Clutch Market for Automotive by Transmission Type (Manual Transmission, AT, AMT & CVT), Clutch Disc/Clutch Plate Size (Below 9 Inches, 9 Inches to 10 Inches, 10 Inches to 11 Inches & 11 Inches and above), and by Geography - Forecast and Analysis to 2019

[230 Pages Report] The clutch transmits engine power to the gearbox without interrupting the running of the engine and enables continuous transmission while a gear is selected. In general terms, the wheels need to be disconnected from the engine sometimes because the engine spins all the time, but the wheels do not. In order to disconnect the engine, clutches are used to smoothly engage a spinning engine to a non-spinning transmission. The major factors driving the demand for automotive clutches are increasing vehicle sales, customer inclination towards more convenient modes of transmission which include semi-automatic and fully automated transmission systems, and the increasing demand for sophisticated and reliable electric vehicles. However, increasing demand for sophisticated and reliable electric vehicles is acting as restraining factors for the automotive clutch market

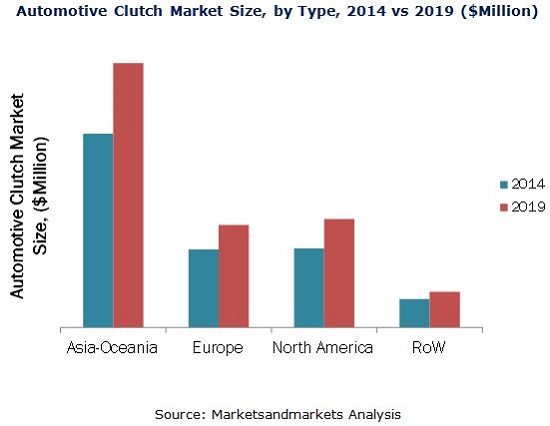

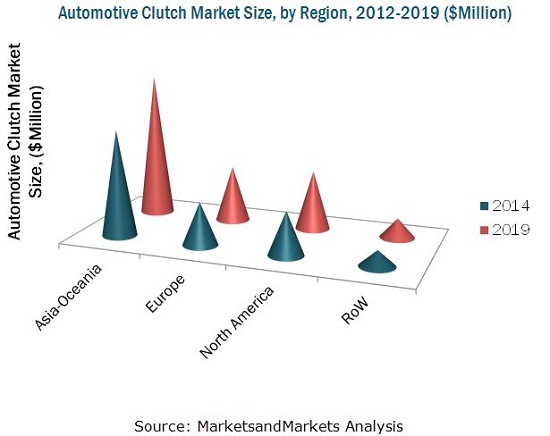

The global automotive clutch market size in terms of volume is projected to reach 125,801.8 thousand units, generating a total estimated market value of around $10,676.0 Million, by 2019. In 2014, the penetration of automotive clutches is estimated to be the highest in the Asia-Oceania region, followed by North America, Europe and RoW.

An increase in the demand for vehicles is expected in coming years in the countries of Asia-Oceania mainly in China, India, South Korea, and Japan. This is anticipated to raise the demand for automotive clutches, as they form an integral part of the transmission system. Sustainable growth in the automotive clutch market will largely depend on penetration of fully automated transmissions, which replace clutches with torque converters.

The automotive clutch markets in the Asia-Oceania and North American regions are expected to grow at a higher rate, owing to increasing production volume of passenger cars. In addition to this, OEMs are expanding their current production capacity and commencing new production facility to cater to rising demand in these regions. This has propelled the growth of the automotive industry, resulting in a significant increase in the demand of automotive clutches in the region.

This report classifies and defines the automotive clutch market in terms of volume and value. It provides a comprehensive analysis and insights into the automotive clutch market (both qualitative and quantitative). The report highlights potential growth opportunities in coming years and reviews the drivers, restraints, growth indicators, challenges, legislation trends, market dynamics, competitive landscape, and other key aspects of the automotive clutch market. The key players in this market are ZF Friedrichshafen AG (Germany), BorgWarner Inc. (U.S.), Schaeffler AG (Germany), Valeo S.A. (France), EXEDY Corporation (Japan), Valeo S.A. (France), Eaton Corporation Plc. (Ireland), FCC Co. Ltd. (Japan), Clutch Auto Ltd. (India), NSK Ltd. (India) and Aisin Seiki Co. Ltd.(Japan)d.

Scope of the Report

The report, global automotive clutch market covers the market by geography into Asia-Oceania, North America, Europe and Rest of the World. The market is further segmented by transmission type (Manual Transmission, Automatic Transmission, Automated Manual Transmission, and Continuously Variable Transmission) and by Clutch Disc size (Below 9 inches, 9 inches to 10 inches, 10 inches to 11 inches, and 11 inches and above). Market size in terms of volume is provided from 2012 to 2019 in thousand units, whereas the market size by value is provided in $Millions.

Automotive Clutch Market: The market size, in terms of value, is projected to grow at a promising CAGR of 6.14% to reach $10,676 Million by 2019.

The clutch transmits engine power to the gearbox without interrupting the running of the engine, and enables continuous transmission while a gear is selected. In general terms, the wheels need to be disengaged from the engine in the event of stopping or braking of the vehicle. In order to connect the engine to transmission, clutches are used to smoothly engage a spinning crankshaft to a non-spinning transmission shaft. A clutch thus provides a separable connection between engine and transmission. This report segments the market in terms of regions into Asia-Oceania, North America, Europe, and the Rest of the World (RoW). The market is further segmented by Transmission Type (Manual Transmission, AT, AMT, & CVT) and by Clutch Disc Size (below 9 inches, 9 to 10 inches, 10 to 11 inches, & 11 inches and above).

The demand for automatic transmission vehicles as compared to vehicles with manual transmission is higher in the mature European market. The demand for automatic transmission systems is growing at a faster rate and also outnumbering the demand for manual transmission in the North American market and is growing considerably in Asia-Pacific, due to the increase in consumer purchasing power. China is expected to be the largest market for automotive clutch systems in the next five years. Countries such as India, the U.K., and the U.S. are expected to exhibit high growth rates with respect to the demand for automotive clutch systems from 2014 to 2019.

The automotive clutch market is dominated by various players, including manufacturers, component suppliers, and automotive clutch companies. The key companies operating in the automotive clutch market are ZF Friedrichshafen AG (Germany), BorgWarner Inc. (U.S.), Schaeffler AG (Germany), Valeo S.A. (France), and EXEDY Corporation (Japan), among others.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data from Secondary Sources

2.3 Primary Data

2.3.1 Breakdown of Primary Interviews: By Company Type, Designation, & Region

2.3.2 Key Industry Insights

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.2.1 Impact of GDP on Commercial Vehicle Sales

2.4.2.2 Urbanization vs. Passenger Car Per 1000 People

2.4.2.3 Infrastructure: Roadways

2.4.3 Supply Side Analysis

2.4.3.1 Vehicle Production Increasing in Developing Countries

2.4.4 Technological Advancement

2.4.5 Influence of Other Factors

2.5 Market Size Estimation

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities in Automotive Clutch Market

4.2 Automotive Clutch Market, By Disc Size

4.3 China Captured the Maximum Estimated Market Share in Automotive Clutch Market, 2014

4.4 Automotive Transmission Market: Rapidly Growing Regions

4.5 Automotive Clutch Market Share, By Countries

4.6 Automotive Clutch Market: Developed vs Developing Nations

4.7 Global Automotive Clutch Market, By Transmission Type

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Low Cost of Traditional Manual Clutch Transmissions as Compared to Advanced High-End Transmission Systems

5.3.1.2 Increasing Global Vehicle Production

5.3.2 Restraints

5.3.2.1 Increasing Penetration of Automatic Transmission Vehicles Offer Better Driving Experience

5.3.2.2 Improved Fuel Efficiency of Automatic Transmission Systems Over Conventional Manual Clutch Transmission Systems

5.3.3 Opportunities

5.3.3.1 Growing Popularity of the DCT Technology

5.3.4 Challenges

5.3.4.1 Absence of Clutches in Electric Vehicles

5.4 Burning Issue

5.4.1 Automatic Transmission (ATS) and Automated Manual Transmissions (AMTS) Replacing the Existing Manual Clutch Modules

6 Global Automotive Clutch Market, By Transmission Type (Page No. - 48)

6.1 Introduction

6.2 Manual Transmission

6.3 Automatic Transmission

6.4 Automated Manual Transmission

6.5 Continuously Variable Transmission

7 Automotive Clutch Market, By Clutch Disc Size (Page No. - 57)

7.1 Introduction

7.2 Below 9 Inches Disc

7.3 9 to 10 Inches Disc

7.4 10 to 11 Inches Disc

7.5 11 Inches and Above Disc

8 Automotive Clutch Market, By Region (Page No. - 82)

8.1 Introduction

8.2 Asia-Oceania

8.2.1 China

8.2.2 Japan

8.2.3 South Korea

8.2.4 India

8.3 Europe

8.3.1 Germany

8.3.2 France

8.3.3 U.K.

8.4 North America

8.4.1 U.S.

8.4.2 Mexico

8.4.3 Canada

8.5 Rest of World (ROW)

8.5.1 Brazil

8.5.2 Russia

8.6 Pest Analysis

8.6.1 Political Factors

8.6.1.1 Europe

8.6.1.2 Asia-Oceania

8.6.1.3 North America

8.6.1.4 Rest of the World

8.6.2 Economic Factors

8.6.2.1 Europe

8.6.2.2 Asia-Oceania

8.6.2.3 North America

8.6.2.4 Rest of the World

8.6.3 Social Factors

8.6.3.1 Europe

8.6.3.2 Asia-Oceania

8.6.3.3 North America

8.6.3.4 Rest of the World

8.6.4 Technological Factors

8.6.4.1 Europe

8.6.4.2 Asia-Oceania

8.6.4.3 North America

8.6.4.4 Rest of the World

9 Competitive Landscape (Page No. - 112)

9.1 Introduction

9.2 Market Share Analysis, Global Automotive Clutch Market

9.3 Competitive Situations & Trends

9.4 Battle for Market Share: Expansions was the Key Strategy

9.4.1 New Product Launches

9.4.2 Expansions

9.4.3 Agreements/Joint Ventures & Supply Contract

10 Company Profiles (Page No. - 120)

10.1 Introduction

10.2 Borgwarner Inc.

10.3 Schaeffler AG.

10.4 ZF Friedrichshafen AG.

10.5 Valeo S.A.

10.6 Eaton Corporation PLC

10.7 Exedy Corporation

10.8 F.C.C. Co., Ltd.

10.9 Clutch Auto Limited

10.10 NSK Ltd.

10.11 Aisin Seiki Co., Ltd.

11 Appendix (Page No. - 148)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Introducing RT: Real Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

12 Available customizations

12.1 By Material

12.2 Clutch System

12.3 By Vehicle type

12.4 Aftermarket/Replacement market

List of Tables (89 Tables)

Table 1 Automotive Transmission Market Size, By Transmission Type, 2012-2019 (‘000 Units)

Table 2 Automotive Transimission Market Size, By Transmission Type, 2012–2019 ($Billion)

Table 3 Manual Transmission: By Region, 2012-2019 (‘000 Units)

Table 4 Manual Transmission: By Region, 2012-2019 ($Billion)

Table 5 Automatic Transmission: By Region, 2012-2019 (‘000 Units)

Table 6 Automatic Transmission: By Region, 2012-2019 ($Billion)

Table 7 Automated Manual Transmission: By Region, 2012-2019 (‘000 Units)

Table 8 Automated Manual Transmission: By Region, 2012-2019 ($Billion)

Table 9 Continuously Variable Transmission: By Region, 2012-2019 (‘000 Units)

Table 10 Continuously Variable Transmission: By Region, 2012-2019 ($Billion)

Table 11 Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (‘000 Units)

Table 12 Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 13 Below 9 Inches Disc: Automotive Clutch Market Size, By Region, 2012-2019 (‘000 Units)

Table 14 Below 9 Inches Disc: Automotive Clutch Market Size, By Region, 2012-2019 ($Million)

Table 15 Asia-Oceania: Automotive Clutch Market Size, By Country, 2012-2019 (‘000 Units)

Table 16 Asia-Oceania: Automotive Clutch (Below 9 Inches) Market Size, By Country, 2012-2019 ($Million)

Table 17 Europe: Automotive Clutch (Below 9 Inches) Market Size, By Country, 2012-2019 (‘000 Units)

Table 18 Europe: Automotive Clutch (Below 9 Inches) Market Size, By Country, 2012-2019 ($Million)

Table 19 North America: Automotive Clutch (Below 9 Inches) Market Size, By Country, 2012-2019 (‘000 Units)

Table 20 North America: Automotive Clutch ( Below 9 Inches) Market Size, By Country, 2012-2019 ($Million)

Table 21 ROW: Automotive Clutch ( Below 9 Inches) Market Size, By Country, 2012-2019 (‘000 Units)

Table 22 ROW: Automotive Clutch ( Below 9 Inches) Market Size, By Country, 2012-2019 ($Million)

Table 23 9 to 10 Inches Disc: Automotive Clutch Market Size, By Region, 2012-2019 (‘000 Units)

Table 24 9 to 10 Inches Disc: Automotive Clutch Market Size, By Region, 2012-2019 ($Million)

Table 25 Asia-Oceania: Automotive Clutch (9 to 10 Inches) Market Size, By Country, 2012-2019 (‘000 Units)

Table 26 Asia-Oceania: Automotive Clutch (9 to 10 Inches) Market Size, By Country, 2012-2019 ($Million)

Table 27 Europe: Automotive Clutch (9 to 10 Inches) Market Size, By Country, 2012-2019 (‘000 Units)

Table 28 Europe: Automotive Clutch (9 to 10 Inches) Market Size, By Country, 2012-2019 (’000 Units)

Table 29 North America: Automotive Clutch (9 to 10 Inches) Market Size, By Country, 2012-2019 (‘000 Units)

Table 30 North America: Automotive Clutch (9 to 10 Inches) Market Size, By Country, 2012-2019 ($Million)

Table 31 ROW: Automotive Clutch (9 to 10 Inches) Market Size, By Country, 2012-2019 (‘000 Units)

Table 32 ROW: Automotive Clutch (9 to 10 Inches) Market Size, By Country, 2012-2019 ($Million)

Table 33 10 to 11 Inches Disc: Automotive Clutch Market Size, By Region, 2012-2019 (‘000 Units)

Table 34 10 to 11 Inches Disc: Automotive Clutch Market Size, By Region, 2012-2019 ($Million)

Table 35 Asia-Oceania: Automotive Clutch (10 to 11 Inches) Market Size, By Country, 2012-2019 (‘000 Units)

Table 36 Asia-Oceania: Automotive Clutch Market (10 to 11 Inches ) Size, By Country, 2012-2019 ($Million)

Table 37 Europe: Automotive Clutch Market (10 to 11 Inches ) Size, By Country, 2012-2019 (‘000 Units)

Table 38 Europe: Automotive Clutch Market (10 to 11 Inches ) Size, By Country, 2012-2019 ($Million)

Table 39 North America: Automotive Clutch Market (10 to 11 Inches ) Size, By Country, 2012-2019 (‘ 000 Units)

Table 40 North America: Automotive Clutch Market (10 to 11 Inches ) Size, By Country, 2012-2019 ($Million)

Table 41 ROW: Automotive Clutch Market (10 to 11 Inches ) Size, By Country, 2012-2019 (‘000 Units)

Table 42 ROW: Automotive Clutch Market (10 to 11 Inches ) Size, By Country, 2012-2019 ($Million)

Table 43 11 Inches and Above Disc: Automotive Clutch Market Size, By Region, 2012-2019 (‘000 Units)

Table 44 11 Inches and Above: Automotive Clutch Market Size, By Region, 2012-2019 ($Million)

Table 45 Asia-Oceania: Automotive Clutch (11 Inches and Above) Market Size, By Country, 2012-2019 (‘000 Units)

Table 46 Asia-Oceania: Automotive Clutch (11 Inches and Above) Market Size, By Country, 2012-2019 ($Million)

Table 47 Europe: Automotive Clutch (11 Inches and Above) Market Size, By Country, 2012-2019 (‘000 Units)

Table 48 Europe: Automotive Clutch (11 Inches and Above) Market Size, By Country, 2012-2019 ($Million)

Table 49 North America: Automotive Clutch (11 Inches and Above) Market Size, By Country, 2012-2019 (‘000 Units)

Table 50 North America: Automotive Clutch (11 Inches and Above) Market Size, By Country, 2012-2019 ($Million)

Table 51 ROW: Automotive Clutch (11 Inches and Above) Market Size, By Country, 2012-2019 (‘000 Units)

Table 52 ROW: Automotive Clutch (11 Inches and Above) Market Size, By Country, 2012-2019 ($Million)

Table 53 Automotive Clutch Market Size, By Region, 2012-2019 (‘000 Units)

Table 54 Automotive Clutch Market Size, By Region, 2012-2019 ($Million)

Table 55 Asia-Oceania: Automotive Clutch Market Size, By Country, 2012-2019 (‘000 Units)

Table 56 Asia-Oceania: Automotive Clutch Market Size, By Country, 2012-2019 ($Million)

Table 57 China: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (‘000 Units)

Table 58 China: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 59 Japan: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (‘000 Units)

Table 60 Japan: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 61 South Korea: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (’000 Units)

Table 62 South Korea: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 63 India: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (‘000 Units)

Table 64 India: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 65 Europe : Automotive Clutch Market Size, By Country, 2012-2019 (‘000 Units)

Table 66 Europe: Automotive Clutch Market Size, By Country, 2012-2019 ($Million)

Table 67 Germany : Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (‘000 Units)

Table 68 Germany: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 69 France: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (‘000 Units)

Table 70 France: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 71 U.K.: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (‘000 Units)

Table 72 U.K.: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 73 North America: Automotive Clutch Market Size, By Country, 2012-2019 (‘000 Units)

Table 74 North America: Automotive Clutch Market Size, By Country, 2012-2019 ($Million)

Table 75 U.S.: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (‘000 Units)

Table 76 U.S.: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 77 Mexico: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (‘000 Units)

Table 78 Mexico: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 79 Canada: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (‘000 Units)

Table 80 Canada: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 81 ROW: Automotive Clutch Market Size, By Country, 2012-2019 (‘000 Units)

Table 82 ROW: Automotive Clutch Market Size, By Country, 2012-2019 ($Million)

Table 83 Brazil: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (‘000 Units)

Table 84 Brazil: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 85 Russia: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 (‘000 Units)

Table 86 Russia: Automotive Clutch Market Size, By Clutch Disc Size, 2012-2019 ($Million)

Table 87 New Product Launches, 2011-2014

Table 88 Expansions, 2010-2014

Table 89 Agreements/Joint Ventures & Supply Contracts, 2011-2014

List of Figures (61 Figures)

Figure 1 Global Automotive Clutch Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Gross Domestic Product (GDP) vs Commercial Vehicle Production

Figure 5 Urbanization vs. Passenger Cars Per 1000 People

Figure 6 Road Network vs Passenger Car Sales

Figure 7 Vehicle Production, 2009-2013

Figure 8 Micro and Macro Factor Analysis

Figure 9 Data Triangulation

Figure 10 Market Size Estimation Methodology: Bottom-Up Approach

Figure 11 Market Size Estimation Methodology: Top-Down Approach

Figure 12 Automotive Clutch Market Snapshot (2014): Asia-Oceania to Capture the Maximum Market Share Among All Region

Figure 13 Automated Manual Transmission to Grow at the Highest CAGR

Figure 14 Automotive Clutch Market Size, By Clutch Disc Size, 2014 vs 2019 ($Million)

Figure 15 China and U.S. to Have the Highest Market Share, 2014

Figure 16 By Clutch Disc Size, Below 9 Inches Disc Dominates the Global Automotive Clutch Market, 2014

Figure 17 Automotive Clutch Market to Grow at a CAGR of 6.14% in the Next Five Years, 2014-2019

Figure 18 Automotive Clutch of Below 9 Inches Disc Market to Grow at a Faster Rate as Compared to Others

Figure 19 North America Region Projected to Grow at a Higher Rate from 2014–2019

Figure 20 China to Command Over One- Fourth of the Market Share (2014)

Figure 21 Developing Markets to Grow Faster Than the Developed Ones

Figure 22 Automated Manual Transmission to Have a Promising Future in Next Five Years, 2014-2019

Figure 23 Global Automotive Clutch Market Segmentation

Figure 24 Low Cost of Traditional Manual Clutch Transmission is Expected to Drive the Market

Figure 25 Automatic Transmission (At) Estimated to Occupy the Largest Market Share in the Automotive Transmission Market in 2014

Figure 26 Europe is Estimated to be Fastest Growing Market for Automatic Transmission ($Billion)

Figure 27 Demand from Asia-Oceania is Driving the Market for Automated Manual Transmission($Billion)

Figure 28 By Clutch Disc Size: The Below 9 Inches Disc Dominated the Global Automotive Clutch Market in 2014

Figure 29 North America is the Fastest Growing Regional Market in the Overall Automotive Clutch (Below 9 Inches) Market, 2014-2019

Figure 30 North American Automotive Clutch (9 to 10 Inches) Market to Grow at a High CAGR%

Figure 31 Asia-Oceania Accounted for Half of the Global Automotive Clutch (10 to 11 Inches) Market in 2014

Figure 32 More Than Half of the Automotive Clutch Market is Dominated By the Asia-Oceania Region

Figure 33 Regional Snapshot (2014) – Rapid-Growth Markets are Emerging as New Hotspots

Figure 34 Asia-Oceania Automotive Clutch Market Snapshot – China Captured the Largest Market Share in the Automotive Clutch Market in 2014

Figure 35 China: Robust Economic Growth & Rapid Urbanization Propels the Market for Automotive Clutches

Figure 36 Europe: U.K. Automotive Clutch Market (Value and Volume) to Grow at the Highest CAGR

Figure 37 U.K.: Snapshot of Automotive Clutch Market, By Clutch Disc Size (Inches)

Figure 38 North American Market Snapshot: Demand for Automotive Clutches to be Driven By the Increasing Rate of Vehicle Production

Figure 39 U.S.: Automotive Clutch (Below 9 Inches) Market is Projected to Grow at the Highest CAGR

Figure 40 By Disc Size Type, the Below 9 Inches Disc Dominates the Brazilian Automotive Clutch Market

Figure 41 ZF Friedrichshafen AG Company Adopted Expansions as Key Growth Strategy During the Past Three Years

Figure 42 Borgwarner Inc. and Eaton Corporation Registered a Healthy Growth from 2008–2013

Figure 43 Automotive Clutch Market Share, 2013

Figure 44 Market Evaluation Framework-Significant Product Launches & Expansions Has Fuelled the Global Market Size from 2011–2014

Figure 45 Region-Wise Revenue Mix of Top 5 Market Players

Figure 46 Competitive Benchmarking of Key Market Players (2008-2013)

Figure 47 Borgwarner Inc.: Company Snapshot

Figure 48 Borgwarner Inc.: SWOT Analysis

Figure 49 Schaeffler AG: Company Snapshot

Figure 50 Schaeffler AG: SWOT Analysis

Figure 51 ZF Friedrichshafen AG.: Company Snapshot

Figure 52 ZF Friedrichshafen AG.: SWOT Analysis

Figure 53 Valeo S.A.:Company Snapshot

Figure 54 Valeo S.A.: SWOT Analysis

Figure 55 Eaton Corporation PLC: Company Snapshot

Figure 56 Eaton Corporation PLC: SWOT Analysis

Figure 57 Exedy Corporation: Company Snapshot

Figure 58 F.C.C. Co., Ltd.: Company Snapshot

Figure 59 Clutch Auto Limited: Company Snapshot

Figure 60 NSK Ltd.: Company Snapshot

Figure 61 Aisin Seiki Co., Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Clutch Market

I would like Manual transmission, non heavy equipment (aka. personal vehicles). Up to 11" plates. United States. Volumes broken down by vehicle make and model. If you have any information on the distribution channels used that would be helpful.

Market share of various suppliers of Clutch Plate in Commercial Vehicles, Passenger Cars, Tractors, 3Wheeler, 2Wheeler in India and Annual sales potential

Clutch Market for Automotive by Transmission Type for India. Require comprehensive report including prices

Dear all, could you kindly confirm that this report contains also market shares by manufacturer (e.g. Valeo) Many thanks, Andre

We are a spring making company, so any information you can provide regarding components that go into the clutch will be helpful.