Beverage Cans Market by Material Type (Aluminium, Steel, and PET), Beverage Type (Alcoholic Beverages, Non-Alcoholic Beverages, and Water), Structure (2-Piece and 3-Piece), & Region (NA, APAC, EUR, SA, and RoW) - Global Forecast to 2026

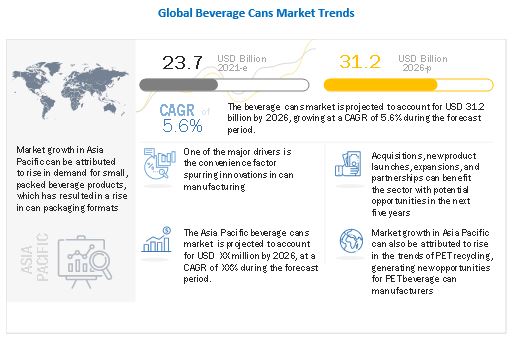

The global beverage cans market is estimated to reach $31.2 billion by 2026, growing at a 5.6% compound annual growth rate (CAGR). The global market size was valued $23.7 billion in 2021. The rise in demand for sustainable products and awareness regarding the environment coupled with increasing demand for convenient packaging will drive the beverage cans market demand and growth of beverage cans globally. The market for beverage cans is driven by factors such as the convenience, ease of transportation, and recyclability of cans. In addition, the increasing popularity of canned craft beers and hard seltzers has contributed to growth in the market. The use of aluminum cans is also increasing as it's lightweight and 100% recyclable which makes it more environmentally friendly compared to other packaging options. However, the market is facing challenges such as increasing raw material costs and competition from alternative packaging options like plastic bottles and cartons.

To know about the assumptions considered for the study, download the pdf brochure

Beverage Cans Market Dynamics

Driver: Increase in popularity of energy and sports drinks

Energy drinks are widely promoted as products that increase energy and enhance mental alertness and physical performance. Next to multivitamins, energy drinks are the most popular dietary supplement consumed by American teens and young adults. One reason can be semantics. Many people interchange sports drinks with energy drinks, but they are markedly different, with the former being formulated specifically for enhanced performance during activity and the latter being designed to inject a burst of energy into the consumer. But semantics alone cannot explain why energy drinks are set to outsell coffee in the next decade. While coffee is still viewed as traditionally consumed by older individuals, energy drinks have a greater appeal among the younger generation, aligning themselves with their lifestyle.

The surge in energy drink sales comes despite criticism of the beverages, namely the argument that they contain too much caffeine and sugar. However, recent innovations now see brands incorporating organic options into their product lines, a move that could shift energy drinks into the health sections. The term “organic” on energy drink labels refers to the use of real coffee beans to infuse caffeine content rather than caffeine that has been manufactured in a lab. Clean energy, along with diet and natural energy drink options, is another innovation that is meant to accommodate the growing cultural health awareness movement, wherein individuals are taking more control of their health.

Restraint: Saturated markets for cans in the developed regions

The demand for cans is directly associated with the sale of packaged products on the retail front. With the growing awareness of consumers regarding health benefits, beverage cans used for carbonated drinks such as alcohol and soft drinks are experiencing sluggish sales. Moreover, the slow growth in demand for other beverage products has hampered the growth of beverage packaging in the last five years. However, in developed regions such as North America and Europe, the consumption of canned beverages is high. The beverage cans market for cans is saturated in the region and has limited scope for further growth.

The total share of beverage cans used for carbonated beverages has declined by 60% as per the data by the US can association, thereby resulting in sluggish demand. The food industry is witnessing significant growth for canned fruits due to the increase in demand for healthy food by consumers, resulting in the penetration of packaged products.

Opportunity: Portable nature of cans makes them more user-friendly

The beverage cans market will see an upward trend shortly due to the changing work lifestyles of consumers across the globe. Rising household income, consumer demand for better quality and safety, and increased awareness of maintaining a healthy diet across multiple formats that are easy to carry are the major factors that will lead to the growing demand for cans in the market. The demand for beverage cans is substantial in developed regions such as North America and Europe and is growing gradually in other developing regions such as Asia Pacific. The demand for fresh and organic beverage products, especially in the non-carbonated segment, will boost the potential growth of beverage cans in the coming years.

Beverages with added nutrients have grown in demand across all geographies. The use of cans has further increased in different types of water as well, especially in the flavored segment. All these changes have gradually increased the market demand for can formats in beverages. In addition to this, canning also helps in retaining the fiber content in healthy drinks, further increasing the shelf line without hampering the quality, which also makes it a go-to option for beverage manufacturers who are producing drinks with soft-functional benefits.

Challenge: High usage of plastic for packaging due to lower cost

There is little awareness about the benefits of metal packaging of beverages in developing countries. Additionally, the high cost of raw materials used, such as steel and aluminum, restricts consumers from using these products. The major challenge faced by metal can manufacturers is the replacement of metal with polyethylene terephthalate (PET) bottles, especially for beverage products. Other sustainable packaging materials, such as paper, glass, and plastic, are more cost-effective than metal packaging. However, PET-based can are gradually getting adopted in the beverage cans Market as well.

Moreover, packaging alternatives for cans include Tetra Pak cartons, glass bottles, PET, and flexible pouches, along with many other innovative packaging techniques. The usage of these packaging products is restricting the growth of the cans market. According to the British Plastics Federation (BPF), 1.1 million tonnes (1.21 million tons) of plastic packaging is recycled. Similarly, the UK also recycles plastic packaging up to 39% every year.

Beverage Cans Market Scope

|

Report Metric |

Details |

| Market valuation in 2021 | USD 23.7 Billion |

| Market valuation in 2022 | USD 25.03 Billion |

| Revenue prediction in 2026 | USD 31.2 Billion |

| Growth rate | CAGR of 5.6% |

|

Number of Pages |

230 Pages Report |

|

Forecast period |

2021–2026 |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Fastest Growing Market |

Asia Pacific |

|

Units considered |

Value (USD) |

|

Report Coverage |

Material Type, Beverage Type, Structure, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Largest Market |

North America |

|

Companies studied |

|

By material type, the aluminum segment is estimated to hold the largest share of the beverage cans market.

Aluminum is a very ductile material. It is derived from bauxite ore. It is the most preferred raw material and is used for packaging beverage products as it offers impermeability and high flexibility. It is a very cost-effective raw material used in the industry and can customize the packaging with colors, 3D prints, and embossing. Therefore, technological developments have led manufacturers to remodel their strategies by using various sizes of cans, along with different shapes. Aluminum cans are a sustainable form of packaging with good waste treatment performance. The application and use benefit of aluminum cans is a means to increase the value of internal storage. According to the Environmental Protection Agency of the United States (EPA), in 2018, 1.9 million tons of aluminum packaging were generated for beers and soft drink cans, and 49.2 percent of aluminum beverage cans were recycled. Hence, aluminum cans are estimated to dominate the beverage cans market.

By beverage type, the non-alcoholic beverage segment is estimated to grow at a higher growth rate in the beverage cans market.

Non-alcoholic beverages majorly constitute carbonated soft drinks containing carbonated water, vapor, color, sweeteners, and preservatives. Carbonated soft drinks are often found to deteriorate in terms of taste and texture when packaged in glass bottles sealed with a crown cork. The two major deteriorative changes that occur in carbonated drinks are loss of carbonation and the rancidification of essential flavoring agents. These deteriorative changes can be reduced by providing effective packaging of beverage cans. In recent years, due to a rise in the consumption of carbonated beverages, the can packaging industry has seen tremendous growth. Further non-alcoholic beverages such as sports and energy drinks play an important role in an athlete’s life. These drinks contain carbohydrates in the form of sugar, electrolytes, proteins, vitamins, and caffeine and are now being widely consumed.

By structure, the 2-piece can segment is projected to grow at the fastest CAGR in the beverage cans market until 2026.

2-piece cans are mainly of three types: draw (shallow draw) whose height is less than their diameter; draw & redraw (DRD); draw & iron (D&I). A 2-piece can comprise two components: a body integrated with a bottom lid and a lid with an opening. 2-piece cans require a double seaming technique to attach the can body with can lids to protect the content from external contamination. Steel and aluminum are the widely used raw materials for the manufacturing of these types of cans. These cans are suitable for the packaging of carbonated and non-carbonated beverages, such as beer, wine, sports drinks, and fruit juices. 2-piece cans have several advantages over 3-piece cans, one of which is that its body has no side seam between the body and bottom end. Therefore, the can is tightly sealed with less consumption of raw materials. The process of manufacturing a 2-piece can is easy and more efficient than 3-piece can. Also, 2-piece food cans are lightweight and available with a stackable feature, because of which can save shelf space. With a continuously evolving packaging technology, the structure of the cans has also been improving with seamless can body and ease of printing on full cans; hence, 2-piece cans are estimated to replace 3-piece cans.

To know about the assumptions considered for the study, download the pdf brochure

The increasing demand for beverages such as carbonated soft drinks, beer, and wine, amongst others, in the Asia Pacific countries, drives the region’s growth rate at a higher pace.

Asia Pacific is one of the emerging regions for the beverage cans market. Countries such as China, India, Japan, Thailand, Indonesia, Australia, and New Zealand are considered for the purpose of the study. Therefore, the growth of the market is expected to be high in this region. Many types of packaging are preferred in the region, such as flexible, rigid plastic, paper, glass, and metal packaging. The demand from the beverage industry is growing due to the rise in population. Global players such as Ball Corporation (US) and Crown Holdings Inc (US) are entering the Asia Pacific market by developing new manufacturing plants in the region. This led to the rise of the cans market for beverages.

In May 2019, Can-Pack India Pvt Ltd, a beverage can manufacturer in the CANPACK Group, announced the formation of the Aluminum Beverages Can Association of India (ABCAI) with Hindalco Industries Ltd and Ball Beverage Packaging (India) Pvt Ltd to promote the use of aluminum cans for beverage packaging. The primary goal of ABCAI's allied partners is to work with corporations, governments, trade associations, and consumer organizations to raise awareness of the economic and environmental benefits of aluminum beverage can use. The Association will also participate in the analysis of beverage can consumption, emphasizing the environmental, logistical, and transportation benefits, as well as water and energy conservation.

High Industrial growth, urbanization, environmental concerns, high disposable income, and lower production of fresh food & beverage products are driving the growth of processed food & beverage products, consequently fueling the demand for beverage cans in this sector.

Top Key Companies in Beverage Cans Market

Key players in this market include major players such as Crown Holdings Inc. (Philadelphia, US), Ardagh Group S.A, (Luxemburg), CPMC Holdings Limited (China), Toyo Seikan Group Holdings Ltd. (Tokyo, Japan), Can-One Berhad (Malaysia), Can-Pack S.A (Poland), Ball Corporation (Colorado, US), Envases Universales (Spain), Universal Can Corporation (Tokyo, Japan), Interpack Group Inc. (China), GZ Industries (Nigeria), Showa Denko K.K (Tokyo, Japan), Swan Industries (Thailand) Limited (Thailand), Nampak Bevcan Limited (South Africa), The Olayan Group (Saudi Arabia), and Techpack Solutions Pvt Limited (Seoul, South Korea). These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In July 2022, Canpack S.A., a subsidiary of the Canpack Group, announced the expansion of its aluminum beverage can manufacturing capacity with a new production facility in Poços de Caldas, Minas Gerais, Brazil. The new plant's initial total capacity will be approximately 1.3 billion cans per year, with a total investment of approximately USD 140 million.

- In October 2020, Ball Corporation announced a partnership with Kroenke Sports & Entertainment to advance sustainability in Sports and Entertainment through aluminum beverage packaging

- In January 2021, Crown Holdings Inc. announced to build a new beverage can in Kentucky. The new facility supports the increased demand for beverage cans in North America for the drinks such as sparkling water, energy drinks, craft beer, and cocktails, among others.

- In March 2019, Ardagh Group S.A. announced plans to expand production in Brazil owing to the rising customer demand for recyclable, sustainable packaging

Frequently Asked Questions (FAQ):

How big is the beverage cans market?

The global beverage cans market is predicted to develop at an 5.6% compound annual growth rate (CAGR) to $31.2 billion by 2026. In 2021, the global market size was valued $23.7 billion.

Which players are involved in the manufacturing of beverage cans market?

Key players in this market include Crown Holdings Inc. (Philadelphia, US), Ardagh Group S.A, (Luxemburg), CPMC Holdings Limited (China), Toyo Seikan Group Holdings Ltd. (Tokyo, Japan), Can-One Berhad (Malaysia), Can-Pack S.A (Poland), Ball Corporation (Colorado, US), Envases Universales (Spain), Universal Can Corporation (Tokyo, Japan), Interpack Group Inc. (China), GZ Industries (Nigeria), Showa Denko K.K (Tokyo, Japan), Swan Industries (Thailand) Limited (Thailand), Nampak Bevcan Limited (South Africa), The Olayan Group (Saudi Arabia), and Techpack Solutions Pvt Limited (Seoul, South Korea).

What is the future growth potential of the beverage cans market?

The future growth potential of the beverage cans market appears promising, driven by several key factors. One of the primary drivers is the increasing demand for convenient and portable packaging solutions, particularly in emerging economies where urbanization and disposable income levels are rising. Beverage cans offer advantages such as lightweight, easy recyclability, and efficient storage, making them preferred choices for both consumers and manufacturers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 INCLUSIONS & EXCLUSIONS

1.5 REGIONS COVERED

1.6 PERIODIZATION CONSIDERED

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2020

1.8 VOLUME UNIT CONSIDERED

1.9 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 BEVERAGE CAN MARKET SIZE ESTIMATION – SUPPLY-SIDE (1/2)

FIGURE 4 MARKET SIZE ESTIMATION – SUPPLY-SIDE (2/2)

FIGURE 5 MARKET SIZE ESTIMATION – DEMAND-SIDE

2.2.1 MARKET SIZE ESTIMATION NOTES

FIGURE 6 BEVERAGE CANS MARKET SIZE ESTIMATION – TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION – BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

FIGURE 9 SCENARIO-BASED MODELLING

2.6.1 COVID-19 HEALTH ASSESSMENT

FIGURE 10 COVID-19: GLOBAL PROPAGATION

FIGURE 11 COVID-19 PROPAGATION: SELECT COUNTRIES

2.7 COVID-19 ECONOMIC ASSESSMENT

FIGURE 12 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.7.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 13 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 14 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 15 MARKET, BY MATERIAL TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 16 BEVERAGE CAN MARKET, BY BEVERAGE TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 17 BEVERAGE CAN MARKET, BY STRUCTURE, 2021 VS. 2026 (USD MILLION)

FIGURE 18 BEVERAGE CAN MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 BRIEF OVERVIEW OF THE MARKET

FIGURE 19 GROWING DEMAND FOR SUITABILITY AND AWARENESS REGARDING THE ENVIRONMENT DRIVING THE MARKET

4.2 NORTH AMERICA MARKET, BY MATERIAL AND APPLICATION

FIGURE 20 ALUMINUM SEGMENT DOMINATING THE NORTH AMERICAN MARKET IN 2020

4.3 BEVERAGE CAN MARKET, BY MATERIAL TYPE AND REGION

FIGURE 21 ALUMINUM SEGMENT TO DOMINATE THE MARKET ACROSS ALL REGIONS IN 2021 (USD MILLION)

4.4 BEVERAGE CANS MARKET, BY KEY COUNTRY

FIGURE 22 CHINA TO BE THE MOST LUCRATIVE MARKET FOR BEVERAGE CANS

4.5 BEVERAGE CAN MARKET, BY REGION

FIGURE 23 NORTH AMERICA PROJECTED TO DOMINATE THE MARKET AMONG ALL REGIONS BY 2026 (USD MILLION)

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

FIGURE 24 OPERATIONAL DRIVERS: BEER PRODUCTION IN NUMBER OF CANS (2019)

5.2 MARKET DYNAMICS

5.3 MACROECONOMIC INDICATORS

5.3.1 INCREASING POPULATION DENSITY

TABLE 2 GLOBAL POPULATION DENSITY, 2019

FIGURE 25 POPULATION GROWTH TREND, 1950–2050

5.3.2 EFFECTS OF RAPID URBANIZATION ON CAN-BASED FORMATS

FIGURE 26 MOST URBANIZED COUNTRIES, 2020

FIGURE 27 MARKET DYNAMICS

5.3.3 DRIVERS

5.3.3.1 Recyclability factor of beverage cans that allow multiple uses

TABLE 3 PACKAGING MATERIAL RECYCLING RATES FOR ALUMINUM AND STEEL, 2017–2020

5.3.3.2 Increase in popularity of energy and sports drinks

5.3.3.3 Convenience factors spurring innovations in can manufacturing

5.3.4 RESTRAINTS

5.3.4.1 Saturated beverage cans market in the developed regions

5.3.4.2 Consumer shift toward alternative options of packaging

5.3.5 OPPORTUNITIES

5.3.5.1 Portable nature of cans makes them more user-friendly

5.3.5.2 Emerging economies offer high-growth potential

5.3.6 CHALLENGES

5.3.6.1 High usage of plastic for packaging due to lower cost

5.3.6.2 Growth in the trend of biodegradable packaging

TABLE 4 PACKAGING MATERIAL RECYCLING RATES FOR PAPER AND WOOD, 2017–2020

5.3.7 COVID-19 IMPACT ANALYSIS: (MARKET DYNAMICS)

6 INDUSTRY TRENDS (Page No. - 62)

6.1 INTRODUCTION

6.2 PRICING ANALYSIS

6.2.1 AVERAGE SELLING PRICE TREND, BY MATERIAL TYPE, 2016-2020

FIGURE 28 PRICE TREND

6.3 TRADE ANALYSIS

TABLE 5 TRADE DATA FOR BEVERAGE CANS (2020)

6.4 PATENT ANALYSIS

FIGURE 29 LIST OF MAJOR PATENTS FOR THE BEVERAGE CANS ECOSYSTEM (2011-2020)

6.4.1 LIST OF MAJOR PATENTS PERTAINING TO RECYCLING AND PROCESSING OF BEVERAGE CANS AND OVERALL ECOSYSTEM (2018-2020)

TABLE 6 PATENTS FOR BEVERAGE CANS (RECYCLING AND PROCESSING)

6.5 YC-YCC SHIFT

FIGURE 30 YC -YCC SHIFT FOR THE MARKET

6.6 TECHNOLOGY ANALYSIS

6.7 ANALYSIS FOR BEVERAGES

6.7.1 FLOW-THOUGH SORTATION

6.7.2 VOICE TECHNOLOGY

6.7.3 IIOT

6.8 ANALYSIS FOR CANS

6.8.1 INTUITIVE OPENING

6.8.2 ENHANCING THE BEVERAGE

6.8.3 INCREASING CONVENIENCE

6.9 VALUE CHAIN

FIGURE 31 BEVERAGE CANS MARKET: VALUE CHAIN

6.10 ECOSYSTEM AND SUPPLY CHAIN FOR BEVERAGE CANS

TABLE 7 MARKET ECOSYSTEM

6.10.1 MANUFACTURERS

6.10.2 RAW MATERIAL SUPPLIERS

6.10.3 END-USER COMPANIES

6.10.4 SUPPLY CHAIN ANALYSIS

FIGURE 32 SUPPLY CHAIN: MARKET

6.10.5 SMOOTH PROCUREMENT OF RAW MATERIALS

6.10.6 APT DISTRIBUTION CHANNEL TO REDUCE DEMAND-SUPPLY GAP

6.11 PORTER’S FIVE FORCES ANALYSIS

6.11.1 MARKET: PORTER’S FIVE FORCES ANALYSIS

6.11.1.1 Threat of new entrants

6.11.1.2 Threat of substitutes

6.11.1.3 Bargaining power of suppliers

6.11.1.4 Bargaining power of buyers

6.11.1.5 Degree of competition

6.12 CASE STUDY ANALYSIS: THE MARKET

TABLE 8 CROWN HOLDINGS: BRINGING BELDEN SOLUTION IN CHICAGO, US

TABLE 9 BALL CORPORATION: STRENGTHENING CUSTOMER AND ACCOUNT MANAGEMENT

TABLE 10 ARDAGH GROUP: SALES & OPERATIONAL PLANNING FOR THE SUPPLY CHAIN

6.13 REGULATIONS

6.13.1 INTRODUCTION

6.13.2 NORTH AMERICA

6.13.2.1 US Environmental Protection Agency: New Source Performance Standards, Section 111

6.13.2.2 US Aluminum Association

6.13.3 EUROPE

6.13.3.1 The European Commission acts as the regulatory body for packaging solutions in the food & beverage segment

6.13.3.2 The Packaging (Producer Responsibility Regulations) and Essential Requirements Regulations

6.13.3.3 Federal Environment Agency: Germany

6.13.4 ASIA PACIFIC

6.13.4.1 General Administration of Quality Supervision, Inspection, and Quarantine

6.13.4.2 Japanese Packaging Recycling Act

7 BEVERAGE CANS MARKET, BY MATERIAL TYPE (Page No. - 78)

7.1 INTRODUCTION

TABLE 11 MATERIAL OVERVIEW

7.2 COVID-19 IMPACT ANALYSIS-MATERIAL TYPE

TABLE 12 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY MATERIAL TYPE, 2018–2021 (USD MILLION)

TABLE 13 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY MATERIAL TYPE, 2018–2021 (USD MILLION)

TABLE 14 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY MATERIAL TYPE, 2018–2021 (USD MILLION)

FIGURE 33 MARKET, BY MATERIAL TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 15 BEVERAGE CAN MARKET SIZE, BY MATERIAL TYPE, 2019-2026 (USD MILLION)

TABLE 16 BEVERAGE CAN MARKET SIZE, BY MATERIAL TYPE, 2018-2026 (MILLION UNITS)

7.3 ALUMINUM

7.3.1 ALUMINUM’S 100% RECYCLABLE ADVANTAGES PREFERRED BY THE BEVERAGE INDUSTRY

TABLE 17 INDUSTRY TRENDS IN ALUMINUM

TABLE 18 MARKET SIZE FOR ALUMINUM, BY REGION, 2019-2026 (USD MILLION)

TABLE 19 MARKET SIZE FOR ALUMINUM, BY REGION, 2018-2026 (MILLION UNITS)

7.4 STEEL

7.4.1 PERCENT OF GLOBAL BEVERAGE CAN MANUFACTURERS PREFERRING ALUMINUM AS THE MATERIAL CANS, RESULTING IN THE DROP IN THE DEMAND FOR STEEL

TABLE 20 INDUSTRY TRENDS IN STEEL

TABLE 21 MARKET SIZE FOR STEEL, BY REGION, 2019-2026 (USD MILLION)

TABLE 22 MARKET SIZE FOR STEEL, BY REGION, 2018-2026 (MILLION UNITS)

7.5 PET

7.5.1 SHARE OF PET IS SLOW IN BEVERAGE CANS

TABLE 23 INDUSTRY TRENDS IN PLASTIC

TABLE 24 MARKET SIZE FOR PET, BY REGION, 2019-2026 (USD MILLION)

TABLE 25 MARKET SIZE FOR PET, BY REGION, 2018-2026 (MILLION UNITS)

8 BEVERAGE CANS MARKET, BY BEVERAGE TYPE (Page No. - 87)

8.1 INTRODUCTION

8.2 COVID-19 IMPACT ANALYSIS-BEVERAGE TYPE

TABLE 26 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY BEVERAGE TYPE, 2018–2021 (USD MILLION)

TABLE 27 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY BEVERAGE TYPE, 2018–2021 (USD MILLION)

TABLE 28 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY BEVERAGE TYPE, 2018–2021 (USD MILLION)

FIGURE 34 MARKET, BY BEVERAGE TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 29 MARKET SIZE, BY BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 30 MARKET SIZE, BY WATER BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 31 MARKET SIZE, BY FLAVORED STILL WATER, 2019-2026 (USD MILLION)

TABLE 32 MARKET SIZE, BY FLAVORED SPARKLING WATER, 2019-2026 (USD MILLION)

8.3 ALCOHOLIC BEVERAGES

8.3.1 POPULARITY OF CANNED BEER IS THE MAJOR DRIVING FACTOR FOR METAL CANS IN THE ALCOHOLIC BEVERAGES SEGMENT

TABLE 33 MARKET SIZE FOR ALCOHOLIC BEVERAGES, BY REGION, 2019-2026 (USD MILLION)

8.4 NON-ALCOHOLIC BEVERAGES

8.4.1 CANS MAKE SOFT DRINKS EASIER TO CARRY

TABLE 34 MARKET SIZE FOR NON-ALCOHOLIC BEVERAGES, BY REGION, 2019-2026 (USD MILLION)

8.5 WATER

8.5.1 CANS WITH ATTRACTIVE PRINTS GAINING TRACTION IN THE SPARKLING AND FUNCTIONAL WATER SEGMENT

TABLE 35 MARKET SIZE FOR WATER, BY REGION, 2019-2026 (USD MILLION)

9 MARKET, BY STRUCTURE (Page No. - 94)

9.1 INTRODUCTION

FIGURE 35 MARKET SIZE, BY STRUCTURE, 2021 VS. 2026 (USD MILLION)

TABLE 36 BEVERAGE CAN MARKET SIZE, BY STRUCTURE, 2019-2026 (USD MILLION)

9.2 COVID-19 IMPACT ANALYSIS

TABLE 37 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS FOR THE BEVERAGE CANS MARKET, BY STRUCTURE, 2018–2021 (USD MILLION)

TABLE 38 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS FOR THE MARKET, BY STRUCTURE, 2018–2021 (USD MILLION)

TABLE 39 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS FOR THE MARKET, BY STRUCTURE, 2018–2021 (USD MILLION)

9.3 2-PIECE CANS

9.3.1 GROWTH IN DEMAND FOR 2-PIECE CANS DUE TO THEIR ECONOMIC STABILITY IN THE MARKET

9.4 3-PIECE CANS

9.4.1 CRITICAL GROWTH POTENTIAL FOR 3-PIECE CANS DESPITE THEIR LOW USAGE IN THE PAST

10 MARKET, BY REGION (Page No. - 99)

10.1 INTRODUCTION

10.2 COVID-19 IMPACT ON THE BEVERAGE CAN MARKET, BY REGION

TABLE 40 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS FOR THE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS FOR THE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS FOR THE BEVERAGE CAN MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 36 NORTH AMERICA AND EUROPE DOMINATED THE MARKET IN 2021 VS. 2026

TABLE 43 MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

10.3 NORTH AMERICA

10.3.1 INDUSTRY TRENDS IN NORTH AMERICA

TABLE 44 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019-2026 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY MATERIAL TYPE, 2019-2026 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY MATERIAL TYPE, 2019-2026 (MILLION UNITS)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY STILL WATER FLAVOR, 2019-2026 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY SPARKLING WATER FLAVOUR, 2019-2026 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY STRUCTURE, 2019-2026 (USD MILLION)

FIGURE 37 NORTH AMERICA SNAPSHOT – BEVERAGE CANS MARKET

10.3.2 US

10.3.2.1 Increase in the production of biodegradable packaging can turn into a threat for metal packaging

TABLE 52 US: MARKET SIZE, BY MATERIAL TYPE, 2019-2026 (USD MILLION)

TABLE 53 US: MARKET SIZE, BY BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 54 US: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 55 US: MARKET SIZE, BY STILL WATER FLAVOUR, 2019-2026 (USD MILLION)

TABLE 56 US: MARKET SIZE, BY SPARKLING WATER FLAVOUR, 2019-2026 (USD MILLION)

10.3.3 CANADA

10.3.3.1 Regulations by the government for sustainable packaging create opportunity for market players

TABLE 57 CANADA: MARKET SIZE, BY MATERIAL TYPE, 2019-2026 (USD MILLION)

TABLE 58 CANADA: MARKET SIZE, BY BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 59 CANADA: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 60 CANADA: MARKET SIZE, BY STILL WATER FLAVOUR, 2019-2026 (USD MILLION)

TABLE 61 CANADA: MARKET SIZE, BY SPARKLING WATER FLAVOUR, 2019-2026 (USD MILLION)

10.3.4 MEXICO

10.3.4.1 Increase in the production of specialty cans for energy drinks to drive the market growth for beverage cans

TABLE 62 MEXICO: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 63 MEXICO: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 64 MEXICO: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 65 MEXICO: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 66 MEXICO: BEVERAGE CANS MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.4 EUROPE

10.4.1 INDUSTRY TRENDS IN EUROPE

TABLE 67 EUROPE: MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 68 EUROPE: MARKET SIZE, BY MATERIAL TYPE, 2019-2026 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE, BY MATERIAL TYPE, 2019-2026 (MILLION UNITS)

TABLE 70 EUROPE: MARKET SIZE, BY BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY STILL WATER FLAVOUR, 2019-2026 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY SPARKLING WATER FLAVOUR, 2019-2026 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY STRUCTURE, 2019-2026 (USD MILLION)

10.4.2 UK

10.4.2.1 Global export of 2.2% of food & drinks driving the metal packaging market in the region

TABLE 75 UK: MARKET SIZE, BY MATERIAL TYPE, 2019-2026 (USD MILLION)

TABLE 76 UK: MARKET SIZE, BY BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 77 UK: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 78 UK: MARKET SIZE, BY STILL WATER FLAVOUR, 2019-2026 (USD MILLION)

TABLE 79 UK: MARKET SIZE, BY SPARKLING WATER FLAVOUR, 2019-2026 (USD MILLION)

10.4.3 FRANCE

10.4.3.1 Rising demand for canned beverages

TABLE 80 FRANCE: MARKET SIZE, BY MATERIAL TYPE, 2019-2026 (USD MILLION)

TABLE 81 FRANCE: MARKET SIZE, BY BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 82 FRANCE: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 83 FRANCE: MARKET SIZE, BY STILL WATER FLAVOUR, 2019-2026 (USD MILLION)

TABLE 84 FRANCE: MARKET SIZE, BY SPARKLING WATER FLAVOUR, 2019-2026 (USD MILLION)

10.4.4 GERMANY

10.4.4.1 Shift from glass packaging to metal packaging

TABLE 85 GERMANY: BEVERAGE CANS MARKET SIZE, BY MATERIAL TYPE, 2019-2026 (USD MILLION)

TABLE 86 GERMANY: MARKET SIZE, BY BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 87 GERMANY: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 88 GERMANY: MARKET SIZE, BY STILL WATER FLAVOUR, 2019-2026 (USD MILLION)

TABLE 89 GERMANY: MARKET SIZE, BY SPARKLING WATER FLAVOUR, 2019-2026 (USD MILLION)

10.4.5 RUSSIA

10.4.5.1 Consumer interest and increase in different types of beverages fueling the market for cans

TABLE 90 RUSSIA: MARKET SIZE, BY MATERIAL TYPE, 2019-2026 (USD MILLION)

TABLE 91 RUSSIA: MARKET SIZE, BY BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 92 RUSSIA: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019-2026 (USD MILLION)

TABLE 93 RUSSIA: MARKET SIZE, BY STILL WATER FLAVOUR, 2019-2026 (USD MILLION)

TABLE 94 RUSSIA: MARKET SIZE, BY SPARKLING WATER FLAVOUR, 2019-2026 (USD MILLION)

10.4.6 SPAIN

10.4.6.1 Demand for beer and wine driving the market growth

TABLE 95 SPAIN: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 96 SPAIN: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 97 SPAIN: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 98 SPAIN: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 99 SPAIN: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.4.7 ITALY

10.4.7.1 Rise in demand for beverages such as alcohol and fruit juices

TABLE 100 ITALY: BEVERAGE CANS MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 101 ITALY: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 102 ITALY: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 103 ITALY: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 104 ITALY: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.4.8 REST OF EUROPE

10.4.8.1 Rise in demand for beverages such as alcohol and fruit juices

TABLE 105 REST OF EUROPE: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 106 REST OF EUROPE: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 107 REST OF EUROPE: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 108 REST OF EUROPE: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 109 REST OF EUROPE: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.5 ASIA PACIFIC

10.5.1 INDUSTRY TRENDS IN ASIA PACIFIC

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY MATERIAL TYPE, 2018–2026 (MILLION UNITS)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY STRUCTURE, 2019–2026 (USD MILLION)

FIGURE 38 ASIA PACIFIC: BEVERAGE CANS MARKET SNAPSHOT

10.5.2 CHINA

10.5.2.1 Increase in demand for soft drinks among Chinese customers

TABLE 118 CHINA: MARKET SIZE, BY MATERIAL TYPE, 2018–2026 (USD MILLION)

TABLE 119 CHINA: MARKET SIZE, BY BEVERAGE TYPE, 2018–2026 (USD MILLION)

TABLE 120 CHINA: MARKET SIZE, BY WATER BEVERAGE TYPE, 2018–2026 (USD MILLION)

TABLE 121 CHINA: MARKET SIZE, BY STILL WATER FLAVOR, 2018–2026 (USD MILLION)

TABLE 122 CHINA: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2018–2026 (USD MILLION)

10.5.3 INDIA

10.5.3.1 Increase in population and high disposable income to drive the market growth for beverage cans

TABLE 123 INDIA: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 124 INDIA: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 125 INDIA: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 126 INDIA: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 127 INDIA: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.5.4 JAPAN

10.5.4.1 Focus of the government on encouraging the production of sustainable packaging to drive the market growth

TABLE 128 JAPAN: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 129 JAPAN: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 130 JAPAN: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 131 JAPAN: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 132 JAPAN: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.5.5 AUSTRALIA

10.5.5.1 Rise in demand for recyclable packaging solutions

TABLE 133 AUSTRALIA: BEVERAGE CANS MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 134 AUSTRALIA: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 135 AUSTRALIA: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 136 AUSTRALIA: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 137 AUSTRALIA: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.5.6 NEW ZEALAND

10.5.6.1 Growth in production of alcoholic and non-alcoholic beverages

TABLE 138 NEW ZEALAND: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 139 NEW ZEALAND: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 140 NEW ZEALAND: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 141 NEW ZEALAND: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 142 NEW ZEALAND: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.5.7 ASEAN COUNTRIES

10.5.7.1 Increase in exports of canned fruits and vegetables to drive the growth

TABLE 143 ASEAN COUNTRIES: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 144 ASEAN COUNTRIES: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 145 ASEAN COUNTRIES: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 146 ASEAN COUNTRIES: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 147 ASEAN COUNTRIES: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.5.8 REST OF ASIA PACIFIC

TABLE 148 REST OF ASIA PACIFIC: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 149 REST OF ASIA PACIFIC: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 150 REST OF ASIA PACIFIC: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 151 REST OF ASIA PACIFIC: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.6 SOUTH AMERICA

10.6.1 INDUSTRY TRENDS IN SOUTH AMERICA

TABLE 153 SOUTH AMERICA: BEVERAGE CANS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 154 SOUTH AMERICA: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 155 SOUTH AMERICA: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (MILLION UNIT)

TABLE 156 SOUTH AMERICA: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 157 SOUTH AMERICA: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 158 SOUTH AMERICA: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 159 SOUTH AMERICA: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 160 SOUTH AMERICA: MARKET SIZE, BY STRUCTURE, 2019–2026 (USD MILLION)

10.6.2 BRAZIL

10.6.2.1 High demand for health-enriching alcoholic beverages

TABLE 161 BRAZIL: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 162 BRAZIL: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 163 BRAZIL: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 164 BRAZIL: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 165 BRAZIL: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.6.3 ARGENTINA

10.6.3.1 Awareness about health-enriching non-alcoholic beverages

TABLE 166 ARGENTINA: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 167 ARGENTINA: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 168 ARGENTINA: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 169 ARGENTINA: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 170 ARGENTINA: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.6.4 REST OF SOUTH AMERICA

TABLE 171 REST OF SOUTH AMERICA: BEVERAGE CANS MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 172 REST OF SOUTH AMERICA: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 173 REST OF SOUTH AMERICA: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 174 REST OF SOUTH AMERICA: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 175 REST OF SOUTH AMERICA: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.7 REST OF THE WORLD (ROW)

10.7.1 INDUSTRY TRENDS IN REST OF THE WORLD

TABLE 176 REST OF THE WORLD: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 177 REST OF THE WORLD: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 178 REST OF THE WORLD: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (MILLION UNIT)

TABLE 179 REST OF THE WORLD: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 180 REST OF THE WORLD: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 181 REST OF THE WORLD: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 182 REST OF THE WORLD: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 183 REST OF THE WORLD: MARKET SIZE, BY STRUCTURE, 2019–2026 (USD MILLION)

10.7.2 TURKEY

10.7.2.1 High demand for alcoholic and non-alcoholic beverages

TABLE 184 TURKEY: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 185 TURKEY: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 186 TURKEY: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 187 TURKEY: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 188 TURKEY: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.7.3 AFRICA

10.7.3.1 Rapid increase in urbanization and change in consumer trends for sports & energy drinks in the region to drive the market growth for metal packaging

TABLE 189 AFRICA: BEVERAGE CANS MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 190 AFRICA: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 191 AFRICA: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 192 AFRICA: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 193 AFRICA: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

10.7.4 MIDDLE EAST

10.7.4.1 Increase in consumer preference for canned beverages offer high growth potential for metal packaging solutions

TABLE 194 MIDDLE EAST: MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 195 MIDDLE EAST: MARKET SIZE, BY BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 196 MIDDLE EAST: MARKET SIZE, BY WATER BEVERAGE TYPE, 2019–2026 (USD MILLION)

TABLE 197 MIDDLE EAST: MARKET SIZE, BY STILL WATER FLAVOR, 2019–2026 (USD MILLION)

TABLE 198 MIDDLE EAST: MARKET SIZE, BY SPARKLING WATER FLAVOR, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 165)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

11.3 MARKET SHARE ANALYSIS

11.4 COMPANY REVENUE ANALYSIS

FIGURE 39 OVERALL REVENUE ANALYSIS OF THE TOP THREE PLAYERS OVER A PERIOD OF FIVE YEARS (2015–2019)

11.5 COVID-19 IMPACT ANALYSIS ON COMPANIES

11.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS): OVERALL MARKET

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE

11.6.4 PARTICIPANTS

FIGURE 40 GLOBAL MARKET COMPETITIVE LEADERSHIP QUADRANT, 2020

11.6.5 PRODUCT FOOTPRINT

TABLE 199 COMPANY MATERIAL TYPE FOOTPRINT

TABLE 200 COMPANY BEVERAGE TYPE FOOTPRINT

TABLE 201 COMPANY REGION FOOTPRINT

TABLE 202 OVERALL COMPANY FOOTPRINT

11.7 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 41 GLOBAL BEVERAGE CANS MARKET: START-UP COMPETITIVE LEADERSHIP QUADRANT 2020

11.8 DEALS AND OTHER DEVELOPMENTS

11.8.1 DEALS

TABLE 203 MARKET, DEALS, FEBRUARY 2018–AUGUST 2020

11.8.2 OTHER DEVELOPMENTS

TABLE 204 BEVERAGE CAN MARKET: OTHER DEVELOPMENTS, NOVEMBER 2018– JANUARY 2021

12 COMPANY PROFILES (Page No. - 178)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

12.1 KEY PLAYERS

12.1.1 CROWN HOLDINGS, INC.

TABLE 205 CROWN HOLDINGS, INC: BUSINESS OVERVIEW

FIGURE 42 CROWN HOLDINGS, INC: COMPANY SNAPSHOT

TABLE 206 CROWN HOLDINGS, INC: PRODUCTS OFFERED

TABLE 207 CROWN HOLDINGS, INC: OTHER DEVELOPMENTS (JANUARY 2018 – JULY 2020)

TABLE 208 CROWN HOLDINGS, INC: DEALS (JANUARY 2018 – DECEMBER 2020)

FIGURE 43 CROWN HOLDINGS, INC: SWOT ANALYSIS

12.1.2 ARDAGH GROUP S.A.

TABLE 209 ARDAGH GROUP SA: BUSINESS OVERVIEW

FIGURE 44 ARDAGH GROUP S.A.: COMPANY SNAPSHOT

TABLE 210 ARDAGH GROUP SA: PRODUCTS OFFERED

TABLE 211 ARDAGH GROUP SA: OTHER DEVELOPMENTS (JANUARY 2018 – NOVEMBER 2019)

TABLE 212 ARDAGH GROUP SA: DEALS (JANUARY 2018 – DECEMBER 2020)

FIGURE 45 ARDAGH GROUP S.A.: SWOT ANALYSIS

12.1.3 CPMC HOLDINGS LIMITED

TABLE 213 CPMC HOLDINGS LIMITED: BUSINESS OVERVIEW

FIGURE 46 CPMC HOLDINGS LIMITED: COMPANY SNAPSHOT

TABLE 214 CPMC HOLDINGS LIMITED: PRODUCT OFFERED

TABLE 215 CPMC HOLDINGS LIMITED: OTHER DEVELOPMENTS (JANUARY 2018 – DECEMBER 2019)

TABLE 216 CPMC HOLDINGS LIMITED: DEALS (JANUARY 2018 – MAY 2019)

FIGURE 47 CPMC HOLDINGS LIMITED: SWOT ANALYSIS

12.1.4 TOYO SEIKAN GROUP HOLDINGS, LTD.

TABLE 217 TOYO SEIKAN GROUP HOLDINGS, LTD.: BEVERAGE CANS MARKET BUSINESS OVERVIEW

FIGURE 48 TOYO SEIKAN GROUP HOLDINGS, LTD.: COMPANY SNAPSHOT

TABLE 218 TOYO SEIKAN GROUP HOLDINGS, LTD.: PRODUCTS OFFERED

TABLE 219 TOYO SEIKAN GROUP HOLDINGS, LTD.: OTHER DEVELOPMENTS (JANUARY 2018 – DECEMBER 2020)

FIGURE 49 SWOT ANALYSIS

12.1.5 CAN-ONE BERHAD

TABLE 220 CAN-ONE BERHAD: BUSINESS OVERVIEW

FIGURE 50 CAN-ONE BERHAD: COMPANY SNAPSHOT

TABLE 221 CAN-ONE BERHAD: PRODUCTS OFFERED

TABLE 222 CAN-ONE BERHAD: DEALS (JANUARY 2018 – APRIL 2019)

FIGURE 51 CAN-ONE BERHAD: SWOT ANALYSIS

12.1.6 CAN-PACK S.A.

TABLE 223 CAN-PACK S.A.: BUSINESS OVERVIEW

TABLE 224 CAN-PACK S.A.: PRODUCTS OFFERED

TABLE 225 CAN-PACK S.A.: OTHER DEVELOPMENTS (JANUARY 2018 – JULY 2020)

TABLE 226 CAN-PACK S.A.: DEALS (JANUARY 2018 – FEBRUARY 2020)

12.1.7 BALL CORPORATION

TABLE 227 BALL CORPORATION: BUSINESS OVERVIEW

FIGURE 52 BALL CORPORATION: COMPANY SNAPSHOT

TABLE 228 BALL CORPORATION: PRODUCTS OFFERED

TABLE 229 BALL CORPORATION: OTHER DEVELOPMENTS (JANUARY 2018 – SEPTEMBER 2020)

12.1.8 ENVASES UNIVERSALES

TABLE 230 ENVASES UNIVERSALES: BUSINESS OVERVIEW

TABLE 231 ENVASES UNIVERSALES: PRODUCTS OFFERED

TABLE 232 ENVASES UNIVERSALES: DEALS (JANUARY 2018 – DECEMBER 2020)

12.1.9 UNIVERSAL CAN CORPORATION

TABLE 233 UNIVERSAL CAN CORPORATION: BEVERAGE CANS MARKET BUSINESS OVERVIEW

TABLE 234 UNIVERSAL CAN CORPORATION: PRODUCTS OFFERED

12.1.10 INTERPACK GROUP INC

TABLE 235 INTERPACK GROUP INC.: BUSINESS OVERVIEW

TABLE 236 INTERPACK GROUP INC.: PRODUCTS OFFERED

12.2 STARTUP/SMES

12.2.1 GZ INDUSTRIES

TABLE 237 GZ INDUSTRIES: BUSINESS OVERVIEW

TABLE 238 GZ INDUSTRIES: PRODUCTS OFFERED

12.2.2 SHOWA DENKO K.K.

TABLE 239 SHOWA DENKO K.K.: BUSINESS OVERVIEW

FIGURE 53 SHOWA DENKO K.K.: COMPANY SNAPSHOT

TABLE 240 SHOWA DENKO K.K.: PRODUCTS OFFERED

TABLE 241 SHOWA DENKO K.K.: OTHER DEVELOPMENTS (JANUARY 2018 – MAY 2019)

12.2.3 SWAN INDUSTRIES (THAILAND) LIMITED

TABLE 242 SWAN INDUSTRIES (THAILAND) LIMITED: BUSINESS OVERVIEW

TABLE 243 SWAN INDUSTRIES (THAILAND) LIMITED: PRODUCTS OFFERED

12.2.4 NAMPAK BEVCAN LIMITED

TABLE 244 NAMPAK BEVCAN LIMITED: BUSINESS OVERVIEW

FIGURE 54 NAMPAK: COMPANY SNAPSHOT

TABLE 245 NAMPAK BEVCAN LIMITED: PRODUCTS OFFERED

12.2.5 THE OLAYAN GROUP

TABLE 246 OLAYAN GROUP: BUSINESS OVERVIEW

TABLE 247 OLAYAN GROUP: PRODUCTS OFFERED

12.2.6 TECHPACK SOLUTIONS CO. LTD.

12.2.7 BAOSTEEL GROUP

12.2.8 BIKANER POLYMERS PVT. LTD.

12.2.9 DAIWA CAN

12.2.10 CEYLON BEVERAGE CAN (PVT.) LTD.

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 219)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 FOOD & BEVERAGE CAN MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.4 FOOD & BEVERAGE CAN MARKET, BY APPLICATION

13.4.1 INTRODUCTION

TABLE 248 FOOD & BEVERAGE CANS MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 249 FOOD & BEVERAGE CAN MARKET SIZE, BY APPLICATION, 2018–2025 (BILLION UNITS)

13.5 BEVERAGE PACKAGING MARKET

13.5.1 MARKET DEFINITION

13.5.2 MARKET OVERVIEW

13.5.3 BEVERAGE PACKAGING MARKET, BY APPLICATION

TABLE 250 BEVERAGE PACKAGING MARKET SIZE, BY APPLICATION, 2012 -2019 (BILLION LITERS)

14 APPENDIX (Page No. - 223)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

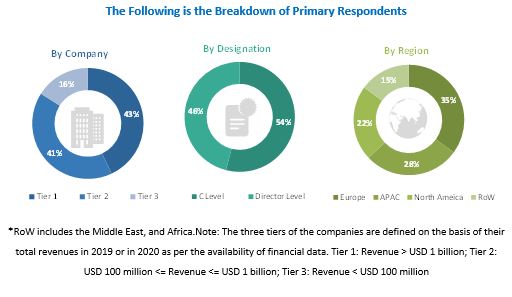

The study involves four major activities to estimate the current beverage cans market size. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. These findings, assumptions, and market size was validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of segments and sub segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, in order to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The beverage cans market comprises several stakeholders such as manufacturers, importers & exporters, traders, distributors, suppliers of beverage cans; food safety authorities; food technologists; food product manufacturers; raw material suppliers; and regulatory bodies such as the Food and Agriculture Organization (FAO), the Environmental Protection Agency (EPA), the Food Safety Council (FSC), government and research organizations, and trade associations and industry bodies. The demand-side of this market is characterized by the rising awareness of shelf life extension among beverage manufacturers. The supply side is characterized by advancements in technology and increased convenience in packaging. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Beverage Cans Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the beverage can market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The value chain and market size of the beverage can market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for key opinions from leaders, such as CEOs, directors, and marketing executives.

Beverage Cans Market Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives:

- To define, segment, and project the global beverage cans market size

- To understand the structure of the beverage can market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per a client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe, Rest of Asia Pacific, and Rest of South America.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Beverage Cans Market