Global Biocide Market - By Types, Applications, Trends & Forecast (2011 2016)

Biocides are substances that kill or inhibit all life forms when introduced in sufficient concentration and/or duration. They are used to control harmful organisms and control bacterial and fungal growth. Different types of biocide such as halogen compounds, metallic compounds, organosulfurs, organic acids, phenolic, etc. are used for various applications in personal care, water treatment, wood preservation, food and beverage, paints and coatings, and others. Growth in water treatment market on account of increasing water consumption due to population growth, changing food habits, and climate change is a major driver for global biocide market.

Biocides are also used as additives in polymers for preventing the growth of bacteria or fungi and also to prevent degradation of polymers physical and sensorial properties, both within the material and at its surface. The incorporation of biocides in plastics and rubbers helps in reducing cost and effort required in cleaning especially, in demanding sectors such as food processing plants, hospitals, and home care.

Biocides are becoming compliant to environment regulations as more and more companies are meeting the regulations. The newer breed of biocide, which have lesser environmental impact and better performance features are key drivers of the biocide market. Higher priced specialty biocides are providing stiff competition to the commodity biocides.

Biocide market is also witnessing an increase in demand for environmentally friendly biocides in disinfectants and sanitizers in household, industrial, and institutional cleaners as compared to other biocide formulations. Other applications of biocides such as health care industry are growing due to increasing health consciousness thus leading to need for protection from infections.

The best growth opportunities for the biocide products are in the Asia-Pacific and Eastern Europe region, whereas mature North American and West European markets are predictable to register a modest growth. Moreover, China will be the fastest-growing country in global biocide market as its strong economic growth continues. In mature markets such as the U.S., Western Europe, and Japan, growth will be driven more by a shift to higher value products rather than by significant volume pick-up.

We have used various secondary sources such as encyclopedia, directories, and databases to identify and collect information useful for this extensive commercial study of biocide market. The primary sources experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess the future prospects of biocides.

We have also profiled leading players of this industry with their recent developments and other strategic industry activities. These include : Albemarle Corporation (U.S.), AkzoNobel N.V. (The Netherlands), Ashland Inc. (U.S.), Baker Hughes Incorporated (U.S.), BASF SE (Germany), Champion Technologies (U.S.), Clariant AG (Switzerland), Cortec Corporation (U.S.), The Dow Chemical Company (U.S.), FMC Corporation (U.S.), GE Water and Process Technologies (U.S.), Kemira Oyj (Finland), Lubrizol Corporation (U.S.), LANXESS AG (Germany), Lonza Group Ltd (Switzerland), Nalco Holding Company (U.S.), Thor Group Limited (U.K.), Troy Corporation (U.S.).

Scope of the report

This biocides market research report categorizes the global market on the basis of applications, product types, and geography; forecasting volume and revenue and analyzing trends in each of the submarkets:

On the basis of applications:

The biocide market is segmented on the basis of end-user applications such as: Personal care, water treatment, wood preservation, food and beverage, and paints and coatings. Each application is further described in detail in the report with volume and revenue forecasted for each application.

On the basis of product type:

Halogen compounds, metallic compounds, organosulfurs, organic acids, and phenolic.

On the basis of geography:

North America, Europe, Asia-Pacific, and ROW and key countries in every region.

Please click here to get the updated version of Biocides Market By Type (Halogen Compounds, Metallic Compounds, Organosulfurs, Organic Acid, Phenolics), Application (Personal Care, Water Treatment, Wood Preservation, Food & Beverages, Paints & Coatings) - Global Trends & Forecasts to 2018

Biocides are used to control harmful organisms and control bacterial and fungal growth. Major types of biocide include halogen compounds, metallic compounds, organosulfurs, organic acids and phenolic. They are used for various applications in personal care, water treatment, wood preservation, food and beverage, paints and coatings, and others.

Biocide market is witnessing an increase in demand on account of growing demand of water and entry of environmentally friendly products. However, growth in the market is hindered by rising raw material costs and difficult and expensive registration process.

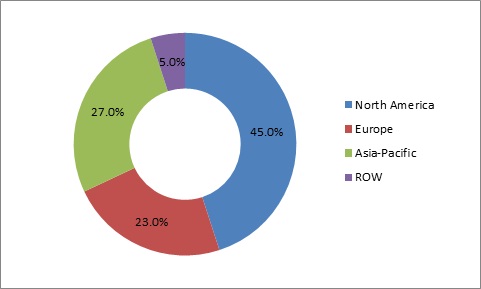

The global market for biocide in terms of revenue was estimated to be worth $7.2 billion in 2010 and is expected to reach $9.4 billion by 2016, growing at a CAGR of 4.3% from 2011 to 2016. North America dominated the global biocide market, accounting for 45.0% of the global biocide demand in 2010. Asia-Pacific is expected to be the fastest growing market in the near future owing to the rapid advancement and increasing demand from key countries such as China and India.

Biocide Market Share, By Geography, 2010

Source: Coaings World, ICIS, MarketsandMarkets Analysis

Market participants are continuously focusing on the Asia-Pacific region to gain market share and improve profitability. Since biocides are specialty chemicals their market is price sensitive. Market participants have thus shifted their focus on product differentiation through innovation. Patents have become common in the market as participants look to capture market share by differentiating on new technologies. The number of patents that have been filed increased due to new product development across the globe. As the consumption level for biocide increased in various applications such as water treatment and wood preservative, the number of patents filings by players also registered an increasing trend. The report also analyzes market share of leading producers, key developments, and strategies deployed to win the market.

Key participants in the global biocide market include AkzoNobel N.V. (The Netherlands), Ashland Inc. (U.S.), BASF SE (Germany), Champion Technologies (U.S.), Clariant AG (Switzerland), Cortec Corporation (U.S.), LANXESS AG (Germany), Lonza Group Ltd (Switzerland), Nalco Holding Company (U.S.), Thor Group Limited (U.K.), and Troy Corporation (U.S.).

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

1.5.1 MARKET SIZE

1.5.2 KEY DATA POINTS TAKEN FROM SECONDARY SOURCES

1.5.3 LIST OF SECONDARY SOURCES

1.5.4 KEY DATA POINTS TAKEN FROM PRIMARY SOURCES

1.5.5 ASSUMPTIONS MADE FOR THIS REPORT

1.5.6 LIST OF COMPANIES COVERED DURING PRIMARIES

1.5.7 KEY QUESTIONS ANSWERED

2 EXECUTIVE SUMMARY

3 MARKET OVERVIEW

3.1 INTRODUCTION

3.2 GLOBAL BIOCIDE MARKET LANDSCAPE

3.3 MARKET SHARE ANALYSIS

3.4 MARKET DYNAMICS

3.4.1 DRIVERS

3.4.1.1 Increasing demand for water

3.4.1.2 Environmental regulations & low and zero voc coatings are driving biocide market

3.4.2 RESTRAINTS

3.4.2.1 Rising raw material cost

3.4.2.2 Lengthy & expensive registration process

3.4.3 OPPORTUNITIES

3.4.3.1 High growth rate in asia-pacific region & eastern europe

3.4.3.2 New applications in plastics

3.5 BURNING ISSUE

3.5.1 GREEN TREND AFFECTS BIOCIDE DEMAND

3.6 WINNING IMPERATIVES

3.6.1 NEW PRODUCT INNOVATION

3.7 RAW MATERIAL ANALYSIS

3.7.1 BROMINE

3.7.2 SULFUR

3.7.3 CHLORINE

3.7.4 AMMONIA

3.8 PORTERS FIVE FORCES

3.8.1 BARGAINING POWER OF SUPPLIERS

3.8.2 BARGAINING POWER OF BUYERS

3.8.3 THREAT OF NEW ENTRANTS

3.8.4 THREAT OF SUBSTITUTES

3.8.5 DEGREE OF COMPETITION

3.9 POLICY & REGULATIONS

3.9.1 REACH

3.9.2 BIOCIDE PRODUCT DIRECTIVE (BPD)

3.9.3 FIFRA

3.9.4 PEST MANAGEMENT REGULATORY AGENCY (PMRA)

3.9.5 ENVIRONMENTAL PROTECTION AGENCY (EPA)

3.10 VALUE CHAIN ANALYSIS

3.11 PATENT ANALYSIS

3.12 PRICE ANALYSIS

4 GLOBAL BIOCIDE MARKET, BY TYPES

4.1 INTRODUCTION

4.2 HALOGEN COMPOUNDS

4.3 METALLIC COMPOUNDS

4.4 ORGANOSULFURS

4.5 ORGANIC ACIDS

4.6 PHENOLIC

4.7 OTHERS

4.7.1 NITROGEN COMPOUNDS

4.7.2 GLUTARALDEHYDE

5 GLOBAL BIOCIDE MARKET, BY APPLICATIONS

5.1 INTRODUCTION

5.2 PERSONAL CARE

5.3 WATER TREATMENT

5.4 WOOD PRESERVATION

5.5 FOOD & BEVERAGE

5.6 PAINTS & COATINGS

6 GEOGRAPHICAL ANALYSIS

6.1 INTRODUCTION

6.2 NORTH AMERICA

6.3 EUROPE

6.4 ASIA-PACIFIC

6.5 REST OF THE WORLD

7 COMPETITIVE LANDSCAPE

7.1 INTRODUCTION

7.2 MERGERS & ACQUISITIONS

7.3 PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/AGREEMENTS/CONTRACTS

7.4 NEW PRODUCTS LAUNCH

7.5 INVESTMENTS, EXPANSIONS & OTHER DEVELOPMENTS

8 COMPANY PROFILES

8.1 AKCROS CHEMICALS LTD

8.1.1 OVERVIEW

8.1.2 FINANCIALS

8.1.3 PRODUCTS & SERVICES

8.1.4 STRATEGY

8.1.5 DEVELOPMENTS

8.2 AKZONOBEL N.V.

8.2.1 OVERVIEW

8.2.2 FINANCIALS

8.2.3 PRODUCTS & SERVICES

8.2.4 STRATEGY

8.2.5 DEVELOPMENTS

8.3 ALBEMARLE CORPORATION

8.3.1 OVERVIEW

8.3.2 FINANCIALS

8.3.3 PRODUCTS & SERVICES

8.3.4 STRATEGY

8.3.5 DEVELOPMENTS

8.4 ANPATH GROUP INCORPORATED

8.4.1 OVERVIEW

8.4.2 FINANCIALS

8.4.3 PRODUCTS & SERVICES

8.4.4 STRATEGY

8.4.5 DEVELOPMENTS

8.5 ASHLAND INC.

8.5.1 OVERVIEW

8.5.2 FINANCIALS

8.5.3 PRODUCTS & SERVICES

8.5.4 STRATEGY

8.5.5 DEVELOPMENTS

8.6 BAKER HUGHES INCORPORATED

8.6.1 OVERVIEW

8.6.2 FINANCIALS

8.6.3 PRODUCTS & SERVICES

8.6.4 STRATEGY

8.6.5 DEVELOPMENTS

8.7 BASF SE

8.7.1 OVERVIEW

8.7.2 FINANCIALS

8.7.3 PRODUCTS & SERVICES

8.7.4 STRATEGY

8.7.5 DEVELOPMENTS

8.8 BUCKMAN LABORATORIES INTERNATIONAL INC.

8.8.1 OVERVIEW

8.8.2 FINANCIALS

8.8.3 PRODUCTS & SERVICES

8.8.4 STRATEGY

8.8.5 DEVELOPMENTS

8.9 BWA WATER ADDITIVE UK LIMITED

8.9.1 OVERVIEW

8.9.2 FINANCIALS

8.9.3 PRODUCTS & SERVICES

8.9.4 STRATEGY

8.9.5 DEVELOPMENTS

8.10 CAMSON BIO TECHNOLOGIES LIMITED

8.10.1 OVERVIEW

8.10.2 FINANCIALS

8.10.3 PRODUCTS & SERVICES

8.10.4 STRATEGY

8.10.5 DEVELOPMENTS

8.11 CHAMPION TECHNOLOGIES INC

8.11.1 OVERVIEW

8.11.2 FINANCIALS

8.11.3 PRODUCTS & SERVICES

8.11.4 STRATEGY

8.11.5 DEVELOPMENTS

8.12 CLARIANT AG

8.12.1 OVERVIEW

8.12.2 FINANCIALS

8.12.3 PRODUCTS & SERVICES

8.12.4 STRATEGY

8.12.5 DEVELOPMENTS

8.13 CORTEC CORPORATION

8.13.1 OVERVIEW:

8.13.2 FINANCIALS

8.13.3 PRODUCTS & SERVICES

8.13.4 STRATEGY

8.13.5 DEVELOPMENTS

8.14 FMC CORPORATION

8.14.1 OVERVIEW

8.14.2 FINANCIALS

8.14.3 PRODUCTS & SERVICES

8.14.4 STRATEGY

8.14.5 DEVELOPMENTS

8.15 GE WATER AND PROCESS TECHNOLOGIES

8.15.1 OVERVIEW

8.15.2 FINANCIALS

8.15.3 PRODUCTS & SERVICES

8.15.4 STRATEGY

8.15.5 DEVELOPMENTS

8.16 KEMIRA OYJ

8.16.1 OVERVIEW

8.16.2 FINANCIALS

8.16.3 PRODUCTS & SERVICES

8.16.4 STRATEGY

8.16.5 DEVELOPMENTS

8.17 LANXESS AG

8.17.1 OVERVIEW

8.17.2 FINANCIALS

8.17.3 PRODUCTS & SERVICES

8.17.4 STRATEGY

8.17.5 DEVELOPMENTS

8.18 LONZA GROUP LTD.

8.18.1 OVERVIEW

8.18.2 FINANCIALS

8.18.3 PRODUCTS & SERVICES

8.18.4 STRATEGY

8.18.5 DEVELOPMENTS

8.19 NALCO HOLDING COMPANY

8.19.1 OVERVIEW

8.19.2 FINANCIALS

8.19.3 PRODUCTS & SERVICES

8.19.4 STRATEGY

8.19.5 DEVELOPMENTS

8.20 RHODIA SA

8.20.1 OVERVIEW

8.20.2 FINANCIALS

8.20.3 PRODUCTS & SERVICES

8.20.4 STRATEGY

8.20.5 DEVELOPMENTS

8.21 SIGMA-ALDRICH CORP

8.21.1 OVERVIEW

8.21.2 FINANCIALS

8.21.3 PRODUCTS & SERVICES

8.21.4 STRATEGY

8.21.5 DEVELOPMENTS

8.22 THE DOW CHEMICAL COMPANY

8.22.1 OVERVIEW

8.22.2 FINANCIALS

8.22.3 PRODUCTS & SERVICES

8.22.4 STRATEGY

8.22.5 DEVELOPMENTS

8.23 THE LUBRIZOL CORPORATION

8.23.1 OVERVIEW

8.23.2 FINANCIALS

8.23.3 PRODUCTS & SERVICES

8.23.4 STRATEGY

8.23.5 DEVELOPMENTS

8.24 THOR GROUP LIMITED

8.24.1 OVERVIEW

8.24.2 FINANCIALS

8.24.3 PRODUCTS & SERVICES

8.24.4 STRATEGY

8.24.5 DEVELOPMENTS

8.25 TROY CORPORATION

8.25.1 OVERVIEW

8.25.2 FINANCIALS

8.25.3 PRODUCTS & SERVICES

8.25.4 STRATEGY

8.25.5 DEVELOPMENTS

LIST OF TABLES

TABLE 1 BIOCIDE MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 2 BROMINE: PRICE TRENDS, 2009 2016 ($/TON)

TABLE 3 SULFUR: PRICE TRENDS, 2009 2016 ($/TON)

TABLE 4 CHLORINE: PRICE TRENDS, 2009 2016 ($/TON)

TABLE 5 BPD REGULATIONS

TABLE 6 PMRA REGULATIONS

TABLE 7 GLOBAL BIOCIDE MARKET REVENUE, BY TYPES, 2009 2016 ($MILLION)

TABLE 8 GLOBAL BIOCIDE MARKET VOLUME, BY TYPES, 2009 2016 (KILO TONS)

TABLE 9 TYPE OF BIOCIDES USED IN INDUSTRIAL APPLICATIONS

TABLE 10 VARIOUS METALS & THEIR CONCENTRATION

TABLE 11 DIFFERENT TYPE OF ORGANIC ACIDS & THEIR APPLICATIONS

TABLE 12 GLOBAL BIOCIDES MARKET REVENUE, BY APPLICATIONS, 2009 2016 ($MILLION)

TABLE 13 GLOBAL BIOCIDES MARKET VOLUME, BY APPLICATIONS, 2009 2016 (KILO TONS)

TABLE 14 BIOCIDE USED IN INDUSTRIAL PRESERVATION

TABLE 15 BIOCIDES USED IN WATER TREATMENT

TABLE 16 BIOCIDES USED IN OTHER APPLICATIONS

TABLE 17 PERSONAL CARE: BIOCIDE MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 18 PERSONAL CARE: BIOCIDE MARKET REVENUE, BY GEOGRAPHY, 2009 2016 (KILO TONS)

TABLE 19 WATER TREATMENT: BIOCIDE MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 20 WATER TREATMENT: BIOCIDE MARKET VOLUME, BY GEOGRAPHY, 2009 2016 (KILO TONS)

TABLE 21 WOOD PRESERVATION: BIOCIDE MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 22 WOOD PRESERVATION: BIOCIDE MARKET VOLUME, BY GEOGRAPHY, 2009 2016 (KILO TONS)

TABLE 23 FOOD & BEVERAGE: BIOCIDE MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 24 FOOD & BEVERAGE: BIOCIDE MARKET VOLUME, BY GEOGRAPHY, 2009 2016 (KILO TONS)

TABLE 25 PAINTS & COATINGS: BIOCIDE MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 26 PAINTS & COATINGS: BIOCIDE MARKET VOLUME, BY GEOGRAPHY, 2009 2016 (KILO TONS)

TABLE 27 BIOCIDE MARKET VOLUME, BY GEOGRAPHY, 2009 2016 (KILO TONS)

TABLE 28 NORTH AMERICA: BIOCIDE MARKET REVENUE, BY COUNTRY, 2009 2016 ($MILLION)

TABLE 29 NORTH AMERICA: BIOCIDE MARKET VOLUME, BY COUNTRY, 2009 2016 (KILO TONS)

TABLE 30 EUROPE: BIOCIDE MARKET REVENUE, BY COUNTRY, 2009 2016 ($MILLION)

TABLE 31 EUROPE: BIOCIDE MARKET VOLUME, BY COUNTRY, 2009 2016 (KILO TONS)

TABLE 32 ASIA-PACIFIC: BIOCIDE MARKET REVENUE, BY COUNTRY, 2009 2016 ($MILLION)

TABLE 33 ASIA-PACIFIC: BIOCIDE MARKET VOLUME, BY COUNTRY, 2009 2016 (KILO TONS)

TABLE 34 ROW: BIOCIDE MARKET REVENUE, BY COUNTRY, 2009 2016 ($MILLION)

TABLE 35 ROW: BIOCIDE MARKET VOLUME, BY COUNTRY, 2009 2016 ($MILLION)

TABLE 36 MERGERS & ACQUISITIONS, 2008 2012

TABLE 37 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, JOINT VENTURES, 2008 2012

TABLE 38 NEW PRODUCTS LAUNCH, 2008 2012

TABLE 39 INVESTMENTS, EXPANSIONS & OTHER DEVELOPMENTS, 2008 2012

TABLE 40 AKCROS CHEMICALS: BIOCIDES FOR PLASTICS

TABLE 41 AKCROS CHEMICALS: BIOCIDES FOR INDUSTRIAL APPLICATIONS

TABLE 42 AKZONOBEL: TOTAL REVENUE, BY SEGMENTS, 2010 2011 ($MILLION)

TABLE 43 AKZONOBEL: TOTAL REVENUE, BY GEOGRAPHY, 2010 - 2011 ($MILLION)

TABLE 44 AKZONOBEL: PRODUCTS PORTFOLIO & ITS APPLICATIONS

TABLE 45 ALBEMARLE CORP: TOTAL REVENUE, BY SEGMENTS, 2010 2011 ($MILLION)

TABLE 46 ALBEMARLE CORP: TOTAL REVENUE, BY GEOGRAPHY, 2010 - 2011 ($MILLION)

TABLE 47 ALBEMARLE CORP: PRODUCTS PORTFOLIO & ITS APPLICATIONS

TABLE 48 ANPATH GROUP INCORPORATED: SURFACE CARE PRODUCTS & ITS APPLICATIONS

TABLE 49 ANPATH GROUP INCORPORATED: GEOBIOCIDES

TABLE 50 ANPATH GROUP INCORPORATED: ANIMAL CARE PRODUCTS

TABLE 51 ASHLAND INC: TOTAL REVENUE, BY SEGMENTS, 2010 - 2011 ($MILLION)

TABLE 52 ASHLAND INC: TOTAL REVENUE, BY GEOGRAPHY, 2010 - 2011 ($MILLION)

TABLE 53 ASHLAND INC: PRODUCTS PORTFOLIO & ITS APPLICATION

TABLE 54 BAKER HUGHES: TOTAL REVENUE, BY SEGMENTS, 2010 - 2011 ($MILLION)

TABLE 55 BAKER HUGHES: TOTAL REVENUE, BY GEOGRAPHY, 2010 - 2011 ($MILLION)

TABLE 56 BAKER HUGHES: PRODUCTS PORTFOLIO & ITS APPLICATION

TABLE 57 BASF SE: TOTAL REVENUE, BY SEGMENTS, 2010 - 2011 ($MILLION)

TABLE 58 BASF SE: PERFORMANCE PRODUCT SEGMENT REVENUE, BY SUB-SEGMENTS, 2010 - 2011 ($MILLION)

TABLE 59 BASF SE: PRODUCTS PORTFOLIO & ITS APPLICATIONS

TABLE 60 BUCKMAN LABORATORIES: PRODUCTS PORTFOLIO & ITS APPLICATIONS

TABLE 61 BWA WATER: PRODUCTS PORTFOLIO & ITS FEATURES

TABLE 62 CAMSON: TOTAL REVENUE, BY SEGMENTS, 2010 - 2011 ($MILLION)

TABLE 63 CAMSON: BIO-INSECTICIDE PORTFOLIO & ITS APPLICATIONS

TABLE 64 CAMSON: BIO-FUNGICIDES PORTFOLIO & ITS APPLICATIONS

TABLE 65 CHAMPION TECHNOLOGIES: PRODUCTS PORTFOLIO & ITS APPLICATIONS

TABLE 66 CLARIANT: TOTAL REVENUE, BY SEGMENTS,2010 - 2011 ($MILLION)

TABLE 67 CLARIANT: TOTAL REVENUE, BY GEOGRAPHY, 2010 - 2011 ($MILLION)

TABLE 68 CLARIANT: DRY-FILM BIOCIDE PORTFOLIO & ITS APPLICATIONS

TABLE 69 CLARIANT: DRY-IN-CAN BIOCIDES FORMULATIONS & ITS APPLICATIONS

TABLE 70 CORTEC CORP: BIOCIDE PORTFOLIO & ITS APPLICATIONS

TABLE 71 FMC CORP: TOTAL REVENUE, BY SEGMENTS, 2010 2011 ($MILLION)

TABLE 72 FMC CORP: TOTAL REVENUE, BY GEOGRAPHY, 2009 - 2010 ($MILLION)

TABLE 73 FMC CORP: PESTICIDES FOR USE IN THE FOOD INDUSTRY

TABLE 74 FMC CORP: PESTICIDES FOR ENVIRONMENTAL USE

TABLE 75 FMC CORP: PESTICIDES FOR LEGIONELLA & REFRIGERATION TOWERS

TABLE 76 FMC CORP: PESTICIDES PORTFOLIO & ITS APPLICATIONS

TABLE 77 FMC CORP: MICROBIAL CONTROL PORTFOLIO & ITS APPLICATIONS

TABLE 78 GE WATER: PRODUCTS PORTFOLIO & ITS APPLICATIONS

TABLE 79 KEMIRA: TOTAL REVENUE, BY SEGMENTS, 2010 - 2011 ($MILLION)

TABLE 80 KEMIRA: AMERICA & ASIA-PACIFIC BIOCIDE PRODUCT LINE FOR OILFIELD APPLICATIONS

TABLE 81 KEMIRA: EUROPE BIOCIDE PRODUCT LINE FOR OILFIELD APPLICATIONS

TABLE 82 LANXESS: TOTAL REVENUE, BY SEGMENTS, 2009 - 2010 ($MILLION)

TABLE 83 LANXESS: TOTAL REVENUE, BY GEOGRAPHY, 2009 - 20110 ($MILLION)

TABLE 84 LANXESS: PRODUCTS PORTFOLIO & ITS APPLICATIONS

TABLE 85 LONZA GROUP: TOTAL REVENUE, BY SEGMENTS, 2010 2011 ($MILLION)

TABLE 86 LONZA GROUP: BIOCIDE PRODUCTS PORTFOLIO & ITS APPLICATIONS

TABLE 87 LONZA GROUP: OTHER BIOCIDE PRODUCTS PORTFOLIO & ITS APPLICATIONS

TABLE 88 NALCO: ANNUAL REVENUE, BY SEGMENTS, 2009 - 2010 ($MILLION)

TABLE 89 NALCO: ANNUAL REVENUE, BY GEOGRAPHY,2009 - 2010 ($MILLION)

TABLE 90 NALCO: PRODUCTS PORTFOLIO & ITS APPLICATIONS

TABLE 91 RHODIA SA: TOTAL REVENUE, 2009 - 2010 ($MILLION)

TABLE 92 RHODIA: TOTAL REVENUE, BY SEGMENTS, 2009 2010 ($MILLION)

TABLE 93 RHODIA: TOTAL REVENUE, BY GEOGRAPHY, 2009 2010 ($MILLION)

TABLE 94 RHODIA: PRODUCTS PORTFOLIO & ITS PROPERTIES

TABLE 95 SIGMA-ALDRICH: TOTAL REVENUE, BY SEGMENTS, 2010 2011 ($MILLION)

TABLE 96 SIGMA-ALDRICH: TOTAL REVENUE, BY GEOGRAPHY, 2010 2011 ($MILLION)

TABLE 97 SIGMA-ALDRICH: PRODUCTS PORTFOLIO & ITS PROPERTIES

TABLE 98 DOW CHEMICAL: TOTAL REVENUE, BY SEGMENTS, 2010 - 2011 ($MILLION)

TABLE 99 DOW CHEMICAL: TOTAL REVENUE, BY GEOGRAPHY, 2010 - 2011 ($MILLION)

TABLE 100 DOW CHEMICAL: BIOCIDE PORTFOLIO & ITS APPLICATIONS

TABLE 101 LUBRIZOL: ANNUAL REVENUE, BY SEGMENTS, 2009 - 2010 ($MILLION)

TABLE 102 LUBRIZOL: PRODUCTS PORTFOLIO & ITS APPLICATIONS

TABLE 103 THOR GROUP: PAINTS & INKS - WET-STATE BIOCIDE & ITS APPLICATIONS

TABLE 104 THOR GROUP: PAINTS & INKS - DRY-FILM BIOCIDE & ITS APPLICATIONS

TABLE 105 THOR GROUP: POLYMER DISPERSIONS & ADHESIVES BIOCIDE & ITS APPLICATIONS

TABLE 106 THOR GROUP: WATER TREATMENT BIOCIDES & ITS APPLICATIONS

TABLE 107 THOR GROUP: FUEL BIOCIDES PRODUCTS PORTFOLIO & ITS APPLICATIONS

TABLE 108 TROY CORP: PRODUCTS PORTFOLIO & ITS APPLICATIONS

LIST OF FIGURES

FIGURE 1 WATER CONSUMPTION, BY GEOGRAPHY, 2010

FIGURE 2 GLOBAL BIOCIDE MARKET LANDSCAPE

FIGURE 3 MARKET SHARE, BY COMPANIES, 2010

FIGURE 4 BIOCIDE MARKET REVENUE, BY GEOGRAPHY, 2010

FIGURE 5 IMPACT OF MAJOR DRIVERS ON GLOBAL BIOCIDE MARKET, 2010 2016

FIGURE 6 IMPACT OF MAJOR RESTRAINTS ON GLOBAL BIOCIDE MARKET, 2010 2016

FIGURE 7 MAJOR OPPORTUNITIES IN GLOBAL BIOCIDE MARKET, 2010 2016

FIGURE 8 AMMONIA MARKET SHARE, BY GEOGRAPHY, 2010

FIGURE 9 PORTERS FIVE FORCES ANALYSIS

FIGURE 10 BIOCIDE INDUSTRY VALUE CHAIN

FIGURE 11 GLOBAL PATENT ANALYSIS, BY PLAYERS, 2007 2011 (%)

FIGURE 12 PATENT ANALYSIS, BY GEOGRAPHY, 2007 2011

FIGURE 13 GLOBAL TRENDS IN PATENT FILINGS, 2007 2011

FIGURE 14 BIOCIDE MARKET, BY AVERAGE PRICES, 2009 2016 (USD/KG)

FIGURE 15 DIFFERENT TYPE OF HALOGEN COMPOUNDS BIOCIDE

FIGURE 16 DIFFERENT TYPE OF METALLIC COMPOUNDS BIOCIDE

FIGURE 17 DIFFERENT TYPE OF ORGANOSULFUR COMPOUNDS BIOCIDE

FIGURE 18 DIFFERENT TYPE OF ORGANIC ACIDS BIOCIDE

FIGURE 19 DIFFERENT TYPE OF PHENOLIC BIOCIDE

FIGURE 20 NITROGEN-BASED BIOCIDE DEMAND, BY GEOGRAPHY, 2010

FIGURE 21 NORTH AMERICA: MARKET SHARE, BY COUNTRY, 2010

FIGURE 22 EUROPE: MARKET SHARE, BY COUNTRY, 2010

FIGURE 23 ASIA-PACIFIC: MARKET SHARE, BY COUNTRY, 2010

FIGURE 24 GLOBAL BIOCIDE MARKET SHARE, BY GROWTH STRATEGIES, 2008 2011

FIGURE 25 GLOBAL BIOCIDE GROWTH STRATEGY, BY COMPANY, 2008 2011

FIGURE 26 TRENDS IN GROWTH STRATEGIES, 2008 2011

FIGURE 27 GROWTH STRATEGIES, BY GEOGRAPHY, 2008 2011

Growth opportunities and latent adjacency in Global Biocide Market

Specific information on biocides used as disinfectant in Ireland

Market data for Biocides market for South Africa region on water industry

Interested to buy report section of Global Biocide Market study

General information on biocides market

Information on future demand for Bromine from high growth markets with a forecast of five years and competitive analysis of top players.

biocides in enhanced oil recovery for Oil & Gas application

Biocide market for Asia and the Pacific and value chain analysis

Specific information on disinfectants used in healthcare application