Automatic Power Factor Controller Market by Type (Active APFC and Passive APFC), Component (Relays, Capacitors, Displays, Microcontrollers, Switches, and Resistors), Industry and Geography - Global Forecast to 2022

The global automatic power factor controller market is estimated to grow at a CAGR of 4.6% and is expected to be valued at USD 4.78 Billion by 2022. APFCs help in lower the power consumption due to the presence of non-linear loads such as transformers, motors, and other machines in industries. Also, the growing demand for APFCs in the utility and manufacturing industries to improve the reactive power and reduce harmonics in the systems drive the growth of the overall APFC market.

The APFC is segmented on the basis of type that includes active and passive APFCs. The active APFCs, which allow the designers to achieve PF as high as 0.99, held the largest automatic power factor controller market share in 2015. The active APFC can be of two types: single stage or multi stage. The single-stage power factor controller use single switch and controller to rectify the input current and maintains the output voltage, while multi stage power factor controller has two or more power stages to reduce the input current harmonics.

The APFC market, segmented on the basis of components, includes relays, capacitors, displays, switches, microcontrollers, and resistors. Displays are used to show the power factor, voltage, current, harmonics, active and reactive power, and apparent power value. In the automatic power factor control panel, various types of displays are used such as LED displays and LCD displays.

Initially APFC panels were used in manufacturing and utility industry; however, APFC ICs are developed that are now being used in commercial, enterprise, and military industry due to the availability of high efficiency and reliable power management of APFCs. The utility industry market occupied the largest automatic power factor controller market in 2015 due to implementation APFCs for reduction in the power loss and improves the quality of distribution systems of utility industry.

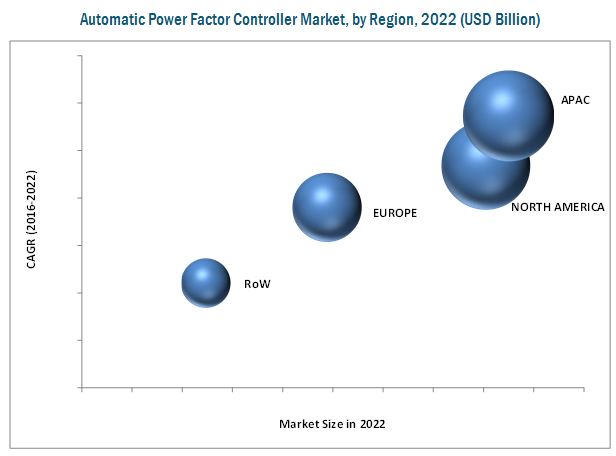

The automatic power factor controller market is estimated to grow at the highest CAGR between 2016 and 2022. The growing development of infrastructures such as commercial buildings, power plants, and others for developing economies of the APAC region would be the driving factor for the market in the APAC region.

High initial investments and installation costs for industries is a major restraint for the APAC market. The cost of designing and developing APFC panels is high due to the presence of high-capacity capacitors and inductors for low-frequency filtration. The equipment for industrial and commercial verticals are expensive and incur one-time cost.

ABB Ltd. (Switzerland) is the leader in the automatic power factor controller market and has played a significant role in the development of these devices for power management. The company offers a wide range of power factor controller equipment. The vector series is one of the comprehensive solutions for power factor correction that comprise high technology solutions which deliver optimized power quality for low-voltage networks. These products are used in mining, heavy industry, chemical, pulp and paper, shipping, cement, plastics, petro-chemical, printing, and food industries. Recently in April 2016, the company launched the modular capacitor for panel builders, which is designed for direct installation in low-voltage panels, switchboards, and power factor correction equipment. These product launches enhance the product efficiency and also protect electronic equipment from damage.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumption

2.4.1 Assumption

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Attractive Growth Opportunities in the Automatic Power Factor Controller Market Between 2016 and 2022

4.2 Automatic Power Factor Controller Market, By Type

4.3 Automatic Power Factor Controller Market, 2015

4.4 U.S. Held the Largest Share of the APFC Market in 2015

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Automatic Power Factor Controller Market, By Type

5.2.2 Market, By Component

5.2.3 Market, By Industry

5.2.4 Market By Installation Type

5.2.5 Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Need for Energy Conservation in Industries and Home Utilities to Reduce Power Losses

5.3.1.2 Growing Requirement of Preventing Damage to Appliances and Equipment Due to Overvoltage Conditions

5.3.2 Restraints

5.3.2.1 High Initial Cost of Installation of Automatic Power Factor Controller Panels for Industrial Verticals

5.3.3 Opportunities

5.3.3.1 Growing Investments in Developing Economies in Infrastructure

5.3.4 Challanges

5.3.4.1 Designing Complex Circuits By Following Standards and Regulatory Requirements to Enhance the Power Factor

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

7 Automatic Power Factor Controller Market, By Type (Page No. - 47)

7.1 Introduction

7.2 Passive APFCs

7.3 Active APFCs

8 Automatic Power Factor Controller Market, By Component (Page No. - 52)

8.1 Introduction

8.2 Relays

8.3 Capacitors

8.4 Resistors

8.5 Displays

8.6 Microcontrollers

8.7 Switches

9 Automatic Power Factor Controller Market, By Installation Type (Page No. - 57)

9.1 Introduction

9.2 Self-Standing APFC Panels

9.3 Wall-Mounted APFC Panels

10 Automatic Power Factor Controller Market, By Industry (Page No. - 60)

10.1 Introduction

10.2 Manufacturing

10.3 Utility

10.4 Commercial

10.5 Enterprise

10.6 Military

11 Automatic Power Factor Controller Market, By Geography (Page No. - 81)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 U.K.

11.3.2 Germany

11.3.3 France

11.3.4 Rest of Europe

11.4 Asia-Pacific (APAC)

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 South Korea

11.4.5 Rest of APAC

11.5 Rest of the World (RoW)

11.5.1 Middle East and Africa

11.5.2 South America

12 Competitive Landscape (Page No. - 102)

12.1 Introduction

12.2 Ranking of Top 5 Players in the Market

12.3 Competitive Analysis

12.4 Recent Developments

12.4.1 New Product Launches & Developments: Automatic Power Factor Controller Market

12.4.2 Partnerships, Joint Ventures, & Collaborations

12.4.3 Agreements

12.4.4 Others

13 Company Profile (Page No. - 109)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 Introduction

13.2 ABB Ltd.

13.3 General Electric Company

13.4 Eaton Corporation PLC

13.5 Schneider Electric SE

13.6 EPCOS AG

13.7 Texas Instruments, Inc.

13.8 Fairchild Semiconductor International, Inc.

13.9 on Semiconductor Corporation

13.10 Stmicroelectronics N.V.

13.11 Crompton Greaves Ltd.

13.12 Larsen & Toubro Limited

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 135)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

List of Tables (65 Tables)

Table 1 Global APFC Market in Terms of Value and Vollume, 2013–2022

Table 2 Global APFC Market, By Type, 2013–2022 (USD Billion)

Table 3 Global Passive APFC Market, By Industry, 2013–2022 (USD Billion)

Table 4 Global Active APFC Market, By Industry, 2013–2022 (USD Billion)

Table 5 Global APFC Market, By Component, 2013–2022 (USD Billion)

Table 6 Global APFC Market Size, By Component, 2013-2022 (Million Units)

Table 7 Global APFC Market, By Industry, 2013–2022 (USD Billion)

Table 8 APFC Market for Manufacturing Industry Market, By Type, 2013–2022 (USD Billion)

Table 9 APFC Market for Manufacturing Industry, By Region, 2013–2022 (USD Billion)

Table 10 APFC Market for Manufacturing Industry in North America, By Country, 2013–2022 (USD Billion)

Table 11 APFC Market for Manufacturing Industry in Europe, By Country, 2013–2022 (USD Billion)

Table 12 APFC Market for Manufacturing Industry in APAC, By Country, 2013–2022 (USD Billion)

Table 13 APFC Market for Manufacturing Industry in RoW, By Region, 2013–2022 (USD Billion)

Table 14 APFC Market for Utility Industry , By Type, 2013–2022 (USD Billion)

Table 15 APFC Market for Utility Industry, By Region, 2013–2022 (USD Billion)

Table 16 APFC Market for Utility Industry in North Ameirca, By Country, 2013–2022 (USD Billion)

Table 17 APFC Market for Utility Industry in Europe, By Country, 2013–2022 (USD Billion)

Table 18 APFC Market for Utility Industry in APAC, By Country, 2013–2022 (USD Billion)

Table 19 APFC Market for Utility Industry in RoW, By Region, 2013–2022 (USD Billion)

Table 20 APFC Market for Commercial Industry, By Type, 2013–2022 (USD Billion)

Table 21 APFC Market for Commercial Industry, By Region, 2013–2022 (USD Billion)

Table 22 APFC Market for Commercial Industry in North America, By Country, 2013–2022 (USD Billion)

Table 23 APFC Market for Commercial Industry in Europe, By Country, 2013–2022 (USD Billion)

Table 24 APFC Market for Commercial Industry in APAC, By Country, 2013–2022 (USD Billion)

Table 25 APFC Market for Commercial Industry in RoW, By Region, 2013–2022 (USD Billion)

Table 26 APFC Market for Enterprise Industry, By Type, 2013–2022 (USD Billion)

Table 27 APFC Market for Enterprise Industry, By Region, 2013–2022 (USD Billion)

Table 28 APFC Market for Enterprise Industry in North America, By Country, 2013–2022 (USD Billion)

Table 29 APFC Market for Enterprise Industry in Europe, By Country, 2013–2022 (USD Billion)

Table 30 APFC Market for Enterprise Industry in APAC, By Country, 2013–2022 (USD Billion)

Table 31 APFC Market for Enterprise Industry in RoW, By Region, 2013–2022 (USD Billion)

Table 32 APFC Market for Military Industry, By Type, 2013–2022 (USD Billion)

Table 33 APFC Market for Military Industry, By Region, 2013–2022 (USD Billion)

Table 34 APFC Market for Military Industry in North America, By Country, 2013–2022 (USD Billion)

Table 35 APFC Market for Military Industry in Europe, By Country, 2013–2022 (USD Million)

Table 36 APFC Market for Military Industry in APAC, By Country, 2013–2022 (USD Million)

Table 37 APFC Market for Military Industry in RoW, By Region, 2013–2022 (USD Billion)

Table 38 Global APFC Market, By Region, 2013–2022 (USD Billion)

Table 39 APFC Market in North America, By Industry, 2013–2022 (USD Million)

Table 40 APFC Market in North America, By Country, 2013–2022 (USD Million)

Table 41 APFC Market in U.S., By Industry, 2013–2022 (USD Billion)

Table 42 APFC Market in Canada, By Industry, 2013–2022 (USD Billion)

Table 43 APFC Market in Mexico, By Industry, 2013–2022 (USD Billion)

Table 44 APFC Market in Europe, By Industry, 2013–2022 (USD Million)

Table 45 APFC Market in Europe, By Country, 2013–2022 (USD Million)

Table 46 APFC Market in U.K., By Industry, 2013–2022 (USD Million)

Table 47 APFC Market in Germany, By Industry, 2013–2022 (USD Billion)

Table 48 APFC Market in France, By Industry, 2013–2022 (USD Million

Table 49 APFC Market in Rest of Europe, By Industry, 2013–2022 (USD Million)

Table 50 APFC Market in APAC, By Industry, 2013–2022 (USD Billion)

Table 51 APFC Market in APAC, By Country, 2013–2022 (USD Billion)

Table 52 APFC Market in China, By Industry, 2013–2022 (USD Billion)

Table 53 APFC Market in Japan, By Industry, 2013–2022 (USD Million)

Table 54 APFC Market in India, By Industry, 2013–2022 (USD Billion)

Table 55 APFC Market in South Korea, By Industry, 2013–2022 (USD Million)

Table 56 APFC Market in Rest of APAC, By Industry, 2013–2022 (USD Million)

Table 57 APFC Market in RoW, By Industry, 2013–2022 (USD Billion)

Table 58 APFC Market in RoW, By Region, 2013–2022 (USD Billion)

Table 59 APFC Market in Middle East and Africa, By Industry, 2013–2022 (USD Billion)

Table 60 APFC Market in South America, By Industry, 2013–2022 (USD Million)

Table 61 Ranking of Top 5 Players in the Automatic Power Factor Controller Market

Table 62 New Product Launches & Developments, 2013–2016

Table 63 Partnerships, Joint Ventures, Collaborations, and Expansions, 2013–2016

Table 64 Agrements, 2013–2016

Table 65 Others, 2013–2016

List of Figures (60 Figures)

Figure 1 Market Segmentation

Figure 2 Automatic Power Factor Controller Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Assumption of the Research Study

Figure 6 The APFC Market in Terms of Volume Expected to Grow at A Significant Rate Between 2016 and 2022

Figure 7 Displays Expected to Hold the Largest Size of the APFC Market By 2022

Figure 8 Utility Industry Expected to Have the Highest CAGR in Market During the Forecast Period

Figure 9 Market for Utility Industry Expected to Grow at the Highest CAGR Between 2016 and 2022

Figure 10 North America Held the Largest Share of the Market in 2015

Figure 11 APFC Market Expected to Grow at A Moderate Rate During the Forecast Period

Figure 12 Active Automatic Power Factor Controller Market to Exhibit High Growth During the Forecast Period

Figure 13 Utility Industry Held the Largest Market Share in 2015

Figure 14 U.S. Held the Largest Market Share in 2015

Figure 15 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Value Chain Analysis (2015): Major Value is Added During the Manufacturing Phase

Figure 17 Porter’s Five Forces Analysis for the Market, 2015

Figure 18 The Impact Analysis of Porter’s Five Force Model, 2015

Figure 19 The Impact Analysis of Intensity of Competitive Rivalry

Figure 20 Imapact Analysis of Threat of Substitutes

Figure 21 Impact Analysis of Bargaining Power of Buyers

Figure 22 Impact Analysis of Bargaining Power of Suppliers

Figure 23 Impact Analysis of Thrat of New Enterants

Figure 24 Active Automatic Power Factor Controller Market Likely to Grow at A Highest CAGR During the Forecast Period

Figure 25 Displays Expected to Have the Highest CAGR During Forecast Period

Figure 26 Installation Type for APFC Equipment

Figure 27 Utility Industry Expected to Lead the Active Automatic Power Factor Market During the Forecast Period

Figure 28 U.S. Likely to Dominate the APFC Market for Manufacturing Industry During the Forecast Period

Figure 29 Utility Industry in APAC Expected to Lead the APFC Market During the Forecast Period

Figure 30 Active APFCs Expected to Dominate the Market During the Forecast Period

Figure 31 APFC Market for Enterprise Industry in APAC Expected to Grow at the Highest CAGR Between 2016 and 2022

Figure 32 Active APFCs for Military Industry Held the Largest Size of the Market in 2015

Figure 33 Geographical Snapshot: Automatic Power Factor Controller Market

Figure 34 Overview of the Market in North America, 2015

Figure 35 APFC Market in North America for Utility Industry Expected to Grow at the Highest CAGR During the Forecast Period

Figure 36 APFC Market in Germany Expected to Grow at the Highest Rate During the Forecast Period

Figure 37 APFC Market for Utility Industry in France Likely to Grow at the Highest CAGR During the Forecast Period

Figure 38 Overview of the Automatic Power Factor Controller Market in APAC, 2015

Figure 39 Utility Industry to Lead the APFC Market in APAC During the Forecast Period

Figure 40 APFC Market for Utility Industry in RoW Expected to Grow at the Highest CAGR Between 2016 and 2022

Figure 41 Companies Adopted New Product Launches & Developments as the Key Growth Strategy Between 2013 and 2016

Figure 42 Market Evaluation Framework: (2013–2016)

Figure 43 Battle for Market Share for Automatic Power Factor Controllers: New Product Launches & Developments Were the Key Strategies

Figure 44 Geographic Revenue Mix of the Major Market Players

Figure 45 ABB Ltd.: Company Snapshot

Figure 46 ABB Ltd.: SWOT Analysis

Figure 47 General Electric Company: Company Snapshot

Figure 48 General Electric Company: SWOT Analysis

Figure 49 Eaton Corporation PLC: Company Snapshot

Figure 50 Eaton Corporation: SWOT Analysis

Figure 51 Schneider Electric SE: Company Snapshot

Figure 52 Schneider Electric SE: SWOT Analysis

Figure 53 EPCOS AG: Company Snapshot

Figure 54 EPCOS AG: SWOT Analysis

Figure 55 Texas Instruments, Inc.: Company Snapshot

Figure 56 Fairchild Semiconductor International, Inc.: Company Snapshot

Figure 57 On Semiconductor Corporation: Company Snapshot

Figure 58 Stmicroelectronics N.V.: Company Snapshot

Figure 59 Crompton Greaves Ltd.: Company Snapshot

Figure 60 Larsen & Toubro Limited (L&T): Company Snapshot

The global automatic power factor controller (APFC) market is expected to be worth USD 4.78 Billion by 2022, growing at a CAGR of 4.6% during the forecast period. In this report, 2015 has been considered as the base year, and the period between 2016 and 2022 has been considered as the forecast period for the study of automatic power factor controller market. The objective of the study of this report is to define, describe, and forecast the global automatic power factor controller market on the basis of type, component, industry, and geography. The report also forecasts the market size of various segments with regard to industry and region. The region includes four main segments, namely, North America, Europe, Asia-Pacific, and RoW. Additionally, the report provides detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). The opportunities have been analyzed in the market for stakeholders by identifying the high-growth segments of the global APFC market. The report also profiles the key players and comprehensively analyzes their market ranking and core competencies, along with detailing the competitive landscape for market leaders.

The top-down and bottom-up approaches have been considered to estimate the size of the APFC market. This research study involves an extensive usage of secondary sources, directories, and databases (such as, Factiva and OneSource) to identify and collect information useful for technical, market-oriented, and commercial aspects of APFC devices. The points below explain the research methodology applied:

- This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, and interviews with industry experts.

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments in the global APFC market.

- Competitive developments such as mergers & acquisitions, new product launches & developments, and research & development in the global automatic power factor controller market have been analyzed.

- All the percentage splits and segment breakdown of the market is based on secondary and primary research.

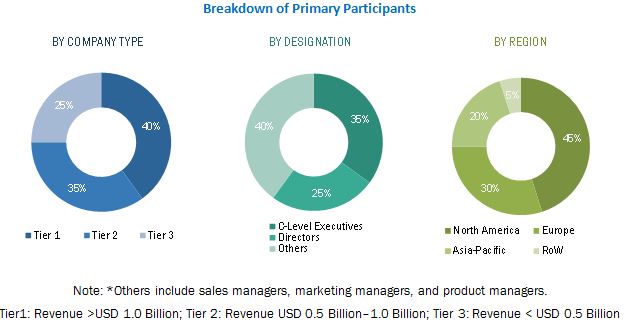

The figure below shows the breakdown of primaries on the basis of company types, designations, and regions conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The APFC ecosystems comprises of key manufacturers, such as Eaton Corporation (Ireland), EPCOS AG (Germany), and Larsen & Turbo (India) among others; APFC panels manufacturers includes ABB Ltd. (Switzerland), General Electric (U.S.), Schneider Electric (France), ON Semiconductor (U.S.), and STMicroelectronics (Switzerland) among others, of microprocessors, displays, capacitors, and other components .

The Target Audience:

- APFC device manufactures

- Software developers

- Research organizations and consulting companies

- Associations, forums, and alliances related to power factor correction

- Investors

- Key players ABB Ltd. (Switzerland), General Electric (U.S.), Schneider Electric SE (France), ON Semiconductor Corporation (U.S.), STMicroelectronics N.V. (Switzerland), and so on.

“Study answers several questions for the target audiences, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments.”

Scope of the Report:

This report categorizes the global automatic power factor controller market for automatic power factor controllers on the basis of type, component, , industry, and geography.

On the Basis of Type:

- Active APFCs

- Passive APFCs

On the Basis of Component:

- Relays

- Capacitors

- Displays

- Microcontrollers

- Switches

- Resistors

On the Basis of Industry:

- Manufacturing

- Utility

- Commercial

- Enterprise

- Military

On the Basis of Geographical Region:

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- Germany

- U.K.

- France

- Rest of Europe (Spain, Ireland, Norway, Sweden, and Italy)

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC (Australia, Malaysia, Indonesia, Thailand, and Singapore)

-

RoW

- Middle East and Africa

- South America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 12)

Growth opportunities and latent adjacency in Automatic Power Factor Controller Market

I would like to receive a PDF Copy of your Report related to the Automatic Power Factor Controller Markets in India as well as the Global.

The organization used a lot of money as a compensation for paying monthly electric bill due to poor power factor. I do need a material support for designing, analysis, and controlling the Automatic power factor correction. Have you covered the materials and components of the same?

Will smart sensors or IoT/IIoT connected sensors or devices be used for automatic power factor controller market? Which is the leading type of APFCs?