RFID and Barcode Printer Market Size, Share & Industry Growth Analysis Report by Printer Type, Format Type (Industrial Printers, Desktop Printers, Mobile Printers), Printing Technology, Printing Resolution, Application, and Region - Global Growth Driver and Industry Forecast to 2026

Updated on : Oct 23, 2024

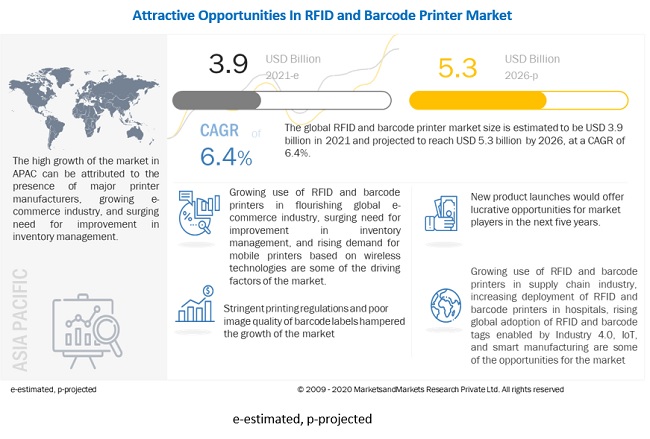

The global RFID and barcode printer market size is projected to reach USD 5.3 billion by 2026. It is expected to grow at a compound annual growth rate (CAGR) of 6.4% during the forecast period.

Increasing installation of RFID and barcode systems in manufacturing units to improve productivity to tackle the impact of COVID-19, growing use of RFID and barcode printers in flourishing global e-commerce industry, surging need for improvement in inventory management, and rising demand for mobile printers based on wireless technologies are the key driving factors for the RFID and barcode printer industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on RFID and Barcode Printer Industry

Currently, the world is battling an economic crisis caused by the outbreak and the spread of the COVID-19 pandemic. The pandemic has affected various industries, such as automotive, retail, sports and entertainment, and education. In the wake of the current situation, the key market players are presently focusing on maintaining and generating revenues to be operational.

This reduced the number of developments, including launches of products and their distribution in the RFID and barcode printer market in 2020. A number of scheduled product launches and related developments have been postponed owing to the spread of the virus. However, the impact of COVID-19 is expected to subside during the forecast period. The operations of RFID and barcode printer manufacturing units worldwide have been affected by the lockdowns imposed worldwide, along with the limited availability of labor and raw materials.

This has resulted in disruptions in the global supply chain to a significant extent. A number of business activities wherein RFID and barcode printers are used, including shopping, sporting, and manufacturing, have been suspended or canceled to avoid mass gatherings. The COVID-19 has halted production, plunged down the sales of RFID and barcode printers, and led key players in the RFID and barcode printer market to buckle up and rethink their plans. Rescheduling the launch of printers and projects related to RFID and barcode printers, stabilizing dealer networks, managing cash flows tightly, and reviewing investment portfolios by companies have affected the production and the sales of RFID and barcode printers globally.

RFID and Barcode Printer Market Dynamics:

Driver: Rising demand for mobile printers based on wireless technologies

Mobile printers include printers ranging from small handheld models to cart-mounted ones. Mobile format printers use a wireless network connection to receive print jobs, label formats, variable data, and other information from host systems or wireless handled devices. Thermal printing technology is perfect for mobile printers owing to the high-quality print output, media usage flexibility, low maintenance requirements, and robust nature of these printers.

Direct thermal technology is popularly used in mobile printing owing to the ease of use and convenience offered by it for high-volume tag printing. Modern mobile printers are light in weight, easy to use, and durable, as well as offer great print quality and support a variety of media. Most printers provide an 802.11 b/g wireless interface, which is used for connecting to local area networks (LAN) and enterprise resource planning (ERP) applications from inside the offices or outside them. 802. 11 b/g is the most widely used wireless network standard that enables devices meant for enterprise applications to offer outstanding performance. It uses a 2.4 GHz frequency band and allows up to 11 Mbps data transfer rates. Mobile point-of-sale (POS) printers are used in retail, hospitality, healthcare, and functional applications wherein ease of use, flexibility, and cost savings are crucial aspects of the business.

Restraint: Stringent printing regulations

Printing regulations ensure that printing practices have a low impact on the environment. Stringent printing regulations in Europe include the European Environmental Legislative Framework, which keeps a check on the emissions of volatile organic compounds from printing solutions. The regulation also ensures the controlled use of chemicals for printing.

The printing industry in Europe is also dedicated to decreasing carbon dioxide emissions and, consequently, help in reducing carbon footprints. In addition, the European Timber Regulation (2013) ensures that the paper products used for printing are not a result of illegal logging. The US Food and Drug Administration, including the Federal Food and Drug Cosmetics Act, ensures that the ink used for printing on food packages is developed by employing good manufacturing practices and is safe to use. The used printing inks are considered as food additives, and hence, they need to adhere to the regulations for food additives. Thus, stringent regulations for printing and the printing ink used to act as a restraint for the growth of the RFID and barcode printer market.

Opportunity: Growing use of RFID and barcode printers in the supply chain industry

The efficient management of the supply chain of deliverable goods is the key to successful business management. RFID and barcode technologies provide enhanced visibility and traceability of shipments. The demand for RFID and barcode printers is increasing owing to the surging incidents of thefts and frauds in consumer goods and pharmaceuticals.

The use of RFID and barcode labels in logistics and supply chain management can ensure efficient management of inventories and effective transportation of shipments within logistic networks, along with the effective monitoring of manufacturing and assembling processes. Additionally, RFID and barcode printers reduce the costs associated with poorly printed labels as they have the option of using barcode verifiers. These verifiers assure the overall quality of the output. RFID and barcode printers have fast returns on investments (ROI). Therefore, the demand for RFID and barcode printers is growing in the supply chain industry during the forecast period.

Challenge: High heat settings of barcode printers can lead to smudged bar lines

Barcode printers produce barcodes using numerous tiny heating elements on a printhead that cause labels to turn black on heating. The ribbon used in a printer is loaded with wax and/or resin; the transfer of heat from the printer to the ribbon moves the wax and/or resin onto the label.

The heating and cooling of the ribbon are not uniform. This may cause irregular printing on the label, resulting in the leading and trailing edges of characters, images, or lines. There should be sufficient contrast between dark lines and light spaces on a label to be recognized by the scanner. If heating is set too high, the barcode appears smudged, and labels come with thick bar lines. Smudged bar lines onto white spaces are expected to hamper the scanning process of barcodes. Similarly, low heating leads to the fading of bar lines.

RFID printers to witness a higher CAGR during the forecast period

The market for RFID printers is expected to grow at a higher CAGR than the barcode printers segment from 2021 to 2026. The increasing demand for RFID-printed labels in the supply chains of the retail and healthcare industries is the key factor contributing to the high growth of this segment of the market. RFID printed labels and tags are used in various industries such as transportation and logistics, healthcare, and transportation to track and assess information related to the assets using radiofrequency in real-time. RFID printers use different types of consumables such as ribbons and labels to achieve RFID print images. They are developed in such a way that these printers can print clear machine-readable barcodes and RFID prints at high printing speeds and low costs.

“Retail application to account for the largest share during the forecast period.”

The retail application to hold the largest size of the RFID and barcode printer market during the forecast period. RFID and barcode labels or tags help retailers in handling retail printing requirements. POS printers are designed to provide printing solutions for tasks at the front and back of stores, along with catering to the requirements of online/e-commerce retail applications.

Retailers use labels or tags for improving operational efficiency and customer satisfaction through the timely delivery of products, as well as with improved management of assets in stores. In the retail environment, RFID and barcode printers are used for identifying products and labeling them with price tags; and printing shelf tags, inventory merchandise, and receipts, along with making promotional and store branding materials; printing on-demand labels for shipping applications; and printing promotional coupons and forms for marketing.

“North America to account for the largest share during 2021–2026.”

In 2020, North America accounted for the largest share of the RFID and barcode printer market, and a similar trend is anticipated to continue during the forecast period. Retail, transportation and logistics, manufacturing and industrial, and healthcare and hospitality are the key applications of RFID and barcode printers in the region.

Several companies offering RFID and barcode printers have their presence in North America that further adds to the growth of the RFID and barcode printer market in the region. Zebra Technologies (US), Honeywell International (US), and AVERY DENNISON CORPORATION (US), etc., are a few providers of RFID and barcode printers having their presence in North America.

To know about the assumptions considered for the study, download the pdf brochure

Top RFID and Barcode Printer Companies - Key Market Players

Zebra Technologies Corp. (US), SATO Holdings Corporation (Japan), Honeywell International (US), Seiko Epson Corp. (Japan), and Star Micronics (US) are among the major players in the RFID and barcode printer market.

Digital Printing Market Report Scope

|

Report Metric |

Details |

|

Market Size Availability for Years |

2017–2026 |

|

Base Year |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By printer type, format type, printing technology, printing resolution, application, and region |

|

Geographies Covered |

North America, Europe, APAC, and RoW |

|

RFID and Barcode Printer Companies Covered |

Zebra Technologies Corp. (US), SATO Holdings Corporation (Japan), Honeywell International (US), Seiko Epson Corp. (Japan), AVERY DENNISON CORPORATION (US), BIXOLON (South Korea), GoDEX International (Taiwan), Toshiba Tec Corporation (Japan), Star Micronics (US), Printronix (US), Primera Technology (US), Postek Electronics (China), Wasp Barcode Technologies (US), and Brother International Corporation (US). A total of 25 players are covered. |

This research report categorizes the RFID and barcode printer market, by printer type, format type, printing technology, printing resolution, application, and region

RFID and Barcode Printer Market Based on Printer Type:

- RFID Printer

- Barcode Printer

Market Based on Format Type:

- Industrial Printers

- Desktop Printers

- Mobile Printers

Market Based on Printing Technology:

- Thermal Transfer

- Direct Thermal

- Others

Market Based on Printing Resolution:

- <300

- 300-600

- >600

Market Based on Application:

- Retail

- Transportation and Logistics

- Manufacturing and Industrial

- Healthcare and Hospitality

- Government

- Others

RFID and Barcode Printer Market Analysis Based on the Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- Taiwan

- Rest of APAC

-

RoW

- South America

- Middle East & Africa

Recent Developments in RFID and Barcode Printer Industry

- In March 2021, BIXOLON launched XM7 series liner and linerless thermal printers for the market in Europe.

- In March 2021, Brother International Corporation launched a new industrial label printer for high-speed warehouse, manufacturing, and supply chain applications.

- In March 2021, AVERY DENNISON CORPORATION acquired US-based startup Zippy Yum, which sells hardware and software solutions for operational automation and inventory management.

- In March 2021, Toshiba Tec Corporation partnered with US-based Catalina to expand the reach of its data-driven marketing solutions for different brands and retailers in Japan.

- In January 2021, Toshiba Tec Corporation introduced a new desktop printer series with increased performance and durability.

Frequently Asked Questions (FAQ):

Which are the major companies in the RFID and barcode printer market? What are their major strategies to strengthen their market presence?

The major companies in the RFID and barcode printer market are – Samsung Zebra Technologies Corp. (US), SATO Holdings Corporation (Japan), Honeywell International (US), Seiko Epson Corp. (Japan), AVERY DENNISON CORPORATION (US), BIXOLON (South Korea), GoDEX International (Taiwan), Toshiba Tec Corporation (Japan), Star Micronics (US), Printronix (US), Primera Technology (US), Postek Electronics (China), Wasp Barcode Technologies (US), and Brother International Corporation (US). Players in this market have adopted product launches and developments, expansions, acquisitions, and agreements strategies to increase their market share.

Which is the potential market for the RFID and barcode printer market in terms of the region?

Among all regions, APAC is expected to register high growth in the RFID and barcode printer market during the forecast period. China, South Korea, Japan, Taiwan, and Rest of APAC are covered under the APAC RFID and barcode printer market analysis. The RFID and barcode printer market growth in APAC is driven by countries such as China, Japan, and South Korea due to the presence of major printer manufacturers, growing e-commerce industry, and surging need for improvement in inventory management.

What are the opportunities for new market entrants?

The growing use of RFID and barcode printers in the supply chain industry, increasing deployment of RFID and barcode printers in hospitals, rising global adoption of RFID and barcode tags enabled by Industry 4.0, IoT, and smart manufacturing are some of the opportunities for the market

Which applications is expected to drive the growth of the market in the next five years?

The consumer application to hold the largest size of the RFID and barcode printer market by 2026. Retailers use labels or tags for improving operational efficiency and customer satisfaction through the timely delivery of products, as well as with improved management of assets in stores. In the retail environment, RFID and barcode printers are used for identifying products and labeling them with price tags; and printing shelf tags, inventory merchandise, and receipts, along with making promotional and store branding materials; printing on-demand labels for shipping applications; and printing promotional coupons and forms for marketing.

Which printer is expected to grow with the highest CAGR during the forecast period?

The market for RFID printers is expected to grow at a higher CAGR than the barcode printers segment from 2021 to 2026. The increasing demand for RFID-printed labels in the supply chains of the retail and healthcare industries is the key factor contributing to the high growth of this segment of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 BARCODE PRINTERS

1.2.2 RFID PRINTERS

1.2.3 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 RFID AND BARCODE PRINTER MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 RFID AND BARCODE PRINTER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Key industry insights

2.1.3.3 Key opinion Leaders

TABLE 1 RFID AND BARCODE PRINTER MARKET: KEY PLAYERS INTERVIEWED

2.2 MARKET SIZE ESTIMATION

FIGURE 3 SUPPLY-SIDE ANALYSIS: RFID AND BARCODE PRINTER MARKET (1/2)

FIGURE 4 SUPPLY-SIDE ANALYSIS: RFID AND BARCODE PRINTER MARKET (2/2)

FIGURE 5 DEMAND-SIDE ANALYSIS: RFID AND BARCODE PRINTER MARKET

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 2 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 9 RFID AND BARCODE PRINTER MARKET SIZE, 2017–2026 (USD BILLION)

3.1 RFID AND BARCODE PRINTER MARKET: PRE- AND POST-COVID-19 SCENARIOS

FIGURE 10 RFID AND BARCODE PRINTER MARKET: OPTIMISTIC, REALISTIC, PESSIMISTIC, AND PRE-COVID-19 SCENARIO ANALYSIS, 2017–2026

3.1.1 RFID AND BARCODE PRINTER MARKET: REALISTIC SCENARIO

3.1.2 RFID AND BARCODE PRINTER MARKET: OPTIMISTIC SCENARIO

3.1.3 RFID AND BARCODE PRINTER MARKET: PESSIMISTIC SCENARIO

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR RFID AND BARCODE PRINTER MARKET

FIGURE 11 RFID AND BARCODE PRINTER MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4.2 RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE

FIGURE 12 BARCODE PRINTERS SEGMENT TO HOLD LARGE SIZE OF RFID AND BARCODE PRINTER MARKET FROM 2021 TO 2026

4.3 RFID AND BARCODE PRINTER MARKET, BY APPLICATION

FIGURE 13 RETAIL SEGMENT TO HOLD LARGEST SIZE OF RFID AND BARCODE PRINTER MARKET IN 2026

4.4 RFID AND BARCODE PRINTER MARKET, BY FORMAT TYPE

FIGURE 14 INDUSTRIAL PRINTERS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF RFID AND BARCODE PRINTER MARKET FROM 2021 TO 2026

4.5 RFID AND BARCODE PRINTER MARKET, BY PRINTING TECHNOLOGY

FIGURE 15 DIRECT THERMAL SEGMENT TO HOLD LARGEST SIZE OF RFID AND BARCODE PRINTER MARKET FROM 2021 TO 2026

4.6 RFID AND BARCODE PRINTER MARKET, BY REGION

FIGURE 16 RFID AND BARCODE PRINTER MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing installation of RFID and barcode systems in manufacturing units to improve productivity to tackle impact of COVID-19

5.2.1.2 Growing use of RFID and barcode printers in flourishing global e-commerce industry

FIGURE 18 GLOBAL E-COMMERCE SALES FROM 2017 TO 2023

5.2.1.3 Surging need for improvement in inventory management

TABLE 3 TYPICAL LOSSES IN DATA CENTERS DURING MANUAL ASSET MANAGEMENT FOR APPROXIMATELY 40 THOUSAND SQ. FT. AREA

5.2.1.4 Rising demand for mobile printers based on wireless technologies

5.2.2 RESTRAINTS

5.2.2.1 Stringent printing regulations

5.2.2.2 Poor image quality of barcode labels

5.2.3 OPPORTUNITIES

5.2.3.1 Growing use of RFID and barcode printers in supply chain industry

FIGURE 19 RFID MARKET SIZE, 2017–2026 (USD BILLION)

5.2.3.2 Increasing deployment of RFID and barcode printers in hospitals

5.2.3.3 Rising global adoption of RFID and barcode tags enabled by Industry 4.0, IoT, and smart manufacturing

5.2.4 CHALLENGES

5.2.4.1 Low contrast of RFID and barcode elements

5.2.4.2 High heat settings of barcode printers can lead to smudged bar lines

5.3 RFID AND BARCODE PRINTER MARKET: VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS: MANUFACTURING AND ASSEMBLING PHASE CONTRIBUTES MAJOR VALUE TO RFID AND BARCODE PRINTERS

TABLE 4 RFID AND BARCODE PRINTER MARKET ECOSYSTEM

5.4 PRICING ANALYSIS

FIGURE 21 INDICATIVE AVERAGE PRICES OF RFID AND BARCODE PRINTERS, 2017–2026

5.5 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 RFID AND BARCODE PRINTER MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 BARGAINING POWER OF SUPPLIERS

5.5.5 DEGREE OF COMPETITION

5.6 PATENT ANALYSIS

TABLE 6 NUMBER OF PATENTS REGISTERED IN RFID PRINTER MARKET IN LAST 10 YEARS

FIGURE 23 TOP 10 RFID and BARCODE PRINTER COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 24 NUMBER OF PATENTS GRANTED PER YEAR, 2011–2020

5.7 STANDARDS AND REGULATIONS REGARDING RFID AND BARCODE PRINTERS

5.7.1 KEY STANDARDS FOR PRINTERS

TABLE 7 KEY REGULATIONS: PRINTERS

5.8 TRADE ANALYSIS

FIGURE 25 IMPORT DATA UNDER HS CODE 8443 FOR TOP 10 COUNTRIES IN RFID AND BARCODE PRINTER MARKET, 2016–2020 (USD BILLION)

FIGURE 26 EXPORT DATA UNDER HS CODE 8443 FOR TOP 10 COUNTRIES IN RFID AND BARCODE PRINTER MARKET, 2016–2020 (USD BILLION)

5.9 CASE STUDIES

5.9.1 INTRODUCTION

5.9.2 SYNGENTA SELECTED CORERFID FOR AUTOMATED SOLUTIONS

TABLE 8 RFID FOR BAG TRACKING

5.9.3 MX GROUP SELECTED CORERFID FOR RFID SOLUTIONS

TABLE 9 RFID TO IMPROVE MANUFACTURING PROCESS EFFICIENCY

5.9.4 ADIDAS SELECTED NEDAP FOR RFID SOLUTIONS

TABLE 10 RFID TO INCREASE SECURITY OF STORE OF ADIDAS

5.9.5 DRMP SELECTED ZEBRA TECHNOLOGIES FOR RFID SOLUTIONS

TABLE 11 RFID TO TRACK AND MANAGE HIGH-VALUE ASSETS

5.10 TECHNOLOGY TRENDS

5.10.1 EMERGENCE OF IOT TECHNOLOGY FOR PRINTING APPLICATIONS

5.10.2 RFID TECHNOLOGY COMPARISON

TABLE 12 COMPARISON OF ACTIVE AND PASSIVE RFID TAGS

6 RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE (Page No. - 72)

6.1 INTRODUCTION

FIGURE 27 RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE

FIGURE 28 BARCODE PRINTERS SEGMENT TO HOLD LARGE SIZE OF RFID AND BARCODE PRINTER MARKET FROM 2021 TO 2026

TABLE 13 RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE, 2017–2020 (USD MILLION)

TABLE 14 RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE, 2021–2026 (USD MILLION)

TABLE 15 RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 16 RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE, 2021–2026 (THOUSAND UNITS)

6.2 BARCODE PRINTERS

TABLE 17 BARCODE PRINTER MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 18 BARCODE PRINTER MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 19 BARCODE PRINTER MARKET, BY PRINTING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 20 BARCODE PRINTER MARKET, BY PRINTING TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 21 BARCODE PRINTER MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 BARCODE PRINTER MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 23 BARCODE PRINTER MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 24 BARCODE PRINTER MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2.1 WITH LINER

6.2.1.1 With liner barcode printers are normal self-adhesive label printers with attached liners

6.2.2 LINERLESS

6.2.2.1 Linerless barcode printers are used to print labels wound up in rolls without the backing of release liners

TABLE 25 LINERLESS BARCODE PRINTER MARKET, BY VALUE AND VOLUME, 2017–2020

TABLE 26 LINERLESS BARCODE PRINTER MARKET, BY VALUE AND VOLUME, 2021–2026

TABLE 27 LINERLESS BARCODE PRINTER MARKET, BY PRINTING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 28 LINERLESS BARCODE PRINTER MARKET, BY PRINTING TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 29 LINERLESS BARCODE PRINTER MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 LINERLESS BARCODE PRINTER MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 RFID PRINTERS

6.3.1 DIRECT THERMAL RFID PRINTERS MARKET TO WITNESS HIGHEST GROWTH FROM 2021 TO 2026

TABLE 31 RFID PRINTER MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 32 RFID PRINTER MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 33 RFID PRINTER MARKET, BY PRINTING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 34 RFID PRINTER MARKET, BY PRINTING TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 35 RFID PRINTER MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 RFID PRINTER MARKET, BY REGION, 2021–2026 (USD MILLION)

7 DIFFERENT CONNECTIVITY TYPES OF RFID AND BARCODE PRINTERS (Page No. - 83)

7.1 INTRODUCTION

FIGURE 29 DIFFERENT CONNECTIVITY TYPES OF RFID AND BARCODE PRINTERS

7.2 ETHERNET

7.2.1 RISEN USE OF RFID AND BARCODE PRINTERS WITH ETHERNET CONNECTIVITY IN OFFICES, HOSPITALS, AND RETAIL STORES

7.3 BLUETOOTH

7.3.1 BLUETOOTH-CONNECTED RFID AND BARCODE PRINTERS MAKE USE OF WIRELESS PROTOCOLS TO TRANSMIT SIGNALS THROUGH AIR

7.4 SERIAL AND PARALLEL COMMUNICATION

7.4.1 USE OF SERIALLY CONNECTED RFID AND BARCODE PRINTERS IN FEW INDUSTRIES OWING TO RELIABILITY AND SPEED OFFERED BY THEM

7.5 UNIVERSAL SERIAL BUS (USB)

7.5.1 UNIVERSAL SERIAL BUS CONNECTIVITY ALLOWS COMPUTERS TO RECOGNIZE DEVICES AND EVEN SEARCH FOR DRIVERS IN SOME CASES

8 RFID AND BARCODE PRINTER MARKET, BY PRINTING TECHNOLOGY (Page No. - 85)

8.1 INTRODUCTION

FIGURE 30 RFID AND BARCODE PRINTER MARKET, BY PRINTING TECHNOLOGY

TABLE 37 ADVANTAGES AND DISADVANTAGES OF PRINTING TECHNOLOGIES

FIGURE 31 DIRECT THERMAL SEGMENT OF RFID AND BARCODE PRINTER MARKET TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 38 RFID AND BARCODE PRINTER MARKET, BY PRINTING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 39 RFID AND BARCODE PRINTER MARKET, BY PRINTING TECHNOLOGY, 2021–2026 (USD MILLION)

8.2 DIRECT THERMAL

8.2.1 DIRECT THERMAL PRINTING TECHNOLOGY ELIMINATES REQUIREMENT OF INSTALLATION OF RIBBONS FOR PRINTING APPLICATIONS

TABLE 40 DIRECT THERMAL TECHNOLOGY-BASED RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE, 2017–2020 (USD MILLION)

TABLE 41 DIRECT THERMAL TECHNOLOGY-BASED RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE, 2021–2026 (USD MILLION)

8.3 THERMAL TRANSFER

8.3.1 THERMAL TRANSFER PRINTING MARKS VARIABLE DATA ON LABELS AND FLEXIBLE PACKAGING

TABLE 42 THERMAL TRANSFER TECHNOLOGY-BASED RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE, 2017–2020 (USD MILLION)

TABLE 43 THERMAL TRANSFER TECHNOLOGY-BASED RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE, 2021–2026 (USD MILLION)

8.4 OTHERS

TABLE 44 OTHER TECHNOLOGY-BASED RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE, 2017–2020 (USD MILLION)

TABLE 45 OTHER TECHNOLOGY-BASED RFID AND BARCODE PRINTER MARKET, BY PRINTER TYPE, 2021–2026 (USD MILLION)

9 RFID AND BARCODE PRINTER MARKET, BY PRINTING RESOLUTION (Page No. - 92)

9.1 INTRODUCTION

FIGURE 32 RFID AND BARCODE PRINTER MARKET, BY PRINTING RESOLUTION

FIGURE 33 >600 DPI SEGMENT OF RFID AND BARCODE PRINTER MARKET TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 46 RFID AND BARCODE PRINTER MARKET, BY PRINTING RESOLUTION, 2017–2020 (USD MILLION)

TABLE 47 RFID AND BARCODE PRINTER MARKET, BY PRINTING RESOLUTION, 2021–2026 (USD MILLION)

9.2 <300 DPI

9.2.1 USE OF DESKTOP RFID AND BARCODE PRINTERS WITH PRINTING RESOLUTION <300 DPI FOR PRINTING LABELS USED IN SHIPPING AND RETAIL INDUSTRIES

9.3 300–600 DPI

9.3.1 300–600 DPI RESOLUTION LABELS SUIT REQUIREMENTS OF HEALTHCARE, TRANSPORTATION, RETAIL, MANUFACTURING, AND ENTERTAINMENT INDUSTRIES

9.4 >600 DPI

9.4.1 INDUSTRIAL RFID AND BARCODE PRINTERS WITH RESOLUTION >600 DPI PRINT LARGE-SIZED LABELS FOR CARTONS, ITEMS, AND EQUIPMENT

10 RFID AND BARCODE PRINTER MARKET, BY FORMAT TYPE (Page No. - 96)

10.1 INTRODUCTION

FIGURE 34 RFID AND BARCODE PRINTER MARKET, BY FORMAT TYPE

FIGURE 35 INDUSTRIAL PRINTERS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF RFID AND BARCODE PRINTER MARKET FROM 2021 TO 2026

TABLE 48 RFID AND BARCODE PRINTER MARKET, BY FORMAT TYPE, 2017–2020 (USD MILLION)

TABLE 49 RFID AND BARCODE PRINTER MARKET, BY FORMAT TYPE, 2021–2026 (USD MILLION)

10.2 INDUSTRIAL PRINTERS

10.2.1 USE OF INDUSTRIAL PRINTERS FOR DURABLE AND RELIABLE PRINTING IN TOUGH ENVIRONMENTS IN LARGE VOLUMES

TABLE 50 INDUSTRIAL RFID AND BARCODE PRINTER MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 51 INDUSTRIAL RFID AND BARCODE PRINTER MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.3 DESKTOP PRINTERS

10.3.1 ADOPTION OF DESKTOP PRINTERS FOR SMALL-VOLUME PRINTING APPLICATIONS IN RETAIL, HEALTHCARE, AND ENTERTAINMENT INDUSTRIES

TABLE 52 DESKTOP RFID AND BARCODE PRINTER MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 53 DESKTOP RFID AND BARCODE PRINTER MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.4 MOBILE PRINTERS

10.4.1 DEMAND FOR MOBILE PRINTERS FROM HOSPITALITY, HEALTHCARE, AND RETAIL SECTORS

TABLE 54 MOBILE RFID AND BARCODE PRINTER MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 55 MOBILE RFID AND BARCODE PRINTER MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11 RFID AND BARCODE PRINTER MARKET, BY APPLICATION (Page No. - 103)

11.1 INTRODUCTION

FIGURE 36 RFID AND BARCODE PRINTER MARKET, BY APPLICATION

FIGURE 37 RETAIL SEGMENT OF RFID AND BARCODE PRINTER MARKET TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 56 RFID AND BARCODE PRINTER MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 57 RFID AND BARCODE PRINTER MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.2 RETAIL

11.2.1 SURGING DEMAND FOR RFID AND BARCODE PRINTERS TO DRIVE GROWTH OF MARKET FOR RETAIL APPLICATION

TABLE 58 RFID AND BARCODE PRINTER MARKET FOR RETAIL, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 RFID AND BARCODE PRINTER MARKET FOR RETAIL, BY REGION, 2021–2026 (USD MILLION)

TABLE 60 RFID AND BARCODE PRINTER MARKET FOR RETAIL, BY FORMAT TYPE, 2017–2020 (USD MILLION)

TABLE 61 RFID AND BARCODE PRINTER MARKET FOR RETAIL, BY FORMAT TYPE, 2021–2026 (USD MILLION)

TABLE 62 RFID AND BARCODE PRINTER MARKET FOR RETAIL, BY PRINTER TYPE, 2017–2020 (USD MILLION)

TABLE 63 RFID AND BARCODE PRINTER MARKET FOR RETAIL, BY PRINTER TYPE, 2021–2026 (USD MILLION)

11.3 TRANSPORTATION AND LOGISTICS

11.3.1 ENHANCING YARD AND FLEET MANAGEMENT PROCESSES AND TRACKING ASSETS WITH USE OF RFID AND BARCODE LABELS

TABLE 64 RFID AND BARCODE PRINTER MARKET FOR TRANSPORTATION AND LOGISTICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 RFID AND BARCODE PRINTER MARKET FOR TRANSPORTATION AND LOGISTICS, BY REGION, 2021–2026 (USD MILLION)

TABLE 66 RFID AND BARCODE PRINTER MARKET FOR TRANSPORTATION AND LOGISTICS, BY FORMAT TYPE, 2017–2020 (USD MILLION)

TABLE 67 RFID AND BARCODE PRINTER MARKET FOR TRANSPORTATION AND LOGISTICS, BY FORMAT TYPE, 2021–2026 (USD MILLION)

TABLE 68 RFID AND BARCODE PRINTER MARKET FOR TRANSPORTATION AND LOGISTICS, BY PRINTER TYPE, 2017–2020 (USD MILLION)

TABLE 69 RFID AND BARCODE PRINTER MARKET FOR TRANSPORTATION AND LOGISTICS, BY PRINTER TYPE, 2021–2026 (USD MILLION)

11.4 MANUFACTURING AND INDUSTRIAL

11.4.1 INCREASING USE OF RFID TAGS AND BARCODES FOR END-TO-END TRACEABILITY AND QUALITY CONTROL IN MANUFACTURING AND INDUSTRIAL ENVIRONMENTS

FIGURE 38 RFID AND BARCODE PRINTER MARKET IN APAC FOR MANUFACTURING AND INDUSTRIAL TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 70 RFID AND BARCODE PRINTER MARKET FOR MANUFACTURING AND INDUSTRIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 RFID AND BARCODE PRINTER MARKET FOR MANUFACTURING AND INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 72 RFID AND BARCODE PRINTER MARKET FOR MANUFACTURING AND INDUSTRIAL, BY FORMAT TYPE, 2017–2020 (USD MILLION)

TABLE 73 RFID AND BARCODE PRINTER MARKET FOR MANUFACTURING AND INDUSTRIAL, BY FORMAT TYPE, 2021–2026 (USD MILLION)

TABLE 74 RFID AND BARCODE PRINTER MARKET FOR MANUFACTURING AND INDUSTRIAL, BY PRINTER TYPE, 2017–2020 (USD MILLION)

TABLE 75 RFID AND BARCODE PRINTER MARKET FOR MANUFACTURING AND INDUSTRIAL, BY PRINTER TYPE, 2021–2026 (USD MILLION)

11.5 HEALTHCARE AND HOSPITALITY

11.5.1 RISING USE OF RFID AND BARCODE PRINTERS IN HEALTHCARE AND HOSPITALITY APPLICATIONS FOR TRACKING DIFFERENT KINDS OF INFORMATION

TABLE 76 RFID AND BARCODE PRINTER MARKET FOR HEALTHCARE AND HOSPITALITY, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 RFID AND BARCODE PRINTER MARKET FOR HEALTHCARE AND HOSPITALITY, BY REGION, 2021–2026 (USD MILLION)

TABLE 78 RFID AND BARCODE PRINTER MARKET FOR HEALTHCARE AND HOSPITALITY, BY FORMAT TYPE, 2017–2020 (USD MILLION)

TABLE 79 RFID AND BARCODE PRINTER MARKET FOR HEALTHCARE AND HOSPITALITY, BY FORMAT TYPE, 2021–2026 (USD MILLION)

TABLE 80 RFID AND BARCODE PRINTER MARKET FOR HEALTHCARE AND HOSPITALITY, BY PRINTER TYPE, 2017–2020 (USD MILLION)

TABLE 81 RFID AND BARCODE PRINTER MARKET FOR HEALTHCARE AND HOSPITALITY, BY PRINTER TYPE, 2021–2026 (USD MILLION)

11.6 GOVERNMENT

11.6.1 ONGOING INITIATIVES TAKEN BY US GOVERNMENT FOR INCREASED SAFETY AND SECURITY OF COUNTRY TO LEAD TO HIGH DEMAND FOR RFID AND BARCODE PRINTERS IN NORTH AMERICA

TABLE 82 RFID AND BARCODE PRINTER MARKET FOR GOVERNMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 83 RFID AND BARCODE PRINTER MARKET FOR GOVERNMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 84 RFID AND BARCODE PRINTER MARKET FOR GOVERNMENT, BY FORMAT TYPE, 2017–2020 (USD MILLION)

TABLE 85 RFID AND BARCODE PRINTER MARKET FOR GOVERNMENT, BY FORMAT TYPE, 2021–2026 (USD MILLION)

TABLE 86 RFID AND BARCODE PRINTER MARKET FOR GOVERNMENT, BY PRINTER TYPE, 2017–2020 (USD MILLION)

TABLE 87 RFID AND BARCODE PRINTER MARKET FOR GOVERNMENT, BY PRINTER TYPE, 2021–2026 (USD MILLION)

11.7 OTHERS

TABLE 88 RFID AND BARCODE PRINTER MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 RFID AND BARCODE PRINTER MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE 90 RFID AND BARCODE PRINTER MARKET FOR OTHER APPLICATIONS, BY FORMAT TYPE, 2017–2020 (USD MILLION)

TABLE 91 RFID AND BARCODE PRINTER MARKET FOR OTHER APPLICATIONS, BY FORMAT TYPE, 2021–2026 (USD MILLION)

TABLE 92 RFID AND BARCODE PRINTER MARKET FOR OTHER APPLICATIONS, BY PRINTER TYPE, 2017–2020 (USD MILLION)

TABLE 93 RFID AND BARCODE PRINTER MARKET FOR OTHER APPLICATIONS, BY PRINTER TYPE, 2021–2026 (USD MILLION)

12 GEOGRAPHIC ANALYSIS (Page No. - 120)

12.1 INTRODUCTION

FIGURE 39 RFID AND BARCODE PRINTER MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 94 RFID AND BARCODE PRINTER MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 95 RFID AND BARCODE PRINTER MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 40 SNAPSHOT: RFID AND BARCODE PRINTER MARKET IN NORTH AMERICA

TABLE 96 RFID AND BARCODE PRINTER MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 97 RFID AND BARCODE PRINTER MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 98 RFID AND BARCODE PRINTER MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 99 RFID AND BARCODE PRINTER MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 100 RFID AND BARCODE PRINTER MARKET IN NORTH AMERICA, BY FORMAT TYPE, 2017–2020 (USD MILLION)

TABLE 101 RFID AND BARCODE PRINTER MARKET IN NORTH AMERICA, BY FORMAT TYPE, 2021–2026 (USD MILLION)

TABLE 102 LINERLESS BARCODE PRINTER MARKET IN NORTH AMERICA, BY PRINTING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 103 LINERLESS BARCODE PRINTER MARKET IN NORTH AMERICA, BY PRINTING TECHNOLOGY, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 US to continue to account for largest share of RFID and barcode printer market in North America from 2021 to 2026

12.2.2 CANADA

12.2.2.1 Rapid growth of e-commerce, IT, retail, and manufacturing industries to lead to growth of RFID and barcode printer market in Canada

12.2.3 MEXICO

12.2.3.1 RFID and barcode printer market in Mexico to grow at highest CAGR from 2021 to 2026

12.3 EUROPE

FIGURE 41 SNAPSHOT: RFID AND BARCODE PRINTER MARKET IN EUROPE

TABLE 104 RFID AND BARCODE PRINTER MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 105 RFID AND BARCODE PRINTER MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 106 RFID AND BARCODE PRINTER MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 107 RFID AND BARCODE PRINTER MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 108 RFID AND BARCODE PRINTER MARKET IN EUROPE, BY FORMAT TYPE, 2017–2020 (USD MILLION)

TABLE 109 RFID AND BARCODE PRINTER MARKET IN EUROPE, BY FORMAT TYPE, 2021–2026 (USD MILLION)

TABLE 110 LINERLESS BARCODE PRINTER MARKET IN EUROPE, BY PRINTING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 111 LINERLESS BARCODE PRINTER MARKET IN EUROPE, BY PRINTING TECHNOLOGY, 2021–2026 (USD MILLION)

12.3.1 UK

12.3.1.1 Surged adoption of RFID and barcode printers in healthcare and manufacturing sectors of UK

12.3.2 GERMANY

12.3.2.1 Risen demand for RFID- and barcode-printed labels from automotive industry of Germany

12.3.3 FRANCE

12.3.3.1 RFID and barcode printer market in France to grow at highest CAGR from 2021 to 2026

12.3.4 ITALY

12.3.4.1 Increased demand for RFID and barcode printers in Italy to contribute to market growth

12.3.5 REST OF EUROPE

12.4 APAC

FIGURE 42 SNAPSHOT: RFID AND BARCODE PRINTER MARKET IN APAC

TABLE 112 RFID AND BARCODE PRINTER MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 113 RFID AND BARCODE PRINTER MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 114 RFID AND BARCODE PRINTER MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 115 RFID AND BARCODE PRINTER MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 116 RFID AND BARCODE PRINTER MARKET IN APAC, BY FORMAT TYPE, 2017–2020 (USD MILLION)

TABLE 117 RFID AND BARCODE PRINTER MARKET IN APAC, BY FORMAT TYPE, 2021–2026 (USD MILLION)

TABLE 118 LINERLESS BARCODE PRINTER MARKET IN APAC, BY PRINTING TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 119 LINERLESS BARCODE PRINTER MARKET IN APAC, BY PRINTING TECHNOLOGY, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 China to account for largest share of RFID and barcode printer market in APAC from 2021 to 2026

12.4.2 JAPAN

12.4.2.1 Flourished healthcare, hospitality, retail, automotive, and transportation industries fuel growth of RFID and barcode printer market in Japan

12.4.3 TAIWAN

12.4.3.1 Emergence of Taiwan as key market for RFID and barcode rinters in APAC

12.4.4 REST OF APAC

12.5 ROW

TABLE 120 RFID AND BARCODE PRINTER MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 121 RFID AND BARCODE PRINTER MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 122 RFID AND BARCODE PRINTER MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 123 RFID AND BARCODE PRINTER MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 124 RFID AND BARCODE PRINTER MARKET IN ROW, BY FORMAT TYPE, 2017–2020 (USD MILLION)

TABLE 125 RFID AND BARCODE PRINTER MARKET IN ROW, BY FORMAT TYPE, 2021–2026 (USD MILLION)

12.5.1 MIDDLE EAST AND AFRICA

12.5.1.1 Retail and manufacturing industries fuel demand for RFID and barcode printers in Middle East and Africa

12.5.2 SOUTH AMERICA

12.5.2.1 Increased industrialization and risen penetration of RFID and barcode printers in retail, entertainment, and government sectors lead to market growth in South America

13 COMPETITIVE LANDSCAPE (Page No. - 141)

13.1 OVERVIEW

13.2 RANKING ANALYSIS OF KEY PLAYERS IN RFID AND BARCODE PRINTER MARKET

TABLE 126 RANKING OF TOP FIVE PLAYERS IN RFID AND BARCODE PRINTER MARKET, 2020

13.3 MARKET SHARE ANALYSIS

TABLE 127 RFID AND BARCODE PRINTER MARKET: DEGREE OF COMPETITION

13.4 REVENUE ANALYSIS

FIGURE 43 REVENUES OF TOP FIVE PLAYERS IN RFID AND BARCODE PRINTER MARKET FROM 2016 TO 2020

13.5 MARKET EVALUATION FRAMEWORK

FIGURE 44 MARKET EVALUATION FRAMEWORK, 2017–2020

13.6 COMPANY EVALUATION MATRIX

13.6.1 STAR

13.6.2 EMERGING LEADER

13.6.3 PERVASIVE

13.6.4 PARTICIPANT

FIGURE 45 RFID AND BARCODE PRINTER MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

13.6.5 PRODUCT FOOTPRINT

TABLE 128 COMPANY PRODUCT FOOTPRINT

TABLE 129 COMPANY APPLICATION FOOTPRINT

TABLE 130 COMPANY REGIONAL FOOTPRINT

TABLE 131 COMPANY FOOTPRINT

13.7 STARTUP/SME EVALUATION MATRIX: RFID AND BARCODE PRINTER MARKET

13.7.1 PROGRESSIVE COMPANY

13.7.2 RESPONSIVE COMPANY

13.7.3 DYNAMIC COMPANY

13.7.4 STARTING BLOCK

FIGURE 46 RFID AND BARCODE PRINTER MARKET: STARTUP/SME EVALUATION MATRIX, 2020

13.8 COMPETITIVE SCENARIO

13.8.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 132 RFID AND BARCODE PRINTER MARKET: KEY PRODUCT LAUNCHES AND DEVELOPMENTS, 2017–2020

13.8.2 DEALS

TABLE 133 RFID AND BARCODE PRINTER MARKET: KEY DEALS, 2017–2020

13.8.3 EXPANSIONS

TABLE 134 RFID AND BARCODE PRINTER MARKET: EXPANSIONS, 2017–2020

14 COMPANY PROFILES (Page No. - 162)

14.1 INTRODUCTION

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.2 KEY PLAYERS

14.2.1 ZEBRA TECHNOLOGIES CORPORATION

FIGURE 47 ZEBRA TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

14.2.2 SATO HOLDINGS CORPORATION

FIGURE 48 SATO HOLDINGS CORPORATION: COMPANY SNAPSHOT

14.2.3 HONEYWELL INTERNATIONAL

FIGURE 49 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

14.2.4 SEIKO EPSON CORPORATION

FIGURE 50 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

14.2.5 AVERY DENNISON CORPORATION

FIGURE 51 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

14.2.6 BIXOLON

FIGURE 52 BIXOLON: COMPANY SNAPSHOT

14.2.7 GODEX INTERNATIONAL

FIGURE 53 GODEX INTERNATIONAL: COMPANY SNAPSHOT

14.2.8 TOSHIBA TEC CORPORATION

FIGURE 54 TOSHIBA TEC CORPORATION: COMPANY SNAPSHOT

14.2.9 LINX PRINTING TECHNOLOGIES

14.2.10 BROTHER INTERNATIONAL CORPORATION

14.3 OTHER KEY PLAYERS

14.3.1 STAR MICRONICS

14.3.2 PRINTRONIX

14.3.3 PRIMERA TECHNOLOGY

14.3.4 POSTEK ELECTRONICS

14.3.5 TSC AUTO ID TECHNOLOGY CO. LTD.

14.3.6 WASP BARCODE TECHNOLOGIES

14.3.7 DASCOM

14.3.8 CAB PRODUKTTECHNIK GMBH & CO.KG

14.3.9 OKI ELECTRIC INDUSTRY CO. LTD.

14.3.10 ATLASRFIDSTORE

14.3.11 CITIZEN SYSTEMS EUROPE

14.3.12 THARO SYSTEMS

14.3.13 STALLION GROUP

14.3.14 RONGTA TECHNOLOGY (XIAMEN) GROUP

14.3.15 BOCA SYSTEMS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 216)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATION

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

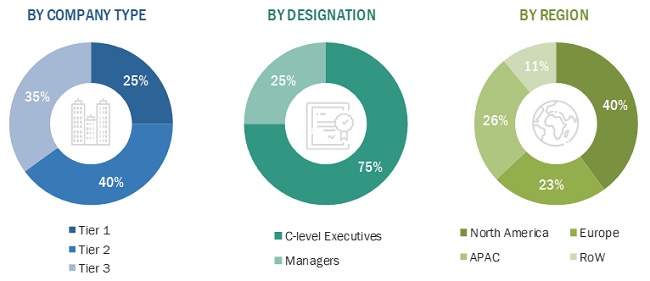

The study has involved four major activities in estimating the size of the RFID and barcode printer market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods have been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the RFID and barcode printer market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand-side and supply-side vendors across four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the RFID and barcode printer market. These methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- Revenue of various RFID and barcode printer manufacturers is considered to arrive at global numbers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained earlier, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the RFID and barcode printer market has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the size of the radio frequency identification (RFID) and barcode printer market based on printer type in terms of value and volume

- To describe and forecast the size of the RFID and barcode printer market based on printing technology, printing resolution, format type, and application in terms of value

- To forecast the size of various segments of the RFID and barcode printer market with respect to four key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To study different types of connectivity used by RFID and barcode printers

- To analyze emerging applications/use cases in the RFID and barcode printer market

- To identify key manufacturers of RFID and barcode printers and analyze their production capabilities for RFID and barcode printers

- To analyze the ecosystem/supply chain of RFID and barcode printers consisting of material and component suppliers, driver integrated circuit (IC) suppliers, manufacturing equipment suppliers, RFID, and barcode printer manufacturers, and brand product manufacturers

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the market opportunities for the stakeholders and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as product launches and developments, agreements, contracts, partnerships, joint ventures, collaborations, mergers and acquisitions, and expansions that have taken place in the market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in RFID and Barcode Printer Market