Bioethanol Market by Feedstock (Starch based, Sugar based, Cellulose-based), Fuel blend (E5, E10, E15 to E70, E75& E85), End-use (transportation, pharmaceutical, cosmetic, alcoholic beverages), Generation and Region Global Forecast to 2028

Updated on : November 11, 2025

Bioethanol Market

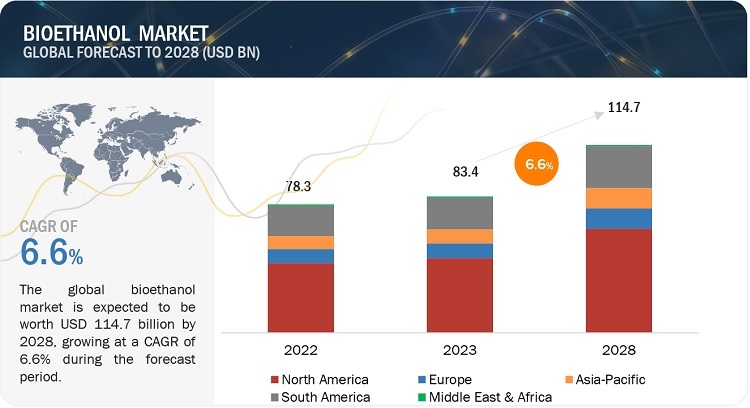

The global bioethanol market was valued at USD 83.4 billion in 2023 and is projected to reach USD 114.7 billion by 2028, growing at 6.6% cagr from 2023 to 2028. Bioethanol, obtained from biomass sources like corn, sugarcane, or cellulosic materials, has extensive applications across various industries. Its primary purpose lies in serving as a renewable fuel source. Bioethanol is frequently combined with gasoline to form ethanol-gasoline blends, which act as alternative fuels for transportation. These blends, known as E10 or E85, provide an environmentally friendly substitute to conventional gasoline, effectively diminishing greenhouse gas emissions and decreasing reliance on non-renewable fossil fuels. The global bioethanol market has been growing steadily in recent years and is expected to continue to grow in the coming years. The bioethanol market is segmented on the basis of feedstock such as starch-based, sugar-based, cellulose-based, and Others. The market of bioethanol has been segmented on the basis of end-use industries such as transportation, pharmaceutical, cosmetics, alcoholic beverages, and others.

Bioethanol Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Bioethanol Market

Bioethanol Market Dynamics

Driver: Need for energy security by countries

The pursuit of energy security frequently results in the implementation of supportive policies and incentives aimed at promoting bioethanol production and utilization. Companies operating in the bioethanol industry can leverage these favorable market conditions to expand their operations, boost production capacity, and explore new market prospects. Additionally, the drive for energy security compels bioethanol companies to invest in research and development endeavors, focusing on enhancing production processes, improving efficiency, and exploring advanced bioethanol production technologies. By embracing technological innovations, companies can position themselves as market leaders and effectively cater to the growing demand for bioethanol.

Restraint: Bioethanol blends, such as E10 or E85, may not be compatible with all vehicles.

Bioethanol blends, such as E10 or E85, may not be compatible with all vehicles. Some older or non-flex-fuel vehicles may not be designed to run on higher ethanol blends. As the number of EVs increases, manufacturers may focus less on developing and supporting vehicles capable of using bioethanol blends, limiting the market for such fuels. Government policies and incentives play a crucial role in shaping the market dynamics. If policymakers prioritize EVs and provide stronger incentives for their adoption, it can impact the demand for bioethanol negatively. Policy shifts that favor electric mobility over liquid biofuels may restrict the growth potential of the bioethanol industry.

Opportunities: The rising demand for bioethanol in the pharmaceutical industry

Bioethanol is used as an excipient or a solvent in the formulation of pharmaceutical drugs. It serves as a carrier for active ingredients, aiding in their dissolution and facilitating drug delivery. The pharmaceutical industry's increasing focus on solubility enhancement and drug delivery systems has led to a higher demand for bioethanol as an excipient. The rising demand for bioethanol in the pharmaceutical industry can be attributed to its role as an excipient in drug formulations, its effectiveness as a disinfectant, its use in extraction and purification processes, its application in pharmaceutical R&D, and its compliance with regulatory standards.

Challenges: Adverse environmental impact of bioethanol production

The expansion of bioethanol feedstock cultivation can lead to land use change, including the conversion of natural ecosystems such as forests, grasslands, and wetlands into agricultural land. This land conversion can result in deforestation, loss of biodiversity, and habitat destruction, leading to adverse environmental impacts. The environmental challenges requires sustainable practices in bioethanol production, including responsible land management, efficient water use, reduced chemical inputs, and the use of non-food feedstocks. It is crucial to strike a balance between bioethanol production and environmental conservation to ensure the overall sustainability of the bioethanol industry.

Bioethanol Market Ecosystem

By feedstock, starch based bioethanol projected to register the highest CAGR during the forecast period

starch is abundantly available in various agricultural crops such as corn, wheat, and barley, making it a widely accessible feedstock for bioethanol production. The abundance of starch feedstocks ensures a consistent and reliable supply, contributing to the dominance of starch-based bioethanol in the market. Starch-based bioethanol also benefits from the existing infrastructure and experience in the production and distribution of ethanol. Many countries already have established facilities and systems for producing bioethanol from starch feedstocks. This infrastructure includes ethanol plants, transportation networks, and blending facilities, which create a favorable market for starch-based bioethanol.

By End-Use Industry, pharmaceutical segment projected to register second highest CAGR during the forecast period.

The utilization of bioethanol in the pharmaceutical industry is driven by several factors, ensuring its widespread adoption and application. Firstly, bioethanol is recognized as a safe and compliant solvent for pharmaceutical purposes, meeting the stringent regulatory requirements and quality standards imposed on pharmaceutical products. Its use provides assurance in terms of safety and adherence to regulatory guidelines, making it a preferred choice for drug manufacturers. Bioethanol's ability to enhance solubility is another significant driver for its use in pharmaceuticals. As a solubilizing agent, bioethanol aids in dissolving hydrophobic active pharmaceutical ingredients (APIs), thereby improving the bioavailability and efficacy of drugs. This characteristic is particularly valuable for drugs with limited water solubility, as bioethanol facilitates their absorption and therapeutic effectiveness.

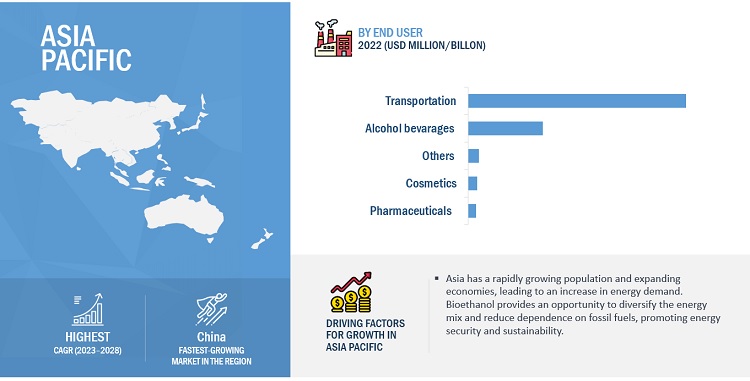

Asia Pacific is projected to account for the highest CAGR in the bioethanol market during the forecast period

The Asia-Pacific region has been experiencing significant economic growth over the past few decades. This growth has been driven by several factors, including increased trade and investment, improved infrastructure, and technological advancements. China, India, and Japan are among the largest economies in the Asia-Pacific region, and have been major drivers of economic growth in the region. In recent years, other countries such as Indonesia, Malaysia, and Vietnam have also emerged as important players in the regional economy. The growth of the bioethanol industry in the Asia Pacific region can be attributed to several factors. Firstly, the region has experienced rapid economic growth and urbanization, leading to an increased demand for energy. In order to meet this demand, countries in the region are seeking renewable and cleaner alternatives to fossil fuels, making bioethanol an attractive option. Government bodies and policymakers in the Asia Pacific region have recognized the potential of bioethanol and are actively promoting its use as part of their energy diversification strategies. These supportive policies and initiatives have created a favorable environment for the growth of the bioethanol industry.

To know about the assumptions considered for the study, download the pdf brochure

Bioethanol Market Players

Bioethanol comprises major manufacturers such as POET LLC (US), Archer Daniels Midland Company (US), Green Plains (US) and Valero Energy (US), Pacific Ethanol (US) The Anderson Inc. (US), Flint Hills Resources (US), Tereos (France) were the leading players in the bioethanol industry. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the bioethanol market.

Read More: Bioethanol Companies

Bioethanol Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 83.4 billion |

|

Revenue Forecast in 2028 |

USD 114.7 billion |

|

CAGR |

6.6% |

|

Market size available for years |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Million/Billion), Volume (Million liters) |

|

Segments |

Feedstock, Generation, Fuel blend, End-Use Industry, and Region. |

|

Regions |

Asia-Pacific, North America, Europe, South America, and Middle East & Africa |

|

Companies |

The major players are POET LLC (US), Archer Daniels Midland Company (US), Green Plains (US) and Valero Energy (US), Pacific Ethanol (US) The Anderson Inc. (US), Flint Hills Resources (US), and Tereos (France) and others covered in the Bioethanol market. |

This research report categorizes the global Bioethanol market on the basis of Feedstock, Generation, Fuel blend, End-Use Industry, and Region.

Bioethanol Market on the basis of feedstock:

- Starch Based

- Sugar Based

- Cellulose Based

- Others

Bioethanol Market on the basis of fuel generation:

- First Generation

- Second Generation

- Third Generation

Bioethanol Market on the basis of fuel blend:

- E5

- E10

- E15 TO E70

- E75 TO E85

- Others

Bioethanol Market on the basis of end-use industry:

- Transportation

- Alcoholic Beverages

- Cosmetics

- Pharmaceuticals

- Others

Bioethanol Market on the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

Recent Developments

- In January 2022, Wolf carbon solutions and Archer Daniels Midland Company (US) partner to advance the decarbonization of ethanol production.

- In October 2021, Archer Daniels Midland Company (US) announced that it has reached an agreement to sell its ethanol production complex in Peoria, Illinois, to BioUrja Group.

- In April 2023, POET LLC. (US) announced the signing of an exclusive partnership agreement with Midwest Commodities in Detroit, Michigan. Midwest Commodities will provide DDGS truck-to-container transload services solely to the company so that the company can more efficiently serve its global customer base.

- In January 2023, United Airlines, Tallgrass, and Green Plains Inc. (US) today announced a new joint venture – Blue Blade Energy – to develop and then commercialize a novel Sustainable Aviation Fuel (SAF) technology that uses ethanol as its feedstock.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the Bioethanol market?

The major driver influencing the growth of the Bioethanol market are rising use of bioethanol in various end-use industries majorly in the transportation and pharmaceutical industry.

What are the major challenges in the Bioethanol market?

The major challenge in the Bioethanol market is price volatility and availability of feedstock.

What are the restraining factors in the Bioethanol market?

The major restraining factor faced by the Bioethanol market is the rising demand for EVs.

What is the key opportunity in the Bioethanol Market?

The policy changes regarding the use of bioethanol have a new opportunity for the Bioethanol market.

What are the end-uses of Bioethanol?

It is primarily used as a fuel additive or blended with gasoline in the transportation sector, where it reduces greenhouse gas emissions and decreases dependence on fossil fuels. Bioethanol is also used in pharmaceuticals & cosmetics. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need for energy security- Adoption of higher blending standards leads to higher consumption of bioethanolRESTRAINTS- Rising demand for EVs and phase-out of fossil fuel vehicles- Engine modification required for higher blends of bioethanolOPPORTUNITIES- Rising demand from pharmaceutical industry- Policy changes regarding use of bioethanol blendsCHALLENGES- Adverse environmental impact of bioethanol production

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 TRENDS AND DISRUPTIONS IMPACTING MARKET GROWTH

-

5.5 VALUE CHAIN ANALYSISRAW MATERIAL PROCUREMENTBIOETHANOL PRODUCTION PLANTSDISTRIBUTION CHANNELSAPPLICATION SEGMENTS

- 5.6 KEY MARKETS FOR EXPORT/IMPORT

-

5.7 PATENT ANALYSIS

-

5.8 TECHNOLOGICAL ANALYSISTECHNOLOGY FOR STARCH-BASED FEEDSTOCK (CORN)- Dry mill method- Wet mill methodBIOETHANOL FROM SUGARCANESUGAR VS. STARCH

-

5.9 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES AND GOVERNMENT AGENCIES

-

5.10 ECOSYSTEM ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.12 MACROECONOMIC OVERVIEWINTRODUCTIONTRENDS AND GDP FORECASTS

-

5.13 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY FUEL BLEND

-

5.14 CASE STUDY ANALYSISIMPLEMENTATION OF ETHANOL BLENDING PROGRAM

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

- 6.2 FIRST GENERATION

- 6.3 SECOND GENERATION

- 6.4 THIRD GENERATION

- 7.1 INTRODUCTION

-

7.2 STARCH-BASEDUS TO DRIVE MARKET DURING FORECAST PERIOD

-

7.3 SUGAR-BASEDBRAZIL TO BE LARGEST CONSUMER OF SUGAR-BASED FEEDSTOCK FOR BIOETHANOL PRODUCTION

-

7.4 CELLULOSE-BASEDGROWING CONCERNS ABOUT FOOD SECURITY TO DRIVE MARKET

- 7.5 OTHERS

- 8.1 INTRODUCTION

-

8.2 E5EMERGING COUNTRIES ADOPTING E5 TO DRIVE MARKET

-

8.3 E10INCREASING ADOPTION OF E10 TO LEAD TO FASTEST GROWTH OF SEGMENT

-

8.4 E15 TO E70BRAZIL TO DOMINATE E15-E70 BLEND SEGMENT WITH HIGHEST ETHANOL-FUEL BLEND RATIO

-

8.5 E75 & E85WIDE USE IN FLEX-FUEL VEHICLES TO DRIVE MARKET

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 TRANSPORTATIONCHANGES IN ETHANOL BLENDING MANDATES TO INCREASE DEMAND

-

9.3 ALCOHOLIC BEVERAGESSEGMENT TO GROW AT MODERATE PACE

-

9.4 COSMETICSUSE IN COSMETIC PRODUCTS FOR SKIN-FRIENDLY AND ODORLESS PROPERTIES TO DRIVE MARKET

-

9.5 PHARMACEUTICALSDEMAND FOR HAND SANITIZERS TO DRIVE MARKET

- 9.6 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACTUS- Easing of regulatory norms for ethanol blending to drive marketCANADA- Largest imports of ethanol fuel to drive marketMEXICO- Liberalization of fuel market to boost demand for bioethanol

-

10.3 SOUTH AMERICARECESSION IMPACTBRAZIL- Government support for ethanol production and consumption as biofuel to drive marketARGENTINA- Increasing use of bioethanol in fuel blends to boost demandCOLOMBIA- Imposition of 20% per gallon tariff on US ethanol imports to drive marketREST OF SOUTH AMERICA

-

10.4 EUROPERECESSION IMPACTGERMANY- Higher emission reduction goals to drive marketFRANCE- Government policies to drive use of E85UK- Starch-based feedstock to be fastest-growing segment during forecast periodSWEDEN- Remarkable growth in bioethanol industry to drive marketNETHERLANDS- Stringent regulatory mandates to fuel marketPOLAND- Starch-based segment to dominate marketSPAIN- Implementation of blending mandates to drive demandITALY- Starch-based feedstock segment to register highest growth during forecast periodREST OF EUROPE

-

10.5 ASIA PACIFICRECESSION IMPACTCHINA- Mandating use of E10 blends to meet carbon emission standards to boost marketINDIA- Promotion of E10 fuel blends to support market growthTHAILAND- Government to increase use of renewable sources in energy mix to boost demandPHILIPPINES- Mandatory use of fuel blends to drive bioethanol demandJAPAN- Consumption of ethanol to be stagnant during forecast periodREST OF ASIA PACIFIC

-

10.6 MIDDLE EAST & AFRICARECESSION IMPACTTURKEY- Increasing demand for bioenergy as alternative source to drive marketSOUTH AFRICA- Government support and mandatory blending regulation to boost market

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS

- 11.3 KEY PLAYERS’ STRATEGIES

- 11.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVEPARTICIPANTS

-

11.6 STARTUP AND SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIOS AND TRENDSDEALSOTHERS

-

12.1 KEY PLAYERSARCHER DANIELS MIDLAND COMPANY- Business overview- Products/Solutions/Services- Recent developments- MnM viewPOET LLC- Business overview- Products/Solutions/Services- Recent developments- MnM viewGREEN PLAINS, INC.- Business overview- Products/Solutions/Services- Recent developments- MnM viewVALERO ENERGY CORPORATION- Business overview- Products/Solutions/Services- Recent developments- MnM viewTEREOS- Business overview- Products/Solutions/Services- MnM viewRAIZEN- Business overview- Products/Solutions/Services- Recent developments- MnM viewTHE ANDERSONS, INC.- Business overview- Products/Solutions/Services- Recent developments- MnM viewALTO INGREDIENTS, INC.- Business overview- Products/Solutions/Services- Recent developmentsSEKAB BIOFUELS & CHEMICALS AB- Business overview- Products/Solutions/Services- Recent developmentsAEMETIS, INC.- Business overview- Products/Solutions/Services- Recent developments

-

12.2 OTHER PLAYERSPANNONIA BIO ZRTBP P.L.C.ABSOLUTE ENERGY L.L.C.BIG RIVER RESOURCES LLCUNITED PETROLEUM PTY LTD.CROPENERGIES BIOETHANOL GMBHWHITE ENERGY, INC.GUARDIAN ENERGY, LLCBLUE BIOFUELS, INC.

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 BIO-LUBRICANTS MARKET

- 13.4 BIO-LUBRICANTS MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 GDP GROWTH RATE, BY REGION, (2019–2027)

- TABLE 2 BIOETHANOL MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 DIFFERENCE BETWEEN DRY MILL METHOD AND WET MILL METHOD

- TABLE 4 BIOETHANOL MARKET: KEY CONFERENCES AND EVENTS

- TABLE 5 WORLDWIDE GDP GROWTH PROJECTION (2018–2026)

- TABLE 6 AVERAGE SELLING PRICE, BY FUEL BLEND (USD/LITER)

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN BIOETHANOL MARKET

- TABLE 8 KEY BUYING CRITERIA FOR BIOETHANOL INDUSTRY

- TABLE 9 BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 10 BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 11 BLENDING MANDATES, BY KEY COUNTRY

- TABLE 12 BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 13 BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 14 BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 15 BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 16 BIOETHANOL MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 BIOETHANOL MARKET, BY REGION, 2021–2028 (MILLION LITERS)

- TABLE 18 NORTH AMERICA: BIOETHANOL MARKET, BY COUNTRY, 2021–2028 (MILLION LITERS)

- TABLE 19 NORTH AMERICA: BIOETHANOL MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 NORTH AMERICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 21 NORTH AMERICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 22 NORTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 24 NORTH AMERICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 26 RENEWABLE FUEL STANDARD (RFS), EPA FINAL/PROPOSED VOLUME STANDARDS (BILLION OF ETHANOL-EQUIVALENT GALLONS)

- TABLE 27 US: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 28 US: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 29 US: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 30 US: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 31 US: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 32 US: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 33 CANADA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 34 CANADA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 35 CANADA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 36 CANADA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 37 CANADA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 38 CANADA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 39 MEXICO: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 40 MEXICO: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 41 MEXICO: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 42 MEXICO: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 43 MEXICO: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 44 MEXICO: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 45 SOUTH AMERICA: BIOETHANOL MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 SOUTH AMERICA: BIOETHANOL MARKET, BY COUNTRY, 2021–2028 (MILLION LITERS)

- TABLE 47 SOUTH AMERICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 48 SOUTH AMERICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 49 SOUTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 50 SOUTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 51 SOUTH AMERICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 52 SOUTH AMERICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 53 BRAZIL: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 54 BRAZIL: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 55 BRAZIL: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 56 BRAZIL: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 57 BRAZIL: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 58 BRAZIL: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 59 ARGENTINA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 60 ARGENTINA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 61 ARGENTINA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 62 ARGENTINA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 63 ARGENTINA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 64 ARGENTINA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 65 COLOMBIA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 66 COLOMBIA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 67 COLOMBIA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 68 COLOMBIA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 69 COLOMBIA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 70 COLOMBIA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 71 REST OF SOUTH AMERICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 72 REST OF SOUTH AMERICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 73 REST OF SOUTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 74 REST OF SOUTH AMERICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 75 REST OF SOUTH AMERICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 76 REST OF SOUTH AMERICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 77 EUROPE: BIOETHANOL MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: BIOETHANOL MARKET, BY COUNTRY, 2021–2028 (MILLION LITERS)

- TABLE 79 EUROPE: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 80 EUROPE: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 81 EUROPE: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 82 EUROPE: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 83 EUROPE: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 84 EUROPE: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 85 GERMANY: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 86 GERMANY: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 87 GERMANY: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 88 GERMANY: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 89 GERMANY: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 90 GERMANY: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 91 FRANCE: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 92 FRANCE: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 93 FRANCE: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 94 FRANCE: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 95 FRANCE: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 96 FRANCE: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 97 UK: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 98 UK: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 99 UK: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 100 UK: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 101 UK: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 102 UK: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 103 SWEDEN: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 104 SWEDEN: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 105 SWEDEN: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 106 SWEDEN: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 107 SWEDEN: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 108 SWEDEN: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 109 NETHERLANDS: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 110 NETHERLANDS: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 111 NETHERLANDS: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 112 NETHERLANDS: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 113 NETHERLANDS: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 114 NETHERLANDS: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 115 POLAND: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 116 POLAND: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 117 POLAND: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 118 POLAND: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 119 POLAND: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 120 POLAND: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 121 SPAIN: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 122 SPAIN: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 123 SPAIN: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 124 SPAIN: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 125 SPAIN: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 126 SPAIN: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 127 ITALY: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 128 ITALY: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 129 ITALY: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 130 ITALY: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 131 ITALY: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 132 ITALY: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 133 REST OF EUROPE: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 134 REST OF EUROPE: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 135 REST OF EUROPE: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 136 REST OF EUROPE: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 137 REST OF EUROPE: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 138 REST OF EUROPE: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 139 ASIA PACIFIC: BIOETHANOL MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: BIOETHANOL MARKET, BY COUNTRY, 2021–2028 (MILLION LITERS)

- TABLE 141 ASIA PACIFIC: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 143 ASIA PACIFIC: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 145 ASIA PACIFIC: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 147 CHINA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 148 CHINA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 149 CHINA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 150 CHINA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 151 CHINA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 152 CHINA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 153 INDIA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 154 INDIA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 155 INDIA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 156 INDIA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 157 INDIA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 158 INDIA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 159 THAILAND: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 160 THAILAND: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 161 THAILAND: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 162 THAILAND: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 163 THAILAND: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 164 THAILAND: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 165 PHILIPPINES: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 166 PHILIPPINES: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 167 PHILIPPINES: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 168 PHILIPPINES: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 169 PHILIPPINES: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 170 PHILIPPINES: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 171 JAPAN: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 172 JAPAN: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 173 JAPAN: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 174 JAPAN: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 175 JAPAN: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 176 JAPAN: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 177 REST OF ASIA PACIFIC: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 179 REST OF ASIA PACIFIC: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 181 REST OF ASIA PACIFIC: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 183 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY COUNTRY, 2021–2028 (MILLION LITERS)

- TABLE 185 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 187 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 189 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 191 TURKEY: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 192 TURKEY: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 193 TURKEY: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 194 TURKEY: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 195 TURKEY: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 196 TURKEY: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 197 SOUTH AFRICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 198 SOUTH AFRICA: BIOETHANOL MARKET, BY FEEDSTOCK, 2021–2028 (MILLION LITERS)

- TABLE 199 SOUTH AFRICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (USD MILLION)

- TABLE 200 SOUTH AFRICA: BIOETHANOL MARKET, BY FUEL BLEND, 2021–2028 (MILLION LITERS)

- TABLE 201 SOUTH AFRICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 202 SOUTH AFRICA: BIOETHANOL MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION LITERS)

- TABLE 204 BIOETHANOL MARKET: LIST OF KEY PLAYERS

- TABLE 205 BIOETHANOL MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 206 DEALS, 2019–2023

- TABLE 207 OTHERS, 2019–2023

- TABLE 208 ARCHER DANIELS MIDLAND COMPANY: COMPANY OVERVIEW

- TABLE 209 ARCHER DANIELS MIDLAND COMPANY: DEALS

- TABLE 210 ARCHER DANIELS MIDLAND COMPANY: OTHERS

- TABLE 211 POET LLC: COMPANY OVERVIEW

- TABLE 212 POET LLC: DEALS

- TABLE 213 POET LLC: OTHERS

- TABLE 214 GREEN PLAINS, INC.: COMPANY OVERVIEW

- TABLE 215 GREEN PLAINS, INC.: DEALS

- TABLE 216 GREEN PLAINS, INC.: OTHERS

- TABLE 217 VALERO ENERGY CORPORATION: COMPANY OVERVIEW

- TABLE 218 VALERO ENERGY CORPORATION: OTHERS

- TABLE 219 TEREOS: COMPANY OVERVIEW

- TABLE 220 RAIZEN: COMPANY OVERVIEW

- TABLE 221 RAIZEN: DEALS

- TABLE 222 RAIZEN: OTHERS

- TABLE 223 THE ANDERSONS, INC.: COMPANY OVERVIEW

- TABLE 224 THE ANDERSONS, INC.: DEALS

- TABLE 225 THE ANDERSONS, INC.: OTHERS

- TABLE 226 ALTO INGREDIENTS, INC.: COMPANY OVERVIEW

- TABLE 227 ALTO INGREDIENTS, INC.: DEALS

- TABLE 228 ALTO INGREDIENTS, INC.: OTHERS

- TABLE 229 SEKAB BIOFUELS & CHEMICALS AB: COMPANY OVERVIEW

- TABLE 230 SEKAB BIOFUELS & CHEMICALS AB.: OTHERS

- TABLE 231 AEMETIS, INC.: COMPANY OVERVIEW

- TABLE 232 AEMETIS, INC.: OTHERS

- TABLE 233 PANNONIA BIO ZRT: COMPANY OVERVIEW

- TABLE 234 BP P.L.C.: COMPANY OVERVIEW

- TABLE 235 ABSOLUTE ENERGY L.L.C.: COMPANY OVERVIEW

- TABLE 236 BIG RIVER RESOURCES LLC: COMPANY OVERVIEW

- TABLE 237 UNITED PETROLEUM PTY LTD.: COMPANY OVERVIEW

- TABLE 238 CROPENERGIES BIOETHANOL GMBH: COMPANY OVERVIEW

- TABLE 239 WHITE ENERGY, INC.: COMPANY OVERVIEW

- TABLE 240 GUARDIAN ENERGY, LLC: COMPANY OVERVIEW

- TABLE 241 BLUE BIOFUELS, INC.: COMPANY OVERVIEW

- TABLE 242 BIO-LUBRICANTS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

- TABLE 243 BIO-LUBRICANTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

- FIGURE 1 BIOETHANOL MARKET SEGMENTATION

- FIGURE 2 BIOETHANOL MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 6 BIOETHANOL MARKET: DATA TRIANGULATION

- FIGURE 7 STARCH-BASED BIOETHANOL ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 8 NORTH AMERICA TO LEAD BIOETHANOL MARKET DURING FORECAST PERIOD

- FIGURE 9 EMERGING COUNTRIES TO OFFER ATTRACTIVE OPPORTUNITIES IN BIOETHANOL MARKET

- FIGURE 10 NORTH AMERICA: US AND E10 BLEND ACCOUNTED FOR LARGEST SHARES OF BIOETHANOL MARKET IN 2022

- FIGURE 11 E10 SEGMENT TO LEAD BIOETHANOL MARKET DURING FORECAST PERIOD

- FIGURE 12 TRANSPORTATION END-USE INDUSTRY TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 13 CHINESE BIOETHANOL MARKET TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BIOETHANOL MARKET

- FIGURE 15 BIOETHANOL MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 16 VALUE CHAIN

- FIGURE 17 GRANTED PATENTS ACCOUNTED FOR 77% OF TOTAL COUNT IN LAST 5 YEARS

- FIGURE 18 PUBLICATION TRENDS

- FIGURE 19 JURISDICTION ANALYSIS

- FIGURE 20 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 21 AVERAGE SELLING PRICE, BY REGION (USD/LITER)

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 23 KEY BUYING CRITERIA IN BIOETHANOL INDUSTRY

- FIGURE 24 STARCH-BASED BIOETHANOL TO GROW AT HIGHEST RATE

- FIGURE 25 E10 SEGMENT TO DRIVE BIOETHANOL MARKET FROM 2023 TO 2028

- FIGURE 26 TRANSPORTATION END-USE INDUSTRY TO DOMINATE BIOETHANOL MARKET

- FIGURE 27 BIOETHANOL CONSUMPTION SHARE, BY COUNTRY, 2022

- FIGURE 28 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICAN MARKET TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 30 NORTH AMERICA: BIOETHANOL MARKET SNAPSHOT

- FIGURE 31 EUROPE: BIOETHANOL MARKET SNAPSHOT

- FIGURE 32 COMPANIES ADOPTED PARTNERSHIP & COLLABORATION AS KEY GROWTH STRATEGY BETWEEN 2019 AND 2023

- FIGURE 33 RANKING OF KEY PLAYERS IN BIOETHANOL MARKET, 2022

- FIGURE 34 MARKET SHARE OF BIOETHANOL MANUFACTURERS (2022)

- FIGURE 35 TOP FIVE PLAYERS DOMINATED MARKET IN LAST FIVE YEARS

- FIGURE 36 COMPANY EVALUATION QUADRANT, 2022

- FIGURE 37 SME MATRIX: BIOETHANOL MARKET, 2022

- FIGURE 38 ARCHER DANIELS MIDLAND COMPANY.: COMPANY SNAPSHOT

- FIGURE 39 GREEN PLAINS, INC.: COMPANY SNAPSHOT

- FIGURE 40 VALERO ENERGY CORPORATION: COMPANY SNAPSHOT

- FIGURE 41 TEREOS: COMPANY SNAPSHOT

- FIGURE 42 THE ANDERSONS, INC.: COMPANY SNAPSHOT

- FIGURE 43 ALTO INGREDIENTS, INC.: COMPANY SNAPSHOT

- FIGURE 44 AEMETIS, INC.: COMPANY SNAPSHOT

- FIGURE 45 VEGETABLE OIL-BASED SEGMENT ACCOUNTED FOR LARGEST SHARE OF BIO-LUBRICANTS MARKET IN 2019

- FIGURE 46 INDUSTRIAL SEGMENT ACCOUNTED FOR LARGEST SHARE OF BIO-LUBRICANTS MARKET IN 2019

- FIGURE 47 EUROPE ACCOUNTED FOR LARGEST SHARE IN BIO-LUBRICANTS MARKET

- FIGURE 48 ASIA PACIFIC TO BE FASTEST-GROWING BIO-LUBRICANTS MARKET FROM 2020-2025

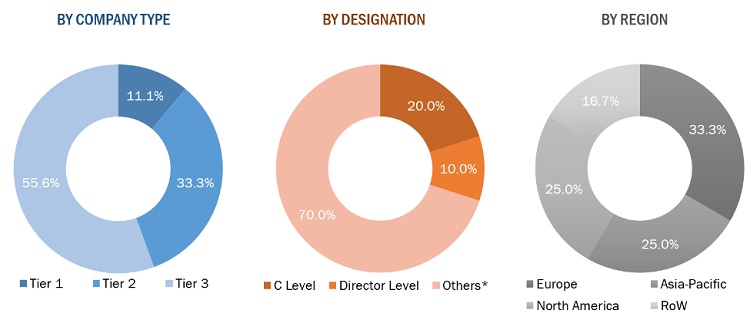

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the Bioethanol market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The Bioethanol market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the Bioethanol market. Primary sources from the supply side include associations and institu tions involved in the Bioethanol industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

Notes: Others include sales, marketing, engineers, and product managers.

Tier 1= USD 1 Billion; Tier 2 = below USD 1 Billion to USD 500 Million; and Tier 3 = Below USD 500 Million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global Bioethanol industry. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

The bioethanol industry refers to the global industry involved in the production, distribution, and consumption of bioethanol as a renewable and sustainable fuel. Bioethanol, also referred to as ethanol, is an alcohol-based fuel derived from biomass sources, including crops, agricultural residues, and waste materials. The production process involves the fermentation of sugars present in biomass, converting them into ethanol through the action of yeast or bacteria. Bioethanol is commonly utilized as a substitute or additive for gasoline, aiming to reduce greenhouse gas emissions and promote cleaner energy options. The bioethanol market encompasses various participants, such as bioethanol producers, feedstock suppliers, fuel distributors, and end-users like the automotive and transportation industries. The growth of the bioethanol industry is driven by factors like heightened environmental concerns, government regulations, energy security objectives, and the global transition towards renewable energy alternatives.

Key Stakeholders

- Raw Material Suppliers and Producers

- Regulatory Bodies

- End User

- Research and Development Organizations

- Industrial Associations

- Bioethanol manufacturers, dealers, traders, and suppliers.

Report Objectives

- To define, describe, and forecast the global Bioethanol market in terms of value and volume.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, raw material, end-use industry, region, and application.

- To forecast the market size, in terms of value and volume, with respect to four main regions: North America, Europe, Asia Pacific, South America, and Middle East & Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market.

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions.

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

The market has been further analyzed for the key countries in each of these regions.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Bioethanol market

- Further breakdown of the Rest of Europe’s Bioethanol market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Bioethanol Market