Bio Decontamination Market by Product (Equipment, Consumables), Agent (Hydrogen Peroxide, Chlorine Dioxide, Nitrogen Dioxide), Type (Room Decontamination, Chamber Decontamination), End User (Hospital & Healthcare facilities) & Region - Global Forecast to 2028

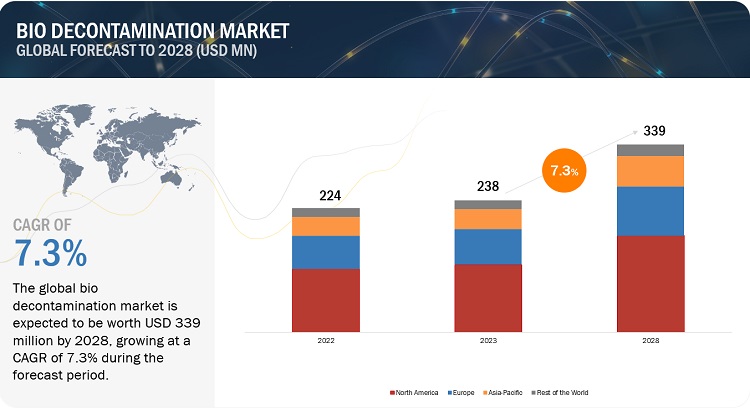

The global bio decontamination market, valued at US$224 million in 2022, stood at US$238 million in 2023 and is projected to advance at a resilient CAGR of 7.3% from 2023 to 2028, culminating in a forecasted valuation of US$339 billion by the end of the period.The growth of this market is majorly driven by the increased outsourcing of bio decontamination services and Growing healthcare sector and increasing outsourcing in emerging economies. However, Challenges associated with Variability of pathogen resistance may threat the growth of this market.

Attractive Opportunities in the Bio Decontamination Market

To know about the assumptions considered for the study, Request for Free Sample Report

Recession Impact on the Bio Decontamination Market

The impact of a recession on the market is increased competition. As organizations become more price-sensitive, they may seek bio decontamination providers or technologies at a lower cost, potentially leading to price pressure and decreased profit margins for existing providers.

However, the market may also be somewhat recession-resistant, as certain industries, such as healthcare and pharmaceuticals, may continue to require bio decontamination services regardless of economic conditions. Additionally, as the importance of public health and safety is emphasized during times of crisis, such as a pandemic, there may be increased awareness and demand for bio decontamination services and technologies.

Bio Decontamination Dynamics

DRIVER: Rising growth in pharmaceutical & biotechnology industries

Bio decontamination equipment, services, consumables, and accessories are widely used in pharmaceutical companies, especially in parenteral (injectable) manufacturing. According to the European Federation of Pharmaceutical Industries & Associations (EFPIA), the global pharmaceuticals were USD 1,077,856 in 2020. Furthermore, according to the Pharmaceutical Executive, the top 15 pharmaceutical companies invested USD 133 billion in 2021 in R&D expenditure. With the rising R&D expenditure and the increasing focus on the development of new therapeutic and diagnostic products, the demand for state-of-the-art facilities equipped with modern machines & instruments and a properly decontaminated environment (for efficient & effective research and manufacturing) is expected to increase in the coming years. This is considered a positive indicator for the growth of the market during the forecast period.

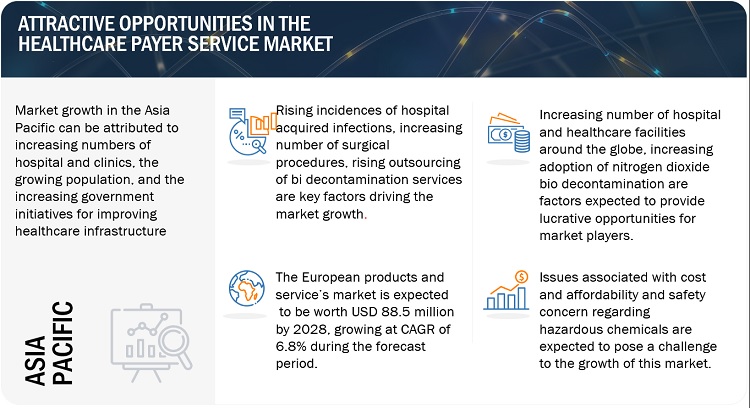

OPPORTUNITY: Growing healthcare sector and increasing outsourcing in emerging economies

Emerging markets, such as India and China, are considered cost-saving hubs by developed countries. During the last decade, businesses in developed markets, such as the US and Europe, have outsourced their manufacturing and packaging operations to China, South Korea, Taiwan, and India to leverage the lower labor costs and less-stringent government regulations in these countries. As these countries are becoming major manufacturing hubs, there is a greater focus on quality parameters and the adoption of technologically advanced products to cater to customer requirements. Consequently, the adoption of bio decontamination products & services is growing across many industries in these countries. According to Dezan Shira & Associates (2020), by 2030, China is expected to account for more than 25% of the global medical device industry (at over USD 200 billion) as decontamination is an essential service in medical devices hence the market is anticipated grow. Moreover, setting up and maintaining in-house bio decontamination capabilities may be expensive. Outsourcing allows them to benefit from economies of scale, as service providers can leverage their resources across multiple clients, resulting in potential cost savings for the healthcare facility this will support to thrive the market in emerging economies during the forecast period.

CHALLENGE: Variability of pathogen-resistance

The variability of pathogen challenge is an important consideration in the market. Different pathogens have varying levels of resistance, persistence, and susceptibility to decontamination methods. Here are some key factors that contribute to the variability of pathogen challenge in bio decontamination:

Pathogen Types: Different types of pathogens pose varying challenges in terms of their resistance and susceptibility to decontamination. Bacteria, viruses, fungi, and spores all have different characteristics and responses to disinfectants and decontamination methods. For example, spores such as those produced by Clostridium difficile, or Bacillus anthracis can be particularly resistant and challenging to eliminate.

Pathogen Resistance: Pathogens can develop resistance to disinfectants and antimicrobial agents over time. Factors such as genetic mutations, adaptation, or exposure to sublethal doses of disinfectants can contribute to the development of resistance. Some pathogens may have inherent resistance mechanisms that make them more difficult to eradicate.

Environmental Conditions: Pathogens can exhibit different levels of survival and persistence under varying environmental conditions. Factors such as temperature, humidity, pH, and the presence of organic matter can influence the viability and susceptibility of pathogens to decontamination methods. Some pathogens may survive longer in certain environments, making them more challenging to eliminate.

Surface Contamination: Pathogens can adhere to surfaces and form biofilms, which provide protective barriers and increase their resistance to disinfection. The type of surface, its texture, porosity, and the presence of organic or inorganic matter can affect the ability of disinfectants to reach and eliminate pathogens effectively.

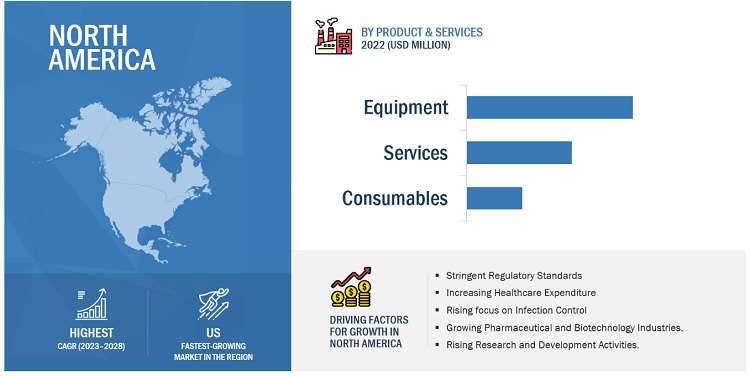

US accounted for the largest share of the North American bio decontamination market in 2022.

Based on the region, the North American market is segmented into US and Canada. In 2022, the US accounted for the largest share of the North American market. Growth in this market can be attributed to presence of stringent regulatory standard, rising healthcare expenditure, rising focus on infection control, the increasing number of surgical procedures performed in the US as Hospitals & healthcare facilities need to be decontaminated, especially in critical areas such as ICUs and operation theatres, the rising geriatric population, presence of majority of key players, and chronic diseases.

China registered the highest growth rate in Asia Pacific bio decontamination market

The APAC market is segmented into Japan, China, India, and Rest of Apac. In 2022, China accounted for the highest growth rate of the Asian market. The high growth rate of China can be attributed to expanding occurrences of HAIs, expansion of pharma, biotech and med tech companies, and alteration of healthcare infrastructure.

Germany in European bio decontamination market to witness the growth rate during the forecast period.

The Europe Market is segmented into Germany, Italy, France, Spain, the UK, and the Rest of Europe. Germany is registered the highest growth rate during the forecast period. The major factors contributing to the growth of this market are the climbing old age population, upsurging incidence infectious diseases, moreover Germany is leading manufacturers of high-quality medical equipment which results high requirement for bio decontamination products and services used by medical device manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

Some of the major players operating in this market are Steris (US), Ecolab (US), TOMI Environmental Solutions, Inc (US). In 2022, Ecolab (US), held the leading position in the market. The company has a strong geographic presence across North America, Europe, and Asia Pacific. Steris PLC (US), held the second position in the bio decontamination market in 2022.

Bio Decontamination Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$238 million |

|

Projected Revenue by 2028 |

$339 million |

|

Revenue Rate |

Poised to Grow at a CAGR of 7.3% |

|

Market Driver |

Rising growth in pharmaceutical & biotechnology industries |

|

Market Opportunity |

Growing healthcare sector and increasing outsourcing in emerging economies |

This research report categorizes the bio decontamination market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Equipment

- Services

- Consumables

By Agent Type

- Hydrogen Peroxide

- Chlorine Dioxide

- Peracetic Acid

- Nitrogen Dioxide

By Type

- Chamber Decontamination

- Room Decontamination

By End User

- Pharmaceutical & Medical Device Manufacturing Companies

- Life Sciences & Biotechnology Research Organizations

- Hospitals & Healthcare Facilities

By Region

- North America

- Europe

- Apac

- RoW

Recent Developments

- In July 22, Ecolab’s (US) Bioquell HPV-AQ received an authorized approval for use in all territories of the European Union and the European Economic Area.

- In Dec 2022, the TOMI Environmental Solutions, Inc (US) launched new SteraMist products, which include the Select Plus-a hybrid product consisting of the Company’s current Surface Select and Environment systems. (The system is 24 volts, allowing for universal outlet usage and convert more of the hydrogen peroxide BIT Solution to hydroxyl radicals thus lowering H2O2 PPM levels allowing for faster turnaround time).

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global bio decontamination market?

The global bio decontamination market boasts a total revenue value of $339 million by 2028.

What is the estimated growth rate (CAGR) of the global bio decontamination market?

The global bio decontamination market has an estimated compound annual growth rate (CAGR) of 7.3% and a revenue size in the region of $238 million in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising incidence of hospital-acquired infections- Increasing number of surgical procedures- Growing outsourcing of bio decontamination services to third-party providers- Rising growth in pharmaceutical & biotechnology industry- Stringent regulatory guidelines for pharmaceutical & medical device manufacturing companiesRESTRAINTS- Use of manual bio decontamination methods in emerging economies- Rising adoption of single-use medical devices- Availability of alternative techniquesOPPORTUNITIES- Growing healthcare sector in emerging markets- Increasing establishment of pharmaceutical & medical device companies- Rising adoption of nitrogen dioxide bio decontamination- Increasing number of hospitals and healthcare facilitiesCHALLENGES- Challenges associated with equipment & technology costs- Variability of pathogen resistance- Safety concerns regarding hazardous chemicalsTRENDS- Increasing focus on infection control- Adoption of eco-friendly decontamination products

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTES

-

5.7 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.8 REGULATORY LANDSCAPENORTH AMERICAEUROPE

-

5.9 PATENT ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS

- 5.11 PRICING ANALYSIS

- 5.12 TRADE ANALYSIS

-

5.13 ECOSYSTEM ANALYSISROLE IN ECOSYSTEMKEY PLAYERS OPERATING IN BIO DECONTAMINATION MARKET

-

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 6.1 INTRODUCTION

-

6.2 EQUIPMENTRISING PREFERENCE FOR AUTOMATED EQUIPMENT TO DRIVE MARKET

-

6.3 SERVICESLOW COST OF SERVICES TO DRIVE MARKET

-

6.4 CONSUMABLESRECURRING USAGE OF CONSUMABLES TO SUPPORT MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 HYDROGEN PEROXIDEADVANTAGES OF SAFETY AND HIGH MATERIAL COMPATIBILITY TO DRIVE MARKET

-

7.3 CHLORINE DIOXIDEEFFECTIVE STERILANT FOR MICROBIOLOGICAL CONTAMINANTS

-

7.4 PERACETIC ACIDUTILIZATION IN AEROSOL SYSTEMS AND CLEANROOMS TO PROPEL MARKET

-

7.5 NITROGEN DIOXIDERAPID & EFFECTIVE DECONTAMINATION AT LOW HUMIDITY LEVELS TO SUPPORT MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 CHAMBER DECONTAMINATIONLOWER COST AND MINIMAL POWER REQUIREMENTS TO DRIVE MARKET

-

8.3 ROOM DECONTAMINATIONREQUIREMENT OF HUMAN INTERVENTION TO RESTRAIN MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 PHARMACEUTICAL AND MEDICAL DEVICE MANUFACTURING COMPANIESCOMPLIANCE WITH STRINGENT REGULATIONS FOR STERILIZATION OF INSTRUMENTS TO DRIVE MARKET

-

9.3 LIFE SCIENCES AND BIOTECHNOLOGY RESEARCH ORGANIZATIONSRISING BIOTECHNOLOGY RESEARCH AND UTILIZATION OF DECONTAMINATORS IN CLEANROOMS TO DRIVE MARKET

-

9.4 HOSPITALS AND HEALTHCARE FACILITIESINCREASING NUMBER OF HOSPITAL-ACQUIRED INFECTIONS AND SURGICAL PROCEDURES TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Increasing number of surgical procedures to drive marketCANADA- Rising investments in healthcare to drive marketNORTH AMERICA: RECESSION IMPACT

-

10.3 EUROPEGERMANY- Implementation of mandates associated with sterilization of healthcare equipment to drive marketUK- Increasing healthcare expenditure and implementation of regulatory guidelines to drive marketFRANCE- Favorable government initiatives for adoption of sterilization services to drive marketITALY- Rising growth in pharmaceutical & biotechnology industry to drive marketSPAIN- Rising expansion of healthcare facilities to support market growthREST OF EUROPEEUROPE: RECESSION IMPACT

-

10.4 ASIA PACIFICJAPAN- High growth in pharmaceutical industry to drive marketCHINA- Increasing growth in medical device manufacturing industry to drive marketINDIA- Establishment of key medical manufacturing companies to drive marketREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

- 10.5 REST OF THE WORLD

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE SHARE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPANY EVALUATION MATRIX FOR SMES/STARTUPSPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.7 COMPANY FOOTPRINT ANALYSIS

- 11.8 COMPETITIVE BENCHMARKING

-

11.9 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND APPROVALSDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSSTERIS PLC- Business overview- Products offered- Services offered- Recent developments- MnM viewECOLAB- Business overview- Products offered- Services offered- Recent developments- MnM viewTOMI ENVIRONMENTAL SOLUTIONS, INC.- Business overview- Products offered- Services offered- Recent developments- MnM viewJCE BIOTECHNOLOGY- Business overview- Products offered- MnM viewFEDEGARI AUTOCLAVI S.P.A- Business overview- Products offeredZHEJIANG TAILIN BIOENGINEERING CO., LTD.- Business overview- Products offeredHOWORTH AIR TECHNOLOGY LIMITED- Business overview- Products offered- Services offeredSOLIDFOG TECHNOLOGIES- Business overview- Products offered- Services offeredCLORDISYS SOLUTIONS, INC.- Business overview- Products offeredAMIRA SRL- Business overview- Products offered- Services offered- Recent developments

-

12.2 OTHER PLAYERSNOXILIZER, INC.TECOMAKDIOP GMBH & CO. KGAM INSTRUMENTS SRLALLEN & COMPANY ENVIRONMENTAL SERVICESSYCHEM LIMITEDCONTROLLED CONTAMINATION SERVICESKLENZAIDSCURIS DECONTAMINATIONIHSS LTD.METALL+PLASTIC GMBHBIO DECONTAMINATION LTD.SYNTEGON TECHNOLOGY GMBHTHE ECOSENSE COMPANYREATORGCLEAMIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT ANALYSIS

- TABLE 2 US: PERCENTAGE INCREASE IN SURGERIES PERFORMED

- TABLE 3 US: NUMBER OF AESTHETIC SURGERIES PERFORMED (2020 VS. 2021)

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS (%)

- TABLE 5 KEY BUYING CRITERIA FOR END USERS

- TABLE 6 INDICATIVE LIST OF REGULATORY AUTHORITIES FOR BIO DECONTAMINATION MARKET

- TABLE 7 LIST OF CONFERENCES AND EVENTS (2023−2024)

- TABLE 8 PRICE RANGE FOR BIO DECONTAMINATION PRODUCTS

- TABLE 9 IMPORT DATA FOR HS CODE 840510, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 840510, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 11 BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 12 BIO DECONTAMINATION MARKET FOR EQUIPMENT, BY REGION, 2021–2028 (USD MILLION)

- TABLE 13 BIO DECONTAMINATION MARKET FOR SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 BIO DECONTAMINATION MARKET FOR CONSUMABLES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 16 BIO DECONTAMINATION MARKET FOR HYDROGEN PEROXIDE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 COMPARISON OF MANUAL DISINFECTION & DECONTAMINATION USING CHLORINE DIOXIDE GAS

- TABLE 18 BIO DECONTAMINATION MARKET FOR CHLORINE DIOXIDE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 BIO DECONTAMINATION MARKET FOR PERACETIC ACID, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 BIO DECONTAMINATION MARKET FOR NITROGEN DIOXIDE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 22 BIO DECONTAMINATION MARKET FOR CHAMBER DECONTAMINATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 ROOM DECONTAMINATION APPLICATION CATEGORIES (INDICATIVE LIST)

- TABLE 24 BIO DECONTAMINATION MARKET FOR ROOM DECONTAMINATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 26 BIO DECONTAMINATION MARKET FOR PHARMACEUTICAL AND MEDICAL DEVICE MANUFACTURING COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 BIO DECONTAMINATION MARKET FOR LIFE SCIENCES AND BIOTECHNOLOGY RESEARCH ORGANIZATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 BIO DECONTAMINATION MARKET FOR HOSPITALS AND HEALTHCARE FACILITIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 BIO DECONTAMINATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: BIO DECONTAMINATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 35 US: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 36 US: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 37 US: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 38 US: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 39 CANADA: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 40 CANADA: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 41 CANADA: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 42 CANADA: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 43 EUROPE: BIO DECONTAMINATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 EUROPE: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 45 EUROPE: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 47 EUROPE: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 48 GERMANY: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 49 GERMANY: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 50 GERMANY: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 51 GERMANY: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 52 UK: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 53 UK: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 54 UK: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 55 UK: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 56 FRANCE: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 57 FRANCE: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 FRANCE: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 59 FRANCE: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 60 ITALY: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 61 ITALY: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 ITALY: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 63 ITALY: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 64 SPAIN: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 65 SPAIN: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 66 SPAIN: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 67 SPAIN: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 68 REST OF EUROPE: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 69 REST OF EUROPE: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 REST OF EUROPE: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 71 REST OF EUROPE: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: BIO DECONTAMINATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 77 JAPAN: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 78 JAPAN: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 JAPAN: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 80 JAPAN: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 81 CHINA: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 82 CHINA: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 CHINA: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 84 CHINA: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 85 INDIA: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 86 INDIA: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 INDIA: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 88 INDIA: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 93 REST OF THE WORLD: BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 94 REST OF THE WORLD: BIO DECONTAMINATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 REST OF THE WORLD: BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2021–2028 (USD MILLION)

- TABLE 96 REST OF THE WORLD: BIO DECONTAMINATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 97 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 98 BIO DECONTAMINATION MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 99 OVERALL FOOTPRINT OF COMPANIES

- TABLE 100 REGIONAL FOOTPRINT OF COMPANIES

- TABLE 101 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 102 BIO DECONTAMINATION MARKET: DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 103 KEY PRODUCT LAUNCHES AND APPROVALS (2020−2023)

- TABLE 104 KEY DEALS (2020−2023)

- TABLE 105 OTHER DEVELOPMENTS (2020−2023)

- TABLE 106 STERIS PLC: BUSINESS OVERVIEW

- TABLE 107 ECOLAB: BUSINESS OVERVIEW

- TABLE 108 TOMI ENVIRONMENTAL SOLUTIONS, INC.: BUSINESS OVERVIEW

- TABLE 109 JCE BIOTECHNOLOGY: BUSINESS OVERVIEW

- TABLE 110 FEDEGARI AUTOCLAVI S.P.A.: BUSINESS OVERVIEW

- TABLE 111 ZHEJIANG TAILIN BIOENGINEERING CO., LTD.: BUSINESS OVERVIEW

- TABLE 112 HOWORTH AIR TECHNOLOGY LIMITED: BUSINESS OVERVIEW

- TABLE 113 SOLIDFOG TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 114 CLORDISYS SOLUTIONS, INC.: BUSINESS OVERVIEW

- TABLE 115 AMIRA SRL: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 KEY INDUSTRY INSIGHTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 BIO DECONTAMINATION MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 BIO DECONTAMINATION MARKET, BY AGENT TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 BIO DECONTAMINATION MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 BIO DECONTAMINATION MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 BIO DECONTAMINATION MARKET: REGIONAL SNAPSHOT

- FIGURE 14 INCREASING INCIDENCE OF HOSPITAL-ACQUIRED INFECTIONS TO DRIVE MARKET

- FIGURE 15 PHARMACEUTICAL & MEDICAL DEVICE MANUFACTURING COMPANIES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 BIO DECONTAMINATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASE

- FIGURE 19 DIRECT DISTRIBUTION-PREFERRED STRATEGY FOR PROMINENT COMPANIES

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 21 KEY BUYING CRITERIA FOR END USERS

- FIGURE 22 NORTH AMERICA: BIO DECONTAMINATION MARKET SNAPSHOT

- FIGURE 23 ASIA PACIFIC: BIO DECONTAMINATION MARKET SNAPSHOT

- FIGURE 24 BIO DECONTAMINATION MARKET: REVENUE SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 25 BIO DECONTAMINATION MARKET: COMPANY EVALUATION MATRIX (GLOBAL)

- FIGURE 26 BIO DECONTAMINATION MARKET: COMPANY EVALUATION MATRIX FOR SMES/STARTUPS

- FIGURE 27 STERIS PLC: COMPANY SNAPSHOT (2022)

- FIGURE 28 ECOLAB: COMPANY SNAPSHOT (2022)

- FIGURE 29 TOMI ENVIRONMENTAL SOLUTIONS, INC.: COMPANY SNAPSHOT (2022)

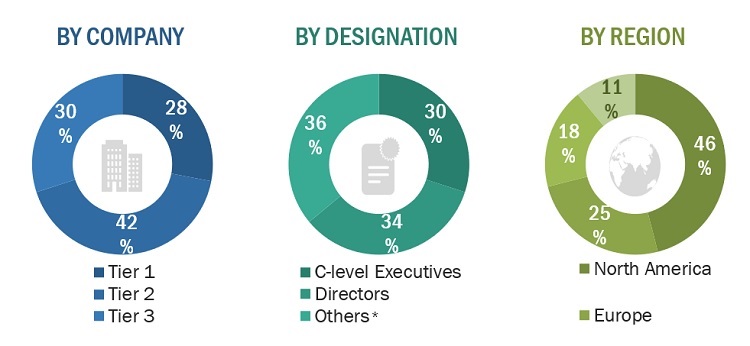

The study involved four major activities in estimating the current size of the bio decontamination market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (Bio Decontamination Technicians/Technologists, Purchase Managers in Healthcare Provider Organizations, Bio-cleaning Specialists, Bio decontamination Supervisors) and supply sides (bio decontamination manufacturers and distributors).

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2. Tiers of companies are defined based on their total revenue. As of 2020: Tier 1 = >USD 5 billion, Tier 2 = USD 500 million to USD 5 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the bio decontamination market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the bio decontamination industry.

Report Objectives

- To define, describe, and forecast the global bio decontamination market based on products, services, region.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, challenges, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)2

- To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies3.

- To track and analyze competitive developments such as acquisitions, expansions, new product launches, and partnerships in the bio decontamination market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company.

- Geographic Analysis: Further breakdown of the European bio decontamination market into specific countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bio Decontamination Market