Alternator Market by Product (Starter Motor & Alternator), Technology (BAS, Enhanced Starter, Direct Start, ISG), Power Output (1.0-3.0KW,3.0-5.0KW,>5.0KW), Type (Electric, Gear Reduction), Vehicle Type (ICE, Micro-Hybrid, Hybrid), & by Region - Forecast to 2020

[146 Pages Report] The starter motor cranks up the engine for initial starting, while the alternator provides the power required for the vehicle electronics. The growth of the starter motor and alternator market can be linked to the increasing vehicle production and rising demand for vehicle electrification.

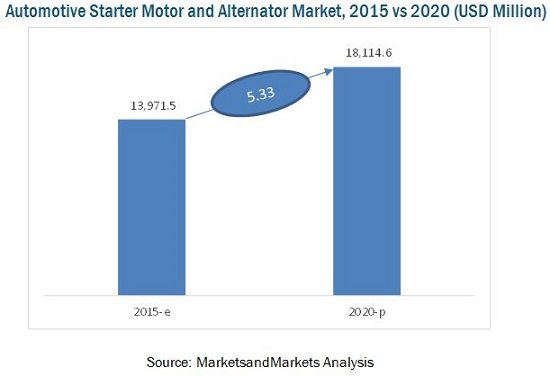

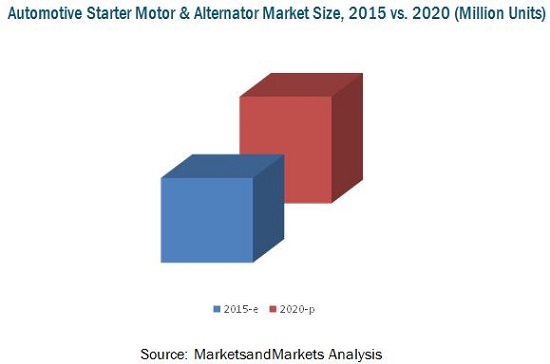

The market for starter motor in terms of value is estimated to grow at a rate of 5.22% from 2015 to 2020, while that of alternator is estimated to grow at a CAGR of 5.38%. Asia-Oceania is estimated to be the largest market for starter motor & alternator. The region houses some of the most populous nations such as China and India, which together constitute two-thirds of the world population. The huge population base associated with economic labor, low production costs, and lenient regulations, provide huge opportunities for automakers. North America is another attractive market for starter motors and alternators, mainly due the low penetration of start-stop vehicles in the region. The region is an attractive market for start-stop systems to grow. The market is estimated to account for approximately 1/4 of the global starter motor and alternator market in 2015 and is projected to grow by value at a CAGR of 4.03% during the forecast.

Based on MarketsandMarkets analysis, the LCV and HCV production is estimated to stabilize between 2015 and 2020, after a volatile period from 2004 to 2013. India is estimated to be highest growing market for HCV production, growing at a CAGR of 6.22% from 2015 to 2020. On the other hand, the market for LCVs in Spain is projected to be growing at an impressive CAGR of 7.87% during the forecast period. The growing vehicle production globally is expected to increase the demand for starter motor and alternator. The market for Integrated Starter generators in North America is estimated to grow at a CAGR 34.97%, to reach a market size of USD 9.9 Million by 2020.

This report classifies and defines the automotive starter motor & alternator market size, in terms of volume and value. It provides a comprehensive analysis and insights (both, qualitative and quantitative) into automotive starter motor and alternator market, while highlighting the potential growth opportunities in the coming years and reviews the market drivers, restraints, growth indicators, challenges, market dynamics, competitive landscape, and other key aspects with respect to automotive starter motor and alternator products.

This report segments the automotive starter motor and alternator market by:

- By Type (electric and gear reduction),

- By vehicle type (ICE, Micro-hybrid, and Hybrid)

- By Technology (Belt-driven alternator, Enhanced Starter, Direct Start, and ISG)

- By Region (North America, Asia-Oceania, Europe, and ROW).

Key players in the automotive emission sensor market have also been identified and profiled.

Target Audience

- Raw material suppliers for automotive starter motor and alternator systems

- Manufacturers of automotive starter motor and alternator systems

- Dealers and distributors of automotive starter motor and alternator systems

- Industry associations

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to company-specific needs.

The following customization options are available for the report:

- Alternator Market, By Components

- Pulley

- Drive end shield

- Roller bearing

- Rotor

- Stator

- Collector ring end shield

- Regulator

- Rectifier

- Protective cap

- Starter Motor Market, By Components

- Armature

- Starter drive gear

- Shift fork

- Return spring

- Solenoid

- Plunger

- Brush

- Field coils

- Starter Motor & Alternator Market, By Off-Highway Vehicles

- Agricultural vehicles

- Construction vehicles

- Rolling Stock/Locomotives

The Alternator market is projected to grow at a CAGR of 5.38% from 2015 to 2020 to reach a value USD 8,871.5 Million by 2020. On the other hand, the market for starter motor is estimated to reach USD 9,087.3 Million by 2020, growing at a CAGR of 5.22%.

Asia-Oceania region is estimated to have the highest market share in automotive alternator market in 2015 and is also projected to lead the starter motor market in the same year. This huge market share can be attributed to growing vehicle production and increasing vehicle electrification. North America is the second fastest growing starter motor and alternator market, where stringent emission norms resulting into development of advance technologies has been driving the market. Stringent fuel emission and fuel economy norms have been introduced by the government globally. This has given rise to the increasing involvement of electrical and electronics components on large scale in an automobile in the past decade. Engine downsizing has led manufacturers to develop starter motor and alternator that comply with the incoming trend. Different technologies such as enhanced starters, integrated starter generator, and direct start have been introduced. These technologies find application in micro-hybrid and hybrid vehicles. Promotion of greener vehicles has been fuelling the demand of these technologies. According to the study done at MarketsandMarkets, Integrated starter generator is projected to grow at the fastest rate from 2015 to 2020.

Key Drivers for automotive starter motor and alternator market include increasing involvement of electrical and electronics component in vehicle, which demands more power and increasing vehicle production, is another factor directly driving the demand for starter motor and alternator. However, increasing demand for electrical vehicles has been posing a serious restraint on the growth of this market.

The global automotive starter motor and alternator market is dominated by major players such as Robert Bosch GmbH (Germany), Denso Corporation (U.S.), Valeo S.A. (France), Hitachi Automotive (Japan), Lucas Electrical (U.K.), Mitsubishi Corporation (Japan), Hella KGaA Hueck & Co., (Germany), Motor Corporation of America (U.S.), Control Power Technology (U.K.), and Mitsuba Corporation (Japan). Robert Bosch GmbH is the market leader adopting new product development and expansion as the key strategy to grow. It has developed technology named as direct start that would replace starter motors from vehicles completely.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Increasing Vehicle Production in Developing Countries

2.4.2.2 Impact of Gross Domestic Product on Commercial Vehicle Sales

2.4.2.3 Urbanization vs Passenger Cars Per 1,000 People

2.4.2.4 Infrastructure: Roadways

2.4.3 Supply-Side Analysis

2.4.3.1 Technological Advancements

2.4.3.2 Influence of Other Factors

2.5 Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Opportunities in the Automotive Starter Motor & Alternator Market

4.2 Regional Analysis for Automotive Starter Motor & Alternator Market, 2015

4.3 Global Automotive Starter Motor Market, By Technology

4.3.1 ICE Vehicle

4.3.2 Micro-Hybrid Vehicles

4.3.3 Hybrid Vehicles

4.4 Global Automotive Starter Motor & Alternator Market, By Power Output

4.5 Global Automotive Starter Motor & Alternator Market Product Life Cycle (PLC)

4.6 Who Supplies to Whom

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Power Output

5.2.3 By Technology

5.2.4 Automotive Starter Motor & Alternator Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Electrification of Vehicles

5.3.1.2 Increasing Vehicle Production

5.3.2 Restraints

5.3.2.1 Increasing Demand for Electric Vehicles

5.3.3 Opportunities

5.3.3.1 Integrated Starter Generator (ISG) and Compact Clutch Integrated Pulley for Alternators & Direct Start

5.3.4 Challenge

5.3.4.1 Developing an Efficient Alternator With Minimal Losses

5.4 Burning Issue

5.4.1 Elimination of Starter Motor

5.5 Value Chain Analysis

5.6 Porters Five Forces Analysis

5.6.1 Threat of New Entrants

5.6.2 Threat of Substitutes

5.6.3 Bargaining Power of Suppliers

5.6.4 Bargaining Power of Buyers

5.6.5 Intensity of Competitive Rivalry

5.7 Technology Overview

5.7.1 Starter Motor

5.7.2 Alternator

5.8 Starter Motor Technologies

5.8.1 Belt-Driven Alternator Starter

5.8.2 Enhanced Starter

5.8.3 Direct Starter

5.8.4 Integrated Starter Generator (ISG)

6 Automotive Starter Motor Market, By Type (Page No. - 63)

6.1 Introduction

6.2 Electric Starter Motors

6.3 Gear Reduction Starter Motors

7 Automotive Starter Motor Market, By Power Output (Page No. - 66)

7.1 Introduction

7.2 1.0 Kw to 3.0 Kw

7.3 3.0 Kw to 5.0 Kw

7.4 5.0 Kw & Above

8 Automotive Starter Motor Market, By Technology (Page No. - 74)

8.1 Introduction

8.2 Belt Driven Starter Alternator

8.2.1 By Vehicle Type

8.3 Enhanced Starter

8.3.1 By Vehicle Type

8.4 Direct Start

8.4.1 By Vehicle Type

8.5 ISG

8.5.1 By Vehicle Type

9 Automotive Starter Motor & Alternator Market, By Region (Page No. - 79)

9.1 Introduction

9.2 Asia-Oceania

9.2.1 China

9.2.2 Japan

9.2.3 South Korea

9.2.4 India

9.2.5 Pest Analysis

9.2.5.1 Political Factors

9.2.5.2 Economic Factors

9.2.5.3 Social Factors

9.2.5.4 Technological Factors

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 U.K.

9.3.4 Spain

9.3.5 Pest Analysis

9.3.5.1 Political Factors

9.3.5.2 Economic Factors

9.3.5.3 Social Factors

9.3.5.4 Technological Factors

9.4 North America

9.4.1 U.S.

9.4.2 Mexico

9.4.3 Canada

9.4.4 Pest Analysis

9.4.4.1 Political Factors

9.4.4.2 Economic Factors

9.4.4.3 Social Factors

9.4.4.4 Technological Factors

9.5 RoW

9.5.1 Brazil

9.5.2 Russia

10 Competitive Landscape (Page No. - 106)

10.1 Market Share Analysis, Starter Motor & Alternator Market

10.2 Competitive Situation and Trends

10.3 Expansions

10.4 Agreements/Joint Ventures/Partnerships

10.5 New Product Launches

10.6 Mergers & Acquisitions

11 Company Profiles (Page No. - 113)

11.1 Introduction

11.2 Robert Bosch GmbH

11.3 Denso Corporation

11.4 Hitachi Automotive Systems, Ltd.

11.5 Mitsuba Corporation

11.6 Mitsubishi Electric Corporation

11.7 Valeo SA

11.8 Hella KGAA Hueck & Co.

11.9 Lucas Electrical

11.10 Motorcar Parts of America

11.11 Controlled Power Technologies Ltd.

11.12 Asimco Technologies

12 Appendix (Page No. - 140)

12.1 Available Customizations

12.1.1 Alternator Market, By Components

12.1.1.1 Pulley

12.1.1.2 Drive End Shield

12.1.1.3 Roller Bearing

12.1.1.4 Rotor

12.1.1.5 Stator

12.1.1.6 Collector Ring End Shield

12.1.1.7 Regulator

12.1.1.8 Rectifier

12.1.1.9 Protective Cap

12.1.2 Starter Motor Market, By Components

12.1.2.1 Armature

12.1.2.2 Starter Drive Gear

12.1.2.3 Shift Fork

12.1.2.4 Return Spring

12.1.2.5 Solenoid

12.1.2.6 Plunger

12.1.2.7 Brush

12.1.2.8 Field Coils

12.1.3 Starter Motor and Alternator Market, By Off-Highway Vehicles

12.1.3.1 Agricultural Vehicles

12.1.4 Construction Vehicles

12.2 Discussion Guide

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Related Reports

List of Tables (71 Tables)

Table 1 Drivers: Impact Analysis

Table 2 Restraints: Impact Analysis

Table 3 Opportunities: Impact Analysis

Table 4 Challenge: Impact Analysis

Table 5 Automotive Starter Motor Market, By Type, 20132020, (000 Units)

Table 6 Automotive Starter Motor Market, By Type, 20132020, (USD Million)

Table 7 Relation Between Powerout & Engine Displacement

Table 8 Automotive Starter Motor Market Size, By Power Output, 20132020 (000 Units)

Table 9 Automotive Starter Motor Market Size, By Power Output, 20132020 (USD Million)

Table 10 Automotive 1 Kw to 3.0 Kw Starter Motor Market Size, By Region, 20132020 (000 Units)

Table 11 Automotive 1.0 Kw to 3.0 Kw Starter Motor Market Size, By Region, 20132020 (USD Million)

Table 12 Automotive 3.0 Kw to 5.0 Kw Starter Motor Market Size, By Region, 20132020 (000 Units)

Table 13 Automotive 3.0 Kw to 5.0 Kw Starter Motor Market Size, By Region, 20132020 (USD Million)

Table 14 Automotive 5.0 Kw & Above Starter Motor Market Size, By Region, 20132020 (000 Units)

Table 15 Automotive 5.0 Kw & Above Starter Motor Market Size, By Region, 20132020 (USD Million)

Table 16 Belt Driven Starter Market, By Vehicle Type, 20132020 (000 Units)

Table 17 Belt Driven Starter Market, By Vehicle Type, 20132020 (USD Million)

Table 18 Enhanced Starter Market, By Vehicle Type, 20132020 (000 Units)

Table 19 Enhanced Starter Market, By Vehicle Type, 20132020 (USD Million)

Table 20 Direct Start Market, By Vehicle Type, 20132020 (000 Units)

Table 21 Direct Start Market, By Vehicle Type, 20132020 (USD Million)

Table 22 ISG Market, By Vehicle Type, 20132020 (000 Units)

Table 23 ISG Market, By Vehicle Type, 20132020 (USD Million)

Table 24 Automotive Starter Motor & Alternator Market, By Region, 20132020 (000 Units)

Table 25 Automotive Starter Motor & Alternator Market, By Region, 20132020 (USD Million)

Table 26 Asia-Oceania: Automotive Starter Motor & Alternator Market, By Country, 20132020 (000 Units)

Table 27 Asia-Oceania: Automotive Starter Motor & Alternator Market, By Country, 20132020 (USD Million)

Table 28 Asia-Oceania: Automotive Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 29 Asia-Oceania: Automotive Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 30 China: Automotive Starter Motor & Alternator Market, By Country, 20132020 (000 Units)

Table 31 China: Automotive Starter Motor & Alternator Market, By Country, 20132020 (USD Million)

Table 32 Japan: Automotive Starter Motor & Alternator Market, By Country, 20132020 (000 Units)

Table 33 Japan: Automotive Starter Motor & Alternator Market, By Country, 20132020 (USD Million)

Table 34 South Korea: Automotive Starter Motor & Alternator Market, By Country, 20132020 (000 Units)

Table 35 South Korea: Automotive Starter Motor & Alternator Market, By Country, 20132020 (USD Million)

Table 36 India: Automotive Starter Motor & Alternator Market, By Country, 20132020 (000 Units)

Table 37 India: Automotive Starter Motor & Alternator Market, By Country, 20132020 (USD Million)

Table 38 Europe: Starter Motor & Alternator Market, By Country, 20132020 (000 Units)

Table 39 Europe: Starter Motor & Alternator Market, By Country, 20132020 (USD Million)

Table 40 Europe: Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 41 Europe: Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 42 Germany: Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 43 Germany: Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 44 France: Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 45 France: Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 46 U.K.: Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 47 U.K.: Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 48 Spain: Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 49 Spain: Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 50 North America: Starter Motor & Alternator Market, By Country, 20132020 (000 Units)

Table 51 North America: Starter Motor & Alternator Market, By Country, 20132020 (USD Million)

Table 52 North America: Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 53 North America: Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 54 U.S.: Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 55 U.S.: Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 56 Mexico: Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 57 Mexico: Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 58 Canada: Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 59 Canada: Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 60 RoW: Starter Motor & Alternator Market, By Country, 20132020 (000 Units)

Table 61 RoW: Starter Motor & Alternator Market, By Country, 20132020 (USD Million)

Table 62 RoW: Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 63 RoW: Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 64 Brazil Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 65 Brazil Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 66 Russia: Starter Motor & Alternator Market, By Product, 20132020 (000 Units)

Table 67 Russia: Starter Motor & Alternator Market, By Product, 20132020 (USD Million)

Table 68 Expansions, 20122015

Table 69 Agreements/Joint Ventures/Partnerships, 2011-2015

Table 70 New Product Launches, 20132015

Table 71 Mergers & Acquisitions, 2012-2015

List of Figures (66 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Vehicle Production, 20092014

Figure 6 Gross Domestic Product vs Total Vehicle Sales

Figure 7 Urbanization vs Passenger Cars Per 1,000 People

Figure 8 Road Network vs Total Vehicle Sales

Figure 9 Economic Factor Analysis

Figure 10 Market Size Estimation Methodology: Bottom-Up Approach

Figure 11 Automotive Starter Motor & Alternator Market, By Value, 2015 to 2020

Figure 12 Global Alternator Market By Region, By Value, 2015 to 2020

Figure 13 Increasing Adoption of Start-Stop Systems Pushing the Demand for Starters & Alternators

Figure 14 Starter Motor With Power Output in the Range 3.0 Kw to 5.0 Kw is the Largest Contributor

Figure 15 Gear Reduction Projected to Be the Fastest Growing Market for Starter Motors

Figure 16 ISG & Direct Start to Offer Lucrative Opportunities for Manufacturers

Figure 17 Starter Motor & Alternator Market By Region, 2015

Figure 18 Asia-Oceania is Projected to Grow at the Fastest CAGR During the Forecast Period

Figure 19 Only Conventional Starter Motors to Dominate the Market By Value

Figure 20 ISG Segment Projected to Grow at the Highest CAGR By Value During the Forecast Period

Figure 21 Belt Driven Starter & Enhanced Starter has the Maximum Share By Value in Hybrid Vehicle Starter Motor Market in 2015

Figure 22 High Demand for Passenger Cars Driving the Demand for 1.0kw to 3.0kw Starter Motors

Figure 23 PLC of Automotive Starter Motor & Alternator Market

Figure 24 Market Segmentation, By Type

Figure 25 Market Segmentation, By Power Output

Figure 26 Market Segmentation, By Technology

Figure 27 Increasing Vehicle Electrification Would Drive the Market for Automotive Starter Motor and Alternator

Figure 28 Vehicle Electrification Market Size , By Technology, 2014 (000 Units)

Figure 29 Global Vehicle Production and Vehicle Parc (20132020)

Figure 30 Electric Vehicle Sales, 20122014 (000 Units)

Figure 31 Engine Downsizing Trend, 20122014

Figure 32 Value Chain Analysis: Major Value is Added During Manufacturing & Assembly Phases

Figure 33 Porters Five Forces Analysis : Automotive Starter Motor & Alternator Market

Figure 34 Schematic Diagram for Starter Motor Working

Figure 35 Starter Motor & Alternator Connection Diagram

Figure 36 Starter Motor Operating Principles

Figure 37 System Layout for ISG

Figure 38 Starter Motor Market, By Type

Figure 39 3.0 Kw to 5.0 Kw Motors to Dominate During the Forecast Period

Figure 40 Asia-Oceania is the Largest Market for 1.0 Kw to 3.0kw Starter Motors

Figure 41 North America: the Highest Growing Market for 3.0 Kw to 5.0 Kw Starter Motors

Figure 42 5.0 Kw & Above Starter Motor Market

Figure 43 Enhanced Starters to Have the Largest Market Size in Terms of Value for Micro-Hybrid Vehicles, 20152020

Figure 44 ISG: the Highest Growing Technology for the Hybrid Vehicles (USD Million), 20152020

Figure 45 China is the Fastest Growing Country in the Global Automotive Starter Motor & Alternator Market

Figure 46 China is the Fastest Growing Market in the Region During the Forecast Period

Figure 47 Canada is the Fastest Growing Market in the Region During Forecast Period

Figure 48 Companies Adopted Product Expansion as the Key Growth Strategy Over the Last Three Years

Figure 49 Market Evaluation Framework: Expansions Have Fuelled the Demand for Starters & Alternators

Figure 50 Denso Corporation Grew at the Fastest CAGR From 2010 to 2013

Figure 51 Battle for Market Share: Expansion Was the Key Strategy

Figure 52 Region-Wise Revenue Mix of Top 5 Players

Figure 53 Competitive Benchmarking of Key Players (20102014): Mitsubishi Electric & Robert Bosch are Growing But Decelerating, Despite A Varied Product Portfolio

Figure 54 Robert Bosch GmbH: Company Snapshot

Figure 55 Robert Bosch GmbH: SWOT Analysis

Figure 56 Denso Corporation: Company Snapshot

Figure 57 Denso Corporation: SWOT Analysis

Figure 58 Company Snapshot: Hitachi Automotive Systems, Ltd.

Figure 59 Company Snapshot: Mitsuba Corporation

Figure 60 Mitsubishi Electric: Company Snapshot

Figure 61 Mitsubishi Electric: SWOT Analysis

Figure 62 Valeo SA: Company Snapshot

Figure 63 Valeo SA: SWOT Analysis

Figure 64 Hella KGAA Hueck & Co.: Company Snapshot

Figure 65 Hella KGAA Hueck & Co.: SWOT Analysis

Figure 66 Motorcar Parts of America: Company Snapshot

Growth opportunities and latent adjacency in Alternator Market