Automotive Fastener Market by Characteristics (Removable, Permanent, Semi-Permanent), Products (Threaded, Non-Threaded), Material Type (Stainless Steel, Plastic, Aluminum), Application, Electric Vehicle Type, and Region - Global Forecast to 2025

The automotive fastener market was valued at USD 20.04 billion in 2017 and is projected to reach USD 25.30 billion by 2025, at a CAGR of 2.39% during the forecast period. The base year for the report is 2017 and the forecast period is 2018 to 2025.

Objectives of the Report

- To define, describe, and provide a detailed analysis of the overall market for automotive fasteners and determine the contribution of each segment to the total market

- To analyze and forecast the global automotive fastener market, in terms of value (USD billion) and volume (billion units), from 2018 to 2025

- To analyze and forecast the automobile fastener market, by volume and value, on the basis of application, product type, material type, characteristics, vehicle type, electric vehicle type, and region

- To analyze regional markets for growth trends, prospects, and their contribution toward the overall market

- To provide a detailed analysis of various factors influencing this market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities offered by various segments of the market to its stakeholders

- To profile key players and analyze their market shares and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansion, and other industrial activities carried out by key industry participants

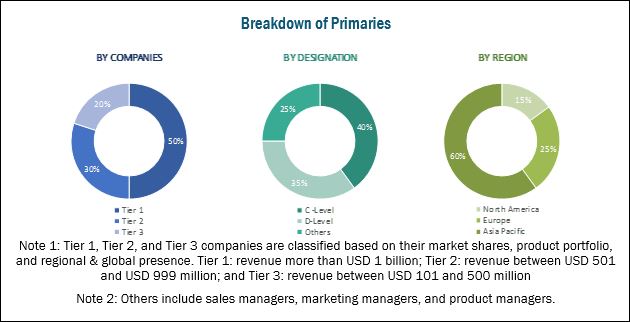

The research methodology used in the report involves primary and secondary sources and follows a bottom-up approach for data triangulation. The study involves the country-level and characteristics-wise analysis of automotive fastener market. This analysis involves historical trends as well as existing market penetrations by country as well as by vehicle type, product type, and material type. The analysis is projected based on various factors such as the growth trends in vehicle production and the global development trends in the fastener industry. The analysis has been discussed with and validated by primary respondents, which include experts from the core and related industries, suppliers, manufacturers, distributors, technology developers, and organizations related to various segments of this industry’s value chain. Secondary sources include associations such as China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), European Automobile Manufacturers Association (ACEA), Society of Indian Automotive Manufacturers (SIAM), and paid databases and directories such as D&B Hoovers, Bloomberg, and Factiva.

The figure below illustrates the break-up of the profiles of industry experts who participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive fastener market consists of established fasteners manufacturers such as Bulten AB (Sweden), KAMAX (Germany), Sundram Fasteners (India), Stanley Black & Decker (US), Shanghai Prime Machinery Company (China), SFS Group (Switzerland) and Lisi Group (France). It also comprises a few other players such as Meidoh Co. (Japan), Nipman Fasteners (India), Piolax (US), Westfield Fasteners (UK), Fontana Gruppo (Italy), Bollhoff (Germany), Nedshroef (Netherlands), Nifco Group (Japan), Boltun Corporation (Taiwan), Chanshu City Standard Parts (China), Wurth Group (Germany), and Simmonds Marshall (India).

Target Audience

- Manufacturers of automotive fasteners

- Automotive OEMs

- Electric vehicle manufacturers

- Industry associations and experts

- Traders, distributors, and suppliers of automotive fasteners

Scope of the Report

-

Market, By Product

- Threaded

- Non-Threaded

-

Market, By Application

- Engine

- Chassis

- Transmission

- Steering

- Front/rear axle

- Interior trim

- Others

-

Market, By Characteristics

- Removable Fasteners

- Permanent Fasteners

- Semi-Permanent Fasteners

-

Market, By Material Type

- Stainless Steel

- Iron

- Bronze

- Nickel

- Aluminum

- Brass

- Plastic

-

Market, By Vehicle Type

- Passenger Car (PC)

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

-

Market, By Electric Vehicle Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

-

Market, By Region

- Asia Pacific

- Europe

- North America

- Rest of World

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Geographic Analysis: Further breakdown of the Rest of Asia Pacific, Rest of North America, Rest of Europe, and Rest of World market

- Company Information: Detailed analysis and profiles of additional market players (up to three companies)

The global automotive fastener market is projected to grow from an estimated USD 21.45 Billion in 2018 to USD 25.30 Billion by 2025, at a CAGR of 2.39% from 2018 to 2025. The market is anticipated to grow owing to various reasons such as the growing vehicle production, shifting focus toward lightweight vehicles, and the increasing use of electronics in vehicles. Moreover, manufacturers are also shifting from standard fasteners to customized fasteners, and this new development will also drive this market.

The interior trim segment is estimated to be the fastest-growing segment of the fastener market, by application, in terms of value. Automobile manufacturers are now focusing on using lightweight fasteners in the major application areas to reduce the weight of the vehicle. The automakers’ focus is high on the interior trims where the application of plastic and aluminum fasteners is increasing to achieve weight reduction, which will drive the requirement of fasteners.

The passenger car segment is estimated to be the largest segment in automotive fastener market, by vehicle type. Increasing demand for lightweight fasteners, government mandates for fuel economy and emission reduction, and increase in per capita income are the factors fueling the demand for passenger cars in developing countries such as China and India. The production of passenger cars has shown steep growth in developing countries. Developed countries in Europe and North America have a high demand for SUVs and premium cars, which will further boost the demand for the passenger car segment. Also, the demand for premium vehicles in India and China has also witnessed an upward market trend in the last few years. These factors have boosted the global demand for the fastener market for passenger car segment.

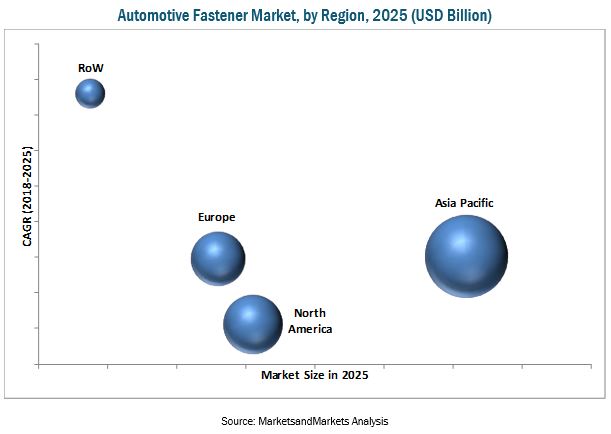

Asia Pacific is estimated to be the largest market for automotive fasteners during the forecast period owing to their large production and sales of vehicles. The government regulations for lightweight vehicles have led to advancements in technology for manufacturing lightweight and durable products in the region. Also, manufacturers are shifting from standard parts to customized parts, which will drive the demand for customized fasteners in the Asia Pacific region.

The major players in Automotive Fastener Market are Bulten AB (Sweden), KAMAX (Germany), Sundram Fasteners (India), Stanley Black & Decker (US), Shanghai Prime Machinery Company (China), SFS Group (Switzerland) and Lisi Group (France). These companies collectively account for a major share of this market.

ITW, Lisi, and Bulten AB are the current dominant players in this market. The extensive competition in the automotive industry has made these companies primarily focusing on upgrading the existing systems and processes. These players have adopted various strategies to diversify their presence globally and increase their market shares. The companies should focus on introducing more innovative products, mainly in lightweight fasteners as the demand for lightweight vehicle is increasing.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Automotive Fastener Market Definition

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Automotive Fastener Market Estimation

2.4.1 Bottom-Up Approach

2.5 Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Automotive Fastener Market

4.2 Market, By Region

4.3 Market, By Product

4.4 Market, By Characteristics

4.5 Market, By Material

4.6 Market, By Application

4.7 Market, By Vehicle Type

4.8 Market, By Electric Vehicle Type

5 Automotive Fastener Market Overview (Page No. - 37)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Significant Growth in the Global Automotive Industry

5.1.1.2 New Developments and Trends in Automotive Fasteners

5.1.2 Restraints

5.1.2.1 Emergence of Alternatives for Automotive Fasteners

5.1.3 Opportunities

5.1.3.1 Government Mandates Related to Safety Features & Increasing Use of Electronics in Vehicle

5.1.3.2 Significant Developments in Powertrain Innovations

5.1.3.3 Growth in the Number of Semi-Autonomous Cars

5.1.3.4 Growth in the Electric Vehicle Industry

5.1.4 Challenges

5.1.4.1 Development of New Fasteners to Achieve Automotive Weight Reduction

5.1.4.2 Intensive Competition in the Coming Years to Cater to the Electric Vehicle Market

6 Automotive Fastener Market, By Product (Page No. - 42)

6.1 Introduction

6.2 Threaded Fastener

6.3 Non-Threaded Fastener

7 Market, By Characteristics (Page No. - 47)

7.1 Introduction

7.2 Removable Fastener

7.3 Permanent Fastener

7.4 Semi-Permanent Fasteners

8 Market, By Application (Page No. - 53)

8.1 Introduction

8.2 Engine

8.3 Chassis

8.4 Interior Trim

8.5 Front/Rear Axle

8.6 Steering

8.7 Transmission

8.8 Other

9 Automotive Fastener Market, By Material Type (Page No. - 63)

9.1 Introduction

9.2 Stainless Steel

9.3 Plastic

9.4 Aluminum

9.5 Iron

9.6 Bronze

9.7 Brass

9.8 Nickel

10 Market, By Vehicle Type (Page No. - 73)

10.1 Introduction

10.2 Passenger Car

10.3 LCV

10.4 HCV

11 Automotive Fastener Market, By Electric Vehicle Type (Page No. - 80)

11.1 Introduction

11.2 BEV

11.3 HEV

11.4 PHEV

12 Market, By Region (Page No. - 86)

12.1 Introduction

12.2 Asia Pacific

12.2.1 China

12.2.2 Japan

12.2.3 India

12.2.4 South Korea

12.3 Europe

12.3.1 Germany

12.3.2 France

12.3.3 Spain

12.3.4 UK

12.3.5 Italy

12.4 North America

12.4.1 United States

12.4.2 Mexico

12.4.3 Canada

12.5 Rest of the World

12.5.1 Brazil

12.5.2 Russia

13 Competitive Landscape (Page No. - 117)

13.1 Overview

13.2 Automotive Fastener Market Ranking Analysis

13.3 Competitive Scenario

13.3.1 Contracts & Agreements

13.3.2 New Product Developments

13.3.3 Expansions

13.3.4 Mergers & Acquisitions

14 Company Profiles (Page No. - 122)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 Sundram Fasteners Limited

14.2 ITW

14.3 LISI Group

14.4 Shanghai Prime Machinery Company Limited

14.5 Bulten Ab

14.6 Stanley Black & Decker

14.7 SFS Group AG

14.8 Kamax

14.9 Meidoh Co. Ltd.

14.10 Nipman Fasteners

14.11 Würth Group

14.12 Piolax

14.13 Westfield Fasteners Limited

14.14 Changshu City Standard Parts Factory

14.15 Fontana Gruppo

14.16 Simmonds Marshall Limited

14.17 Sterling Tools Limited

14.18 Bollhoff

14.19 Nedschroef

14.20 Nifco Group

14.21 Boltun Corporation

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 146)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Related Reports

15.4 Author Details

List of Tables (106 Tables)

Table 1 Average American Dollar Exchange Rate (Per 1 USD)

Table 2 Global Automotive Fastener Market, By Product, 2016–2025 (USD Billion)

Table 3 Global Market, By Product, 2016–2025 (Billion Units)

Table 4 Threaded Fastener Market, By Region, 2016–2025 (USD Billion)

Table 5 Threaded Fastener Market, By Region, 2016–2025 (Billion Units)

Table 6 Non-Threaded Fastener Market, By Region, 2016–2025 (USD Billion)

Table 7 Non-Threaded Fastener Market, By Region, 2016–2025 (Billion Units)

Table 8 Automotive Fasteners Market, By Characteristics, 2016–2025 (USD Billion)

Table 9 Automotive Fasteners Market, By Characteristics, 2016–2025 (Billion Units)

Table 10 Removable Fastener Market, By Region, 2016–2025 (USD Billion)

Table 11 Removable Fastener Market, By Region, 2016–2025 (Billion Units)

Table 12 Permanent Fastener Market, By Region, 2016–2025 (USD Billion)

Table 13 Permanent Fastener Market, By Region, 2016–2025 (Billion Units)

Table 14 Semi-Permanent Fastener Market, By Region, 2016–2025 (USD Billion)

Table 15 Semi-Permanent Fastener Market, By Region, 2016-2025 (Billion Units)

Table 16 Global Market, By Application, 2016–2025 (USD Billion)

Table 17 Global Market, By Application, 2016–2025 (Billion Units)

Table 18 Engine: Market, By Region, 2016–2025 (USD Billion)

Table 19 Engine: Market, By Region, 2016–2025 (Billion Units)

Table 20 Chassis: Market, By Region, 2016–2025 (USD Billion)

Table 21 Chassis: Market, By Region, 2016–2025 (Billion Units)

Table 22 Interior Trim: Market, By Region, 2016–2025 (USD Billion)

Table 23 Interior Trim: Market, By Region, 2016–2025 (Billion Units)

Table 24 Front/Rear Axle: Market, By Region, 2016–2025 (USD Billion)

Table 25 Front/Rear Axle: Market, By Region, 2016–2025 (Million Units)

Table 26 Steering: Market, By Region, 2016–2025 (USD Billion)

Table 27 Steering: Market, By Region, 2016–2025 (Billion Units)

Table 28 Transmission: Market, By Region, 2016–2025 (USD Billion)

Table 29 Transmission: Market, By Region, 2016–2025 (Billion Units)

Table 30 Other: Market, By Region, 2016–2025 (USD Billion)

Table 31 Other: Market, By Region, 2016–2025 (Billion Units)

Table 32 Market, By Material, 2016–2025 (USD Billion)

Table 33 Market, By Material, 2016–2025 (Billion Units)

Table 34 Stainless Steel Fastener Market, By Region, 2016–2025 (USD Billion)

Table 35 Stainless Steel Fastener Market, By Region, 2016–2025 (Billion Units)

Table 36 Plastic Fastener Market, By Region, 2016–2025 (USD Billion)

Table 37 Plastic Fastener Market, By Region, 2016–2025 (Billion Units)

Table 38 Aluminum Fastener Market, By Region, 2016–2025 (USD Billion)

Table 39 Aluminum Fastener Market, By Region, 2016–2025 (Billion Units)

Table 40 Iron Fastener Market, By Region, 2016–2025 (USD Billion)

Table 41 Iron Fastener Market, By Region, 2016–2025 (Billion Units)

Table 42 Bronze Fastener Market, By Region, 2016–2025 (USD Billion)

Table 43 Bronze Fastener Market, By Region, 2016–2025 (Billion Units)

Table 44 Brass Fastener Market, By Region, 2016–2025 (USD Billion)

Table 45 Brass Fastener Market, By Region, 2016–2025 (Billion Units)

Table 46 Nickel Fastener Market, By Region, 2016–2025 (USD Billion)

Table 47 Nickel Fastener Market, By Region, 2016–2025 (Billion Units)

Table 48 Fastener Market, By Vehicle Type, 2016–2025 (Billion Units)

Table 49 Fastener Market, By Vehicle Type, 2016–2025 (USD Billion)

Table 50 Passenger Car: Market, By Region, 2016–2025 (Billion Units)

Table 51 Passenger Car: Market, By Region, 2016–2025 (USD Billion)

Table 52 LCV: Market, By Region, 2016–2025 (Billion Units)

Table 53 LCV: Market, By Region, 2016–2025 (USD Million)

Table 54 HCV: Market, By Region, 2016–2025 (Billion Units)

Table 55 HCV: Market, By Region, 2016–2025 (USD Billion)

Table 56 Market, By Electric Vehicle Type, 2016–2025 (Million Units)

Table 57 Market, By Electric Vehicle Type, 2016–2025 (USD Million)

Table 58 BEV: Market, By Region, 2016–2025 (Million Units)

Table 59 BEV: Market, By Region, 2016–2025 (USD Million)

Table 60 HEV: Market, By Region, 2016–2025 (Million Units)

Table 61 HEV: Market, By Region, 2016–2025 (USD Million)

Table 62 PHEV: Market, By Region, 2016–2025 (Million Units)

Table 63 PHEV: Market, By Region, 2016–2025 (USD Million)

Table 64 Automotive Fastener Market, By Region, 2016–2025 (Billion Units)

Table 65 Market, By Region, 2016–2025 (USD Billion)

Table 66 Asia Pacific: Market, By Country, 2016–2025 (Billion Units)

Table 67 Asia Pacific: Market, By Country, 2016–2025 (USD Billion)

Table 68 China: Market, By Material Type, 2016–2025 (Billion Units)

Table 69 China: Market, By Material Type, 2016-2025 (USD Billion)

Table 70 Japan: Market, By Material Type, 2016–2025 (Billion Units)

Table 71 Japan: Market, By Material Type, 2016–2025 (USD Billion)

Table 72 India: Market, By Material Type, 2016–2025 (Billion Units)

Table 73 India: Market, By Material Type, 2016–2025 (USD Billion)

Table 74 South Korea: Market, By Material Type, 2016–2025 (Billion Units)

Table 75 South Korea: Market, By Material Type, 2016–2025 (USD Billion)

Table 76 Europe: Market, By Country, 2016–2025 (Billion Units)

Table 77 Europe: Market, By Country, 2016–2025 (USD Billion)

Table 78 Germany: Market, By Material Type, 2016–2025 (Billion Units)

Table 79 Germany: Market, By Material Type, 2016–2025 (USD Billion)

Table 80 France: Market, By Material Type, 2016–2025 (Billion Units)

Table 81 France: Market, By Material Type, 2016–2025 (USD Billion)

Table 82 Spain: Market, By Material Type, 2016–2025 (Billion Units)

Table 83 Spain: Market, By Material Type, 2016–2025 (USD Billion)

Table 84 UK: Market, By Material Type, 2016–2025 (Billion Units)

Table 85 UK: Market, By Material Type, 2016–2025 (USD Billion)

Table 86 Italy: Market, By Material Type, 2016–2025 (Billion Units)

Table 87 Italy: Market, By Material Type, 2016–2025 (USD Billion)

Table 88 North America: Market, By Country, 2016–2025 (Billion Units)

Table 89 North America: Market, By Country, 2016–2025 (USD Billion)

Table 90 United States: Market, By Material Type, 2016–2025 (Billion Units)

Table 91 United States: Market, By Material Type, 2016–2025 (USD Billion)

Table 92 Mexico: Market, By Material Type, 2016–2025 (Billion Units)

Table 93 Mexico: Market, By Material Type, 2016–2025 (USD Billion)

Table 94 Canada: Market, By Material Type, 2016–2025 (Billion Units)

Table 95 Canada: Market, By Material Type, 2016–2025 (USD Billion)

Table 96 Rest of the World: Market, By Country, 2016–2025 (Billion Units)

Table 97 Rest of the World: Market, By Country, 2016–2025 (USD Billion)

Table 98 Brazil: Market, By Material Type, 2016–2025 (Billion Units)

Table 99 Brazil: Market, By Material Type, 2016–2025 (USD Billion)

Table 100 Russia: Market, By Material Type, 2016–2025 (Billion Units)

Table 101 Russia: Market, By Material Type, 2016–2025 (USD Billion)

Table 102 Automotive Fastener Market Ranking Analysis, 2016

Table 103 Contracts & Agreements, 2015–2018

Table 104 New Product Developments, 2015–2018

Table 105 Expansions, 2015–2018

Table 106 Mergers & Acquisitions, 2015–2018

List of Figures (45 Figures)

Figure 1 Automotive Fastener Market: Segmentations Covered

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews:

Figure 5 Bottom-Up Approach

Figure 6 Market, By Region, 2018 vs 2025 (USD Billion)

Figure 7 Market, By Product, 2018 vs 2025 (USD Billion)

Figure 8 Market, By Characteristics, 2018 vs 2025 (USD Billion)

Figure 9 Market, By Material, 2018 vs 2025 (USD Billion)

Figure 10 Market, By Application, 2018 vs 2025 (USD Billion)

Figure 11 Market, By Vehicle Type, 2018 vs 2025 (USD Billion)

Figure 12 Growth of the Asia Pacific Automotive Industry is Expected to Drive the Fastener Market Between 2018 and 2025

Figure 13 Asia Pacific is Estimated to Lead this Market, 2018 (USD Billion)

Figure 14 Threaded Fastener is Estimated to Lead this Market, 2018 & 2025 (USD Billion)

Figure 15 Removable is Estimated to Lead the global Market, 2018 & 2025 (USD Billion)

Figure 16 Stainless Steel is Estimated to Lead the Market, By Material, 2018 & 2025 (USD Billion)

Figure 17 Interior Trim Segment is Estimated to Lead the global Market, By Application, 2018 & 2025 (USD Billion)

Figure 18 Passenger Car Segment is Estimated to Lead this Market, 2018 & 2025 (USD Billion)

Figure 19 HEV Segment is Estimated to Lead the global Market, 2018 & 2025 (USD Million)

Figure 20 Automotive Fastener: Market Dynamics

Figure 21 Electric Vehicle Sales, 2010–2016

Figure 22 Market, By Product, 2018 vs 2025 (USD Billion)

Figure 23 Market, By Characteristics, 2018 vs 2025 (USD Billion)

Figure 24 Market, By Application, 2018 vs 2025 (USD Billion)

Figure 25 Market, By Material, 2018 vs 2025 (USD Million)

Figure 26 Market, By Vehicle Type, 2018 vs 2025 (USD Billion)

Figure 27 Market, By Electric Vehicle Type,

Figure 28 Market, Countrywise Growth

Figure 29 Asia Pacific: Automotive Fastener Market Snapshot

Figure 30 Asia Pacific: Market, By Country, 2018 vs 2025 (USD Billion)

Figure 31 Europe: Market Snapshot

Figure 32 Europe: Market, By Country, 2018 vs 2025 (USD Billion)

Figure 33 North America: Market Snapshot

Figure 34 North America: Market, By Country, 2018 vs 2025 (USD Billion)

Figure 35 Rest of the World: Market, By Country, 2018 vs 2025 (USD Billion)

Figure 36 Companies Adopted Expansion as the Key Growth Strategy, 2015–2018

Figure 37 Sundram Fasteners Limited: Company Snapshot

Figure 38 ITW: Company Snapshot

Figure 39 LISI Group: Company Snapshot

Figure 40 Shanghai Prime Machinery Company Limited: Company Snapshot

Figure 41 Bulten Ab: Company Snapshot

Figure 42 Stanley Black & Decker: Company Snapshot

Figure 43 SFS Group AG: Company Snapshot

Figure 44 Kamax: Company Snapshot

Figure 45 Meidoh Co.Ltd: Company Snapshot

Growth opportunities and latent adjacency in Automotive Fastener Market