Blockchain Devices Market Size, Share, Industry Growth, Trends & Analysis by Type (Hardware Wallets, Blockchain Smartphones, Crypto ATMs, PoS Devices, Blockchain IoT Gateways), Connectivity, Application, End User, and Region

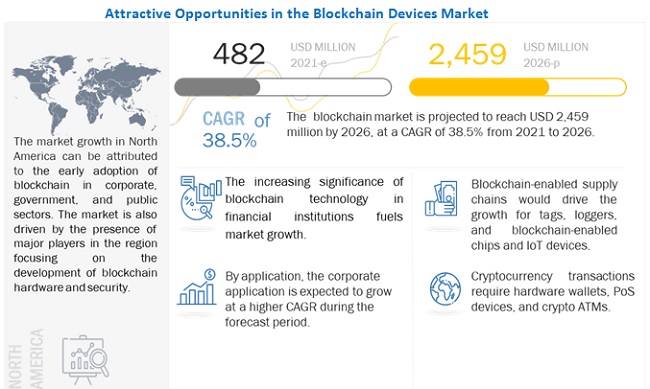

The blockchain devices market Size, Share, Industry Growth, Trends & Analysis projected to grow from USD 482 million in 2021 to USD 2,459 million by 2026; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 38.5% from 2021 to 2026.

The market has a promising growth potential due to several driving factors including, growing visibility of benefits of blockchain technology in financial sector; rapid development of blockchain technology in retail & supply chain management applications; growth in cryptocurrency market capitalization and initial coin offering (ICO); and decentralized structure and various other attributes associated with blockchain technology.

Blockchain Devices Market Segmentaion: An In-Depth Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on current blockchain devices market size and forecast

The COVID-19 pandemic has impacted the growth of the blockchain devices industry. From a regional point of view, the COVID-19 outbreak has caused a major setback to countries with an export-oriented economy owing to the shutting down of manufacturing plants.

The hardware business is the most impacted in the IT industry. Due to the slowdown in the supply of hardware and the reduced manufacturing capacity, the IT infrastructure growth slowed down in the first half of 2020. The software and service businesses also slowed down for a short span.

However, the adoption of collaborative applications, security solutions, big data, and contactless transactions was a major driver for the growth of the market. This scenario depicts the blockchain devices market taking into consideration the current impact of the pandemic. In this scenario, the market is likely to witness a slight plunge in year-on-year growth in 2021 as a result of the affected supply chains and limited adoption of blockchain devices in 2020 and the first half of 2021 due to the lockdowns and shifting priorities of healthcare and other end-use industries. However, with significant benefits offered by blockchain devices, the market is expected to witness rapid recovery in the second half of 2021. Major developments are being observed in the crypto ATM device installation.

- According to Coin ATM Radar, the global crypto ATM installations witnessed a growth of 54.5% in FY 2020 over FY 2019.

- On January 1, 2021, the total number of crypto ATMs installed globally was 14,004; by September 30, 2021, the number doubled to 28,487. The number of crypto ATMs installed between January 2021 and September 2021 was 14,483, implying that nearly 54 crypto ATMs were installed each day from January 1, 2021, to September 30, 2021.

Blockchain Devices Market Dynamics

Driver : Growing visibility of benefits of blockchain technology in financial sector

The adoption of blockchain technology increased rapidly after the introduction of Bitcoin and is being used by various financial institutions. This technology is being increasingly used in various business applications, such as payments, exchanges, smart contracts, documentation, and digital identity.

Blockchain technology offers secure and tamper-proof ledgers, thereby infusing greater accuracy and secure information sharing into the financial services ecosystem. According to National Payments Corporation of India (NPCI), blockchain technology will significantly increase transparency between market participants. Blockchain implementations encourage the creation of an ecosystem of public records of activities to which all market participants have real-time access. Furthermore, blockchain maintains an immutable record of transactions and asset ownership in each transaction on the blockchain. This significantly reduces risk as well as the need for associated mitigating operations for multiple asset types.

This capability can help to reduce the occurrence of theft, fraud, and mis-selling of high-value assets and intellectual property. It will also be helpful in the case of assets where provenance determines value by leaving a digital footprint on the blockchain. Blockchain technology has the potential to be used in the financial sector for numerous applications such as real-time fund settlement via smart contracts, peer-to-peer payments, micropayments and retail payments, fraud risk management, real-time trade execution, and regulatory compliance and optimization. Blockchain technology and distributed ledger technology (DLT) have enormous application potential in the banking industry. Blockchain technology, for example, could enable faster payments at lower fees than banks by establishing a decentralized ledger for payments (cryptocurrencies); and distributed ledgers can reduce operational costs and bring us closer to real-time transactions between financial institutions. Furthermore, by storing customer information on decentralized blocks, blockchain technology can make information sharing between financial institutions easier and safer.

Restraint : Regulatory uncertainty associated with blockchain implementation

Regulatory uncertainty is one of the most significant barriers to blockchain implementation across industries. All major blockchain associations and consortiums, such as Hyperledger, R3CEV Blockchain Consortium, and Financial Blockchain Shenzhen Consortium (FBSC), Blockchain Collaborative Consortium (BCCC), CU Ledger, and Global Payments Steering Group (GPSG), have their own set of standards and codes.

However, there is a lack of a unified set of standards for cryptocurrency transactions. Currently, one of the major impediments to the manufacturing and adoption of blockchain devices across most verticals is the lack of regulations and the resulting uncertainty. For instance, financial legal provisions pose a challenge to blockchain implementation. Blockchain applications will have to define the process for identifying the perpetrator in the event of a fraud, which will be difficult.

Other regulatory aspects of blockchain technology must be established first in order to facilitate its widespread adoption. Both blockchain developers and research organizations are having difficulty identifying and interpreting these regulatory requirements. Furthermore, regulatory agencies and policymakers are yet to provide clear guidelines for blockchain stakeholders to achieve compliance. The distributed ledger technology (DTL) is still in its nascent stage. Regulatory bodies and policymakers, both at national and international levels, are skeptical about the potential of blockchain technology, as not all use cases of this technology can be regulated. The regulatory status of blockchain technology remains uncertain, owing to its standardization and interoperability.

Opportunity : Increasing acceptance of cryptocurrencies as mode of payment across various industries

Cryptocurrencies are becoming more accessible to the general public due to the increasing adoption of blockchain devices. The use of cryptocurrency is expected to grow in industries such as media & entertainment, automotive, retail & e-commerce, travel & hospitality, transportation & logistics and IT & telecommunications.

By collaborating with companies in these verticals, cryptocurrency companies and exchanges are developing use cases across various regions. For instance, Microsoft (US) allows users to top up their Microsoft accounts with Bitcoin and accepts Bitcoin as a form of payment at Xbox and Windows online stores. In July 2021, AMC Theatres (US), the largest movie theater chain in the US, announced the acceptance of Bitcoin as a form of payment. By the end of 2021, AMC Theatres will begin accepting Bitcoin for online ticket purchases. Similarly, the multinational e-commerce company Shopify (Canada) accepts cryptocurrencies as payment for its services.

The online store lists multiple cryptocurrency payment providers as alternative payment methods on its website, including Coinbase, BitPay, GoCoin, and CoinPayments. Aside from Bitcoin, the e-commerce company also accepts Ethereum, Litecoin, and other cryptocurrencies. Virgin Galactic (US), an American spaceflight company, accepts Bitcoin as a payment method for space tourists.

The Old Fitzroy (Australia), a pub in Sydney, also accepts Bitcoins as mode of payment. Thus, the increased acceptance of cryptocurrencies is helping create a strong ecosystem for cryptocurrencies. The increasing exchange of cryptocurrencies is expected to fuel the demand for blockchain devices such as PoS systems in the retail industry in the future. In January 2020, ElectrioPay (China) introduced multi-cryptocurrency PoS device EletroPay Mobi. EletroPay Mobi supports major currencies and payment methods. It accepts Bitcoin, Dash, Bitcoin Cash, Litecoin, Wechat Pay, and Alipay as payment methods. The XPOS device manufactured by Pundi X (Singapore) is the first wireless PoS solution that enables merchants and consumers to carry out secure digital transactions on the blockchain in physical stores. Transactions include purchases of goods and services as well as topping up cryptocurrencies. Many companies such as Binance (Seychelles), Coinbase (US), Wirex (UK), Crypto.com (Honk Kong), and Nexo (UK) offer cryptocurrency cards similar to traditional debit and credit cards. The user can manage coins or tokens in their cards by pairing them with crypto wallet apps.

Challenge : Security-, privacy-, and control-related challenges associated with blockchain technology

Blockchain technology has the potential to transform transactions and make them more convenient. However, in order to reap the benefits of blockchain, organizations must overcome challenges related to security, privacy, and control.

Because blockchain transactions are recorded in a distributed public ledger, hackers have a larger attack surface to gain access to critical and sensitive information. If a blockchain device is used to store confidential contract information or payment data, replicating the file may give hackers more access to it. If a key is compromised, it can be used to access the database in both hub-and-spoke and a node-and-spoke models. Everyone on a public blockchain in the network has legal access to the encrypted and anonymous data.

Transactional data could be used to track down the identity of a person in the network, similar to how web trackers and cookies are normally used by businesses. Unfortunately, this demonstrates that blockchain is not completely secure. The deployment of cryptographic solutions is low as privacy is a major challenge in these solutions. For instance, the founders of Africrypt (South Africa) are suspected of absconding with USD 3.6 billion in Bitcoin in June 2021. In May 2019, hackers used Binance's (Seychelles) security system to steal USD 40 million in Bitcoins. According to Binance (Seychelles), hackers were able to obtain a large number of user application programming interface (API) keys, 2FA codes, and potentially other information. The hackers employed a number of methods, including phishing, viruses, and other attacks. Similarly, during a security incident in September 2018, the Osaka-based cryptocurrency exchange Zaif (Japan) lost USD 60 million in company and user funds. In January 2018, NEM tokens worth USD 400 million were stolen from Japan-based virtual currency exchange Coincheck (Japan).

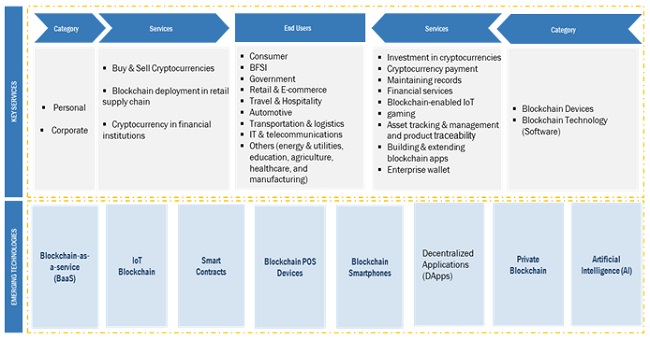

Blockchain Devices Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Blockchain devices Market Dynamics

The blockchain devices market for crypto ATMs to grow at fastest CAGR during the forecast period

The crypto ATMs segment is expected to grow at the highest CAGR during the forecast period. Recent advancements in crypto ATMs software and support for multiple cryptocurrencies have fueled the market for crypto ATMs.

Other factors contributing to the growth of this market include more enhanced stabilization of revenues against crypto volatility, flexibility to buy or sell cryptocurrencies in any location, and anti-money laundering (AML) capabilities. The market cap of crypto ATMs witnessed a growth of ~59% in FY 2020 over 2019.

Growth in cryptocurrency market capitalization and initial coin offering (ICO) is another major driving factor for the anticipated growth of the crypto ATMs segment during the forecast period. Businesses have recognized the potential of blockchain devices in delivering enhanced customer experiences and have started adopting crypto ATMs in retail stores. As a result, in 2020, merchants who accepted cryptocurrency payments received an average ROI of 327% (tripleA). In the past two years, almost 8 US states have worked on bills accepting or promoting the use of Bitcoin and blockchain technology, and some of them have already passed laws for these. In North America, over 12,450 crypto ATMs were installed in FY 2020, indicating an increase of 63% compared with FY 2019 (Coin ATM Radar).

Consumer End user segment to dominate blockchain devices market during the forecast period

The consumer end user segment is expected to dominate the market and grow at a significant CAGR during the forecast period, driven by the increasing adoption of cryptocurrencies and the acceptance of cryptocurrencies as a payment method by businesses.

As of April 2021, global crypto ownership is estimated to be 3.9%, with over 300 million crypto users worldwide (Source: tripleA). This encourages consumers and businesses to use cryptocurrencies for transactions, subsequently driving the blockchain devices market.

The consumer goods industry is growing as a result of the increasing need for improved inventory optimization. The need to develop cost-effective global business strategies for enhancing business productivity is also driving the adoption of blockchain-enabled supply chain solutions in the industry. Blockchain, when combined with IoT devices and sensors, provides unparalleled visibility and efficiency gains into the logical and physical movement of goods throughout their entire value cycle, which is expected to elevate the demand for blockchain-enabled tracking and monitoring devices in the consumer segment.

Wired segment is projected to lead blockchain devices market from 2021 to 2026

The wired blockchain devices are expected to dominate the market throughout the forecast period. Blockchain devices are in the nascent stage, and the first-generation devices are mostly wired. The growing market for crypto ATMs is a major driver for the wired segment.

Preconfigured devices, such as blockchain computers, are also wired. Wired hardware wallets enable users to carry out secure digital transactions on the blockchain by connecting the device with a personal computer. However, with developments in blockchain hardware, wireless blockchain devices are gaining popularity and market share. The demand for wired connectivity is high in the blockchain devices market, as it enables high-quality, uninterrupted connection compared with wireless connectivity. The increasing installation of crypto ATMs globally is further expected to drive the market for this segment.

Blockchain devices market in North America is expected to maintain the highest share during 2021–2026

North America is expected to hold the largest share of the blockchain devices market throughout the forecast period. North America is a pioneer in the use of blockchain technology. The leading blockchain service providers in North America include Microsoft (US), IBM (US), and Oracle (US).

These players provide blockchain services that can be integrated with blockchain hardware and IoT devices to monitor and track assets throughout the supply chain. North America is also a hub for blockchain-based security chips and solutions that improve corporate blockchain security. Xage Security (US), NXM Labs (US), GridPlus (US), and NetObjex (US) are a few companies based in North America that provide blockchain-based security chips and blockchain IoT gateways to corporations. Therefore, the North American region depicts high potential for the blockchain devices market in next four to five years, especially for the tracking and monitoring of assets and chip-level security.

The recent COVID-19 pandemic is expected to impact the global blockchain devices industry. The entire supply chain is disrupted due to limited supply of hardware parts. The market is likely to witness a slight plunge in year-on-year growth in 2021 as a result of the affected supply chains and limited adoption of blockchain devices in 2020 and the first half of 2021 due to the lockdowns and shifting priorities of healthcare and other end-use industries. However, with significant benefits offered by blockchain devices, the market is expected to witness rapid recovery in the second half of 2021. Major developments are being observed in the crypto ATM device installation. According to Coin ATM Radar, nearly 54 crypto ATMs were installed each day from January 1, 2021, to September 30, 2021. The total number of crypto ATMs installed in 2021 till September are almost double as compared to last year figures.

Key Market Players in Blockchain Devices Industry

The blockchain devices companies such as Ledger (France), SatoshiLabs (Czech Republic), SIRIN LABS (Switzerland), Pundi X (Singapore), Genesis Coin (US).

Blockchain Devices Market Report Scope:

|

Report Metric |

Detail |

| Market Size Value in 2021 | USD 482 Million |

| Revenue Forecast in 2026 | USD 2459 Million |

| Growth Rate | 38.5% |

|

Market Size Available for Years |

2018-2026 |

|

Base Year |

2020 |

|

Forecast Period |

2021-2026 |

|

Units |

Value (USD Million) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Companies Covered |

|

This report categorizes the blockchain devices market based on type, connectivity, application, end user, and region.

Blockchain devices Market, by Component:

- Hardware Wallets

- Blockchain Smartphones

- PoS Devices

- Crypto ATMs

- Blockchain IoT Gateways

- Other Devices (tags, loggers, pre-configured devices, and chips)

Blockchain devices Market, by Connectivity:

- Wired

- Wireless

Blockchain devices Market, by Application:

- Personal

- Corporate

Blockchain devices Market, by End User:

- Consumer

- BFSI

- Government

- Retail & E-commerce

- Travel & Hospitality

- Automotive

- Transportation & Logistics

- IT & Telecommunication

- Others (Energy & Utilities, Education, Agriculture, Healthcare, Manufacturing)

Blockchain devices Market, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Austria

- Rest of Europe

-

APAC

- Singapore

- South Korea

- China

- Japan

- India

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

Recent Developments in Blockchain Devices Industry

- In November 2020, Pundi X (Singapore) partnered with Merkle Science—a Singapore based cryptocurrency risk and intelligence company. The partnership is focused on preventing the illegal use of cryptocurrencies on the Pundi X platform to create a safe ecosystem for carrying legal transactions.

- In December 2020, SatoshiLabs (Czech Republic) announced that its subsidiary Tropic Square (Czech Republic) would create a secure and transparent chip called TASSIC. TASSIC is the first custom chip (ASIC) with a minimalistic implementation of fundamental functionality—secure storage and associated cryptography—to securely store digital data. The prototype is likely to be developed by the end of 2021.

- In December 2020, SatoshiLabs (Czech Republic) added a new holding to its portfolio: the startup Invity (Czech Republic). Invity has created a cryptocurrency exchange rate comparison tool and taken over the successful Coinmap.org project with an aim to mainstream cryptocurrencies by onboarding people with traditional investment knowledge but limited technical know-how. The standalone website of Invity serves as a comparison tool that simplifies the purchase of cryptocurrencies and exchange transactions.

Frequently Asked Questions (FAQ):

How big blockchain devices market?

The blockchain devices market is projected to grow from USD 482 million in 2021 to USD 2,459 million by 2026, CAGR of 38.5%.

What will be the dynamics for the adoption of blockchain devices based on type?

Hardware wallets accounted for the largest (~76% in terms of value; ~98% in terms of volume) share of the blockchain devices market mainly due to the ability of such wallets to store the private keys of users without the risk of getting them exposed to malicious threats over the Internet. Hardware wallets are often referred to as cold storage because they are not connected to the Internet. When connected to a computer, a hardware wallet does not share the private keys with the computer or over the Internet. The only transaction that takes place between the hardware wallet and the computer is of an unsigned and signed contract.

How big blockchain devices market?

The blockchain devices market is projected to grow from USD 482 million in 2021 to USD 2,459 million by 2026, CAGR of 38.5%.

Which region is expected to adopt blockchain devices at a fast rate?

North America is expected to adopt blockchain devices at the fastest rate. US-based insurance companies are taking various measures for implementing blockchain in insurance. The region is an early adopter of blockchain technology. The presence of key market players is the major factor driving the growth of the North American blockchain market. The US and Canada have advanced infrastructures, with high adoption of innovative technologies. Organizations and businesses have recognized the potential of blockchain devices in delivering enhanced customer experiences and, hence, have started adopting the technology to develop business applications.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

The market has a promising growth potential due to several driving factors including, rapid development of blockchain technology in retail & supply chain management applications, growing visibility of benefits of blockchain technology in financial sector, growth in cryptocurrency market capitalization and initial coin offering (ICO), and decentralized structure and various other attributes associated with blockchain technology. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 2 PROCESS FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—REVENUE GENERATED BY MARKET PLAYERS FROM SALES OF BLOCKCHAIN DEVICES

FIGURE 5 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 7 HARDWARE WALLETS TO HOLD LARGEST SHARE OF BLOCKCHAIN DEVICES MARKET DURING FORECAST PERIOD

FIGURE 8 WIRED SEGMENT OF BLOCKCHAIN DEVICES MARKET IS PROJECTED TO GROW AT HIGHER RATE THAN WIRELESS SEGMENT DURING FORECAST PERIOD

FIGURE 9 CORPORATE APPLICATION TO HOLD LARGER SHARE OF BLOCKCHAIN DEVICES MARKET DURING FORECAST PERIOD

FIGURE 10 BLOCKCHAIN DEVICES MARKET FOR TRAVEL & HOSPITALITY TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA WAS LARGEST MARKET FOR BLOCKCHAIN DEVICES IN 2020

3.1 COVID-19 IMPACT ON BLOCKCHAIN DEVICES MARKET

FIGURE 12 GLOBAL PROPAGATION OF COVID-19

TABLE 1 RECOVERY SCENARIOS FOR GLOBAL ECONOMY

FIGURE 13 BLOCKCHAIN DEVICES MARKET SIZE IN PRE-COVID-19 AND POST-COVID-19 SCENARIOS

3.1.1 PRE-COVID-19 SCENARIO

3.1.2 POST-COVID-19 SCENARIO

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES IN BLOCKCHAIN DEVICES MARKET

FIGURE 14 INCREASING SIGNIFICANCE OF BLOCKCHAIN TECHNOLOGY IN FINANCIAL INSTITUTIONS HAS FUELED MARKET GROWTH

4.2 BLOCKCHAIN DEVICES MARKET FOR CRYPTO ATMS

FIGURE 15 ONE-WAY CRYPTO ATMS ESTIMATED TO HOLD A LARGER SHARE OF CRYPTO ATM FOR BLOCKCHAIN DEVICES MARKET IN 2021

4.3 BLOCKCHAIN DEVICES MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

FIGURE 16 CORPORATE APPLICATION AND US ARE ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN BLOCKCHAIN DEVICES MARKET IN 2021

4.4 BLOCKCHAIN DEVICES MARKET, BY END USER

FIGURE 17 TRAVEL & HOSPITALITY END USER SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.5 BLOCKCHAIN DEVICES MARKET, BY KEY COUNTRIES

FIGURE 18 BLOCKCHAIN DEVICES MARKET IN US HOLD LARGEST SHARE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 BLOCKCHAIN DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 20 IMPACT OF DRIVERS ON BLOCKCHAIN DEVICES MARKET

5.2.1.1 Decentralized structure and various other attributes associated with blockchain technology

5.2.1.2 Rapid penetration of blockchain technology in retail & supply chain management applications

FIGURE 21 PATENTS FOR BLOCKCHAIN TECHNOLOGY IN RETAIL & SUPPLY CHAIN MANAGEMENT, 2015–2020

5.2.1.3 Growing visibility of benefits of blockchain technology in financial sector

5.2.1.4 Growth in cryptocurrency market capitalization and initial coin offering (ICO)

FIGURE 22 TOTAL CRYPTOCURRENCY MARKET CAPITALIZATION DURING JANUARY 01, 2017–SEPTEMBER 16, 2021

FIGURE 23 TOTAL UNITS OF CRYPTO ATMS INSTALLED FROM JANUARY 2014 TO SEPTEMBER 2021

5.2.2 RESTRAINTS

FIGURE 24 IMPACT OF RESTRAINTS ON BLOCKCHAIN DEVICES MARKET

5.2.2.1 Regulatory uncertainty associated with blockchain implementation

5.2.2.2 Lack of awareness, comprehension, and user experience about blockchain technology

5.2.3 OPPORTUNITIES

FIGURE 25 IMPACT OF OPPORTUNITIES ON BLOCKCHAIN DEVICES MARKET

5.2.3.1 Increasing acceptance of cryptocurrencies as mode of payment across various industries

5.2.3.2 Anticipated adoption of blockchain technology in automotive industry for maintaining records and securing payments

5.2.3.3 Integration of blockchain technology with Internet of Things (IoT), artificial intelligence (AI), and cloud

FIGURE 26 PATENTS FOR IOT BLOCKCHAIN DEVICES, 2015–2020

5.2.4 CHALLENGES

FIGURE 27 IMPACT OF CHALLENGES ON BLOCKCHAIN DEVICES MARKET

5.2.4.1 Security-, privacy-, and control-related challenges associated with blockchain technology

5.3 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS OF BLOCKCHAIN DEVICES ECOSYSTEM: MANUFACTURING AND SOFTWARE INTEGRATION PHASES CONTRIBUTE MOST VALUE

5.3.1 PLANNING AND REVISING FUND

5.3.2 RESEARCH & DEVELOPMENT

5.3.3 MANUFACTURING & SOFTWARE INTEGRATION

5.3.4 ASSEMBLY, DISTRIBUTION, AND AFTER-SALES SERVICES

5.4 ECOSYSTEM

FIGURE 29 BLOCKCHAIN DEVICES ECOSYSTEM

TABLE 2 LIST OF COMPANIES AND THEIR ROLE IN BLOCKCHAIN DEVICES ECOSYSTEM

5.5 TRENDS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 30 REVENUE SHIFT IN BLOCKCHAIN DEVICES MARKET

5.6 CASE STUDIES

5.6.1 MOBILITY OPEN BLOCKCHAIN INITIATIVE (US) IS WORKING TO CO-DESIGN BLOCKCHAIN AND DISTRIBUTED LEDGER TECHNOLOGY STANDARDS TO IMPROVE SUPPLY CHAIN EFFICIENCY IN AUTOMOTIVE INDUSTRY

5.6.2 SARNA PLASTEC (SWITZERLAND) ACCELERATED ITS DEVELOPMENT PROCESS WITH MODUM'S (SWITZERLAND) BLOCKCHAIN-POWERED DATA INTEGRITY SOLUTION

5.6.3 COINJAR (AUSTRALIA) WAS ABLE TO SCALE UP BUSINESS BY EMPLOYING COMBINATION OF BITGO (US) CUSTODY AND SETTLEMENT, ALONG WITH HOT, WARM, AND COLD WALLETS

5.6.4 FORTMATIC (US) CHOSE ALCHEMY (US) AS ITS BLOCKCHAIN FUNCTIONAL INFRASTRUCTURE PROVIDER TO ENSURE RELIABILITY AND HIGH-SPEED TRANSACTION

5.6.5 WALMART (US) ACHIEVED UNPRECEDENTED TRANSPARENCY IN FOOD SUPPLY CHAIN WITH HYPERLEDGER FABRIC MODULAR BLOCKCHAIN FRAMEWORK

5.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 31 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 BLOCKCHAIN DEVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF BUYERS

5.7.4 BARGAINING POWER OF SUPPLIERS

5.7.5 DEGREE OF COMPETITION

5.8 TECHNOLOGY ANALYSIS

5.8.1 KEY TECHNOLOGY

5.8.1.1 Single hardware wallet supporting multiple blockchains

5.8.1.2 Rise of blockchain smartphones owing to their benefits and features

5.8.2 COMPLEMENTARY TECHNOLOGY

5.8.2.1 Emergence of cloud services—blockchain-as-a-service (BaaS) platforms

5.8.3 ADJACENT TECHNOLOGY

5.8.3.1 Blockchain IoT hardware for enterprises of all size

5.9 TRADE ANALYSIS

5.9.1 IMPORT SCENARIO

5.9.1.1 Import scenario for blockchain devices market

TABLE 4 IMPORT DATA FOR UNITS OF AUTOMATIC DATA-PROCESSING MACHINES (INCLUDING BLOCKCHAIN DEVICES), BY KEY COUNTRY, 2012–2020 (USD BILLION)

FIGURE 32 IMPORT DATA FOR UNITS OF AUTOMATIC DATA-PROCESSING MACHINES (INCLUDING BLOCKCHAIN DEVICES) FOR TOP FIVE COUNTRIES, 2016–2020 (USD BILLION)

5.9.2 EXPORT SCENARIO

5.9.2.1 Export scenario for blockchain devices market

TABLE 5 EXPORT DATA FOR UNITS OF AUTOMATIC DATA-PROCESSING MACHINES (INCLUDING BLOCKCHAIN DEVICES), BY KEY COUNTRY, 2012–2020 (USD BILLION)

FIGURE 33 EXPORT DATA FOR UNITS OF AUTOMATIC DATA-PROCESSING MACHINES (INCLUDING BLOCKCHAIN DEVICES) FOR TOP FIVE COUNTRIES, 2016–2020 (USD BILLION)

5.10 PATENT ANALYSIS

TABLE 6 PATENTS FILED FOR VARIOUS TYPES OF BLOCKCHAIN DEVICES, 2020

FIGURE 34 BLOCKCHAIN DEVICES PATENTS PUBLISHED FROM 2014 TO 2020

FIGURE 35 TOP 10 COMPANIES WITH LARGEST NO. OF PATENT APPLICATIONS, 2014–2020

5.11 TARIFFS AND REGULATIONS

5.11.1 TARIFFS

TABLE 7 MFN TARIFFS LEVIED BY US ON A FEW KEY COUNTRIES FOR EXPORTS OF PRODUCTS CONSIDERED UNDER HS CODE 847180

TABLE 8 MFN TARIFFS LEVIED BY CHINA ON A FEW KEY COUNTRIES FOR EXPORTS OF PRODUCTS CONSIDERED UNDER HS CODE 847180

5.11.1.1 Positive impact of tariffs on blockchain devices ecosystem

5.11.1.2 Negative impact of tariffs on the blockchain devices ecosystem

5.11.2 REGULATIONS AND STANDARDS

FIGURE 36 VARIOUS STANDARDS FOR BLOCKCHAIN DEVICES

5.11.2.1 Service Organization Control (SOC)

5.11.2.2 CryptoCurrency Security Standard (CCSS)

5.11.2.3 Restriction of Hazardous Substances (RoHS)

5.11.2.4 Regional regulatory landscape

5.11.2.4.1 North America: regulatory landscape

TABLE 9 REGULATIONS AND ASSOCIATIONS FOR BLOCKCHAIN TECHNOLOGY & DEVICES IN NORTH AMERICA

5.11.2.4.2 Europe: Regulatory landscape

TABLE 10 REGULATIONS AND ASSOCIATIONS FOR BLOCKCHAIN TECHNOLOGY & DEVICES IN EUROPE

5.11.2.4.3 Asia Pacific: Regulatory landscape

0 REGULATIONS AND ASSOCIATIONS FOR BLOCKCHAIN TECHNOLOGY & DEVICES IN APAC (Page No. - 103)

5.11.2.4.4 RoW: Regulatory landscape

TABLE 12 REGULATIONS AND ASSOCIATIONS FOR BLOCKCHAIN TECHNOLOGY & DEVICES IN ROW

5.12 AVERAGE SELLING PRICE TRENDS

TABLE 13 AVERAGE SELLING PRICES OF BLOCKCHAIN DEVICES

5.13 TYPES OF BLOCKCHAIN

5.13.1 PUBLIC BLOCKCHAIN

5.13.2 PRIVATE BLOCKCHAIN

5.13.3 HYBRID BLOCKCHAIN

5.14 BLOCKCHAIN ASSOCIATIONS AND CONSORTIUMS

5.14.1 ENTERPRISE ETHEREUM ALLIANCE

5.14.2 CONTINUOUS LINKED SETTLEMENT (CLS)

5.14.3 R3CE V BLOCKCHAIN CONSORTIUM

5.14.4 HYPERLEDGER CONSORTIUM

5.14.5 GLOBAL PAYMENTS STEERING GROUP (GPSG)

5.14.6 FINANCIAL BLOCKCHAIN SHENZHEN CONSORTIUM (FBSC)

5.14.7 CULEDGER

5.14.8 BLOCKCHAIN COLLABORATIVE CONSORTIUM (BCCC)

5.14.9 GLOBAL BLOCKCHAIN BUSINESS COUNCIL

5.14.10 WALL STREET BLOCKCHAIN ALLIANCE (WSBA)

5.14.11 OTHER BLOCKCHAIN ASSOCIATIONS

6 BLOCKCHAIN DEVICES MARKET, BY TYPE (Page No. - 111)

6.1 INTRODUCTION

FIGURE 37 HARDWARE WALLETS TO HOLD LARGEST SIZE OF BLOCKCHAIN DEVICES MARKET IN 2026

TABLE 14 BLOCKCHAIN DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 15 BLOCKCHAIN DEVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 16 BLOCKCHAIN DEVICES MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 17 BLOCKCHAIN DEVICES MARKET, BY TYPE, 2021–2026 (UNITS)

6.2 HARDWARE WALLETS

6.2.1 HARDWARE WALLETS GENERATE PRIVATE KEYS OFFLINE IN COLD STORAGE AND PROTECT THOSE FROM VULNERABILITIES AND VIRUSES

TABLE 18 PLAYERS OFFERING HARDWARE WALLETS

TABLE 19 BLOCKCHAIN DEVICES MARKET FOR HARDWARE WALLETS, BY REGION, 2018–2020 (USD MILLION)

FIGURE 38 NORTH AMERICA TO HOLD LARGEST SHARE OF BLOCKCHAIN DEVICES MARKET FOR HARDWARE WALLETS IN 2026

TABLE 20 BLOCKCHAIN DEVICES MARKET FOR HARDWARE WALLETS, BY REGION, 2021–2026 (USD MILLION)

6.2.2 CRYPTO HARDWARE WALLETS

6.2.2.1 Acceptance of cryptocurrencies across various regions and sectors is driving market for crypto hardware wallets

6.2.3 CAR WALLETS

6.2.3.1 Car wallets enable autonomous payment of parking fees, toll fees, and battery recharging

6.2.4 SMART CARDS

6.2.4.1 Smart cards are funded by cryptocurrency balance of users

6.3 BLOCKCHAIN SMARTPHONES

6.3.1 BLOCKCHAIN SMARTPHONES SECURELY STORE PRIVATE KEYS AND OTHER SENSITIVE INFORMATION WITHOUT GIVING ACCESS TO ANY THIRD-PARTY SOFTWARE

TABLE 21 PLAYERS OFFERING BLOCKCHAIN SMARTPHONES

TABLE 22 BLOCKCHAIN SMARTPHONES MARKET, BY REGION, 2018–2020 (USD MILLION)

FIGURE 39 BLOCKCHAIN SMARTPHONES MARKET IN APAC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 23 BLOCKCHAIN SMARTPHONES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4 CRYPTO ATMS

6.4.1 AVAILABILITY OF CRYPTO ATMS CUSTOMIZABLE FOR REGULATORY COMPLIANCE AND END-USER REQUIREMENTS PROVIDES GROWTH OPPORTUNITIES

TABLE 24 PLAYERS OFFERING CRYPTO ATMS

TABLE 25 CRYPTO ATMS MARKET, BY REGION, 2018–2020 (USD MILLION)

FIGURE 40 NORTH AMERICA TO LEAD CRYPTO ATMS MARKET DURING FORECAST PERIOD

TABLE 26 CRYPTO ATMS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 27 CRYPTO ATMS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 28 CRYPTO ATM MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.4.2 ONE-WAY CRYPTO ATMS

6.4.2.1 One-way crypto ATMs only perform one function at terminal

6.4.3 TWO-WAY CRYPTO ATMS

6.4.3.1 Two-way crypto ATMs segment would grow at higher rate than one-way crypto ATMs

6.5 POS DEVICES

6.5.1 POS DEVICES ALLOW FLEXIBLE PAYMENT PROCESSING OF CRYPTOCURRENCIES FROM ANY LOCATION

TABLE 29 PLAYERS OFFERING POS DEVICES

TABLE 30 POS DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

FIGURE 41 MARKET FOR POS DEVICES TO GROW AT FASTEST RATE IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 31 POS DEVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.6 BLOCKCHAIN IOT GATEWAYS

6.6.1 INTEGRATION OF BLOCKCHAIN TECHNOLOGY WITH IOT DEVICES ENSURES EXTRA LEVEL OF SECURITY WITH QUICK AND TRANSPARENT COMMUNICATION AMONG IOT DEVICES

TABLE 32 PLAYERS OFFERING BLOCKCHAIN IOT GATEWAY PRODUCTS/SOLUTIONS

TABLE 33 BLOCKCHAIN IOT GATEWAYS MARKET, BY REGION, 2018–2020 (USD MILLION)

FIGURE 42 NORTH AMERICA TO LEAD BLOCKCHAIN IOT GATEWAYS MARKET DURING FORECAST PERIOD

TABLE 34 BLOCKCHAIN IOT GATEWAYS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.7 OTHER BLOCKCHAIN DEVICES

TABLE 35 PLAYERS OFFERING OTHER BLOCKCHAIN DEVICES/SOLUTIONS

TABLE 36 OTHER BLOCKCHAIN DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

FIGURE 43 NORTH AMERICA TO HOLD LARGEST SHARE OF OTHER BLOCKCHAIN DEVICES MARKET DURING FORECAST PERIOD

TABLE 37 OTHER BLOCKCHAIN DEVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

7 BLOCKCHAIN DEVICES MARKET, BY CONNECTIVITY (Page No. - 133)

7.1 INTRODUCTION

FIGURE 44 WIRED SEGMENT IS PROJECTED TO LEAD BLOCKCHAIN DEVICES MARKET FROM 2021 TO 2026

TABLE 38 BLOCKCHAIN DEVICES MARKET, BY CONNECTIVITY, 2018–2020 (USD MILLION)

TABLE 39 BLOCKCHAIN DEVICES MARKET, BY CONNECTIVITY, 2021–2026 (USD MILLION)

7.2 WIRED

7.2.1 WIRED BLOCKCHAIN DEVICES OFFER BETTER CONNECTIVITY THAN WIRELESS BLOCKCHAIN DEVICES

TABLE 40 PLAYERS OFFERING WIRED BLOCKCHAIN DEVICES

TABLE 41 BLOCKCHAIN DEVICES MARKET FOR WIRED CONNECTIVITY, BY TYPE, 2018–2020 (USD MILLION)

FIGURE 45 CRYPTO ATMS SEGMENT OF WIRED BLOCKCHAIN DEVICES MARKET TO GROW AT HIGHER RATE THAN HARDWARE WALLETS DURING FORECAST PERIOD

TABLE 42 WIRED BLOCKCHAIN DEVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.3 WIRELESS

7.3.1 WIRELESS BLOCKCHAIN DEVICES ARE WITNESSING SIGNIFICANT GROWTH

TABLE 43 PLAYERS OFFERING WIRELESS BLOCKCHAIN DEVICES

TABLE 44 MARKET FOR WIRELESS BLOCKCHAIN DEVICES, BY TYPE, 2018–2020 (USD MILLION)

FIGURE 46 HARDWARE WALLETS TO HOLD LARGEST SHARE OF WIRELESS BLOCKCHAIN DEVICES MARKET DURING FORECAST PERIOD

TABLE 45 MARKET FOR WIRELESS BLOCKCHAIN DEVICES, BY TYPE, 2021–2026 (USD MILLION)

8 BLOCKCHAIN DEVICES MARKET, BY APPLICATION (Page No. - 140)

8.1 INTRODUCTION

FIGURE 47 BLOCKCHAIN DEVICES MARKET FOR CORPORATE APPLICATION TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 46 BLOCKCHAIN DEVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 47 BLOCKCHAIN DEVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 PERSONAL

8.2.1 INCREASING GLOBAL ACCEPTANCE OF CRYPTOCURRENCIES IS DRIVING USE OF BLOCKCHAIN DEVICES FOR PERSONAL USE

TABLE 48 BLOCKCHAIN DEVICES MARKET FOR PERSONAL APPLICATION, BY REGION, 2018–2020 (USD MILLION)

FIGURE 48 NORTH AMERICA TO BE LARGEST MARKET FOR PERSONAL APPLICATION DURING FORECAST PERIOD

TABLE 49 BLOCKCHAIN DEVICES MARKET FOR PERSONAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.3 CORPORATE

8.3.1 ADOPTION OF BLOCKCHAIN TECHNOLOGY ACROSS SUPPLY CHAIN FOR TRACKING AND MONITORING OF ASSETS IS DRIVING USE OF BLOCKCHAIN DEVICES

TABLE 50 BLOCKCHAIN DEVICES MARKET FOR CORPORATE APPLICATION, BY REGION, 2018–2020 (USD MILLION)

FIGURE 49 NORTH AMERICA TO BE LARGEST MARKET FOR CORPORATE APPLICATION DURING FORECAST PERIOD

TABLE 51 BLOCKCHAIN DEVICES MARKET FOR CORPORATE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.3.2 BLOCKCHAIN DEVICES MARKET FOR CORPORATE APPLICATION, BY ENTERPRISE SIZE

TABLE 52 BLOCKCHAIN DEVICES MARKET FOR CORPORATE, BY ENTERPRISE SIZE, 2018–2020 (USD MILLION)

FIGURE 50 LARGE ENTERPRISES TO HOLD LARGER SHARE OF BLOCKCHAIN DEVICES MARKET FOR CORPORATE APPLICATION DURING FORECAST PERIOD

TABLE 53 BLOCKCHAIN DEVICES MARKET FOR CORPORATE, BY ENTERPRISE SIZE, 2021–2026 (USD MILLION)

8.3.2.1 Large enterprises

8.3.2.1.1 Drivers for blockchain devices market for large enterprises

8.3.2.1.2 Large enterprises: Impact of COVID-19

8.3.2.2 Small and medium-sized enterprises

8.3.2.2.1 Drivers for blockchain devices market for small and medium-sized enterprises

8.3.2.2.2 Small and medium-sized enterprises: Impact of COVID-19

9 BLOCKCHAIN DEVICES MARKET, BY END USER (Page No. - 151)

9.1 INTRODUCTION

FIGURE 51 CONSUMER END USER SEGMENT TO DOMINATE BLOCKCHAIN DEVICES MARKET DURING FORECAST PERIOD

TABLE 54 BLOCKCHAIN DEVICES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 55 BLOCKCHAIN DEVICES MARKET, BY END USER, 2021–2026 (USD MILLION)

9.1.1 CONSUMER

9.1.1.1 Blockchain-enabled devices help trace products, determine whether warranty has expired, and conduct full recalls

TABLE 56 BLOCKCHAIN DEVICES MARKET FOR CONSUMER, BY REGION, 2018–2020 (USD MILLION)

FIGURE 52 NORTH AMERICA TO LEAD BLOCKCHAIN DEVICES MARKET FOR CONSUMER DURING FORECAST PERIOD

TABLE 57 BLOCKCHAIN DEVICES MARKET FOR CONSUMER, BY REGION, 2021–2026 (USD MILLION)

9.1.2 BFSI

9.1.2.1 Implementing blockchain in BFSI helps reduce frauds, minimize risks, and increase customer satisfaction

TABLE 58 BLOCKCHAIN DEVICES MARKET FOR BFSI, BY REGION, 2018–2020 (USD MILLION)

FIGURE 53 NORTH AMERICA TO DOMINATE BLOCKCHAIN DEVICES MARKET FOR BFSI THROUGHOUT FORECAST PERIOD

TABLE 59 BLOCKCHAIN DEVICES MARKET FOR BFSI, BY REGION, 2021–2026 (USD MILLION)

9.1.3 GOVERNMENT

9.1.3.1 Blockchain technology enables recording of transactions on distributed ledgers to increase transparency in government agencies

TABLE 60 BLOCKCHAIN DEVICES MARKET FOR GOVERNMENT, BY REGION, 2018–2020 (USD MILLION)

FIGURE 54 NORTH AMERICA TO DOMINATE BLOCKCHAIN DEVICES MARKET FOR GOVERNMENT THROUGHOUT FORECAST PERIOD

TABLE 61 BLOCKCHAIN DEVICES MARKET FOR GOVERNMENT, BY REGION, 2021–2026 (USD MILLION)

9.1.4 RETAIL & E-COMMERCE

9.1.4.1 Blockchain technology prevents data manipulation, which is expected to drive blockchain devices market for retail & e-commerce

TABLE 62 BLOCKCHAIN DEVICES MARKET FOR RETAIL & E-COMMERCE, BY REGION, 2018–2020 (USD MILLION)

FIGURE 55 NORTH AMERICA TO DOMINATE BLOCKCHAIN DEVICES MARKET FOR RETAIL & E-COMMERCE THROUGHOUT FORECAST PERIOD

TABLE 63 BLOCKCHAIN DEVICES MARKET FOR RETAIL & E-COMMERCE, BY REGION, 2021–2026 (USD MILLION)

9.1.5 TRAVEL & HOSPITALITY

9.1.5.1 Blockchain technology can assist in eliminating middlemen, promoting direct provider-to-consumer interaction, and lowering costs

TABLE 64 BLOCKCHAIN DEVICES MARKET FOR TRAVEL & HOSPITALITY, BY REGION, 2018–2020 (USD MILLION)

FIGURE 56 NORTH AMERICA TO LEAD BLOCKCHAIN DEVICES MARKET FOR TRAVEL & HOSPITALITY DURING FORECAST PERIOD

TABLE 65 BLOCKCHAIN DEVICES MARKET FOR TRAVEL & HOSPITALITY, BY REGION, 2021–2026 (USD MILLION)

9.1.6 AUTOMOTIVE

9.1.6.1 Blockchains could be used to track automotive parts in supply chain and identify counterfeits

TABLE 66 BLOCKCHAIN DEVICES MARKET FOR AUTOMOTIVE, BY REGION, 2018–2020 (USD MILLION)

FIGURE 57 NORTH AMERICA TO DOMINATE BLOCKCHAIN DEVICES MARKET FOR AUTOMOTIVE DURING FORECAST PERIOD

TABLE 67 BLOCKCHAIN DEVICES MARKET FOR AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

9.1.7 TRANSPORTATION & LOGISTICS

9.1.7.1 Blockchain technology helps track freights, offers secure transactions, and validate user identities through multi-factor authentication

TABLE 68 BLOCKCHAIN DEVICES MARKET FOR TRANSPORTATION & LOGISTICS, BY REGION, 2018–2020 (USD MILLION)

FIGURE 58 APAC BLOCKCHAIN DEVICES MARKET FOR TRANSPORTATION & LOGISTICS TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 69 BLOCKCHAIN DEVICES MARKET FOR TRANSPORTATION & LOGISTICS, BY REGION, 2021–2026 (USD MILLION)

9.1.8 IT & TELECOMMUNICATION

9.1.8.1 Operational support provided by blockchain devices for OSS/BSS and surge in data security concerns to drive blockchain devices market for IT & telecommunication

TABLE 70 BLOCKCHAIN DEVICES MARKET FOR IT & TELECOMMUNICATION, BY REGION, 2018–2020 (USD MILLION)

FIGURE 59 NORTH AMERICA TO DOMINATE BLOCKCHAIN DEVICES MARKET FOR IT & TELECOMMUNICATION DURING FORECAST PERIOD

TABLE 71 BLOCKCHAIN DEVICES MARKET FOR IT & TELECOMMUNICATION, BY REGION, 2021–2026 (USD MILLION)

9.1.9 OTHERS

9.1.9.1 Other end users would present significant growth opportunities for blockchain solutions

TABLE 72 BLOCKCHAIN DEVICES MARKET FOR OTHERS, BY REGION, 2018–2020 (USD MILLION)

FIGURE 60 NORTH AMERICA TO DOMINATE BLOCKCHAIN DEVICES MARKET FOR IT & TELECOMMUNICATION DURING FORECAST PERIOD

TABLE 73 BLOCKCHAIN DEVICES MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 174)

10.1 INTRODUCTION

FIGURE 61 ROW BLOCKCHAIN DEVICES MARKET TO REGISTER HIGHEST CAGR BETWEEN 2021 AND 2026

FIGURE 62 NORTH AMERICA TO LEAD BLOCKCHAIN DEVICES MARKET DURING FORECAST PERIOD

TABLE 74 BLOCKCHAIN DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 75 BLOCKCHAIN DEVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 63 NORTH AMERICA: SNAPSHOT OF BLOCKCHAIN DEVICES MARKET

TABLE 76 BLOCKCHAIN DEVICES MARKET IN NORTH AMERICA, BY TYPE, 2018–2020 (USD MILLION)

TABLE 77 BLOCKCHAIN DEVICES MARKET IN NORTH AMERICA, BY TYPE, 2021–2026 (USD MILLION)

TABLE 78 BLOCKCHAIN DEVICES MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 79 BLOCKCHAIN DEVICES MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 80 BLOCKCHAIN DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 81 BLOCKCHAIN DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Large presence of vendors and growing need for simplifying business processes to drive market growth

10.2.2 CANADA

10.2.2.1 Rapid infrastructure development through distributed ledger technology to deliver secure and transparent services to drive growth of Canadian market

10.2.3 MEXICO

10.2.3.1 Increasing focus on digitalization to drive growth of blockchain devices market in Mexico

10.3 EUROPE

FIGURE 64 EUROPE: SNAPSHOT OF BLOCKCHAIN DEVICES MARKET

TABLE 82 BLOCKCHAIN DEVICES MARKET IN EUROPE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 83 BLOCKCHAIN DEVICES MARKET IN EUROPE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 84 BLOCKCHAIN DEVICES MARKET IN EUROPE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 85 BLOCKCHAIN DEVICES MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 86 BLOCKCHAIN DEVICES MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 87 BLOCKCHAIN DEVICES MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Growing adoption of blockchain in automotive and pharmaceutical industries to drive market growth in Germany

10.3.2 UK

10.3.2.1 Initiatives for integration of blockchain technology into manufacturing industries and supply chains to drive market growth

10.3.3 FRANCE

10.3.3.1 Presence of leading blockchain devices vendors and government-led initiatives to drive market growth in France

10.3.4 AUSTRIA

10.3.4.1 Increasing research and development and initiatives by public and private sector companies for development of blockchain devices to drive market growth

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 65 ASIA PACIFIC: SNAPSHOT OF BLOCKCHAIN DEVICES MARKET

TABLE 88 BLOCKCHAIN DEVICES MARKET IN APAC, BY TYPE, 2018–2020 (USD MILLION)

TABLE 89 BLOCKCHAIN DEVICES MARKET IN APAC, BY TYPE, 2021–2026 (USD MILLION)

TABLE 90 BLOCKCHAIN DEVICES MARKET IN APAC, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 91 BLOCKCHAIN DEVICES MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 92 BLOCKCHAIN DEVICES MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 93 BLOCKCHAIN DEVICES MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Increasing investments and R&D in blockchain technologies to drive market growth in China

10.4.2 JAPAN

10.4.2.1 Japan to create lucrative opportunities for blockchain devices market for various applications

10.4.3 SOUTH KOREA

10.4.3.1 Government-led initiatives to fuel growth of blockchain devices market in South Korea

10.4.4 SINGAPORE

10.4.4.1 Initiatives by government and growing adoption of blockchain devices in retail industry to drive market growth

10.4.5 INDIA

10.4.5.1 Growing crypto ownership in India to drive growth of blockchain devices market

10.4.6 REST OF ASIA PACIFIC

10.5 ROW

FIGURE 66 ROW: SNAPSHOT OF BLOCKCHAIN DEVICES MARKET

TABLE 94 BLOCKCHAIN DEVICES MARKET IN ROW, BY TYPE, 2018–2020 (USD MILLION)

TABLE 95 BLOCKCHAIN DEVICES MARKET IN ROW, BY TYPE, 2021–2026 (USD MILLION)

TABLE 96 BLOCKCHAIN DEVICES MARKET IN ROW, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 97 BLOCKCHAIN DEVICES MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 98 BLOCKCHAIN DEVICES MARKET IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 99 BLOCKCHAIN DEVICES MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 100 BLOCKCHAIN DEVICES MARKET IN SOUTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 101 BLOCKCHAIN DEVICES MARKET IN SOUTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Increasing infrastructure development in South America to fuel market growth

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Rapid adoption of blockchain technology in financial institutions to fuel market growth

11 COMPETITIVE LANDSCAPE (Page No. - 207)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 102 OVERVIEW OF STRATEGIES DEPLOYED BY TOP MARKET PLAYERS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC PLAY

11.3 MARKET SHARE ANALYSIS, 2020

FIGURE 67 SHARE OF MAJOR PLAYERS IN BLOCKCHAIN DEVICES MARKET, 2020

TABLE 103 DEGREE OF COMPETITION, BLOCKCHAIN DEVICES MARKET (2020)

11.4 RANKING OF KEY PLAYERS IN BLOCKCHAIN DEVICES MARKET

FIGURE 68 BLOCKCHAIN DEVICES MARKET: RANKING OF KEY PLAYERS, 2020

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 69 BLOCKCHAIN DEVICES MARKET: COMPANY EVALUATION QUADRANT, 2020

11.6 STARTUP/SME EVALUATION MATRIX

TABLE 104 STARTUPS/SMES IN BLOCKCHAIN DEVICES MARKET

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANY

11.6.3 DYNAMIC COMPANY

11.6.4 STARTING BLOCK

FIGURE 70 BLOCKCHAIN DEVICES MARKET, STARTUP/SME EVALUATION MATRIX, 2020

11.7 COMPANY FOOTPRINT (40 COMPANIES)

TABLE 105 COMPANY FOOTPRINT

TABLE 106 TYPE FOOTPRINT OF COMPANIES (40 COMPANIES)

TABLE 107 APPLICATION FOOTPRINT OF COMPANIES (40 COMPANIES)

TABLE 108 REGIONAL FOOTPRINT OF COMPANIES (40 COMPANIES)

11.8 COMPETITIVE SITUATION AND TRENDS

11.8.1 PRODUCT LAUNCHES

TABLE 109 PRODUCT LAUNCHES, OCTOBER 2019–DECEMBER 2020

11.8.2 DEALS

TABLE 110 DEALS, JUNE 2020–DECEMBER 2020

11.8.3 OTHERS

TABLE 111 EXPANSIONS, NOVEMBER 2018 - DECEMBER 2020

12 COMPANY PROFILES (Page No. - 227)

(Business Overview, Products/solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 LEDGER

TABLE 112 LEDGER: BUSINESS OVERVIEW

12.1.2 SATOSHILABS

TABLE 113 SATOSHILABS: BUSINESS OVERVIEW

12.1.3 SIRIN LABS

TABLE 114 SIRIN LABS: BUSINESS OVERVIEW

12.1.4 PUNDI X

TABLE 115 PUNDI X: BUSINESS OVERVIEW

12.1.5 GENERAL BYTES

TABLE 116 GENERAL BYTES: BUSINESS OVERVIEW

12.1.6 GENESIS COIN

TABLE 117 GENESIS COIN: BUSINESS OVERVIEW

12.1.7 HTC

TABLE 118 HTC: BUSINESS OVERVIEW

FIGURE 71 HTC: COMPANY SNAPSHOT

12.1.8 RIDDLE&CODE

TABLE 119 RIDDLE&CODE: BUSINESS OVERVIEW

12.1.9 BITACCESS

TABLE 120 BITACCESS: BUSINESS OVERVIEW

12.1.10 SHAPESHIFT

TABLE 121 SHAPESHIFT: BUSINESS OVERVIEW

12.2 OTHER KEY PLAYERS

12.2.1 COINSOURCE

12.2.2 AVADO

12.2.3 SAMSUNG

12.2.4 PAYMYNT

12.2.5 LAMASSU INDUSTRIES

12.2.6 INFINEON TECHNOLOGIES

12.2.7 TANGEM

12.2.8 HELIUM SYSTEMS

12.2.9 MODUM

12.2.10 SAFEPAL

12.2.11 NXM LABS

*Details on Business Overview, Products/solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 275)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

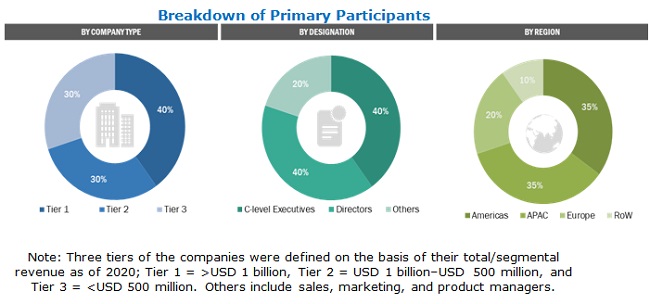

Extensive secondary sources, directories, and databases such as D&B Hoovers, Bloomberg Businessweek, Factiva, and OneSource were used to identify and collect relevant information for the technical, market-oriented, and commercial study of the blockchain devices market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of major companies in the market, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as to assess the future market prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information pertinent to this study. These include annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles from recognized authors, directories, and databases. Secondary research was conducted to obtain key information about the industry’s supply chain, market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology oriented perspectives.

After the complete market engineering (which includes calculations for market statistics, market breakdown, data triangulation, market size estimations, and market forecasting), extensive primary research was carried out to gather information, as well as to verify and validate the critical numbers arrived at.

Primary research was also conducted to identify the segmentation types; key players; competitive landscape; and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the blockchain devices market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list the key information and insights throughout the report.

Secondary sources used for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the blockchain devices market scenario through secondary research. Several primary interviews were conducted with market experts from both demand (commercial application providers) and supply (equipment manufacturers and distributors) sides across four major regions: the Americas, Europe, APAC, and RoW. Approximately 25% and 75% of primary interviews were conducted with parties from the demand side and supply side, respectively. The primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches were used to estimate the size of the blockchain devices market and other dependent submarkets. Extensive qualitative and quantitative analyses were performed during the complete market engineering process to list the key information/insights throughout the report. The following table explains the process flow for market size estimation.

The key market players were determined through primary and secondary research. The research methodology involved the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) about the blockchain devices market. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market segments covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets.

Blockchain devices Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Breakdown and Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market was also validated using top-down and bottom-up approaches.

Report Objectives

- To define, analyze, and forecast the blockchain devices market based on type, connectivity, application, end users, and region

- To describe and forecast the blockchain devices market, in terms of volume, based on type

- To describe and forecast the market size, in terms of value, for four main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the supply chain of the blockchain devices ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the blockchain devices market

- To benchmark the market players using the proprietary Company Evaluation Quadrant, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape of the market

- To analyze competitive developments such as joint ventures, mergers & acquisitions, product launches and developments, and research and development (R&D) undertaken by the market players

1. Micromarkets are defined as the further segments and subsegments of the blockchain devices market included in the report.

2. Core competencies of companies are captured in terms of their key developments and strategies adopted by them to sustain their position in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blockchain Devices Market