RPA and Hyperautomation Market by Component (Solution, Services), Business Function (IT, Operations & Supply Chain, and HR), Deployment Mode (Cloud, On-premises), Vertical (BFSI, IT & Telecom, and Manufacturing) and Region - Global Forecast to 2027

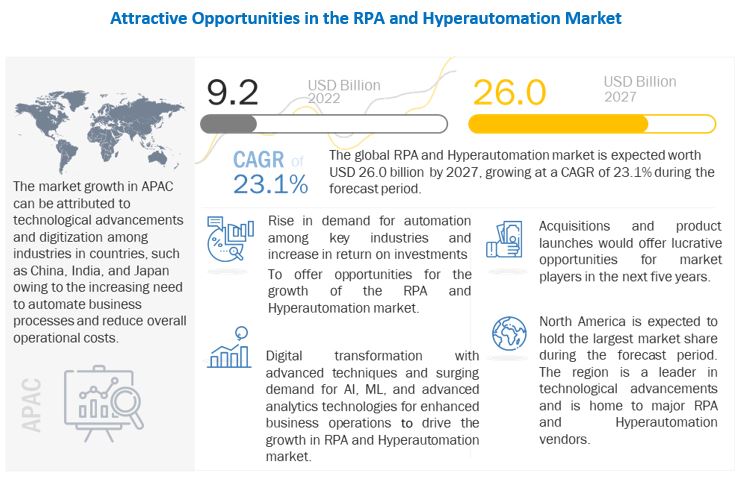

[326 Pages Report] The global RPA and Hyperautomation market size is to grow from USD 9.2 billion in 2022 to USD 26.0 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 23.1% during the forecast period. The rise in demand for automation among key industries and increase in return on investments to offer opportunities for the growth of RPA and Hyperautomation market in upcoming years. Organizations across the globe are dedicatedly investing in AI and ML technologies to improve user experience and stay competitive in the ever-changing market environment. However, the major challenges for adopting RPA and Hyperautomation solutions are identifying the right business processes to automate and optimizing business processes before automation.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

How growth of digital transformation with advanced techniques in RPA and Hyperautomation?

Hyperautomation is a true digital transformation with the help of advanced techniques such as Robotic Process Automation (RPA), Machine Learning (ML), and Artificial Intelligence (AI). It automates complicated business processes, even where topic specialists were formerly needed. This is an expansion of the processes of traditional business-process automation. Hyperautomation allows automation to do virtual tasks performed by businesspeople by merging AI technologies with RPA. Hyperautomation is rising with the evolution of automation technologies. Companies are moving their practices to people-centered and intelligent working environments. This transition has led to a new age for businesses that rely on technology and automation instruments to keep their edge competitive. With all types of automation working together in close collaboration, businesses can go past technology's unique advantages to true digital agility and scale flexibility.

How to implement accounting for regulatory and enterprise constraints?

After implementing their digital workforce, large organizations often realize that their expectations are misaligned with enterprise constraints and visibility into critical business processes. Automated business processes tied to evolving touchpoints, controls, or decisions must be pulled from production, re-analyzed, and then modified before they can be operational again. Parallel or conflicting digital initiatives have a major impact on digital transformation initiatives and related ROI. With the accelerated advancement in technologies, organizations want to accelerate the implementation of their digital programs to use different capabilities. Hence, in some cases, many technological initiatives are being worked out to achieve the desired goal.

What opportunities does an increase in demand for automation among major industries?

The technology is developing, and every sector is trying to update itself with the evolving technology. Hyperautomation helps enterprises uncover safety violations so that they do not become accidents or liabilities. The Hyperautomation also helps to ensure that onsite workers are inaccurate pedestrian walking lanes, confirms the security of safety equipment and also it is being worn all the time and also provides real-time data of job sites behavior so that the adjustments can be made on the data and not speculations and thus integration and high adoption of automation in the construction, as well as other industries, are expected to boost the opportunity for the market.

How to identify the right business processes to automate?

RPA gained power and began to be viewed as a technology and the next phase of business process evolution, the procedure to identify business processes for automation. Due to which in many cases, a few criticalities of the processes are missed during the evaluation phase. This later caused challenges to overall automation. Such criticalities are difficult to determine due to high manual involvement, which can lead to numerous flaws for the same process. Most organizations looked at capacity creation as the key advantage and consideration to determine a business case. This was due to the high ROI expectation linked to workforce release. Majority of the automated processes led to failure as they were not amenable for automation but were still automated as they were highly manual. Instead, ideally the ROI should be realized by making business processes more dependable, quicker, and better. This will free up employee’s time spent on performing these every day and repetitive tasks, allowing them to focus more on critical, high-value deliverables linked to business objectives. Detailed visibility to the business process is critical in determining the business case for its implementation. Hence, the challenge for the enterprise executives sponsoring their RPA business cases is to determine processes that need automation.

The solution segment is expected to account for the larger market share during the forecast period

The market size of the solutions segment is expected to hold a larger market share during the forecast period. RPA and Hyperautomation solutions to improve operational efficiency and minimize human work processes. RPA and Hyperautomation is the application of AI and related emerging technologies to robotic process automation, such as computer vision, cognitive automation, and ML. These solutions are enhanced with cognitive capabilities that enable programs to earn, interpret, and respond. It provides smart technologies and exile processes to users, enabling them to make faster and more informed decisions. Organizations can drastically reduce the time and expense necessary to perform business operations and workflows using RPA and Hyperautomation solution.

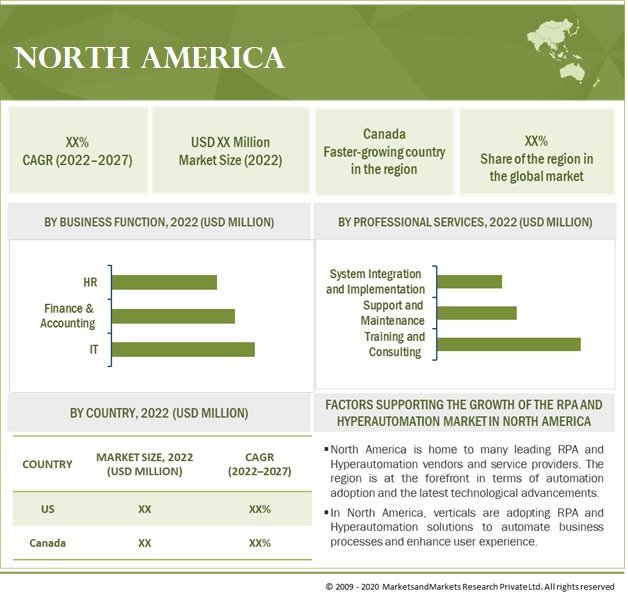

North America is expected to hold the largest share during the forecast period

North America is expected to be a prominent contributor to the global RPA and Hyperautomation during the forecast period. Enterprises in this region are the early adopters of technologies, and most of the North American industry verticals have already gone through digital transformation. This rapid adoption of technologies has led to the generation of huge data by North American companies and presented positive opportunities for deploying RPA and Hyperautomation software to maintain and manage such data. The automation of business processes results in less need for manpower and saves a lot of time and cost, enabling companies to focus on business-critical decisions. Industries such as BFSI, IT & Telecom, transportation & logistics, manufacturing, and retail & consumer goods are at the forefront of adopting RPA and Hyperautomation solutions.

To know about the assumptions considered for the study, download the pdf brochure

RPA and Hyperautomation Companies

IBM (US), Microsoft (US), SAP (Germany), Alteryx (US), Appian (US), Juniper Networks (US), NICE (Israel), Zendesk (US), Pegasystems (US), Automation Anywhere (US), UiPath (US), ProcessMaker (US), SolveXia (Australia), PagerDuty (US), Celonis (US), Blue Prism (UK), Laserfiche (US), akaBot (Vietnam), HelpSystems (US), Decisions (US), Datamatics (US), Quale Infotech (India), Laiye (China), Rocketbot (Chile), ElectroNeek (US), Automate.io (US), AutomationEdge (US), Techforce.ai (US), Turbotic (Sweden), Simple Fractal (US), and G1ANT (England).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

USD Million |

|

Segments covered |

By Component, Business Function, Deployment Mode, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa and Latin America |

|

List of Companies in RPA and Hyperautomation |

IBM (US), Microsoft (US), SAP (Germany), Alteryx (US), Appian (US), Juniper Networks (US), NICE (Israel), Zendesk (US), Pegasystems (US), Automation Anywhere (US), UiPath (US), ProcessMaker (US), SolveXia (Australia), PagerDuty (US), Celonis (US), Blue Prism (UK), Laserfiche (US), akaBot (Vietnam), HelpSystems (US), Decisions (US), Datamatics (US), Quale Infotech (India), Laiye (China), Rocketbot (Chile), ElectroNeek (US), Automate.io (US), AutomationEdge (US), Techforce.ai (US), Turbotic (Sweden), Simple Fractal (US), and G1ANT (England). |

This research report categorizes RPA and Hyperautomation market, by Component, Business Function, Deployment Mode, Vertical, and Region.

By Component:

-

Solution

- Standalone

- Integrated

-

Services

-

Professional Services

- Training & Consulting

- System integration & implementations

- Support & Maintenance

- Managed Services

-

Professional Services

By Deployment Mode

- Cloud

- On-premises

By Organzisation Size

- SMEs

- Large Enterprises

By Business function

- Sales & Marketing

- Finance & Accounting

- Human Resources (HR)

- Supply Chain & Operations

- Information Technology (IT)

By Verticals

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Healthcare & Life Sciences

- Manufacturing

- Transportation & Logistics

- Other Verticals (Education, Government, Automotive, and Energy & Utilities)

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- India

- China

- Japan

- Rest of APAC

-

Middle East & Africa

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In April 2022, Juniper Networks announced that it has been selected by PP Telecommunication Sdn. Bhd. (PPTEL), a leading network service provider based in Sarawak, to provide solutions to build a new core network that will support its growth plans. This network will provide the foundation to help PPTEL meet the demand for critical high-speed internet connectivity, enabling consumers and businesses access to richer digital experiences and services.

- In April 2022, SkillStorm, a leader in technology talent development, announced that it has become an Appian Education Partner. SkillStorm deploys specialized teams of custom-trained U.S. tech talent to its commercial and federal services clients. As an authorized Appian Education Partner, SkillStorm will help its clients accelerate their digital transformation initiatives by providing an exclusive pipeline of custom-trained and certified Appian Developers at scale through its Hire, Train, Deploy (“HTD”) and upskilling programs.

- In February 2022, IBM and SAP established a partnership to deliver technology and consulting experience to help clients adopt a hybrid cloud strategy and migrate mission-critical workloads from SAP solutions to the cloud for regulated and non-regulated industries.

- In January 2022, Alteryx announced USD 400 million in cash for acquiring Trifacta, subject to typical purchase price modifications. Trifacta would deliver a highly competent cloud-first engineering, product, and go-to-market team with decades of expertise designing and bringing mission-critical, cloud-native analytics solutions to market. Trifacta and Alteryx broadened the total addressable market by providing new opportunities for Global 2000 companies to pursue new data and cloud transformation efforts.

- In December 2021, Juniper Networks announced that it has been selected by Bharti Airtel (Airtel), India’s premier communications solutions provider, to deliver network upgrades for the expansion of Airtel’s nationwide broadband coverage across India.

Frequently Asked Questions (FAQ):

How big is the RPA and Hyperautomation market?

What is growth rate of the RPA and Hyperautomation market?

Who are the key players in RPA and Hyperautomation market?

Who will be the leading hub for RPA and Hyperautomation market?

What is the RPA and Hyperautomation market segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 45)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2021

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 50)

2.1 RESEARCH DATA

FIGURE 1 RPA AND HYPERAUTOMATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF THE RPA AND HYPERAUTOMATION MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF RPA AND HYPERAUTOMATION THROUGH OVERALL RPA AND HYPERAUTOMATION SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 9 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON RPA AND HYPERAUTOMATIONMARKET

FIGURE 10 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 66)

TABLE 4 GLOBAL RPA AND HYPERAUTOMATION MARKET SIZE AND GROWTH RATE, 2019–2021 (USD MILLION, Y-O-Y% )

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y%)

FIGURE 11 MARKET SNAPSHOT, BY COMPONENT

FIGURE 12 MARKET SNAPSHOT, BY SOLUTION

FIGURE 13 MARKET SNAPSHOT, BY SERVICE

FIGURE 14 MARKET SNAPSHOT, BY PROFESSIONAL SERVICE

FIGURE 15 MARKET SNAPSHOT, BY BUSINESS FUNCTION

FIGURE 16 MARKET SNAPSHOT, BY DEPLOYMENT MODE

FIGURE 17 MARKET SNAPSHOT, BY ORGANIZATION SIZE

FIGURE 18 MARKET SNAPSHOT, BY VERTICAL

FIGURE 19 MARKET SNAPSHOT, BY REGION

4 PREMIUM INSIGHTS (Page No. - 72)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE RPA AND HYPERAUTOMATION MARKET

FIGURE 20 DIGITAL TRANSFORMATION WITH ADVANCED TECHNIQUES AND SURGING DEMAND FOR AI, ML, AND ADVANCED ANALYTICS TECHNOLOGIES FOR ENHANCED BUSINESS OPERATIONS TO DRIVE THE GROWTH OF THE MARKET

4.2 MARKET: TOP THREE BUSINESS FUNCTIONS

FIGURE 21 HUMAN RESOURCE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET: BY REGION

FIGURE 22 NORTH AMERICA TO HOLD THE HIGHEST MARKET SHARE IN 2022

4.4 MARKET IN NORTH AMERICA, BY TOP THREE BUSINESS FUNCTION AND VERTICAL

FIGURE 23 IT BUSINESS FUNCTION AND BFSI VERTICAL TO ACCOUNT FOR THE HIGHEST SHARES IN THE MARKET IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 75)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: RPA AND HYPERAUTOMATION MARKET

5.2.1 DRIVERS

5.2.1.1 Digital transformation with advanced techniques

5.2.1.2 Surging demand for AI, ML, and advanced analytics technologies for enhanced business operations

5.2.1.3 Rising demand for automated solutions for business continuity and planning

5.2.2 RESTRAINTS

5.2.2.1 Accounting for regulatory and enterprise constraints

5.2.2.2 Lack of skilled manpower in the Hyperautomation

5.2.2.3 High cost of investment

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in demand for automation among key industries

5.2.3.2 Increase in return on investments

5.2.4 CHALLENGES

5.2.4.1 Identifying the right business processes to automate

5.2.4.2 Optimizing business processes prior to automation

5.3 COVID-19 MARKET OUTLOOK FOR RPA AND HYPERAUTOMATION MARKET

FIGURE 25 MARKET TO WITNESS MINIMAL SLOWDOWN IN GROWTH IN 2020

5.3.1 CUMULATIVE GROWTH ANALYSIS

TABLE 6 MARKET: CUMULATIVE GROWTH ANALYSIS

5.4 INDUSTRY TRENDS

5.4.1 CASE STUDY

5.4.1.1 BFSI

5.4.1.1.1 Use case 1: Future-proofing a captive auto finance organization with Pegasystems

5.4.1.1.2 Use case 2: SolveXia helps IOOF to optimize and automate the preparation of their APRA returns

5.4.1.2 Retail and consumer goods

5.4.1.2.1 Use case 1: UiPath helps with RPA Frees Mercadinhos São Luiz Employees to Focus on Store Customers

5.4.1.3 Energy and utilities

5.4.1.3.1 Use case 1: Water Plus adopted UiPath RPA for quick results for the customer benefits

5.4.1.4 Media and entertainment

5.4.1.4.1 Use case 1: Datamatics helps MullenLowe auto-summarize the lengthy articles

5.4.1.5 IT and telecom

5.4.1.5.1 Use case 1: Automation Anywhere helps Symantec to reduce manual processes

5.4.1.6 Healthcare and life sciences

5.4.1.6.1 Use case 1: Laiye built AI-powered conversational robot for AstraZeneca

5.4.2 REGULATORY LANDSCAPE

5.4.2.1 Regulatory bodies, government agencies, and other organizations

TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.5 RPA AND HYPERAUTOMATION: EVOLUTION

FIGURE 26 EVOLUTION: RPA AND HYPERAUTOMATION

5.6 VALUE CHAIN ANALYSIS

FIGURE 27 RPA AND HYPERAUTOMATION MARKET: VALUE CHAIN ANALYSIS

5.7 ECOSYSTEM

TABLE 12 MARKET ECOSYSTEM

5.8 PATENT ANALYSIS

FIGURE 28 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 13 TOP TWENTY PATENT OWNERS (UNITED STATES)

FIGURE 29 NUMBER OF PATENTS GRANTED IN A YEAR, 2012-2021

5.9 PRICING ANALYSIS

TABLE 14 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED RPA AND HYPERAUTOMATION

5.10 TECHNOLOGY ANALYSIS

5.10.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.10.2 NATURAL LANGUAGE GENERATION

5.10.3 OPTICAL CHARACTER RECOGNITION

5.10.4 CLOUD COMPUTING

5.11 TRENDS AND DISRUPTIONS IMPACTING BUYERS

FIGURE 30 REVENUE SHIFT FOR RPA AND HYPERAUTOMATION MARKET

5.12 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 15 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 16 MARKET: PORTER’S FIVE FORCES MODEL

FIGURE 31 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 THREAT OF SUBSTITUTES

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 BARGAINING POWER OF SUPPLIERS

5.13.5 RIVALRY AMONG EXISTING COMPETITORS

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICAL

TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICAL (%)

5.14.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE VERTICAL

TABLE 18 KEY BUYING CRITERIA FOR TOP THREE VERTICAL

6 RPA AND HYPERAUTOMATION MARKET, BY COMPONENT (Page No. - 100)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID–19 IMPACT

FIGURE 34 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

TABLE 19 MARKET, BY COMPONENT, 2019–2021(USD MILLION)

TABLE 20 MARKET, BY COMPOMENT, 2022–2027(USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: MARKET DRIVERS

FIGURE 35 STANDALONE SOLUTION SEGMENT TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

TABLE 21 MARKET, BY SOLUTION, 2019–2021(USD MILLION)

TABLE 22 MARKET, BY SOLUTION, 2022–2027(USD MILLION)

TABLE 23 SOLUTION: MARKET, BY REGION, 2019–2021(USD MILLION)

TABLE 24 SOLUTION: MARKET, BY REGION, 2022–2027(USD MILLION)

6.2.2 STANDALONE

6.2.3 INTERGATED

6.3 SERVICES

6.3.1 SERVICES: RPA AND HYPERAUTOMATION MARKET DRIVERS

FIGURE 36 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 25 MARKET, BY SERVICES, 2019–2021 (USD MILLION)

TABLE 26 MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 27 SERVICES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 28 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

FIGURE 37 SYSTEM INTEGRATION & IMPLEMENTATION SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 29 MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

TABLE 30 MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 31 PROFESSIONAL SERVICES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 32 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2.1 Training & consulting

TABLE 33 TRAINING AND CONSULTING: RPA AND HYPERAUTOMATION MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 34 TRAINING AND CONSULTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2.2 Support & maintenance

TABLE 35 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 36 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2.3 System integration & implementation

TABLE 37 SYSTEM INTEGRATION & IMPLEMENTATION: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 38 SYSTEM INTEGRATION AND IMPLEMENTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 MANAGED SERVICES

TABLE 39 MANAGED SERVICES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 40 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 RPA AND HYPERAUTOMATION MARKET, BY DEPLOYMENT MODE (Page No. - 113)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODE: COVID–19 IMPACT

FIGURE 38 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 41 MARKET, BY DEPLOYMENT MODE, 2019–2021(USD MILLION)

TABLE 42 MARKET, BY DEPLOYMENT MODE, 2022–2027(USD MILLION)

7.2 ON-PREMISES

7.2.1 ON-PREMISES: MARKET DRIVERS

TABLE 43 ON-PREMISES: MARKET, BY REGION, 2019–2021(USD MILLION)

TABLE 44 ON-PREMISES: MARKET SIZE, BY REGION, 2022–2027(USD MILLION)

7.3 CLOUD

7.3.1 CLOUD: MARKET DRIVERS

TABLE 45 CLOUD: MARKET BY REGION, 2019–2021(USD MILLION)

TABLE 46 CLOUD: MARKET BY REGION, 2022–2027(USD MILLION)

8 RPA AND HYPERAUTOMATION MARKET, BY ORGANIZATION SIZE (Page No. - 118)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 39 LARGE ENTERPRISES TO HOLD A LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 47 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

TABLE 48 MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 LARGE ENTERPRISES

8.2.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 49 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 50 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 SMALL ENTERPRISES: MARKET DRIVERS

TABLE 51 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 52 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 RPA AND HYPERAUTOMATION MARKET, BY BUSINESS FUNCTION (Page No. - 123)

9.1 INTRODUCTION

9.1.1 BUSINESS FUNCTIONS: COVID-19 IMPACT

FIGURE 40 IT BUSINESS FUNCTION TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 53 MARKET, BY BUSINESS FUNCTION, 2019–2021 (USD MILLION)

TABLE 54 MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

9.2 SALES & MARKETING

9.2.1 SALES AND MARKETING: MARKET DRIVERS

TABLE 55 SALES & MARKETING: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 56 SALES & MARKETING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 FINANCE & ACCOUNTING

9.3.1 FINANCE & ACCOUNTING: MARKET DRIVERS

TABLE 57 FINANCE & ACCOUNTING: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 58 FINANCE & ACCOUNTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 HUMAN RESOURCES

9.4.1 HUMAN RESOURCES: RPA AND HYPERAUTOMATION MARKET DRIVERS

TABLE 59 HUMAN RESOURCES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 60 HUMAN RESOURCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 OPERATIONS & SUPPLY CHAIN

9.5.1 OPERATIONS&SUPPLY CHAIN: MARKET DRIVERS

TABLE 61 OPERATIONS & SUPPLY CHAIN: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 62 OPERATIONS & SUPPLY CHAIN: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 INFORMATION TECHNOLOGY

9.6.1 INFORMATION TECHNOLOGY: MARKET DRIVERS

TABLE 63 INFORMATION TECHNOLOGY: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 64 INFORMATION TECHNOLOGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 RPA AND HYPERAUTOMATION MARKET, BY VERTICAL (Page No. - 132)

10.1 INTRODUCTION

10.1.1 VERTICAL: COVID-19 IMPACT

FIGURE 41 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 65 MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

TABLE 66 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.2.1 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET DRIVERS

TABLE 67 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 68 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.2 BFSI APPLICATION

FIGURE 42 LENDING OPERATIONS SEGMENT TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 69 RPA AND HYPERAUTOMATION MARKET, BY BANKING, FINANCIAL SERVICES, AND INSURANCE APPLICATION, 2019–2021 (USD MILLION)

TABLE 70 MARKET, BY BANKING, FINANCIAL SERVICES, AND INSURANCE APPLICATION, 2022–2027 (USD MILLION)

10.2.2.1 Banking servicing

10.2.2.2 Payment operations

10.2.2.3 Lending operations

10.2.2.4 Other BFSI applications

10.3 IT & TELECOM

10.3.1 IT & TELECOM: MARKET DRIVERS

TABLE 71 IT & TELECOM: RPA AND HYPERAUTOMATION, BY REGION, 2019–2021 (USD MILLION)

TABLE 72 IT & TELECOM: RPA AND HYPERAUTOMATION, BY REGION, 2022–2027 (USD MILLION)

10.3.2 IT & TELECOM APPLICATION

FIGURE 43 INVOICE & PURCHASE ORDER PROCESSING SEGMENT TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 73 RPA AND HYPERAUTOMATION MARKET, BY IT & TELECOM APPLICATION, 2019–2021 (USD MILLION)

TABLE 74 MARKET, BY IT & TELECOM APPLICATION, 2022–2027 (USD MILLION)

10.3.2.1 Customer support

10.3.2.2 Network management

10.3.2.3 Invoice & purchase order processing

10.3.2.4 Other IT & telecom applications

10.4 RETAIL & CONSUMER GOODS

10.4.1 RETAIL&CONSUMER GOODS: MARKET DRIVERS

TABLE 75 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 76 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4.2 RETAIL & CONSUMER GOODS APPLICATION

FIGURE 44 RISK MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 77 RPA AND HYPERAUTOMATION MARKET, BY RETAIL & CONSUMER GOODS APPLICATION, 2019–2021 (USD MILLION)

TABLE 78 MARKET, BY RETAIL & CONSUMER GOODS APPLICATION, 2022–2027 (USD MILLION)

10.4.2.1 Order management

10.4.2.2 Inventory & warehouse management

10.4.2.3 Risk management

10.4.2.4 Other applications

10.5 HEALTHCARE & LIFE SCIENCES

10.5.1 HEALTHCARE&LIFE SCIENCES: MARKET DRIVERS

TABLE 79 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 80 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.2 HEALTHCARE & LIFE SCIENCES APPLICATION

FIGURE 45 APPOINTMENT SCHEDULING SEGMENT TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 81 RPA AND HYPERAUTOMATION MARKET, BY HEALTHCARE & LIFE SCIENCES APPLICATION, 2019–2021 (USD MILLION)

TABLE 82 MARKET, BY HEALTHCARE & LIFE SCIENCES APPLICATION, 2022–2027 (USD MILLION)

10.5.2.1 Claims management

10.5.2.2 Reporting & analytics

10.5.2.3 Appointment scheduling

10.5.2.4 Other healthcare & life sciences applications

10.6 MANUFACTURING

10.6.1 MANUFACTURING: MARKET DRIVERS

TABLE 83 MANUFACTURING & LOGISTICS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 84 MANUFACTURING & LOGISTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6.2 MANUFACTURING APPLICATION

FIGURE 46 INVOICE PROCESSING SEGMENT TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 85 RPA AND HYPERAUTOMATION MARKET, BY MANUFACTURING APPLICATION, 2019–2021 (USD MILLION)

TABLE 86 MARKET, BY MANUFACTURING APPLICATION, 2022–2027 (USD MILLION)

10.6.2.1 Supply chain & inventory management

10.6.2.2 Risk & compliance management

10.6.2.3 Invoice processing

10.6.2.4 Other manufacturing applications

10.7 TRANSPORTATION & LOGISTICS

10.7.1 TRANSPORTATION & LOGISTICS: MARKET DRIVERS

TABLE 87 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 88 TRANSPORTATION & LOGISTICS: RPA AND HYPERAUTOMATION, BY REGION, 2022–2027 (USD MILLION)

10.7.2 TRANSPORTATION & LOGISTICS APPLICATION

FIGURE 47 WAREHOUSE MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 89 RPA AND HYPERAUTOMATION MARKET, BY TRANSPORTATION & LOGISTICS APPLICATION, 2019–2021 (USD MILLION)

TABLE 90 MARKET, BY TRANSPORTATION & LOGISTICS APPLICATION, 2022–2027 (USD MILLION)

10.7.2.1 Shipment scheduling & tracking

10.7.2.2 Procurement & inventory management

10.7.2.3 Warehouse management

10.7.2.4 other transportation & logistics applications

10.8 OTHER VERTICALS

TABLE 91 OTHER VERTICALS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 92 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 RPA AND HYPERAUTOMATION MARKET, BY REGION (Page No. - 157)

11.1 INTRODUCTION

FIGURE 48 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR THE DURING FORECAST PERIOD

TABLE 93 MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 94 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: COVID-19 IMPACT

11.2.2 NORTH AMERICA: MARKET DRIVERS

11.2.3 NORTH AMERICA: REGULATORY IMPLICATIONS

11.2.3.1 Health Insurance Portability and Accountability Act (HIPAA)

11.2.3.2 Gramm–Leach–Bliley Act (GLB Act)

11.2.3.3 Health Information Technology for Economic and Clinical Health (HITECH) Act

11.2.3.4 Sarbanes Oxley (SOX) Act

11.2.3.5 United States Securities and Exchange Commission (SEC)

11.2.3.6 California Consumer Privacy Act (CCPA)

11.2.3.7 Federal Information Security Management Act (FISMA)

11.2.3.8 Federal Information Processing Standards (NIST)

FIGURE 49 NORTH AMERICA: MARKET SNAPSHOT

TABLE 95 NORTH AMERICA: RPA AND HYPERAUTOMATION MARKET, BY COMPONENTS, 2019–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY COMPONENTS, 2022–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY SERVICE, 2019–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET, BY BUSINESS FUNCTION, 2019–2021 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

TABLE 106 NORTH AMERICA: RPA AND HYPERAUTOMATION MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.4 UNITED STATES

11.2.4.1 Rapid growth in technological innovations and the need for RPA and Hyperautomation to drive market growth

TABLE 113 UNITED STATES: RPA AND HYPERAUTOMATION MARKET, BY COMPONENTS, 2019–2021 (USD MILLION)

TABLE 114 UNITED STATES: MARKET, BY COMPONENTS, 2022–2027 (USD MILLION)

11.2.5 CANADA

11.2.5.1 Adoption of automation-based technologies to drive market growth in Canada

TABLE 115 CANADA: MARKET, BY COMPONENTS, 2019–2021 (USD MILLION)

TABLE 116 CANADA: MARKET, BY COMPONENTS, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: COVID-19 IMPACT

11.3.2 EUROPE: MARKET DRIVERS

11.3.3 EUROPE: REGULATIONS

11.3.3.1 European Market Infrastructure Regulation (EMIR)

11.3.3.2 General Data Protection Regulation (GDPR)

11.3.3.3 European Committee for Standardization (CEN)

11.3.3.4 European Technical Standards Institute (ETSI)

TABLE 117 EUROPE: RPA AND HYPERAUTOMATION MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY SERVICE, 2019–2021 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY BUSINESS FUNCTION, 2019–2021 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 127 EUROPE: RPA AND HYPERAUTOMATION MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

TABLE 128 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 129 EUROPE: MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

TABLE 130 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 131 EUROPE: MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

TABLE 132 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 133 EUROPE: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 134 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.4 UNITED KINGDOM

11.3.4.1 Increased investments and presence of major RPA vendors to drive market growth

TABLE 135 UNITED KINGDOM: RPA AND HYPERAUTOMATION MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 136 UNITED KINGDOM: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.3.5 GERMANY

11.3.5.1 Technological advancements and increased adoption of RPA solutions to drive market growth

TABLE 137 GERMANY: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 138 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.3.6 FRANCE

11.3.6.1 Significant demand for RPA and Hyperautomation solutions in various sectors to drive market growth

TABLE 139 FRANCE: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 140 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 141 REST OF EUROPE: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 142 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: COVID-19 IMPACT

11.4.2 ASIA PACIFIC: RPA AND HYPERAUTOMATION MARKET DRIVERS

11.4.3 ASIA PACIFIC: REGULATIONS

11.4.3.1 Privacy Commissioner for Personal Data (PCPD)

11.4.3.2 Act on the Protection of Personal Information (APPI)

11.4.3.3 Critical Information Infrastructure (CII)

11.4.3.4 International Organization for Standardization (ISO) 27001

11.4.3.5 Personal Data Protection Act (PDPA)

FIGURE 50 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 143 ASIA PACIFIC: RPA AND HYPERAUTOMATION MARKET, BY COMPONENTS, 2019–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY COMPONENTS, 2022–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY SERVICES, 2019–2021 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY BUSINESS FUNCTION, 2019–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 155 ASIA PACIFIC: RPA AND HYPERAUTOMATION MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.4 CHINA

11.4.4.1 Increased investment by the government in adopting new technologies to drive market growth

TABLE 161 CHINA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 162 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.4.5 INDIA

11.4.5.1 Increased adoption of AI-based technologies and the need for automating business processes to drive market growth

TABLE 163 INDIA: RPA AND HYPERAUTOMATION MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 164 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.4.6 JAPAN

11.4.6.1 Advanced infrastructure and government investments in the latest technologies to drive market growth

TABLE 165 JAPAN: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 166 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 167 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 168 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA: COVID-19 IMPACT

11.5.2 MIDDLE EAST & AFRICA: MARKET DRIVERS

11.5.3 MIDDLE EAST & AFRICA: REGULATIONS

11.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

11.5.3.2 Cloud Computing Framework (CCF)

11.5.3.3 GDPR Applicability in the KSA

11.5.3.4 Protection of Personal Information (POPI) Act

TABLE 169 MIDDLE EAST & AFRICA: RPA AND HYPERAUTOMATION MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2019–2021 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY CHANNEL MODE, 2019–2021 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MARKET, BY CHANNEL MODE, 2022–2027 (USD MILLION)

TABLE 179 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: RPA AND HYPERAUTOMATION MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.4 KINGDOM OF SAUDI ARABIA

11.5.4.1 Growing penetration of new technologies to drive market growth

TABLE 187 KINGDOM OF SAUDI ARABIA: RPA AND HYPERAUTOMATION MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 188 KINGDOM OF SAUDI ARABIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.5.5 UNITED ARAB EMIRATES

11.5.5.1 Growing policies and regulations to drive market growth

TABLE 189 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 190 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.5.6 SOUTH AFRICA

11.5.6.1 Growing penetration of new technologies to drive market growth

TABLE 191 SOUTH AFRICA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 192 SOUTH AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.5.7 REST OF MIDDLE EAST & AFRICA

TABLE 193 REST OF MIDDLE EAST & AFRICA: RPA AND HYPERAUTOMATION MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 194 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: COVID-19 IMPACT

11.6.2 LATIN AMERICA: MARKET DRIVERS

11.6.3 LATIN AMERICA: REGULATIONS

11.6.3.1 Brazil Data Protection Law

11.6.3.2 Federal Law on Protection of Personal Data Held by Individuals

TABLE 195 LATIN AMERICA: RPA AND HYPERAUTOMATION MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET, BY SERVICE, 2019–2021 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY BUSINESS FUNCTION, 2019–2021 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2019–2021 (USD MILLION)

TABLE 206 LATIN AMERICA: RPA AND HYPERAUTOMATION MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.4 BRAZIL

11.6.4.1 Increasing adoption of digital technology and advancement of the country to drive market growth

TABLE 213 BRAZIL: RPA AND HYPERAUTOMATION MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 214 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.6.5 MEXICO

11.6.5.1 Government awareness toward making digitally advanced country to drive market growth

TABLE 215 MEXICO: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 216 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.6.6 REST OF LATIN AMERICA

TABLE 217 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 218 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 211)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

TABLE 219 OVERVIEW OF STRATEGIES ADOPTED BY KEY RPA AND HYPERAUTOMATION VENDORS

12.3 REVENUE ANALYSIS

12.3.1 HISTORICAL REVENUE ANALYSIS

FIGURE 51 REVENUE ANALYSIS OF TOP FIVE LEADING PLAYERS, 2019–2021

12.4 MARKET SHARE ANALYSIS

FIGURE 52 MARKET SHARE ANALYSIS FOR KEY COMPANIES

TABLE 220 RPA AND HYPERAUTOMATION MARKET: DEGREE OF COMPETITION

12.5 MARKET EVALUATION FRAMEWORK

FIGURE 53 MARKET EVALUATION FRAMEWORK: EXPANSIONS AND CONSOLIDATIONS IN THE MARKET BETWEEN 2019–2022

12.6 COMPANY EVALUATION QUADRANT

12.6.1 STAR

12.6.2 EMERGING LEADER

12.6.3 PERVASIVE

12.6.4 PARTICIPANT

FIGURE 54 MARKET: COMPANY EVALUATION QUADRANT, 2022

12.7 COMPETITIVE BENCHMARKING

12.7.1 COMPANY PRODUCT FOOTPRINT

FIGURE 55 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE RPA AND HYPERAUTOMATION MARKET

FIGURE 56 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

TABLE 221 COMPANY OFFERING FOOTPRINT

TABLE 222 COMPANY REGION FOOTPRINT

TABLE 223 RPA AND HYPERAUTOMATION: COMPETITIVE BENCHMARKING OF KEY PLAYERS

12.8 STARTUP/SME EVALUATION QUADRANT

12.8.1 PROGRESSIVE COMPANIES

12.8.2 RESPONSIVE COMPANIES

12.8.3 DYNAMIC COMPANIES

12.8.4 STARTING BLOCKS

FIGURE 57 MARKET, STARTUP/SME EVALUATION QUADRANT

12.9 STARTUP/SME COMPETITIVE BENCHMARKING

12.9.1 COMPANY PRODUCT FOOTPRINT

FIGURE 58 PRODUCT PORTFOLIO ANALYSIS OF STARTUP/SME IN THE RPA AND HYPERAUTOMATION MARKET

FIGURE 59 BUSINESS STRATEGY EXCELLENCE OF STARTUP/SME IN THE MARKET

TABLE 224 STARTUP/SME COMPANY OFFERING FOOTPRINT

TABLE 225 STARTUP/SME COMPANY REGION FOOTPRINT

TABLE 226 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 227 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12.10 COMPETITIVE SCENARIO AND TRENDS

12.10.1 NEW PRODUCT LAUNCHES

TABLE 228 NEW SERVICE/PRODUCT LAUNCHES, 2017–2021

12.10.2 DEALS

TABLE 229 DEALS, 2019–2022

13 COMPANY PROFILES (Page No. - 240)

13.1 INTRODUCTION

(Business Overview, Products/Solutions/Services Offered, Recent Developments, COVID-19-related developments, and MnM View)*

13.2 IBM

TABLE 230 IBM: BUSINESS OVERVIEW

FIGURE 60 IBM: COMPANY SNAPSHOT

TABLE 231 IBM: PRODUCTS OFFERED

TABLE 232 IBM: SERVICES OFFERED

TABLE 233 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 234 IBM: DEALS

13.3 SAP

TABLE 235 SAP: BUSINESS OVERVIEW

FIGURE 61 SAP: COMPANY SNAPSHOT

TABLE 236 SAP: PRODUCTS OFFERED

TABLE 237 SAP: SERVICES OFFERED

TABLE 238 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 239 SAP: DEALS

13.4 ALTERYX

TABLE 240 ALTERYX: BUSINESS OVERVIEW

FIGURE 62 ALTERYX: COMPANY SNAPSHOT

TABLE 241 ALTERYX: PRODUCTS OFFERED

TABLE 242 ALTERYX: SERVICES OFFERED

TABLE 243 ALTERYX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 244 ALTERYX: DEALS

13.5 JUNIPER NETWORKS

TABLE 245 JUNIPER NETWORKS: BUSINESS OVERVIEW

FIGURE 63 JUNIPER NETWORKS: COMPANY SNAPSHOT

TABLE 246 JUNIPER NETWORKS: PRODUCTS OFFERED

TABLE 247 JUNIPER NETWORKS: SERVICES OFFERED

TABLE 248 JUNIPER NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 249 JUNIPER NETWORKS: DEALS

13.6 APPIAN

TABLE 250 APPIAN: BUSINESS OVERVIEW

FIGURE 64 APPIAN: COMPANY SNAPSHOT

TABLE 251 APPIAN: PRODUCTS OFFERED

TABLE 252 APPIAN: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 253 APPIAN: DEALS

13.7 MICROSOFT

TABLE 254 MICROSOFT: BUSINESS OVERVIEW

FIGURE 65 MICROSOFT: COMPANY SNAPSHOT

TABLE 255 MICROSOFT: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 256 MICROSOFT: PRODUCT LAUNCHES

TABLE 257 MICROSOFT: DEALS

13.8 NICE

TABLE 258 NICE: BUSINESS OVERVIEW

FIGURE 66 NICE: COMPANY SNAPSHOT

TABLE 259 NICE: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 260 NICE: PRODUCT LAUNCHES

TABLE 261 NICE: DEALS

13.9 ZENDESK

TABLE 262 ZENDESK: BUSINESS OVERVIEW

FIGURE 67 ZENDESK: COMPANY SNAPSHOT

TABLE 263 ZENDESK: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 264 ZENDESK: PRODUCT LAUNCHES

13.9.4 ZENDESK: COVID-19 DEVELOPMENT

13.10 PEGASYSTEMS

TABLE 265 PEGA: BUSINESS OVERVIEW

FIGURE 68 PEGA: COMPANY SNAPSHOT

TABLE 266 PEGA: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 267 PEGA: PRODUCT LAUNCHES

TABLE 268 PEGA: DEALS

13.10.4 PEGA: COVID-19 DEVELOPMENT

13.11 AUTOMATION ANYWHERE

TABLE 269 AUTOMATION ANYWHERE: BUSINESS OVERVIEW

TABLE 270 AUTOMATION ANYWHERE: PRODUCTS OFFERED

TABLE 271 AUTOMATION ANYWHERE: SERVICES OFFERED

TABLE 272 AUTOMATION ANYWHERE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 273 AUTOMATION ANYWHERE: DEALS

13.12 UIPATH

TABLE 274 UIPATH: BUSINESS OVERVIEW

TABLE 275 UIPATH: PRODUCTS OFFERED

TABLE 276 UIPATH: DEALS

13.13 PROCESSMAKER

TABLE 277 PROCESSMAKER: BUSINESS OVERVIEW

TABLE 278 PROCESSMAKER: PRODUCTS OFFERED

TABLE 279 PROCESSMAKER: SERVICES OFFERED

TABLE 280 PROCESSMAKER: DEALS

13.14 SOLVEXIA

TABLE 281 SOLVEXIA: BUSINESS OVERVIEW

TABLE 282 SOLVEXIA: PRODUCTS OFFERED

TABLE 283 SOLVEXIA: SERVICES OFFERED

TABLE 284 SOLVEXIA: DEALS

13.15 PAGERDUTY

13.16 CELONIS

13.17 BLUE PRISM

13.18 LASERFICHE

13.19 AKABOT

13.2 HELPSYSTEMS

13.21 DECISIONS

13.22 DATAMATICS

13.23 SMES/ STARTUPS

13.23.1 QUALE INFOTECH

13.23.2 LAIYE

13.23.3 ROCKETBOT

13.23.4 ELECTRONEEK

13.23.5 AUTOMATE.IO

13.23.6 AUTOMATIONEDGE

13.23.7 TECHFORCE.AI

13.23.8 TURBOTIC

13.23.9 SIMPLE FRACTAL

13.23.10 G1ANT

* Business Overview, Products/Solutions/Services Offered, Recent Developments, COVID-19-related developments, and MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 301)

14.1 INTRODUCTION

14.2 INTELLIGENT PROCESS AUTOMATION MARKET - GLOBAL FORECAST TO 2027

14.2.1 MARKET DEFINITION

14.2.2 MARKET OVERVIEW

14.2.2.1 Intelligent process automation market, by component

TABLE 285 INTELLIGENT PROCESS AUTOMATION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 286 INTELLIGENT PROCESS AUTOMATION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

14.2.2.2 Intelligent process automation market, by application

TABLE 287 INTELLIGENT PROCESS AUTOMATION MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 288 INTELLIGENT PROCESS AUTOMATION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

14.2.2.3 Intelligent process automation market, by business function

TABLE 289 INTELLIGENT PROCESS AUTOMATION MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD MILLION)

TABLE 290 INTELLIGENT PROCESS AUTOMATION MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

14.2.2.4 Intelligent process automation market, by deployment mode

TABLE 291 INTELLIGENT PROCESS AUTOMATION MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 292 INTELLIGENT PROCESS AUTOMATION MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

14.2.2.5 Intelligent process automation market, by organization size

TABLE 293 INTELLIGENT PROCESS AUTOMATION MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 294 INTELLIGENT PROCESS AUTOMATION MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

14.2.2.6 Intelligent process automation market, by vertical

TABLE 295 INTELLIGENT PROCESS AUTOMATION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 296 INTELLIGENT PROCESS AUTOMATION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

14.2.2.7 Intelligent process automation market, by region

TABLE 297 INTELLIGENT PROCESS AUTOMATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 298 INTELLIGENT PROCESS AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3 ADVANCED ANALYTICS MARKET - GLOBAL FORECAST TO 2026

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.2.1 Advanced analytics market, by component

TABLE 299 ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 300 ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

14.3.2.2 Advanced analytics market, by business function

TABLE 301 ADVANCED ANALYTICS MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 302 ADVANCED ANALYTICS MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

14.3.2.3 Advanced analytics market, by type

TABLE 303 ADVANCED ANALYTICS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 304 ADVANCED ANALYTICS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

14.3.2.4 Advanced analytics market, by deployment mode

TABLE 305 ADVANCED ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 306 ADVANCED ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

14.3.2.5 Advanced analytics market, by organization size

TABLE 307 ADVANCED ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 308 ADVANCED ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

14.3.2.6 Advanced analytics market, by vertical

TABLE 309 ADVANCED ANALYTICS MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 310 ADVANCED ANALYTICS MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

14.3.2.7 Advanced analytics market, by region

TABLE 311 ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 312 ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 316)

15.1 INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

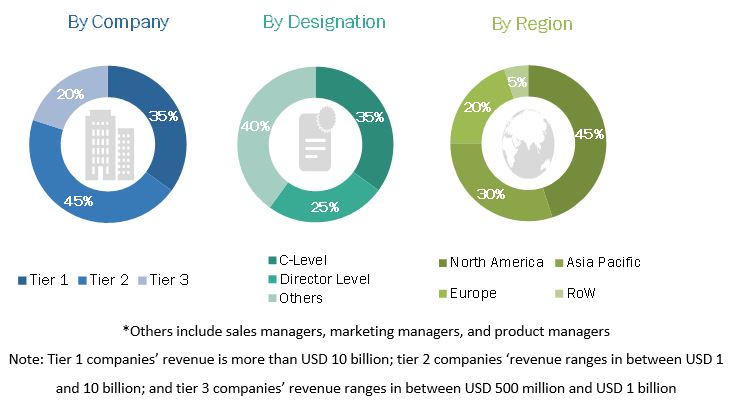

The research study for the RPA and Hyperautomation market involved extensive secondary sources, directories, the Journal of Information Systems and Technology Management (JISTEM), and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred RPA and Hyperautomation providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering RPA and Hyperautomation solutions and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

Various sources were referred to in the secondary research process to identify and collect information for this study. Secondary sources included annual reports, press releases, investor presentations of companies; white papers, journals, certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, RPA and Hyperautomation spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, functionality, applications, verticals, and regions, and key developments from both markets and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and RPA and Hyperautomation expertise; related key executives from RPA and Hyperautomation solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end-users using RPA and Hyperautomation solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of RPA and Hyperautomation solutions and services, which would impact the overall RPA and Hyperautomation market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the RPA and Hyperautomation market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of solutions and services.

Key market players were not limited to such as IBM (US), Microsoft (US), SAP (Germany), Alteryx (US), Appian (US), Juniper Networks (US), NICE (Israel), Zendesk (US), Pegasystems (US), Automation Anywhere (US), UiPath (US), ProcessMaker (US), SolveXia (Australia), PagerDuty (US), Celonis (US), Blue Prism (UK), Laserfiche (US), akaBot (Vietnam), HelpSystems (US), Decisions (US), Datamatics (US), Quale Infotech (India), Laiye (China), Rocketbot (Chile), ElectroNeek (US), Automate.io (US), AutomationEdge (US), Techforce.ai (US), Turbotic (Sweden), Simple Fractal (US), and G1ANT (England).

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in RPA and Hyperautomation Market