Blood Culture Tests Market by Method (Conventional, Automated), Product (Consumables, Instruments), Technology (Culture, Molecular, Proteomics), Application (Bacteremia, Fungemia), End User (Hospitals, Reference Labs) & Region- Global Forecast to 2028

Market Growth Outlook Summary

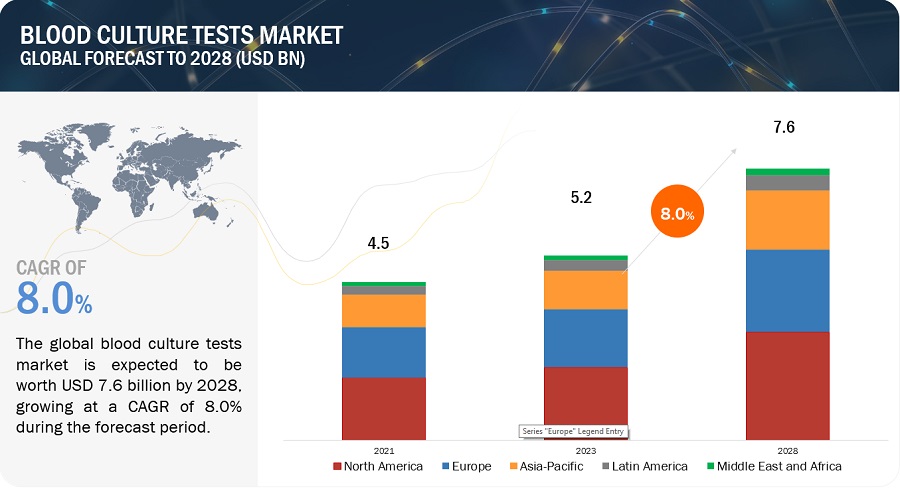

The global blood culture tests market, valued at US$4.5 billion in 2021, stood at US$5.2 billion in 2023 and is projected to advance at a resilient CAGR of 8.0% from 2023 to 2028, culminating in a forecasted valuation of US$7.6 billion by the end of the period. Growth in this market is majorly driven by the factors such as the growing incidence of sepsis cases and high cost treatment, rising geriatric population, high incidence of bloodstream infections, growing demand for rapid diagnostic techniques and high prevalence of infectious diseases. On the other hand, high cost of automated instruments and lack of trained laboratory technicians are expected to restrain the market growth to some extent in the future.

Blood Culture Tests Market - Global Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Blood Culture Tests Market Opportunities

Blood Culture Tests Market Dynamics

Drivers: Growing incidence of sepsis cases and high cost of treatment

Sepsis is a medical condition in which the body is prone to severe inflammatory responses to fungal and bacterial infections. Patients with chronic illness, implanted devices, and those with suppressed immune systems are more prone to growing sepsis.

Sepsis is considered a significant global socioeconomic burden as sepsis and septic shock are associated with a high morbidity rate (which may result in a prolonged hospital stay and increase the associated healthcare costs) and mortality rate. According to the Centre of Disease Control and Prevention (CDC), every year in the US, sepsis leads to more deaths than opioid overdoses, prostate cancer and breast cancer combined.

Restraints: Lack of trained laboratory technicians

Advancements in the technology in blood culture tests have increased their adoption among hospital and reference laboratories, which are major end users of these tests. Clinical guidelines and clinician education influence how diagnostic tests are incorporated into clinical practices. For providing improved patient care, it becomes necessary to engage a clinician’s expertise to determine the best diagnostic tests and interpret correct laboratory results. As the level of awareness about the latest technological advancements in blood culture tests is low among technicians (especially in emerging economies), the adoption of advanced technologies is restricted to a great extent. This is limiting the use of best diagnostic practices and restraining the greater uptake of technologically advanced products.

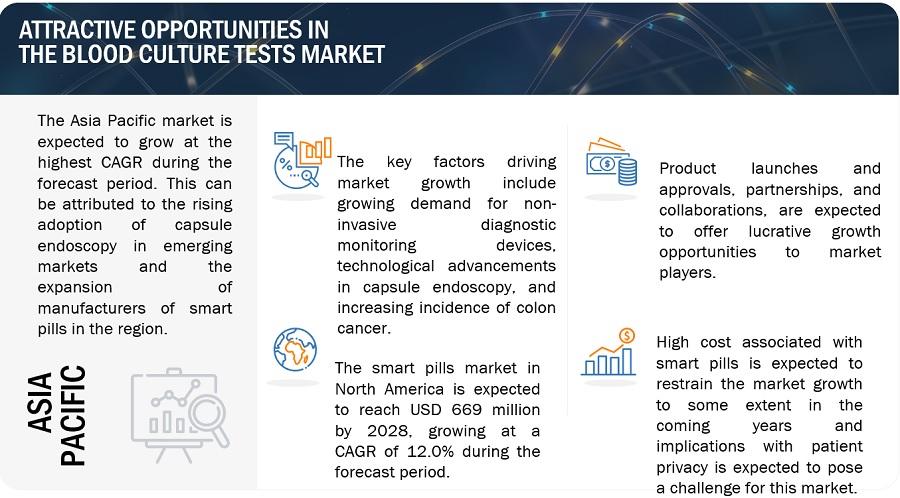

Opportunities: Growth opportunities in emerging economies

Growing countries such as China, India, Brazil, South Korea, Turkey, South Africa and Russia are expected to offer significant growth opportunities to market players during the forecast period. The economic boom over the last few years in these countries is expected to boost the growth of the healthcare sector and create growth opportunities for players operating in the blood culture test market.

Such significant spending will result in the adoption of advanced systems, such as automated blood culture systems, among hospital and reference laboratories in these regions. This, in turn, is expected to provide potential growth opportunities for players operating in the market in the future.

Challenges: Market Cannibalization for conventional products

In recent years, several technologically advanced products that provide enhanced solutions for the detection of microorganisms present in the bloodstream have been launched in the market. These advanced products are expected to cannibalize the market for conventional products, such as microscopes and polystainers, thereby affecting the growth of conventional blood culture testing products. To maintain a competitive position in the market, players need to diversify their product portfolio by adopting new technologies. This will be a challenging task for the market players who have an established portfolio of conventional products to discard all their available products.

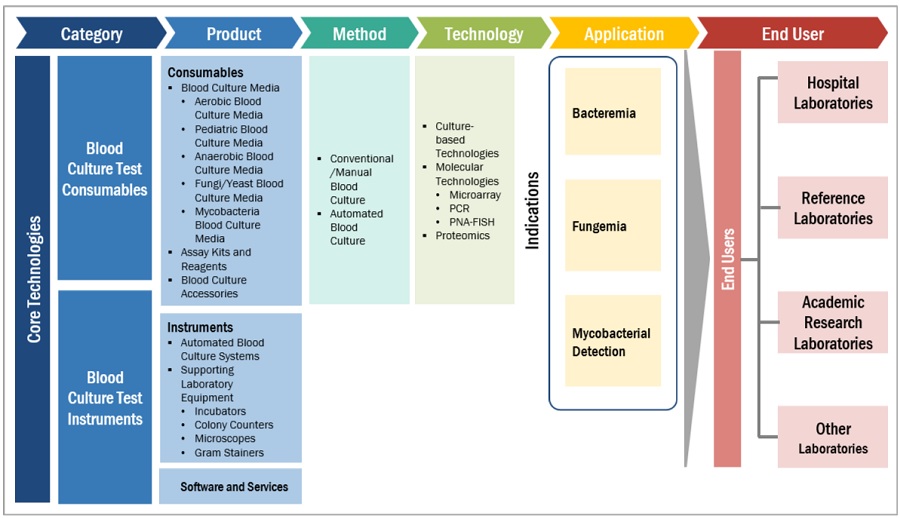

Blood Culture Tests Market Ecosystem Analysis

The conventional/manual blood culture segment has accounted for the largest share of the blood culture tests market during the forecast period.

Based on method, the market is segmented into conventional/manual blood culture and automated blood culture methods. The conventional/manual blood culture methods segment accounted for the largest share of of the global blood culture tests market. The large share of this segment can be attributed to ease of using conventional systems. Also, conventional systems do not require the purchase of expensive instruments.

The consumables segment has accounted for the largest share of the blood culture tests market during the forecast period.

Based on products, the market is primarily divided into consumables, instruments, and software and services. Due to the repeated purchase of media for the detection of bacteria, fungi, and yeast, the consumables segment captures the largest share and is also the fastest growing.

The culture-based technologies segment has accounted for the largest share of the blood culture tests market during the forecast period.

Based on technology, culture-based technologies, molecular technologies, and proteomics make up the major segments of this market. The molecular technologies segment accounted for the high growth in the global blood culture tests market. This can be attributed to the increasing incidence of sepsis, which demands rapid diagnostic techniques for detecting the presence of bacteria, fungi, and mycobacteria from blood samples.

The bacteremia segment has accounted for the largest share of the blood culture tests market during the forecast period.

Based on application, the market is divided into bacteremia, fungemia, and mycobacterial detection. Bacteremia segment is accounted for the largest as well as the highest growing share in the blood culture tests market. This is due to the increasing number of bloodstream infections and the growing number of sepsis cases worldwide.

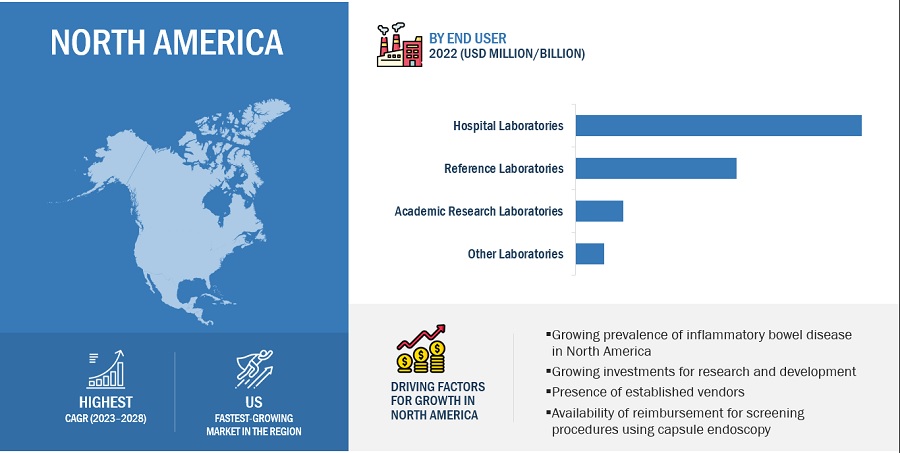

The hospital laboratories segment has accounted for the largest share of the blood culture tests market during the forecast period.

Based on end users, the market is bifurcated into hospital laboratories, reference laboratories, academic research laboratories, and other laboratories (includes pathology laboratories, bacteriological laboratories, physician office laboratories (POLs), and independent research laboratories). The reference laboratories segment is expected to grow at the highest rate in this market. The high growth of this segment is due to the increasing outsourcing of blood culture tests by hospitals to reference laboratories.

North America accounted for the largest share of the blood culture tests market.

The market is segmented into four major regions–North America, Europe, the Asia Pacific (APAC), and the Middle East & Africa. North America has accounted for the largest market share. Factors such as the increasing incidence of bloodstream infections, high prevalence of infectious diseases, rapidly rising geriatric population, the significant presence of blood culture test providers, and growing product approvals are driving the growth of the market in North America.

Blood Culture Tests Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in blood culture tests market are Biobase Biotech (Jinan) Co., Ltd. (China), Scenker Biological Technology Co., Ltd. (China), Bulldog Bio (England), Anaerobe Systems, Inc. (US), Himedia Laboratories Pvt. Ltd. (India), Autobio Diagnostics Co., Ltd. (China), Axiom Laboratories (India), Iridica (US), Biosystems, Inc (US), BINDER GmBH (Germany), Terumo Corporation (Japan), Becton, Dickinson and Company (US), BioMérieux (France), Thermo Fisher Scientific Inc. (US), Danaher (US), Luminex Corporation (US), Bruker (US), Roche Diagnostics (Switzerland), Mikroscan Technologies, Inc. (US), Labotronics Ltd. (UK), Hardy Diagnostics (US), OpGen, Inc. (US), Meditech Technologies India Private Limited (India), Carl Zeiss AG (Germany) and Nikon Corporation (Japan).

Blood Culture Tests Market Report Scope

|

Report Metric |

Details |

|

Market Size in 2023 |

USD 5.2 billion |

|

Forecasted Size by 2028 |

USD 7.6 billion |

|

Market Growth Rate |

Driven by a CAGR of 8.0% |

|

Market Driver |

Growing incidence of sepsis cases and high cost of treatment |

|

Market Opportunity |

Growth opportunities in emerging economies |

This research report categorizes the blood culture tests market to forecast revenue and analyze trends in each of the following submarkets:

By Method

- Conventional/Manual Methods

- Automated Methods

By Product

-

Consumables

-

Blood Culture Media

- Aerobic Blood Culture Media

- Pediatric Aerobic Blood Culture Media

- Anaerobic Blood Culture Media

- Mycobacterial Blood Culture Media

- Fungi/Yeast Blood Culture Media

- Assay Kits & Reagents

- Blood Culture Accessories

-

Blood Culture Media

-

Instruments

- Automated Blood Culture Systems

-

Supporting Laboratory Equipment

- Incubators

- Colony Counters

- Microscopes

- Gram Stainers

- Software and Services

By Technology

- Culture-Based Technology

-

Molecular Technologies

- Microarrays

- PCR (Polymerase Chain Reaction)

- PNA-FiSH (Peptide Nucleic Acid – Fluroscent in Situ Hybridization)

- Proteomics Technology

By Application

- Bacteremia

- Fungemia

- Mycobacterial Detection

By End User

- Hospital Laboratories

- Reference Laboratories

- Academic Research Laboratories

- Other Laboratories

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Blood Culture Tests Market

- In 2023, BioMérieux, announced that it has submitted a 510(k) premarket notification to the US Food and Drug Administration (FDA) for the VITEK REVEAL, formerly known as SPECIFIC REVEALRapid AST System. This rapid, modular, antimicrobial-susceptibility test platform that can deliver actionable results for Gram-negative bacteria directly from positive blood cultures in an average of five and a half hours1 enabling same-day treatment decision-making for patients suffering from bacteremia sepsis.

- In 2023, Bruker introduces fast next-generation MALDI Biotyper IVD Software. The MBT Compass HT IVD software provides a high sample throughput for microbial identification with time-to-result of ~5 minutes for 96 sample spots. Because of a fast sample target exchange, the MBT system can now analyze up to 600 samples per hour, while covering over 4,600 species in the reference library.

- In 2022, BioMérieux, a world leader in the field of in vitro diagnostics, has entered into an agreement to acquire Specific Diagnostics, a privately held US based company that has developed a rapid antimicrobial susceptibility test (AST) system that delivers phenotypic AST directly from positive blood cultures. BioMérieux has held a minority stake in Specific Diagnostics since 2019, and the two companies had signed a co-distribution agreement covering the European market in 2021. With the addition of SPECIFIC REVEAL Rapid AST, the unique and comprehensive BioMérieux Sepsis Solution allows same-day AST results for Gram-negative bacteria to enable more targeted therapy and improve patient outcomes.

- In 2022, Beckman Coulter, partnered with Germany-based company Smart4Diagnostics to close the preanalytical data gap between blood collection and laboratory analysis due to errors that take place before the sample arrives in the laboratory, such as sample collection, patient identification, sample handling, sample transportation, sample loss, etc.

- In 2020, Becton, Dickinson and Company obtained the CE mark approval for the BD Vacutainer UltraTouch Push Button Blood Collection Set (BCS) with Preattached Holder. The one-handed safety activation of the push button allows clinicians to activate the safety mechanism while still attending to the patient and venipuncture site.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global blood culture tests market between 2023 and 2028?

The global blood culture tests market is projected to grow from USD 5.2 billion in 2023 to USD 7.6 billion by 2028, demonstrating a robust CAGR of 8.0%.

What are the key factors driving the blood culture tests market?

The major factors driving the blood culture tests market include the growing incidence of sepsis cases, high cost of treatment, the increasing geriatric population, and the high prevalence of infectious diseases.

What are the main challenges facing the blood culture tests market?

The blood culture tests market faces challenges such as the high cost of automated instruments and a lack of trained laboratory technicians, which may hinder the adoption of advanced technologies.

Which regions are expected to show growth in the blood culture tests market?

Emerging economies such as China, India, Brazil, South Korea, Turkey, South Africa, and Russia are expected to provide significant growth opportunities for the blood culture tests market due to increased healthcare spending and demand for advanced diagnostic solutions.

What are the key products used in blood culture testing?

Key products in blood culture testing include consumables (such as blood culture media), automated blood culture systems, and supporting laboratory equipment like incubators and microscopes.

How does the increasing prevalence of bloodstream infections affect the blood culture tests market?

The rising prevalence of bloodstream infections is driving the demand for blood culture tests, particularly in identifying bacteremia and fungemia cases, thereby enhancing market growth.

What are the recent developments in the blood culture tests market?

Recent developments include BioMérieux's submission of a 510(k) premarket notification for the VITEK REVEAL system and Bruker's introduction of fast next-generation MALDI Biotyper IVD Software to enhance microbial identification capabilities.

What role do hospital laboratories play in the blood culture tests market?

Hospital laboratories account for the largest share of the blood culture tests market, with a growing trend of outsourcing blood culture tests to reference laboratories for enhanced efficiency and accuracy.

How is the geriatric population impacting the blood culture tests market?

The rising geriatric population contributes to an increased incidence of infections and sepsis, thereby driving the demand for blood culture tests as a crucial diagnostic tool in managing health issues in older adults.

What advancements in technology are influencing the blood culture tests market?

Technological advancements in blood culture testing, including automation and molecular diagnostics, are significantly improving the speed and accuracy of results, fostering market growth and innovation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 INTRODUCTIONDRIVERS- Increasing number of sepsis patients and rising cost of treatment- Rapid growth in geriatric population with chronic diseases- High incidence of nosocomial bloodstream infections- Growing demand for rapid diagnostic techniques with faster turnaround times- High prevalence of infectious diseases globallyRESTRAINTS- High cost of automated blood culture instruments- Lack of trained laboratory techniciansOPPORTUNITIES- Growth opportunities in emerging economies- Increased need to identify antibiotic-resistant microorganismsCHALLENGES- Market cannibalization for conventional products- Difficulty in survival of new entrants

-

5.2 INDUSTRY TRENDSLABORATORY AUTOMATION FOR INCREASED EFFICIENCY AND ACCURATE DIAGNOSISFOCUS ON ANTIMICROBIAL STEWARDSHIP

-

5.3 TECHNOLOGY ANALYSISADVANCED FLUORESCENCE DETECTION TECHNOLOGY

-

5.4 AVERAGE SELLING PRICE, BY TYPEAVERAGE SELLING PRICE FOR BLOOD CULTURE TEST PRODUCTS, BY KEY PLAYER (2022)

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM MAPPING

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 TARIFF AND REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY ANALYSIS- North America- EuropeASIA PACIFIC- Japan- China- India

-

5.10 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR BLOOD CULTURE TESTS MARKETINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 CONVENTIONAL/MANUAL BLOOD CULTURECONVENTIONAL/MANUAL BLOOD CULTURE METHOD TO ACCOUNT FOR LARGER SHARE OF BLOOD CULTURE TESTS MARKET

-

6.3 AUTOMATED BLOOD CULTUREINCREASED R&D INVESTMENTS BY MANUFACTURERS FOR DEVELOPING NOVEL PRODUCTS TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 CONSUMABLESBLOOD CULTURE MEDIA- Aerobic blood culture media- Pediatric aerobic blood culture media- Anaerobic blood culture media- Mycobacterial blood culture media- Fungi/yeast blood culture mediaASSAY KITS & REAGENTS- Increased need for rapid identification of bacteria and yeast from positive blood cultures to drive marketBLOOD CULTURE ACCESSORIES- Growing number of blood culture tests to drive market

-

7.3 INSTRUMENTSAUTOMATED BLOOD CULTURE SYSTEMS- Need for automated imaging systems and advanced algorithms to drive marketSUPPORTING LABORATORY EQUIPMENT- Incubators- Colony counters- Microscopes- Gram stainers

-

7.4 SOFTWARE & SERVICESINCREASED NEED FOR AUTOMATED SYSTEMS IN HOSPITAL-BASED LABORATORIES TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 CULTURE-BASED TECHNOLOGIESDRAWBACKS ASSOCIATED WITH TRADITIONAL CULTURE-BASED TECHNOLOGIES TO LIMIT MARKET

-

8.3 TOP OF FORMMOLECULAR TECHNOLOGIESMICROARRAYS- Determination of better genotyping characterization and identification of bacterial infections to drive segmentPCR- Reduced risk of contaminations and easy detection of bloodstream infections to drive segmentPNA-FISH- PNA-FISH to use genetic markers for analysis of pathogens directly from whole blood samples

-

8.4 PROTEOMICSPROTEOMICS TO CONTROL INFECTIOUS DISEASES AND ANALYZE COMPLEX MICROBIAL SYSTEMS WITHIN HUMAN FLUIDS

- 9.1 INTRODUCTION

-

9.2 BACTEREMIAGROWING INCIDENCE OF SEPSIS CASES GLOBALLY TO DRIVE MARKET

-

9.3 FUNGEMIAINCREASING INCIDENCE OF BLOODSTREAM INFECTIONS TO DRIVE MARKET

-

9.4 MYCOBACTERIAL DETECTIONRISING GERIATRIC POPULATION WITH TUBERCULOSIS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 HOSPITAL LABORATORIESINCREASED ABILITY TO CONDUCT LARGE VOLUME OF BLOOD CULTURE TESTS TO DRIVE MARKET

-

10.3 REFERENCE LABORATORIESINCREASING REQUIREMENT OF ROUTINE AND SPECIALTY TESTS TO DRIVE MARKET

-

10.4 ACADEMIC RESEARCH LABORATORIESINCREASING FOCUS ON R&D OF INNOVATIVE TESTS FOR BLOODSTREAM INFECTIONS TO DRIVE MARKET

- 10.5 OTHER LABORATORIES

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAUS- US to dominate blood culture tests market during study periodCANADA- Increasing incidence of bloodstream infections to drive marketNORTH AMERICA: RECESSION IMPACT

-

11.3 EUROPEGERMANY- Germany commanded largest share of European blood culture tests market in 2022UK- High burden of sepsis and increased geriatric population to drive marketFRANCE- Rising geriatric population and favorable government regulations to drive marketITALY- Slow growth in healthcare sector with increased health expenditure to limit marketSPAIN- Rapid increase in diagnostic procedures and improved healthcare infrastructure to drive marketREST OF EUROPEEUROPE: RECESSION IMPACT

-

11.4 ASIA PACIFICJAPAN- Japan to be largest market for blood culture tests in Asia PacificCHINA- Rapid economic growth and rising disposable income of middle-class population to drive marketINDIA- Rising prevalence of infectious diseases and growing geriatric population to drive marketREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

11.5 LATIN AMERICAFAVORABLE GOVERNMENT INITIATIVES TO DRIVE MARKETLATIN AMERICA: RECESSION IMPACT

-

11.6 MIDDLE EAST & AFRICAINFRASTRUCTURAL DEVELOPMENTS AND ADVANCED HEALTHCARE FACILITIES TO DRIVE MARKETMIDDLE EAST & AFRICA: RECESSION IMPACT

- 12.1 MARKET OVERVIEW

- 12.2 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS

- 12.3 MARKET SHARE ANALYSIS

-

12.4 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.5 COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

12.6 COMPANY FOOTPRINTMETHOD FOOTPRINTPRODUCT FOOTPRINTTECHNOLOGY FOOTPRINTAPPLICATION FOOTPRINTEND USER FOOTPRINTREGIONAL FOOTPRINT

-

12.7 COMPETITIVE SCENARIOS AND TRENDSKEY PRODUCT LAUNCHES AND APPROVALSKEY DEALS

-

13.1 KEY PLAYERSBECTON, DICKINSON AND COMPANY- Business overview- Products offered- Recent developments- MnM viewBIOMÉRIEUX- Business overview- Products offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC INC.- Business overview- Products offered- MnM viewDANAHER- Business overview- Products offered- Recent developments- MnM viewLUMINEX CORPORATION- Business overview- Products offered- Recent developments- MnM viewBRUKER- Business overview- Products offered- Recent developmentsROCHE DIAGNOSTICS- Business overview- Products offered- Recent developmentsIRIDICA- Business overview- Products offeredT2 BIOSYSTEMS, INC.- Business overview- Products offered- Recent developmentsBINDER GMBH- Business overview- Products offeredBIOBASE BIOTECH (JINAN) CO., LTD.- Business overview- Products offeredSCENKER BIOLOGICAL TECHNOLOGY CO., LTD.- Business overview- Products offeredBULLDOG BIO- Business overview- Products offeredANAEROBE SYSTEMS, INC.- Business overview- Products offeredHIMEDIA LABORATORIES PVT. LTD.- Business overview- Products offeredAUTOBIO DIAGNOSTICS CO., LTD.- Business overview- Products offeredAXIOM LABORATORIES- Business overview- Products offeredMIKROSCAN TECHNOLOGIES, INC.- Business overview- Products offered- Recent developmentsLABOTRONICS LTD.- Business overview- Products offeredHARDY DIAGNOSTICS- Business overview- Products offered

-

13.2 OTHER PLAYERSOPGEN, INC.MEDITECH TECHNOLOGIES INDIA PRIVATE LIMITEDCARL ZEISS AGNIKON CORPORATIONTERUMO CORPORATION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 RISK ASSESSMENT: BLOOD CULTURE TESTS MARKET

- TABLE 3 US: FIVE MOST EXPENSIVE CONDITIONS TREATED IN HOSPITALS

- TABLE 4 GERIATRIC POPULATION: KEY STATISTICS

- TABLE 5 REGIONAL PRICING ANALYSIS OF BLOOD CULTURE TEST PRODUCTS, BY TYPE, 2021 (USD)

- TABLE 6 PORTER’S FIVE FORCES ANALYSIS: BLOOD CULTURE TESTS MARKET

- TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 9 US: TIME, COST, AND COMPLEXITY OF REGISTRATION

- TABLE 10 CANADA: CLASSIFICATION OF PRODUCTS

- TABLE 11 CANADA: TIME, COST, AND COMPLEXITY OF REGISTRATION

- TABLE 12 EUROPE: ACCREDITATION BODIES FOR MEDICAL LABORATORIES

- TABLE 13 BLOOD CULTURE TESTS MARKET: LIST OF PATENTS (2020–2023)

- TABLE 14 BLOOD CULTURE TESTS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS IN 2023–2024

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN BLOOD CULTURE TESTS MARKET (%)

- TABLE 16 KEY BUYING CRITERIA FOR BLOOD CULTURE TEST METHODS

- TABLE 17 BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 18 EXAMPLES OF CONVENTIONAL/MANUAL BLOOD CULTURE PRODUCTS

- TABLE 19 BLOOD CULTURE TESTS MARKET FOR CONVENTIONAL/MANUAL BLOOD CULTURE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 EXAMPLES OF AUTOMATED BLOOD CULTURE PRODUCTS

- TABLE 21 BLOOD CULTURE TESTS MARKET FOR AUTOMATED BLOOD CULTURE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 23 BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 24 BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 EXAMPLES OF BLOOD CULTURE MEDIA

- TABLE 26 BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 27 BLOOD CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 AEROBIC BLOOD CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 PEDIATRIC AEROBIC BLOOD CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 ANAEROBIC BLOOD CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 MYCOBACTERIAL BLOOD CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 FUNGI/YEAST BLOOD CULTURE MEDIA MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 EXAMPLES OF BLOOD CULTURE ASSAY KITS & REAGENTS

- TABLE 34 ASSAY KITS & REAGENTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 EXAMPLES OF BLOOD CULTURE ACCESSORIES

- TABLE 36 BLOOD CULTURE ACCESSORIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 38 EXAMPLES OF AUTOMATED BLOOD CULTURE SYSTEMS

- TABLE 39 AUTOMATED BLOOD CULTURE SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 41 SUPPORTING LABORATORY EQUIPMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 INCUBATORS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 COLONY COUNTERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 MICROSCOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 GARAM STAINERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 BLOOD CULTURE TESTS MARKET FOR SOFTWARE & SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 48 BLOOD CULTURE TESTS MARKET FOR CULTURE-BASED TECHNOLOGIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 50 BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 MICROARRAYS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 PCR MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 PNA-FISH MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 BLOOD CULTURE TESTS MARKET FOR PROTEOMICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 EXAMPLES OF MALDI-TOF MS SYSTEMS

- TABLE 56 BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028(USD MILLION)

- TABLE 57 BLOOD CULTURE TESTS MARKET FOR BACTEREMIA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 BLOOD CULTURE TESTS MARKET FOR FUNGEMIA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 BLOOD CULTURE TESTS MARKET FOR MYCOBACTERIAL DETECTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 61 BLOOD CULTURE TESTS MARKET FOR HOSPITAL LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 BLOOD CULTURE TESTS MARKET FOR REFERENCE LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 BLOOD CULTURE TESTS MARKET FOR ACADEMIC RESEARCH LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 BLOOD CULTURE TESTS MARKET FOR OTHER LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 BLOOD CULTURE TESTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 77 US: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 78 US: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 79 US: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 80 US: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 US: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 US: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 US: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 84 US: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 85 US: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 US: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 CANADA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 88 CANADA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 89 CANADA: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 CANADA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 CANADA: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 92 CANADA: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 CANADA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 94 CANADA: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 CANADA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 96 CANADA: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 97 EUROPE: BLOOD CULTURE TESTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 98 EUROPE: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 99 EUROPE: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 100 EUROPE: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 EUROPE: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 EUROPE: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 EUROPE: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 105 EUROPE: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 EUROPE: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 107 EUROPE: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 108 GERMANY: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 109 GERMANY: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 110 GERMANY: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 GERMANY: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 112 GERMANY: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 GERMANY: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 GERMANY: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 115 GERMANY: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 116 GERMANY: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 117 GERMANY: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 118 UK: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 119 UK: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 120 UK: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 UK: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 UK: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 123 UK: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 UK: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 125 UK: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 UK: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 127 UK: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 128 FRANCE: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 129 FRANCE: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 130 FRANCE: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 FRANCE: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 FRANCE: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 FRANCE: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 FRANCE: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 135 FRANCE: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 FRANCE: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 137 FRANCE: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 138 ITALY: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 139 ITALY: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 140 ITALY: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 ITALY: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 142 ITALY: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 ITALY: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 144 ITALY: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 145 ITALY: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 ITALY: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 147 ITALY: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 148 SPAIN: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 149 SPAIN: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 150 SPAIN: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 151 SPAIN: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 152 SPAIN: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 153 SPAIN: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 154 SPAIN: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 155 SPAIN: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 SPAIN: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 157 SPAIN: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 158 REST OF EUROPE: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 159 REST OF EUROPE: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 160 REST OF EUROPE: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 REST OF EUROPE: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 162 REST OF EUROPE: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 163 REST OF EUROPE: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 164 REST OF EUROPE: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 165 REST OF EUROPE: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 REST OF EUROPE: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 167 REST OF EUROPE: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 169 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 171 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 179 JAPAN: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 180 JAPAN: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 181 JAPAN: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 182 JAPAN: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 183 JAPAN: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 184 JAPAN: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 185 JAPAN: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 186 JAPAN: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 187 JAPAN: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 188 JAPAN: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 189 CHINA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 190 CHINA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 191 CHINA: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 192 CHINA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 193 CHINA: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 194 CHINA: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 195 CHINA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 196 CHINA: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 197 CHINA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 198 CHINA: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 199 INDIA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 200 INDIA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 201 INDIA: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 202 INDIA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 203 INDIA: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 204 INDIA: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 205 INDIA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 206 INDIA: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 207 INDIA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 208 INDIA: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 215 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 216 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 217 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 218 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 219 LATIN AMERICA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 220 LATIN AMERICA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 221 LATIN AMERICA: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 223 LATIN AMERICA: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 224 LATIN AMERICA: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 225 LATIN AMERICA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 227 LATIN AMERICA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 228 LATIN AMERICA: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: MOLECULAR TECHNOLOGIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 239 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN BLOOD CULTURE TESTS MARKET

- TABLE 240 BLOOD CULTURE TESTS MARKET: DEGREE OF COMPETITION

- TABLE 241 BLOOD CULTURE TESTS MARKET: COMPANY FOOTPRINT ANALYSIS

- TABLE 242 BLOOD CULTURE TESTS MARKET: METHOD FOOTPRINT ANALYSIS

- TABLE 243 BLOOD CULTURE TESTS MARKET: PRODUCT FOOTPRINT ANALYSIS

- TABLE 244 BLOOD CULTURE TESTS MARKET: TECHNOLOGY FOOTPRINT ANALYSIS

- TABLE 245 BLOOD CULTURE TESTS MARKET: APPLICATION FOOTPRINT ANALYSIS

- TABLE 246 BLOOD CULTURE TESTS MARKET: END USER FOOTPRINT ANALYSIS

- TABLE 247 BLOOD CULTURE TESTS MARKET: REGIONAL FOOTPRINT ANALYSIS

- TABLE 248 KEY PRODUCT LAUNCHES AND APPROVALS (JANUARY 2020–JULY 2023)

- TABLE 249 KEY DEALS (JANUARY 2020–JULY 2023)

- TABLE 250 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 251 BIOMÉRIEUX: COMPANY OVERVIEW

- TABLE 252 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 253 DANAHER: COMPANY OVERVIEW

- TABLE 254 LUMINEX CORPORATION: COMPANY OVERVIEW

- TABLE 255 BRUKER: COMPANY OVERVIEW

- TABLE 256 ROCHE DIAGNOSTICS: COMPANY OVERVIEW

- TABLE 257 IRIDICA: COMPANY OVERVIEW

- TABLE 258 T2 BIOSYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 259 BINDER GMBH: COMPANY OVERVIEW

- TABLE 260 BIOBASE BIOTECH (JINAN) CO., LTD.: COMPANY OVERVIEW

- TABLE 261 SCENKER BIOLOGICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 262 BULLDOG BIO: COMPANY OVERVIEW

- TABLE 263 ANAEROBE SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 264 HIMEDIA LABORATORIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 265 AUTOBIO DIAGNOSTICS CO., LTD.: COMPANY OVERVIEW

- TABLE 266 AXIOM LABORATORIES: COMPANY OVERVIEW

- TABLE 267 MIKROSCAN TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 268 LABOTRONICS LTD.: COMPANY OVERVIEW

- TABLE 269 HARDY DIAGNOSTICS: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

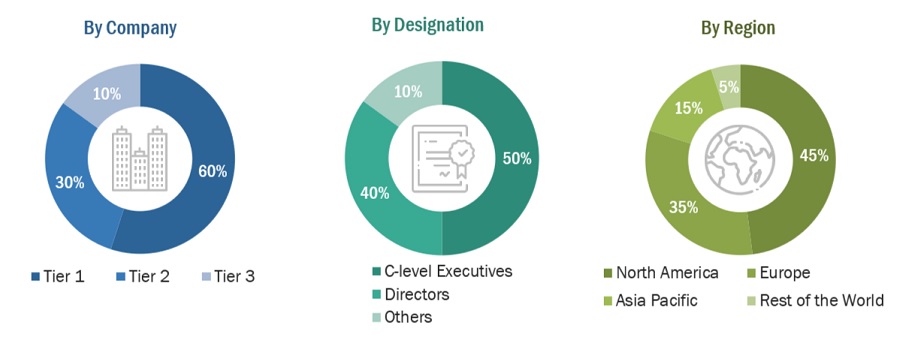

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 5 SEGMENTAL EXTRAPOLATION: GLOBAL BLOOD CULTURE TESTS MARKET (2022)

- FIGURE 6 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2023–2028)

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET DATA TRIANGULATION METHODOLOGY

- FIGURE 9 BLOOD CULTURE TESTS MARKET, BY METHOD, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 BLOOD CULTURE TESTS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF BLOOD CULTURE TESTS MARKET

- FIGURE 15 GROWING INCIDENCE OF SEPSIS CASES AND HIGH COST OF TREATMENT TO DRIVE MARKET

- FIGURE 16 CONSUMABLES SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 CONVENTIONAL/MANUAL BLOOD CULTURE SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC BLOOD CULTURE TESTS MARKET IN 2022

- FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH RATE DURING STUDY PERIOD

- FIGURE 19 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 20 BLOOD CULTURE TESTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- FIGURE 22 SUPPLY CHAIN ANALYSIS: BLOOD CULTURE TESTS MARKET

- FIGURE 23 ECOSYSTEM MAPPING: BLOOD CULTURE TESTS MARKET

- FIGURE 24 PATENT PUBLICATION TRENDS (JANUARY 2011–JUNE 2023)

- FIGURE 25 TOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR BLOOD CULTURE TEST PATENTS (JANUARY 2011–JUNE 2023)

- FIGURE 26 TOP APPLICANTS FOR BLOOD CULTURE TEST PATENTS (COUNTRY/REGION) (JANUARY 2011–JULY 2023)

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN BLOOD CULTURE TESTS MARKET

- FIGURE 28 KEY BUYING CRITERIA FOR BLOOD CULTURE TEST METHODS

- FIGURE 29 NORTH AMERICA: BLOOD CULTURE TESTS MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET SNAPSHOT

- FIGURE 31 BLOOD CULTURE TESTS MARKET: REVENUE SHARE ANALYSIS OF MAJOR PLAYERS

- FIGURE 32 BLOOD CULTURE TESTS MARKET SHARE ANALYSIS, BY KEY PLAYER (2022)

- FIGURE 33 BLOOD CULTURE TESTS MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- FIGURE 34 BLOOD CULTURE TESTS MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)

- FIGURE 35 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- FIGURE 36 BIOMÉRIEUX: COMPANY SNAPSHOT (2022)

- FIGURE 37 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- FIGURE 38 DANAHER: COMPANY SNAPSHOT (2022)

- FIGURE 39 LUMINEX CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 40 BRUKER: COMPANY SNAPSHOT (2022)

- FIGURE 41 ROCHE DIAGNOSTICS: COMPANY SNAPSHOT (2022)

- FIGURE 42 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- FIGURE 43 T2 BIOSYSTEMS, INC.: COMPANY SNAPSHOT (2022)

This study involved three major activities in estimating the size of the blood culture tests market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), American Society for Gastrointestinal Endoscopy (ASGE), International Federation of Societies of Endoscopic Surgeons (IFSES), Asia-Pacific Association for Gynecologic Endoscopy and Minimally Invasive Therapy (APAGE), European Society of Gastrointestinal Endoscopy (ESGE), Centers for Disease Control and Prevention (CDC), Organisation for Economic Co-operation and Development (OECD), Food and Drug Administration (FDA), Centers for Disease Control and Prevention (CDC), European Medicines Agency (EMA), Annual Reports, SEC Filings, Investor Presentations, Journals, Publications from Government Sources and Professional Associations, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the clinical decision support system market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the blood culture tests market. The primary sources from the demand side included industry experts, consultants, healthcare providers, hospital administration, and government bodies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

Breakdown of Primary Interviews

Note 1: Companies are classified into tiers based on their total revenue. As of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Bottom-up approaches was used to estimate and validate the total size of the blood culture tests market. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Approach 1: Revenue Share Analysis

Revenues of individual companies were gathered from public sources and databases.

Shares of the blood culture tests business of leading players were gathered from secondary sources to the extent available. In certain cases, the share of the blood culture tests business was ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling price, and geographic reach and strength.

Individual shares or revenue estimates were validated through expert interviews.

The following figure shows an illustrative representation of the overall market size estimation process employed for this study.

To know about the assumptions considered for the study, Request for Free Sample Report

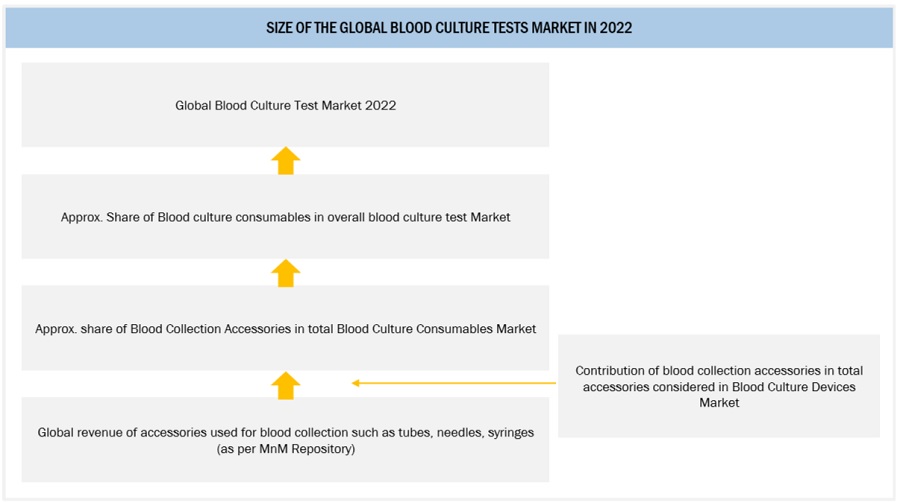

Approach 2: Segmental Extrapolation

Revenue of Accessories such as tubes, needles, and syringes used in blood collection and testing for 2022 was considered referring to the MnM repository.

Considering the contribution of blood collection accessories in the accessories considered for blood culture testing, specific revenue for tubes, needles and syringes (Accessories) was determined.

Estimating the share of blood culture accessories in total blood culture consumables, overall revenue of blood culture consumables was determined for 2022, which was further extrapolated to estimate the global blood culture tests market in 2022.

Segmental EXTRAPOLATION: global blood culture tests market 2022

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the provider, payer, and other industries.

Market Definition

Blood culture testing detects the presence of microbes such as bacteria, yeast, and other microorganisms in a blood specimen. This type of testing determines the nature and severity of blood infections, identifies the causative organisms of blood infections, and helps prevent adverse consequences.

Key Stakeholders

- Molecular diagnostics companies

- Clinical microbiology instrument and consumable manufacturers

- Research and consulting firms

- Clinical diagnostic laboratories

- Healthcare institutions (hospitals, medical schools, group practices, individual surgeons, and governing bodies)

- Medical device vendors/service providers

- Research institutes

- Venture capitalists and investors

Report Objectives

- To define, describe, and forecast the blood culture tests market based on the application,product, method, technology,end user and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges).

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall blood culture tests market.

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, and the Middle East & Africa.

- To strategically analyze the market structure and profile the key players and their core competencies2 in the global blood culture tests market.

- To track and analyze competitive developments such as product launches and approvals, contracts, acquisitions, partnerships, and agreements in the blood culture tests market.

Customization Options

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix: Detailed comparison of the product portfolios of the top companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blood Culture Tests Market