Automotive Upholstery Market by Application (Carpets, Dashboards, Roof Liners, Seat Covers, Sun Visors & Trunk Liners), Upholstery Materials, Fabric Type (Non-woven & Woven), Integrated Technology, Vehicle Type, and Region - Global Forecast to 2025

[173 Pages Report] The global automotive upholstery market size was valued at USD 4.39 billion in 2016 and is expected to reach USD 7.74 billion by 2025 at a CAGR of 6.59% during the forecast period 2017-2025. The base year for the report is 2016 and the forecast period is 2017–2025. The market for automotive upholstery is primarily driven by the growing vehicle production, consumer demand for in-vehicle comfort and customized automotive interiors. Additionally, the market is also influenced by the increasing level of driving automation and progress toward fully autonomous vehicles.

Objectives of the Report

- To define, describe, and project the automotive upholstery market (2015–2025), in terms of volume (tons) and value (USD thousand)

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To analyze and forecast the market and forecast the market size, by volume and value, based on application, upholstery materials, fabric type, integrated technology, vehicle type, and region

- To forecast the market size, by volume and value, of the market for four regions, namely, North America, Europe, Asia Oceania, and the Rest of the World (RoW)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product development, and expansions in the market

The research methodology used in the report involves primary and secondary sources and follows bottom-up and top-down approaches for data triangulation. The study involves country-level OEM and model-wise analysis of automotive upholstery applications. This analysis involves historical trends as well as existing penetrations by country as well as vehicle type. The analysis is projected based on various factors such as growth trends in vehicle production and regulations or mandates on the usage of automotive interior upholstery materials. The analysis has been discussed and validated by primary respondents, which include experts from the automotive upholstery industry, manufacturers, and suppliers. Secondary sources include associations such as International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), and paid databases and directories such as Factiva and Bloomberg.

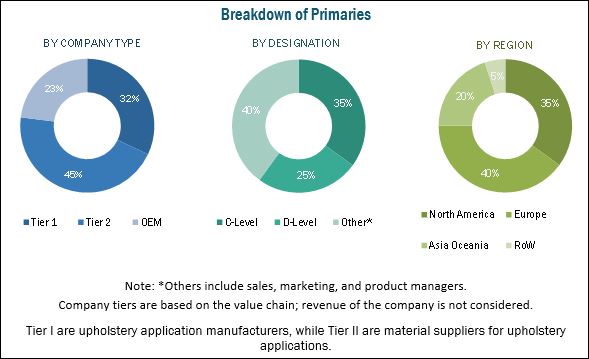

The below figure illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive upholstery market consists of automotive interior application providers such as Lear Corporation (US), Adient PLC (Ireland), and Toyota Boshoku Corporation (Japan). These applications are supplied to automotive OEMs such as BMW Group (Germany), Daimler AG (Germany), Volkswagen AG (Germany), and others.

Target Audience

- Automotive interior manufacturers and component suppliers

- Automotive interior upholstery manufacturers

- Automotive upholstery raw material suppliers

- Automotive OEMs

- Industry associations and other driver assistance systems manufacturers

- The automobile industry and related end-user industries

Scope of the Report

Market, By Application

Market, By Upholstery Materials

Market, By Fabric Type

Market, By Integrated Technology

Market, By Vehicle Type

Market, By Region

-

- Carpets

- Dashboards

- Roof Liners

- Seat Covers

- Sun Visors

- Trunk Liners

- Automotive Textiles

- Leather

- Plastics

- Smart Fabrics

- Synthetic Leather

- Thermoplastic Polymers

- Non-woven

- Woven

- Conventional

- Smart Seats

- Ventilated

- Passenger Cars

- Commercial Vehicles

- Asia Oceania (China, Japan, India, and South Korea)

- Europe (Germany, France, Spain, and the UK)

- North America (Canada, Mexico, and the US)

- Rest of the World (Brazil, Russia)

Available Customizations

-

Market, By End Market & Region (Volume & Value)

- OE

- Aftermarket

- Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Market Ranking

The automotive upholstery market is estimated to be USD 4.65 Billion in 2017 and is projected to grow at a CAGR of 6.59% from 2017 to 2025, to reach a market size of USD 7.74 Billion by 2025. The key drivers for the market are the increasing demand for advanced automotive technologies and automotive interiors, rising focus on lightweight automotive materials, and the development of a varied non-fabric substitutes for automotive upholstery.

The seat covers application is estimated to be the largest growing segment for the automotive upholstery market by automotive application, in terms of volume and value. The growth of this application can be attributed directly to the growth of vehicle production. Seat covers utilize the maximum upholstery material in an automotive application. Each car seat utilizes up to 2 meters of upholstery material. The upholstery material required for automotive seat covers varies depending on the vehicle model and vehicle type. The comfort of vehicle seats has become an important factor in influencing a purchase decision for a buyer who spends a significant amount of time in road transit. To cater to the growing demand for comfortable seats and seat covers from customers, automotive OEMs are providing customized seats. Today, customers can choose from a wide variety of seat covers, that are offered as a standard fit on car seats as well as diverse options in the aftermarket. Driver fatigue, which is observed as a major reason for vehicle accidents, can be reduced with ergonomically structured automotive seats and perforated seat covers. As a result, the coming decades will witness an increase in the uptake of advanced seat technologies such as sensor enabled seats, which monitor a driver’s biometrics and ventilated seats, which will subsequently drive the growth of the automotive seats upholstery market.

The synthetic leather, upholstery materials type is estimated to be the largest segment of the automotive upholstery market. Synthetic leather offers key advantages over genuine leather. Apart from being more cost-effective, synthetic leather is also comparatively lightweight and easily washable. Genuine leather is processed and tanned for automotive interior applications. This process emits toxic waste which is hazardous for the environment. Synthetic leather is made of polyurethane and poly-vinyl chloride that are comparatively less harmful to the environment and can be recycled at the end of a vehicle’s life.

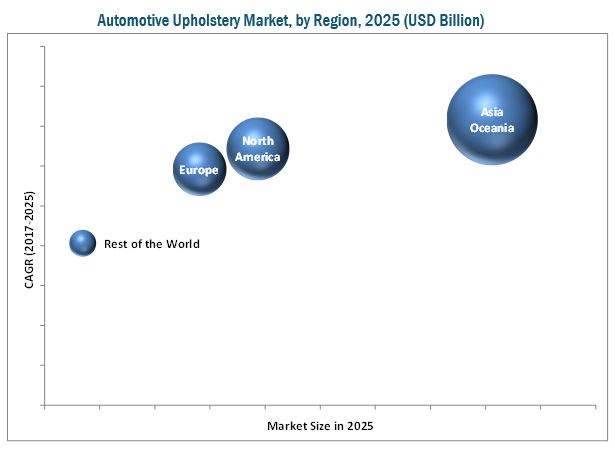

Asia Oceania is expected to dominate the automotive upholstery market during the forecast period. The demand for automotive upholstery in this region is directly linked to the vehicle production in China and India, which are both automotive hubs. The demand for luxury vehicles in this region is anticipated to grow, which will further, drive the demand for automotive upholstery from this region.

A key factor restraining the growth of the automotive upholstery market is the fluctuating price of upholstery raw materials. Automotive upholstery for interior applications is a combination of plastics, thermoplastic polymers, and synthetic leather. Polypropylene and polyester are commonly used across different automotive interior upholstery applications. However, the prices of these raw materials have seen an upward trend over the last year due to fluctuating crude oil prices. China is one of the world’s largest producer of polyester and controls the price of these commodities in the global market. Due to this, many raw material suppliers are entering the market to gain advantage of the low costs. China is home to many raw material suppliers and dominates the polymer and plastics market, which is a key raw material for automotive upholstery. The market is dominated by a few global players and several regional players. Some of the key manufacturers operating in the market are Adient Plc (Ireland), Lear Corporation (US), and Toyota Boshoku (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Automotive Upholstery Market Definition

1.2.1 Markets Covered

1.2.2 Years Considered in the Study

1.3 Currency

1.4 Units Considered

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.2.1 Increased Demand for Luxury Vehicles and Environmentally-Friendly Vehicles

2.4.3 Supply Side Analysis

2.4.3.1 Significant Focus By Oems on Convenience and Comfort Systems in Vehicles

2.5 Automotive Upholstery Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 32)

3.1 Automotive Upholstery Market, By Region, 2017 vs 2025

3.2 Market, By Application, 2017 vs 2025

3.3 Market, By Upholstery Material, 2017 vs 2025

3.4 Market, By Fabric Type, 2017 vs 2025

3.5 Market, By Integrated Technology, 2017 vs 2025

3.6 Market, By Vehicle Type, 2017 vs 2025

4 Premium Insights (Page No. - 38)

4.1 Automotive Upholstery Market Overview

4.2 Market, By Application, 2017 vs 2025

4.3 Market, By Region, 2017 vs 2025

4.4 Market, By Material Type

4.5 Market, By Fabric Type, 2017 vs 2025

4.6 Market, By Integrated Technology, 2017 vs 2025

4.7 Market, By Vehicle Type, 2017 vs 2025

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Automotive Upholstery Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Advanced Technologies and Customized Automotive Interiors

5.2.1.2 Increasing Demand for Lightweight Automotive Materials

5.2.1.3 Availability of Diverse Non-Fabric Substitutes

5.2.2 Restraints

5.2.2.1 Volatility in Raw Material Prices

5.2.3 Opportunities

5.2.3.1 Increasing Use of Non-Woven Fabrics

5.2.3.2 Development of Autonomous Vehicles to Present New Opportunities for Automotive Interior Design

5.2.4 Challenges

5.2.4.1 Stringent Government Mandates to Reduce Hap Emissions

5.2.4.2 Tvoc Emissions From Vehicle Interiors

5.3 Macroindicator Analysis

5.3.1 Introduction

5.3.1.1 Premium Vehicle Sales as Percentage of Total Sales

5.3.1.2 GDP (USD Billion)

5.3.1.3 GNI Per Capita, Atlas Method (USD)

5.3.1.4 GDP Per Capita, PPP (USD)

5.3.2 Macroindicators Influencing the Automotive Upholstery Market in the Three Countries

5.3.2.1 China

5.3.2.2 Japan

5.3.2.3 US

6 Market, By Application & Region (Page No. - 50)

6.1 Introduction

6.2 Asia Oceania

6.2.1 China

6.2.2 India

6.2.3 Japan

6.2.4 South Korea

6.2.5 Rest of Asia Oceania

6.3 Europe

6.3.1 France

6.3.2 Germany

6.3.3 Spain

6.3.4 UK

6.3.5 Rest of Europe

6.4 North America

6.4.1 US

6.4.2 Canada

6.4.3 Mexico

6.5 Rest of the World

6.5.1 Brazil

6.5.2 Russia

6.5.3 Other RoW Countries

7 Market, By Application & Material Type (Page No. - 84)

7.1 Introduction

7.2 Asia Oceania

7.3 Europe

7.4 North America

7.5 Rest of the World

8 Market, By Fabric Type (Page No. - 116)

8.1 Introduction

8.2 Non-Woven Fabric

8.3 Woven Fabric

9 Market, By Integrated Technology (Page No. - 121)

9.1 Introduction

9.2 Conventional Seats

9.3 Smart Seats

9.4 Ventilated Seats

10 Market, By Vehicle Type (Page No. - 129)

10.1 Introduction

10.2 Light-Duty Vehicles

10.3 Heavy-Duty Vehicles

11 Competitive Landscape (Page No. - 134)

11.1 Introduction

11.2 Automotive Upholstery Market Ranking Analysis

11.3 Competitive Situation & Trends

11.3.1 Expansions

11.3.2 Joint Ventures/Partnerships/Collaborations/Supply Contracts

11.3.3 New Product Developments

11.3.4 Mergers & Acquisitions

12 Company Profiles (Page No. - 142)

(Business Overview, Products Offered, Developments, SWOT Analysis & MnM View)*

12.1 Lear Corporation

12.2 Toyota Boshoku Corporation

12.3 Faurecia S.A.

12.4 Grammer AG

12.5 Adient PLC

12.6 Grupo Antolin Irausa, S.A.

12.7 Seiren Co., Ltd

12.8 Sage Automotive Interiors

12.9 Acme Mills Company

12.10 Martur Automotive Seating Systems

12.11 Haartz Corporation

12.12 Borgers Se & Co. KGaA

*Details on Business Overview, Products Offered, Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 166)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (139 Tables)

Table 1 Currency Dollar Exchange Rates (W.R.T. USD)

Table 2 Automotive Upholstery Market, By Region, 2015–2025 (Tons)

Table 3 Market, By Region, 2015–2025 (Thousand USD)

Table 4 Market, By Application, 2015–2025 (Tons)

Table 5 Market, By Application, 2015–2025 (Thousand USD)

Table 6 Asia Oceania: Market, By Application, 2015–2025 (Tons)

Table 7 Asia Oceania: Market, By Application, 2015–2025 (Thousand USD)

Table 8 Asia Oceania: Market, By Country, 2015–2025 (Tons)

Table 9 Asia Oceania: Market, By Country, 2015–2025 (Thousand USD)

Table 10 China: Market, By Application, 2015–2025 (Tons)

Table 11 China: Market, By Application, 2015–2025 (Thousand USD)

Table 12 India: Market, By Application, 2015–2025 (Tons)

Table 13 India: Market, By Application, 2015–2025 (Thousand USD)

Table 14 Japan: Market, By Application, 2015–2025 (Tons)

Table 15 Japan: Market, By Application, 2015–2025 (Thousand USD)

Table 16 South Korea: Market, By Application, 2015–2025 (Tons)

Table 17 South Korea: Market, By Application, 2015–2025 (Thousand USD)

Table 18 Rest of Asia Oceania: Market, By Application, 2015–2025 (Tons)

Table 19 Rest of Asia Oceania: Market, By Application, 2015–2025 (Thousand USD)

Table 20 Europe: Market, By Application, 2015–2025 (Tons)

Table 21 Europe: Market, By Application, 2015–2025 (Thousand USD)

Table 22 Europe: Market, By Country, 2015–2025 (Tons)

Table 23 Europe: Market, By Country, 2015–2025 (Thousand USD)

Table 24 France: Market, By Application, 2015–2025 (Tons)

Table 25 France: Market, By Application, 2015–2025 (Thousand USD)

Table 26 Germany: Market, By Application, 2015–2025 (Tons)

Table 27 Germany: Market, By Application, 2015–2025 (Thousand USD)

Table 28 Spain: Market, By Application, 2015–2025 (Tons)

Table 29 Spain: Market, By Application, 2015–2025 (Tons)

Table 30 UK: Market, By Application, 2015–2025 (Tons)

Table 31 UK: Market, By Application, 2015–2025 (Thousand USD)

Table 32 Rest of Europe: Market, By Application, 2015–2025 (Tons)

Table 33 Rest of Europe: Market, By Application, 2015–2025 (Thousand USD)

Table 34 North America: Automotive Upholstery Market, By Application, 2015–2025 (Tons)

Table 35 North America: Market, By Application, 2015–2025 (Thousand USD)

Table 36 North America: Market, By Country, 2015–2025 (Tons)

Table 37 North America: Market, By Country, 2015–2025 (Thousand USD)

Table 38 US: Market, By Application, 2015–2025 (Tons)

Table 39 US: Market, By Application, 2015–2025 (Thousand USD)

Table 40 Canada: Market, By Application, 2015–2025 (Tons)

Table 41 Canada: Market, By Application, 2015–2025 (Thousand USD)

Table 42 Mexico: Market, By Application, 2015–2025 (Tons)

Table 43 Mexico: Market, By Application, 2015–2025 (Thousand USD)

Table 44 RoW: Market, By Application, 2015–2025 (Tons)

Table 45 RoW: Market, By Application, 2015–2025 (Thousand USD)

Table 46 RoW: Market, By Country, 2015–2025 (Tons)

Table 47 RoW: Market, By Country, 2015–2025 (Thousand USD)

Table 48 Brazil: Market, By Application, 2015–2025 (Tons)

Table 49 Brazil: Market, By Application, 2015–2025 (Thousand USD)

Table 50 Russia: Market, By Application, 2015–2025 (Tons)

Table 51 Russia: Market, By Application, 2015–2025 (Thousand USD)

Table 52 Other RoW Countries: Market, By Application, 2015–2025 (Tons)

Table 53 Other RoW Countries: Market, By Application, 2015–2025 (Thousand USD)

Table 54 Market, By Material Type, 2015–2025 (Tons)

Table 55 Market, By Material Type, 2015–2025 (Thousand USD)

Table 56 Market, By Region, 2015–2025 (Tons)

Table 57 Market, By Region, 2015–2025 (Thousand USD)

Table 58 Asia Oceania: Automotive Upholstery Market, By Material Type, 2015–2025 (Tons)

Table 59 Asia Oceania: Market, By Material Type, 2015–2025 (Thousand USD)

Table 60 Asia Oceania: Market for Carpets, By Material Type, 2015–2025 (Tons)

Table 61 Asia Oceania: Market for Carpets, By Material Type, 2015–2025 (Thousand USD)

Table 62 Asia Oceania: Market for Dashboards, By Material Type, 2015–2025 (Tons)

Table 63 Asia Oceania: Market for Dashboards, By Material Type, 2015–2025 (Thousand USD)

Table 64 Asia Oceania: Market for Roof Liners, By Material Type, 2015–2025 (Tons)

Table 65 Asia Oceania: Market for Roof Liners, By Material Type, 2015–2025 (Thousand USD)

Table 66 Asia Oceania: Market for Seat Covers, By Material Type, 2015–2025 (Tons)

Table 67 Asia Oceania: Market for Seat Covers, By Material Type, 2015–2025 (Thousand USD)

Table 68 Asia Oceania: Market for Sun Visors, By Material Type, 2015–2025 (Tons)

Table 69 Asia Oceania: Market for Sun Visors, By Material Type, 2015–2025 (Thousand USD)

Table 70 Asia Oceania: Market for Trunk Liners, By Material Type, 2015–2025 (Tons)

Table 71 Asia Oceania: Market for Trunk Liners, By Material Type, 2015–2025 (Thousand USD)

Table 72 Europe: Market, By Material Type, 2015–2025 (Tons)

Table 73 Europe: Market, By Material Type, 2015–2025 (Thousand USD)

Table 74 Europe: Market for Carpets, By Material Type, 2015–2025 (Tons)

Table 75 Europe: Market for Carpets, By Material Type, 2015–2025 (Thousand USD)

Table 76 Europe: Market for Dashboards, By Material Type, 2015–2025 (Tons)

Table 77 Europe: Market for Dashboards, By Material Type, 2015–2025 (Thousand USD)

Table 78 Europe: Market for Roof Liners, By Material Type, 2015–2025 (Tons)

Table 79 Europe: Market for Roof Liners, By Material Type, 2015–2025 (Thousand USD)

Table 80 Europe: Market for Seat Covers, By Material Type, 2015–2025 (Tons)

Table 81 Europe: Market for Seat Covers, By Material Type, 2015–2025 (Thousand USD)

Table 82 Europe: Market for Sun Visors, By Material Type, 2015–2025 (Tons)

Table 83 Europe: Market for Sun Visors, Material Type, 2015–2025 (Thousand USD)

Table 84 Europe: Market for Trunk Liners, By Material Type, 2015–2025 (Tons)

Table 85 Europe: Market for Trunk Liners, By Material Type, 2015–2025 (Thousand USD)

Table 86 North America: Automotive Upholstery Market, By Material Type, 2015–2025 (Tons)

Table 87 North America: Market, By Material Type, 2015–2025 (Thousand USD)

Table 88 North America: Market for Carpets, By Material Type, 2015–2025 (Tons)

Table 89 North America: Market for Carpets, By Material Type, 2015–2025 (Thousand USD)

Table 90 North America: Market for Dashboards, By Material Type, 2015–2025 (Tons)

Table 91 North America: Market for Dashboards, By Material Type, 2015–2025 (Thousand USD)

Table 92 North America: Market for Roof Liners, By Material Type, 2015–2025 (Tons)

Table 93 North America: Market for Roof Liners, By Material Type, 2015–2025 (Thousand USD)

Table 94 North America: Market for Seat Covers, By Material Type, 2015–2025 (Tons)

Table 95 North America: Market for Seat Covers, By Material Type, 2015–2025 (Thousand USD)

Table 96 North America: Market for Sun Visors, By Material Type, 2015–2025 (Tons)

Table 97 North America: Market for Sun Visors, By Material Type, 2015–2025 (Thousand USD)

Table 98 North America: Market for Trunk Liners, By Material Type, 2015–2025 (Tons)

Table 99 North America: Market for Trunk Liners, By Material Type, 2015–2025 (Thousand USD)

Table 100 RoW: Automotive Upholstery Market, By Material Type, 2015–2025 (Tons)

Table 101 RoW: Market, By Material Type, 2015–2025 (Thousand USD)

Table 102 RoW: Market for Carpets, By Material Type, 2015–2025 (Tons)

Table 103 RoW: Market for Carpets, By Material Type, 2015–2025 (Thousand USD)

Table 104 RoW: Market for Dashboards, By Material Type, 2015–2025 (Tons)

Table 105 RoW: Market for Dashboards, By Material Type, 2015–2025 (Thousand USD)

Table 106 RoW: Market for Roof Liners, By Material Type, 2015–2025 (Tons)

Table 107 RoW: Market for Roof Liners, By Material Type, 2015–2025 (Thousand USD)

Table 108 RoW: Market for Seat Covers, By Material Type, 2015–2025 (Tons)

Table 109 RoW: Market for Seat Covers, By Material Type, 2015–2025 (Thousand USD)

Table 110 RoW: Market for Sun Visors, By Material Type, 2015–2025 (Tons)

Table 111 RoW: Market for Sun Visors, By Material Type, 2015–2025 (Thousand USD)

Table 112 RoW: Market for Trunk Liners, By Material Type, 2015–2025 (Tons)

Table 113 RoW: Market for Trunk Liners, By Material Type, 2015–2025 (Thousand USD)

Table 114 Automotive Upholstery Market Size, By Fabric Type, 2015–2025 (Tons)

Table 115 Market Size, By Fabric Type, 2015–2025 (Thousand USD)

Table 116 Non-Woven Market Size, By Region 2015–2025 (Tons)

Table 117 Non-Woven Market Size, By Region 2015–2025 (Thousand USD)

Table 118 Woven Market Size, By Region 2015–2025 (Tons)

Table 119 Woven Market Size, By Region 2015–2025 (Thousand USD)

Table 120 Market Size, By Integrated Technology, 2015–2025 (Tons)

Table 121 Market Size, By Integrated Technology, 2015–2025 (Thousand USD)

Table 122 Market Size, By Region, 2015–2025 (Tons)

Table 123 Market Size, By Region, 2015–2025 (Thousand USD)

Table 124 Market Size for Conventional Seats, By Region, 2015–2025 (Tons)

Table 125 Market Size for Conventional Seats, By Region, 2015–2025 (Thousand USD)

Table 126 Market Size for Smart Seats, By Region, 2015–2025 (Tons)

Table 127 Market Size for Smart Seats, By Region, 2015–2025 (Thousand USD)

Table 128 Market Size for Ventilated Seats, By Region, 2015–2025 (Tons)

Table 129 Market Size for Ventilated Seats, By Region, 2015–2025 (Thousand USD)

Table 130 Market Size, By Vehicle Type, 2015–2025 (Tons)

Table 131 Automotive Upholstery Market Size, By Vehicle Type, 2015–2025 (Thousand USD)

Table 132 Light-Duty Vehicle Upholstery Market Size, By Region, 2015–2025 (Tons)

Table 133 Light-Duty Vehicle Upholstery Market Size, By Region, 2015–2025 (Thousand USD)

Table 134 Heavy-Duty Vehicle Upholstery Market Size, By Region, 2015–2025 (Tons)

Table 135 Heavy-Duty Vehicle Upholstery Market Size, By Region, 2015–2025 (Thousand USD)

Table 136 Expansions, 2014–2017

Table 137 Joint Ventures/Partnerships/Collaborations/Supply Contracts, 2014–2017

Table 138 New Product Developments, 2014–2017

Table 139 Mergers & Acquisitions, 2014–2017

List of Figures (48 Figures)

Figure 1 Automotive Upholstery Market: Research Design

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Global Premium Vehicle Sales Growth (2012-2016)

Figure 5 Market for Automotive: Bottom-Up Approach

Figure 6 Market for Automotive: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Asia Oceania Accounted for the Largest Share in the Market in 2017 (Thousand USD)

Figure 9 Seat Covers Segment Accounted for the Largest Share in the Market in 2017 (Thousand USD)

Figure 10 PU/PVC Combination Segment Accounted for the Largest Share in the Market in 2017

Figure 11 Woven Fabric Segment Accounted for the Largest Share of the Market in 2017 (Thousand USD)

Figure 12 Conventional Seats Segment Accounted for Largest Share the Market in 2017 (Thousand USD)

Figure 13 Light Duty Vehicles Segment Accounted for Largest Share the Market in 2017 (Thousand USD)

Figure 14 Rising Vehicle Demand and Production to Drive the Market

Figure 15 Seat Covers Segment Accounted for the Largest Share of the Market in 2017 (Thousand USD)

Figure 16 Asia Oceania Market for Automotive Upholstery to Grow at the Highest CAGR During the Forecast Period (Thousand USD)

Figure 17 Synthetic Leather Segment Accounted for the Largest Share in 2017

Figure 18 Woven Fabric Type is Expected to Have the Largest Market Size During the Forecast Period (Thousand USD)

Figure 19 Ventilated Seats is Expected to Have the Highest CAGR During the Forecast Period (Thousand USD)

Figure 20 Light Duty Vehicles Segment Accounted for the Largest Market Size (Thousand USD)

Figure 21 Drivers, Restraints, Opportunities, and Challenges

Figure 22 Annual Number of Air Toxics Emitting Facilities With EPA Evaluation and Concluded Enforcement Actions (US)

Figure 23 Increasing Per Capita GDP and Income to Positively Influence the Demand for Automobiles

Figure 24 Improving GDP and Focus on Innovation in the Automotive Industry Have Made Japan A Strong Market for Exporting Vehicles

Figure 25 Rising GNI Per Capita and Increased Consumer Spending are Expected to Support the Demand for Premium Vehicles

Figure 26 Geographic Growth Opportunities: Market, By Country (Tons)

Figure 27 Asia Oceania: Market Snapshot

Figure 28 Europe: Market, By Application, 2017 vs 2025 (Tons)

Figure 29 North America: Market Snapshot

Figure 30 RoW: Market, By Application, 2017 vs 2025 (Tons)

Figure 31 Market, By Material Type, 2020 vs 2025 (Tons)

Figure 32 Market, By Fabric Type, 2017 vs 2025 (Tons)

Figure 33 Market, By Integrated Technology, 2017 vs 2025 (Tons)

Figure 34 Market, By Vehicle Type, 2017 vs 2025

Figure 35 Key Developments By Leading Players in the Market, 2014–2017

Figure 36 Automotive Upholstery Market Ranking, 2016

Figure 37 Lear Corporation: Company Snapshot

Figure 38 Lear Corporation: SWOT Analysis

Figure 39 Toyota Boshoku Corporation: Company Snapshot

Figure 40 Toyota Boshoku Corporation: SWOT Analysis

Figure 41 Faurecia S.A.: Company Snapshot

Figure 42 Faurecia S.A.: SWOT Analysis

Figure 43 Grammer AG: Company Snapshot

Figure 44 Grammer AG: SWOT Analysis

Figure 45 Adient PLC: Company Snapshot

Figure 46 Adient PLC: SWOT Analysis

Figure 47 Grupo Antolin Irausa, S.A.: Company Snapshot

Figure 48 Seiren Co., Ltd: Company Snapshot

Growth opportunities and latent adjacency in Automotive Upholstery Market