Automation COE Market by Service (Implementation Support, Governance, Design & Testing), Organization Size (SMEs and Large Enterprises), Vertical (BFSI, Manufacturing, Healthcare & Life Sciences) and Region - Global Forecast to 2027

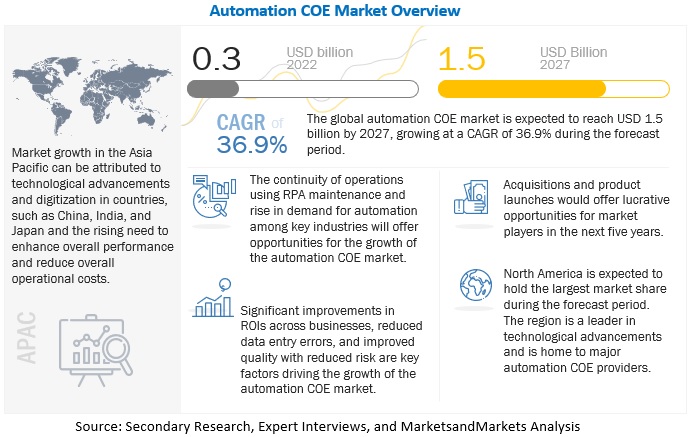

The Automation COE Market was valued at USD 0.3 billion in 2022 and is anticipated to grow at a CAGR of 36.9% from 2022 to 2027 to reach USD 1.5 billion. The automation COE market is expected to grow at a significant rate during the forecast period, owing to monitor and track performance. Some factors driving the growth of the automation COE market are significant improvements in ROIs across businesses, reduced data entry errors, and improved quality with reduced risk.

To know about the assumptions considered for the study, Request for Free Sample Report

Automation COE Market Dynamics

Driver: Improvement in ROI across businesses

Without an automation operating model, a decentralized approach to ROI can easily spiral out of control due to ineffective process automation selection, RPA acquisition, training, and support. Additionally, business units frequently pick projects that are prime candidates for automation in order to gain quick returns on investment. Businesses often stay away from trickier strategic projects that, among other things, call for IT support. Bigger ROIs, however, are associated with bigger, more complicated undertakings. According to a survey conducted in 2021, RPA has the ability to reduce manual errors more efficiently than most other automation processes. It is estimated that human mistakes and poor data quality cost firms billions of dollars annually. Because bots do not miss or duplicate data and produce event logs for additional analysis and audit, utilizing RPA can produce data of higher quality

Restraints: High development & deployment costs

This makes up a major chunk of an RPA program's total cost of ownership and can account for between 40–50% of the start-up costs. Developers are often informed about automation design using antiquated PDDs (process design documents) or SDDs (solution design documents), which are typically written on paper. These automation efforts are destined to fail from the start without an appropriate governance mechanism in place. As a result of the high development and deployment expenses, time, and money spent on maintenance and support, the total cost of ownership of an RPA program is 65%.

Opportunity: Continuity of operations using RPA maintenance

A 2021 research study discovered that automation created prospects for autonomy and employment creation. According to the study, employees stated that automation helped to reduce their repetitive work, providing them with more opportunities to engage in internal and external collaborations and working relationships, redevelop services, and/or think about and solve more complex work-related problems, which can lead to value-adding solutions and innovations. Automation will eventually slow down how quickly companies hire for growth. This gain in efficiency will allow companies to hire a smaller, happier, and more productive crew. This will present numerous opportunities to lower churn.

Robotics can increase corporate flexibility by reducing employee stress and freeing up resources when the target system cannot launch, necessitating incident and problem management. One of the top private sector banks in India serves as a practical example. A majority of the bank's employees were compelled to work from home during the COVID-19 lockdown. RPA automation maintained the regular operation of the bank's critical processes. The bank had more than 100 procedures on the RPA platform that were automated, allowing the business to keep providing financial services despite the lockdown.

Challenge: Lack of knowledge among departments, employee hesitation and fear of automation

1Because standard IT solutions impact numerous other organizational systems and processes, implementation calls for an enterprise-wide strategy. However, RPA is a simple solution that the company can start and configure on its own with little to no help from the IT department. Without an enterprise-wide strategy, firms run the risk of implementing local, ad hoc automation solutions without ever achieving end-to-end improvements. This means that enterprises are confronted with the problem of sifting through the web of bots and figuring out how and where each one belongs within the corporation as they strive to achieve RPA at scale.

Although automation has the potential to replace some professions, it can also open up new opportunities and free up time for value-added work. Employees in call centers, for instance, can change their focus from meticulously and mechanically documenting exchanges to proactive assistance or sales. Company-wide communication and a clear explanation of the value of automation are essential for securing staff buy-in. Employee experiences can be enhanced by treating them as issue solvers and giving them access to automation technologies. Rather than administering the tools from a central authority, distributing authority to employees—teaching them how the tools function and perhaps how to configure or write them—can lead to increased employee engagement and continual improvements in the organization. Such outcomes are consistent with other programs that many businesses are currently launching to empower employees, such as Agile development and continuous delivery. High achievers whose positions will be made redundant can also be given consideration for other positions within the company.

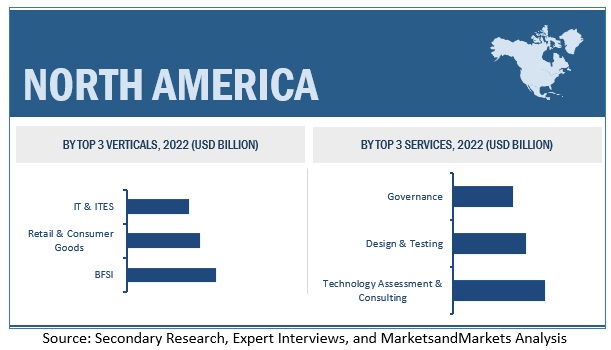

Governance Services to register the highest CAGR during the forecast period

Based on services, the automation COE market is segmented into technology assessment & consulting services, design & testing services, governance services, and implementation support services. Without governance, software robot deployments run the risk of becoming ineffective, expensive, and cumbersome. Automation becomes more responsive, nimble, and less rule-bound without a structure to guide it. However, when automation is expanded and employed more widely, issues may arise since there is a lack of clear governance. To manage complications and ambiguity while automating business processes, automation COE governance is required. The Digital Workforce Robot as a Service is the fastest and the most flexible way to utilize digital workers. This industrial automation platform allows for building and connecting with automation capabilities in the same solution.

Large Enterprises to account for the larger market size during the forecast period

The automation coe market by organizational size user includes large enterprises and SMEs. Large enterprises have a broad corporate network and numerous sources of income. To operate efficiently, they often invest in the latest technologies. Due to the complexity of their partner networks compared to SMEs, large enterprises have a stronghold in the automation COE market. Large businesses struggle with integrating their current systems with cutting-edge automation COE solutions. These businesses prefer to implement platforms and the services that go along with them on-site, which can help boost revenues and preserve data privacy. Many large businesses use automation to shorten the time spent on routine tasks and use the extra time to make strategic decisions. Moreover, automation enables large enterprises to reduce human errors, reduce overhead expenses, improve work efficiency, and improve adherence to regulatory compliance.

North America to have the largest market size during the forecast period

North America is expected to be the largest contributor among all regions to the automation COE market. The top countries contributing to the growth of the automation COE market in North America include the US and Canada. These countries have well-established economies, which enable automation COE solution providers to invest in new technologies. The region is also regarded as the center of innovation, where IT giants are encouraged to innovate and develop new offerings and aggressive collaborations take place. Organizations in various countries of this region, especially in the US, leverage AI, ML, and deep learning technologies as a part of their ongoing business processes. The Association for Advancing Automation reported that factories producing consumer products and medicines received 52% of the total number of robots requested in North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Automation CoE service providers have implemented various types of organic and inorganic growth strategies, such as related projects launches, related product launches, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major players in the automation CoE market include SS&C Blue Prism (UK), UiPath (US), Automation Anywhere (US), NICE (Israel), Digital Workforce (Finland), HelpSystems (US), Ctrl365 (Argentina), FASTPATH (Netherlands), ElectroNeek (US), AnyRobot (US), Roboyo (Germany), Nintex (US), Chazey Partners (US), Smartbridge (US), Blueprint (US), Robocloud (UK), Verint (US), Appian (US), Cigniti (India), Innominds (US), TestingXperts (US), KiwiQA (Australia), Calidad Infotech (India), CIGNEX (US), ChoiceWORX (US), and XenonStack (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Market size value in 2022 |

USD 0.3 Billion |

|

Revenue forecast in 2027 |

USD 1.5 Billion |

|

Growth rate |

CAGR of 36.9% |

|

Segments covered |

Services, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

SS&C Blue Prism (UK), UiPath (US), Automation Anywhere (US), NICE (Israel), Digital Workforce (Finland), HelpSystems (US), Ctrl365 (Argentina), FASTPATH (Netherlands), ElectroNeek (US), AnyRobot (US), Roboyo (Germany), Nintex (US), Chazey Partners (US), Smartbridge (US), Blueprint (US), Robocloud (UK), Verint (US), HelpSystems (US), Cigniti (India), Innominds (US), TestingXperts (US), KiwiQA (Australia), Calidad Infotech (India), CIGNEX (US), ChoiceWORX (US), and XenonStack (US) |

This research report categorizes the automation CoE market based on services, organization size, vertical, and region.

By Services:

- Technology assessment & consulting

- Design & testing

- Governance

- Implementation support

By Organization Size:

- Large Enterprises

- SMEs

By Verticals:

- BFSI

- IT & ITES

- Retail & Consumer Goods

- Healthcare & Life Sciences

- Manufacturing

- Transportation & Logistics

- Others (Education, government, telecom, and energy & utilities)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- India

- Japan

- China

- Rest of Asia Pacific

-

Rest of the World (RoW)

- Middle East & Africa

- Latin America

Recent Developments:

- In May 2022, UiPath, a leading enterprise automation software company, introduced Automation Cloud Robots alongside a wealth of other powerful new capabilities as a part of the UiPath 2022.4 platform release. The new release provides enterprises with an even more comprehensive automation foundation to achieve fast and accurate outcomes. The new SaaS robots—along with added features that simplify how developers create automations, uplevel security and governance, and expand access to automation to Mac—deepen the reach of automation in the enterprise.

- UiPath has acquired Re:infer, a natural language processing (NLP) company focused on unstructured documents and communications. Re:infer unlocks the value in business communications by mining, monitoring, and extracting context and semantics from the unstructured data found in a variety of communications methods. When combined with the UiPath Automation Platform, developers can now easily build automations that optimize the customer experience (CX) and operational scalability of contact centers. Developers can also enhance existing automations that work with email to make them smarter with Re:infer.

- Digital Workforce Services Plc announced its acquisition with The Eclair Group, one of the leading automation vendors in Ireland. The acquisition opens market for Digital Workforce Services for continuous services in Ireland. It also expands Digital Workforce’s client base internationally in sectors including finance services and healthcare and strengthens its market presence in Ireland and the UK. The Eclair group provides automation solutions within Ireland, UK and the US in the financial services, transport, retail, telecoms, and healthcare sectors.

- In Dec 2021, NICE introduced new AI-powered capabilities that enable organizations to maximize the benefits of Robotic Process Automation (RPA) for the business. Included in version 7.6, NICE RPA’s new capabilities include document digitization, ROI-based recommendation of ideal processes to automate, and a complimentary resource center with ready-made low-code/no-code resources for sharing. In addition to reducing process analysis time and automating manual tasks, the innovative new capabilities also help organizations boost ROI and maximize the value of automation projects for the business.

- Automation Anywhere, a global leader in robotic process automation (RPA), announced its acquisition with cloud pioneer FortressIQ, a leading process discovery and mining company based in San Francisco. Combining FortressIQ with Automation Anywhere ushered a new era of intelligent automation by enabling organizations to accelerate automation initiatives and transform in a digital-first world.

Frequently Asked Questions (FAQ):

What is Automation COE?

Frontline training refers to training programs and initiatives for frontline workers across healthcare, education, grocery and retail, hospitality, and more. Frontline workers often work long hours, often not at a desk or in front of a computer, and face compounding challenges, such as a lack of resources and occupational uncertainty.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, and France in the European region.

Which are the key services implemented by the end users to build automated COE ?

The key services implemented by the end users to build automated COE are technology assessment & consulting, governance, implementation support, and desig & testing.

Which are the key opportunities provide for the growth of the automation COE market?

The key opportunities provide for the growth of the automation COE market include reduced churn, continuity of operations using RPA maintenance, and rise in demand for automation among different industries.

Who are the key vendors in the automation COE market?

The key players in the automation COE market include SS&C Blue Prism (UK), UiPath (US), Automation Anywhere (US), NICE (Israel), Digital Workforce (Finland), HelpSystems (US), Ctrl365 (Argentina), FASTPATH (Netherlands), ElectroNeek (US), AnyRobot (US), Roboyo (Germany), Nintex (US), Chazey Partners (US), Smartbridge (US), Blueprint (US), Robocloud (UK), Verint (US), Appian (US), Cigniti (India), Innominds (US), TestingXperts (US), KiwiQA (Australia), Calidad Infotech (India), CIGNEX (US), ChoiceWORX (US), and XenonStack (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2021

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 AUTOMATION COE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP & DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 AUTOMATION COE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY – BOTTOM-UP APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – BOTTOM-UP APPROACH 2 (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SERVICES

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY – BOTTOM-UP APPROACH 3 (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SERVICES

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY – BOTTOM-UP APPROACH 4 (DEMAND SIDE): SHARE OF AUTOMATION COE THROUGH OVERALL SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

TABLE 4 GLOBAL AUTOMATION COE MARKET SIZE AND GROWTH RATE, 2020–2027 (USD MILLION, Y-O-Y%)

FIGURE 8 TECHNOLOGY ASSESSMENT & CONSULTING SEGMENT TO HOLD LARGER SHARE OF MARKET IN 2022

FIGURE 9 LARGE ENTERPRISES TO DOMINATE MARKET IN 2022

FIGURE 10 BFSI VERTICAL TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

FIGURE 11 NORTH AMERICA TO HOLD HIGHEST SHARE OF MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 OPPORTUNITIES IN AUTOMATION COE MARKET

FIGURE 12 SIGNIFICANT IMPROVEMENTS IN ROI ACROSS BUSINESSES TO DRIVE GROWTH IN MARKET

4.2 MARKET: BY TOP 2 SERVICES AND TOP 3 VERTICALS

FIGURE 13 TECHNOLOGY ASSESSMENT & CONSULTING SEGMENT AND BFSI VERTICAL TO HOLD HIGH MARKET SHARES IN 2022

4.3 MARKET: BY REGION

FIGURE 14 NORTH AMERICA TO HOLD HIGHEST SHARE IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 AUTOMATION COE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Significant improvements in ROI across businesses

5.2.1.2 Reduced data entry errors

5.2.1.3 Improved quality with reduced risk

5.2.2 RESTRAINTS

5.2.2.1 High development and deployment costs

5.2.2.2 Dependence on suppliers and inadequate capabilities to scale automation over time

5.2.3 OPPORTUNITIES

5.2.3.1 Reduced churn

5.2.3.2 Continuity of operations using RPA maintenance

5.2.3.3 Rise in demand for automation from different industries

5.2.4 CHALLENGES

5.2.4.1 Employee hesitation and fear of automation due to worries about losing jobs

5.2.4.2 Lack of knowledge among departments

5.2.4.3 Optimizing business processes prior to automation

5.3 INDUSTRY TRENDS

5.3.1 MARKET EVOLUTION

FIGURE 16 EVOLUTION OF AUTOMATION COE MARKET

5.3.2 PATENT ANALYSIS

5.3.2.1 Methodology

5.3.2.2 Document type

TABLE 5 PATENTS FILED, 2018–2021

5.3.2.3 Innovation and patent applications

FIGURE 17 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2018–2021

5.3.2.4 Top applicants

FIGURE 18 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

5.4 TARIFF AND REGULATORY LANDSCAPE

5.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.5 TECHNOLOGY ANALYSIS

5.5.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.5.2 NATURAL LANGUAGE PROCESSING

5.5.3 OPTICAL CHARACTER RECOGNITION

5.5.4 CLOUD COMPUTING

5.5.5 COMPUTER VISION

5.6 CASE STUDY ANALYSIS

5.6.1 CASE STUDY: PROSEGUR SECURES USD 12 MILLION IN SAVINGS WITH STRATEGIC INTELLIGENT AUTOMATION PROGRAM

5.6.2 CASE STUDY: OHIO’S HOSPICE DELIVERS IMPROVED PATIENT AND EMPLOYEE EXPERIENCE WITH NEW DIGITAL WORKFORCE

5.6.3 CASE STUDY: AGCO EMPLOYEES NEGOTIATE CONTRACTS AND LET DIGITAL WORKERS MANAGE PAPERWORK

5.6.4 CASE STUDY: AGCO IS FUTURE-PROOFING ITS BUSINESS WITH INTELLIGENT AUTOMATION

5.6.5 CASE STUDY: UNIPER TRANSFORMS BUSINESS WITH AUTOMATION

5.6.6 CASE STUDY: CUSTODIAL AGENCY AT DUTCH MINISTRY OF JUSTICE USES AUTOMATION TO IMPROVE SERVICES FOR RESIDENTS OF NETHERLANDS

5.6.7 CASE STUDY: WALL-TO-WALL AUTOMATION 360 SAVES NEWCASTLE HOSPITALS 7,000 HOURS ANNUALLY, IMPROVING STAFF WORK-LIFE BALANCE

5.6.8 CASE STUDY: RAPID ROI FROM RPA – SYNERGY AUTOMATES BILLING TO REALIZE SIGNIFICANT VALUE

5.6.9 CASE STUDY: LUMEVITY – FINDING QUICK AUTOMATION WINS WITH FORTRESSIQ

5.6.10 CASE STUDY: ARAB NATIONAL BANK SAVED 64K+ HOURS BY SUCCESSFULLY IMPLEMENTING BOTS TO AUTOMATE PROCESSES

5.7 ECOSYSTEM

FIGURE 19 AUTOMATION COE MARKET: ECOSYSTEM

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 20 SUPPLY CHAIN ANALYSIS

TABLE 11 MARKET: SUPPLY CHAIN

5.9 SEVEN PILLARS OF ROBOTIC OPERATING MODEL (ROM)

FIGURE 21 SEVEN PILLARS OF ROM

5.9.1 INTRODUCTION

5.10 KEY PRACTICES TO ACHIEVE AUTOMATION COE

5.10.1 INTRODUCTION

5.11 AUTOMATION COE ACROSS MAJOR BUSINESS FUNCTIONS

5.11.1 INTRODUCTION

5.11.2 HUMAN RESOURCES

5.11.3 FINANCE & ACCOUNTING

5.11.4 SALES & MARKETING

5.11.5 SUPPLY CHAIN & OPERATIONS

5.11.6 INFORMATION TECHNOLOGY

5.12 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 12 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 AUTOMATION COE MARKET, BY SERVICE (Page No. - 71)

6.1 INTRODUCTION

6.1.1 SERVICES: MARKET DRIVERS

FIGURE 22 TECHNOLOGY ASSESSMENT & CONSULTING SERVICES TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 13 MARKET, BY SERVICE, 2020–2027 (USD MILLION)

6.2 TECHNOLOGY ASSESSMENT & CONSULTING SERVICES

6.2.1 NEED TO IDENTIFY AND EVALUATE AUTOMATION TO IMPROVE BUSINESS OPERATIONS TO DRIVE MARKET

TABLE 14 TECHNOLOGY ASSESSMENT & CONSULTING SERVICES: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 DESIGN & TESTING SERVICES

6.3.1 ADVANTAGES SUCH AS REDUCED REDUNDANCIES AND IMPROVED PROCESS QUALITY TO BOOST ADOPTION

TABLE 15 DESIGN & TESTING SERVICES: AUTOMATION COE MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 GOVERNANCE SERVICES

6.4.1 ABILITY OF GOVERNANCE SERVICES TO PROMOTE AND SUPPORT ORGANIZATION-WIDE AUTOMATION TO FUEL DEMAND

TABLE 16 GOVERNANCE SERVICES: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.5 IMPLEMENTATION SUPPORT SERVICES

6.5.1 NEED TO EMBED INTELLIGENT DECISION-MAKING CAPABILITIES INTO BUSINESS SOLUTIONS TO DRIVE ADOPTION

TABLE 17 IMPLEMENTATION SUPPORT SERVICES: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 AUTOMATION COE MARKET, BY ORGANIZATION SIZE (Page No. - 77)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 23 SMALL AND MEDIUM-SIZED ENTERPRISES TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

TABLE 18 MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

7.2 LARGE ENTERPRISES

7.2.1 GROWING DEMAND FOR AUTOMATION SOLUTIONS TO SHORTEN TIME SPENT ON ROUTINE TASKS IN LARGE ENTERPRISES TO DRIVE MARKET

TABLE 19 LARGE ENTERPRISES: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

7.3.1 ADVANTAGES SUCH AS COST-EFFECTIVENESS AND INCREASED PRODUCTIVITY TO DRIVE DEMAND FOR AUTOMATION COE AMONG SMES

TABLE 20 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 AUTOMATION COE MARKET, BY VERTICAL (Page No. - 81)

8.1 INTRODUCTION

8.1.1 VERTICALS: MARKET DRIVERS

FIGURE 24 HEALTHCARE & LIFE SCIENCES VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 21 MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

8.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

8.2.1 HIGH ADOPTION OF INTELLIGENT AUTOMATION IN BFSI VERTICAL TO FOSTER GROWTH

TABLE 22 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 MANUFACTURING

8.3.1 NEED TO ACHIEVE AUTOMATED EFFICIENCY IN AREAS OTHER THAN PRODUCTION LINE TO DRIVE ADOPTION IN MANUFACTURING PLANTS

TABLE 23 MANUFACTURING: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.4 RETAIL & CONSUMER GOODS

8.4.1 GROWING ADOPTION OF AUTOMATION IN RETAIL TO SUPPORT INVENTORY, SUPPLY CHAIN, AND INVOICING TO AID GROWTH

TABLE 24 RETAIL & CONSUMER GOODS: AUTOMATION COE MARKET, BY REGION, 2020–2027 (USD MILLION)

8.5 TRANSPORTATION & LOGISTICS

8.5.1 GROWING INVESTMENTS BY LOGISTICS & TRANSPORTATION COMPANIES IN INTELLIGENT AUTOMATION TO PROPEL MARKET

TABLE 25 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.6 IT & ITES

8.6.1 GROWING USE OF AUTOMATION SOLUTIONS TO AUTOMATE REPETITIVE TASKS TO PROMOTE MARKET

TABLE 26 IT & ITES: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.7 HEALTHCARE & LIFE SCIENCES

8.7.1 INCREASING VOLUME OF PATIENT DATA TO INCREASE ADOPTION OF AUTOMATION SOLUTIONS IN HEALTHCARE VERTICAL

TABLE 27 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.8 OTHER VERTICALS

TABLE 28 OTHER VERTICALS: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 AUTOMATION COE MARKET, BY REGION (Page No. - 90)

9.1 INTRODUCTION

9.1.1 REGION: MARKET DRIVERS

FIGURE 25 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 26 INDIA TO REGISTER HIGHEST GROWTH IN MARKET

TABLE 29 MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: REGULATIONS

9.2.1.1 Health Insurance Portability and Accountability Act (HIPAA)

9.2.1.2 Gramm–Leach–Bliley Act (GLB Act)

9.2.1.3 Health Information Technology for Economic and Clinical Health (HITECH) Act

9.2.1.4 Sarbanes-Oxley (SOX) Act

9.2.1.5 United States Securities and Exchange Commission (SEC)

9.2.1.6 California Consumer Privacy Act (CCPA)

9.2.1.7 Federal Information Security Management Act (FISMA)

9.2.1.8 Federal Information Processing Standards (FIPS)

FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

TABLE 30 NORTH AMERICA: AUTOMATION COE MARKET, BY SERVICE, 2020–2027 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.2 US

9.2.2.1 Rapid growth in technological innovations and rising need to automate business operations to drive market

9.2.3 CANADA

9.2.3.1 High adoption of automation-based technologies to reduce errors to boost market

9.3 EUROPE

9.3.1 EUROPE: REGULATIONS

9.3.1.1 European Market Infrastructure Regulation (EMIR)

9.3.1.2 General Data Protection Regulation (GDPR)

9.3.1.3 European Committee for Standardization (CEN)

9.3.1.4 European Technical Standards Institute (ETSI)

TABLE 34 EUROPE: MARKET, BY SERVICE, 2020–2027 (USD MILLION)

TABLE 35 EUROPE: MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 36 EUROPE: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 37 EUROPE: AUTOMATION COE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Increased investments and presence of major automation COE vendors to support growth

9.3.3 GERMANY

9.3.3.1 Significant demand for automation solutions across various sectors to fuel growth

9.3.4 FRANCE

9.3.4.1 Rising digital transformation across key verticals to automate business operations to boost growth

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: REGULATIONS

9.4.1.1 Office of the Privacy Commissioner for Personal Data (PCPD)

9.4.1.2 Act on the Protection of Personal Information (APPI)

9.4.1.3 Critical Information Infrastructure (CII)

9.4.1.4 International Organization for Standardization (ISO) 27001

9.4.1.5 Personal Data Protection Act (PDPA)

FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 38 ASIA PACIFIC: AUTOMATION COE MARKET, BY SERVICE, 2020–2027 (USD MILLION)

TABLE 39 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 40 ASIA PACIFIC: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 41 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.4.2 INDIA

9.4.2.1 Increased adoption of automation technologies to enhance business processes to build market

9.4.3 JAPAN

9.4.3.1 Innovative IT infrastructure and rising government investments in innovative technologies to drive growth

9.4.4 CHINA

9.4.4.1 Growing government investments to leverage innovative technologies to aid growth

9.4.5 REST OF ASIA PACIFIC

9.5 REST OF THE WORLD

TABLE 42 REST OF THE WORLD: MARKET, BY SERVICE, 2020–2027 (USD MILLION)

TABLE 43 REST OF THE WORLD: MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 44 REST OF THE WORLD: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 45 REST OF THE WORLD: AUTOMATION COE MARKET, BY REGION, 2020–2027 (USD MILLION)

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Growing adoption of RPA by BFSI sector to propel market

9.5.2 LATIN AMERICA

9.5.2.1 Major shift toward digitalization in recent years to support growth

10 COMPETITIVE LANDSCAPE (Page No. - 110)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES

TABLE 46 OVERVIEW OF STRATEGIES ADOPTED BY KEY AUTOMATION COE VENDORS

10.3 MARKET EVALUATION FRAMEWORK

FIGURE 29 MARKET EVALUATION FRAMEWORK: EXPANSIONS & CONSOLIDATION IN AUTOMATION COE MARKET BETWEEN 2019–2022

10.4 REVENUE ANALYSIS

10.4.1 HISTORICAL REVENUE ANALYSIS

FIGURE 30 REVENUE ANALYSIS OF KEY PLAYERS, 2019–2021 (USD MILLION)

10.5 RANKING OF KEY MARKET PLAYERS, 2022

FIGURE 31 RANKING OF KEY PLAYERS, 2022

10.6 COMPARATIVE ANALYSIS OF KEY VENDORS IN MARKET, 2022

FIGURE 32 MARKET: COMPARATIVE ANALYSIS OF KEY PLAYERS

FIGURE 33 MARKET: COMPARATIVE ANALYSIS OF OTHER KEY PLAYERS

TABLE 47 MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

TABLE 48 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

10.7 COMPETITIVE SCENARIO AND TRENDS

10.7.1 PRODUCT LAUNCHES

TABLE 49 PRODUCT & SERVICE LAUNCHES, 2019–2022

10.7.2 DEALS

TABLE 50 DEALS, 2019–2022

11 COMPANY PROFILES (Page No. - 120)

11.1 INTRODUCTION

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

11.2 KEY PLAYERS

11.2.1 SS&C BLUE PRISM

TABLE 51 SS&C BLUE PRISM: BUSINESS OVERVIEW

FIGURE 34 SS&C BLUE PRISM: COMPANY SNAPSHOT (2021)

TABLE 52 SS&C BLUE PRISM: PRODUCT LAUNCHES & UPGRADES

TABLE 53 SS&C BLUE PRISM: DEALS

11.2.2 UIPATH

TABLE 54 UIPATH: BUSINESS OVERVIEW

FIGURE 35 UIPATH: COMPANY SNAPSHOT (2022)

TABLE 55 UIPATH: PRODUCT LAUNCHES & UPGRADES

TABLE 56 UIPATH: DEALS

11.2.3 AUTOMATION ANYWHERE

TABLE 57 AUTOMATION ANYWHERE: BUSINESS OVERVIEW

TABLE 58 AUTOMATION ANYWHERE: PRODUCT LAUNCHES & UPGRADES

TABLE 59 AUTOMATION ANYWHERE: DEALS

11.2.4 NICE

TABLE 60 NICE: BUSINESS OVERVIEW

FIGURE 36 NICE: COMPANY SNAPSHOT (2021)

TABLE 61 NICE: PRODUCT LAUNCHES & DEALS

TABLE 62 NICE: DEALS

11.2.5 DIGITAL WORKFORCE

TABLE 63 DIGITAL WORKFORCE: BUSINESS OVERVIEW

FIGURE 37 DIGITAL WORKFORCE: COMPANY SNAPSHOT (2021)

TABLE 64 DIGITAL WORKFORCE: DEALS

11.2.6 HELPSYSTEMS

TABLE 65 HELPSYSTEMS: BUSINESS OVERVIEW

TABLE 66 HELPSYSTEMS: PRODUCT LAUNCHES & UPGRADES

TABLE 67 HELPSYSTEMS: DEALS

11.3 OTHER PLAYERS

11.3.1 CTRL365

11.3.2 FASTPATH

11.3.3 ELECTRONEEK

11.3.4 ANYROBOT

11.3.5 NINTEX

11.3.6 CHAZEY PARTNERS

11.3.7 SMARTBRIDGE

11.3.8 BLUEPRINT

11.3.9 ROBOCLOUD

11.3.10 VERINT

11.3.11 CIGNITI

11.3.12 INNOMINDS

11.3.13 TESTINGXPERTS

11.3.14 KIWIQA

11.3.15 CIGNEX

11.3.16 ROBOYO

11.3.17 CALIDAD INFOTECH

11.3.18 CHOICEWORX

11.3.19 XENONSTACK

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view

(Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS (Page No. - 150)

12.1 INTRODUCTION

12.2 INTELLIGENT PROCESS AUTOMATION MARKET – GLOBAL FORECAST TO 2027

12.2.1 MARKET DEFINITION

12.2.2 MARKET OVERVIEW

12.2.2.1 Intelligent process automation market, by component

TABLE 68 INTELLIGENT PROCESS AUTOMATION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 69 INTELLIGENT PROCESS AUTOMATION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.2.2.2 Intelligent process automation market, by application

TABLE 70 INTELLIGENT PROCESS AUTOMATION MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 71 INTELLIGENT PROCESS AUTOMATION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.2.2.3 Intelligent process automation market, by business function

TABLE 72 INTELLIGENT PROCESS AUTOMATION MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD MILLION)

TABLE 73 INTELLIGENT PROCESS AUTOMATION MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

12.2.2.4 Intelligent process automation market, by deployment mode

TABLE 74 INTELLIGENT PROCESS AUTOMATION MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 75 INTELLIGENT PROCESS AUTOMATION MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

12.2.2.5 Intelligent process automation market, by organization size

TABLE 76 INTELLIGENT PROCESS AUTOMATION MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 77 INTELLIGENT PROCESS AUTOMATION MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

12.2.2.6 Intelligent process automation market, by vertical

TABLE 78 INTELLIGENT PROCESS AUTOMATION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 79 INTELLIGENT PROCESS AUTOMATION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

12.2.2.7 Intelligent process automation market, by region

TABLE 80 INTELLIGENT PROCESS AUTOMATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 81 INTELLIGENT PROCESS AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 RPA AND HYPERAUTOMATION MARKET – GLOBAL FORECAST TO 2027

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.2.1 RPA and hyperautomation market, by component

TABLE 82 RPA AND HYPERAUTOMATION MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 83 RPA AND HYPERAUTOMATION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.3.2.2 RPA and hyperautomation market, by deployment mode

TABLE 84 RPA AND HYPERAUTOMATION MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

TABLE 85 RPA AND HYPERAUTOMATION MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

12.3.2.3 RPA and hyperautomation market, by organization size

TABLE 86 RPA AND HYPERAUTOMATION MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

TABLE 87 RPA AND HYPERAUTOMATION MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

12.3.2.4 RPA and hyperautomation market, by business function

TABLE 88 RPA AND HYPERAUTOMATION MARKET, BY BUSINESS FUNCTION, 2019–2021 (USD MILLION)

TABLE 89 RPA AND HYPERAUTOMATION MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

12.3.2.5 RPA and hyperautomation market, by vertical

TABLE 90 RPA AND HYPERAUTOMATION MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

TABLE 91 RPA AND HYPERAUTOMATION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

12.3.2.6 RPA and hyperautomation market, by region

TABLE 92 RPA AND HYPERAUTOMATION MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 93 RPA AND HYPERAUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

13 APPENDIX (Page No. - 162)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

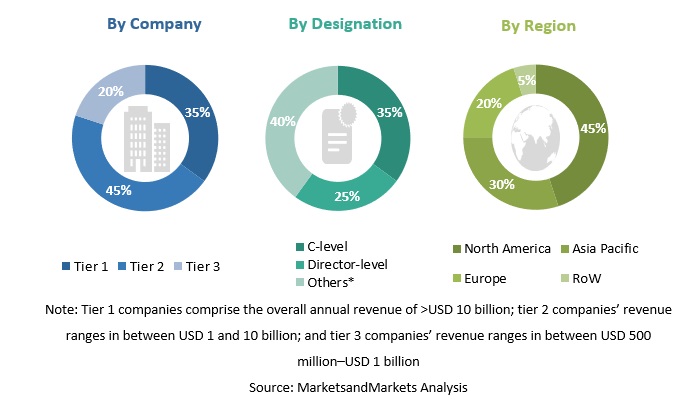

The research study for the automation COE market involved extensive use of secondary sources, directories, the Journal of Information Systems & Technology Management, the RPA Journal, and paid databases. Primary sources were mainly industry experts from core and related industries, preferred automation COE solution and service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information, and assess the prospects of the market. The following figure highlights the market research methodology applied in making this report.

Secondary Research

The market size of companies offering automation COE services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to in order to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, information about the spending on automation COE solutions by various countries was extracted from respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on services; market classification; segmentation according to the offerings of major players; industry trends related to solutions, services, modes of learning, organization size, deployment modes, applications, training types, user types, and regions; and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the automation COE market. Primary sources from the supply side included various industry experts, including chief experience officers (CXOs); vice presidents (VPs); directors from business development, marketing, and automation COE expertise; related key executives from automation COE solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding the various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as chief information officers (CIOs), chief technology officers (CTOs), chief strategy officers (CSOs), and end users using automation COE solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current need of automation COE, which would impact the overall market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this approach for market estimation, key automation COE service vendors such as SS&C Blue Prism (UK), UiPath (US), Automation Anywhere (US), NICE (Israel), Digital Workforce (Finland), Ctrl365 (Argentina), FASTPATH (Netherlands), ElectroNeek (US), AnyRobot (US), Roboyo (Germany), Nintex (US), Chazey Partners (US), Smartbridge (US), Blueprint (US), Robocloud (UK), Verint (US), HelpSystems (US), Cigniti (India), Innominds (US), TestingXperts (US), KiwiQA (Australia), Calidad Infotech (India), CIGNEX (US), ChoiceWORX (US), and XenonStack (US) were identified. These vendors contribute nearly 40–45% to the global automation COE market. The market is fragmented due to the presence of several vendors. After confirming these companies through primary interviews with industry experts, their total revenue was estimated through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. Revenues pertaining to business units (BUs) that offer automation COE solutions were identified through similar sources. Through primaries, the data of revenue generated from specific automation COE solutions was collected. The collective revenue of key companies that offer automation COE solutions accounts for 40–50% of the market, which was again confirmed through primary interviews with industry experts.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on automation COE based on some key use cases. These factors are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers & acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the automation COE market’s regional penetration. Based on secondary research, the regional spending on information and communications technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major automation COE providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall automation COE market size and subsegment were determined and confirmed using the study.

Report Objectives

- To define, describe, and predict the automation COE market by service, organization size, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of four main regions: North America, Europe, Asia Pacific, and the Rest of the World (Middle East & Africa and Latin America)

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers & acquisitions, in the automation COE market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American automation COE market

- Further breakup of the European market

- Further breakup of the Asia Pacific automaton COE market

- Further breakup of the Rest of the World market

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automation COE Market