Autosamplers Market by Product (Systems (Liquid Chromatography, GC (Liquid, Headspace, All-in-one)), Accessories (Syringe & Needle, Vial, Septum) & Enduser (Pharmaceutical companies, Oil & Gas, Food & Beverage, Environment testing) & Geography - Global Forecast to 2022

The global autosamplers market is projected to grow at a CAGR of 7.6%. Advantages of autosamplers over manual injection systems, growing importance of chromatography in drug approvals, and increasing production of crude and shale oil are some of the key factors driving the growth of the market.

- Base Year: 2016

- Forecast Period: 2017–2022

Objectives of the study are:

- To describe, segment, and forecast the global autosamplers market by product, end user, and region

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile key players in the market and comprehensively analyze their core competencies2

- To track and analyze competitive developments such as product launches; agreements, partnerships, and joint ventures; mergers and acquisitions; and research and development activities in the global autosamplers industry

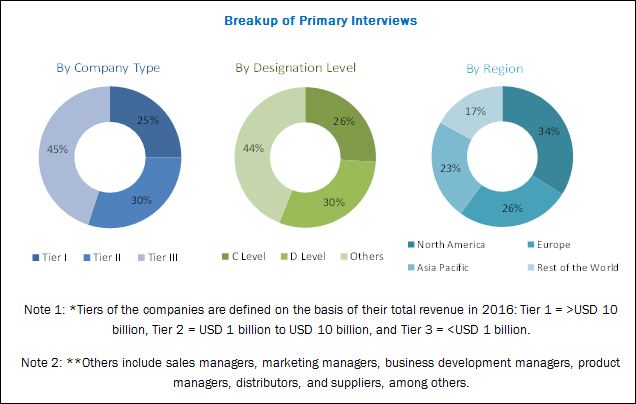

This research study involves the extensive usage of secondary sources, directories, and databases (such as Hoover’s, Bloomberg Business, Factiva, and Avention), in order to identify and collect information useful for this technical, market-oriented, and financial study of the Analytical Standards market. In-depth interviews were conducted with various primary respondents, including subject-matter experts (SMEs), C-level executives of key market players, and industry consultants to obtain and verify qualitative and quantitative information and to assess market prospects.

To know about the assumptions considered for the study, download the pdf brochure

As of 2016, the global autosamplers market was dominated by Agilent (US), Waters (US), Shimadzu (Japan), Thermo Fisher (US), and PerkinElmer (US). These companies accounted for a majority share of the global autosamplers market in 2016. The other players involved in this market include Merck (Germany), Bio-Rad (US), Restek (US), Gilson (US), JASCO (US), and SCION (US).

Stakeholders

- Autosamplers manufacturers, suppliers, and providers

- Chromatography instrument manufacturers

- Chromatography consumable manufacturers

- Third-party chromatography instrument suppliers

- Instrument raw material suppliers

- Environment protection agencies and institutes

- Food and beverage industry

- Pharmaceutical and biotechnology companies

- Cosmetic companies

- Oil & Gas companies

- Market research and consulting firms

- Regulatory bodies

- Research and academic institutes

- Venture capitalists

Scope of the Report

This report categorizes the global autosamplers market into the following segments and subsegments:

Global Autosamplers Market, by Product

-

Autosampler Systems

- LC Autosamplers

-

GC Autosamplers

- Liquid Autosamplers

- Headspace Autosamplers

- All-in-one autosamplers

-

Autosamplers Accessories

- Syringes & Needles

- Vials

- Septum

Global Autosamplers Market, by End user

- Pharmaceutical & Biopharmaceutical Industry

- Oil & Gas Industry

- Food & Beverage Industry

- Environmental Testing Industry

- Other End Users

Global Autosamplers Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the RoW autosamplers market into Latin America, the Middle East, and Africa

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

This report broadly segments the autosamplers market into product and end user. On the basis of product, the market is categorized into autosampler systems and autosampler accessories. The autosampler systems segment is further segmented into liquid chromatography (LC) autosampler and Gas Chromatography (GC) autosampler, while autosampler accessories are further segmented into vials, syringes, needles, and septum. GC autosampler systems are further segmented into three types–liquid, headspace, and all in one.

In 2017, the autosamplers systems segment is expected to account for the largest share. Largest share of this segment is mainly attributed to LC autosamplers systems being adopted rapidly in various industries like pharmaceutical and food & beverages.

Based on end user, the autosamplers market is segmented into pharmaceutical and biopharmaceutical industry, oil and gas industry, food and bevarage industry, Environmental Testing industry, and other end user segment. The pharmaceutical and biopharmaceutical segment is estimated to command the largest share of the global autosamplers market in 2017. Growing importance of chromatography tests in the drug approval process and increasing funds for R&D activities in pharmaceutical and biopharmaceutical industries are key factors driving the growth of the market.

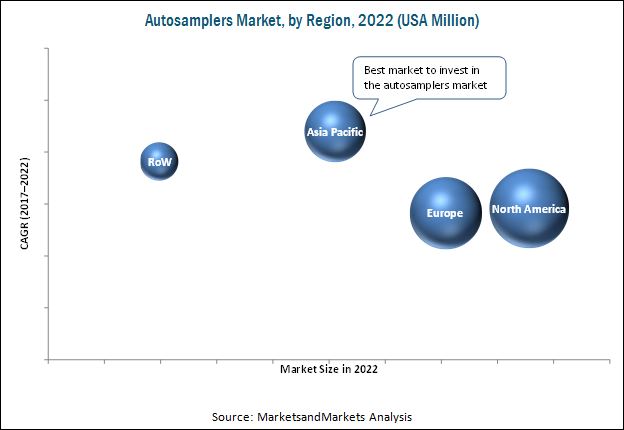

The report covers the autosamplers market across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America is expected to command the largest share of the market in 2017 due to the increasing funds for R&D activities in healthcare industries, growing funding for environmental testing and cleanup activities in the US, government initiatives to improve laboratory infrastructure, and government investments for environmental protection in Canada. However, Asia Pacific is expected to register the highest growth rate during the forecast period, due strategic expansions done by some of major players of autosamplers in China, growth in medical and biomedical research in Japan, and the growing pharmaceutical industry in India.

High cost of autosamplers combined with steep prices of consumables act as a deterrent for widespread acceptance among small and mid-sized end users such as small pharmaceutical & biopharmaceutical companies and academic & research institutes.

The major players of the autosamplers market are Agilent (US), Waters (US), Shimadzu (Japan), Thermo Fisher (US), and PerkinElmer (US). The other players in this market include Merck (Germany), Bio-Rad (US), Restek (US), Gilson (US), JASCO (US), and SCION (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Autosamplers Market: Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Autosamplers Market: Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Research

2.2.1 Secondary Sources

2.3 Primary Research

2.3.1 Primary Sources

2.3.1.1 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.5 Market Breakdown and Data Triangulation

2.6 Research Assumptions

3 Autosamplers Market: Executive Summary (Page No. - 24)

4 Autosamplers Market: Premium Insights (Page No. - 28)

4.1 Global Autosamplers Market (2017–2022)

4.2 Global Autosamplers Market, By Products (2017 vs 2022)

4.3 Global Autosamplers Accessories Market, By Type (2017 vs 2022)

4.4 Global Autosampler Systems Market, By Type (2017 vs 2022)

4.5 Global Autosamplers Systems Market, By End User (2017 vs 2022)

4.6 Global Autosamplers Market, By Country (2017)

5 Autosamplers Market: Overview (Page No. - 33)

5.1 Overview

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Advantages of Autosamplers

5.2.1.2 Growing Importance of Chromatography in Drug Approval

5.2.1.3 Increasing Production of Crude and Shale Oil

5.2.1.4 Collaboration Between Manufacturers and Research Laboratories, Academic Institutes

5.2.1.5 Growing Food Safety Concerns

5.2.1.6 Patent Expiry of Major Drugs and Biomolecules

5.2.2 Restraints

5.2.2.1 Budgetary Constraints of Small and Mid-Size Market Players

5.2.3 Opportunities

5.2.3.1 Emerging Markets Such as India, China, Brazil, and South Africa Offer Significant Growth Opportunities

5.2.3.2 New Oilfield Discoveries

5.2.4 Challenges

5.2.4.1 Dearth of Skilled Professionals

5.2.4.2 Operational Errors

6 Autosamplers Market, By Product Type (Page No. - 39)

6.1 Introduction

6.2 Systems

6.2.1 LC Autosamplers

6.2.2 GC Autosamplers

6.2.2.1 Liquid Autosamplers

6.2.2.2 Headspace Autosamplers

6.2.2.3 All-In-One Autosamplers

6.3 Accessories

6.3.1 Syringes & Needles

6.3.2 Vials

6.3.3 Septum

7 Autosamplers Systems Market, By End User (Page No. - 49)

7.1 Introduction

7.2 Pharmaceutical and Biopharmaceutical Industry

7.3 Oil and Gas Industry

7.4 Environmental Testing Laboratory

7.5 Food & Beverage Industry

7.6 Other End Users

8 Autosamplers Market, By Region (Page No. - 56)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.3 Europe

8.3.1 UK

8.3.2 Germany

8.3.3 France

8.3.4 Rest of Europe (RoE)

8.4 Asia Pacific

8.4.1 China

8.4.2 Japan

8.4.3 India

8.4.4 Rest of APAC

8.5 Rest of the World (RoW)

9 Autosamplers Market: Competitive Landscape (Page No. - 94)

9.1 Market Ranking Analysis, 2016

10 Company Profile (Page No. - 97)

(Business Overview, Products Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments.)*

10.1 Agilent

10.2 Waters

10.3 Shimadzu

10.4 Thermo Fisher

10.5 Perkinelmer

10.6 Merck

10.7 GE Healthcare

10.8 Bio-Rad

10.9 LECO

10.10 Restek

10.11 Gilson

10.12 JASCO

10.13 SCION

10.14 HTA srl

10.15 Falcon

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, Key Relationships Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 137)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (82 Tables)

Table 1 Drugs That Lost Patent Protection Between 2015 & 2017

Table 2 New Oilfields in Different Regions

Table 3 Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 4 Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 5 Autosampler Systems Market, By Region, 2015-2022 (Units)

Table 6 LC Autosampler Systems Market, By Region, 2015-2022 (USD Million)

Table 7 LC Autosamplers Systems Market, By Region, 2015-2022 (Units)

Table 8 GC Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 9 GC Autosamplers Systems Market, By Region, 2015-2022 (USD Million)

Table 10 GC Autosampler Systems Market, By Region, 2015-2022 (Units)

Table 11 GC Liquid Autosamplers Systems Market, By Region, 2015-2022 (USD Million)

Table 12 GC HeaDSPace Autosampler Systems Market, By Region, 2015-2022 (USD Million)

Table 13 GC All-In-One Autosamplers Systems Market, By Region, 2015-2022 (USD Million)

Table 14 Autosampler Accessories Market, By Type, 2015-2022 (USD Million)

Table 15 Autosamplers Accessories Market, By Region, 2015-2022 (USD Million)

Table 16 Autosampler Syringes & Needles Market, By Region, 2015-2022 (USD Million)

Table 17 Autosamplers Vials Market, By Region, 2015-2022 (USD Million)

Table 18 Autosampler Septum Market, By Region, 2015-2022 (USD Million)

Table 19 Autosamplers Systems Market, By End User, 2015-2022 (USD Million)

Table 20 Autosampler Systems Market for the Pharmaceutical and Biopharmaceutical Industry, By Region, 2015-2022 (USD Million)

Table 21 Autosampler Systems Market for the Oil & Gas Industry, By Region, 2015-2022 (USD Million)

Table 22 Autosamplers Systems Market for the Environmental Testing Industry, By Region, 2015-2022 (USD Million)

Table 23 Autosampler Systems Market for the Food & Beverage Industry, By Region, 2015-2022 (USD Million)

Table 24 Autosamplers Systems Market for Other End Users, By Region, 2015-2022 (USD Million)

Table 25 Global Autosamplers Market, By Region, 2015-2022 (USD Million)

Table 26 North America: Autosamplers Market, By Country, 2015-2022 (USD Million)

Table 27 North America: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 28 North America: Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 29 North America: Autosamplers Systems Market, By Type, 2015-2022 (Units)

Table 30 North America: GC Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 31 North America: Autosamplers Accessories Market, By Type, 2015-2022 (USD Million)

Table 32 North America: Autosampler Systems Market, By End User, 2015-2022 (USD Million)

Table 33 US: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 34 US: Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 35 US: Autosamplers Accessories Market, By Type, 2015-2022 (USD Million)

Table 36 Canada: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 37 Canada: Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 38 Canada: Autosamplers Accessories Market, By Type, 2015-2022 (USD Million)

Table 39 Europe: Autosamplers Market, By Country, 2015-2022 (USD Million)

Table 40 Europe: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 41 Europe: Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 42 Europe: Autosamplers Systems Market, By Type, 2015-2022 (Units)

Table 43 Europe: GC Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 44 Europe: Autosampler Accessories Market, By Type, 2015-2022 (USD Million)

Table 45 Europe: Autosamplers Systems Market, By End User, 2015-2022 (USD Million)

Table 46 UK: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 47 UK: Autosamplers Systems Market, By Type, 2015-2022 (USD Million)

Table 48 UK: Autosampler Accessories Market, By Type, 2015-2022 (USD Million)

Table 49 Germany: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 50 Germany: Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 51 Germany: Autosamplers Accessories Market, By Type, 2015-2022 (USD Million)

Table 52 France: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 53 France: Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 54 France: Autosamplers Accessories Market, By Type, 2015-2022 (USD Million)

Table 55 RoE: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 56 RoE: Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 57 RoE: Autosamplers Accessories Market, By Type, 2015-2022 (USD Million)

Table 58 Asia Pacific: Autosamplers Market, By Country, 2015-2022 (USD Million)

Table 59 Asia Pacific: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 60 Asia Pacific: Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 61 Asia Pacific: Autosamplers Systems Market, By Type, 2015-2022 (Units)

Table 62 Asia Pacific: GC Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 63 Asia Pacific: Autosampler Accessories Market, By Type, 2015-2022 (USD Million)

Table 64 Asia Pacific: Autosamplers Systems Market, By End User, 2015-2022 (USD Million)

Table 65 China: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 66 China: Autosamplers Systems Market, By Type, 2015-2022 (USD Million)

Table 67 China: Autosampler Accessories Market, By Type, 2015-2022 (USD Million)

Table 68 Japan: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 69 Japan: Autosamplers Systems Market, By Type, 2015-2022 (USD Million)

Table 70 Japan: Autosampler Accessories Market, By Type, 2015-2022 (USD Million)

Table 71 India: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 72 India: Autosamplers Systems Market, By Type, 2015-2022 (USD Million)

Table 73 India: Autosampler Accessories Market, By Type, 2015-2022 (USD Million)

Table 74 RoAPAC: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 75 RoAPAC: Autosamplers Systems Market, By Type, 2015-2022 (USD Million)

Table 76 RoAPAC: Autosampler Accessories Market, By Type, 2015-2022 (USD Million)

Table 77 RoW: Autosamplers Market, By Product Type, 2015-2022 (USD Million)

Table 78 RoW: Autosamplers Systems Market, By Type, 2015-2022 (USD Million)

Table 79 RoW: Autosampler Systems Market, By Type, 2015-2022 (Units)

Table 80 RoW: GC Autosampler Systems Market, By Type, 2015-2022 (USD Million)

Table 81 RoW: Autosamplers Accessories Market, By Type, 2015-2022 (USD Million)

Table 82 RoW: Autosampler Systems Market, By End User, 2015-2022 (USD Million)

List of Figures (30 Figures)

Figure 1 Autosamplers Market: Research Design

Figure 2 Autosamplers Market: Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 3 Autosamplers Market: Bottom-Up Approach

Figure 4 Autosamplers Market: Top-Down Approach

Figure 5 Autosamplers Market, By Product, 2017 & 2022

Figure 6 Autosampler Systems Market, By Type, 2017 & 2022

Figure 7 Autosamplers Accessories Market, By Type, 2017 & 2022

Figure 8 Autosampler Systems Market, By End User, 2017

Figure 9 Geographical Snapshot of the Global Autosamplers Market, 2017

Figure 10 Growing Importance of Chromatography in Drug Approvals to Drive the Growth of the Autosamplers Market

Figure 11 Autosamplesr Systems Will Continue to Dominate the Autosamplers Market During Forecast Period

Figure 12 Vials Will Continue to Dominate the Autosampler Accessories Market During the Forecast Period

Figure 13 LC Autosamplers Systems Will Continue to Dominate the Autosampler Systems Market During the Forecast Period

Figure 14 Pharmaceutical & Biopharmaceutical Industry Will Continue to Dominate the Autosamplers Systems Market During the Forecast Period

Figure 15 North America is Expected to Dominate the Autosamplers Market in 2017

Figure 16 Autosamplers Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 North America Autosampler Market Snapshot

Figure 18 Europe Autosamplers Market Snapshot

Figure 19 Asia Pacific Autosamplers Market Snapshot

Figure 20 Rest of the World Autosampler Market Snapshot

Figure 21 Global Autosamplers Market Ranking, 2016

Figure 22 Agilent: Company Snapshot

Figure 23 Waters: Company Snapshot

Figure 24 Shimadzu: Company Snapshot

Figure 25 Thermo Fisher : Company Snapshot

Figure 26 Perkinelmer: Company Snapshot

Figure 27 Merck: Company Snapshot

Figure 28 GE Healthcare: Company Snapshot

Figure 29 Bio-Rad: Company Snapshot

Figure 30 Techcomp : Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Autosamplers Market