Automotive Camera and Integrated Radar and Camera Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Automotive Camera, Integrated Radar and Camera), Application (ADAS, Park Assist), View Type, Vehicle Type, and Geography (2021-2026)

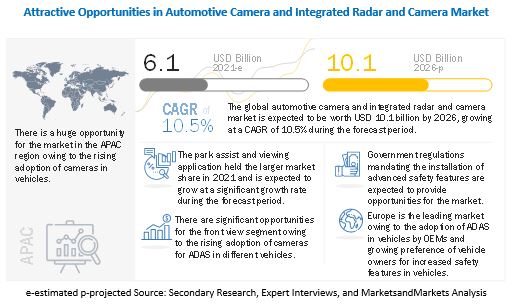

[217 Pages Report] The global Automotive Camera and Integrated Radar and Camera Market Size is projected to grow from USD 6.1 billion in 2021 to USD 10.1 billion by 2026; it is expected to grow at a CAGR of 10.5% from 2021 to 2026.

The growth of the automotive camera and integrated radar and camera industry is majorly driven by increasing consumer demand for advanced security systems, rising demand for vehicles safety systems for premium segment vehicles, and increasing number of regulations mandating safety features in vehicles.

To know about the assumptions considered for the study, download the pdf brochure

Automotive Camera and Integrated Radar and Camera Market Dynamics

Driver: Increasing demand for advanced security systems

The demand for safety features, such as parking assistance, collision avoidance, lane departure warning (LDW), traction control, electronic stability control, tire pressure monitoring, airbags, and telematics, is growing due to the increasing number of road accidents worldwide. Integrated radar and camera systems are used in advanced driver assistance systems (ADAS), which can detect and classify certain objects on the road and alert drivers accordingly. These systems can also automatically decelerate or stop the vehicle in case of accidents. There has been a significant growth in deaths due to road accidents in recent years. According to World Health Organization’s 2020 reports, nearly 1.35 million people die in road accidents each year worldwide. Moreover, more teenagers die due to road accidents than other age groups. These factors lead to a growth in the demand for safety features in vehicles. Automobile companies are developing and introducing safety features to meet the needs of customers. Thus, the demand for safety features propels the growth of the automotive camera and integrated radar and camera market.

Restraint: High installation costs and complex structure

The high cost associated with installing safety systems in vehicles is expected to restrain the growth of the automotive camera and integrated radar and camera market, as it increases the cost of vehicles. Providing premium features in vehicles incurs additional expenses for consumers in the form of hardware, applications, and telecom service charges, which eventually hamper the growth of the automotive camera and integrated radar and camera market. Moreover, servicing such vehicles is a complex process, requiring skilled workers due to the presence of several electronic components and sensors. Furthermore, the high cost of the systems has been slightly hindering the market growth. ADAS, such as adaptive cruise control (ACC), forward collision warning system (FCWS), and automatic emergency braking (AEB), require 3 to 6 cameras and a lot more sensors to be installed on the vehicle. Thus, high initial costs and complex structure are expected to significantly impact the growth of the market.

Opportunity: Growing number of technological advancements and innovations in ADAS

Technological advancements have already redefined the way vehicles use fuel, with electric, hybrid, and solar energy systems in vehicles beginning to displace internal combustion engines and fuel-fed engines. The growth of autonomous technologies and innovations in ADAS systems have simultaneously begun to increase user interactivity while decreasing the need to take direct control of driving. This has been made possible largely due to the emergence of onboard navigation systems. In the development of mobility technologies, the focus of manufacturers is turning from hardware to the innovation of complex software, including ADAS. As the role of software is increasing, vehicle manufacturers are striving to deliver more innovations while boosting the safety of vehicles and occupants. Hence, the increasing number of technological developments and innovations in ADAS are creating huge opportunities for the automotive camera and integrated radar and camera market.

Challenge: Constraints in real-time image processing in surround view systems

The architecture of multi-camera systems is based on integrated digital signal processing (DSP) units. This architecture operates in an order set by the programmed algorithm. DSP-based multi-camera systems find it difficult to extract various views from inputs of multiple cameras and display them in real time in a short period. For instance, in May 2018, Uber’s autonomous car with surround-view cameras could not take corrective action when a pedestrian came in the way of the vehicle, leading to an accident. To reduce such incidents, cameras and other active systems should be more accurate and provide real-time results. Also, gathering data from different cameras and translating it into a single image involves the risk of deteriorating the quality of the rest of the image, thereby creating barriers for real-time streaming of video.

Front view segment expected to contribute the largest share to the automotive camera and integrated radar and camera market during the forecast period

The front view segment is projected to account for the largest size of the integrated radar and camera market from 2021 to 2026. The growth of this segment is driven by the increasing demand for ADAS functions to monitor the traffic ahead to enable the car to maintain a safe and legal speed, stay in its lane, keep its distance with vehicles ahead, and react to emergencies. Front view cameras are mainly used for dash camera applications and ADAS applications. ADAS front view cameras enhance active safety and driver assistance functions, such as autonomous emergency braking (AEB), adaptive cruise control (ACC), lane-keeping assist system (LKAS), and traffic jam assist (TJA). Rising trends of connected vehicles and autonomous vehicles, and growing adoption of ADAS drives the growth of the front view segment. Increasing encouragement from governments for OEMs to adopt advanced safety features in vehicles and growing preference of end users for advanced safety features are the major factors driving the growth of ADAS in vehicles, which, in turn, drives the demand for front view automotive cameras.

Integrated radar and camera segment expected to grow at the highest CAGR in the automotive camera and integrated radar and camera market in 2021

The integrated radar and camera segment is expected to register a higher growth rate during the forecast market. It is currently a niche market. An integrated radar camera system includes camera and radar components housed in a single module. The module can be employed in a vehicle for safety applications such as ACC, forward collision warning (FCW), collision mitigation or avoidance via autonomous braking, and LDW. The integration of the camera and the radar into a single module results in a reduction in sensor costs. Additionally, camera and radar integration employs common or shared electronics and signal processing. With the increasing adoption of ADAS, the integrated radar and camera market is expected to witness significant growth in the coming years.

Automotive camera and integrated radar and camera market in Europe contributed the largest share in 2020.

Europe accounted for the largest share of the automotive camera and integrated radar and camera market in 2020. Some of the major drivers for the growth of the market in Europe include the technological developments within the country, emerging applications, demand for automotive cameras and integrated radar and camera systems in the region, and the presence of a strong automotive industry in the region. These factors would further boost the automotive camera and integrated radar and camera market in Europe. This, in turn, has created a significant demand for automotive camera and integrated radar and camera.

Key Market Players

Automotive camera and integrated radar and camera companies have implemented various types of organic as well as inorganic growth strategies, such as product launches, product developments, and acquisitions to strengthen their offerings in the market. The major players are Robert Bosch GmbH (Germany), Continental AG (Germany), Valeo SA (France), Aptiv PLC (Ireland), and Magna International (Canada), are some of the major players in automotive camera and integrated radar and camera market.

The study includes an in-depth competitive analysis of these key players in the automotive camera and integrated radar and camera market with their company profiles, recent developments, and key market strategies.

Automotive Camera and Integrated Radar and Camera Market Report Scope

|

Report Metric |

Details |

|

Years considered |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD million and USD billion), Volume (Million Units) |

|

Segments covered |

Type, View Type, Vehicle Type, Application, And Region |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Robert Bosch GmbH (Germany), Continental AG (Germany), Valeo SA (France), Aptiv PLC (Ireland), Magna Corporation (Canada), Intel Corporation (US), Infineon Technologies AG (Germany), ZF Friedrichshafen (Germany), and Veoneer Inc. (Sweden). |

In this report, the overall automotive camera and integrated radar and camera market has been segmented based on type, view type, vehicle type, application, and region

Automotive camera and integrated radar and camera Market, By Type:

- Automotive camera

- Integrated radar and camera

Automotive camera and integrated radar and camera Market, By View Type

- Front view

- Rearview

- Surround view

Automotive camera and integrated radar and camera Market, By Vehicle Type

- Passenger cars

- Commercial vehicles

- Heavy-commercial vehicles

Automotive camera and integrated radar and camera Market, By Application

- ADAS

- Park assist and viewing

Geographic Analysis

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, Spain, and Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, and Rest of APAC)

- Rest of the World (South America and Middle East & Africa)

Recent Developments

- In December 2019, Bosch launched a new interior monitoring system that enhances the safety, comfort, and convenience of all vehicle occupants. The system can detect driver distraction, signs of drowsiness, and even whether a child has been left behind in the vehicle, and it alerts the driver regarding critical situations. Safety systems, e.g., the seat belt alert function, are further enhanced using the information acquired from a vehicle’s interior.

- In October 2019, Continental AG developed a left-turn assist for agricultural machines. The system warns the agricultural machine’s driver about the obstacles on the left side of the vehicle through an acoustic or optical signal. The system can detect approaching vehicles at a distance of up to 250 meters. This is made possible by radar technology. It will be combined with camera technology soon to offer a more efficient solution.

- In September 2019, Aptiv PLC entered into a joint venture agreement with Hyundai Motor Co., a South Korean automotive company, to develop autonomous vehicles for the commercialization of level 4 and level 5 self-driving technologies. The joint venture agreement could help the company expand its capabilities in the autonomous vehicles market in South Korea.

Frequently Asked Questions (FAQ):

What is the market size of automotive camera and integrated radar and camera market expected in 2021?

Automotive camera and integrated radar and camera market is expected to be valued USD 6.1 billion by 2021.

Which are the top players in the automotive camera and integrated radar and camera market?

The major vendors operating in the automotive camera and integrated radar and camera market include Robert Bosch GmbH, Continental AG, Valeo SA, Aptiv PLC , and among others.

Which major countries are considered in the North America region?

The report includes an analysis of the US, Canada, and Mexico countries.

Which are the major application of automotive camera and integrated radar and camera?

ADAS and park assist and viewing are major applications of automotive camera and integrated radar and camera.

Does this report include the impact of COVID-19 on the market?

Yes, the report includes the impact of COVID-19 on the automotive camera and integrated radar and camera market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE) – IDENTIFICATION OF REVENUE GENERATED BY COMPANIES FROM AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis (demand side)

FIGURE 5 MARKET: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FOR ESTIMATING SIZE OF AUTOMOTIVE CAMERA AND INTEGRATED RADAR CAMERA MARKET

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis (supply side)

FIGURE 7 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 9 AUTOMOTIVE CAMERA SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 10 FRONT-VIEW SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2021 TO 2026

FIGURE 11 ADAS APPLICATION TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 12 EUROPE TO HOLD LARGEST SHARE OF INTEGRATED RADAR AND CAMERA MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA MARKET

FIGURE 13 MARKET TO GROW AT SIGNIFICANT RATE FROM 2021 TO 2026

4.2 MARKET, BY TYPE

FIGURE 14 AUTOMOTIVE CAMERA SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.3 MARKET, BY VIEW TYPE

FIGURE 15 FRONT VIEW SEGMENT TO LEAD MARKET FROM 2021 TO 2026

4.4 MARKET, BY VEHICLE TYPE

FIGURE 16 PASSENGER CARS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2026

4.5 MARKET IN EUROPE, BY APPLICATION AND BY COUNTRY

FIGURE 17 PARK ASSIST AND VIEWING SEGMENT AND GERMANY EXPECTED TO LEAD MARKET IN EUROPE IN 2021

4.6 AUTOMOTIVE CAMERA INTEGRATED RADAR AND CAMERA MARKET GROWTH RATE, BY COUNTRY

FIGURE 18 MARKET TO GROW AT HIGHEST RATE IN CHINA DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for advanced security systems

5.2.1.2 Rising demand for vehicles safety systems for premium segment vehicles

5.2.1.3 Increasing number of regulations mandating safety features in vehicles

FIGURE 20 IMPACT OF DRIVERS ON MARKET

5.2.2 RESTRAINTS

5.2.2.1 High installation costs and complex structure

5.2.3 OPPORTUNITIES

5.2.3.1 Growing number of technological advancements and innovations in ADAS

5.2.3.2 Increasing development of autonomous systems

5.2.3.3 Rising adoption of cameras by OEMs for emerging applications

FIGURE 21 IMPACT OF OPPORTUNITIES ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Constraints in real-time image processing in surround view systems

5.2.4.2 Slowdown in automotive industry due to COVID-19

FIGURE 22 IMPACT OF RESTRAINTS AND CHALLENGES ON MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS OF MARKET

5.4 MARKET: ECOSYSTEM ANALYSIS

TABLE 3 MARKET: SUPPLY CHAIN

5.5 CASE STUDIES

TABLE 4 MARKET: CASE STUDIES

5.6 PORTER’S FIVE FORCES

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS (2020)

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 TECHNOLOGY ANALYSIS

5.7.1 AUTOMOTIVE CAMERAS

5.7.2 RADAR

5.7.3 INTEGRATED RADAR AND CAMERA SYSTEMS

5.8 PATENTS ANALYSIS

TABLE 6 PATENTS RELATED TO INTEGRATED RADAR AND CAMERAS

5.9 REGULATIONS

5.9.1 CANADA

5.9.2 US

5.9.3 EUROPEAN PARLIAMENT

5.9.4 NATIONAL AGENCY FOR AUTOMOTIVE SAFETY & VICTIMS’ AID (NASVA), JAPAN

5.10 TRADE ANALYSIS

TABLE 7 IMPORTS DATA FOR HS CODE 8708, BY COUNTRY, 2016–2020 (USD THOUSAND)

TABLE 8 EXPORTS DATA FOR HS CODE 8708, BY COUNTRY, 2016–2020 (USD THOUSAND)

5.11 ASP ANALYSIS

FIGURE 24 ASP ANALYSIS OF AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA

6 AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA MARKET, BY TYPE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 25 INTEGRATED RADAR AND CAMERA MARKET TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

TABLE 9 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 10 MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 11 MARKET, BY TYPE, 2019–2026 (MILLION UNITS)

6.2 AUTOMOTIVE CAMERA

6.2.1 RISING IMPORTANCE OF ADAS IN VEHICLES TO DRIVE GROWTH OF AUTOMOTIVE CAMERAS

6.3 INTEGRATED RADAR AND CAMERA

6.3.1 COMPACT SIZE OF INTEGRATED RADAR AND CAMERA DRIVES THEIR ADOPTION FOR DEVELOPMENT OF COST-EFFECTIVE FUSION SYSTEMS

6.4 IMPACT OF COVID-19 ON MARKET

7 AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA MARKET, BY VIEW TYPE (Page No. - 81)

7.1 INTRODUCTION

FIGURE 26 FRONT VIEW SEGMENT TO GROW AT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 12 MARKET, BY VIEW TYPE, 2017–2020 (USD MILLION)

TABLE 13 MARKET, BY VIEW TYPE, 2021–2026 (USD MILLION)

7.2 FRONT VIEW

7.2.1 RISING ADOPTION OF ADAS DRIVES GROWTH OF FRONT VIEW SEGMENT

FIGURE 27 PASSENGER CARS SEGMENT TO LEAD AUTOMOTIVE RADAR AND CAMERA MARKET FOR FRONT VIEW DURING FORECAST PERIOD

TABLE 14 MARKET FOR FRONT VIEW, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 15 MARKET FOR FRONT VIEW, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

7.3 REARVIEW

7.3.1 RISING ADOPTION OF BACKUP CAMERAS DRIVES GROWTH OF REARVIEW SEGMENT

TABLE 16 MARKET FOR REARVIEW, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 17 MARKET FOR REARVIEW, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

7.4 SURROUND VIEW

7.4.1 RISING TRENDS OF AUTONOMOUS DRIVING TO PROVIDE OPPORTUNITY FOR SURROUND VIEW SOLUTIONS

TABLE 18 MARKET FOR SURROUND VIEW, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 19 MARKET FOR SURROUND VIEW, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

8 AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA MARKET, BY VEHICLE TYPE (Page No. - 87)

8.1 INTRODUCTION

FIGURE 28 PASSENGER CARS SEGMENT TO LEAD MARKET

TABLE 20 MARKET, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 21 MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

8.2 PASSENGER CARS

8.2.1 INCREASING MANDATES FOR DEPLOYMENT OF ADAS IN PASSENGER CARS DRIVES GROWTH OF THIS SEGMENT

FIGURE 29 FRONT VIEW SEGMENT TO HOLD LARGEST SIZE OF MARKET FROM 2021 TO 2026

TABLE 22 MARKET FOR PASSENGER CARS, BY VIEW TYPE, 2017–2020 (USD MILLION)

TABLE 23 MARKET FOR PASSENGER CARS, BY VIEW TYPE, 2021–2026 (USD MILLION)

FIGURE 30 EUROPE TO HOLD LARGEST SIZE OF MARKET FOR PASSENGER CARS DURING FORECAST PERIOD

TABLE 24 MARKET FOR PASSENGER CARS, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 MARKET FOR PASSENGER CARS, BY REGION, 2021–2026 (USD MILLION)

8.2.1.1 Economy vehicles

8.2.1.2 Mid-priced vehicles

8.2.1.3 Luxury vehicles

TABLE 26 MARKET FOR PASSENGER CARS FOR FRONT VIEW, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 MARKET FOR PASSENGER CARS FOR FRONT VIEW, BY REGION, 2021–2026 (USD MILLION)

TABLE 28 MARKET FOR PASSENGER CARS FOR REAR VIEW, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 MARKET FOR PASSENGER CARS FOR REAR VIEW, BY REGION, 2021–2026 (USD MILLION)

TABLE 30 MARKET FOR PASSENGER CARS FOR SURROUND VIEW, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 MARKET FOR PASSENGER CARS FOR SURROUND VIEW, BY REGION, 2021–2026 (USD MILLION)

8.2.2 COMMERCIAL VEHICLES

8.2.2.1 Cameras are used in commercial vehicles to enhance safety and improve fleet efficiency

TABLE 32 MARKET FOR COMMERCIAL VEHICLES, BY VIEW TYPE, 2017–2020 (USD MILLION)

TABLE 33 MARKET FOR COMMERCIAL VEHICLES, BY VIEW TYPE, 2021–2026 (USD MILLION)

FIGURE 31 NORTH AMERICA TO HOLD LARGEST SIZE OF MARKET FOR COMMERCIAL VEHICLES DURING FORECAST PERIOD

TABLE 34 MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2021–2026 (USD MILLION)

TABLE 36 MARKET FOR COMMERCIAL VEHICLES FOR FRONT VIEW, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 MARKET FOR COMMERCIAL VEHICLES FOR FRONT VIEW, BY REGION, 2021–2026 (USD MILLION)

TABLE 38 MARKET FOR COMMERCIAL VEHICLES FOR REAR VIEW, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 MARKET FOR COMMERCIAL VEHICLES FOR REAR VIEW, BY REGION, 2021–2026 (USD MILLION)

TABLE 40 MARKET FOR COMMERCIAL VEHICLES FOR SURROUND VIEW, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 MARKET FOR COMMERCIAL VEHICLES FOR SURROUND VIEW, BY REGION, 2021–2026 (USD MILLION)

8.2.3 HEAVY COMMERCIAL VEHICLES

8.2.3.1 Cameras can be used to increase traffic safety and reduce accidents, damages, and downtime

TABLE 42 MARKET FOR HEAVY COMMERCIAL VEHICLES, BY VIEW TYPE, 2017–2020 (USD MILLION)

TABLE 43 MARKET FOR HEAVY COMMERCIAL VEHICLES, BY VIEW TYPE, 2021–2026 (USD MILLION)

TABLE 44 MARKET FOR HEAVY COMMERCIAL VEHICLES, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 MARKET FOR HEAVY COMMERCIAL VEHICLES, BY REGION, 2021–2026 (USD MILLION)

TABLE 46 MARKET FOR HEAVY COMMERCIAL VEHICLES FOR FRONT VIEW, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 MARKET FOR HEAVY COMMERCIAL VEHICLES FOR FRONT VIEW, BY REGION,2021–2026 (USD MILLION)

TABLE 48 MARKET FOR HEAVY COMMERCIAL VEHICLES FOR REAR VIEW, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 MARKET FOR HEAVY COMMERCIAL VEHICLES FOR REAR VIEW, BY REGION, 2021–2026 (USD MILLION)

TABLE 50 MARKET FOR HEAVY COMMERCIAL VEHICLES FOR SURROUND VIEW, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 MARKET FOR HEAVY COMMERCIAL VEHICLES FOR SURROUND VIEW, BY REGION, 2021–2026 (USD MILLION)

9 AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA MARKET, BY APPLICATION (Page No. - 103)

9.1 INTRODUCTION

FIGURE 32 MARKET FOR ADAS TO GROW AT A HIGHER CAGR FROM 2021 TO 2026

TABLE 52 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 53 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

9.2 ADAS

9.2.1 INCREASING APPLICATIONS OF ADAS AND TECHNOLOGIES IN AUTONOMOUS VEHICLES DRIVE GROWTH OF THIS SEGMENT

FIGURE 33 APAC TO LEAD MARKET BY 2026

TABLE 54 MARKET FOR ADAS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 MARKET FOR ADAS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 56 MARKET IN NORTH AMERICA FOR ADAS APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 57 MARKET IN NORTH AMERICA FOR ADAS APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 58 MARKET IN EUROPE FOR ADAS APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 59 MARKET IN EUROPE FOR ADAS APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 60 MARKET IN APAC FOR ADAS APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 61 MARKET IN APAC FOR ADAS APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 62 MARKET IN ROW FOR ADAS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 MARKET IN ROW FOR ADAS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.2.1.1 Blind spot detection

9.2.1.2 Adaptive cruise control

9.2.1.3 Lane departure warning system

9.2.1.4 Forward collision warning systems

9.2.1.5 Traffic sign recognition systems

9.2.1.6 Night vision and pedestrian detection

9.3 PARKING ASSIST AND VIEWING

9.3.1 SURGING DEMAND FOR SAFETY FEATURES IN AUTONOMOUS VEHICLES DRIVES DEMAND FOR PARKING ASSIST AND VIEWING SOLUTIONS

TABLE 64 MARKET FOR PARK ASSIST AND VIEWING APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 MARKET FOR PARK ASSIST AND VIEWING APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 66 MARKET IN NORTH AMERICA FOR PARK ASSIST AND VIEWING APPLICATION,BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 67 MARKET IN NORTH AMERICA FOR PARK ASSIST AND VIEWING APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 68 MARKET IN EUROPE FOR PARK ASSIST AND VIEWING APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 69 MARKET IN EUROPE FOR PARK ASSIST AND VIEWING APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 70 MARKET IN APAC FOR PARK ASSIST AND VIEWING APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 71 MARKET IN APAC FOR PARK ASSIST AND VIEWING APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 72 MARKET IN ROW FOR PARK ASSIST AND VIEWING APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 MARKET IN ROW FOR PARK ASSIST AND VIEWING APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.4 IMPACT OF COVID-19 ON MARKET

10 GEOGRAPHIC ANALYSIS (Page No. - 115)

10.1 INTRODUCTION

10.1.1 IMPACT OF COVID-19 ON AUTOMOTIVE RADAR AND INTEGRATED RADAR AND CAMERA MARKET

FIGURE 34 GROWTH RATE OF AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA MARKET, BY COUNTRY/REGION

TABLE 74 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 MARKET, BY REGION, 2021–2026 (USD MILLION)

FIGURE 35 GLOBAL AUTOMOTIVE PRODUCTION FOR ALL TYPES OF VEHICLES, 2019–2020

FIGURE 36 GLOBAL REGISTRATION OF NEW VEHICLES, 2019–2020, 2019–2020

TABLE 76 MARKET, BY REGION, 2019–2026 (MILLION UNITS)

10.2 NORTH AMERICA

FIGURE 37 SNAPSHOT: INTEGRATED RADAR AND CAMERA MARKET IN NORTH AMERICA

TABLE 77 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 78 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 79 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 80 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 81 MARKET IN NORTH AMERICA, BY VIEW TYPE, 2017–2020 (USD MILLION)

TABLE 82 MARKET IN NORTH AMERICA, BY VIEW TYPE, 2021–2026 (USD MILLION)

TABLE 83 MARKET IN NORTH AMERICA, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 84 MARKET IN NORTH AMERICA, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 US to be largest market for integrated radar and camera market in North America from 2021 to 2026

10.2.2 CANADA

10.2.2.1 Establishment of automotive R&D centers would favor market growth in Canada

10.2.3 MEXICO

10.2.3.1 Presence of large number of established automotive manufacturers would underpin market growth in Mexico

10.3 EUROPE

FIGURE 38 SNAPSHOT: INTEGRATED RADAR AND CAMERA MARKET IN EUROPE

TABLE 85 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 86 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 39 ADAS SEGMENT TO REGISTER HIGHER CAGR IN AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA MARKET IN EUROPE DURING FORECAST PERIOD

TABLE 87 MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 88 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 89 MARKET IN EUROPE, BY VIEW TYPE, 2017–2020 (USD MILLION)

TABLE 90 MARKET IN EUROPE, BY VIEW TYPE, 2021–2026 (USD MILLION)

TABLE 91 MARKET IN EUROPE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 92 MARKET IN EUROPE, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

10.3.1 UK

10.3.1.1 Increasing number of connected and autonomous vehicles projects to drive market growth in UK

10.3.2 GERMANY

10.3.2.1 Demand from premium car segment to support market growth in Germany

10.3.3 FRANCE

10.3.3.1 Booming commercial sector in the automotive manufacturing fueling the adoption of the integrated radar and camera systems in commercial vehicles

10.3.4 SPAIN

10.3.4.1 Established automotive industry to substantiate market growth in Spain

10.3.5 REST OF EUROPE

10.4 APAC

FIGURE 40 SNAPSHOT: INTEGRATED RADAR AND CAMERA MARKET IN APAC

TABLE 93 AUTOMOTIVE CAMERA AN INTEGRATED RADAR AND CAMERA MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 94 AUTOMOTIVE CAMERA AN INTEGRATED RADAR AND CAMERA MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 95 MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 96 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 97 MARKET IN APAC, BY VIEW TYPE, 2016–2019 (USD MILLION)

TABLE 98 MARKET IN APAC, BY VIEW TYPE, 2020–2025 (USD MILLION)

TABLE 99 MARKET IN APAC, BY VEHICLE TYPE, 2016–2019 (USD MILLION)

TABLE 100 MARKET IN APAC, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Focus on development of high-end autonomous vehicles to support market growth in China

10.4.2 JAPAN

10.4.2.1 Large-scale vehicle production in Japan to generate demand for automotive cameras and integrated radar and camera systems

10.4.3 SOUTH KOREA

10.4.3.1 Government initiatives to strengthen automotive industryto augment market growth in South Korea

10.4.4 INDIA

10.4.4.1 Increased automobile production to strengthen market growth in India

10.4.5 REST OF APAC

10.5 REST OF THE WORLD

TABLE 101 AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 102 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 103 MARKET IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 104 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 105 MARKET IN ROW, BY VIEW TYPE, 2017–2020 (USD MILLION)

TABLE 106 MARKET IN ROW, BY VIEW TYPE, 2021–2026 (USD MILLION)

TABLE 107 MARKET IN ROW, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 108 MARKET IN ROW, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Upcoming vehicle manufacturing/assembly plants in Middle East and growing construction and infrastructure projects in Africa to drive market growth

10.5.2 SOUTH AMERICA

10.5.2.1 Towering passenger car sales to fuel growth of market in South America

11 COMPETITIVE LANDSCAPE (Page No. - 139)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

TABLE 109 OVERVIEW OF STRATEGIES DEPLOYED BY KEY AUTOMOTIVE RADAR AND INTEGRATED RADAR AND CAMERA OEMS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS (2015–2019)

FIGURE 41 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS (2015–2019)

11.4 MARKET RANKING ANALYSIS: AUTOMOTIVE CAMERA AND INTEGRATED RADAR AND CAMERA MARKET, 2020

TABLE 110 RANKING ANALYSIS OF MARKET, 2020

11.5 MARKET SHARE ANALYSIS: MARKET, 2020

TABLE 111 DEGREE OF COMPETITION, 2020

11.6 COMPANY EVALUATION QUADRANT

11.6.1 STAR

11.6.2 EMERGING LEADER

11.6.3 PERVASIVE

11.6.4 PARTICIPANT

FIGURE 42 MARKET: COMPANY EVALUATION QUADRANT, 2020

TABLE 112 PRODUCT FOOTPRINT OF COMPANIES

TABLE 113 APPLICATION FOOTPRINT OF COMPANIES

TABLE 114 REGIONAL FOOTPRINT OF COMPANIES

TABLE 115 INDUSTRY FOOTPRINT OF COMPANIES

11.7 STARTUP/SME EVALUATION QUADRANT

TABLE 116 LIST OF STARTUPS/SMES IN MARKET

11.7.1 PROGRESSIVE COMPANY

11.7.2 RESPONSIVE COMPANY

11.7.3 DYNAMIC COMPANY

11.7.4 STARTING BLOCKS

FIGURE 43MARKET: STARTUP/SME EVALUATION QUADRANT, 2020

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES

TABLE 117 MARKET: PRODUCT LAUNCHES, JANUARY 2019–FEBRUARY 2021

11.8.2 DEALS

TABLE 118 MARKET: DEALS, JANUARY 2019–FEBRUARY 2021

12 COMPANY PROFILES (Page No. - 156)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 ROBERT BOSCH GMBH

TABLE 119 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 44 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

12.1.2 CONTINENTAL AG

TABLE 120 CONTINENTAL AG: BUSINESS OVERVIEW

FIGURE 45 CONTINENTAL AG: COMPANY SNAPSHOT

12.1.3 VALEO SA

TABLE 121 VALEO SA: BUSINESS OVERVIEW

FIGURE 46 VALEO SA: COMPANY SNAPSHOT

12.1.4 APTIV PLC

TABLE 122 APTIV PLC: BUSINESS OVERVIEW

FIGURE 47 APTIV PLC: COMPANY SNAPSHOT

12.1.5 MAGNA INTERNATIONAL

TABLE 123 MAGNA INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 48 MAGNA INTERNATIONAL: COMPANY SNAPSHOT

12.1.6 ZF FRIEDRICHSHAFEN AG

TABLE 124 ZF FRIEDRICHSHAFEN: BUSINESS OVERVIEW

FIGURE 49 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

12.1.7 VEONEER, INC.

TABLE 125 VEONEER, INC.: BUSINESS OVERVIEW

FIGURE 50 VEONEER, INC.: COMPANY SNAPSHOT

12.1.8 NIDEC CORPORATION

TABLE 126 NIDEC CORPORATION: BUSINESS OVERVIEW

FIGURE 51 NIDEC CORPORATION: COMPANY SNAPSHOT

12.1.9 INTEL CORPORATION

TABLE 127 INTEL CORPORATION: BUSINESS OVERVIEW

FIGURE 52 INTEL CORPORATION: COMPANY SNAPSHOT

12.1.10 INFINEON TECHNOLOGIES AG

TABLE 128 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 53 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

12.2 OTHER PLAYERS

12.2.1 FICOSA INTERNATIONAL SA

12.2.2 FAURECIA-CLARION ELECTRONICS

12.2.3 AMBARELLA, INC.

12.2.4 GENTEX

12.2.5 HITACHI

12.2.6 FLIR SYSTEMS

12.2.7 HYUNDAI MOBIS

12.2.8 MCNEX CO., LTD

12.2.9 STONKAM CO., LTD.

12.2.10 BRIGADE

12.2.11 DENSO CORPORATION

12.2.12 NXP SEMICONDUCTORS

12.2.13 ROIIVE

12.2.14 RENESAS ELECTRONIC CORPORATION

12.2.15 GAZER

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 211)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

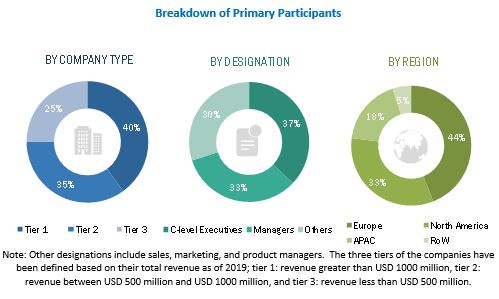

The study involves four major activities for estimating the size of the automotive camera and integrated radar and camera market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the automotive camera and integrated radar and camera market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size estimations, which have been further validated by primary research.

Primary Research

In the primary research process, a number of primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information pertaining to this report. Several primary interviews have been conducted with market experts from both demand and supply sides (automotive camera manufacturers and OEMs). This primary data has been collected through questionnaires, emails, and telephonic interviews. Approximately 20% of the primary interviews have been conducted with the demand side and 80% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Additionally, questionnaires and emails were used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the automotive camera and integrated radar and camera market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value and volume, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the automotive camera and integrated radar and camera market size, by type, vehicle type, view type, and application, in terms of value and volume

- To describe and forecast the automotive camera and integrate radar and camera market size for 4 key regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the automotive camera and integrate radar and camera market

- To provide a detailed impact of COVID-19 on the automotive camera and integrate radar and camera market, market segments, and market players

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players, comprehensively analyze their market position in terms of ranking and core competencies, and provide details of the competitive landscape of the market

- To analyze strategic approaches such as product launches, collaborations, contracts, acquisitions, agreements, expansion, and partnerships in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Camera and Integrated Radar and Camera Market