Automotive Piston Pin Market by Vehicle Type (Passenger Car, LCV, HCV, and Agricultural), Fuel (Diesel, Gasoline, and Alternative Fuel), Material (Steel and Aluminum & Titanium), Coating Type, Sales Channel, and Region - Forecast to 2025

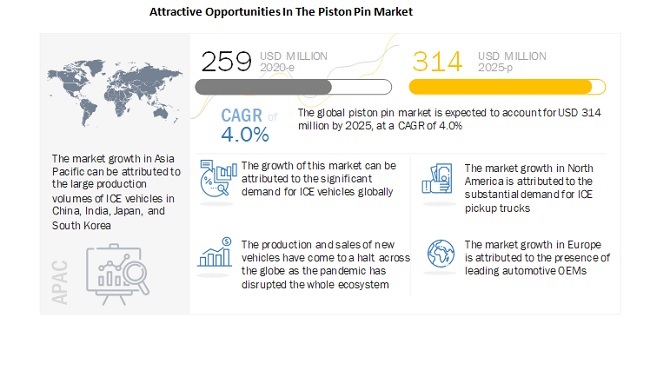

[188 Pages Report] The global automotive piston pin market size is projected to grow from USD 259 million in 2020 to USD 314 million by 2025, at a CAGR of 4.0%. Extensive production and sales volumes of ICE vehicles in all the segments, including passenger cars, LCVs, and HCVs, are primarily driving the demand for piston pins. The piston pin market has witnessed growth in developing as well as developed countries.

According to industry experts, electric vehicles are the future of the automotive industry. ICE vehicles are still in focus with significant production and sales, especially in developing countries such as India and the majority of the Middle East & African countries. Also, OEMs and Tier I suppliers have been focusing on designing and developing long-lasting piston pins that can sustain or withstand all the loading or stresses applied and the wear and tear involved during engine operations. Thus, advancements in metallurgy and material science fields might help the automotive piston pin market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact On Automotive Piston Pin Market:

The COVID-19 pandemic is expected to have a severe impact on the automotive piston pin market. The production and sales of new vehicles have come to a halt across the globe as the pandemic has disrupted the whole ecosystem. OEMs had to wait until lockdowns were lifted to resume production, which affected their business. Hence, vehicle manufacturers would need to adjust the production volume. In addition, component manufacturing is also suspended, and small Tier II and Tier III manufacturers could face liquidity issues. The automotive industry is highly capital-intensive and relies on frequent financing to continue operations. Thus, the production suspension during the outbreak and lower demand post the pandemic will have an unprecedented impact on piston pin providers.

The automotive piston pin market is estimated to observe a decline post-COVID-19 due to the impact on vehicle production. However, a steady recovery post-2020 in vehicle production will support the growth of this market in the coming years. Just like most of the companies in the automotive industry, piston pin manufacturers suffered from the outbreak as well. For instance, Bohai Trimet Automotive Holding had halted its production for around 40 days until May 11, 2020, which must have affected its performance in that quarter. Similarly, Elgin Industries, too, experienced the heat of COVID-19, especially in the US. The company had to follow strict guidelines for social distancing. For instance, in March 2020, the company announced that it was reducing its working hours to 32 hours per week for the safety of its employees. The reduced hours of production must have affected the overall production rate of the company, resulting in losses in that quarter.

Market Dynamics:

Driver: Substantial production and sales volumes of ICE vehicles

As piston pins are necessary in every type of ICE vehicle, the biggest driver for the global piston pin market is the continuously increasing production of ICE vehicles across the world. Although most countries are concerned about the emissions caused by ICE vehicles, most of the automotive market is still dominated by ICE vehicles. Lack of infrastructure and shortcomings of electric vehicles such as short-range and high initial cost are reasons why ICE vehicles are always the first choice in the majority of the cities in the world, especially in developing countries such as India and the Middle Eastern countries. As 100% adoption of electric vehicles will take some time, ICE vehicles will continue to remain in demand, resulting in significant production volumes.

Restraint: Much anticipated growth of electric vehicles

The rising demand for battery-operated vehicles to curb pollution can hinder the growth of the automotive piston pin market. Governments of several countries have set up mandatory emission standards to limit NOx and CO2 emission. Moreover, the growing stringency of emission norms has increased the demand for battery-operated vehicles. The increase in demand for electric vehicles affects conventional engine materials, such as pistons, piston rings, and piston pins. These vehicles operate on batteries and various control units that not only improve performance but also nullify emissions. According to the US Environmental Protection Agency (US EPA), approximately 26% of the total greenhouse gas emissions are from the automotive and transportation sector. The increasing focus on reducing vehicular emissions and the rising demand for fuel-efficient vehicles are compelling automotive OEMs to develop energy-efficient solutions.

The stringent regulations formulated to reduce C02 emission are likely to impact the automotive sector in the US, China, and Japan over the next decade. While automotive OEMs are focused on the electrification of vehicles, consumers are becoming more aware of the impact of vehicular emissions on the environment. Moreover, governments are also taking effective measures such as tax subsidies to promote the adoption of electric vehicles. For instance, in India, the budget for FY2020 announced a reduction in the GST rate for electric vehicles from 12% to 5%. An additional income tax deduction of USD 2,146 (INR 1.5 lakh) on the interest paid on the loans taken to purchase electric vehicles is further propelling OEMs to invest in e-mobility. Conventional ICEs are expected to be replaced by electric and hybrid powertrains by 2025. The absence of engines in electric vehicles would eliminate the need for piston pins. Thus, the shift toward vehicles will adversely affect the global automotive piston pin market in the coming years.

Opportunity: Pistons pins will be required in CNG, LPG, hybrid, and plug-in hybrid vehicles

The increasing prevalence of localized air quality regulations has been driving the need for alternative fuel technologies to reduce emissions from conventional ICE vehicles. Growing demand for emission-free and energy-efficient vehicles, government regulations, fluctuations in oil prices, and vehicle conversions have compelled automotive OEMs to develop technologies supporting alternative fuel usage. In this pursuit, automotive OEMs and component manufacturers are exploring ways to manufacture engines that use renewable oil and gas resources such as CNG, LPG, and ethanol for improved fuel efficiency. Also, most countries are not yet ready for fully electric vehicles because of the lack of supporting infrastructure. Hence, hybrid and plug-in hybrid vehicles will experience growth in times ahead. All these types of vehicles, including CNG, LPG, ethanol, hybrid, and plug-in hybrid vehicles, have an ICE with the usual piston-cylinder assembly. Thus, the increasing trend of these vehicles would benefit the piston pin market during the forecast period.

Challenge: Designing long-lasting & lightweight piston pins and dealing with complex lubrication & maintenance

The choice of material and size of the pin is the primary concern during the designing and manufacturing piston pins. The metals that are generally used to produce piston pins are alloys of steel, owing to their respective mechanical and chemical characteristics. These characteristics include thermal expansion, resistance to wear-and-tear, strength, and density, among others. Also, the piston pin should be light in weight so that the weight of the engine remains optimum. Thus, it is a challenge for manufacturers to design piston pins for customized requirements in lightweight and high-performance racing engines. The external surface of the pins needs to be hardened properly to make these pins strong enough to withstand all the shear and bending stresses. The method of hardening decides the choice of pin material. Usually, there are two key choices for hardening methods—case hardening (carburizing) and nitride hardening.

Besides the designing of pins, the maintenance and lubrication also play a vital role in piston pin life. Piston slap is a condition that occurs when there is some adhesive wear in the pin, where the piston can become slightly loose and increase the overall vibration of the engine. Also, to achieve the desired or required lubricity, manufacturers must use coatings for these pins. For instance, Diamond Like Coating (DLC) improves the overall lubricity of piston pins, resulting in better engine performance. The piston pins and cylinder walls are lubricated with the help of oil fling through the rotating crankshaft.

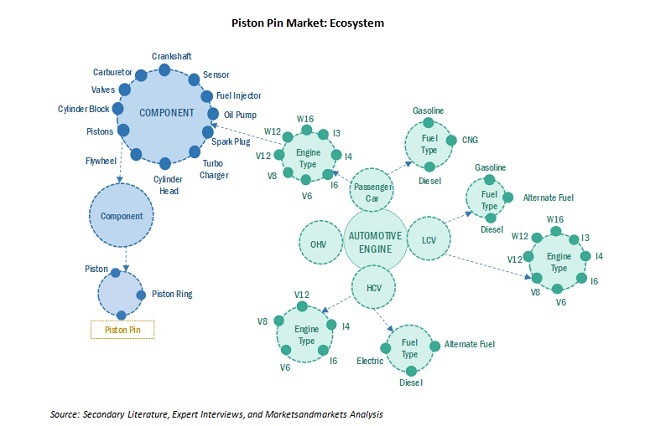

Piston Pin Market: Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The passenger vehicle segment is expected to be the largest vehicle type market

The passenger car segment is projected to have the largest share of the automotive piston pin market during the forecast period. The key factor driving the passenger car segment is the dominance of passenger cars in global vehicle production. For instance, as MarketsandMarkets analysis, in 2019, approximately 80% of the total global vehicle production is dominated by the passenger car segment. Apart from popular 4-cylinder engines, passenger cars also have engines with 6, 8, 10, and 12 cylinders, which, in turn, is driving the segment.

The gasoline segment will be leading the piston pin market during the forecast period

The gasoline segment is projected to have the largest share of the automotive piston pin market during the forecast. The growth of the gasoline segment can be attributed to the growing preference over diesel engines due to the strict emission standards across the world. Also, the life of gasoline engines is almost double than that of diesel engines. Gasoline engines require less maintenance. On the other hand, diesel engines require servicing/maintenance of the components after ~5,000–6,000 km. In the aftermarket, gasoline vehicles require minimal replacement of components. However, in the case of diesel engines, components of the piston system get replaced more often. All these factors have contributed to the demand for gasoline passenger vehicles.

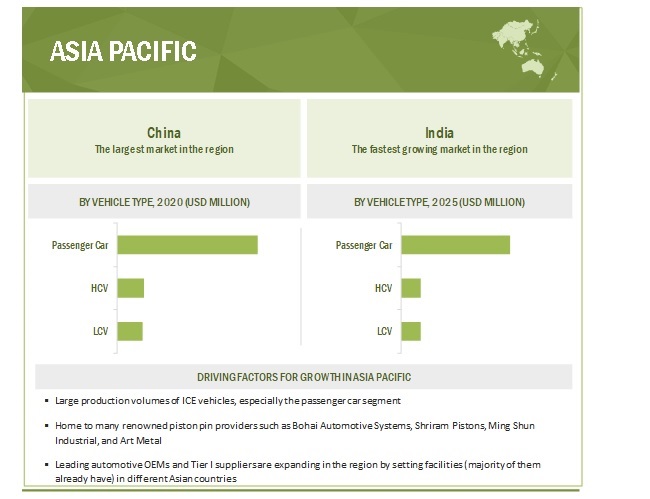

The Asia Pacific piston pin market is projected to hold the largest share by 2025

Asia Pacific is projected to be the largest and fastest-growing automotive piston pin market during the forecast period. China, Japan, South Korea, and India are some of the largest ICE vehicle producers globally. According to OICA, passenger car production in Asia Pacific accounts for around 54% of the global passenger car production. Hence, the Asia Pacific is the largest market for automotive piston pins, followed by Europe and North America.

Key Market Players

The global automotive piston pin market is dominated by major players such as Burgess Norton (US), Tenneco (US), MAHLE (Germany), Art Metal (Japan), and Rheinmetall Corporation (Germany). The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Volume (Million Units) and Value (USD Million) |

|

Segments covered |

Vehicle Type, Fuel, Material, Coating, Sales Channel, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

Burgess Norton (US), Tenneco (US), MAHLE (Germany), Art Metal (Japan), and Rheinmetall Corporation (Germany) |

This research report categorizes the automotive piston pin market based on vehicle type, fuel, material, coating, sales channel, and region.

Based on the vehicle type:

- Passenger Car

- LCV

- HCV

- Tractor

Based on the fuel:

- Diesel

- Gasoline

- Alternative

Based on the material:

- Steel

- Aluminum & Titanium

Based on the coating:

- DLC (Diamond-Like Coating)

- CRN (Chromium Nitride)

Based on the sales channel:

- OEM

- Aftermarket

Based on the region:

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Russia

- Rest of Europe

- Rest of the World

- Brazil

- South Africa

- Others

Recent Developments

- In March 2020, JE Pistons introduced a new ultra-lightweight IMCA/USRA 2-barrel piston. The piston is specifically designed for racing applications.

- In November 2019, Rheinmetall received an order from one of the world's biggest car producers. The order is for modern lightweight pistons for gasoline engines with the ring carrier and coolant gallery technology. The order runs until 2028. Made for a 1.5-liter turbocharged engine, in the future, these pistons will be used in all the customer's new four-cylinder series in China. The pistons are particularly low-weight, low-friction components. They meet the strict requirements for reduced fuel consumption and emissions, enabling them, among other things, to meet the latest exhaust emission standards in China.

- In November 2019, JE Pistons partnered with Parts Unlimited and Drag Specialties for the distribution of products.

- In January 2019, Tenneco announced the acquisition of Öhlins Racing A.B., a Sweden-based company. Öhlins offers suspension systems and components to the automotive and motorsport industries. This acquisition will accelerate the development of advanced original equipment (OE) intelligent suspension solutions, while also fast-tracking their time to market. It will also enhance Tenneco’s portfolio in broader mobility markets with the addition of Öhlins’ range of premium OE and aftermarket automotive and motorsports performance products.

- In May 2019, Bohai Automotive Systems officially started a technical center in China—Bohai Automotive Technical Center.

- In August 2018, Bohai Automotive Systems acquired 75% of the shares in the TRIMET Automotive Holding GmbH, Germany, which manufactures high-quality die-casting engine components for vehicles. The remaining 25% stake will be held by TRIMET.

- In 2018, Burgess Norton started its new piston pin manufacturing plant in Shanghai, China in 2018.

- In March 2017, Art Metal and Aisin Seiki completed their merger. The piston business unit of the Aisin Seiki was transferred to Art Metal.

Frequently Asked Questions (FAQ):

What is the current size of the global piston pin market?

The global piston pin market is estimated to be USD 259 million in 2020 and projected to reach USD 314 million by 2025, at a CAGR of 4.0%

Who are the winners in the global piston pin market?

Burgess Norton, Tenneco, MAHLE, Art Metal, Rheinmetall, and Bohai Automotive Systems fall under the winners' category. These companies have been competing for developing advanced and innovative piston pins that are compatible with different engines. Also, companies are partnering with different automotive OEMs for piston pins. With advanced R&D facilities, large production capacities, and strong distribution networks (geographical presence), these companies have managed to stay ahead of the tail-enders.

What is the Covid-19 impact on piston pin manufacturers?

The piston pin market is estimated to observe a decline post-COVID-19 due to the impact on vehicle production. However, a steady recovery post-2020 in vehicle production will support the growth of this market in the coming years. Just like most of the companies in the automotive industry, piston pin manufacturers suffered from the outbreak as well. For instance, Bohai Trimet Automotive Holding had halted its production for around 40 days until May 11, 2020, which must have affected the company’s performance in that quarter. Similarly, Elgin Industries, too, experienced the heat of COVID-19, especially in the US. The company had to follow strict guidelines for social distancing. For instance, in March 2020, the company announced that it was reducing its working hours to 32 hours per week for the safety of its employees. The reduced hours of production must have affected the overall production rate of the company, resulting in losses in that quarter.

What are the different types of materials and coatings used in piston pins?

Piston pins are usually made of steel alloys (carburized steel), along with the addition of chromium, manganese, and nickel, for the necessary structure to withstand the stress and temperature. However, few manufacturers prefer materials like aluminum & titanium for manufacturing piston pins. The durability of piston pins at high temperatures depends on the type of material used (it also depends on piston pins in different types of engines). DLC and CRN are the types of coatings often used for piston pins in automotive applications.

What are the different fuel type segments considered in the piston pin market?

The fuel types considered are gasoline, diesel, and alternative fuels. Alternative fuels include CNG and LNG. All these fuels can be used in an IC engine, and thus, require piston pins. .

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES

1.2 PRODUCT DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS: AUTOMOTIVE PISTON PIN MARKET

1.3 MARKET SCOPE

FIGURE 1 AUTOMOTIVE PISTON PIN MARKET: MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources for vehicle production

2.1.1.2 Key secondary sources for market sizing

2.1.1.3 Data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, & REGION

2.1.2.1 Sampling techniques & data collection methods

2.1.2.2 Primary participants

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 BOTTOM-UP APPROACH - AUTOMOTIVE PISTON PIN MARKET, BY REGION, VEHICLE TYPE

2.2.2 TOP-DOWN APPROACH

FIGURE 6 TOP-DOWN APPROACH - AUTOMOTIVE PISTON PIN MARKET, BY MATERIAL TYPE

2.2.3 AUTOMOTIVE PISTON PIN MARKET: RESEARCH METHODOLOGY ILUSTRATION OF COMPANY-BASED REVENUE ESTIMATION

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

2.4 ASSUMPTIONS

TABLE 2 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 7 AUTOMOTIVE PISTON PIN MARKET: MARKET DYNAMICS

FIGURE 8 PISTON PIN MARKET, BY REGION, 2020-2025

FIGURE 9 AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2020 VS. 2025

FIGURE 10 COVID-19 IMPACT ON AUTOMOTIVE PISTON PIN MARKET, 2018-2025

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN THE PISTON PIN MARKET

FIGURE 11 SIGNIFICANT PRODUCTION VOLUMES OF ICE VEHICLES IN ASIA PACIFIC TO DRIVE THE MARKET

4.2 PISTON PIN MARKET GROWTH RATE, BY REGION

FIGURE 12 ASIA PACIFIC IS PROJECTED TO BE THE LARGEST MARKET

4.3 PISTON PIN MARKET, BY VEHICLE TYPE

FIGURE 13 PASSENGER CAR SEGMENT TO BE THE LARGEST, 2020 VS. 2030 (USD THOUSAND)

4.4 PISTON PIN MARKET, BY SALES CHANNEL

FIGURE 14 OEM SEGMENT EXPECTED TO BE THE LARGEST, 2020 VS. 2025 (USD THOUSAND)

4.5 AUTOMOTIVE PISTON PIN MARKET, BY FUEL TYPE

FIGURE 15 GASOLINE SEGMENT PROJECTED TO BE THE LARGEST, 2020 VS. 2025 (THOUSAND UNITS)

4.6 PISTON PIN MARKET, BY MATERIAL TYPE

FIGURE 16 STEEL SEGMENT PROJECTED TO BE THE LARGEST, 2020 VS. 2025 (THOUSAND UNITS)

4.7 AUTOMOTIVE PISTON PIN MARKET, BY COATING TYPE

FIGURE 17 DLC SEGMENT PROJECTED TO BE THE LARGEST, 2020 VS. 2025 (THOUSAND UNITS)

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 AUTOMOTIVE PISTON PIN MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Substantial production and sales volumes of ICE vehicles

TABLE 3 GLOBAL AUTOMOTIVE PRODUCTION DATA (UNITS)

5.2.1.2 Significant demand for high performance & premium vehicles is compelling OEMs to incorporate bigger engines in vehicles

TABLE 4 SOME EXAMPLES OF BRANDS OFFERING VARIETY OF ENGINE OPTIONS

5.2.2 RESTRAINTS

5.2.2.1 Much anticipated growth of electric vehicles

FIGURE 19 GLOBAL BEV SALES, 2017-2019, (THOUSAND UNITS)

5.2.2.2 Growing trend of engine downsizing

FIGURE 20 ENGINE DOWNSIZING TREND, BY CYLINDER TYPE, 2012-2020

5.2.3 OPPORTUNITIES

5.2.3.1 Pistons pins will be required in CNG, LPG, hybrid, and plug-in hybrid vehicles

TABLE 5 TOP 5 MOST NGVS (CNG+LNG) SOLD IN EUROPE

TABLE 6 COMPRESSED NATURAL GAS (CNG) VEHICLE SALES, BY REGION, 2018-2027 (THOUSAND UNITS)

5.2.3.2 Use of varied materials and compositions

5.2.4 CHALLENGES

5.2.4.1 Designing long-lasting & lightweight piston pins and dealing with complex lubrication & maintenance

5.2.5 IMPACT OF MARKET DYNAMICS

TABLE 7 PISTON PIN MARKET: IMPACT OF MARKET DYNAMICS

5.3 PORTER'S FIVE FORCES

FIGURE 21 PORTER'S FIVE FORCES: AUTOMOTIVE PISTON PIN MARKET

5.4 AVERAGE SELLING PRICE TREND

TABLE 8 AUTOMOTIVE PISTON PINS: PRICE RANGE ANALYSIS, 2019 (USD)

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 22 PISTON PIN MARKET: SUPPLY CHAIN ANALYSIS

5.6 ECOSYSTEM

FIGURE 23 ECOSYSTEM: AUTOMOTIVE PISTON PIN MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 INTRODUCTION

5.7.2 HEATING & QUENCHING

5.7.3 NITRIDING

5.7.4 CARBURIZING

5.8 PATENT ANALYSIS

TABLE 9 IMPORTANT PATENT REGISTRATIONS RELATED TO AUTOMOTIVE PISTON PIN MARKET

5.9 CASE STUDY

5.1 TRADE DATA (VEHICLE EXPORT AND IMPORT DATA OF KEY MARKETS)

5.10.1 EUROPE (GERMANY AND SWEDEN)

TABLE 10 TOTAL IMPORT/EXPORT OF VEHICLES IN EUROPE, UNITS

5.10.2 JAPAN

TABLE 11 TOTAL IMPORT/EXPORT OF VEHICLES IN JAPAN, UNITS

5.10.3 CHINA

TABLE 12 TOTAL IMPORT/EXPORT OF VEHICLES IN CHINA, UNITS

5.10.4 US

TABLE 13 TOTAL IMPORT/EXPORT OF VEHICLES IN US, UNITS

5.11 REGULATORY OVERVIEW

5.11.1 CANADA

TABLE 14 EXISTING SUBSIDIES AND TAX STRUCTURE, CANADA

5.11.2 CHINA

TABLE 15 EXISTING SUBSIDIES AND TAX STRUCTURE, CHINA

5.11.3 FRANCE

TABLE 16 EXISTING SUBSIDIES AND TAX STRUCTURE, FRANCE

5.11.4 AUSTRIA

TABLE 17 EXISTING SUBSIDIES AND TAX STRUCTURE, AUSTRIA

5.11.5 GERMANY

TABLE 18 EXISTING SUBSIDIES AND TAX STRUCTURE, GERMANY

5.11.6 SPAIN

TABLE 19 EXISTING SUBSIDIES AND TAX STRUCTURE, SPAIN

5.12 INTRODUCTION TO COVID-19

5.13 COVID-19 HEALTH ASSESSMENT

FIGURE 24 COVID-19: THE GLOBAL PROPAGATION

FIGURE 25 COVID-19 PROPAGATION: SELECT COUNTRIES

5.14 COVID-19 ECONOMIC ASSESSMENT

FIGURE 26 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.14.1 COVID-19 ECONOMIC IMPACT-SCENARIO ASSESSMENT

FIGURE 27 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 28 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

5.14.2 IMPACT ON AUTOMOTIVE PISTON PIN MARKET

5.15 PISTON PIN MARKET, SCENARIOS (2020-2025)

FIGURE 29 AUTOMOTIVE PISTON PIN MARKET - FUTURE TRENDS & SCENARIO, 2020-2025 (USD THOUSAND)

5.15.1 MOST LIKELY SCENARIO

TABLE 20 MOST LIKELY SCENARIO, BY REGION, 2020-2025 (USD THOUSAND)

5.15.2 OPTIMISTIC SCENARIO

TABLE 21 OPTIMISTIC SCENARIO, BY REGION, 2020-2025 (USD THOUSAND)

5.15.3 PESSIMISTIC SCENARIO

TABLE 22 PESSIMISTIC SCENARIO, BY REGION, 2020-2025 (USD THOUSAND)

6 PISTON PIN MARKET, BY VEHICLE TYPE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 30 AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2020 VS. 2025

TABLE 23 PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 24 PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

6.2 OPERATIONAL DATA

TABLE 25 GLOBAL PASSENGER CAR PRODUCTION DATA, 2016-2019, MILLION UNITS

6.2.1 ASSUMPTIONS

6.2.2 RESEARCH METHODOLOGY

6.3 PASSENGER CAR

TABLE 26 PASSENGER CAR: AUTOMOTIVE PISTON PIN MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

TABLE 27 PASSENGER CAR: PISTON PIN MARKET, BY REGION, 2018-2025 (USD THOUSAND)

6.4 LIGHT COMMERCIAL VEHICLE (LCV)

TABLE 28 LIGHT COMMERCIAL VEHICLE: PISTON PIN MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

TABLE 29 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE PISTON PIN MARKET, BY REGION, 2018-2025 (USD THOUSAND)

6.5 HEAVY COMMERCIAL VEHICLE (HCV)

TABLE 30 HEAVY COMMERCIAL VEHICLE: PISTON PIN MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

TABLE 31 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE PISTON PIN MARKET, BY REGION, 2018-2025 (USD THOUSAND)

6.6 AGRICULTURAL EQUIPMENT (TRACTOR)

TABLE 32 AGRICULTURAL EQUIPMENT (TRACTOR): AUTOMOTIVE PISTON PIN MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

TABLE 33 AGRICULTURAL EQUIPMENT (TRACTOR): PISTON PIN MARKET, BY REGION, 2018-2025 (USD THOUSAND)

6.7 KEY INDUSTRY INSIGHTS

7 PISTON PIN MARKET, BY FUEL TYPE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 31 PISTON PIN MARKET, BY FUEL TYPE, 2020 VS. 2025

TABLE 34 PISTON PIN MARKET, BY FUEL TYPE, 2018-2025 (THOUSAND UNITS)

7.2 OPERATIONAL DATA

FIGURE 32 MARKET SHARE OF GASOLINE VS. DIESEL PASSENGER CARS IN EUROPE, 2017-2020 (%)

7.2.1 ASSUMPTIONS

7.2.2 RESEARCH METHODOLOGY

7.3 DIESEL

TABLE 35 DIESEL: PISTON PINS MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

7.4 GASOLINE

TABLE 36 GASOLINE: PISTON PIN MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

7.5 ALTERNATIVE FUEL

TABLE 37 ALTERNATIVE FUEL: PISTON PIN MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

7.6 KEY INDUSTRY INSIGHTS

8 PISTON PIN MARKET, BY MATERIAL TYPE (Page No. - 97)

8.1 INTRODUCTION

FIGURE 33 AUTOMOTIVE PISTON PIN MARKET, BY MATERIAL, 2020 VS. 2025

TABLE 38 PISTON PIN MARKET, BY MATERIAL TYPE, 2018-2025 (THOUSAND UNITS)

8.2 OPERATIONAL DATA

TABLE 39 ASIA PACIFIC PASSENGER CAR PRODUCTION DATA, 2016-2019, THOUSAND UNITS

8.2.1 ASSUMPTIONS

8.2.2 RESEARCH METHODOLOGY

8.3 ALUMINUM & TITANIUM

TABLE 40 ALUMINUM & TITANIUM: PISTON PINS MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

8.4 STEEL

TABLE 41 STEEL: AUTOMOTIVE PISTON PIN MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

8.5 KEY INDUSTRY INSIGHTS

9 PISTON PIN MARKET, BY COATING TYPE

9.1 INTRODUCTION

TABLE 42 PERFORMANCE OF PINS WITH DIFFERENT COATINGS WITH SN 50 BASE OIL

TABLE 43 PERFORMANCE OF PINS WITH DIFFERENT COATINGS WITH 1950N OF LOAD AND 20W50 ENGINE OIL

FIGURE 34 AUTOMOTIVE PISTON PIN MARKET, BY COATING TYPE, 2020 VS. 2025

TABLE 44 PISTON PIN MARKET, BY COATING TYPE, 2018-2025 (THOUSAND UNITS)

9.2 OPERATIONAL DATA

TABLE 45 EUROPE PASSENGER CAR PRODUCTION DATA, 2016-2019, THOUSAND UNITS

9.2.1 ASSUMPTIONS

9.2.2 RESEARCH METHODOLOGY

9.3 CRN

TABLE 46 CRN: PISTON PINS MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

9.4 DLC

TABLE 47 DLC: PISTON PIN MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

9.5 KEY INDUSTRY INSIGHTS

10 PISTON PIN MARKET, BY SALES CHANNEL (Page No. - 102)

10.1 INTRODUCTION

FIGURE 35 AUTOMOTIVE PISTON PIN MARKET, BY SALES CHANNEL, 2020 VS. 2025

TABLE 48 PISTON PIN MARKET, BY SALES CHANNEL, 2018-2025 (THOUSAND UNITS)

TABLE 49 PISTON PIN MARKET, BY SALES CHANNEL, 2018-2025 (USD THOUSAND)

10.2 OPERATIONAL DATA

TABLE 50 GLOBAL LIGHT COMMERCIAL VEHICLE PRODUCTION DATA, 2017-2019, THOUSAND UNITS

10.2.1 ASSUMPTIONS

10.2.2 RESEARCH METHODOLOGY

10.3 OEM

TABLE 51 OEM: PISTON PINS MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

TABLE 52 OEM: PISTON PINS MARKET, BY REGION, 2018-2025 (USD THOUSAND)

10.4 AFTERMARKET

TABLE 53 AFTERMARKET: AUTOMOTIVE PISTON PIN MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

TABLE 54 AFTERMARKET: PISTON PIN MARKET, BY REGION, 2018-2025 (USD THOUSAND)

10.5 KEY INDUSTRY INSIGHTS

11 PISTON PIN MARKET, BY REGION (Page No. - 107)

11.1 INTRODUCTION

FIGURE 36 AUTOMOTIVE PISTON PIN MARKET, BY REGION, 2020 VS. 2025

TABLE 55 PISTON PIN MARKET, BY REGION, 2018-2025 (THOUSAND UNITS)

TABLE 56 PISTON PIN MARKET, BY REGION, 2018-2025 (USD THOUSAND)

11.2 ASIA PACIFIC

11.2.1 HIGH PRODUCTION VOLUMES OF ICE VEHICLES TO DRIVE THE MARKET

11.2.2 ASIA PACIFIC: VEHICLE PRODUCTION

TABLE 57 ASIA PACIFIC: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

FIGURE 37 ASIA PACIFIC: AUTOMOTIVE PISTON PIN MARKET SNAPSHOT

TABLE 58 ASIA PACIFIC: PISTON PIN MARKET, BY COUNTRY, 2018-2025 (THOUSAND UNITS)

TABLE 59 ASIA PACIFIC: PISTON PIN MARKET, BY COUNTRY, 2018-2025 (USD THOUSAND)

11.2.3 CHINA

11.2.3.1 China: Vehicle Production Data

TABLE 60 CHINA: VEHICLE PRODUCTION DATA (THOUSAND UNITS)

11.2.3.2 China: Vehicle Production Comparison

TABLE 61 CHINA: VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.2.3.3 China: Vehicle Sales Comparison

TABLE 62 CHINA: VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.2.3.4 Highest production of vehicles in the country will drive the market

TABLE 63 CHINA: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 64 CHINA: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.2.4 JAPAN

11.2.4.1 Japan: Vehicle Production Data

TABLE 65 JAPAN: VEHICLE PRODUCTION DATA (THOUSAND UNITS)

11.2.4.2 Japan: Decline in vehicle production due to COVID-19

TABLE 66 JAPAN: VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.2.4.3 Japan: Decline in vehicle sales due to COVID-19

TABLE 67 JAPAN: VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.2.4.4 Presence of leading passenger car OEMs will drive the market

TABLE 68 JAPAN: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 69 JAPAN: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.2.5 SOUTH KOREA

11.2.5.1 South Korea: Vehicle Production Data

TABLE 70 SOUTH KOREA: VEHICLE PRODUCTION DATA (THOUSAND UNITS)

11.2.5.2 South Korea: Decline in vehicle production due to COVID-19

TABLE 71 SOUTH KOREA: VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.2.5.3 South Korea: Vehicle sales after Covid-19

TABLE 72 SOUTH KOREA: VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.2.5.4 Increasing exports of hybrid models to drive the market in South Korea

TABLE 73 SOUTH KOREA: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 74 SOUTH KOREA: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.2.6 INDIA

11.2.6.1 India: Vehicle Production Data

TABLE 75 INDIA: VEHICLE PRODUCTION DATA (THOUSAND UNITS)

11.2.6.2 India: Decline in vehicle production due to COVID-19

TABLE 76 INDIA: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.2.6.3 India: Decline in vehicle sales due to COVID-19

TABLE 77 INDIA: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.2.6.4 Increase in demand for gasoline vehicles to drive the market

TABLE 78 INDIA: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 79 INDIA: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.2.7 REST OF ASIA PACIFIC

11.2.7.1 Rest of Asia Pacific: Vehicle Production Data

TABLE 80 REST OF ASIA PACIFIC: VEHICLE PRODUCTION DATA (THOUSAND UNITS)

11.2.7.2 Thailand vehicle production data

TABLE 81 THAILAND VEHICLE PRODUCTION (THOUSAND UNITS)

11.2.7.3 Thailand: Decline in vehicle production due to COVID-19

TABLE 82 THAILAND: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.2.7.4 Thailand: Decline in vehicle sales due to COVID-19

TABLE 83 THAILAND: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.2.7.5 Increasing vehicle production will drive the market

TABLE 84 REST OF ASIA PACIFIC: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 85 REST OF ASIA PACIFIC: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.3 NORTH AMERICA

11.3.1 NORTH AMERICA: VEHICLE PRODUCTION

TABLE 86 NORTH AMERICA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

FIGURE 38 NORTH AMERICA: AUTOMOTIVE PISTON PIN MARKET SNAPSHOT

TABLE 87 NORTH AMERICA: PISTON PIN MARKET, BY COUNTRY, 2018-2025 (THOUSAND UNITS)

TABLE 88 NORTH AMERICA: PISTON PIN MARKET, BY COUNTRY, 2018-2025 (USD THOUSAND)

11.3.2 US

11.3.2.1 US: Vehicle production Data

TABLE 89 US: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.3.2.2 US: Decline in vehicle production due to COVID-19

TABLE 90 US: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.3.2.3 US: Decline in vehicle sales due to COVID-19

TABLE 91 US: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.3.2.4 Increase in light commercial vehicle production to drive the market

TABLE 92 US: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 93 US: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.3.3 CANADA

11.3.3.1 Canada: Vehicle Production Data

TABLE 94 CANADA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.3.3.2 Canada: Decline in vehicle production due to COVID-19

TABLE 95 CANADA: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.3.3.3 Canada: Decline in vehicle sales due to COVID-19

TABLE 96 CANADA: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.3.3.4 Rising focus toward gasoline engines to drive the market

TABLE 97 CANADA: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 98 CANADA: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.3.4 MEXICO

11.3.4.1 Mexico: Vehicle Production Data

TABLE 99 MEXICO: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.3.4.2 Mexico: Decline in vehicle production due to COVID-19

TABLE 100 MEXICO: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.3.4.3 Mexico: Decline in vehicle sales due to COVID-19

TABLE 101 MEXICO: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.3.4.4 Growing demand for HCV to drive the Mexican piston pin market

TABLE 102 MEXICO: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 103 MEXICO: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.4 EUROPE

11.4.1 EUROPE: VEHICLE PRODUCTION DATA

TABLE 104 EUROPE: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

FIGURE 39 EUROPE: AUTOMOTIVE PISTON PIN MARKET, 2020 VS. 2025 (USD THOUSAND)

TABLE 105 EUROPE: PISTON PIN MARKET, BY COUNTRY, 2018-2025 (THOUSAND UNITS)

TABLE 106 EUROPE: PISTON PIN MARKET, BY COUNTRY, 2018-2025 (USD THOUSAND)

11.4.2 GERMANY

11.4.2.1 Germany: Vehicle production

TABLE 107 GERMANY: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.4.2.2 Germany: Decline in vehicle production due to COVID-19

TABLE 108 GERMANY: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.4.2.3 Germany: Decline in vehicle sales due to COVID-19

TABLE 109 GERMANY: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.4.2.4 Presence of major players to drive the German market

TABLE 110 GERMANY: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 111 GERMANY: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.4.3 FRANCE

11.4.3.1 France: Vehicle Production Data

TABLE 112 FRANCE: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.4.3.2 France: Decline in vehicle production due to COVID-19

TABLE 113 FRANCE: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.4.3.3 France: Decline in vehicle sales due to COVID-19

TABLE 114 FRANCE: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.4.3.4 Increase in production of LCVs will drive the market

TABLE 115 FRANCE: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 116 FRANCE: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.4.4 UK

11.4.4.1 UK: Vehicle production

TABLE 117 UK: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.4.4.2 UK: Decline in vehicle production due to COVID-19

TABLE 118 UK: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.4.4.3 UK: Decline in vehicle sales due to COVID-19

TABLE 119 UK: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.4.4.4 Light commercial vehicle segment will witness growth in the UK market

TABLE 120 UK: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 121 UK: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.4.5 SPAIN

11.4.5.1 Spain: Vehicle production

TABLE 122 SPAIN: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.4.5.2 Spain: Decline in vehicle production due to COVID-19

TABLE 123 SPAIN: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.4.5.3 Spain: Decline in vehicle sales due to COVID-19

TABLE 124 SPAIN: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.4.5.4 Light commercial vehicle segment will drive the market

TABLE 125 SPAIN: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 126 SPAIN: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.4.6 ITALY

11.4.6.1 Italy: Vehicle production

TABLE 127 ITALY: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.4.6.2 Italy: Decline in vehicle production due to COVID-19

TABLE 128 ITALY: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.4.6.3 Italy: Decline in vehicle sales due to COVID-19

TABLE 129 ITALY: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.4.6.4 Increase in LCV production will drive the market

TABLE 130 ITALY: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 131 ITALY: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.4.7 RUSSIA

11.4.7.1 Russia: Vehicle production

TABLE 132 RUSSIA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.4.7.2 Growing passenger car and HCV segment will drive the market

TABLE 133 RUSSIA: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 134 RUSSIA: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.4.8 REST OF EUROPE

11.4.8.1 Rest of Europe: Vehicle production

TABLE 135 REST OF EUROPE: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.4.8.2 Increase in passenger car production will drive the market

TABLE 136 REST OF EUROPE: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 137 REST OF EUROPE: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.5 REST OF THE WORLD

11.5.1 REST OF THE WORLD: VEHICLE PRODUCTION

TABLE 138 REST OF THE WORLD: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

FIGURE 40 REST OF THE WORLD: AUTOMOTIVE PISTON PIN MARKET, 2020 VS. 2025 (USD THOUSAND)

TABLE 139 REST OF THE WORLD: PISTON PIN MARKET, BY COUNTRY, 2018-2025 (THOUSAND UNITS)

TABLE 140 REST OF THE WORLD: PISTON PIN MARKET, BY COUNTRY, 2018-2025 (USD THOUSAND)

11.5.2 BRAZIL

11.5.2.1 Brazil: Vehicle Production Data

TABLE 141 BRAZIL: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.5.2.2 Brazil: Decline in vehicle production due to COVID-19

TABLE 142 BRAZIL: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

11.5.2.3 Brazil: Decline in vehicle sales due to COVID-19

TABLE 143 BRAZIL: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

11.5.2.4 Growing HCV segment will drive the market

TABLE 144 BRAZIL: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 145 BRAZIL: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.5.3 SOUTH AFRICA

11.5.3.1 South Africa: Vehicle Production Data

TABLE 146 SOUTH AFRICA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.5.3.2 Overall growth in the automotive industry will drive the market

TABLE 147 SOUTH AFRICA: AUTOMOTIVE PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 148 SOUTH AFRICA: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

11.5.4 OTHERS

11.5.4.1 Vehicle Production in other countries

TABLE 149 OTHERS: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016-2019 (THOUSAND UNITS)

11.5.4.2 Positive initiatives toward emission control will drive the market for gasoline vehicles

TABLE 150 OTHERS: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (THOUSAND UNITS)

TABLE 151 OTHERS: PISTON PIN MARKET, BY VEHICLE TYPE, 2018-2025 (USD THOUSAND)

12 COMPETITIVE LANDSCAPE (Page No. - 144)

12.1 MARKET EVALUATION FRAMEWORK

FIGURE 41 MARKET EVALUATION FRAMEWORK

12.2 OVERVIEW

FIGURE 42 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE AUTOMOTIVE PISTON PIN MARKET

12.3 MARKET SHARE AND MARKET RANKING ANALYSIS FOR PISTON PIN MARKET

FIGURE 43 MARKET SHARE ANALYSIS

12.4 MARKET RANKING ANALYSIS FOR PISTON PIN MARKET

FIGURE 44 MARKET RANKING ANALYSIS, 2019

12.5 MARKET EVALUATION FRAMEWORK: REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 45 TOP PUBLIC/LISTED PLAYERS DOMINATING THE AUTOMOTIVE PISTON PIN MARKET IN LAST 3 YEARS

12.6 COMPETITIVE SCENARIO

12.6.1 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ PARTNERSHIPS/AGREEMENTS

TABLE 152 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/PARTNERSHIPS/ AGREEMENTS, 2017-2020

12.6.2 NEW PRODUCT DEVELOPMENTS

TABLE 153 NEW PRODUCT DEVELOPMENTS, 2017-2020

12.6.3 MERGERS & ACQUISITIONS, 2017-2020

TABLE 154 MERGERS & ACQUISITIONS, 2017-2020

12.6.4 EXPANSIONS, 2017-2020

TABLE 155 EXPANSIONS, 2018S-2020

12.7 COMPETITIVE LEADERSHIP MAPPING FOR PISTON PIN MARKET

12.7.1 STARS

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE

12.7.4 EMERGING COMPANIES

FIGURE 46 AUTOMOTIVE PISTON PIN MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

12.8 STRENGTH OF PRODUCT PORTFOLIO:

FIGURE 47 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN PISTON PIN MARKET

12.9 BUSINESS STRATEGY EXCELLENCE:

FIGURE 48 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN PISTON PIN MARKET

12.10 WINNERS VS. TAIL-ENDERS

TABLE 156 WINNERS VS. TAIL-ENDERS

13 COMPANY PROFILES (Page No. - 157)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 BURGESS NORTON

FIGURE 49 BURGESS NORTON: SWOT ANALYSIS

13.2 TENNECO

FIGURE 50 TENNECO: COMPANY SNAPSHOT

FIGURE 51 TENNECO: SWOT ANALYSIS

13.3 MAHLE GMBH

FIGURE 52 MAHLE: COMPANY SNAPSHOT

FIGURE 53 MAHLE GMBH: SWOT ANALYSIS

13.4 ART METAL MFG., LTD.

FIGURE 54 ART METAL: SWOT ANALYSIS

13.5 RHEINMETALL AUTOMOTIVE AG

FIGURE 55 RHEINMETALL AUTOMOTIVE AG: COMPANY SNAPSHOT

FIGURE 56 RHEINMETALL AUTOMOTIVE AG: SWOT ANALYSIS

13.6 BOHAI AUTOMOTIVE SYSTEMS

FIGURE 57 BOHAI AUTOMOTIVE SYSTEMS: COMPANY SNAPSHOT

13.7 ROSS RACING PISTONS

13.8 MING SHUN INDUSTRIAL CO., LTD.

13.9 ELGIN INDUSTRIES

13.1 JE PISTONS

13.11 ART-SERINA

13.12 SHRIRAM PISTONS & RINGS LTD.

FIGURE 58 SHRIRAM PISTONS & RINGS: COMPANY SNAPSHOT

13.13 ADDITIONAL COMPANY PROFILES

13.13.1 ASIA PACIFIC

13.13.1.1 Dong Yang Piston

13.13.1.2 Menon Piston

13.13.1.3 Avon Industrial Corporation

13.13.1.4 Prabhat Engineering Corporation

13.13.1.5 SAMKRG Pistons and Rings Limited

13.13.2 EUROPE

13.13.2.1 Capricorn

13.13.2.2 Cosworth

13.13.2.3 Coker Engineering Ltd.

13.13.3 NORTH AMERICA

13.13.3.1 CP Carrillo, Inc.

13.13.3.2 Wiseco

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

14 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 181)

14.1 JAPAN, KOREA, AND INDIA EMERGING AS PROMISING ALTERNATIVES TO CHINA FOR SUPPLY OF AUTOMOTIVE COMPONENTS

14.2 HIGH-PERFORMANCE PASSENGER CARS & LIGHT- AND HEAVY-DUTY VEHICLES CAN BE KEY FOCUS AREA FOR MANUFACTURERS

14.3 CONCLUSION

15 APPENDIX (Page No. - 182)

15.1 KEY INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

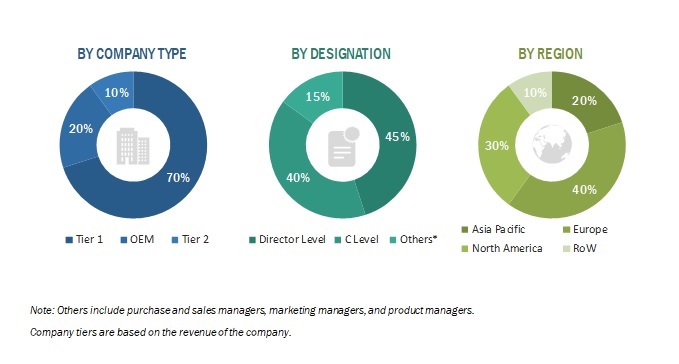

The study involved four major activities in estimating the current size of the piston pin market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of engine/component manufacturers, International Organisation of Motor vehicle Manufacturers (OICA), European Automobile Manufacturers’ Association (ACEA), Regional Transportation Authority (RTA), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT)], piston pin/piston systems magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, government organizations websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global automotive piston pin market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across three major regions, namely, Asia Pacific, Europe, North America. Approximately 30% and 70% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

Breakdown of Primaries

To know about the assumptions considered for the study, download the pdf brochure

Note: Others include purchase and sales managers, marketing managers, and product managers.

Company tiers are based on the revenue of the company.

Market Size Estimation

The bottom-up approach was used to estimate and validate the total market size. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the size of the automotive piston pin market, in terms of value (USD million) and volume (million units)

- To define, describe, and forecast the size of the automotive piston pin market based on sales channel, material, coating type, vehicle, fuel, and region

- To segment and forecast the market size, by sales channel (OEM and aftermarket)

- To segment and forecast the market size by fuel (Diesel, Gasoline, and Alternative Fuels)

- To segment and forecast the market size, by material (steel and aluminum & titanium)

- To segment and forecast the market size, by coating type [diamond-like carbon coating (DLC) and Chromium Nitride (CrN)]

- To cover the automotive piston pin market by vehicle (passenger cars, light commercial vehicle, heavy commercial vehicle, and tractor)

- To segment and forecast the market size, by region (Asia Pacific, Europe, North America, and RoW)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the automotive piston pin market

- To analyze the ranking of key players operating in the automotive piston pin market

- To understand the dynamics of competitors in the automotive piston pin market and distinguish them into star, emerging leaders, pervasive, and participants according to their product portfolio strength and business strategies

- To analyze recent developments, joint ventures, mergers & acquisitions, supply contracts, new product launches, collaborations, and other activities carried out by key industry players in the automotive piston pin market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To analyze the impact of COVID-19 on the overall automotive piston pin market

- To strategically profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- Piston Pin Market, By Fuel Type at country level (For countries covered in the report)

- Piston Pin Market, By Material Type at country level (For countries covered in the report)

- Company Information

- Profiling of Additional Market Players (Up to 5)

Growth opportunities and latent adjacency in Automotive Piston Pin Market