan: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 22 Taiwan: Market Size, By Type, 20152022 (USD Million)

Table 23 Taiwan: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 24 Singapore:Market Size, By Type, 20152022 (USD Million)

Table 25 Singapore: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 26 India: Market Size, By Type, 20152022 (USD Million)

Table 27 India: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 28 Rest of Asia-Pacific: Market Size, By Type, 20152022 (USD Million)

Table 29 Rest of Asia-Pacific: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 30 Europe: Market Size, By Country, 20152022 (USD Million)

Table 31 Europe: Market Size, By Type, 20152022 (USD Million)

Table 32 Europe: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 33 Germany: Market Size, By Type, 20152022 (USD Million)

Table 34 Germany: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 35 France: Market Size, By Type, 20152022 (USD Million)

Table 36 France: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 37 U.K.: Market Size, By Type, 20152022 (USD Million)

Table 38 U.K.: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 39 Italy: Market Size, By Type, 20152022 (USD Million)

Table 40 Italy: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 41 Belgium: Market Size, By Type, 20152022 (USD Million)

Table 42 Belgium: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 43 Rest of Western Europe: Market Size, By Type, 20152022 (USD Million)

Table 44 Rest of Western Europe: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 45 Russia: Market Size, By Type, 20152022 (USD Million)

Table 46 Russia: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 47 Turkey: Market Size, By Type, 20152022 (USD Million)

Table 48 Turkey: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 49 Rest of Central & Eastern Europe: Market Size, By Type, 20152022 (USD Million)

Table 50 Rest of Central & Eastern Europe: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 51 North America: Market Size, By Country, 20152022 (USD Million)

Table 52 North America: Market Size, By Type, 20152022 (USD Million)

Table 53 North America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 54 U.S.: Market Size, By Type, 20152022 (USD Million)

Table 55 U.S.: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 56 Canada: Market Size, By Type, 20152022 (USD Million)

Table 57 Canada: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 58 Mexico: Market Size, By Type, 20152022 (USD Million)

Table 59 Mexico: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 60 RoW: Market Size, By Country, 20152022 (USD Million)

Table 61 RoW: Market Size, By Type, 20152022 (USD Million)

Table 62 RoW: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 63 Middle East & Africa: Market Size, By Type, 20152022 (USD Million)

Table 64 Middle East & Africa: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 65 South America: Market Size, By Type, 20152022 (USD Million)

Table 66 South America: Market Size, By End-Use Industry, 20152022 (USD Million)

List of Figures (42 Figures)

Figure 1 Bonding Films Market Segmentation

Figure 2 Bonding Films Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Bonding Films: Data Triangulation

Figure 6 Epoxy Bonding Film Was the Largest Segment Across All Region in 2016

Figure 7 Electrical & Electronics to Dominate Bonding Films Market Between 2017 and 2022

Figure 8 Epoxy Bonding Films to Be the Fastest-Growing Type of Segment Between 2017 and 2022

Figure 9 Asia-Pacific Dominated Bonding Films Market in 2016.

Figure 10 Bonding Films Market to Witness High Growth During Forecast Period

Figure 11 Epoxy Bonding Films to Be the Fastest-Growing Segment Between 2017 and 2022

Figure 12 Asia-Pacific Was the Largest Market in 2016

Figure 13 Bonding Films Market to Register High Growth in Asia-Pacific Between 2017 and 2022

Figure 14 Drivers, Restraints, Opportunities, and Challenges of Bonding Films Market

Figure 15 Porters Five Forces Analysis for Bonding Films Market

Figure 16 Epoxy Bonding Films to Be the Fastest-Growing During 20172022

Figure 17 Asia-Pacific to Be the Largest Market for Epoxy Bonding Films Between 2017 and 2022

Figure 18 Asia-Pacific to Be the Fastest-Growing Market for Acrylic Bonding Films Between 2017 and 2022

Figure 19 Asia-Pacific to Be the Largest Market for Polyurethane Bonding Films Between 2017 and 2022

Figure 20 Asia-Pacific to Be the Largest Market for Other Bonding Films Between 2017 and 2022

Figure 21 Electrical & Electronics to Be the Largest End-Use Industry in Bonding Films Market Between 2017 and 2022

Figure 22 Asia-Pacific to Be the Largest Market for Electrical & Electronics End-Use Industry During Forecast Period

Figure 23 Asia-Pacific to Be the Largest Market for Transportation End-Use Industry During Forecast Period

Figure 24 Asia-Pacific to Be the Largest Market for Bonding Films in Packaging Industry During Forecast Period

Figure 25 Asia-Pacific to Be the Largest Segment for Bonding Films in Other End-Use Industries During Forecast Period

Figure 26 Regional Snapshot: Taiwan to Emerge as the Fastest-Growing Market During Forecast Period

Figure 27 Asia-Pacific Market Snapshot: Taiwan to Be Fastest-Growing Market, 20172022

Figure 28 European Market Snapshot: Germany to Be Largest Bonding Films Market During Forecast Period

Figure 29 North American Market Snapshot: U.S. to Be the Fastest-Growing Market

Figure 30 RoW Market Snapshot 20172022

Figure 31 Bonding Films Market (Global) Competitive Leadership Mapping, 2016

Figure 32 Global Bonding Films Market Key Players Ranking, 2016

Figure 33 Henkel AG & Co. KGaA: Company Snapshot

Figure 34 3M: Company Snapshot

Figure 35 Cytec Solvay Group: Company Snapshot

Figure 36 Hitachi Chemical Co., Ltd.: Company Snapshot

Figure 37 Arkema S.A..: Company Snapshot

Figure 38 H.B. Fuller: Company Snapshot

Figure 39 Hexcel Corporation: Company Snapshot

Figure 40 Dupont: Company Snapshot

Figure 41 Gurit: Company Snapshot

Figure 42 Koninklijke Ten Cate BV: Company Snapshot

Growth opportunities and latent adjacency in Bonding Films Market