Automotive Ignition System Market by Components (Ignition Switch, Spark Plug, Glow Plug, Ignition Coil, Ignition Control Module, Crankshaft & Camshaft Position Sensor), Ignition Type (Coil on Plug & Simultaneous) and Region - Industry Trends & Forecast to 2019

[153 Pages Report] The automotive ignition system comprises of an ignition circuit which supplies high voltage surges to the spark plugs in the engine cylinders. These surges produce electric sparks across the spark plug gaps. Heat generated from spark ignites the compressed air-fuel mixture in the combustion chamber. Although there are various types of ignition systems available in the market today, most can be placed in one of three groups: Conventional Breaker-Point Ignition, Electronic Ignition; or a newer type the Distributorless Ignition, which is fast becoming the most popular ignition system. Modern day vehicles use an engine control module (ECM) to control ignition systems that use designs such as coil-on-plug to distribute power to each cylinder. The global market for automotive ignition system is projected to grow at a CAGR of 9.07% from 2014 to 2019. For the ignition system market, the simultaneous ignition type was estimated to have the market share of about 43%, in terms of value, in 2014.

The growing vehicle production across the globe has resulted in environmental impacts which have led to technological advancements like electronic ignition which improves the efficiency and fuel economy of the vehicle. The electronic ignition system produces a better spark that is needed to ignite the leaner fuel. The use of new and improved electronic ignition system has increased the spark plug life as it provides lesser deposits and a much cleaner combustion as compared to the conventional ignition system.

There are various components involved in the electronic ignition system. Firstly the ignition switches which starts the complete electric circuit with the help of the key. Secondly the spark plugs, which play a very important role in the internal combustion (IC) engines entire ignition system, by triggering the ignition of the air and fuel mixture in order to provide the combustion. Glow plugs are used in diesel engines to heat up the combustion chambers before the actual combustion takes place. This provides a better combustion for diesel engines during cold weathers. Lastly, ignition coil is also used in the complete ignition system. The major function of the ignition coil is to convert the low voltage from the battery to thousands of volts of current in order to provide a better spark in the combustion chamber for burning of air and fuel mixture. During the course of time, the ignition system has changed from distributor ignition to distributorless ignition system and present day update is direct ignition and cap-on-plug ignition systems.

The report segments the market by engine type (gasoline & diesel), ignition type (coil-on-plug, simultaneous & compression ignition system), & region and sizes in revenue ($million) as well as volume (thousand units) for aforesaid segments. It covers Porters Five Forces Analysis and value chain of the global Ignition System market for gasoline engines. It contains qualitative data about drivers, restraints and opportunities presented by the global Ignition System market.

Scope of the Report

The global ignition system market is analysed in terms of volume (thousand units) and value ($million) for the below mentioned ignition types, engine types, and regions & respective major countries.

- By Geography

- Asia-Oceania

- Europe

- North America

- RoW

- By Engine Type

- Gasoline

- Diesel

- By Ignition Type

- Coil on Plug Ignition

- Simultaneous Ignition

- Compression Ignition

Additional Customizations Available:

- Off-Highway Ignition System Market

- Agriculture

- Construction

- Two-Wheeler Ignition System Market

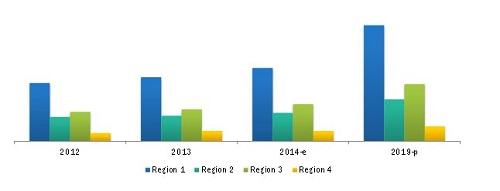

Automotive Ignition Systems Market Size, by Region, 2012-2019 ($Million)

Source: MarketsandMarkets

The global automotive ignition system market size in terms of value is projected to grow to $7.6 Billion by 2019 at a CAGR of 6.2%.

The ignition system which is used in all transportation applications forms an integral component to provide the starting power to the electrical and mechanical components used in these applications. Automotive ignition systems continued to evolve from the 1950s, the automobile manufacturers began to use semiconductor devices the predecessors of todays electronic components as standard equipment. Transistorized ignition was the first step in this direction, and was followed by a variant in which the mechanical contact was replaced by an electronic pulse generator, known as the Hall generator. Today, the high voltage is commonly generated by individual coils, which transmit power directly to the spark plugs.

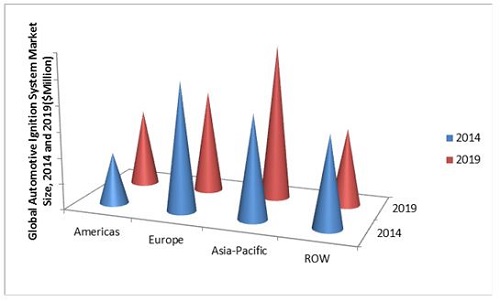

U.S. new-car sales have been rising as a consequence of improving economy, generous incentive spending and increased demand for trucks and sport-utilities have lifted the annualized selling pace to an unprecedented high. Robust manufacturing, new housing strength and rising employment have been seen as the reasons for continued optimism. Western Europe car sales are expected to recover from the long slump with a two or three per cent gain in medium term. However, the torrid period since the global financial crash has seen the disappearance of more than 2-1/2 million sales every year in Western Europe. Asia-Oceania and North America are growing at a good pace owing to the increase in automotive production and demand for vehicles in these regions. Increase in purchasing power and low penetration of automobiles in emerging nations such as China, Brazil and India has resulted in an increase in demand for personal transportation. Asia-Oceania is estimated to be the largest market for ignition systems and is projected to grow at a highest rate from 2014 to 2019.

Global ignition system market is dominated by few top players such as Delphi Automotive (U.K.), BorgWarner (U.S.),Federal-Mogul Corp(U.S.),Denso Corp( Japan),Robert Bosch GmbH (Germany), SEM(Sweden), Mitsubishi Electric Corporation(Japan) along with regional suppliers. Robert Bosch has successfully developed the components of a laser ignition system and is ready to start a series developments soon as the market needs this new technology.

Global Automotive Ignition System Market Size, by Geography, 2014 vs 2019($ Million)

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.3.2.1 Key Industry Insights

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.2.1 Impact of GDP on Commercial Vehicle Sales

2.4.2.2 Urbanization vs Passenger Car Per 1000 People

2.4.2.3 Infrastructure: Roadways

2.4.3 Supply Side Analysis

2.4.3.1 Vehicle Production Increasing in Developing Countries

2.4.4 Technological Advancements

2.4.5 Influence of Other Factors

2.5 Market Size Estimation

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Automotive Ignition System Market

4.2 Automotive Ignition System Market, By Vehicle Type (2019)

4.3 Opportunities in the Automotive Ignition System Market

4.4 Automotive Ignition System Market, By Ignition Type, 2014 -2019 ($Million)

4.5 Automotive Ignition System Market: Rapidly Growing Regions

4.6 Automotive Ignition System Market, By Key Players (2013)

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Engine Type

5.2.2 By Ignition Type

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Government Regulations and Mandates Pertaining to Fuel Efficiency and Emissions

5.3.1.2 Increasing Number of Vehicles

5.3.1.3 Improved Vehicle Performance

5.3.1.4 Major Automobile Manufacturers Partnering With Domestic Players

5.3.2 Restraint

5.3.2.1 Shifting Focus Towards Electric Vehicles

5.3.3 Opportunities

5.3.3.1 New and Improved Ignition Systems

5.3.3.2 Benefits for Related Markets

5.3.4 Challenges

5.3.4.1 Maintaining A Balance Between Low Cost and High-Performance Ignition Systems

5.4 Burning Issues

5.4.1 Fluctuating Demand for Gasoline and Diesel Engines in the Passenger Car Segment

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.1.1 Loyalty of Customers Towards Established Brands

6.3.1.2 Well-Established Players

6.3.2 Threat of Substitutes

6.3.2.1 Increasing Penetration of Electric Vehicles

6.3.3 Bargaining Power of Buyers

6.3.3.1 Long-Term Supply Contracts

6.3.3.2 High Switching Cost

6.3.4 Bargaining Power of Suppliers

6.3.4.1 Well-Established Players With Excellent Supply and Distribution Network

6.3.4.2 Technological Expertise

6.3.5 Intensity of Competitive Rivalry

6.4 Pest Analysis

6.4.1 Political Factors

6.4.2 Economic Factors

6.4.3 Social Factors

6.4.4 Technological Factors

7 Automotive Ignition System Components Market, By Engine & Vehicle Type (Page No. - 54)

7.1 Introduction

7.1.1 Market Estimates, By Engine Type

7.1.1.1 Spark Ignition Market Estimates

7.1.1.2 Compression Ignition Market Estimates

7.1.2 Gasoline Engine Type, By Region

7.1.3 Diesel Engine Type, By Region

7.2 Market Estimates, By Vehicle Type

7.2.1 Automotive Ignition System Component Market, By Gasoline Vehicle

7.2.1.1 Gasoline Passenger Car Ignition System Market, By Component

7.2.1.2 Gasoline LCV Ignition System Market, By Component

7.2.2 Automotive Ignition System Component Market, By Diesel Vehicle

7.2.2.1 Diesel Passenger Car Ignition System Market, By Component

7.2.2.2 Diesel LCV Ignition System Market, By Component

7.2.2.3 Diesel HCV Ignition System Market, By Component

8 Automotive Ignition System Market, By Ignition Type* (Page No. - 80)

(*Note: The Chapter Covers Ignition Type Market at Country-Level U.S., Canada, Mexico, Germany, U.K. France, China, Japan, India, South Korea, Brazil, and Russia)

8.1 Introduction

8.2 Coil-On-Plug Ignition System

8.2.1 North America

8.2.2 Europe

8.2.3 Asia-Oceania

8.2.4 RoW

8.3 Simultaneous Ignition System

8.3.1 North America

8.3.2 Europe

8.3.3 Asia-Oceania

8.3.4 RoW

8.4 Compression Ignition

8.4.1 North America

8.4.2 Europe

8.4.3 Asia-Oceania

8.4.4 RoW

9 Automotive Ignition System Market, By Region (Page No. - 103)

9.1 Introduction

9.2 Asia-Oceania

9.3 Europe

9.4 North America

9.5 Rest of World (RoW)

10 Competitive Landscape (Page No. - 112)

10.1 Overview

10.2 Market Share Analysis, Automotive Ignition System Market

10.3 Competitive Situation & Trends

10.4 Battle for Market Share: New Product Development/Launch Was the Key Strategy

10.5 New Product Developments/Launches

10.6 Supply Contracts & Collaborations

10.7 Expansions

10.8 Mergers & Acquisitions

11 Company Profiles (Page No. - 121)

11.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.2 Robert Bosch Gmbh

11.3 Denso Corporation

11.4 Borgwarner Inc.

11.5 Mitsubishi Electric Corporation

11.6 Federal-Mogul Corporation

11.7 Delphi Automotive Plc

11.8 Diamond Electric Mfg. Co. Ltd.

11.9 NGK Spark Plug Co., Ltd

11.10 Valeo S.A.

11.11 Hitachi Ltd.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 148)

12.1 Available Customizations

12.1.1 Off-Highway Ignition System Market

12.1.1.1 Agriculture

12.1.1.2 Construction

12.2.2 Two-Wheeler Ignition System Market

12.2.3 Alternative Fuel Vehicles Ignition System Market, By Components

12.2.4 Who Supplies Whom

12.2.5 Additional Company Profiles

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Related Reports

List of Tables (82 Tables)

Table 1 Micro and Macro Factor Analysis

Table 2 Overview of Emission and Fuel Economy Regulation Specifications for Passenger Cars

Table 3 Impact of Drivers on the Ignition System Market

Table 4 Impact of Restraints on the Ignition System Market

Table 5 Impact of Opportunities on the Ignition System Market

Table 6 Impact of Challenges on the Ignition System Market

Table 7 Automotive Spark Ignition Engine System Market, By Component Type, 2012-2019 (000 Units)

Table 8 Automotive Spark Ignition Engine System Market, By Component Type, 2012-2019 ($Million)

Table 9 Automotive Compression Ignition Engine System Market, By Component Type, 2012-2019 (000 Units)

Table 10 Automotive Compression Ignition Engine System Market, By Component Type, 2012-2019 ($Million)

Table 11 Asia-Oceania Automotive Spark Ignition Engine System Market, By Component Type, 2012-2019 (000 Units)

Table 12 Asia-Oceania : Automotive Spark Ignition Engine System Market, By Component Type, 2012-2019 ($Million)

Table 13 Europe: Automotive Spark Ignition Engine System Market,By Component Type, 2012-2019 (000 Units)

Table 14 Europe: Automotive Spark Ignition Engine System Market, By Component Type, 2012-2019 ($Million)

Table 15 North America: Automotive Spark Ignition Engine System Market, By Component Type, 2012-2019 (000 Units)

Table 16 North America: Automotive Spark Ignition Engine System Market, By Component Type, 2012-2019 ($Million)

Table 17 ROW: Automotive Spark Ignition Engine System Market, By Component Type, 2012-2019 (000 Units)

Table 18 ROW: Automotive Spark Ignition Engine System Market, By Component Type, 2012-2019 ($Million)

Table 19 Asia-Oceania: Automotive Compression Ignition Engine System Market, By Component Type, 2012-2019 (000 Units)

Table 20 Asia-Oceania: Automotive Compression Ignition Engine System Market, By Component Type, 2012-2019 ($Million)

Table 21 Europe: Automotive Compression Ignition Engine System Market, By Component Type, 2012-2019 (000 Units)

Table 22 Europe: Automotive Compression Ignition Engine System Market,By Component Type, 2012-2019 ($Million)

Table 23 North America: Automotive Compression Ignition Engine System Market, By Component Type, 2012-2019 (000 Units)

Table 24 North America: Automotive Compression Ignition Engine System Market, By Component Type, 2012-2019 ($Million)

Table 25 ROW: Automotive Compression Ignition Engine System Market, By Component Type, 2012-2019 (000 Units)

Table 26 ROW: Automotive Compression Ignition Engine System Market, By Component Type, 2012-2019 ($Million)

Table 27 Passenger Car Spark Ignition System Market, By Component Type, 2012-2019 (000 Unit)

Table 28 Passenger Car Spark Ignition System Market, By Component Type, 2012-2019 ($Million)

Table 29 LCV Spark Ignition System Market, By Component Type, 2012-2019 (000 Units)

Table 30 LCV Spark Ignition System Market, By Component Type, 2012-2019 ($Million)

Table 31 Global Passenger Car Compression Ignition System Market, By Component Type, 2012-2019 (000 Units)

Table 32 Global Passenger Car Compression Ignition System Market, By Component Type, 2012-2019 ($Million)

Table 33 LCV Compression Ignition System Market, By Component Type, 2012-2019 (000 Units)

Table 34 LCV Compression Ignition System Market, By Component Type, 2012-2019 ($Million)

Table 35 HCV Compression Ignition System Market, By Component Type, 2012-2019 (000 Units)

Table 36 HCV Compression Ignition System Market, By Component Type, 2012-2019 ($Million)

Table 37 Automotive Ignition Systems Market Size, By Ignition Type, 2012-2019 (000 Units)

Table 38 Automotive Ignition Systems Market Size, By Ignition Type, 2012-2019 ($Million)

Table 39 Coil-On-Plug: Ignition Systems Market Size, By Region, 2012-2019 (000 Units)

Table 40 Coil-On-Plug: Ignition Systems Market Size, By Region, 2012-2019 ($Million)

Table 41 North America: Coil-On-Plug Ignition Systems Market Size, By Country, 2012-2019 (000 Units)

Table 42 North America: Coil-On-Plug Ignition Systems Market Size, By Country, 2012-2019 ($Million)

Table 43 Europe: Coil-On-Plug Ignition Systems Market Size, By Country, 2012-2019 (000 Units)

Table 44 Europe: Coil-On-Plug Ignition Systems Market Size, By Country, 2012-2019 ($Million)

Table 45 Asia-Oceania: Coil-On-Plug Ignition Systems Market Size, By Country, 2012-2019 (000 Units)

Table 46 Asia-Oceania: Coil-On-Plug Ignition Systems Market Size, By Country, 2012-2019 ($Million)

Table 47 ROW: Coil-On-Plug Ignition Systems Market Size, By Country,2012-2019 (000 Units)

Table 48 ROW: Coil-On-Plug Ignition Systems Market Size, By Country, 2012-2019 ($Million)

Table 49 Simultan eous: Ignition Systems Market Size, By Region, 2012-2019 (000 Units)

Table 50 Simultan eous: Ignition System Market Size, By Region, 2012-2019 ($Million)

Table 51 North America: Simultan eous Ignition System Market Size, By Country, 2012-2019 (000 Units)

Table 52 North America: Simultan eous Ignition System Market Size, By Country, 2012-2019 ($Million)

Table 53 Europe: Simultan eous Ignition System Market Size, By Country, 2012-2019 (000 Units)

Table 54 Europe: Simultan eous Ignition System Market Size, By Country, 2012-2019 ($Million)

Table 55 Asia-Oceania: Simultan eous Ignition System Market Size, By Country, 2012-2019 (000 Units)

Table 56 Asia-Oceania: Simultan eous Ignition System Market Size, By Country, 2012-2019 ($Million)

Table 57 ROW: Simultan eous Ignition System Market Size, By Country, 2012-2019 (000 Units)

Table 58 ROW: Simultan eous Ignition System Market Size, By Country, 2012-2019 ($Million)

Table 59 Compression: Ignition System Market Size, By Region, 2012-2019 (000 Units)

Table 60 Compression: Ignition System Market Size, By Region, 2012-2019 ($Million)

Table 61 North America: Compression Ignition System Market Size, By Country, 2012-2019 (000 Units)

Table 62 North America: Compression Ignition System Market Size, By Country, 2012-2019 ($Million)

Table 63 Europe: Compression Ignition System Market Size, By Country, 2012-2019 (000 Units)

Table 64 Europe: Compression Ignition System Market Size, By Country2012-2019 ($Million)

Table 65 Asia-Oceania: Compression Ignition System Market Size, By Country, 2012-2019 (000 Units)

Table 66 Asia-Oceania: Compression Ignition System Market Size, By Country, 2012-2019 ($Million)

Table 67 ROW: Compression Ignition System Market Size, By Country, 2012-2019 (000 Units)

Table 68 ROW: Compression Ignition System Market Size, By Country, 2012-2019 ($Million)

Table 69 Global Automotive Ignition System Market Size, By Region, 2012-2019 (000 Units)

Table 70 Global Automotive Ignition System Market Size, By Region, 2012-2019 ($Million)

Table 71 Asia-Oceania Automotive Ignition System Market Size, By Engine Type, 2012-2019 (000 Units)

Table 72 Asia-Oceania Automotive Ignition System Market Size, By Engine Type, 2012-2019 ($Million)

Table 73 European Automotive Ignition System Market Size, By Engine Type, 2012-2019 (000 Units)

Table 74 European Automotive Ignition System Market Size, By Engine Type, 2012-2019 ($Million)

Table 75 North American Automotive Ignition System Market Size, By Engine Type, 2012-2019 (000 Units)

Table 76 North American Automotive Ignition System Market Size, By Engine Type, 2012-2019 ($Million)

Table 77 ROW Automotive Ignition System Market Size, By Engine Type, 2012-2019 (000 Units)

Table 78 ROW Automotive Ignition System Market Size, By Engine Type, 2012-2019 ($Million)

Table 79 New Product Developments/Launches, 2013-2014

Table 80 Supply Contracts & Agreements, 20132014

Table 81 Expansions, 2013-2014

Table 82 Mergers & Acquisitions, 2012

List of Figures (71 Figures)

Figure 1 Automotive Ignition System: Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation & Region

Figure 5 Gross Domestic Product (GDP) vs Commercial Vehicle Production

Figure 6 Urban ization vs Passenger Cars Per 1000 People

Figure 7 Road Network vs Passenger Car Sales

Figure 8 Vehicle Production, 2009-2013

Figure 9 Market Size Estimation Methodology: Bottom-Up Approach

Figure 10 Automotive Ignition System Components Market Snapshot (2014 vs 2019 in $Million): Market for EUC is Projected to GROW the Most in the Next Five Years

Figure 11 Automotive Ignition System Market Share (Volume), By Region, 2014

Figure 12 Asia-Oceania is the Fastest Growing Region, By Value ($Million)

Figure 13 Compression-Ignition Systems Are Estimated to GROW at the Highest Cagr of 10.45% in Terms of Market Value($Million) Over the Next Five Years

Figure 14 Automotive Spark Ignition Market Share , By Component, ($Million) (2014 to 2019)

Figure 15 Automotive Compression Ignition Market Share , By Component, ($Million) (2014 to 2019)

Figure 16 Passenger Car Segment to be the Key Driver for the Automotive Ignition System Market in Asia-Ocean

Figure 17 Compression Ignition System Market Emerging on A Global Scale

Figure 18 Compression Ignition System to GROW at the Fastest Rate Over the Next Five Years

Figure 19 Asia-Oceania and Compression Ignition System to be Major Contributors to the Growth of the Automotive Ignition System Market

Figure 20 Top Five Market Players Account for 80.8% of Market Share

Figure 21 Market Segmentation By Engine Type

Figure 22 Market Segmentation, By Ignition Type

Figure 23 Market Segmentation, By Region

Figure 24 Automotive Ignition System Market Dynamics

Figure 25 Global Vehicle Production and Vehicle Parc (2012-2019)

Figure 26 Electric Vehicle (EV) Sales, By Region, 2012-2014 (000 Units)

Figure 27 Global Passenger Cars Gasoline vs Diesel Vehicle Production (000 Units)

Figure 28 Automotive Ignition System: Value Chain

Figure 29 Porters Five Forces Analysis

Figure 30 Automotive Spark Ignition Engine System Market, By Component Type

Figure 31 Automotive Compression Ignition Engine System Market,By Component Type

Figure 32 EUC is the Highest Value Generating Component in the Spark Ignition Engine System Components Market From 2014to 2019

Figure 33 The Market Share By Value for Spark Plugs is Projected to be 13% By 2019 62

Figure 34 EUC Market Size in Terms of Value is Projected to GROW at the Highest Cagr of 9.41%

Figure 35 EUC Accounts for 52% of the Market Share in Terms of Value in 2014

Figure 36 Diesel EUC is the Fastest Growing Market, Accounting for 68% of the Market Share in Terms of Value in 2014

Figure 37 Market Share in Terms of Value for Glow Plugs is 13% in 2014 & 11%in 2019

Figure 38 The Market Share in Terms of Value of Ignition Switch Remains Constan t at 4% During 20142019

Figure 39 EUC Set to Witness an Increase of 3% in Market Share in Terms of Value From 2014 to 2019

Figure 40 Gasoline Passenger Car Ignition System Components Dominates the Market in 2014

Figure 41 The Market Share for Fusible Link is Low, But is Growing at A High Rate of 9.59%

Figure 42 Glow Plug is Projected to GROW at the Second Highest Rate of 9.72% After Ecu

Figure 43 The Market Growth of EUC is Comparatively Low in the Hcv Segment

Figure 44 Compression Ignition System is Projected to be Growing at the Fastest Cagr of 10.45% Over 2014-2019

Figure 45 Asia-Oceania Leading the Cop Ignition System Market From 2014-2019 ($Million)

Figure 46 Asia-Oceania to be the Fastest Growing Simultan eous Ignition System Market Through 2014-2019 ($Million)

Figure 47 North America to Show the Fastest Growth in Compression Ignition Systems Through 2014-2019 ($Million)

Figure 48 China Projected to Lead the Automotive Ignition System Market During 2014-2019, ($Million)

Figure 49 Asia-Oceania Market Snapshot (2014): Largest Market for Automotive Ignition System

Figure 50 North America Market Snapshot (2014): Projected to GROW at Second Highest Cagr From 20142019

Figure 51 Companies Adopted New Product Development and Launch as the Key Growth Strategy in the Past Five Years (2010-2014)

Figure 52 Denso Corporation & Federal Mogul Grew at the Highest Rate From 20102013

Figure 53 Automotive Ignition System Market Share, By Key Player, 2013

Figure 54 Market Evolution Framework - Significant Expansions & New Product Developments Increased the Global Market Size Between 2012 & 2014

Figure 55 Region-Wise Revenue Mix of Top 5 Players

Figure 56 Competitive Benchmarking of Key Players (2008-2013): Denso Proved to be A Front Runner With its Wide & Robust Product Portfolio

Figure 57 Robert Bosch GMBH: Company Snapshot

Figure 58 Robert Bosch GMBH: SWOT Analysis

Figure 59 Denso Corporation: Company Snapshot

Figure 60 Denso Corporation: SWOT Analysis

Figure 61 Borgwarner Inc.: Company Snapshot

Figure 62 Borgwarner Inc.: SWOT Analysis

Figure 63 Mitsubishi Electric Corporation: Company Snapshot

Figure 64 Federal-Mogul Corporation: Company Snapshot

Figure 65 Federal-Mogul Corporation: SWOT Analysis

Figure 66 Delphi Automotive PLC: Company Snapshot

Figure 67 Diamond Electric Mfg. Co. Ltd.: Company Snapshot

Figure 68 NGK Spark Plug Co., Ltd.: Company Snapshot

Figure 69 NGK Spark Plug Co. Ltd.: SWOT Analysis

Figure 70 Valeo S.A.: Company Snapshot

Figure 71 Hitachi Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Automotive Ignition System Market

I am looking for the details of automotive ignition system market, for example, the component persentages of ECU with Igniter and Coil on Plug with igniter, Smart IGBT and discrete IGBT.

I am conducting an academic research project on ignition cables as part of one of my courses and would like to get access to this report to have a better idea of the ignition cable market and its geographical segmentation.