Biomarker Technologies Market by Profiling Technology (Chromatography, NGS, PCR, Mass Spectrometry, Immunoassay, Liquid Biopsy (ddPCR, DHPLC)), Research Area (Proteomics, Lipidomics), Application (Biomarker Validation, Biomarker Discovery) & Geography

The global biomarker technologies market is projected to grow at a CAGR of 9.7%. While significant advances have been made in the area of biomarkers, translating them into useful clinical assays is tedious and a prime hurdle to the clinical use of these biomarkers. The growth of this market is driven by factors such as increasing healthcare expenditure, increase in R&D funding, and the increasing utility of Biomarkers for diagnostic purposes, and rising biomarker research.

Objectives of the Study

- To define, describe, and forecast the biomarker technologies market by test type, product, application, profiling technology, disease indication, system, and research type

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and to provide details of the competitive landscape for market leaders

- To forecast the size of the market in North America, Europe, Asia Pacific, and Rest of the World

Research Methodology

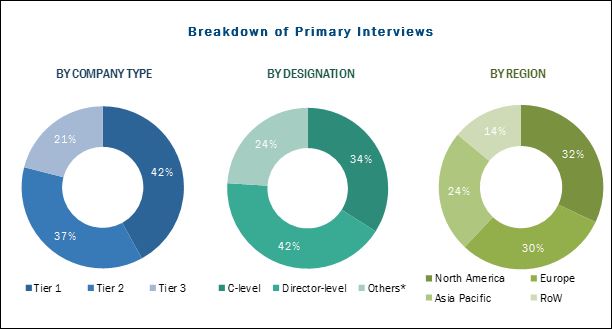

Top-down and bottom-up approaches were used to validate the size of the biomarker technologies industry and estimate the size of various other dependent submarkets. Major players in the market were identified through secondary research and their market revenues determined through primary and secondary research. Secondary research included the study of the annual and financial reports of top market players, whereas primary research included extensive interviews with key opinion leaders such as CEOs, Directors, and Marketing Executives. The percentage splits, shares, and breakdowns of the segments were determined using secondary sources and verified through primary sources. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

MnM assisted a US based leading specialty measurement company to identify USD 25 million revenue by helping in tapping into the Asia Pacific biomarker clinical diagnostics and research market

Client’s Problem Statement

The client was keen to know the market of biomarkers in clinical diagnostics including drug discovery and development and in research globally with specific forcus on Asia Pacific where the business potential is higher than mature markets namely North America and Europe

Our Client, a leading provider of analytical laboratory instruments and software, was keen to understand

.The global market for different segments, including biomarkers instruments market, diseases indication and consumables market by application, and consumables market by assay kits & reagents

.The bifurcation of the total biomarker market in drug discovery and development and diagnostics use; the latter being further segmented in research and clinical use

.Detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

.Market share analysis of key players in the mass spectroscopy segment

MnM Approach

MnM started by identifying key technologies used in biomarker identification and profiling. Later, MnM identified key applications and diseases where each of these technologies is used. MnM interviewed a host of product suppliers and potential customers/end-use industries to understand their unmet needs, possible use cases, and benefits from these technologies as well as what they looked for in a technology partner.

This helped our client to assess the market potential across various application areas, including clinical diagnostics, research, and drug discovery. Further, MnM also helped the client to build an understanding of the competitive landscape, varying business models, and strategies of different players in the biomarker technology market. This helped them to devise a differentiated product offering and forge suitable alliances to help them win in this market.

Revenue Impact (RI)

MnM work resulted in the client tapping into the global biomarker technologies market pegged at approximately USD 51.5 billion, with projected market of USD 25 million in Asia Pacific in next five years

The biomarker technologies market is highly competitive. The major players in this market are Thermo Fisher Scientific (US), Agilent Technologies (US), Roche (Switzerland), Danaher Corporation (US), Waters Corporation (US), Shimadzu Corporation (Japan), and Bio-Rad Laboratories (US).

Target Audience

- Hospitals and clinics

- Research institutes and clinical research organizations

- Market research and consulting firms

- Authorities framing reimbursement policies for the use of cancer diagnostics

- Companies offering kits/assays/platforms/technologies for biomarker testing

- Pharmaceutical Companies

Scope of the Report

The research report categorizes the biomarker technologies market into the following segments and subsegments:

Biomarker Technologies Market, by Test Type

- Solid Biopsy

- Liquid Biopsy

Biomarker Liquid Biopsy Market, by Application

- Clinical Diagnostics

- Research

- Drug Discovery & Development

Liquid Biopsy Market, by Technology

- ddPCR

- NGS

- Mass Spectrometry

- DHPLC

- Other Technologies

Biomarker Technologies Market, by Product

- Consumables

- Instruments

- Services

- Software/Informatics

Biomarker Products Market, by Application

-

Consumables

-

Diagnostics

- Clinical Use

- Research

- Drug Discovery & Development

-

Diagnostics

-

Instruments

-

Diagnostics

- Clinical Use

- Research

- Drug Discovery & Development

-

Diagnostics

-

Services

-

Diagnostics

- Clinical Use

- Research

- Drug Discovery & Development

-

Diagnostics

-

Software/Informatics

-

Diagnostics

- Clinical Use

- Research

- Drug Discovery & Development

-

Diagnostics

Biomarker Technologies Market, by Profiling Technology

-

Immunoassay

- ELISA

- Western Blot

- Protein Microarray

- PCR

- Imaging Technologies

- Mass Spectrometry

- NGS

- Chromatography

- Cytogenetics

- Other Profiling Technologies

Biomarker Profiling Technologies Market, by Application

-

Immunoassay

- Clinical Diagnostics

- Research

- Drug Discovery and Development

-

PCR

- Clinical Diagnostics

- Research

- Drug Discovery and Development

-

Mass Spectrometry

- Clinical Diagnostics

- Research

- Drug Discovery and Development

-

NGS

- Clinical Diagnostics

- Research

- Drug Discovery and Development

-

Imaging Technologies

- Clinical Diagnostics

- Research

- Drug Discovery and Development

-

Cytogenetics

- Clinical Diagnostics

- Research

- Drug Discovery and Development

-

Other Technologies

- Clinical Diagnostics

- Research

- Drug Discovery and Development

Biomarker Disease Indication Market, by Application

-

Cancer

-

Diagnostics

- Clinical Use

- Research

- Drug Discovery & Development

-

Diagnostics

-

Infectious Diseases

-

Diagnostics

- Clinical Use

- Research

- Drug Discovery & Development

-

Diagnostics

-

Autoimmune Disorders

-

Diagnostics

- Clinical Use

- Research

- Drug Discovery & Development

-

Diagnostics

-

Neurological Disorders

-

Diagnostics

- Clinical Use

- Research

- Drug Discovery & Development

-

Diagnostics

-

Cardiovascular Disorders

-

Diagnostics

- Clinical Use

- Research

- Drug Discovery & Development

-

Diagnostics

-

Other Disease Indications

-

Diagnostics

- Clinical Use

- Research

- Drug Discovery & Development

-

Diagnostics

Biomarker Technologies Market, by Application

- Biomarker Identification, Validation & Development Research

- Routine Biomarker-based tests

Biomarker Technology Applications Market, by Product

-

Biomarker Identification, Validation & Development Research

- Consumables

- Instruments

- Services

- Software

-

Routine Biomarker-based tests

- Consumables

- Instruments

- Services

- Software

Biomarker Technologies Market, by Research Area

- Genomics

- Proteomics

-

Metabolomics

- Metabolic Flux

- Lipidomics

- Others

- Other Research Areas

Biomarker Technologies Market, by Region

- North America

- Europe

- Asia Pacific

- RoW

Available Customization

Company Information: - Detailed analysis and profiling of five market players.

Based on product type, the biomarker technologies market is classified into consumables, instruments, services, and software/informatics. In 2017, the consumables segment was expected to account for the largest share of the market due to their larger sales volume as compared to instruments. The consumables market is further segmented into reagents & kits and chromatography columns. In 2017, the reagents & kits segment accounted for the largest share of the consumables market.

By profiling technology, the biomarker technologies market is classified into immunoassay, PCR, imaging technology, mass spectrometry, NGS, chromatography, cytogenetics, and other technologies. The immunoassay segment accounted for the largest share in 2017. This segment is further divided into ELISA, western blot, and protein microarray. In 2017, the ELISA segment accounted for the largest share of the immunoassay market. ELISA can simultaneously quantify levels of multiple proteins and have the potential to accelerate the validation of protein biomarkers for clinical use. Such factors are increasing the use of ELISA for confirmatory studies in biomarker discovery.

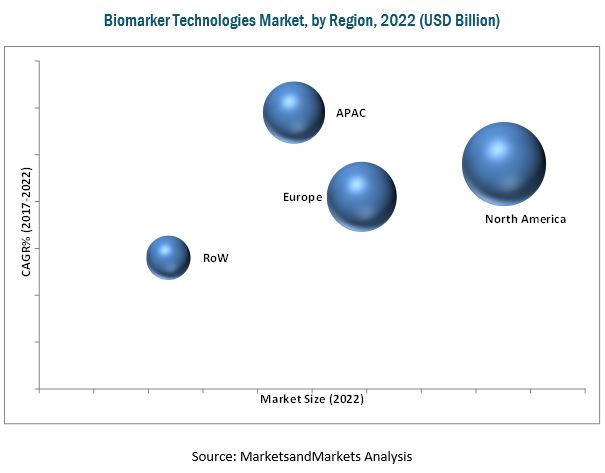

In 2017, North America accounted for the largest share of the biomarker technologies market. Asia Pacific is expected to register the highest growth from 2017 to 2022 for the biomarker technologies market. Factors such as the rising incidence of cancer, growing geriatric population, and support from private and public organizations for biomarker research are driving the growth of this regional segment.

Technological developments have resulted in an increase in the prices of mass spectrometry systems. Similarly, high capital investments are required for the discovery, development, and validation of biomarkers. These factors are restraining the growth of the biomarker technologies market.

The key players of this market are Agilent Technologies (US), Thermo Fisher Scientific (US), Roche (Switzerland), Waters Corporation (US), Danaher Corporation (US), Shimadzu Corporation (Japan), and Bio-Rad Laboratories (US).

Frequently Asked Questions (FAQs):

What is the size of Biomarker Technologies Market?

The global biomarker technologies market is projected to grow at a CAGR of 9.7%.

What are the major growth factors of Biomarker Technologies Market?

While significant advances have been made in the area of biomarkers, translating them into useful clinical assays is tedious and a prime hurdle to the clinical use of these biomarkers. The growth of this market is driven by factors such as increasing healthcare expenditure, increase in R&D funding, and the increasing utility of Biomarkers for diagnostic purposes, and rising biomarker research.

Who all are the prominent players of Biomarker Technologies Market?

The key players in the biomarker technologies market are Thermo Fisher Scientific (US), Agilent Technologies (US), Roche (Switzerland), Danaher Corporation (US), Waters Corporation (US), Shimadzu Corporation (Japan), and Bio-Rad Laboratories (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Biomarker Technologies Market: Introduction

2 Biomarker Technologies Market: Research Methodology

3 Biomarker Technologies Market, By Test Type

3.1 Introduction

3.2 Solid Biopsy

3.3 Liquid Biopsy

4 Biomarkers Liquid Biopsy Market, By Application

4.1 Introduction

4.2 Clinical Diagnostics

4.3 Research

4.4 Drug Discovery and Development

5 Liquid Biopsy Market, By Technology

5.1 DDPCR

5.2 NGS

5.3 Mass Spectrometry

5.4 DHPLC

5.5 Other

6 Biomarker Technologies Market, By Product

6.1 Consumables

6.2 Instruments

6.3 Services

6.4 Software/Informatics

7 Biomarker Product Market, By Application

7.1 Consumables

7.1.1 Diagnostics

7.1.1.1 Clinical Use

7.1.1.2 Research

7.1.2 Drug Discovery & Development

7.2 Instruments

7.2.1 Diagnostics

7.2.1.1 Clinical Use

7.2.1.2 Research

7.2.2 Drug Discovery & Development

7.3 Services

7.3.1 Diagnostics

7.3.1.1 Clinical Use

7.3.1.2 Research

7.3.2 Drug Discovery & Development

7.4 Software/Informatics

7.4.1 Diagnostics

7.4.1.1 Clinical Use

7.4.1.2 Research

7.4.2 Drug Discovery & Development

8 Biomarker Technologies Market, By Profiling Technology

8.1 Immunoassay

8.1.1 Elisa

8.1.2 Western Blot

8.1.3 Protein Microarray

8.2 PCR

8.3 Mass Spectrometry

8.4 NGS

8.5 Chromatography

8.6 Imaging Technologies

8.7 Cytogenetics

8.8 Others

9 Biomarker Profiling Technology Market, By Application

9.1 Immunoassay

9.1.1 Clinical Diagnostics

9.1.2 Research

9.1.3 Drug Discovery and Development

9.2 PCR

9.2.1 Clinical Diagnostics

9.2.2 Research

9.2.3 Drug Discovery and Development

9.3 Mass Spectrometry

9.3.1 Clinical Diagnostics

9.3.2 Research

9.3.3 Drug Discovery and Development

9.4 NGS

9.4.1 Clinical Diagnostics

9.4.2 Research

9.4.3 Drug Discovery and Development

9.5 Imaging Technologies

9.5.1 Clinical Diagnostics

9.5.2 Research

9.5.3 Drug Discovery and Development

9.6 Cytogenetics

9.6.1 Clinical Diagnostics

9.6.2 Research

9.6.3 Drug Discovery and Development

9.7 Others

9.7.1 Clinical Diagnostics

9.7.2 Research

9.7.3 Drug Discovery and Development

10 Biomarker Disease Indication Market, By Application

10.1 Cancer

10.1.1 Diagnostics

10.1.1.1 Clinical Use

10.1.1.2 Research

10.1.2 Drug Discovery & Development

10.2 Infectious Diseases

10.2.1 Diagnostics

10.2.1.1 Clinical Use

10.2.1.2 Research

10.2.2 Drug Discovery & Development

10.3 Autoimmune Disorders

10.3.1 Diagnostics

10.3.1.1 Clinical Use

10.3.1.2 Research

10.3.2 Drug Discovery & Development

10.4 Neurological Disorders

10.4.1 Diagnostics

10.4.1.1 Clinical Use

10.4.1.2 Research

10.4.2 Drug Discovery & Development

10.5 Cardiovascular Disorders

10.5.1 Diagnostics

10.5.1.1 Clinical Use

10.5.1.2 Research

10.5.2 Drug Discovery & Development

10.6 Other

10.6.1 Diagnostics

10.6.1.1 Clinical Use

10.6.1.2 Research

10.6.2 Drug Discovery & Development

11 Biomarker Technologies Market, By Application

11.1 Biomarker Identification, Validation & Development Research

11.2 Routine Biomarker-Based Tests

12 Biomarker Technology Applications Market, By Product

12.1 Biomarker Identification, Validation & Development Research

12.1.1 Consumables

12.1.2 Instruments

12.1.3 Services

12.1.4 Software

12.2 Routine Biomarker-Based Tests

12.2.1 Consumables

12.2.2 Instruments

12.2.3 Services

12.2.4 Software

13 Biomarker Technologies Market, By Research Area

13.1 Genomics

13.2 Proteomics

13.3 Metabolomics

13.3.1 Metabolic Flux

13.3.2 Lipidomics

13.3.3 Others

13.4 Other Research Types

14 Market Share Analysis

14.1 Biomarker Technologies Market for Mass Spectrometry: Market Share Analysis

14.2 Biomarker Technologies Market for Chromatography: Market Share Analysis

15 Biomarker Technologies Market, By Region

15.1 North America

15.1.1 US

15.1.2 Canada

15.2 Europe

15.3 Asia Pacific

15.4 RoW

List of Tables (134 Tables)

Table 1 Global Biomarkers Tests Market, By Region, 2015-2022 (USD Billion)

Table 2 North America: Biomarkers Tests Market, By Country, 2015-2022 (USD Billion)

Table 3 Global Biomarkers Market, By Test Type,

Table 4 Global Biomarkers Liquid Biopsy Market, By Application, 2017-2022 (USD Billion)

Table 5 Global Biomarkers Liquid Biopsy Market, By Technology, 2017-2022 (USD Billion)

Table 6 Global Biomarkers Market, By Product,

Table 7 Global Biomarkers Consumables Market, By Type, 2015-2022 (USD Billion)

Table 8 Global Biomarkers Products Market, By Region,

Table 9 North America: Biomarkers Products Market, By Country,

Table 10 Global Consumables Market, By Region,

Table 11 Global Reagents & Kits Market, By Region, 2015-2022 (USD Billion)

Table 12 North America: Consumables Market, By Country, 2015-2022 (USD Billion)

Table 13 Global Chromatography Columns Market, By Region, 2015-2022 (USD Billion)

Table 14 Global Instruments Market, By Region,

Table 15 North America: Instruments Market, By Country,

Table 16 Global Services Market, By Region,

Table 17 North America: Services Market, By Region, 2015-2022 (USD Billion)

Table 18 Global Software/Informatics Market, By Region, 2015-2022 (USD Billion)

Table 19 North America: Software/Informatics Market, By Country, 2015-2022 (USD Billion)

Table 20 Global Consumables Market, By Application, 2015-2022 (USD Billion)

Table 21 Global Consumables Market for Diagnostics, By Region, 2015-2022 (USD Billion)

Table 22 Global Consumables Market for Diagnostics, By Application, 2015-2022 (USD Billion)

Table 23 Global Consumables Market for Drug Discovery & Development, By Region, 2015-2022 (USD Billion)

Table 24 Global Instruments Market, By Application, 2015-2022 (USD Billion)

Table 25 Global Instruments Market for Diagnostics, By Region, 2015-2022 (USD Billion)

Table 26 Global Instruments Market for Diagnostics, By Application, 2015-2022 (USD Billion)

Table 27 Global Instruments Market for Drug Discovery & Development, By Region, 2015-2022 (USD Billion)

Table 28 Global Services Market, By Application, 2015-2022 (USD Billion)

Table 29 Global Services Market for Diagnostics, By Region, 2015-2022 (USD Billion)

Table 30 Global Services Market for Diagnostics, By Application, 2015-2022 (USD Billion)

Table 31 Global Services Market for Drug Discovery & Development, By Region, 2015-2022 (USD Billion)

Table 32 Global Software/Informatics Market, By Application, 2015-2022 (USD Billion)

Table 33 Global Software/Informatics Market for Diagnostics, By Region, 2015-2022 (USD Billion)

Table 34 Global Software/Informatics Market for Diagnostics, By Application, 2015-2022 (USD Billion)

Table 35 Global Software/Informatics Market for Drug Development & Discovery, By Region, 2015-2022 (USD Billion)

Table 36 Global Biomarkers Market, By Profiling Technology, 2015-2022 (USD Billion)

Table 37 Global Biomarkers Market for Immunoassays, By Type, 2015-2022 (USD Billion)

Table 38 Global Biomarkers Market for Profiling Technologies, By Region, 2015-2022 (USD Billion)

Table 39 North America: Biomarkers Market for Profiling Technologies, By Country, 2015-2022 (USD Billion)

Table 40 Global Immunoassays Market, By Region, 2015-2022 (USD Billion)

Table 41 Global Elisa Market, By Region,

Table 42 North America: Immunoassays Market, By Country, 2015-2022 (USD Billion)

Table 43 Global Elisa Market, By Region,

Table 44 Global Western Blot Market, By Region,

Table 45 Global Protein Microarray Market, By Region, 2015-2022 (USD Billion)

Table 46 North America: Western Blot Market, By Country, 2015-2022 (USD Billion)

Table 47 Global Protein Microarray Market, By Region, 2015-2022 (USD Billion)

Table 48 Key Evolutionary Milestones in the Field of QPCR/DPCR

Table 49 Global PCR Market, By Region,

Table 50 North America: PCR Market, By Country,

Table 51 Global Mass Spectrometry Market, By Region,

Table 52 North America: Mass Spectrometry Market, By Country,

Table 53 List of Sequencing Platforms Launched By Market Players During 2015-2017

Table 54 Global NGS Market, By Region,

Table 55 North America: NGS Market, By Country,

Table 56 Global Chromatography Market, By Region, 2015-2022 (USD Billion)

Table 57 North America: Chromatography Market, By Country, 2015-2022 (USD Billion)

Table 58 Global Imaging Technology Market, By Region, 2015-2022 (USD Billion)

Table 59 Global Cytogenetics Market, By Region,

Table 60 North America: Imaging Technology Market, By Country, 2015-2022 (USD Billion)

Table 61 North America: Cytogenetics Market, By Country, 2015-2022 (USD Billion)

Table 62 Global Biomarkers Market for Other Technologies, By Region,

Table 63 North America: Biomarkers Market for Other Technologies, By Country, 2015-2022 (USD Billion)

Table 64 Global Biomarker Profiling Technology Market for Immunoassay, By Application, 2017-2022 (USD Billion)

Table 65 Global Biomarker Profiling Technology Market for PCR, By Application, 2017-2022 (USD Billion)

Table 66 Global Biomarker Profiling Technology Market for Mass Spectrometry, By Application, 2017-2022 (USD Billion)

Table 67 Global Biomarker Profiling Technology Market for NGS, By Application, 2017-2022 (USD Billion)

Table 68 Global Biomarker Profiling Technology Market for Imaging Technology, By Application, 2017-2022 (USD Billion)

Table 69 Global Biomarker Profiling Technology Market for Cytogenetics, By Application, 2017-2022 (USD Billion)

Table 70 Global Biomarker Profiling Technology Market for Other Technologies, By Application, 2017-2022 (USD Billion)

Table 71 Global Biomarkers Market, By Disease Indication, 2015-2022 (USD Billion)

Table 72 Global Cancer Biomarkers Market, By Region, 2015-2022 (USD Billion)

Table 73 North America: Cancer Biomarkers Market, By Country, 2015-2022 (USD Billion)

Table 74 Global Cancer Biomarkers Market, By Application, 2015-2022 (USD Billion)

Table 75 Global Cancer Biomarkers Market for Diagnostics, By Region, 2015-2022 (USD Billion)

Table 76 Global Cancer Biomarkers Market for Diagnostics, By Application, 2015-2022 (USD Billion)

Table 77 Global Cancer Biomarkers Market for Drug Discovery & Development, By Region, 2015-2022 (USD Billion)

Table 78 Global Infectious Disease Biomarkers Market, By Region, 2015-2022 (USD Billion)

Table 79 North America: Infectious Disease Biomarkers Market, By Country, 2015-2022 (USD Billion)

Table 80 Global Infectious Disease Biomarkers Market, By Application, 2015-2022 (USD Billion)

Table 81 Global Infectious Disease Biomarkers Market for Diagnostics, By Region, 2015-2022 (USD Billion)

Table 82 Global Infectious Disease Biomarkers Market for Diagnostics, By Application, 2015-2022 (USD Billion)

Table 83 Global Infectious Disease Biomarkers Market for Drug Discovery & Development, By Region, 2015-2022 (USD Billion)

Table 84 Global Autoimmune Disorder Biomarkers Market, By Region, 2015-2022 (USD Billion)

Table 85 North America: Autoimmune Disorder Biomarkers Market, By Country, 2015-2022 (USD Billion)

Table 86 Global Autoimmune Disorder Biomarkers Market, By Application, 2015-2022 (USD Billion)

Table 87 Global Autoimmune Disorder Biomarkers Market for Diagnostics, By Region, 2015-2022 (USD Billion)

Table 88 Global Autoimmune Disorder Biomarkers Market for Diagnostics, By Application, 2015-2022 (USD Billion)

Table 89 Global Autoimmune Disorder Biomarkers Market for Drug Discovery & Development, By Region, 2015-2022 (USD Billion)

Table 90 Global Neurological Disorder Biomarkers Market, By Type, 2015-2022 (USD Billion)

Table 91 Global Neurological Disorder Biomarkers Market, By Region, 2015-2022 (USD Billion)

Table 92 North America: Neurological Disorder Biomarkers Market, By Country, 2015-2022 (USD Billion)

Table 93 Global Degenerative Disorder Biomarkers Market, By Region, 2015-2022 (USD Billion)

Table 94 Global Other Neurological Disorder Biomarkers Market, By Region, 2015-2022 (USD Billion)

Table 95 Global Degenerative Disorder Biomarkers Market, By Region, 2015-2022 (USD Billion)

Table 96 Global Other Neurological Disorder Biomarkers Market, By Region, 2015-2022 (USD Billion)

Table 97 Global Neurological Disorder Biomarkers Market, By Application, 2015-2022 (USD Billion)

Table 98 Global Neurological Disorder Biomarkers Market for Diagnostics, By Region, 2015-2022 (USD Billion)

Table 99 Global Neurological Disorder Biomarkers Market for Diagnostics, By Application, 2015-2022 (USD Billion)

Table 100 Global Neurological Disorder Biomarkers Market for Drug Discovery & Development, By Region, 2015-2022 (USD Billion)

Table 101 Global Cardiovascular Disease Biomarkers Market, By Region, 2015-2022 (USD Billion)

Table 102 North America: Cardiovascular Disease Biomarkers Market, By Country, 2015-2022 (USD Billion)

Table 103 Global Cardiovascular Disease Biomarkers Market, By Application, 2015-2022 (USD Billion)

Table 104 Global Cardiovascular Disease Biomarkers Market for Diagnostics, By Region, 2015-2022 (USD Billion)

Table 105 Global Cardiovascular Disease Biomarkers Market for Diagnostics, By Application, 2015-2022 (USD Billion)

Table 106 Global Cardiovascular Disease Biomarkers Market for Drug Discovery & Development, By Region, 2015-2022 (USD Billion)

Table 107 Global Other Disease Biomarkers Market, By Region, 2015-2022 (USD Billion)

Table 108 North America: Other Disease Biomarkers Market, By Country, 2015-2022 (USD Billion)

Table 109 Global Other Disease Biomarkers Market, By Application, 2015-2022 (USD Billion)

Table 110 Global Other Disease Biomarkers Market for Diagnostics, By Region, 2015-2022 (USD Billion)

Table 111 Global Other Disease Biomarkers Market for Diagnostics, By Application, 2015-2022 (USD Billion)

Table 112 Global Other Disease Biomarkers Market for Drug Discovery & Development, By Region, 2015-2022 (USD Billion)

Table 113 Global Biomarkers Market, By System, 2015-2022 (USD Billion)

Table 114 Global Biomarker Identification, Validation & Development Research Market, By Region, 2015-2022 (USD Billion)

Table 115 Global Routine Biomarker-Based Tests Market, By Region, 2015-2022 (USD Billion)

Table 116 Biomarker Identification, Validation and Development Research, By Product, 2017-2022 (USD Billion)

Table 117 Routine Biomarker Based Test / Assays for Clinical Use, By Product, 2017-2022 (USD Billion)

Table 118 Global Biomarkers Market, By Research Type, 2015-2022 (USD Billion)

Table 119 Global Biomarker Identification, Validation and Development Research Market, By Research Type, 2015-2022 (USD Billion)

Table 120 Global Genomics Market, By Region,

Table 121 Global Proteomics Market, By Region,

Table 122 Global Metabolomics Market, By Type,

Table 123 Global Metabolomics Market, By Region,

Table 124 Global Lipidomics Market, By Region,

Table 125 Global Metabolic Flux Market, By Region,

Table 126 Global Other Metabolomics Market, By Region, 2015-2022 (USD Billion)

Table 127 Global Microbiome Market, By Region,

Table 128 Global Other Research Types Market, By Region,

Table 129 Strength of Product Portfolio (Key Players)

Table 130 Business Strategy Excellence (Key Players)

Table 131 Strength of Product Portfolio (Key Players)

Table 132 Business Strategy Excellence (Key Players)

Table 133 Global Biomarker Market, By Region,

Table 134 North America: Biomarker Market, By Country, 2015-2022 (USD Billion)

List of Figures (7 Figures)

Figure 1 Paradigm Shift: RX to CDX

Figure 2 Biomarker Discovery: Traditional vs Conventional

Figure 3 Number of Publications Using Maldi MSI

Figure 4 Proteomics Approach: Autoimmune Disease Biomarker Discovery

Figure 5 Metabolomics Platform Showing Flow of Information of Metabolites

Figure 6 Global Biomarkers Market for Mass Spectrometry: Market Share Analysis, By Key Player

Figure 7 Global Biomarkers Market for Chromatography: Market Share Analysis, By Key Players, 2017

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biomarker Technologies Market