Autonomous Navigation Market by Solution (Hardware (Sensing Systems, Processing Units), and Software (AI)), Platform (Airborne (Autonomous Aircraft, Autonomous Drones), Land, Marine, Space, Weapons), Application, and Region – Global Forecast to 2028

Updated on: 10/7/2024

Autonomous Navigation Market Size & Growth

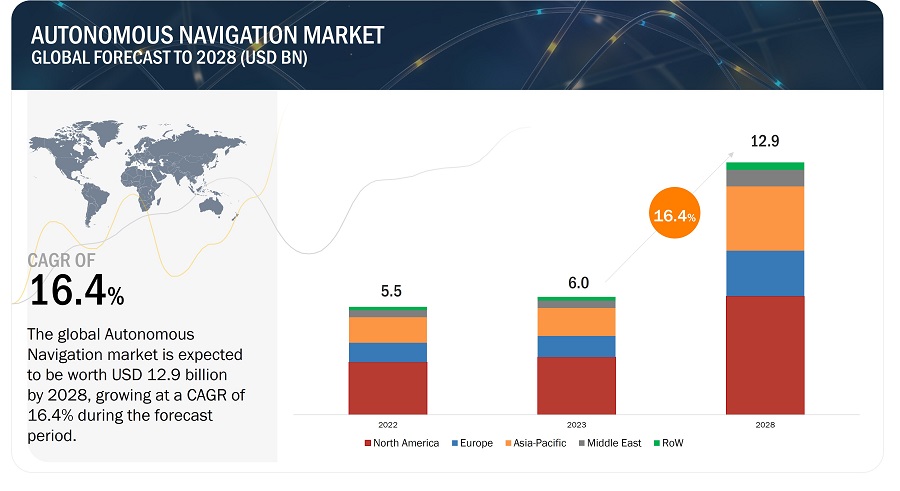

Autonomous Navigation Market size is estimated to be USD 6.0 billion in 2023 and is projected to reach USD 12.9 billion by 2028, at a CAGR of 16.4% during the forecast period. The Autonomous Navigation Industry is driven by factors such as growing efforts aimed at advancing autonomous systems and increasing the adoption of 5G and AI.

Autonomous Navigation Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Autonomous Navigation Market Trends

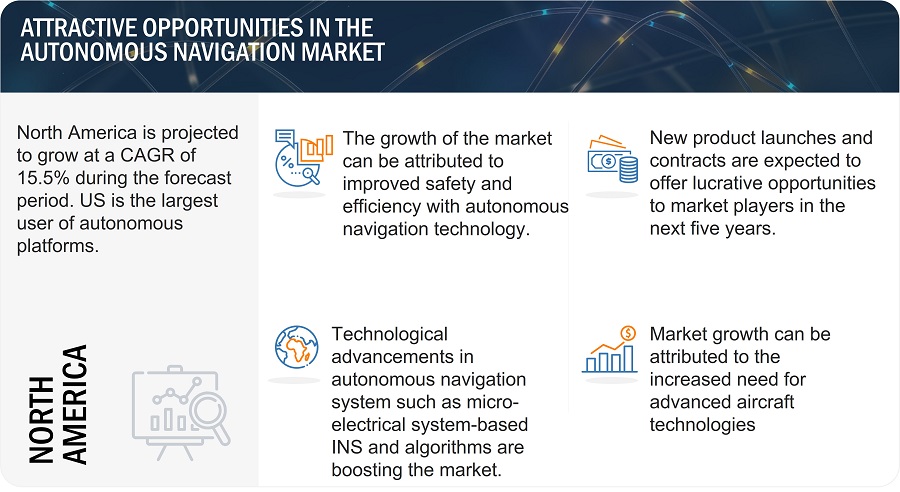

Drivers: Improved safety and efficiency with autonomous navigation technology

Autonomous navigation systems contribute to improved safety by reducing the risks associated with human error and enhancing the ability to respond to changing conditions. Human operators can make mistakes due to factors like fatigue, distraction, or limited situational awareness. In contrast, autonomous systems operate with consistent accuracy and reliability, minimizing the likelihood of errors. Autonomous vehicles can maintain safe distances, detect and respond to obstacles or pedestrians, and execute precise maneuvers in real-time. This significantly reduces the probability of accidents and improves overall safety. Additionally, autonomous systems can be deployed in high-risk environments, such as disaster zones or military operations, where human involvement could be dangerous. By removing humans from such hazardous situations, autonomous navigation helps safeguard human lives and ensures the continuity of critical operations.

Besides, autonomous navigation also offers enhanced efficiency through optimized path planning, continuous operation, resource management, and streamlined processes. Autonomous systems can analyze real-time data from various sensors and algorithms to determine the most efficient routes, considering factors like traffic conditions, fuel consumption, or time constraints. This results in minimized travel times, reduced fuel consumption, and improved overall productivity. Moreover, autonomous systems can operate continuously without the need for breaks or rest, leading to increased operational uptime and faster task completion. For instance, in the logistics industry, autonomous vehicles can operate round-the-clock, enabling faster delivery times and improved customer satisfaction. Autonomous navigation also enables intelligent resource management, where systems can optimize the usage of energy, fuel, or materials based on real-time data. This reduces waste, minimizes costs, and supports sustainable practices. Furthermore, by automating navigation tasks and eliminating manual errors and time-consuming procedures, autonomous navigation streamlines processes, enhancing overall operational efficiency.

The advantages of improved safety and efficiency through autonomous navigation are demonstrated in various real-world applications. For instance, in the aerospace industry, autonomous drones are employed for aerial inspections of infrastructure, reducing the need for humans to access dangerous or hard-to-reach areas. This improves safety and efficiency in inspection processes. In the transportation sector, autonomous vehicles are being developed and tested extensively. These vehicles aim to reduce accidents caused by human error, optimize traffic flow, and enable efficient use of road infrastructure. Additionally, autonomous robots are used in industries like manufacturing and warehousing to streamline processes, increasing efficiency and reducing the risk of accidents caused by human interaction with heavy machinery.

Restraints: Unproven performance in unfamiliar environments and inadequate high-level interfacing

When autonomous navigation systems are untested or unproven in certain environments, there may be concerns about their reliability, safety, and ability to handle unpredictable or challenging conditions. This can create hesitation and reluctance in adopting autonomous navigation solutions, particularly in critical applications such as aerospace and defense.

Furthermore, the lack of high-level interfacing, which refers to seamless integration and communication between autonomous systems and existing infrastructure or systems, can impede the adoption and scalability of autonomous navigation. Interfacing challenges may arise when autonomous navigation systems need to interact with legacy infrastructure, other autonomous systems, or human-operated vehicles or equipment. The lack of standardized protocols or interfaces can hinder interoperability, data sharing, and coordinated decision-making, leading to limited acceptance and utilization of autonomous navigation technologies.

Addressing these limitations requires comprehensive testing and validation of autonomous navigation systems in a wide range of environments and scenarios to demonstrate their performance and reliability. Additionally, establishing robust and standardized high-level interfacing protocols is essential to ensure seamless integration and interoperability with existing systems, enabling the widespread adoption and effective deployment of autonomous navigation.

Opportunities: Increasing adoption of 5G and AI

The increasing adoption of artificial intelligence (AI) technology can significantly boost the demand for autonomous navigation systems. AI plays a crucial role in enabling autonomous navigation by providing advanced algorithms, machine learning capabilities, and real-time decision-making capabilities. As AI continues to advance, it enhances the perception, interpretation, and decision-making abilities of autonomous navigation systems, leading to improved safety, efficiency, and reliability. The ability of AI to analyze vast amounts of data, learn from experience, and adapt to changing environments makes it a key driver in the development and deployment of autonomous navigation. The growing recognition of AI's potential to revolutionize various industries, such as transportation, logistics, and defense, is fueling the demand for autonomous navigation systems. Organizations and industries are increasingly realizing the benefits of autonomous systems, such as increased operational efficiency, reduced human error, and enhanced safety. As a result, there is a growing demand for autonomous navigation technologies that leverage AI, leading to the development and innovation of advanced sensors, computing systems, and intelligent algorithms to meet these requirements.

Additionally, with developments in technologies and AI algorithms, the cost of unmanned vehicles has decreased. While LiDAR unmanned ground vehicle units used to cost USD 85,000 until a few years back, their current price has decreased to well under USD 10,000. As the trend persists, the return on investment is growing, particularly for retailers such as grocers, where uninterrupted and repetitive deliveries could help them accomplish economies of scale on their investments. Moreover, with the utilization of natural language processing, AI, and cloud computer networking, AGVs can boost the speed and efficiency of unmanned vehicles. These factors are likely to boost the development of autonomous navigation systems.

Challenges: Unclear regulatory framework for autonomous systems use

Currently, legislation related to the operation of autonomous robots is not clear. In marine, the International Maritime Organization (IMO) requires all vessels deployed in international waters to have the minimum number of crew on board. Standards regarding the construction and safety of autonomous ships are also of great concern for the regulators as it will be dangerous to ply the ships without proper ground rules related to safety. Members of the Advanced Autonomous Waterborne Applications Initiative (AAWA) project and two other European groups are working toward formulating a regulatory framework for fully autonomous ships. In the UK, the Maritime Autonomous Systems Regulatory Working Group is already working on a regulatory framework for autonomous ships to ensure its adoption by the International Convention on Safety of Life at Sea.

Current conventions, such as SOLAS (Safety of Life at Sea) and COLREGs (Collision Regulations), need to update technical and operational standards for autonomous ships so as to include commercial agreements, such as management, insurance, and chartering.

Below are some of the key signed conventions for commercial ships after the formation of IMO in 1948.

- Convention on the International Regulations for Preventing Collisions at Sea (COLREGs)

- The International Management Code for the Safe Operations of Ships and for Pollution Prevention (ISM code)

- The International Convention of Standards of Training, Certification, and Watchkeeping for Seafarers (STCW)

- The International Convention for the Prevention of Pollution from Ships (MARPOL)

- The International Convention on Maritime Search and Rescue (SAR)

- The International Convention on Load Lines (CLL68/88)

- The International Convention for Safe Containers The Double Hull/Double Bottom (DH/DB) Regulation

- The International Convention of the Maritime Satellite Organization (INMARSAT)

As and when autonomous vehicles penetrate the consumer market, they are likely to be used for commute. This will raise the possibility of accidents, resulting in a series of lawsuits and court proceedings as the autonomous technology expands its breadth and depth. Hence, many possible scenarios need to be tested before introducing autonomous cars in the market. Unclear regulatory policies can hamper the growth of autonomous robots, subsequently inhibiting the market growth for autonomous navigation.

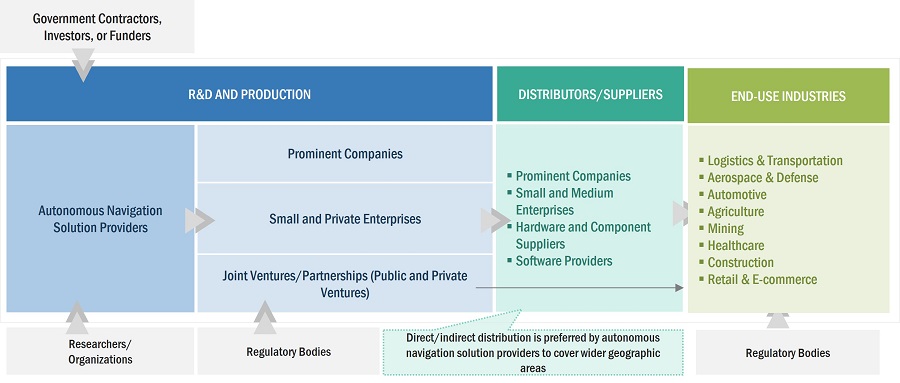

Autonomous Navigation Market Ecosystem

Autonomous Navigation Market Segmentation

Based on solution, the hardware segment of the market is projected to grow at the second highest CAGR from 2023 to 2028.

Based on the solution, the autonomous navigation market has been segmented into hardware and software. Hardware advancements in autonomous navigation have revolutionized the field, with sensors, processors, and connectivity driving vehicles to perceive their surroundings, make swift decisions, and navigate securely. These technological strides have paved the way for the practical implementation of self-driving cars and other autonomous systems.

Based on platform, the airborne segment of the market is projected to grow at the second highest CAGR from 2023 to 2028.

Based on the platform, the autonomous navigation market has been segmented into airborne, land, marine space, and weapons. Increasing investments in the development of autonomous aircraft and UAVs are expected to drive the airborne segment’s market. The market for autonomous aircraft is expected to commercialize by 2024 in a few countries, and this commercialization is anticipated to exponentially increase in other countries post-2026. Increasing demand for autonomous aircraft for passenger travel and freight transport is expected to drive the autonomous aircraft navigation market.

Autonomous Navigation Market Regional Analysis

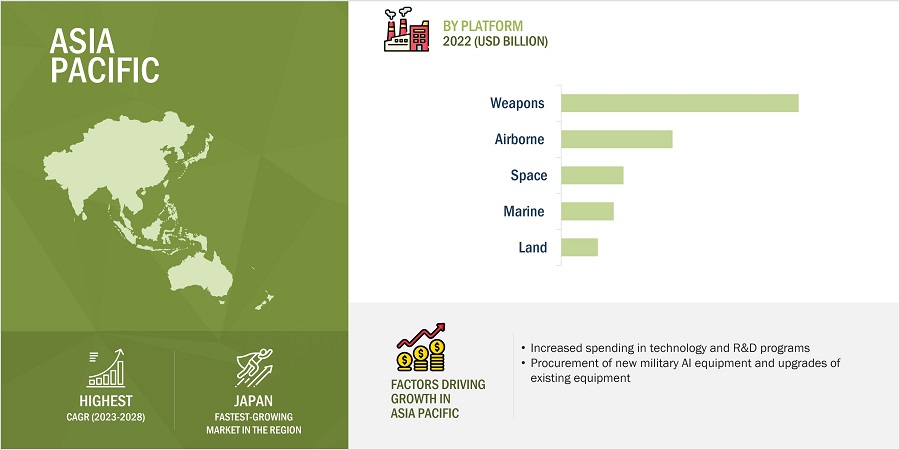

Asia Pacific is expected to account for the highest CAGR in the forecasted period.

Asia Pacific is estimated to account for the highest CAGR in the forecasted period. Asia Pacific, which comprises emerging economies, such as China and India, and developed nations, such as Japan, is the largest market for automobiles. In recent years, the region has also emerged as a hub for automobile production. Infrastructural developments and industrialization in emerging economies have opened new avenues, creating several opportunities for automotive OEMs. The growing purchasing capability of the population has triggered the demand for automobiles, thereby increasing the demand for the autonomous navigation market.

Autonomous Navigation Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Autonomous Navigation Companies: Key Market Players

Key players covered in market scope such as Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Thales Group (France), Safran SA (France), and Honeywell International Inc. (US). The report covers various industry trends and new technological innovations in the Autonomous Navigation Companies for the period 2020-2028.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate (CAGR) |

16.4% |

|

Estimated Market Size in 2023 |

USD 6 Billion |

|

Projected Market Size in 2028 |

USD 12.9 Billion |

|

Market size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Solution, By Platform, By Application, |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East, and Rest of the World |

|

Companies covered |

Honeywell International Inc. (US), Thales Group (France), Northrop Grumman Corporation (US), General Dynamics Corporation (US), RH Marine (Netherlands), and Raytheon Technologies Corporation (US) |

Autonomous Navigation Market Highlights

The study categorizes autonomous navigation based on solution, platform, application, and region.

|

Segment |

Subsegment |

|

By Solution |

|

|

By Platform |

|

|

By Application |

|

|

By Region |

|

Recent Developments

- In June 2023, Northrop Grumman Corporation secured a production contract from the US Navy. As part of this contract, the company will develop a new AN/WSN-12 Inertial Sensor Module (ISM), which is a next-generation sensor that significantly enhances surface ships and submarines’ maritime navigation in areas where GPS is not available.

- In March 2023, Raytheon Technologies Corporation won a contract from the US Army to develop an autonomous navigation system for the Optionally Manned Fighting Vehicle (OMFV). This system will use artificial intelligence and machine learning to enable the OMFV to navigate autonomously in complex terrain.

- In March 2023, Safran SA developed a dynamic ecosystem of dependable navigation & timing solutions by utilizing its global expertise in the field. The company has increased its focus on innovation as it understands the development of precise and consistent signals from Global Navigation Satellite Systems (GNSS) has become increasingly important for advancements in aerospace technology, defense, autonomous vehicles, vital infrastructure, and even commercial products.

- In December 2022, Raytheon Technologies Corporation collaborated with the US Air Force to develop an autonomous navigation system for the Next Generation Bomber (NGB). This system will use artificial intelligence and machine learning to enable the NGB to navigate autonomously in contested airspace.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Autonomous navigation market?

Response: The rising adoption of autonomous robots for logistic operations and the incorporation of advanced sense and avoid systems in unmanned vehicles are a few growth prospects of the autonomous navigation market.

What are the key sustainability strategies adopted by leading players operating in the Autonomous navigation market?

Response: Major players in the autonomous navigation industry have introduced various organic and inorganic strategies to make their presence in the market. The key players include Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Thales Group (France), Safran SA (France), and Honeywell International Inc. (US). These players have adopted many sustainable strategies, such as new product launches, acquisitions, partnerships & agreements, and contracts to strengthen their position in the market.

What are the new emerging technologies and use cases disrupting the autonomous navigation market?

Response: The emerging technologies in the autonomous navigation market are sensor fusion solutions, control algorithms, Micro-electro-mechanical systems based inertial navigation systems, and high-end Inertial Navigation Systems (INS).

What is the current size of the autonomous navigation market?

Response: The autonomous navigation market is expected to grow from an estimated USD 6.0 billion in 2023 to USD 12.9 billion by 2028 at a CAGR of 16.4% from 2023 to 2028.

What are some of the opportunities in the autonomous navigation market?

Response: Growing efforts aimed at advancing autonomous systems, assistance, and services offered by autonomous robots and increasing adoption of 5G and AI are a few of the opportunities of the autonomous navigation market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Incorporation of advanced sense and avoid systems in unmanned vehicles- Widespread adoption of autonomous robots for commercial and military applications- Improved safety and efficiency with autonomous navigation technology- Rising adoption of autonomous robots for logistic operationsRESTRAINTS- Unproven performance in unfamiliar environments and inadequate high-level interfacing- Lack of required infrastructure for autonomous systems in emerging economiesOPPORTUNITIES- Increasing adoption of 5G and AI- Growing efforts aimed at advancing autonomous systems- Assistance and services offered by autonomous robotsCHALLENGES- Vulnerability of autonomous systems to cyber threats due to automation- Unclear regulatory framework for use of autonomous systems

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR AUTONOMOUS NAVIGATION MANUFACTURERS

-

5.5 AUTONOMOUS NAVIGATION MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND-USE INDUSTRIES

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.7 TRADE DATA STATISTICS

- 5.8 PRICING ANALYSIS

- 5.9 REGULATORY LANDSCAPE

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.11 KEY CONFERENCES AND EVENTS IN 2023–2024

- 6.1 INTRODUCTION

-

6.2 KEY TECHNOLOGICAL TRENDS IN AUTONOMOUS NAVIGATION MARKETNAVIGATION TECHNOLOGY FOR AUTONOMOUS SYSTEMS- Sensor fusion solutions- Control algorithms- Research on standard operating systems for robots- Micro-electro-mechanical systems-based inertial navigation systems- High-end inertial navigation systems

- 6.3 TECHNOLOGY ROADMAP

-

6.4 USE CASE ANALYSISAUTONOMOUS DELIVERY DRONES IN URBAN ENVIRONMENTSAUTONOMOUS MINING TRUCKS IN OPEN-PIT MINES

-

6.5 IMPACT OF MEGATRENDSARTIFICIAL INTELLIGENCEBIG DATA ANALYTICSSATELLITE NAVIGATION

- 6.6 INNOVATIONS AND PATENT REGISTRATIONS

- 7.1 INTRODUCTION

-

7.2 AIRBORNEAUTONOMOUS AIRCRAFT- Increasing demand for autonomous aircraft to drive airborne autonomous navigation marketAUTONOMOUS DRONES- Increasing need for air medical services and cargo delivery in commercial and military sectors to drive demand for navigation systems in autonomous drones

-

7.3 LANDAUTONOMOUS VEHICLES- High demand from military and commercial sectors to drive market for autonomous self-driving vehiclesAUTONOMOUS TRAINS- Need for efficient transportation, low electricity consumption, and more passenger room to drive demand for autonomous trains.AUTONOMOUS INDUSTRIAL ROBOTS- Increasing demand for autonomous industrial robots in logistics to drive market

-

7.4 MARINEAUTONOMOUS SHIPS- Increasing investments in autonomous ships to drive marketAUTONOMOUS SURFACE VEHICLES- Increasing demand from commercial and defense sectors to drive market for autonomous surface vehiclesAUTONOMOUS UNDERWATER VEHICLES- Growing military and commercial operations to drive demand for autonomous underwater vehicles

-

7.5 SPACEINCREASING DEMAND FOR SPACE EXPLORATION ACTIVITIES TO DRIVE MARKET

-

7.6 WEAPONSTACTICAL MISSILES- Rising military testing to drive demand for autonomous tactical missilesGUIDED ROCKETS- Advancements in autonomous guided rockets to drive demandGUIDED AMMUNITION- Rising deployment of autonomous guided ammunition to drive segmentTORPEDOES- Increased flexibility, operational range, and improved effectiveness in underwater warfare to drive demand for torpedoesLOITERING MUNITION- Advancements in drone technology to drive loitering munition segment

- 8.1 INTRODUCTION

-

8.2 COMMERCIALINCREASING DEMAND FOR AUTONOMOUS ROBOTS IN LOGISTICS, AUTOMOTIVE, AND MARINE SECTORS TO DRIVE COMMERCIAL SEGMENT

-

8.3 MILITARY & GOVERNMENTAPPLICATION OF ROBOTS IN SURVEILLANCE OPERATIONS AND DECLINE IN CASUALTIES DUE TO REPLACEMENT OF HUMANS WITH OFFENSIVE ROBOTS TO DRIVE MILITARY & GOVERNMENT SEGMENT

- 9.1 INTRODUCTION

-

9.2 HARDWARESENSING SYSTEMS- INS- GNSS- Radar- LiDAR- Ultrasonic systems- Cameras- AIS- OthersPROCESSING UNITS- Growing requirement for sensors in autonomous platforms to increase demand for processing units

-

9.3 SOFTWAREARTIFICIAL INTELLIGENCE- Machine learning- Computer vision

- 10.1 INTRODUCTION

- 10.2 REGIONAL RECESSION IMPACT ANALYSIS

-

10.3 NORTH AMERICARECESSION IMPACT ANALYSIS: NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Increasing investment in autonomous vehicles and systems to enhance safety and reduce human effortCANADA- Growing demand for industrial robots, increasing government grants & funds, and growing venture capital investments to drive market

-

10.4 EUROPERECESSION IMPACT ANALYSIS: EUROPEPESTLE ANALYSIS: EUROPEUK- Rising government investment in R&D activities to drive marketFRANCE- Surge in demand for autonomous robots from various industries to drive marketGERMANY- Increasing investment in autonomous cars and ships to drive marketRUSSIA- Surge in adoption of ships with advanced navigation capability to boost marketITALY- Increasing investment in autonomous UAVs to drive marketREST OF EUROPE

-

10.5 ASIA PACIFICRECESSION IMPACT ANALYSIS: ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Increasing demand for efficient transportation solutions and military modernization to boost marketINDIA- Increasing focus on improving defense capabilities and border surveillance to boost marketJAPAN- Increasing aging population and advancements in mobility solutions to drive marketSOUTH KOREA- Increasing investment in autonomous cars to drive marketAUSTRALIA- Growing investment in autonomous cars and UAVs to drive marketREST OF ASIA PACIFIC

-

10.6 MIDDLE EASTRECESSION IMPACT ANALYSIS: MIDDLE EASTPESTLE ANALYSIS: MIDDLE EASTISRAEL- Increasing investment in autonomous robots to drive marketUAE- Growing adoption of self-driving cars to drive marketSAUDI ARABIA- High investment in mass transit systems to drive marketREST OF MIDDLE EAST

-

10.7 REST OF THE WORLDLATIN AMERICA- Increasing investment in autonomous vehicles to drive marketAFRICA- Increasing investment in developing autonomous cars to drive market

- 11.1 INTRODUCTION

- 11.2 RANKING ANALYSIS OF KEY PLAYERS IN AUTONOMOUS NAVIGATION MARKET, 2022

- 11.3 REVENUE ANALYSIS, 2022

- 11.4 MARKET SHARE ANALYSIS, 2022

-

11.5 COMPETITIVE EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALSOTHERS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNORTHROP GRUMMAN CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MNM viewSAFRAN SA- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewABB- Business overview- Products/Services/Solutions offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsGENERAL DYNAMICS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsROLLS-ROYCE PLC- Business overview- Products/Services/Solutions offered- Recent developmentsMOOG INC.- Business overview- Products/Services/Solutions offered- Recent developmentsKONGSBERG GRUPPEN ASA- Business overview- Products/Services/Solutions offeredRH MARINE- Business overview- Products/Services/Solutions offeredTRIMBLE INC.- Business overview- Products/Services/Solutions offered- Recent developmentsFURUNO ELECTRIC CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments

-

12.3 OTHER PLAYERSSHIELD AISKYDIO, INC.NEAR EARTH AUTONOMY INC.CLEARPATH ROBOTICS INC.BLUEBOTICSVELODYNE LIDAR, INC.LEDDARTECH INC.NOVATEL INC.SEA MACHINESAUTONODYNE LLC

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 AUTONOMOUS NAVIGATION MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 LIST OF PRODUCTS WITH AUTONOMOUS NAVIGATION CAPABILITIES

- TABLE 4 TIMELINE AND DESIGN DEVELOPMENT TARGETS FOR AUTONOMOUS SHIPS

- TABLE 5 AUTONOMOUS DRIVING INITIATIVES BY AUTOMAKERS

- TABLE 6 AUTONOMOUS NAVIGATION MARKET ECOSYSTEM

- TABLE 7 AUTONOMOUS NAVIGATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 COUNTRY-WISE IMPORTS, 2019-2021 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE EXPORTS, 2019-2021 (USD THOUSAND)

- TABLE 10 COST OF INERTIAL NAVIGATION SYSTEMS OFFERED BY INS MANUFACTURERS FOR VARIOUS GRADES

- TABLE 11 AUTONOMOUS NAVIGATION MARKET: REGULATORY LANDSCAPE

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- TABLE 14 AUTONOMOUS NAVIGATION MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 15 INNOVATIONS AND PATENT REGISTRATIONS, 2022

- TABLE 16 AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 17 AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 18 AIRBORNE: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 19 AIRBORNE: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 20 LAND: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 21 LAND: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 22 MARINE: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 23 MARINE: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 24 WEAPONS: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 25 WEAPONS: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 26 AUTONOMOUS NAVIGATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 27 AUTONOMOUS NAVIGATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 29 AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 30 AUTONOMOUS NAVIGATION MARKET, BY HARDWARE SOLUTION, 2020–2022 (USD MILLION)

- TABLE 31 AUTONOMOUS NAVIGATION MARKET, BY HARDWARE SOLUTION, 2023–2028 (USD MILLION)

- TABLE 32 SENSING SYSTEMS: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 33 SENSING SYSTEMS: AUTONOMOUS NAVIGATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 34 AUTONOMOUS NAVIGATION MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 35 AUTONOMOUS NAVIGATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 37 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 42 US: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 43 US: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 44 US: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 45 US: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 46 CANADA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 47 CANADA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 48 CANADA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 49 CANADA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 50 EUROPE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 51 EUROPE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 52 EUROPE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 53 EUROPE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 54 EUROPE: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 55 EUROPE: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 56 UK: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 57 UK: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 58 UK: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 59 UK: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 60 FRANCE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 61 FRANCE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 62 FRANCE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 63 FRANCE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 64 GERMANY: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 65 GERMANY: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 66 GERMANY: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 67 GERMANY: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 68 RUSSIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 69 RUSSIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 70 RUSSIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 71 RUSSIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 72 ITALY: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 73 ITALY: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 74 ITALY: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 75 ITALY: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 76 REST OF EUROPE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 77 REST OF EUROPE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 78 REST OF EUROPE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 79 REST OF EUROPE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 81 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 83 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 CHINA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 87 CHINA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 88 CHINA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 89 CHINA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 90 INDIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 91 INDIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 92 INDIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 93 INDIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 94 JAPAN: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 95 JAPAN: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 96 JAPAN: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 97 JAPAN: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 98 SOUTH KOREA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 99 SOUTH KOREA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 100 SOUTH KOREA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 101 SOUTH KOREA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 102 AUSTRALIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 103 AUSTRALIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 104 AUSTRALIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 105 AUSTRALIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 110 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 111 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 112 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 113 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 115 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 ISRAEL: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 117 ISRAEL: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 118 ISRAEL: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 119 ISRAEL: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 120 UAE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 121 UAE: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 122 UAE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 123 UAE: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 124 SAUDI ARABIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 125 SAUDI ARABIA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 126 SAUDI ARABIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 127 SAUDI ARABIA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 128 REST OF MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 129 REST OF MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 131 REST OF MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 132 REST OF THE WORLD: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 133 REST OF THE WORLD: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 134 REST OF THE WORLD: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 135 REST OF THE WORLD: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 136 REST OF THE WORLD: AUTONOMOUS NAVIGATION MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 137 REST OF THE WORLD: AUTONOMOUS NAVIGATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 138 LATIN AMERICA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 139 LATIN AMERICA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 140 LATIN AMERICA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 141 LATIN AMERICA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 142 AFRICA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 143 AFRICA: AUTONOMOUS NAVIGATION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 144 AFRICA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 145 AFRICA: AUTONOMOUS NAVIGATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 146 KEY GROWTH STRATEGIES OF LEADING PLAYERS IN AUTONOMOUS NAVIGATION MARKET

- TABLE 147 AUTONOMOUS NAVIGATION MARKET: DEGREE OF COMPETITION

- TABLE 148 COMPANY FOOTPRINT

- TABLE 149 COMPANY PLATFORM FOOTPRINT

- TABLE 150 COMPANY REGION FOOTPRINT

- TABLE 151 PRODUCT LAUNCHES, FEBRUARY 2019–MAY 2023

- TABLE 152 DEALS, JULY 2019–MAY 2023

- TABLE 153 OTHERS, JUNE 2019–MARCH 2023

- TABLE 154 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 155 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 156 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 157 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 158 RAYTHEON TECHNOLOGIES CORPORATION: OTHERS

- TABLE 159 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 160 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 161 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 162 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 163 HONEYWELL INTERNATIONAL INC.: OTHERS

- TABLE 164 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 165 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 166 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 167 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 168 THALES GROUP: COMPANY OVERVIEW

- TABLE 169 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 THALES GROUP: DEALS

- TABLE 171 SAFRAN SA: COMPANY OVERVIEW

- TABLE 172 SAFRAN SA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 173 SAFRAN SA: PRODUCT LAUNCHES

- TABLE 174 SAFRAN SA: DEALS

- TABLE 175 SAFRAN SA: OTHERS

- TABLE 176 ABB: COMPANY OVERVIEW

- TABLE 177 ABB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 178 ABB: PRODUCT LAUNCHES

- TABLE 179 ABB: DEALS

- TABLE 180 ABB: OTHERS

- TABLE 181 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 182 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 183 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 184 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 185 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- TABLE 186 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 187 GENERAL DYNAMICS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 188 GENERAL DYNAMICS CORPORATION: OTHERS

- TABLE 189 ROLLS-ROYCE PLC: COMPANY OVERVIEW

- TABLE 190 ROLLS-ROYCE PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 191 ROLLS-ROYCE PLC: DEALS

- TABLE 192 MOOG INC.: COMPANY OVERVIEW

- TABLE 193 MOOG INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 194 MOOG INC.: OTHERS

- TABLE 195 KONGSBERG GRUPPEN ASA: COMPANY OVERVIEW

- TABLE 196 KONGSBERG GRUPPEN ASA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 197 RH MARINE: COMPANY OVERVIEW

- TABLE 198 RH MARINE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 199 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 200 TRIMBLE INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 201 TRIMBLE INC.: PRODUCT LAUNCHES

- TABLE 202 TRIMBLE INC.: DEALS

- TABLE 203 FURUNO ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 204 FURUNO ELECTRIC CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 205 FURUNO ELECTRIC CO., LTD.: OTHERS

- TABLE 206 SHIELD AI: COMPANY OVERVIEW

- TABLE 207 SKYDIO, INC.: COMPANY OVERVIEW

- TABLE 208 NEAR EARTH AUTONOMY INC.: COMPANY OVERVIEW

- TABLE 209 CLEARPATH ROBOTICS INC.: COMPANY OVERVIEW

- TABLE 210 BLUEBOTICS: COMPANY OVERVIEW

- TABLE 211 VELODYNE LIDAR, INC.: COMPANY OVERVIEW

- TABLE 212 LEDDARTECH INC.: COMPANY OVERVIEW

- TABLE 213 NOVATEL INC.: COMPANY OVERVIEW

- TABLE 214 SEA MACHINES: COMPANY OVERVIEW

- TABLE 215 AUTONODYNE LLC: COMPANY OVERVIEW

- FIGURE 1 AUTONOMOUS NAVIGATION MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

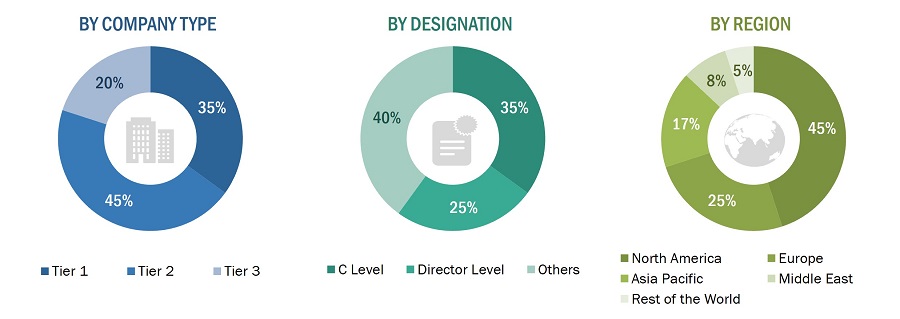

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

- FIGURE 9 HARDWARE SEGMENT TO LEAD AUTONOMOUS NAVIGATION MARKET FROM 2023 TO 2028

- FIGURE 10 COMMERCIAL SEGMENT TO RECORD HIGHER GROWTH RATE THAN MILITARY & GOVERNMENT SEGMENT DURING FORECAST PERIOD

- FIGURE 11 LAND SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 WIDESPREAD ADOPTION OF AUTONOMOUS PLATFORMS IN COMMERCIAL AND MILITARY APPLICATIONS TO DRIVE MARKET

- FIGURE 13 COMMERCIAL SEGMENT TO LEAD MARKET BY 2028

- FIGURE 14 SOFTWARE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 MARINE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 AUTONOMOUS NAVIGATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 POTENTIAL CYBERATTACK ROUTES FOR MARINE VESSELS

- FIGURE 18 VALUE CHAIN ANALYSIS

- FIGURE 19 REVENUE SHIFT IN AUTONOMOUS NAVIGATION MARKET

- FIGURE 20 AUTONOMOUS NAVIGATION MARKET ECOSYSTEM

- FIGURE 21 PORTER’S FIVE FORCES ANALYSIS FOR AUTONOMOUS NAVIGATION MARKET

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- FIGURE 24 TECHNOLOGICAL TRENDS IN AUTONOMOUS NAVIGATION MARKET

- FIGURE 25 AIRBORNE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 COMMERCIAL SEGMENT TO RECORD HIGHER CAGR THAN MILITARY & GOVERNMENT SEGMENT BETWEEN 2023 AND 2028

- FIGURE 27 SOFTWARE SEGMENT TO RECORD HIGHER CAGR THAN HARDWARE SEGMENT DURING FORECAST PERIOD

- FIGURE 28 REGIONAL SNAPSHOT: GROWTH RATE ANALYSIS, 2023–2028

- FIGURE 29 NORTH AMERICA: AUTONOMOUS NAVIGATION MARKET SNAPSHOT

- FIGURE 30 EUROPE: AUTONOMOUS NAVIGATION MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: AUTONOMOUS NAVIGATION MARKET SNAPSHOT

- FIGURE 32 MIDDLE EAST: AUTONOMOUS NAVIGATION MARKET SNAPSHOT

- FIGURE 33 RANKING OF KEY PLAYERS IN AUTONOMOUS NAVIGATION MARKET, 2022

- FIGURE 34 REVENUE ANALYSIS OF KEY COMPANIES IN AUTONOMOUS NAVIGATION MARKET, 2020–2022

- FIGURE 35 AUTONOMOUS NAVIGATION MARKET SHARE ANALYSIS OF KEY COMPANIES, 2022

- FIGURE 36 AUTONOMOUS NAVIGATION MARKET (KEY PLAYERS): COMPANY EVALUATION MATRIX, 2022

- FIGURE 37 AUTONOMOUS NAVIGATION MARKET (STARTUPS/SMES): COMPANY EVALUATION MATRIX, 2022

- FIGURE 38 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 40 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 41 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 42 SAFRAN SA: COMPANY SNAPSHOT

- FIGURE 43 ABB: COMPANY SNAPSHOT

- FIGURE 44 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 45 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 ROLLS-ROYCE PLC: COMPANY SNAPSHOT

- FIGURE 47 MOOG INC.: COMPANY SNAPSHOT

- FIGURE 48 KONGSBERG GRUPPEN ASA: COMPANY SNAPSHOT

- FIGURE 49 TRIMBLE INC.: COMPANY SNAPSHOT

- FIGURE 50 FURUNO ELECTRIC CO., LTD.: COMPANY SNAPSHOT

This research study on the autonomous navigation market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva, to identify and collect information relevant to the market. Primary sources included industry experts as well as manufacturers, system providers, technology developers, alliances, and organizations related to the segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market and assess its growth prospects.

Secondary Research

Secondary sources referred to for this research study included financial statements of companies offering autonomous navigation for all types of applications, such as commercial, military, business & general aviation, unmanned aerial vehicles, and advanced air mobility, along with various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents. The ranking analysis of companies in the autonomous navigation market was determined using secondary data from paid and unpaid sources and by analyzing product portfolios and service offerings of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the autonomous navigation market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. This primary data was collected through questionnaires, emails, and telephonic interviews. In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as vice presidents, directors, regional managers, technology providers, product development teams, distributors, and end users.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the trends related to technology, application, platform, and region. Stakeholders from the demand side, such as CXOs, production managers, engineers, and installation teams of end users, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and future outlook of their business, which could affect the autonomous navigation market.

To know about the assumptions considered for the study, download the pdf brochure

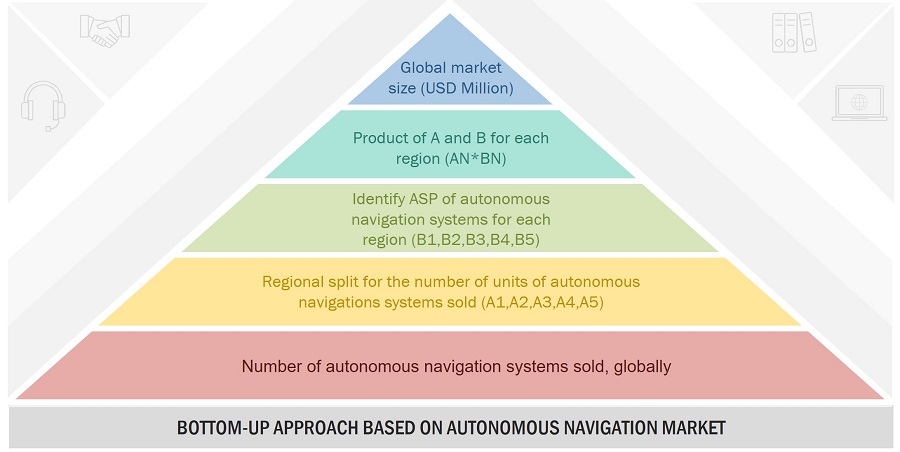

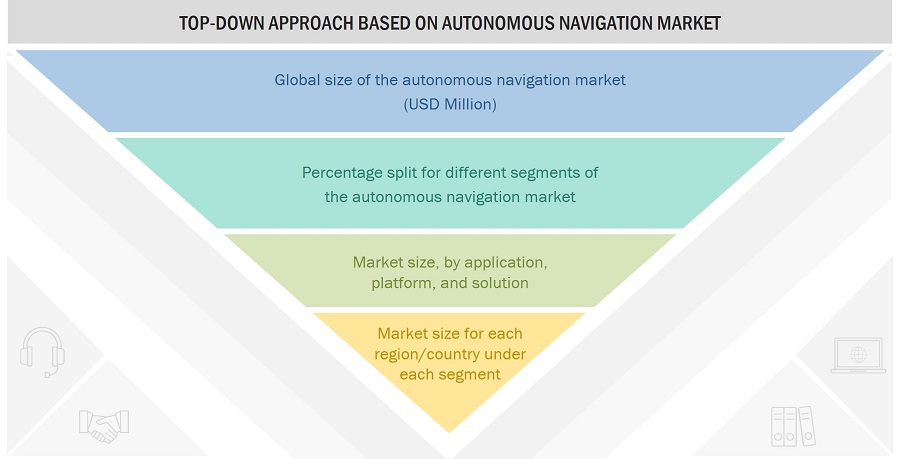

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the autonomous navigation market. These methods were also used extensively to estimate the size of various segments and sub-segments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Bottom-Up Approach

Top Down Approach

Market Definition

Autonomous navigation includes all the sensors used by a platform to plan and execute its maneuver without human intervention. While there are some remote navigation aids used in the planning process, the platform does have its own set of sensors. The platform can also use visual and acoustic sensing for navigation. Based on the information gathered from various sensors, machine intelligence is applied to help the platform decide its course of action in reaching its destination.

Key Stakeholders

- Original Equipment Manufacturers (OEMs)

- Suppliers of Autonomous Navigation Solutions

- Software/Hardware/Service/Solution Providers

- Platform End Users

- Defense Agencies

- Research Centers for Autonomous Mobility

- Regulatory Authorities

Objectives of the Report

- To define, describe, and forecast the size of the autonomous navigation market based on platform, application, and solution, along with regional analysis.

- To forecast the size of different segments of the market with respect to five key regions, namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with their key countries

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To identify technology trends currently prevailing in the market

- To provide an overview of the tariff and regulatory landscape with respect to autonomous navigation across different regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To analyze the impact of the recession on the market and its stakeholders

- To profile the leading market players and comprehensively analyze their market share and core competencies.

- To analyze the degree of competition in the market by identifying key growth strategies, such as constant innovation, high R&D investments, new product and software launches, collaborations & expansions, contracts, acquisitions, partnerships, and agreements, adopted by the leading market players.

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the autonomous navigation market, along with a ranking analysis, market share analysis, and revenue analysis of the key players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the autonomous navigation market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the autonomous navigation market.

Growth opportunities and latent adjacency in Autonomous Navigation Market