Intelligent Motor Controller Market by Voltage (Low & Medium), by Motor Type, by End User (Oil & Gas, Power & Water, Food, Mining, Chemicals, & Pharmaceutical), by Application (Pump, Fan & Compressor), & by Region - Global Trends & Forecasts to 2021

[161 Pages Report] The global intelligent motor controller market is estimated to be USD 656.9 Million in 2016, and is projected to reach USD 857.6 Million by 2021, at a CAGR of 5.48% from 2016 to 2021. Increasing demand for smart and multifunctional integrated devices, rising penetration of automation in developed region, and growing concerns regarding the efficiency of motors are driving the intelligent motor controller market. The intelligent motor controller market has been segmented on the basis of motor type, voltage, application, end-user, and region. The years considered for the study are:

- Base Year 2015

- Estimated Year 2016

- Projected Year 2021

- Forecast Period 2016 to 2021

2015 has been considered as the base year for company profiles. Whenever information was unavailable for the base year, the prior year has been considered.

Research Methodology:

- This research study involved extensive usage of secondary sources, directories, and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for a technical, market-oriented, and commercial study of the intelligent motor controller market

- In-depth interviews have been conducted with various primary respondents that include key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, among other experts

- After arriving at the overall market size, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all the segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable

- The data has been triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size has been validated using both the top-down and bottom-up approaches

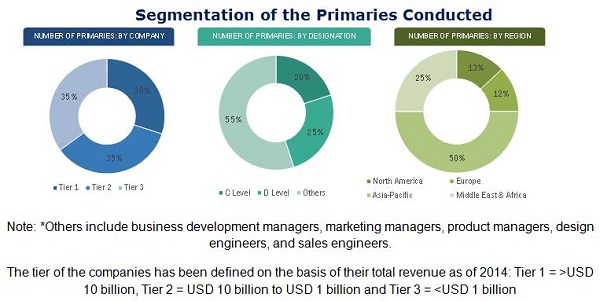

The figure below shows the breakdown of the primaries on the basis of company type, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The study answers several questions for stakeholders, primarily which market segments to focus on in the next 25 years for prioritizing efforts and investments.

Target Audience:

- OEMS

- Distributers & suppliers

- Consulting firms

- Private equity groups

- Investment houses

- Equity research firms

- Other similar entities

Scope of the Report:

- By Motor Type:

- AC Motors

- Others

- By Application:

- Pumps

- Fans

- Compressors

- Others

- By Voltage

- Low Voltage

- Medium Voltage

- By Industry

- Oil & Gas

- Water & Wastewater

- Power Generation

- Food & Beverage

- Metals & Mining

- Chemicals & Petrochemicals

- Cement & Aggregates

- Pharmaceuticals

- Others

- By Region

- Asia-Pacific

- Europe

- North America

- South America

- The Middle East & Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The intelligent motor controller market is projected to reach a size of USD 857.6 Million by 2021, at a CAGR of 5.48% from 2016 to 2021. The report segments the intelligent motor controller market on the basis of major end-user industries into oil & gas, water & wastewater, power generation, food & beverage, metals & mining, chemicals & petrochemicals, cement & aggregates, pharmaceuticals, and others. The water & wastewater industry is projected to be the fastest-growing segment in the intelligent motor controller market during the forecast period. Rising urbanization and increasing pressure on efficient use of existing water resources and reuse have led to growing investments in the water & wastewater industry across the globe.

In terms of motor type, AC motors are estimated to constitute the largest & fastest-growing segment in the market. The demand for intelligent motor controller for AC motors is higher than that of other motor types. These motors are expected to dominate the market during the forecast period. AC motors due to their low cost, robust construction, and compatibility to almost all applications within the industry are used the most within the industrial segment.

In terms of voltage, the report has been segment into low voltage and medium voltage segment. The low voltage segment is the largest market for intelligent motor controllers. Preference for intelligent motor controllers is higher in the low voltage segment when compared to the medium voltage segment. Most applications in the low voltage segment are fixed speed applications; intelligent motor controllers are cost-effective solution for motor control and protection as compared to other alternatives.

In the market, based on application, the pumps segment occupies the largest share in the intelligent motor controller market because majority of industrial motor driven applications involve pumping.. Other major applications include fans and compressors.

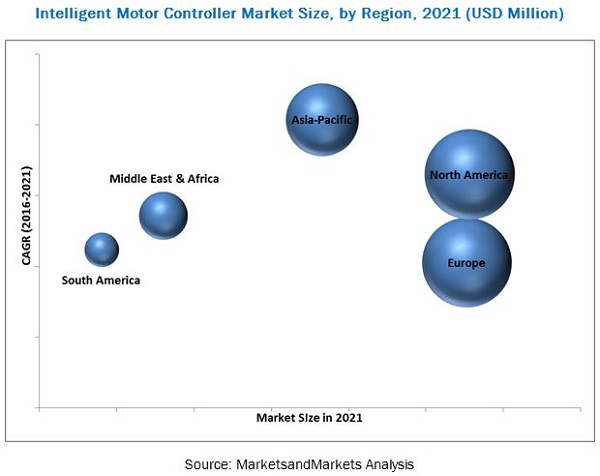

Europe led the market for intelligent motor controller in 2015, owing to higher adoption of smart devices in the region. Industries in North America are currently focusing on developing existing infrastructure and are adopting smart motor control devices for better control and higher energy savings. The U.S. is expected to be the fastest growing market in the North American region from 2016 to 2021. The figure below shows the market size of major regions between 2016 and 2021 along with the CAGR for the forest period.

Prices of the major components required for intelligent motor controller are relatively high, making the overall assembly of the device expensive as compared to conventional controllers. This restrains the growth of intelligent motor controller products despite its attractive features. However, the price difference has little consequence when the process is critical and requires superior efficiency and control.

Leading players are trying to penetrate developing economies, and are adopting various methods to increase their market share. New product development was the strategy most commonly adopted by the top players in the market, constituting 50% of the total development share from 2012 to 2015. It was followed by expansions and other developments.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

3.1 Introduction

3.2 Historical Backdrop, Evolution, & Current Scenario

3.3 Future Outlook

3.4 Conclusion

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Intelligent Motor Controller Market

4.2 Intelligent Motor Controller Market: By Motor Type

4.3 Europe Dominated the Intelligent Motor Controller Market in 2015

4.4 Low Voltage Segment to Dominate the Market

4.5 Intelligent Motor Controller Market: North America

4.6 Intelligent Motor Controller Market, By End-User

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Voltage

5.2.2 By Motor Type

5.2.3 By Application

5.2.4 By End-User

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rising Demand for Smart, Multifunctional, Integrated Motor Control & Protection Devices

5.3.1.2 Increased Industrial Plant Up-Time

5.3.1.3 Rising Thrust on Increasing Motor Efficiency & Energy Savings

5.3.2 Restraints

5.3.2.1 Availability of Low-Cost Labor in Developing Regions

5.3.3 Opportunities

5.3.3.1 Increasing Adoption of Industrial Automation in Developed Regions

5.3.4 Challenges

5.3.4.1 Dominance of Conventional Motor Controllers

5.3.4.2 Availability of Better Alternatives Such as Vfd Or Asd

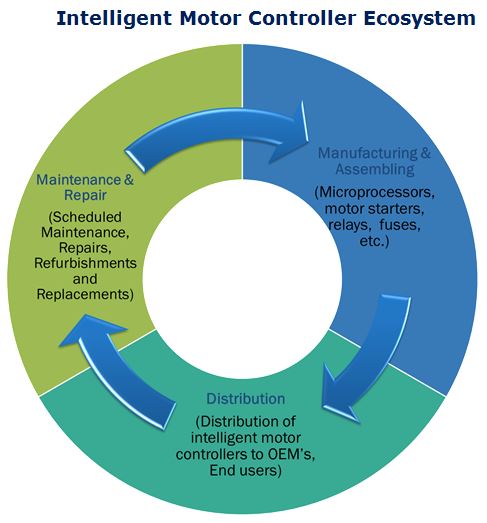

5.4 Supply Chain Analysis

5.5 Porters Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Suppliers

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Competitive Rivalry

6 Intelligent Motor Controller Market, By Motor Type (Page No. - 53)

6.1 Introduction

6.2 AC

6.3 Others

7 Intelligent Motor Controller Market, By Voltage (Page No. - 57)

7.1 Introduction

7.2 Low Voltage

7.3 Medium Voltage

8 Intelligent Motor Controller Market, By Application (Page No. - 61)

8.1 Introduction

8.2 Pumps

8.3 Fans

8.4 Compressors

8.5 Others

9 Intelligent Motor Controller Market, By End-User (Page No. - 67)

9.1 Introduction

9.2 Oil & Gas

9.3 Water & Wastewater

9.4 Power Generation

9.5 Food & Beverage

9.6 Metals & Mining

9.7 Chemicals & Petrochemicals

9.8 Pharmaceuticals

9.9 Cement & Aggregates

9.10 Others

10 Intelligent Motor Controller Market, By Region (Page No. - 78)

10.1 Introduction

10.2 Europe

10.2.1 Germany

10.2.2 The U.K.

10.2.3 France

10.2.4 Russia

10.2.5 Rest of Europe

10.3 North America

10.3.1 The U.S.

10.3.2 Canada

10.3.3 Mexico

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia

10.4.5 South Korea

10.4.6 Rest of Asia-Pacific

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

10.5.4 Rest of the Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Venezuela

10.6.3 Argentina

10.6.4 Rest of South America

11 Competitive Landscape (Page No. - 113)

11.1 Overview

11.2 Competitive Situation & Trends

11.3 New Product Developments

11.4 Expansions

11.5 Contracts & Agreements

11.6 Mergers & Acquisitions

12 Company Profiles (Page No. - 121)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 ABB Ltd.

12.3 General Electric Company

12.4 Mitsubishi Electric Corporation

12.5 Schneider Electric SE

12.6 Siemens AG

12.7 Larsen & Toubro

12.8 Lsis Co. Ltd.

12.9 NXP Semiconductors

12.10 Rockwell Automation

12.11 Fairford Electronics

12.12 Nanotec Electronic GmbH & Co. Kg

12.13 Roboteq Inc.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 152)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (73 Tables)

Table 1 Intelligent Motor Controller Market Size, By Motor Type, 20142021 (USD Million)

Table 2 Ac: Intelligent Motor Controller Market Size, By Region, 20142021 (USD Million)

Table 3 Others: Intelligent Motor Controller Market Size, By Region, 20142021 (USD Million)

Table 4 Intelligent Motor Controller Market Size, By Voltage, 20142021 (USD Million)

Table 5 Low Voltage: By Market Size, By Region, 20142021 (USD Million)

Table 6 Medium Voltage: By Market Size, By Region, 20142021 (USD Million)

Table 7 Intelligent Motor Controller Market Size, By Application, 20142021 (USD Million)

Table 8 Pumps: By Market Size, By Region, 20142021 (USD Million)

Table 9 Fans: By Market Size, By Region, 20142021 (USD Million)

Table 10 Compressors: Intelligent Motor Controller Market Size, By Region, 20142021 (USD Million)

Table 11 Others: Intelligent Motor Controller Market Size, By Region, 20142021 (USD Million)

Table 12 Intelligent Motor Controller Market Size, By End-User, 20142021 (USD Million)

Table 13 Oil & Gas: By Market Size, By Region, 20142021 (USD Million)

Table 14 Water & Wastewater: By Market Size, By Region, 20142021 (USD Million)

Table 15 Power Generation: By Market Size, By Region, 20142021 (USD Million)

Table 16 Food & Beverage: By Market Size, By Region, 20142021 (USD Million)

Table 17 Metals & Mining: By Market Size, By Region, 20142021 (USD Million)

Table 18 Chemicals & Petrochemicals: By Market Size, By Region, 20142021 (USD Million)

Table 19 Pharmaceuticals: By Market Size, By Region, 20142021 (USD Million)

Table 20 Cement & Aggregates: By Market Size, By Region, 20142021 (USD Million)

Table 21 Others: By Market Size, By Region, 20142021 (USD Million)

Table 22 Intelligent Motor Controller Market Size, By Region, 20142021 (USD Million)

Table 23 Europe: Intelligent Motor Controller Market Size, By Country, 20142021 (USD Million)

Table 24 Europe: By Market Size, By Voltage, 20142021 (USD Million)

Table 25 Europe: By Market Size, By Motor Type, 20142021 (USD Million)

Table 26 Europe: By Market Size, By Application, 20142021 (USD Million)

Table 27 Europe: By Market Size, By End-User, 20142021 (USD Million)

Table 28 Germany: By Market Size, By Voltage, 20142021 (USD Million)

Table 29 U.K.: By Market Size, By Voltage, 20142021 (USD Million)

Table 30 France: By Market Size, By Voltage, 20142021 (USD Million)

Table 31 Russia: By Market Size, By Voltage, 20142021 (USD Million)

Table 32 Rest of Europe: By Market Size, By Voltage, 20142021 (USD Million)

Table 33 North America: By Market Size, By Country, 20142021 (USD Million)

Table 34 North America: By Market Size, By Voltage, 20142021 (USD Million)

Table 35 North America: By Market Size, By Motor Type, 20142021 (USD Million)

Table 36 North America: By Market Size, By Application, 20142021 (USD Million)

Table 37 North America: By Market Size, By End-User, 20142021 (USD Million)

Table 38 U.S.: By Market Size, By Voltage, 20142021 (USD Million)

Table 39 Canada: By Market Size, By Voltage, 20142021 (USD Million)

Table 40 Mexico: By Market Size, By Voltage, 20142021 (USD Million)

Table 41 Asia-Pacific: By Market Size, By Country, 20142021 (USD Million)

Table 42 Asia-Pacific: By Market Size, By Voltage, 20142021 (USD Million)

Table 43 Asia-Pacific: By Size, By Motor Type, 20142021 (USD Million)

Table 44 Asia-Pacific: By Market Size, By Application, 20142021 (USD Million)

Table 45 Asia-Pacific: By Market Size, By End-User, 20142021 (USD Million)

Table 46 China: By Market Size, By Voltage, 20142021 (USD Million)

Table 47 Japan: By Market Size, By Voltage, 20142021 (USD Million)

Table 48 India: By Market Size, By Voltage, 20142021 (USD Million)

Table 49 Australia: By Market Size, By Voltage, 20142021 (USD Million)

Table 50 South Korea: By Market Size, By Voltage, 20142021 (USD Million)

Table 51 Rest of Asia-Pacific: By Market Size, By Voltage, 20142021 (USD Million)

Table 52 Middle East & Africa: By Market Size, By Country, 20142021 (USD Million)

Table 53 Middle East & Africa: By Market Size, By Voltage, 20142021 (USD Million)

Table 54 Middle East & Africa: By Market Size, By Motor Type, 20142021 (USD Million)

Table 55 Middle East & Africa: By Market Size, By Application, 20142021 (USD Million)

Table 56 Middle East & Africa: By Market Size, By End-User, 20142021 (USD Million)

Table 57 Saudi Arabia: By Market Size, By Voltage, 20142021 (USD Million)

Table 58 Uae: Intelligent Motor Controller Market Size, By Voltage, 20142021 (USD Million)

Table 59 South Africa: By Market Size, By Voltage, 20142021 (USD Million)

Table 60 Rest of the Middle East & Africa: By Market Size, By Voltage, 20142021 (USD Million)

Table 61 South America: By Market Size, By Country, 20142021 (USD Million)

Table 62 South America: By Market Size, By Voltage, 20142021 (USD Million)

Table 63 South America: By Market Size, By Motor Type, 20142021 (USD Million)

Table 64 South America: By Market Size, By Application, 20142021 (USD Million)

Table 65 South America: By Market Size, By End-User, 20142021 (USD Million)

Table 66 Brazil: By Market Size, By Voltage, 20142021 (USD Million)

Table 67 Venezuela: By Market Size, By Voltage, 20142021 (USD Million)

Table 68 Argentina: By Market Size, By Voltage, 20142021 (USD Million)

Table 69 Rest of South America: By Market Size, By Voltage,20142021 (USD Million)

Table 70 New Product Developments, 20152016

Table 71 Expansions, 20142016

Table 72 Contracts & Agreements, 20122015

Table 73 Mergers & Acquisitions, 20132015

List of Figures (51 Figures)

Figure 1 Intelligent Motor Controller: Market Segmentation

Figure 2 Intelligent Motor Controller Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Assumptions of the Research Study

Figure 7 Limitations of the Research Study

Figure 8 North America Accounted for the Largest Market Share in the Intelligent Motor Controller Market in 2015

Figure 9 Oil & Gas Segment is Expected to Dominate the Market During the Forecast Period

Figure 10 Pumps Segment is Expected to Witness the Maximum Demand During the Forecast Period

Figure 11 North America is Projected to Dominate the Intelligent Motor Controller Market By 2021

Figure 12 Low Voltage Intelligent Motor Controller Market is Expected to Grow at the Highest CAGR From 2016 to 2021

Figure 13 Top Market Developments (20122015

Figure 14 Increase in Demand for Smart, Multifunctional, & Integrated Devices is Expected to Drive the Intelligent Motor Controller Market

Figure 15 Ac Motors Segment is Expected to Hold the Largest Market Share During the Forecast Period

Figure 16 Germany to Hold the Largest Share in the European Market During the Forecast Period

Figure 17 Low Voltage Segment is Projected to Hold the Largest Market Share From 20162021

Figure 18 North America to Hold the Largest Share in the Global Intelligent Motor Controller Market By 2021

Figure 19 Oil & Gas Industry is Projected to Account for the Largest Market Share During the Forecast Period

Figure 20 Intelligent Motor Controller Market: Market Segmentation

Figure 21 Rising Demand for Smart, Multifunctional, Integrated Devices for Motor Control & Protection to Drive the Intelligent Motor Controller Market

Figure 22 Global Minimum Energy Performance Standards for Motors

Figure 23 Supply Chain Analysis: Intelligent Motor Controller Market

Figure 24 Porters Five Forces Analysis: Intelligent Motor Controller Market

Figure 25 Ac Motors Segment is Expected to Dominate the Market With the Maximum Share During the Forecast Period

Figure 26 Global Snapshot: Low Voltage Segment is Expected to Dominate the Market During the Forecast Period

Figure 27 Global Snapshot: Pump Segment is Expected to Dominate the Market During the Forecast Period

Figure 28 Oil & Gas Segment Accounted for the Largest Market Share in 2015

Figure 29 Regional Snapshot (2015): Growing Markets are Emerging as New Hotspots

Figure 30 Asia-Pacific: the Fastest Growing Market, 20162021

Figure 31 Europe: Market Overview

Figure 32 North America: Market Overview

Figure 33 Companies Adopted New Product Development as the Key Growth Strategy, 20122015

Figure 34 Market Leaders Based on Developments, 20122015

Figure 35 Market Evaluation Framework, 20122015

Figure 36 Battle for Market Share: New Product Development Was the Key Strategy, 20122015

Figure 37 Regional Revenue Mix of the Top 5 Market Players

Figure 38 ABB Ltd.: Company Snapshot

Figure 39 ABB Ltd.: SWOT Analysis

Figure 40 General Electric Company: Company Snapshot

Figure 41 General Electric Company: SWOT Analysis

Figure 42 Mitsubishi Electric Corporation: Company Snapshot

Figure 43 Mitsubishi Electric Corporation: SWOT Analysis

Figure 44 Schneider Electric SE: Company Snapshot

Figure 45 Schneider Electric SE: SWOT Analysis

Figure 46 Siemens AG: Company Snapshot

Figure 47 Siemens AG: SWOT Analysis

Figure 48 Larsen & Toubro: Company Snapshot

Figure 49 Lsis Co. Ltd.: Company Snapshot

Figure 50 NXP Semiconductors: Company Snapshot

Figure 51 Rockwell Automation : Company Snapshot

Growth opportunities and latent adjacency in Intelligent Motor Controller Market