Anatomic Pathology Track and Trace Solutions Market by Product (Software, Hardware (Printer & Labeling Systems), Consumables), Technology (Barcode, RFID), Application (Tissue Cassette, Slide Tracking), End User (Hospital Labs) - Global Forecast to 2023

[164 Pages Report] The anatomic pathology track and trace solutions market was valued at USD 385.3 million in 2017 and is estimated to grow at a CAGR of 10.4% during the forecast period to reach USD 695.7 million by 2023. The increasing volume of diagnostic tests performed in anatomic pathology laboratories and the increasing number of legal cases around cancer misdiagnosis are the key factors driving the growth of the anatomic pathology track and trace solutions market.

Years Considered for This Report

- 2017 – Base Year

- 2018 – Estimated Year

- 2023 – Projected Year

Objectives of the Study

- To define, describe, and forecast the anatomic pathology track and trace solutions market on the basis of product, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the anatomic pathology track and trace solutions market with respect to North America, Europe, Asia Pacific, and the Rest of the World

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players in the anatomic pathology track and trace solutions market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as R&D activities; product launches; acquisitions; expansions; and collaborations, agreements, and partnerships of the leading players operating in the anatomic pathology track and trace solutions market

Research Methodology

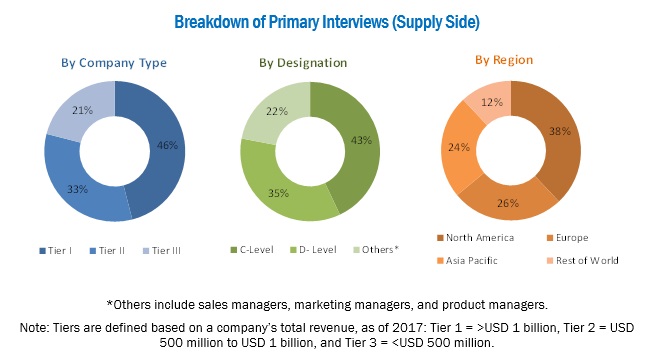

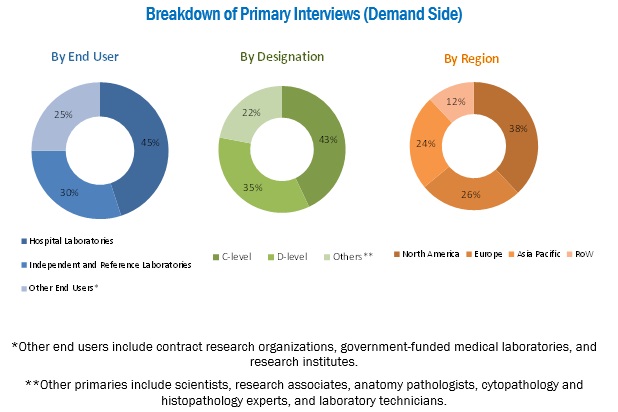

Top-down and bottom-up approaches were used to validate the size of the anatomic pathology track and trace solutions market and to estimate the size of other dependent submarkets. Various secondary sources, such as the Association of Anatomical Pathology Technology (AAPT), Anatomical Pathology Patient Interest Association, College of American Pathologists, Healthcare Information and Management Systems Society (HIMSS), American Health Information Management Association (AHIMA), American Cancer Society (ACS), GLOBOCAN, Centers for Disease Control and Prevention (CDC), National Institutes of Health (NIH), Cancer Research UK, World Bank, US Food and Drug Administration, American Society for Clinical Pathology, annual reports/SEC filings, investor presentations, press releases, white papers, journals/magazines, and news articles have been used to identify and collect information useful for the study of this market. Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess the dynamics of this market. The breakdown of primary interviews has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The major players in the anatomic pathology track and trace solutions market are Thermo Fisher Scientific (US), Leica Biosystems (Germany), General Data Healthcare (US), Ventana Medical Systems (US), Agilent Technologies (US), Sunquest Information Systems (US), Zebra Technologies (US), Primera Technology (US), Cerebrum Corporation (US), AP Easy Software Solutions (US), and LigoLab (US).

Target Audience

- Software Providers of Anatomic Pathology Track and Trace Solutions

- Original Equipment Manufacturers

- Hardware System Manufacturers, Suppliers, and Distributors

- Independent and Reference Laboratories

- Histopathology and Cytopathology Laboratories

- Hospital Laboratories

- Reference and Independent Laboratories

- Cancer Treatment Centers

- Contract Research Organizations

- Academic and Research Institutes

- Government Associations

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Scope of the Report

This research report categorizes the anatomic pathology track and trace solutions market into the following segments and subsegments:

Anatomic Pathology Track and Trace Solutions Market, by Product

- Software

-

Hardware

- Printers and Labeling Systems

- Barcode Scanners and RFID Readers

- Mobile Computing Systems

-

Consumables

- Barcode Labels and RFID Tags

- Slides

- Specimen Containers, Tissue Cassettes, and Blocks

- Transport Bags

Anatomic Pathology Track and Trace Solutions Market, by Technology

- Barcode

- RFID

Anatomic Pathology Track and Trace Solutions Market, by Application

- Slides Tracking

- Tissue Cassettes & Blocks Tracking

- Specimen Tracking

Anatomic Pathology Track and Trace Solutions Market, by End User

- Hospital Laboratories

- Independent and Reference Laboratories

- Other End Users (Contract Research Organizations, Government-funded Medical Laboratories, and Research Institutes)

Anatomic Pathology Track and Trace Solutions Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe (RoE)

- Asia Pacific

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the APAC anatomic pathology track and trace solutions market into Japan, China, and India

- Further breakdown of the Rest of the World anatomic pathology track and trace solutions market into Latin America and the Middle East & Africa

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

The global anatomic pathology track and trace solutions market is projected to reach USD 695.7 million by 2023 from USD 424.2 million in 2018, at a CAGR of 10.4%. The increasing volume of diagnostic tests performed in anatomic pathology laboratories, rising number of legal cases around cancer misdiagnosis, benefits of automated labeling solutions, increasing consolidation among anatomic pathology laboratories, and the growing adoption of automated systems to enhance the efficiency of laboratories are the major factors driving the growth of this market. However, the high cost associated with the implementation of track and trace solutions in anatomic pathology laboratories is expected to restrain the growth of this market during the forecast period.

In this report, the anatomic pathology track and trace solutions market is segmented based on product, technology, application, end user, and region. Based on product, the market is segmented into software, hardware, and consumables. In 2018, the software segment is expected to account for the largest share of this market. This can majorly be attributed to the growing need to automate the sample labeling process for reducing manual errors, increasing focus on improving the efficiency of anatomic laboratories, growing adoption of cloud-based LIMS, and the increasing workload in anatomic pathology laboratories.

On the basis of technology, the anatomic pathology track and trace solutions market is segmented into barcode and RFID. In 2018, the barcode segment is expected to account for a larger share of the market majorly due to the higher adoption of barcode systems among end users owing to their lower cost (as compared to RFID).

Based on application, the anatomic pathology track and trace solutions market is segmented into slide tracking, tissue cassettes and blocks tracking, and specimen tracking. The slide tracking segment is estimated to register the highest CAGR during the forecast period primarily due to the implementation of tracking systems for reducing specimen identification errors and increasing workflow efficiency in anatomic pathology laboratories.

Based on end user, the anatomic pathology track and trace solutions market is segmented into hospital laboratories, independent and reference laboratories, and other end users (contract research organizations, government-funded medical laboratories, and research institutes). The independent and reference laboratories segment is estimated to register the highest CAGR during the forecast period. The growth of this segment can be attributed to the increasing number of cancer diagnostic tests performed in independent and reference laboratories and the increasing number of large-sized reference laboratories across the globe.

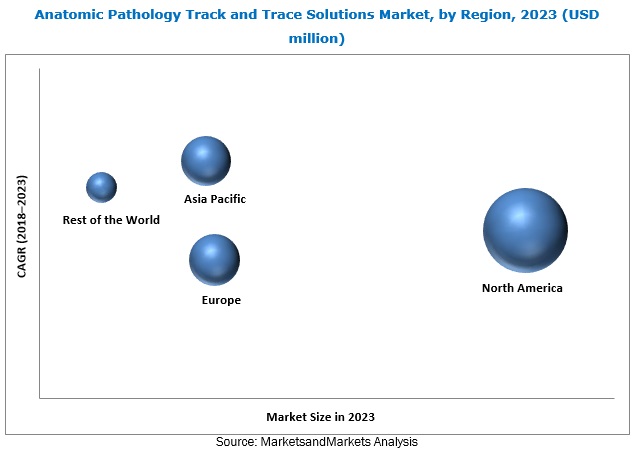

The anatomic pathology track and trace solutions market is segmented into four major regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World. During the forecast period, the North American market is estimated to witness the highest growth. This can be attributed to the increasing volume of diagnostic tests performed in anatomic pathology laboratories, rising prevalence of chronic diseases (resulting in the increasing need for quality diagnostic services), and the presence of leading market players in the region. Moreover, the need for automated labeling systems to reduce specimen identification errors is driving the demand for automated labeling systems in several anatomic pathology laboratories across North America.

Thermo Fisher Scientific (US), Leica Biosystems (US), and Ventana Medical Systems (US) dominated the global anatomic pathology track and trace solutions market in 2017. Some of the other players operating in this market are General Data Healthcare (US), Agilent Technologies (US), Sunquest Information Systems (US), Cerebrum Corp (US), AP Easy Software Solutions (US), Zebra Technologies Corporation (US), Primera Technology (US), and LigoLab (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.3.2 Markets Covered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 37)

4.1 Anatomic Pathology Track and Trace Solutions Market: Overview

4.2 Geographic Snapshot of the Anatomic Pathology Track and Trace Solutions Market (2017)

4.3 Geographic Mix: Anatomic Pathology Track and Trace Solutions Market, 2018–2023 (USD Million)

4.4 Anatomic Pathology Track and Trace Solutions Market: Developing vs Developed Markets, 2018 vs 2023 (USD Million)

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics: Impact Analysis

5.2.1 Drivers

5.2.1.1 Increasing Volume of Diagnostic Tests Performed in Anatomic Pathology Laboratories

5.2.1.2 Increasing Number of Legal Cases Around Cancer Misdiagnosis

5.2.1.3 Increasing Consolidation Among Anatomic Pathology Laboratories

5.2.1.4 Increasing Adoption of Automated Systems to Enhance Laboratory Efficiency

5.2.2 Restraint

5.2.2.1 High Cost Associated With the Implementation of Track and Trace Solutions in Anatomic Pathology Laboratories

5.2.3 Opportunities

5.2.3.1 Integration of Laboratory Information Systems With Track and Trace Pathology Systems

5.2.3.2 Rapid Growth in the Emerging Markets of APAC and Latin America

5.2.4 Challenge

5.2.4.1 Lack of Common Standards Regarding the Labeling of Specimens at Anatomic Pathology Laboratories

6 Industry Insights (Page No. - 47)

6.1 Industry Trends

6.1.1 Technological Advancements

6.1.2 Increasing Focus on Improving the Efficiency of Laboratories

6.2 Regulatory Analysis

6.2.1 Health Insurance Portability and Accountability Act (HIPAA)

6.2.2 Clinical Laboratory Improvement Amendments

6.2.3 ISBT 128 Barcode Standard

6.2.4 Cap Regulations for Labeling Specimen Samples in Anatomic Pathology Laboratories

7 Anatomic Pathology Track and Trace Solutions Market, By Product (Page No. - 51)

7.1 Introduction

7.2 Software

7.3 Hardware

7.3.1 Printers and Labeling Systems

7.3.2 Barcode Scanners and RFID Readers

7.3.3 Mobile Computing Systems

7.4 Consumables

7.4.1 Barcode Labels and RFID Tags

7.4.2 Slides

7.4.3 Specimen Containers, Tissue Cassettes & Blocks

7.4.4 Transport Bags

8 Anatomic Pathology Track and Trace Solutions Market, By Technology (Page No. - 68)

8.1 Introduction

8.2 Barcode

8.3 Radiofrequency Identification (RFID)

9 Anatomic Pathology Track and Trace Solutions Market, By Application (Page No. - 73)

9.1 Introduction

9.2 Slides Tracking

9.3 Tissue Cassettes & Blocks Tracking

9.4 Specimen Tracking

10 Anatomic Pathology Track and Trace Solutions Market, By End User (Page No. - 79)

10.1 Introduction

10.2 Hospital Laboratories

10.3 Independent and Reference Laboratories

10.4 Other End Users

11 Geographic Analysis (Page No. - 85)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.3 Europe

11.3.1 Germany

11.3.2 UK

11.3.3 France

11.3.4 Rest of Europe

11.4 Asia Pacific

11.5 Rest of the World

12 Competitive Landscape (Page No. - 123)

12.1 Overview

12.2 Product Portfolio Assessment

12.2.1 Anatomic Pathology Track and Trace Solutions: Product Portfolio Matrix

12.3 Strategic Benchmarking

12.4 Market Share Analysis

12.5 Competitive Situations and Trends

12.5.1 Product Launches

12.5.2 Partnerships, Collaborations, and Agreements

12.5.3 Acquisitions

12.5.4 Expansions

13 Company Profiles (Page No. - 131)

(Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Thermo Fisher Scientific Inc.

13.2 Leica Biosystems Nussloch GmbH (Subsidiary of Danaher Corporation)

13.3 General Data Healthcare Inc.

13.4 Ventana Medical Systems, Inc.

13.5 Agilent Technologies, Inc.

13.6 Sunquest Information Systems, Inc.

13.7 Cerebrum Corp

13.8 AP Easy Software Solutions

13.9 Zebra Technologies Corporation

13.10 Primera Technology, Inc.

13.11 LigoLab, LLC.

* Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 155)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (112 Tables)

Table 1 Standard Currency Conversion Rates

Table 2 Anatomic Pathology Track and Trace Solutions Market Snapshot, 2018 vs 2023

Table 3 Cost Range of Track and Trace Solutions for Anatomic Pathology Laboratories

Table 4 Anatomic Pathology Track and Trace Solutions Market, By Product, 2016–2023 (USD Million)

Table 5 Leading Manufacturers of Software Solutions for Anatomic Pathology Track and Trace Solutions Market

Table 6 Software Market, By Country, 2016–2023 (USD Million)

Table 7 Hardware Market, By Type, 2016–2023 (USD Million)

Table 8 Hardware Market, By Country, 2016–2023 (USD Million)

Table 9 Leading Manufacturers of Printers and Labeling Systems for Anatomic Pathology Laboratories

Table 10 Printers and Labeling Systems Market, By Country, 2016–2023 (USD Million)

Table 11 Leading Manufacturers of Barcode Scanners and RFID Readers

Table 12 Barcode Scanners and RFID Readers Market, By Country, 2016–2023 (USD Million)

Table 13 Leading Manufacturers of Mobile Computing Systems

Table 14 Mobile Computing Systems Market, By Country, 2016–2023 (USD Million)

Table 15 Consumables Market, By Type, 2016–2023 (USD Million)

Table 16 Consumables Market, By Country, 2016–2023 (USD Million)

Table 17 Barcode Labels and RFID Tags Market, By Country, 2016–2023 (USD Million)

Table 18 Slides Market, By Country, 2016–2023 (USD Million)

Table 19 Specimen Containers, Tissue Cassettes & Blocks Market, By Country, 2016–2023 (USD Million)

Table 20 Transport Bags Market, By Country, 2016–2023 (USD Million)

Table 21 Traditional Anatomic Pathology Track & Trace Processes vs New Anatomic Pathology Track & Trace Processes

Table 22 Anatomic Pathology Track and Trace Solutions Market, By Technology, 2016–2023 (USD Million)

Table 23 Barcode Technology vs RFID Technology

Table 24 Barcode Solutions Market, By Country, 2016–2023 (USD Million)

Table 25 Radiofrequency Identification Solutions Market, By Country, 2016–2023 (USD Million)

Table 26 Anatomic Pathology Track and Trace Solutions Market, By Application, 2016–2023 (USD Million)

Table 27 Slides Tracking Solutions Market, By Country, 2016–2023 (USD Million)

Table 28 Tissue Cassettes and Slides Tracking Solutions

Table 29 Tissue Cassettes & Blocks Tracking Solutions Market, By Country, 2016–2023 (USD Million)

Table 30 Specimen Tracking Solutions Market, By Country, 2016–2023 (USD Million)

Table 31 Anatomic Pathology Track and Trace Solutions Market, By End User, 2016-2023 (USD Million)

Table 32 Anatomic Pathology Track and Trace Solutions Market for Hospital Laboratories, By Country, 2016–2023 (USD Million)

Table 33 Anatomic Pathology Track and Trace Solutions Market for Independent and Reference Laboratories, By Country, 2016–2023 (USD Million)

Table 34 Anatomic Pathology Track and Trace Solutions Market for Other End Users, By Country/Region, 2016–2023 (USD Million)

Table 35 Cancer Incidence (ASR) and Mortality (ASR), By Region

Table 36 Anatomic Pathology Track and Trace Solutions Market, By Region, 2016–2023 (USD Million)

Table 37 North America: Anatomic Pathology Track and Trace Solutions Market, By Country, 2016–2023 (USD Million)

Table 38 North America: Anatomic Pathology Track and Trace Solutions Market, By Product, 2016–2023 (USD Million)

Table 39 North America: Hardware Market, By Type, 2016–2023 (USD Million)

Table 40 North America: Consumables Market, By Type, 2016–2023 (USD Million)

Table 41 North America: Anatomic Pathology Track and Trace Solutions Market, By Technology, 2016–2023 (USD Million)

Table 42 North America: Anatomic Pathology Track and Trace Solutions Market, By Application, 2016–2023 (USD Million)

Table 43 North America: Anatomic Pathology Track and Trace Solutions Market, By End User, 2016–2023 (USD Million)

Table 44 Conferences/Meetings/Courses/Workshops Held/To Be Held in the US

Table 45 US: Key Macroindicators

Table 46 US: Anatomic Pathology Track and Trace Solutions Market, By Product, 2016–2023 (USD Million)

Table 47 US: Hardware Market, By Type, 2016–2023 (USD Million)

Table 48 US: Consumables Market, By Type, 2016–2023 (USD Million)

Table 49 US: Anatomic Pathology Track and Trace Solutions Market, By Technology, 2016–2023 (USD Million)

Table 50 US: Anatomic Pathology Track and Trace Solutions Market, By Application, 2016–2023 (USD Million)

Table 51 US: Anatomic Pathology Track and Trace Solutions Market, By End User, 2016–2023 (USD Million)

Table 52 Canada: Key Macroindicators

Table 53 Canada: Anatomic Pathology Track and Trace Solutions Market, By Product, 2016–2023 (USD Million)

Table 54 Canada: Hardware Market, By Type, 2016–2023 (USD Million)

Table 55 Canada: Consumables Market, By Type, 2016–2023 (USD Million)

Table 56 Canada: Anatomic Pathology Track and Trace Solutions Market, By Technology, 2016–2023 (USD Million)

Table 57 Canada: Anatomic Pathology Track and Trace Solutions Market, By Application, 2016–2023 (USD Million)

Table 58 Canada: Anatomic Pathology Track and Trace Solutions Market, By End User, 2016–2023 (USD Million)

Table 59 Europe: Anatomic Pathology Track and Trace Solutions Market, By Country, 2016–2023 (USD Million)

Table 60 Europe: Anatomic Pathology Track and Trace Solutions Market, By Product, 2016–2023 (USD Million)

Table 61 Europe: Hardware Market, By Type, 2016–2023 (USD Million)

Table 62 Europe: Consumables Market, By Type, 2016–2023 (USD Million)

Table 63 Europe: Anatomic Pathology Track and Trace Solutions Market, By Technology, 2016–2023 (USD Million)

Table 64 Europe: Anatomic Pathology Track and Trace Solutions Market, By Application, 2016–2023 (USD Million)

Table 65 Europe: Anatomic Pathology Track and Trace Solutions Market, By End User, 2016–2023 (USD Million)

Table 66 Germany: Key Macroindicators

Table 67 Germany: Anatomic Pathology Track and Trace Solutions Market, By Product, 2016–2023 (USD Million)

Table 68 Germany: Hardware Market, By Type, 2016–2023 (USD Million)

Table 69 Germany: Consumables Market, By Type, 2016–2023 (USD Million)

Table 70 Germany: Anatomic Pathology Track and Trace Solutions Market, By Technology, 2016–2023 (USD Million)

Table 71 Germany: Anatomic Pathology Track and Trace Solutions Market, By Application, 2016–2023 (USD Million)

Table 72 Germany: Anatomic Pathology Track and Trace Solutions Market, By End User, 2016–2023 (USD Million)

Table 73 UK: Key Macroindicators

Table 74 UK: Anatomic Pathology Track and Trace Solutions Market, By Product, 2016–2023 (USD Million)

Table 75 UK: Hardware Market, By Type, 2016–2023 (USD Million)

Table 76 UK: Consumables Market, By Type, 2016–2023 (USD Million)

Table 77 UK: Anatomic Pathology Track and Trace Solutions Market, By Technology, 2016–2023 (USD Million)

Table 78 UK: Anatomic Pathology Track and Trace Solutions Market, By Application, 2016–2023 (USD Million)

Table 79 UK: Anatomic Pathology Track and Trace Solutions Market, By End User, 2016–2023 (USD Million)

Table 80 France: Key Macroindicators

Table 81 France: Anatomic Pathology Track and Trace Solutions Market, By Product, 2016–2023 (USD Million)

Table 82 France: Hardware Market, By Type, 2016–2023 (USD Million)

Table 83 France: Consumables Market, By Type, 2016–2023 (USD Million)

Table 84 France: Anatomic Pathology Track and Trace Solutions Market, By Technology, 2016–2023 (USD Million)

Table 85 France: Anatomic Pathology Track and Trace Solutions Market, By Application, 2016–2023 (USD Million)

Table 86 France: Anatomic Pathology Track and Trace Solutions Market, By End User, 2016–2023 (USD Million)

Table 87 Italy & Spain: Key Macroindicators

Table 88 RoE: Anatomic Pathology Track and Trace Solutions Market, By Product, 2016–2023 (USD Million)

Table 89 RoE: Hardware Market, By Type, 2016–2023 (USD Million)

Table 90 RoE: Consumables Market, By Type, 2016–2023 (USD Million)

Table 91 RoE: Anatomic Pathology Track and Trace Solutions Market, By Technology, 2016–2023 (USD Million)

Table 92 RoE: Anatomic Pathology Track and Trace Solutions Market, By Application, 2016–2023 (USD Million)

Table 93 RoE: Anatomic Pathology Track and Trace Solutions Market, By End User, 2016–2023 (USD Million)

Table 94 Japan, China, and India: Key Macroindicators

Table 95 Asia Pacific: Anatomic Pathology Track and Trace Solutions Market, By Product, 2016–2023 (USD Million)

Table 96 Asia Pacific: Hardware Market, By Type, 2016–2023 (USD Million)

Table 97 Asia Pacific: Consumables Market, By Type, 2016–2023 (USD Million)

Table 98 Asia Pacific: Anatomic Pathology Track and Trace Solutions Market, By Technology, 2016–2023 (USD Million)

Table 99 Asia Pacific: Anatomic Pathology Track and Trace Solutions Market, By Application, 2016–2023 (USD Million)

Table 100 Asia Pacific: Anatomic Pathology Track and Trace Solutions Market, By End User, 2016–2023 (USD Million)

Table 101 Brazil & Mexico: Key Macroindicators

Table 102 RoW: Anatomic Pathology Track and Trace Solutions Market, By Product, 2016–2023 (USD Million)

Table 103 RoW: Hardware Market, By Type, 2016–2023 (USD Million)

Table 104 RoW: Consumables Market, By Type, 2016–2023 (USD Million)

Table 105 RoW: Anatomic Pathology Track and Trace Solutions Market, By Technology, 2016–2023 (USD Million)

Table 106 RoW: Anatomic Pathology Track and Trace Solutions Market, By Application, 2016–2023 (USD Million)

Table 107 RoW: Anatomic Pathology Track and Trace Solutions Market, By End User, 2016–2023 (USD Million)

Table 108 Growth Strategy Matrix

Table 109 Product Launches (2015 – July 2018)

Table 110 Partnerships, Collaborations , and Agreements (2015–July 2018)

Table 111 Acquisitions (2015–July 2018)

Table 112 Expansions (2014–July 2018)

List of Figures (34 Figures)

Figure 1 Research Design

Figure 2 Primary Sources

Figure 3 Breakdown of Primary Interviews (Supply-Side): By Company Type, Designation, and Region

Figure 4 Breakdown of Primary Interviews (Demand-Side): By End User, Designation, and Region

Figure 5 Data Triangulation Methodology

Figure 6 Anatomic Pathology Track and Trace Solutions Market, By Product, 2018 vs 2023

Figure 7 Hardware Market, By Type, 2018 vs 2023

Figure 8 Consumables Market, By Type, 2018 vs 2023

Figure 9 Anatomic Pathology Track and Trace Solutions Market, By Application, 2018 vs 2023

Figure 10 Anatomic Pathology Track and Trace Solutions Market, By Technology, 2018 vs 2023

Figure 11 Anatomic Pathology Track and Trace Solutions Market, By End User, 2018 vs 2023

Figure 12 Geographic Snapshot: Anatomic Pathology Track and Trace Solutions Market

Figure 13 Increasing Volume of Diagnostic Tests Performed in Anatomic Pathology Laboratories to Drive Market Growth

Figure 14 The US Accounted for the Largest Share of the Anatomic Pathology Track and Trace Solutions Market in 2017

Figure 15 APAC to Grow at the Highest CAGR During the Forecast Period

Figure 16 Developing Markets to Register Higher Growth During the Forecast Period

Figure 17 Consumables Segment to Witness Highest Growth During the Forecast Period

Figure 18 Printers and Labeling Systems Segment to Dominate the Hardware Market During the Forecast Period

Figure 19 RFID Technology Segment to Register the Highest Growth Rate During the Forecast Period

Figure 20 Slides Tracking Segment to Register the Highest Growth Rate During the Forecast Period

Figure 21 Independent and Reference Laboratories Segment to Register Highest CAGR During the Forecast Period

Figure 22 Anatomic Pathology Track and Trace Solutions Market: Geographic Growth Opportunities

Figure 23 North America: Anatomic Pathology Track and Trace Solutions Market Snapshot

Figure 24 Europe: Anatomic Pathology Track and Trace Solutions Market Snapshot

Figure 25 Asia Pacific: Anatomic Pathology Track and Trace Solutions Market Snapshot

Figure 26 Key Developments of Major Players Between 2015 and 2018

Figure 27 Strategic Benchmarking: Product Launches (2015- July 2018)

Figure 28 Anatomic Pathology Track and Trace Solutions Market Share Analysis, By Key Player, 2017

Figure 29 Thermo Fisher Scientific: Company Snapshot (2017)

Figure 30 Danaher Corporation: Company Snapshot (2017)

Figure 31 Roche Diagnostics: Company Snapshot (2017)

Figure 32 Agilent Technologies: Company Snapshot (2017)

Figure 33 Roper Technologies, Inc.: Company Snapshot (2017)

Figure 34 Zebra Technologies : Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Anatomic Pathology Track and Trace Solutions Market