Automotive Adhesive Tapes Market by Adhesive Type (Acrylic, Silicone, Rubber), Backing Material (Polypropylene, Poly-Vinyl Chloride, Paper), Application (Exterior, Interior, Electric Vehicle), and Region - Global Forecast to 2026

Updated on : September 03, 2025

Automotive Adhesive Tapes Market

The global automotive adhesive tapes market was valued at USD 8.5 billion in 2020 and is projected to reach USD 12.1 billion by 2026, growing at 5.9% cagr from 2020 to 2026. As these tapes provide excellent bonding/joining to different substrates used in lightweight vehicles, automotive adhesive tapes are estimated to become a key component in the future of the automotive industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global automotive adhesive tapes market

The pandemic is estimated to have an impact on various factors of the value chain of the automotive adhesive tapes market, which is expected to reflect during the forecast period, especially in the year 2020. The impact of COVID-19 is as follows:

COVID-19 has resulted in a decline in vehicle production, which is directly proportionate to the decline in the overall automotive adhesive tapes market. Halt in automotive production, supply chain disruptions, and lowered demand from aftermarket services are all resulted in a decline in the market till 2021. The demand for new vehicles in pandemic-affected countries was low due to lockdowns in effect during the period. The extent and pace of the potential rebound for the automotive industry are expected to depend on a range of factors which includes potential second and third waves of the pandemic, the pace of economic recovery, and willingness along with the ability of consumers and businesses to purchase new cars.

Automotive Adhesive Tapes Market Dynamics

Driver: Growing demand for automotive adhesives tapes in electric vehicle battery manufacturing

Adhesive tapes are projected to have high demand as a lightweight sealing solution in electric vehicles during the forecast period. They are used in electric vehicle battery manufacturers worldwide to improve production lines, increase safety, and reduce vehicle weight. Automotive adhesive tapes manufacturers are constantly developing new adhesive tapes specifically for electric and hybrid vehicles in close cooperation with the world’s leading OEMs and suppliers. Electric vehicle battery manufacturers depend on high-quality tapes, adhesives, and encapsulation materials to hold electric car batteries in place and protect them from elements. Hence, light-weighting is important as electric vehicle manufacturers must offset the additional battery weight to extend the vehicle range.

Opportunity: Growing trend of lightweight vehicles to drive market growth

With the increasing global concern on climate change and energy security, automobile manufacturers are facing increasing pressure to improve fuel efficiency on their fleet. Automobile manufacturers are turning to aluminum and composite materials as a building platform for vehicles. Both aluminum and composite materials are more expensive than steel. Therefore, the automobile industry are also looking at areas where they can use adhesive tapes instead of rivets and bolts to reduce costs. Structural adhesive tapes are engineered for multi-material bonding and joining and are the excellent adhesive solution for lightweight and high-performance designs.

Challenge: Rising concerns over harmful environmental impacts of producing solvent-based adhesives

The key concern with solvent-based adhesives is that they can adversely affect the environment and human health. Solvent-based adhesives contain binders dissolved in a carrier fluid that contains volatile organic compounds (VOCs). The health and environmental hazards of solvent-based adhesives, however, have been recognized since the 1970s, and these products have been under increasing regulatory pressure during the past 30 years. These regulations require manufacturers either to shift from solvent-based to water-based technology or to develop the technology to produce more environment-friendly solvent-based adhesives, which is a big challenge for the adhesive and adhesive tape manufacturers.

Acrylic is expected to dominate the automotive adhesive tapes market during 2021-2026

By adhesive type, acrylic is leading the market during the forecast period. Acrylic adhesives offer excellent bonding to a wide range of substrates, including metal, plastics, glass, ceramics, and stainless steel.

By backing material, poly-vinyl chloride (PVC) is the fastest-growing segment during the forecast period of 2021 to 2026.

Poly-vinyl chloride (PVC) is expected to grow at a faster rate during the forecast period as it is a major backing materials used in the automotive adhesive tapes industry. Poly-vinyl chloride-backed automotive adhesive tapes are used for special applications in the insulation and assembly of electronic components.

By application, the electric vehicle segment is the fastest-growing market during the forecast period

The electric vehicle segment is projected to grow with the highest CAGR during 2021-2026. The growth is due to the advancements in electric vehicle’s battery technology which are creating opportunities for adhesive tapes in bonding and heat management applications.

Asia Pacific is expected to dominate the automotive adhesive tapes market during 2021-2026”

Asia Pacific dominated the global automotive adhesive tapes market, in terms of value, in 2020. It is due to the high demand from China, Japan, and India. The governments of these emerging economies have recognized the growth potential of the electric vehicles market and, hence, taken different initiatives to attract major OEMs to manufacture electric vehicles for domestic markets. For instance, the Government of India, to increase the adoption of electric vehicles announced plans for financial support—a zero-rated goods and services tax (GST) for a window of three years for electric vehicles and a scheme called Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME). Such initiatives will enhance the demand for automotive adhesive tapes.

To know about the assumptions considered for the study, download the pdf brochure

Automotive Adhesive Tapes Market Players

The key market players include 3M (US), Nitto Denko Corporation (Japan), tesa SE (US), Avery Dennison Corporation (US), Lohmann GmbH & Co.KG (Germany), Henkel AG & Co. KGAA (Germany), Sika AG (Switzerland), Intertape Polymer Group (US), Lintec Corporation (Japan), Shurtape Technologies, LLC (US), Scapa (UK), and L&L Products (US). These players have adopted expansions, joint ventures, mergers, acquisitions, agreements, collaborations, product launches, and partnerships as their growth strategies.

Automotive Adhesive Tapes Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 8.5 Billion |

|

Revenue Forecast in 2026 |

USD 12.1 Billion |

|

CAGR |

5.9% |

|

Market Size Available for Years |

2019–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million ) |

|

Segments Covered |

Adhesive Type, Application, Backing Material, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

3M (US), Nitto Denko Corporation (Japan), tesa SE (US), Avery Dennison Corporation (US), Lohmann GmbH & Co.KG (Germany), Henkel AG & Co. KGAA (Germany), Sika AG (Switzerland), Intertape Polymer Group (US), Lintec Corporation (Japan), Shurtape Technologies, LLC (US), Scapa (UK), L&L Products (US), Coating & Converting Technologies, Inc. (US), PPI Adhesive Products (Ireland), ORAFOL Europe GmbH (Germany), Saint-Gobain (France), Berry Global Group, Inc. (US), ThreeBond International, Inc. (US), Adchem (US), PPG Industries, Inc. (US), GERGONNE- The Adhesive Solution (France), ECHOtape (Canada), Mactac (US), Advance Tapes International (UK), ATP Adhesive Systems AG (Switzerland), and American Biltrite Inc. (US) |

This research report categorizes the automotive adhesive tapes market based on adhesive type, application, backing material, and region.

Automotive Adhesive Tapes Market based on Adhesive Type:

- Acrylic,

- Silicone

- Rubber

- Others (Polyurethane (PU), Ethylene-vinyl Acetate (EVA), and Butyl)

Automotive Adhesive Tapes Market based on Backing Material:

- Polypropylene (PP)

- Polyvinylchloride (PVC)

- Paper

- Others (Non -woven, PET, Foam and Cotton)

Automotive Adhesive Tapes Market based on Application:

- Exterior

- Interior

- Electric Vehicle

Automotive Adhesive Tapes Market based on Region:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments in Automotive Adhesive Tapes Market

- In December 2020, 3M launched 2480 3M Hi-Tack silicone adhesive tapes. The products provide sheer performance, stronger adhesion, and longer-wear time.

- In May 2020, tesa SE expanded a new plant in Vietnam for the production of adhesive tapes for the Asian market, which will start from 2023. This will enable the tesa group to strengthen its presence in Asia, and significantly increase its capacities.

Upcoming Changes

In the previous version of the report, the automotive adhesives market size was projected until 2024. In the latest version, the market size is estimated and calculated until 2026, along with historical market data (2017, 2018, and 2019), and the CAGR is considered for the forecast period 2021 to 2026. The updated version of the report also covers an analysis of the impact of the COVID-19 on the automotive adhesives market across the segments and regions.

- Changes in the scope: The impact of COVID-19 on various regions, countries, and applications has been considered while designing the market engineering process and forecasting the new edition of the automotive adhesives market.

- Latest product portfolio : Tracking product portfolios helps analyze the automotive adhesive products available in the market. Therefore, the new edition of the report provides an updated product portfolio of the companies profiled in the report.

- Newer and improved representation of financial information: The new edition of the report provides updated financial information in the context of the automotive adhesives market till 2020 (depending on the availability) for each listed company in a graphical format in a single diagram (instead of multiple tables). This would help easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, segment revenues, and business segment focus in terms of the highest revenue-generating segment.

- Recent market developments: Recent developments help identify the market trends and growth strategies adopted by the market players. In the current analysis, there are new developments, including new product launches, mergers & acquisitions, and investments & expansions, which have taken place during 2015–2021.

The latest report also includes the following new sections for a comprehensive analysis:

- COVID-19 Impact

- Average Price Analysis

- Value Chain Analysis

- Patent Analysis

- Ecosystem/Market Map

- Trade Analysis

- Company Evaluation Matrix

- SME Matrix

- Market Share Analysis

- Market Evaluation Framework

Frequently Asked Questions (FAQ):

What is the current size of the global automotive adhesive tapes market?

The global automotive adhesive tapes market size was USD 8.5 billion in 2020 and is projected to reach USD 12.1 billion by 2026.

Who are the leading players in the global automotive adhesive tapes market?

The leading companies in the automotive adhesive tapes market include 3M (US), Nitto Denko Corporation (Japan), tesa SE (US), Avery Dennison Corporation (US), Lohmann GmbH & Co.KG (Germany), Henkel AG & Co. KGAA (Germany), Sika AG (Switzerland), Intertape Polymer Group (US), Lintec Corporation (Japan), Shurtape Technologies, LLC (US), Scapa (UK), and L&L Products (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 COMPETITIVE INTELLIGENCE

1.3 MARKET DEFINITION

1.4 AUTOMOTIVE ADHESIVE TAPES MARKET: INCLUSIONS & EXCLUSIONS

1.5 MARKET SCOPE

FIGURE 1 AUTOMOTIVE ADHESIVE TAPES: MARKET SEGMENTATION

FIGURE 2 GEOGRAPHIC SCOPE

1.5.1 YEARS CONSIDERED FOR THE STUDY

1.5.2 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 RESEARCH LIMITATIONS

1.9 SUMMARY OF CHANGES MADE IN REVAMPED VERSION

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 3 AUTOMOTIVE ADHESIVE TAPES MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

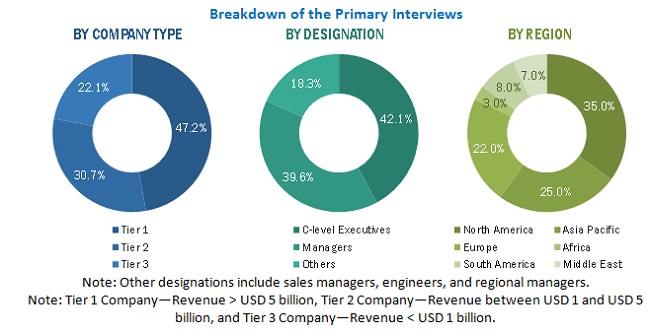

2.2.2.2 Breakdown of primaries

2.3 MATRIX CONSIDERED FOR DEMAND SIDE

FIGURE 5 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR AUTOMOTIVE ADHESIVE TAPES

2.4 MARKET SIZE ESTIMATION

FIGURE 6 METHODOLOGY FOR “DEMAND-SIDE” SIZING OF AUTOMOTIVE ADHESIVE TAPES MARKET

2.4.1 CALCULATION FOR DEMAND-SIDE ANALYSIS

2.4.2 KEY ASSUMPTIONS FOR CALCULATING DEMAND-SIDE MARKET SIZE

2.4.3 LIMITATIONS

FIGURE 7 METHODOLOGY FOR ASSESSING SUPPLY OF AUTOMOTIVE ADHESIVE TAPES

2.4.4 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

FIGURE 8 AUTOMOTIVE ADHESIVE TAPES MARKET: SUPPLY-SIDE ANALYSIS

2.4.5 FORECAST

2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.6 MARKET CAGR PROJECTIONS FROM ADHESIVE TAPES MARKET (PARENT MARKET) ACROSS REGIONS

2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 9 POLYPROPYLENE TO DOMINATE AUTOMOTIVE ADHESIVE TAPES MARKET

FIGURE 10 ACRYLIC SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2020

FIGURE 11 INTERIOR APPLICATION SEGMENT TO LEAD AUTOMOTIVE ADHESIVE TAPES MARKET DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING AUTOMOTIVE ADHESIVE TAPES MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE ADHESIVE TAPES MARKET

FIGURE 13 INCREASING USE IN ELECTRIC VEHICLES TO BOOST MARKET

4.2 AUTOMOTIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL

FIGURE 14 POLYPROPYLENE TO BE LARGEST MARKET SEGMENT

4.3 AUTOMOTIVE ADHESIVE TAPES MARKET, BY REGION

FIGURE 15 ASIA PACIFIC TO LEAD AUTOMOTIVE ADHESIVE TAPES MARKET DURING FORECAST PERIOD

4.4 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET, BY APPLICATION AND COUNTRY

FIGURE 16 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR AUTOMOTIVE ADHESIVE TAPES MARKET

5.2.1 DRIVERS

5.2.1.1 Growing demand for automotive adhesives tapes in electric vehicle battery manufacturing

TABLE 1 COMMON APPLICATIONS OF ADHESIVE TAPES IN ELECTRIC VEHICLE BATTERIES:

TABLE 2 PRODUCT OFFERINGS OF TESA FOR ELECTRIC VEHICLE INDUSTRY

FIGURE 18 ELECTRIC VEHICLE BATTERY PRODUCTION CAPACITY FORECAST OF KEY PLAYERS (2018 AND 2025)

5.2.1.2 Replacing traditional fastening systems in automotive

5.2.1.3 Electrification of vehicles due to government regulations and purchase incentives

TABLE 3 VEHICLE ELECTRIFICATION GOALS ANNOUNCED BY SELECT NATIONAL-LEVEL GOVERNMENTS

FIGURE 19 GLOBAL ELECTRIC LIGHT-VEHICLE SALES PERCENT OF TOTAL AUTOMOTIVE SALES

FIGURE 20 ELECTRIC VEHICLE MARKET SHARE BY OEMS BRAND, (2018 VS 2019)

FIGURE 21 GLOBAL ELECTRIC CAR SALES IN KEY GEOGRAPHIES

FIGURE 22 IMPACT OF DRIVERS ON AUTOMOTIVE ADHESIVE TAPES MARKET

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices leading to disruptions in supply chain

5.2.2.2 High upfront cost of electric vehicles and limited availability of charging stations

FIGURE 23 IMPACT OF RESTRAINTS ON AUTOMOTIVE ADHESIVE TAPES MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Advancements in technology solutions such as automated taping solutions (ATS)

5.2.3.2 Growing trend of lightweight vehicles to drive market growth

TABLE 4 COMMON APPLICATIONS OF STRUCTURAL AUTOMOTIVE ADHESIVE TAPES IN CARS

FIGURE 24 IMPACT OF OPPORTUNITIES ON AUTOMOTIVE ADHESIVE TAPES MARKET

5.2.4 CHALLENGES

5.2.4.1 Liquidity crunch due to COVID-19 on automotive industry

5.2.4.2 Rising concerns over harmful environmental impacts of producing solvent-based adhesives

FIGURE 25 IMPACT OF CHALLENGES ON AUTOMOTIVE ADHESIVE TAPES MARKET

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 AUTOMOTIVE ADHESIVE TAPES MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 AUTOMOTIVE ADHESIVE TAPES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF RIVALRY

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 27 AUTOMOTIVE ADHESIVE TAPES MARKET: SUPPLY CHAIN ANALYSIS

5.5 ECOSYSTEM/MARKET MAP OF AUTOMOTIVE ADHESIVE TAPES

FIGURE 28 AUTOMOTIVE ADHESIVE TAPES MARKET: ECOSYSTEM/MARKET MAP

TABLE 6 AUTOMOTIVE ADHESIVE TAPES MARKET: ECOSYSTEM/MARKET MAP

5.6 TECHNOLOGY ANALYSIS

5.7 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE ADHESIVE TAPES

FIGURE 29 AVERAGE PRICE OF AUTOMOTIVE ADHESIVE TAPES (2016-2020)

5.8 TRENDS AND DISRUPTIONS IN TECHNOLOGY

5.8.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR PROVIDERS

FIGURE 30 REVENUE SHIFT FOR AUTOMOTIVE ADHESIVE TAPES MARKET

5.8.2 YC, YCC DRIVERS

5.9 PATENT ANALYSIS

5.9.1 DOCUMENT TYPE

FIGURE 31 PATENTS BY DOCUMENT TYPE - LAST 10 YEARS

TABLE 7 AUTOMOTIVE ADHESIVE TAPES, PATENTS BY DOCUMENT TYPE, 2010-2020

5.9.2 PATENT PUBLICATION TREND

FIGURE 32 PATENT PUBLICATION TREND - LAST 10 YEARS

5.9.3 JURISDICTION ANALYSIS

FIGURE 33 JURISDICTION ANALYSIS – TOP REGIONS (2010-2020)

5.9.4 TOP COMPANIES/APPLICANTS

FIGURE 34 TOP APPLICANTS/COMPANIES WITH HIGHEST NUMBER OF PATENTS

TABLE 8 PATENTS BY NITTO DENKO CORPORATION

TABLE 9 PATENTS BY TESA SE

TABLE 10 PATENTS BY 3M INNOVATIVE PROPERTIES COMPANY

TABLE 11 PATENTS BY DEXERIALS CORPORATION

TABLE 12 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS FOR AUTOMOTIVE ADHESIVE TAPES

5.10 TRADE DATA STATISTICS

TABLE 13 COUNTRY-WISE IMPORT OF HS CODE 590610 (TEXTILE FABRICS, RUBBERISED; (EXCLUDING THOSE OF HEADING NO. 5902), ADHESIVE TAPE OF A WIDTH NOT EXCEEDING 20CM)

TABLE 14 TABLE 9 COUNTRY-WISE EXPORT OF HS CODE 590610 (TEXTILE FABRICS, RUBBERISED; (EXCLUDING THOSE OF HEADING NO. 5902), ADHESIVE TAPE OF A WIDTH NOT EXCEEDING 20CM)

5.11 REGULATORY LANDSCAPE

5.11.1 VOC EMISSION FROM ADHESIVES IN AUTOMOTIVE

5.11.2 EPA: CONTROL OF VOLATILE ORGANIC COMPOUNDS (VOCS)

TABLE 15 VOC CONTENT LIMITS FOR ADHESIVES, APPLIED TO PARTICULAR SUBSTRATES

TABLE 16 VOC CONTENT LIMITS FOR ADHESIVES APPLIED TO LISTED SUBSTRATES

5.11.3 EXEMPTIONS AND EXCEPTIONS

5.11.4 VOCS IN ASIA

5.11.5 VOCS IN EUROPE

5.11.6 CHANGING LANDSCAPE

5.11.7 COMPANIES PROVIDING ADHESIVE SOLUTIONS

5.12 CASE STUDY

5.12.1 RENAULT EXPECTATIONS FROM TAPE TECHNOLOGY

5.12.2 RENAULT EXPECTATIONS FROM TAPE MANUFACTURERS

6 COVID-19 IMPACT ON AUTOMOTIVE ADHESIVE TAPES MARKET (Page No. - 90)

6.1 INTRODUCTION

6.1.1 COVID-19 IMPACT ON LIVES AND LIVELIHOOD

6.1.1.1 Economic outlook by International Monetary Fund (IMF)

TABLE 17 COVID-19 IMPACT: ECONOMIC OUTLOOK, 2020–2021

6.1.1.2 Stimulus package by G-20 countries

TABLE 18 RELIEF PACKAGES ANNOUNCED BY G-20 COUNTRIES

6.1.2 IMPACT OF COVID-19 ON AUTOMOTIVE ADHESIVE TAPES MARKET

6.1.2.1 Introduction

TABLE 19 COUNTRY-WISE COMMERCIAL VEHICLES PRODUCTION, 2019-2020

FIGURE 35 GLOBAL SALES OF PASSENGER CARS

TABLE 20 COUNTRY-WISE MOTOR VEHICLES PRODUCTION, 2019-2020

7 AUTOMOTIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE (Page No. - 95)

7.1 INTRODUCTION

TABLE 21 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY ADHESIVE TYPE, 2016–2019 (USD MILLION)

TABLE 22 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY ADHESIVE TYPE, 2020–2026 (USD MILLION)

TABLE 23 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY ADHESIVE TYPE, 2016–2019 (MILLION SQUARE METER)

TABLE 24 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY ADHESIVE TYPE, 2020–2026 (MILLION SQUARE METER)

FIGURE 36 ACRYLIC TO BE LEADING ADHESIVE TYPE IN AUTOMOTIVE ADHESIVE TAPES MARKET

7.2 ACRYLIC-BASED AUTOMOTIVE ADHESIVE TAPES

7.2.1 HIGH DURABILITY, EXCELLENT TACK & MECHANICAL STRENGTH BOOSTING DEMAND

7.3 RUBBER-BASED AUTOMOTIVE ADHESIVE TAPES

7.3.1 GOOD ADHESION TO PLASTICS, NON-POLAR, AND LOW-ENERGY SURFACES AND LOW-COST INCREASING DEMAND

TABLE 25 ADVANTAGES OF NATURAL RUBBER-BASED ADHESIVES

TABLE 26 DISADVANTAGES OF NATURAL RUBBER-BASED ADHESIVES

7.4 SILICONE-BASED AUTOMOTIVE ADHESIVE TAPES

7.4.1 EXCELLENT PERFORMANCE ON LOW SURFACE ENERGY SUBSTRATES DRIVING THE GROWTH

7.5 OTHER AUTOMOTIVE ADHESIVE TAPES

8 AUTOMOTIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL (Page No. - 101)

8.1 INTRODUCTION

TABLE 27 ADVANTAGES OF DIFFERENT BACKING MATERIALS IN AUTOMOTIVE ADHESIVE TAPES

FIGURE 37 POLYPROPYLENE SEGMENT TO LEAD OVERALL AUTOMOTIVE ADHESIVE TAPES MARKET

TABLE 28 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2016–2019 (USD MILLION)

TABLE 29 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (USD MILLION)

TABLE 30 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2016–2019 (MILLION SQUARE METER)

TABLE 31 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2020–2026 (MILLION SQUARE METER)

8.2 POLYPROPYLENE (PP)

8.2.1 REINFORCED BOPP TO DRIVE SEGMENT GROWTH

8.3 PAPER

8.3.1 REPULPABLE NATURE OF PAPER TO INCREASE USE OF PAPER BACKING MATERIALS

8.4 POLY-VINYL CHLORIDE (PVC)

8.4.1 FLAME RETARDANCY AND ELECTRICAL INSULATION PROPERTIES DRIVING CONSUMPTION

8.5 OTHERS

9 AUTOMOTIVE ADHESIVE TAPES MARKET, BY APPLICATION (Page No. - 107)

9.1 INTRODUCTION

TABLE 32 COMMON ADVANTAGES OF USING AUTOMOTIVE ADHESIVE TAPES

TABLE 33 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 34 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 35 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 36 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

FIGURE 38 INTERIOR TO BE LEADING APPLICATION IN AUTOMOTIVE ADHESIVE TAPES MARKET

9.2 INTERIOR APPLICATIONS

9.2.1 GROWING DEMAND IN WIRE HARNESSING APPLICATIONS

TABLE 37 COMMON FEATURES OF WIRE HARNESSING SOLUTIONS

TABLE 38 COMMON AREA OF APPLICATIONS FOR AUTOMOTIVE INTERIOR MOUNTING TAPE

9.3 EXTERIOR APPLICATIONS

9.3.1 INCLINATION FOR VISUAL APPEAL TO DRIVE PAINT MASKING TAPES SEGMENT

TABLE 39 COMMON AREA OF APPLICATION FOR AUTOMOTIVE MASKING TAPE

TABLE 40 COMMON AREA OF APPLICATION FOR AUTOMOTIVE LABELING

TABLE 41 COMMON AREA OF APPLICATION FOR PART MOUNTING & FIXING

9.4 ELECTRIC VEHICLE APPLICATIONS

10 AUTOMOTIVE ADHESIVE TAPES MARKET, BY REGION (Page No. - 115)

10.1 INTRODUCTION

FIGURE 39 ASIA PACIFIC TO LEAD AUTOMOTIVE ADHESIVE TAPES MARKET

TABLE 42 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 44 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY REGION, 2016–2019 (MILLION SQUARE METER)

TABLE 45 AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY REGION, 2020–2026 (MILLION SQUARE METER)

10.2 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SNAPSHOT

TABLE 46 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 47 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 48 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION SQUARE METER)

TABLE 49 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2026 (MILLION SQUARE METER)

TABLE 50 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 51 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 52 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 53 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

TABLE 54 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY INTERIOR APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 55 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY INTERIOR APPLICATION, 2020–2026 (MILLION SQUARE METER)

TABLE 56 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY EXTERIOR APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 57 ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY EXTERIOR APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.2.1 CHINA

10.2.1.1 Increasing demand for electric vehicles

TABLE 58 CHINA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 59 CHINA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 60 CHINA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 61 CHINA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.2.2 SOUTH KOREA

10.2.2.1 Rising investment in electric vehicles to boost demand

TABLE 62 SOUTH KOREA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 63 SOUTH KOREA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 64 SOUTH KOREA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 65 SOUTH KOREA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.2.3 JAPAN

10.2.3.1 Presence of battery giants supporting market growth

TABLE 66 JAPAN: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 67 JAPAN: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 68 JAPAN: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 69 JAPAN: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.2.4 THAILAND

10.2.4.1 Strong automotive sector to propel demand for electric vehicles

TABLE 70 THAILAND: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 71 THAILAND: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 72 THAILAND: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 73 THAILAND: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.2.5 INDIA

10.2.5.1 Support of the government and automobile manufacturers for electric vehicles

TABLE 74 INDIA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 75 INDIA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 76 INDIA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 77 INDIA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.2.6 INDONESIA

10.2.6.1 Investments by various automobile manufacturers

TABLE 78 INDONESIA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 79 INDONESIA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 80 INDONESIA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 81 INDONESIA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.2.7 REST OF ASIA PACIFIC

TABLE 82 REST OF ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 83 REST OF ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 84 REST OF ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 85 REST OF ASIA PACIFIC: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.3 EUROPE

FIGURE 41 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SNAPSHOT

TABLE 86 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 87 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 88 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION SQUARE METER)

TABLE 89 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2026 (MILLION SQUARE METER)

TABLE 90 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 91 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 92 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 93 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

TABLE 94 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY INTERIOR APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 95 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY INTERIOR APPLICATION, 2020–2026 (MILLION SQUARE METER)

TABLE 96 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY EXTERIOR APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 97 EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY EXTERIOR APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.3.1 GERMANY

10.3.1.1 Focus on reducing emissions by promoting electric vehicles

TABLE 98 GERMEN ELECTRIC VEHICLE INCENTIVES/EV GRANTS (VALID FROM 1/7/2020 TO 31/12/2021)

TABLE 99 GERMANY: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 100 GERMANY: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 101 GERMANY: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 102 GERMANY: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.3.2 FRANCE

10.3.2.1 Growing number of battery electric vehicles and plug-in hybrid electric vehicles

TABLE 103 FRANCE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 104 FRANCE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 105 FRANCE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 106 FRANCE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.3.3 ITALY

10.3.3.1 Adopting electric vehicles at a significant pace

TABLE 107 ITALY: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 108 ITALY: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 109 ITALY: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 110 ITALY: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.3.4 UK

10.3.4.1 Government measures on CO2 emission from vehicles

TABLE 111 UK: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 112 UK: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 113 UK: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 114 UK: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.3.5 SPAIN

10.3.5.1 Growth in production of commercial vehicles

TABLE 115 SPAIN: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 116 SPAIN: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 117 SPAIN: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 118 SPAIN: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.3.6 REST OF EUROPE

TABLE 119 REST OF EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 120 REST OF EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 121 REST OF EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 122 REST OF EUROPE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.4 NORTH AMERICA

FIGURE 42 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SNAPSHOT

TABLE 123 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 124 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 125 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION SQUARE METER)

TABLE 126 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2026 (MILLION SQUARE METER)

TABLE 127 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 128 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 129 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 130 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

TABLE 131 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY INTERIOR APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 132 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY INTERIOR APPLICATION, 2020–2026 (MILLION SQUARE METER)

TABLE 133 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY EXTERIOR APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 134 NORTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY EXTERIOR APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.4.1 US

10.4.1.1 High level of innovation and growing demand for electric vehicles

TABLE 135 US: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 136 US: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 137 US: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 138 US: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.4.2 CANADA

10.4.2.1 Government policies to support electric vehicle sales contributing to market growth

TABLE 139 CANADA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 140 CANADA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 141 CANADA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 142 CANADA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.4.3 MEXICO

10.4.3.1 Investments of key players in electric vehicles

TABLE 143 MEXICO: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 144 MEXICO: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 145 MEXICO: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 146 MEXICO: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.5 MIDDLE EAST & AFRICA

TABLE 147 MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 149 MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION SQUARE METER)

TABLE 150 MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2026 (MILLION SQUARE METER)

TABLE 151 MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 154 MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

TABLE 155 MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY INTERIOR APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 156 MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY INTERIOR APPLICATION, 2020–2026 (MILLION SQUARE METER)

TABLE 157 MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY EXTERIOR APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 158 MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY EXTERIOR APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.5.1 UAE

10.5.1.1 Plans to reduce vehicle emission and switch to electric vehicles

TABLE 159 UAE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 160 UAE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 161 UAE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 162 UAE: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.5.2 KSA

10.5.2.1 Growing investment in the automotive sector to propel demand

TABLE 163 KSA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 164 KSA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 165 KSA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 166 KSA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.5.3 REST OF THE MIDDLE EAST & AFRICA

TABLE 167 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 168 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 169 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 170 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.6 SOUTH AMERICA

TABLE 171 SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 172 SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 173 SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION SQUARE METER)

TABLE 174 SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2026 (MILLION SQUARE METER)

TABLE 175 SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 176 SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 177 SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 178 SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

TABLE 179 SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY INTERIOR APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 180 SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY INTERIOR APPLICATION, 2020–2026 (MILLION SQUARE METER)

TABLE 181 SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY EXTERIOR APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 182 SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY EXTERIOR APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.6.1 BRAZIL

10.6.1.1 High presence of automobile manufacturers in Brazil to drive market growth

TABLE 183 BRAZIL: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 184 BRAZIL: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 185 BRAZIL: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 186 BRAZIL: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.6.2 ARGENTINA

10.6.2.1 Growth in car production to enhance market for automotive adhesive tapes

TABLE 187 ARGENTINA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 188 ARGENTINA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 189 ARGENTINA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 190 ARGENTINA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

10.6.3 REST OF SOUTH AMERICA

TABLE 191 REST OF SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 192 REST OF SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 193 REST OF SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION SQUARE METER)

TABLE 194 REST OF SOUTH AMERICA: AUTOMOTIVE ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2026 (MILLION SQUARE METER)

11 COMPETITIVE LANDSCAPE (Page No. - 171)

11.1 KEY PLAYERS’ STRATEGIES

TABLE 195 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2020

11.2 REVENUE SHARE ANALYSIS

FIGURE 43 REVENUE ANALYSIS OF TOP PLAYERS IN AUTOMOTIVE ADHESIVE TAPES MARKET

11.3 MARKET SHARE ANALYSIS

FIGURE 44 AUTOMOTIVE ADHESIVE TAPES: MARKET SHARE ANALYSIS

TABLE 196 AUTOMOTIVE ADHESIVE TAPES MARKET: DEGREE OF COMPETITION

TABLE 197 AUTOMOTIVE ADHESIVE TAPES MARKET: APPLICATION FOOTPRINT

TABLE 198 AUTOMOTIVE ADHESIVE TAPES MARKET: REGION FOOTPRINT

11.9 COMPANY EVALUATION QUADRANT

11.9.1 STAR

11.9.2 PERVASIVE

11.9.3 EMERGING LEADER

11.9.4 PARTICIPANT

FIGURE 45 AUTOMOTIVE ADHESIVE TAPES MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

11.1 COMPETITIVE SCENARIO

TABLE 199 AUTOMOTIVE ADHESIVE TAPES MARKET: PRODUCT LAUNCHES, FEBRUARY 2018-DECEMBER 2020

TABLE 200 AUTOMOTIVE ADHESIVE TAPES MARKET: DEALS, JANUARY 2018-MAY 2020

TABLE 201 AUTOMOTIVE ADHESIVE TAPES MARKET: OTHER DEVELOPMENTS, APRIL 2018- MAY 2020

12 COMPANY PROFILES (Page No. - 189)

12.1 KEY COMPANIES

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 3M

TABLE 202 3M: BUSINESS OVERVIEW

FIGURE 46 3M: COMPANY SNAPSHOT

TABLE 203 3M: PRODUCT OFFERINGS

TABLE 204 3M: PRODUCT LAUNCHES

TABLE 205 3M: DEALS

12.1.2 NITTO DENKO CORPORATION

TABLE 206 NITTO DENKO CORPORATION: BUSINESS OVERVIEW

FIGURE 47 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

TABLE 207 NITTO DENKO CORPORATION: PRODUCT OFFERINGS

12.1.3 TESA SE

TABLE 208 TESA SE: BUSINESS OVERVIEW

FIGURE 48 TESA SE: COMPANY SNAPSHOT

TABLE 209 TESA SE: PRODUCT OFFERINGS

TABLE 210 TESA SE: PRODUCT LAUNCHES

TABLE 211 TESA SE: DEALS

TABLE 212 TESA SE: OTHERS

12.1.4 AVERY DENNISON CORPORATION

TABLE 213 AVERY DENNISON CORPORATION: BUSINESS OVERVIEW

FIGURE 49 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

TABLE 214 AVERY DENNISON CORPORATION: PRODUCT OFFERINGS

TABLE 215 AVERY DENNISON CORPORATION: PRODUCT LAUNCHES

12.1.5 LOHMANN GMBH & CO.KG

TABLE 216 LOHMANN GMBH & CO.KG: BUSINESS OVERVIEW

TABLE 217 LOHMANN GMBH & CO.KG: PRODUCT OFFERINGS

TABLE 218 LOHMANN GMBH & CO.KG: PRODUCT LAUNCHES

12.1.6 HENKEL AG & CO. KGAA

TABLE 219 HENKEL AG & CO. KGAA PRODUCTS: BUSINESS OVERVIEW

FIGURE 50 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

TABLE 220 HENKEL AG & CO. KGAA: PRODUCT OFFERINGS

TABLE 221 HENKEL AG & CO. KGAA: PRODUCT LAUNCHES

TABLE 222 HENKEL AG & CO. KGAA: DEALS

TABLE 223 HENKEL AG & CO. KGAA: OTHERS

12.1.7 SIKA AG

TABLE 224 SIKA AG: BUSINESS OVERVIEW

FIGURE 51 SIKA AG: COMPANY SNAPSHOT

TABLE 225 SIKA AG: PRODUCT OFFERINGS

TABLE 226 SIKA AG: PRODUCT LAUNCHES

TABLE 227 SIKA AG: DEALS

12.1.8 INTERTAPE POLYMER GROUP

TABLE 228 INTERTAPE POLYMER GROUP: BUSINESS OVERVIEW

FIGURE 52 INTERTAPE POLYMER GROUP: COMPANY SNAPSHOT

TABLE 229 INTERTAPE POLYMER GROUP: PRODUCT OFFERINGS

TABLE 230 INTERTAPE POLYMER GROUP: DEALS

TABLE 231 INTERTAPE POLYMER GROUP: OTHERS

12.1.9 DOW

TABLE 232 DOW: BUSINESS OVERVIEW

FIGURE 53 DOW: COMPANY SNAPSHOT

TABLE 233 DOW: PRODUCT OFFERINGS

TABLE 234 DOW: PRODUCT LAUNCHES

12.1.10 LINTEC CORPORATION

TABLE 235 LINTEC CORPORATION: BUSINESS OVERVIEW

FIGURE 54 LINTEC CORPORATION: COMPANY SNAPSHOT

TABLE 236 LINTEC CORPORATION: PRODUCT OFFERINGS

TABLE 237 LINTEC CORPORATION: PRODUCT LAUNCHES

12.1.11 SHURTAPE TECHNOLOGIES, LLC

TABLE 238 SHURTAPE TECHNOLOGIES, LLC: BUSINESS OVERVIEW

TABLE 239 SHURTAPE TECHNOLOGIES, LLC: PRODUCT OFFERINGS

TABLE 240 SHURTAPE TECHNOLOGIES, LLC: DEALS

12.1.12 SCAPA

TABLE 241 SCAPA: BUSINESS OVERVIEW

FIGURE 55 SCAPA: COMPANY SNAPSHOT

TABLE 242 SCAPA: PRODUCT OFFERINGS

TABLE 243 SCAPA: DEALS

TABLE 244 SCAPA: OTHERS

12.1.13 L&L PRODUCTS

TABLE 245 L&L PRODUCTS: BUSINESS OVERVIEW

TABLE 246 L&L PRODUCTS: PRODUCT OFFERINGS

TABLE 247 L&L PRODUCTS: PRODUCT LAUNCHES

TABLE 248 L&L PRODUCTS: DEALS

12.2 OTHER PLAYERS

12.2.1 THREEBOND INTERNATIONAL, INC

TABLE 249 THREEBOND INTERNATIONAL, INC: COMPANY OVERVIEW

12.2.2 BEMIS ASSOCIATES INC

TABLE 250 BEMIS ASSOCIATES INC: COMPANY OVERVIEW

12.2.3 HALCO EUROPE LTD

TABLE 251 HALCO EUROPE LTD: COMPANY OVERVIEW

12.2.4 PPG INDUSTRIES, INC.

TABLE 252 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

12.2.5 AMERICAN BILTRITE INC.

TABLE 253 AMERICAN BILTRITE INC.: COMPANY OVERVIEW

12.2.6 ADCHEM

TABLE 254 ADCHEM: COMPANY OVERVIEW

12.2.7 SAINT-GOBAIN

TABLE 255 SAINT-GOBAIN: COMPANY OVERVIEW

12.2.8 BERRY GLOBAL INC.

TABLE 256 BERRY GLOBAL INC.: COMPANY OVERVIEW

12.2.9 ADVANCE TAPES INTERNATIONAL

TABLE 257 ADVANCE TAPES INTERNATIONAL: COMPANY OVERVIEW

12.2.10 MACTAC

TABLE 258 MACTAC: COMPANY OVERVIEW

12.2.11 ATP ADHESIVE SYSTEMS AG

TABLE 259 ATP ADHESIVE SYSTEMS AG: COMPANY OVERVIEW

12.2.12 GERGONNE- THE ADHESIVE SOLUTION

TABLE 260 GERGONNE- THE ADHESIVE SOLUTION: COMPANY OVERVIEW

12.2.13 ORAFOL EUROPE GMBH

TABLE 261 ORAFOL EUROPE GMBH: COMPANY OVERVIEW

12.2.14 PPI ADHESIVE PRODUCTS

TABLE 262 PPI ADHESIVE PRODUCTS: COMPANY OVERVIEW

12.2.15 ECHOTAPE

TABLE 263 ECHOTAPE: COMPANY OVERVIEW

12.2.16 COATING & CONVERTING TECHNOLOGIES, INC.

ABLE 264 COATING & CONVERTING TECHNOLOGIES, INC.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 256)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETS ANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

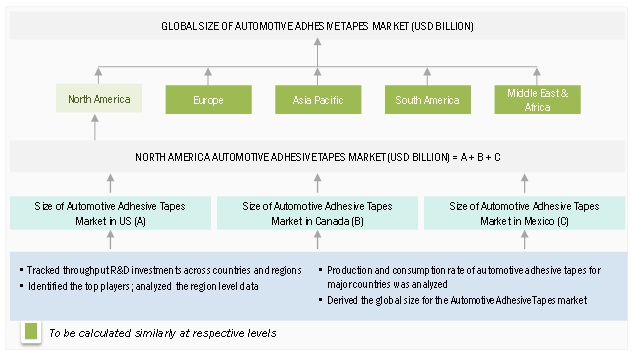

The study involved four major activities in estimating the current size of the automotive adhesive tapes market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the automotive adhesive tapes value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from recognized authors, and databases of various companies and associations. The secondary research was mainly used to obtain key information about the use of automotive adhesive tapes by key end users, cost of adhesive tapes, key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both tapes and automotive perspectives.

Primary Research

The automotive adhesive tapes market comprises several stakeholders, such as manufacturers of adhesive tapes, adhesives, and other feedstock chemical manufacturers; traders, distributors, and suppliers of adhesive tapes; government and regional agencies and research organizations; regional manufacturers’ associations and general EV adhesives associations.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the automotive adhesive tapes market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the automotive adhesive tapes market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through both primary and secondary research.

- The value chain and market size of the automotive adhesive tapes market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global automotive adhesive tapes market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To analyze and forecast the size of the automotive adhesive tapes market in terms of value and volume

- To define, describe, and forecast the market size by component, technological solutions, application, vertical, and region

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, joint ventures, mergers, acquisitions, agreements, collaborations, product launches, and partnerships as in the automotive adhesive tapes market

Competitive Intelligence

- To identify and profile the key players in the automotive adhesive tapes market

- To determine the top players offering various products in the automotive adhesive tapes market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Adhesive Tapes Market