Automotive Front End Module Market by Component (Radiator, Condenser, Core Support, Headlight, Front Grill, Bumpers, Fenders, Crash Management System, and Others), Vehicle Type, Region, Material and by Aftermarket - Global Forecast to 2020

[217 Pages Report] The increasing vehicle production, growing concerns regarding driver and passenger safety, and rising demand for lightweight automotive front-end modules (FEMs) are driving the growth of the FEM market. The global market is estimated to be USD 89.75 Billion in 2015, and is projected to reach USD 119.08 Billion by 2020, growing at a CAGR of 5.82% from 2015 to 2020. The base year considered in this report is 2014, and the market forecast is provided from 2015 to 2020. The report segments the FEM market on the basis of component (radiator, condenser, core support, headlight, front grill, bumpers, fenders, crash management system and others), vehicle type (PC, LCV, and HCV) region (Asia-Pacific, Europe, North America, and RoW), and material (steel, aluminum, plastic, and composites).

The trend of FEM modularization is gaining traction, as modularization helps OEMs save on cost, time, and manpower during the manufacturing process. Previously, each and every component of the FEM was assembled by OEMs on the assembly line; this was time-consuming and extended the production process of the vehicle. However, the advent of modularization has enabled OEMs to save on these costs and opt for outsourcing these functions. OEMs save around 20 to 30% of costs through modularization, in comparison with the traditional front-end methods. Model differentiation can be achieved through material, color, and finish. In addition to this, FEMs can be added late in the assembly sequence, which helps automakers to improve assembly-line ergonomics by reducing the time taken to assemble and shortening the assembly line. Modularization also helps to improve the fit-and-finish on the vehicles front-end, by accurately locating headlamps, bumpers, fascia, and grills in a single package. The new, compact, lightweight, modular, and integrated FEMs are directly fitted onto the vehicle.

The initial designs of FEM consisted of heavy steel carriers. However, the growing demand for vehicle weight reduction in recent years has led to lightweight composites being used instead of steel and iron for the structural carriers of FEMs. Using composites for the FEMs helps to improve the fuel efficiency and performance of the vehicle. Thermoplastic resins such as polypropylene (PP) and nylon are the most commonly used materials for composite FEMs. Initially, all-composite FEM designs were focused on compression-moldable glass-mat thermoplastic (GMT) composites with chopped-fiber mats. However, GMT was replaced by injection-molded pelletized long-fiber thermoplastics (LFT) to reduce costs. More recently, LFT is being replaced by inline-compounded (ILC) injection- or compression-molded direct-LFT (D-LFT). However, OEMs are using hybrid metal/composite designs for heavier vehicles for added stiffness and strength. The technology chosen by OEMs for FEMs depends on the overall cost incurred from the adoption of the technology.

The bottom-up approach has been used to estimate and validate the size of the global market. Various secondary sources, such as company annual reports/presentations, industry association publications, automotive magazine articles, directories, technical handbooks and articles, World Economic Outlook, trade websites, and databases have been used to identify and collect information for an extensive study of the FEM market. The primary sourcesexperts from related industries, OEMs, and suppliershave been interviewed to obtain and verify critical information, as well as to assess future prospects and market estimations.

TARGET AUDIENCE

- Raw material suppliers of FEM components/systems

- Tier-I manufacturers integrating FEM components in their products

- Traders, distributors, and suppliers of FEM components/systems

- Automotive OEMs

- Industry associations

- Aftermarket retailers, E-trailers, suppliers, and distributors

Scope Of The Report

The global FEM market is analyzed in terms of volume (000 units) and value (USD million) for the segments mentioned below.

Automotive FEM Market, By Type

- Radiator

- Motor Fan

- Condenser

- Internal Air Cooler

- Radiator Core Support

- Oil Cooler

- Headlight

- Front Grill

- Front Active Grill

- Bumpers

- Horn Assembly

- Fenders

- Hose Assembly

- Bracket Assembly

- Automotive Air Quality Sensor

- Crash Management System

Automotive FEM Market, By Vehicle Type

- PC

- LCV

- HCV

Automotive FEM Market, By Region

- North America

- Asia-Pacific

- Europe

- RoW

Automotive FEM Market, By Material

- Steel

- Composites

- Plastic

- Hybrid

Available Customization

- FEM market for countries not covered (additional 5 countries can be covered)

- Aftermarket for countries not covered (additional 5 countries can be covered)

The global automotive front-end module (FEM) market is estimated to be USD 89.75 Billion in 2015, and is projected to reach USD 119.08 Billion by 2020, growing at a CAGR of 5.82%. The FEM market is primarily driven by the increasing production of light passenger vehicles and heavy-duty vehicles, growing demand for FEM modularization, and rising demand for lightweight FEMs.

The trend of FEM modularization is gaining traction, as modularization helps OEMs save on cost, time, and manpower during the manufacturing process. Previously, each and every component of the FEM was assembled by OEMs on the assembly line; this was time-consuming and extended the production process of the vehicle. However, the advent of modularization has enabled OEMs to save on these costs and opt for outsourcing these functions. OEMs save around 20 to 30% of costs through modularization, in comparison with the traditional front-end methods. Model differentiation can be achieved through material, color, and finish. In addition to this, FEMs can be added late in the assembly sequence, which helps automakers to improve assembly-line ergonomics by reducing the time taken to assemble and shortening the assembly line.

Every product has a certain lifespan during which it is operational. The operational life of a particular component or product depends on its sustainability, usability, quality, and material. Similarly, components of the automotive FEM have a certain lifespan. They undergo wear-and-tear and require regular replacement for the proper functioning of the vehicle and its sub-systems. This wear-and-tear can be caused by corrosion, degradation due to various fluids and time, or material loss due to extended usage. A rise in the number of miles driven is also estimated to increase the wear-and-tear of the FEM components.

Asia-Pacific is projected to generate high demand for FEMs, owing to growing population, increasing vehicle production, and rising demand for comfort and luxury features in automobiles. The Asia-Pacific FEM market is projected to grow at a CAGR of 5.80% from 2015 to 2020. The FEM market in China is projected to grow at a CAGR of 7.39% during the same period.

One of the biggest challenges faced by players in the FEM aftermarket is counterfeit products. About 40% of the parts that are sold in the aftermarket are fake/counterfeit. Counterfeit products are mainly unauthorized spare parts that are available in the market. These unauthorized parts include those that are not genuine and are sold to dealers by suppliers.

The automotive FEM market is dominated by a few global players, such as Faurecia SA (France), Denso Corporation (Japan), MAHLE GmbH (Germany), Calsonic Kansei Corporation (Japan), HBPO Group (Germany), Magna International Inc. (Canada), Hyundai Mobis (South Korea), Plastic Omnium (France), and Samvardhana Motherson Group (The Netherlands). Industry players are making investments and expansions across the globe, including in high-growth markets, to gain traction in the automotive FEM market.

Table of Content

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.3 Supply Side Analysis

2.4.4 Technological Advancements

2.4.5 Influence of Other Factors

2.5 Market Estimation

2.5.1 Bottom-Up Approach

2.5.2 Data Triangulation

2.5.3 Limitation

2.5.4 Assumptions

3 Executive Summary (Page No. - 40)

4 Premium Insights (Page No. - 45)

4.1 Automotive Front-End Module Market, 20152020

4.2 Automotive Front-End Module Market Growth Rate, By Region

4.3 Automotive Front-End Module Market Share, By Material

4.4 Market, By Vehicle Type

4.5 Market, By Component

5 Market Overview (Page No. - 52)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Automotive Front-End Module Market, By Component Type

5.2.2 Market, By Vehicle Type

5.2.3 Market, By Material Type

5.2.4 Market, By Region

5.2.5 Automotive Front-End Module Aftermarket, By Component Type

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Vehicle Production Across the Globe

5.3.1.2 Increasing Demand for Fem Modularization

5.3.2 Restraints

5.3.2.1 Safety & Technological Constraints Involved in Lightweight Fems

5.3.3 Opportunities

5.3.3.1 Growing Aftermarket

5.3.3.2 Government Regulations and Mandates Pertaining to Fuel Efficiency & Emissions

5.3.4 Challenges

5.3.4.1 Counterfeit Fem Components

5.4 Burning Issue

5.4.1 Maintaining A Balance Between Performance, Cost, & Weight Savings

5.5 Value Chain Analysis

5.6 Porters Five Forces Analysis

5.6.1 Threat of New Entrants

5.6.2 Threat of Substitutes

5.6.3 Bargaining Power of Suppliers

5.6.4 Bargaining Power of Buyers

5.6.5 Intensity of Competitive Rivalry

6 Upcoming Front-End Module Technologies for Passenger/Pedestrian Safety and Crash Management Systems (Page No. - 72)

6.1 Introduction

6.2 Compact and Integrated Front-End Module

6.3 Lightweight Front-End Module for Vehicles

6.4 Crash Management Systems By Major Suppliers

6.4.1 Pedestrian Protection Systems Based on Acceleration and Pressure Sensors By Continental Ag

6.4.2 Pedestrian Protection System By Trw

6.4.3 Safe4u By Valeo SA

6.4.4 Vehicle Crash Management System By Constellium

6.5 Challenges in Crash Prevention Technologies

6.5.1 Security

6.5.2 Spectrum Arguments

6.5.3 Deployment Levels

6.5.4 Driver Response

6.5.5 Cost

7 Automotive Front-End Module Market, By Component (Page No. - 80)

7.1 Introduction

7.2 Radiator

7.3 Motor Fan

7.4 Condenser

7.5 Internal Air Cooler

7.6 Radiator Core Support

7.7 Oil Cooler

7.8 Headlight

7.9 Front Grill

7.10 Front Active Grill

7.11 Bumper

7.12 Horn Assembly

7.13 Fenders

7.14 Hose Assembly

7.15 Bracket Assembly

7.16 Automotive Air Quality Sensor

7.17 Bumper Beam

7.18 Cruise Control Sensor

7.19 Crash Sensor

7.20 Night Vision Sensor

7.21 Park Assist

8 Global Automotive Front-End Module Market, By Vehicle Type (Page No. - 108)

8.1 Introduction

8.2 Passenger Car

8.3 Light Commercial Vehicle

8.4 Heavy Commercial Vehicle

9 Automotive Front-End Module Market, By Material (Page No. - 118)

9.1 Introduction

9.2 Steel

9.3 Aluminum

9.4 Plastic

9.5 Hybrid

9.6 Composites

10 Automotive Front-End Module, By Region (Page No. - 124)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Asia-Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.4 Europe

10.4.1 Germany

10.4.2 France

10.4.3 U.K.

10.5 Rest of the World (RoW)

10.5.1 Brazil

10.5.2 Russia

10.6 Asia-Pacific

10.6.1 Pest Analysis

10.6.1.1 Political Factors

10.6.1.2 Economic Factors

10.6.1.3 Social Factors

10.6.1.4 Technological Factors

10.7 Europe

10.7.1 Pest Analysis

10.7.1.1 Political Factors

10.7.1.2 Economic Factors

10.7.1.3 Social Factors

10.7.1.4 Technological Factors

10.8 North America

10.8.1 Pest Analysis

10.8.1.1 Political Factors

10.8.1.2 Economic Factors

10.8.1.3 Social Factors

10.8.1.4 Technological Factors

10.9 RoW

10.9.1 Pest Analysis

10.9.1.1 Political Factors

10.9.1.2 Economic Factors

10.9.1.3 Social Factors

10.9.1.4 Technological Factors

11 Overview of Front-End Module Aftermarket Channels (Page No. - 151)

11.1 Aftermarket Value Chain Analysis

11.2 Private Labeling

11.3 Counterfeit Products

11.4 New Regulatory Demands to Impact the Aftermarket

11.5 Increasing Participation of Oems in the Aftermarket

12 Competitive Landscape (Page No. - 174)

12.1 Overview

12.2 Key Market Player Ranking

12.3 Competitive Situation & Trends

12.4 Battle for Market Share: Expansion/Investments Was the Key Strategy

12.5 Expansion/Investments

12.6 Joint Ventures/Partnerships/Supply Contracts

12.7 New Product Launch/New Product Development/New Technology

12.8 Mergers & Acquisitions

13 Company Profiles (Page No. - 182)

13.1 Introduction

13.2 Faurecia SA

13.2.1 Business Overview

13.2.2 Products Offered

13.2.3 MnM View

13.2.4 Recent Developments

13.2.5 SWOT Analysis

13.3 Denso Corporation

13.3.1 Business Overview

13.3.2 Products Offered

13.3.3 MnM View

13.3.4 Recent Developments

13.3.5 SWOT Analysis

13.4 Mahle GmbH

13.4.1 Business Overview

13.4.2 Products Offered

13.4.3 MnM View

13.4.4 Recent Developments

13.4.5 SWOT Analysis

13.5 Calsonic Kansei Corporation

13.5.1 Business Overview

13.5.2 Products Offered

13.5.3 MnM View

13.5.4 Recent Developments

13.5.5 SWOT Analysis

13.6 Hbpo Group

13.6.1 Business Overview

13.6.2 Products Offered

13.6.3 MnM View

13.6.4 Recent Developments

13.7 Magna International Inc.

13.7.1 Business Overview

13.7.2 Products Offered

13.7.3 MnM View

13.7.4 Recent Developments

13.7.5 SWOT Analysis

13.8 Hyundai Mobis

13.8.1 Business Overview

13.8.2 Products Offered

13.8.3 MnM View

13.8.4 Recent Developments

13.9 Plastic Omnium

13.9.1 Business Overview

13.9.2 Products Offered

13.9.3 MnM View

13.9.4 Recent Developments

13.10 Samvardhana Motherson Automotive Systems Group Bv

13.10.1 Business Overview

13.10.2 Products Offered

13.10.3 MnM View

13.10.4 Recent Developments

13.11 SL Corporation

13.11.1 Business Overview

13.11.2 Products Offered

13.11.3 MnM View

13.11.4 Recent Developments

13.12 Valeo S.A.

13.12.1 Business Overview

13.12.2 Products Offered

13.12.3 Key Strategy

13.12.4 Recent Developments

13.13 Montaplast GmbH

13.13.1 Business Overview

13.13.2 Products

13.13.3 Recent Developments

14 Appendix (Page No. - 213)

14.1 Insights From Key Industry Experts

14.2 Discussion Guides

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.4.1 Regional Analysis

14.4.2 Company Information

14.5 Related Reports

14.6 Other Developments

List of Tables (136 Tables)

Table 1 Impact of Drivers on the Automotive Front-End Module Market

Table 2 Impact of Restraints on the Automotive Front-End Module Market

Table 3 Impact of Opportunities on the Front-End Module Market

Table 4 Impact of Challenges on the Front-End Module Market

Table 5 Automotive Front-End Module Market, By Component Type, 20132020 (Million Units)

Table 6 Market, By Component Type, 20132020 (USD Million)

Table 7 Radiator Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 8 Radiator Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 9 Motor Fan Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 10 Motor Fan Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 11 Condenser Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 12 Condenser Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 13 Internal Air Cooler Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 14 Internal Air Cooler Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 15 Radiator Core Support Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 16 Radiator Core Support Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 17 Oil Cooler Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 18 Oil Cooler Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 19 Headlight Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 20 Headlight Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 21 Front Grill Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 22 Front Grill Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 23 Front Active Grill Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 24 Front Active Grill Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 25 Bumper Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 26 Bumper Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 27 Horn Assembly Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 28 Horn Assembly Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 29 Fenders Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 30 Fenders : Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 31 Hose Assembly Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 32 Hose Assembly Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 33 Bracket Assembly Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 34 Bracket Assembly Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 35 Automotive Air Quality Sensor Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 36 Automotive Air Quality Sensor : Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 37 Bumper Beam Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 38 Bumper Beam Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 39 Cruise Control Sensor Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 40 Cruise Control Sensor : Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 41 Crash Sensor Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 42 Crash Sensor Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 43 Night Vision Sensor Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 44 Night Vision Sensor Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 45 Park Assist Front-End Module Market Size, By Vehicle Type, 20132020 (Million Units)

Table 46 Park Assist Front-End Module Market Size, By Vehicle Type, 20132020 (USD Million)

Table 47 Global Automotive Front-End Module Market, By Vehicle Type, 20132020 (000 Units)

Table 48 Market, By Vehicle Type, 20132020 (USD Million)

Table 49 Global Passenger Car Front-End Module Market, By Component Type, 20132020 (000 Units)

Table 50 Global Passenger Car Front-End Module Market, By Component Type, 20132020 (USD Million)

Table 51 Global Light Commercial Vehicle Front-End Module Market, By Component Type, 20132020 (000 Units)

Table 52 Global Light Commercial Vehicle Front-End Module Market, By Component Type, 20132020 (USD Million)

Table 53 Global Heavy Commercial Vehicle Front-End Module Market, By Component Type, 20132020 (000 Units)

Table 54 Global Heavy Commercial Vehicle Front-End Module Market, By Component Type, 20132020 (USD Million)

Table 55 Front-End Module Market Size, By Material, 20132020 (Million Kg)

Table 56 Steel Front-End Module Market Size, By Vehicle Type, 20132020 (Million Kg)

Table 57 Aluminum Front-End Module Market Size, By Vehicle Type, 20132020 (Million Kg)

Table 58 Plastic Front-End Module Market Size, By Vehicle Type, 20132020 (Million Kg)

Table 59 Hybrid Front-End Module Market Size, By Vehicle Type, 20132020 (Million Kg)

Table 60 Composite Front-End Module Market Size, By Vehicle Type, 20132020 (Million Kg)

Table 61 Automotive Front-End Module Market, By Region, 20132020 (Million Units)

Table 62 Market, By Region, 20132020 (USD Billion)

Table 63 North America: Automotive Front-End Module Market, By Country, 20132020 (Million Units)

Table 64 North America: Market, By Country, 20132020 (USD Billion)

Table 65 U.S.: Automotive Front-End Module Market, By Vehicle Type, 20132020 (Million Units)

Table 66 U.S.: Market, By Vehicle Type, 20132020 (USD Billion)

Table 67 Canada: Automotive Front-End Module Market, By Vehicle Type, 20132020 (000 Units)

Table 68 Canada: Market, By Vehicle Type, 20132020 (USD Million)

Table 69 Mexico: Automotive Front-End Module Market, By Vehicle Type, 20132020 (Million Units)

Table 70 Mexico: Market, By Vehicle Type, 20132020 (USD Million)

Table 71 Asia-Pacific: Automotive Front-End Module Market, By Country, 20132020 (Million Units)

Table 72 Asia-Pacific: Market, By Country, 20132020 (USD Billion)

Table 73 China: Automotive Front-End Module Market, By Vehicle Type, 20132020 (Million Units)

Table 74 China: Market, By Vehicle Type, 20132020 (USD Billion)

Table 75 Japan: Automotive Front-End Module Market, By Vehicle Type, 20132020 (Million Units)

Table 76 Japan: Market, By Vehicle Type, 20132020 (USD Million)

Table 77 India: Automotive Front-End Module Market, By Vehicle Type, 20132020 (000 Units)

Table 78 India: Market, By Vehicle Type, 20132020 (USD Million)

Table 79 Europe: Automotive Front-End Module Market, By Country, 20132020 (Million Units)

Table 80 Europe: Market, By Country, 20132020 (USD Billion)

Table 81 Germany: Automotive Front-End Module Market, By Vehicle Type, 20132020 (000 Units)

Table 82 Germany: Market, By Vehicle Type, 20132020 (USD Million)

Table 83 France: Automotive Front-End Module Market, By Vehicle Type, 20132020 (000 Units)

Table 84 France: Market, By Vehicle Type, 20132020 (USD Million)

Table 85 U.K.: Automotive Front-End Module Market, By Vehicle Type, 20132020 (000 Units)

Table 86 U.K.: Market, By Vehicle Type, 20132020 (USD Million)

Table 87 RoW: Automotive Front-End Module Market, By Country, 20132020 (000 Units)

Table 88 RoW: Market, By Country, 20132020 (USD Million)

Table 89 Brazil: Automotive Front-End Module Market, By Vehicle Type, 20132020 (000 Units)

Table 90 Brazil: Market, By Vehicle Type, 20132020 (USD Million)

Table 91 Russia: Automotive Fem Market, By Type, 20132020 (000 Units)

Table 92 Russia: Market, By Vehicle Type, 20132020 (USD Million)

Table 93 Front-End Module Aftermarket Size, By Component, 20132020 ('000 Units)

Table 94 Front-End Module Aftermarket Size, By Component, 20132020 ('000 Units)

Table 95 Radiator Aftermarket, By Vehicle Type, 20132020 (000 Units)

Table 96 Radiator Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 97 Motor Fan Aftermarket, By Vehicle Type, 20132020 (000 Units)

Table 98 Motor Fan Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 99 Condenser Aftermarket, By Vehicle Type, 20132020 (000 Units)

Table 100 Condenser Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 101 Oil Cooler Aftermarket, By Vehicle Type, 20132020 (000 Units)

Table 102 Oil Cooler Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 103 Internal Air Cooler Aftermarket, By Vehicle Type, 20132020 (000 Units)

Table 104 Internal Air Cooler Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 105 Headlight Aftermarket, By Vehicle Type, 20132020 (000 Units)

Table 106 Headlight Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 107 Horn Assembly Aftermarket, By Vehicle Type, 20132020 (000 Units)

Table 108 Horn Assembly Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 109 Hose Assembly Aftermarket, By Vehicle Type, 20132020 (000 Units)

Table 110 Hose Assembly Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 111 Air Quality Sensor Aftermarket, By Vehicle Type, 20132020 (000 Units)

Table 112 Air Quality Sensor Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 113 Radiator Core Support Aftermarket, By Vehicle Type, 20132020 ('000 Units)

Table 114 Radiator Core Support Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 115 Front Active Grill Aftermarket, By Vehicle Type, 20132020 ('000 Units)

Table 116 Front Active Grill Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 117 Bumper Aftermarket, By Vehicle Type, 20132020 ('000 Units)

Table 118 Bumper Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 119 Bumper Beam Aftermarket, By Vehicle Type, 20132020 ('000 Units)

Table 120 Bumper Beam Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 121 Fender Aftermarket, By Vehicle Type, 20132020 ('000 Units)

Table 122 Fender Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 123 Crash Sensor Aftermarket, By Vehicle Type, 20132020 ('000 Units)

Table 124 Crash Sensor Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 125 Cruise Control Sensor Aftermarket, By Vehicle Type, 20132020 ('000 Units)

Table 126 Cruise Control Sensor Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 127 Bracket Assembly Aftermarket, By Vehicle Type, 20132020 ('000 Units)

Table 128 Bracket Assembly Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 129 Night Vision Sensor Aftermarket, By Vehicle Type, 20132020 ('000 Units)

Table 130 Night Vision Sensor Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 131 Park Assist Sensor Aftermarket, By Vehicle Type, 20132020 ('000 Units)

Table 132 Park Assist Sensor Aftermarket, By Vehicle Type, 20132020 (USD Million)

Table 133 Expansions/Investments, 2015

Table 134 Joint Ventures/Partnerships/Supply Contracts, 20142015

Table 135 New Product Launch/New Product Development/New Technology, 2012-3013

Table 136 Mergers & Acquisitions, 20132015

List of Figures (62 Figures)

Figure 1 Research Design

Figure 2 Research Methodology Model

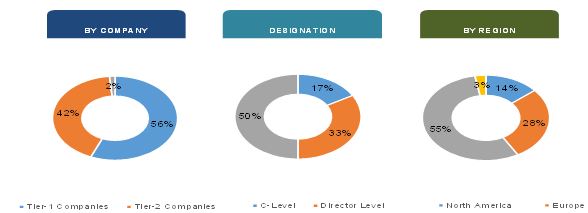

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Gross Domestic Product vs Commercial Vehicle Production

Figure 5 Urbanization vs Passenger Cars Per 1,000 People

Figure 6 Road Network vs Total Vehicle Sales

Figure 7 Vehicle Production, 20092014

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Data Triangulation

Figure 10 Automotive Front-End Module Market, By Vehicle Type, 20152020: Passenger Car Segment to Hold the Largest Share

Figure 11 Automotive Front-End Module Market Growth, By Material, 20152020: Composite Material is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Aftermarket Share of Automotive FrontEnd Module, By Component (2015)

Figure 13 Attractive Opportunities in the Automotive Front-End Module Market, 20152020

Figure 14 China, U.S., and India to Be the Fastest-Growing Markets for Automotive Front-End Modules, 20152020 (USD Million)

Figure 15 Automotive Front-End Module Market, By Material Type, 20152020 (Million Kg)

Figure 16 Passenger Cars to Constitute the Largest Vehicle Type Segment of the Front-End Module Market, 20152020

Figure 17 Automotive Front-End Module Market Size, By Component Type, 2015 vs 2020, (USD Million)

Figure 18 Growing Global Vehicle Production to Drive the Automotive Front-End Module Market in the Future

Figure 19 Global Vehicle Production, 20132020 (000 Units):

Figure 20 Value Chain Analysis: Major Value is Added During the Manufacturing and Assembly Phases

Figure 21 Porters Five Forces Analysis (2014): Automotive Front-End Module Market

Figure 22 The Radiator Segment of the LCV Market is Expected to Register the Highest Growth, By Value, 20152020

Figure 23 Passenger Car Segment Estimated to Lead the Automotive Motor Fan Market From 2015 to 2020

Figure 24 LCV Segment Projected to Be the Fastest-Growing Headlight Market From 2015 to 2020

Figure 25 Front Active Grill Market in PC Segment Projected to Hold the Largest Share, By Value, 2015 & 2020

Figure 26 Passenger Car Segment to Dominate the Bumper Beam Market From 2015 to 2020

Figure 27 Crash Sensor Market for Passenger Car Segment Projected to Hold the Largest Market Share, By Value, 2015 & 2020

Figure 28 Passenger Car Segment to Constitute the Largest Market Globally, 2015 vs 2020 (000 Units)

Figure 29 Global Automotive Front-End Module Market, By Vehicle Type, 2015 vs 2020 (USD Million)

Figure 30 Hybrid Material to Lead the Front-End Module Material Market From 2015 to 2020

Figure 31 Regional Snapshot of Automotive Front-End Module Market Share (2015) Rapid-Growth Markets Emerging as New Hotspots

Figure 32 North American Market Snapshot: Fastest-Growing Market for Automotive Front-End Modules (2015)

Figure 33 Asia-Pacific Market Snapshot: China is the Largest Market for Automotive Front-End Modules (2015)

Figure 34 European Market Snapshot: Automotive Front-End Module Market (2015)

Figure 35 RoW Market Snapshot: Brazil is the Largest Market for Automotive Front-End Modules in the Region (2015)

Figure 36 Aftermarket Value Chain Analysis

Figure 37 Average Margin for Branded & Private Label Products in the U.S., 20132014

Figure 38 Aftermarket Share in the U.S., 2010 vs 2015Estimate

Figure 39 Passenger Car Segment to Occupy the Largest Share, By Value, in the Radiator Core Support Aftermarket, 2015 & 2020

Figure 40 Passenger Car Segment to Lead the Automotive Bumper Aftermarket From 2015 to 2020

Figure 41 The Commercial Vehicle Segment of the Bracket Assembly Aftermarket is Expected to Witness the Highest Growth, 2015 & 2020

Figure 42 Companies Adopted Expansion/Investment as the Key Growth Strategy From 2012 to 2015

Figure 43 Top Automotive Front-End Module Market Players Ranking, 2015

Figure 44 Market Evolution Framework: Expansions Have Fuelled Growth & Innovation From 2012 to 2015

Figure 45 Region-Wise Revenue Mix of Five Major Players

Figure 46 Faurecia SA: Company Snapshot

Figure 47 SWOT Analysis: Faurecia SA

Figure 48 Denso Corporation: Company Snapshot

Figure 49 SWOT Analysis: Denso Corporation

Figure 50 Mahle GmbH: Company Snapshot

Figure 51 SWOT Analysis: Mahle GmbH

Figure 52 Calsonic Kansei Corporation: Company Snapshot

Figure 53 SWOT Analysis: Calsonic Kansei Corporation

Figure 54 Hbpo Group: Company Snapshot

Figure 55 Magna International Inc.: Company Snapshot

Figure 56 SWOT Analysis: Magna International Inc.

Figure 57 Hyundai Mobis: Company Snapshot

Figure 58 Plastic Omnium: Company Snapshot

Figure 59 Samvardhana Motherson Group: Company Snapshot

Figure 60 SL Corporation: Company Snapshot

Figure 61 Valeo S.A.: Company Snapshot

Figure 62 Montaplast GmbH

Growth opportunities and latent adjacency in Automotive Front End Module Market