Automatic Content Recognition Market by Component, Content, Technology, Applications (Broadcast Monitoring and AD Targeting & Pricing), Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2027

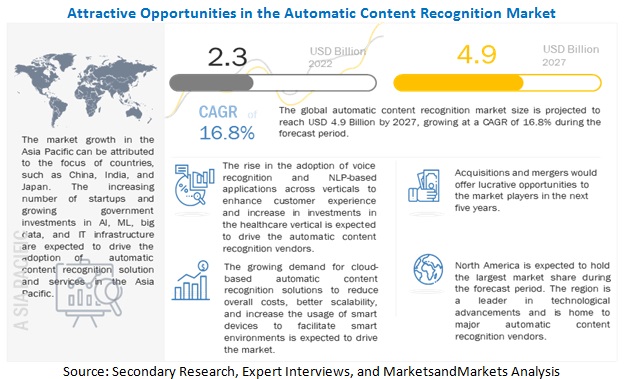

The global Automatic Content Recognition Market size is projected to reach $4.9 billion by 2027, at a CAGR of 16.8% during the forecast period. The automatic content recognition market is expected to grow at a rapid pace due to the evolution of new technologies, and adoption and scaling of digital initiatives.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

COVID–19 has globally changed the dynamics of business operations. Nevertheless, the COVID–19 outbreak has frightened light on limitations in business models across verticals, it has presented individual opportunities to digitalize and increase their business across regions as the adoption and addition of technologies such as cloud, AI, analytics, IoT, and blockchain has amplified in the lockdown period. Machine learning and data analytics have been important in the fight against COVID-19, a latest lethal pandemic. Practically all countries have employed automatic content recognition encouraged by machine learning, and AI analysis in some manner to establish the growth rate of the curve of infected individuals and the death rate caused by the pandemic.

The most complicated aspect of using automatic content recognition during COVID-19 is collecting data. This appears to be one of the typical difficult challenges that all business are currently facing.

COVID-19 is an unprecedented crisis that will impact business models and disrupt business continuity for companies around the globe. Data and technology have essentially changed the ability to combat a threat, such as the pandemic, and adopt various measures for the future. Organizations are acquiring insights into their data and businesses in new and innovative ways to make appropriate business decisions.

Market Dynamics

Driver: Rising use of smart devices and content streaming services

With the rise in the number of smart devices such as smartphones, TVs, and wearables, there has been an urgent need – both among the companies and end users – for content identification, recognition, and enhancement. This has led businesses to adopt automatic content recognition solutions and services, which has made the life hack simple in many ways. The trend was first started by Shazam with the launch of a music recognition application based on digital fingerprinting technology. Later, many companies followed the trend and launched automatic content recognition-based second screen applications for smart TVs and smartphones. The rise of on-demand video services, such as Netflix, Hotstar, Amazon Prime, and YouTube, is driving the demand for automatic content recognition solution and services.

Restraint: Data Security Concerns

The backbone of automatic content recognition solutions, data, remains an important aspect that most organizations find challenging to manage. The inadequacy of managing exabytes and petabytes of data has boosted the chances of security breaches and data losses. As IoT becomes more widespread, organizations will increasingly require more robust security and privacy to avoid breaches. The issue of security endangers the success of digitalization. In today’s competitive marketplace, marketing teams require real-time and secure data to deliver an outstanding customer experience. Organizations are gathering data through several touchpoints and measure them virtually. Such data is used in support and communication and may include a variety of data types. These data types comprise public information, big data, and small data collected from customers. With the growing number of IoT-enabled systems, the number of security and privacy issues will also increase, and every endpoint, gateway, sensor, and smartphone will become a potential target for hackers.

Opportunity: Increase in adoption of AI, ML and NLP technologies

The generation of a ample amount of data and the need to analyze it in real-time have obliged organizations to adopt new technologies, such as AI, ML, and NLP. These technologies have helped the complete process of gathering insights from data. Usually, data analysis was done through graphs and charts. To an untrained eye, the data analysis was not user-friendly, and there was a risk of misconception and poor decision-making.

Challenge: Overcoming loopholes in automatic content recognition technologies

The most popular automatic content recognition technologies, digital fingerprinting and watermarking, have a few loopholes that are major challenges for this market. The digital fingerprinting technique has a drawback where users have the ability to modify the data. However, digital watermarking has even more significant loopholes, which are a major challenge for companies using it in the automatic content recognition market. Placing the watermark in the content creates a distraction in the media file, apart from altering the properties of the original file. However, watermarking is a more secure technique as compared to fingerprinting.

North America to account for largest market size during the forecast period

North America is expected to have the largest market share in the automatic content recognition market. Key factors favoring the growth of the automatic content recognition market in North America include the increasing technological advancements in the region. The growing number of automatic content recognition players across regions is expected to further drive market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The automatic content recognition vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global automatic content recognition market include.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 2.3 Billion |

|

Revenue forecast in 2027 |

USD 4.9 Billion |

|

Growth rate |

CAGR of 16.8% |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022–2027 |

|

Segments covered |

Automatic Content Recognition Market with Covid-19 Impact Analysis, By Component, Content, Technology, Applications (Broadcast Monitoring and AD Targeting & Pricing), Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2027 |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Microsoft (US), Google (US), Digimarc (US), Apple (US), Nuance Communications (US), ArcSoft (US), ACRCloud (China), Audible Magic (US), KT Corporation (South Korea), Kudelski Group (Switzerland), Gracenote (US), VoiceInteraction (Portugal), VoiceBase (US), Vobile (US), mufin GMBH (Germany), Beatgrid Media BV (Netherlands), Clarifai (US), DataScouting (Greece), ivitec (Germany), Viscovery Pte Ltd (Taiwan), Zapr Media Labs (India), Valossa (Finland), SenseTime (China), Verbit (US), Megvii (China), and SambaTV (US). |

This research report categorizes the Automatic content recognition to forecast revenues and analyze trends in each of the following submarkets:

Based on Component, the Automatic content recognition has the following segments:

- Software

- Services

Based on Technology, the Automatic content recognition has the following segments:

- Audio and Video Watermarking

- Audio and Video Fingerprinting

- Speech Recognition

- Optical Character Recognition

- Other Technologies (ML, NLP, and computer vision)

Based on Content, the Automatic content recognition has the following segments:

- Audio

- Video

- Text

- Image

Based on Platform, the Automatic content recognition has the following segments:

- Linear TV

- Connected TV

- OTT Applications

- Other Platforms (content-sharing websites and applications, DVR, MVPDs, and VOD).

Based on Application, the Automatic content recognition has the following segments:

- Audience Segmentation & Measurement

- Broadcast Monitoring

- Advertisement Targeting & Pricing

- Content Filtering

- Other applications (content enhancement and copyright infringement detection).

Based on Deployment Mode, the Automatic content recognition has the following segments:

- Cloud

- On-premises

Based on Organization Size, the Automatic content recognition has the following segments:

- Small and Medium-Sized Enterprises

- Large Enterprises

Based on Vertical, the Automatic content recognition has the following segment

- Media & Entertainment

- Consumer Electronics

- Retail & eCommerce

- Education

- Automotive

- IT & Telecommunication

- Healthcare & Life Sciences

- Government & Defense

- Avionics

- Other Verticals (BFSI, hospitality, energy & utilities, and robotics).

Based on regions, the Automatic content recognition has the following segments:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- India

- China

- Japan

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- South Africa

- UAE

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2022, IBM acquired Neudesic, a leading US cloud services consultancy specializing primarily in the Microsoft Azure platform, along with bringing skills in multi-cloud. This acquisition will significantly expand IBM's portfolio of hybrid multi-cloud services and further advance the company's hybrid cloud and AI strategy.

- In August 2021, the partnership between Google and TCS aimed to set up Google Garages within its innovation hub in New York, Amsterdam, and Tokyo to start businesses to evaluate cloud solutions and prototype and develop applications and apply analytics and AI to address business opportunities.

- In April 2020, IBM released novel AI-powered technologies. IBM released novel AI-powered technologies to help the Health and Research Community accelerate the discovery of medical insights and treatments for COVID-19.

- In October 2019, Nuance Communications announced a new emergency medicine solution for its Dragon Medical Advisor (DMA) with integrated content from The Sullivan Group (TSG) at the American College of Emergency Physicians (ACEP) conference. This partnership helps ED physicians improve patient safety and lower liability risks.

- In July 2018, Cadence Design Systems, Inc. and ArcSoft partnered to develop ai and vision applications for Cadence Tensilica Vision dsps. beauty shot, high dynamic range (HDR), bokeh, and facial unlock applications. they have been ported to the vision p6 dsp by ArcSoft in partnership with cadence. The combined solution has been integrated into a leading global provider's applications processor and is now available in smartphones.

Frequently Asked Questions (FAQ):

What is a automatic content recognition?

Automatic content recognition (ACR) is a system that uses a content database to recognise and identify video and audio content that a user is actively engaged with. It's a technology found in cable television (CTV) and over-the-top (OTT) video streaming services. It refers to the ability to recognise and identify streaming content, down to individual objects in a video, by sampling its components and comparing them to database records. ACR-enabled devices (mostly smartphones and smart TVs) assist marketers in analysing content consumption patterns by comparing digital 'fingerprints' contained in video to provide viewing insights. For instance, ACR technology can determine whether a given ad was played on a specific device during a specific time period.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, and France in the European region.

Which are key verticals adopting automatic content recognition solutions and services?

Key verticals adopting automatic content recognition solutions and services include media & entertainment, consumer electronics, retail & eCommerce, education, automotive, IT & Telecommunication, healthcare & life sciences, government & defense, avionics and other verticals.

Who are the key vendors in the automatic content recognition market?

The key vendors in the global automatic content recognition market include IBM (US), Microsoft (US), Google (US), Digimarc (US), Apple (US), Nuance Communications (US), ArcSoft (US), ACRCloud (China), Audible Magic (US), KT Corporation (South Korea), Kudelski Group (Switzerland), Gracenote (US), VoiceInteraction (Portugal), VoiceBase (US), Vobile (US), mufin GMBH (Germany), Beatgrid Media BV (Netherlands), Clarifai (US), DataScouting (Greece), ivitec (Germany), Viscovery Pte Ltd (Taiwan), Zapr Media Labs (India), Valossa (Finland), SenseTime (China), Verbit (US), Megvii (China), and SambaTV (US) .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 AUTOMATIC CONTENT RECOGNITION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF AUTOMATIC CONTENT RECOGNITION MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/ SERVICES OF MARKET

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF AUTOMATIC CONTENT RECOGNITION THROUGH OVERALL AUTOMATIC CONTENT RECOGNITION SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

TABLE 4 IMPACT OF COVID-19

2.5 COMPANY EVALUATION MATRIX

FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 9 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR STUDY

2.8 LIMITATIONS OF STUDY

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 5 GLOBAL AUTOMATIC CONTENT RECOGNITION MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y%)

TABLE 6 GLOBAL MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y%)

FIGURE 10 SOLUTION SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

FIGURE 11 AUDIO & VIDEO FINGERPRINTING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

FIGURE 12 AUDIENCE SEGMENTATION & MEASUREMENT SEGMENT TO HOLD THE LARGEST MARKET SIZE IN 2022

FIGURE 13 VIDEO SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

FIGURE 14 CONNECTED TV SEGMENT TO HOLD LARGEST MARKET SIZE IN 2022

FIGURE 15 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE IN 2022

FIGURE 16 ON-PREMISES SEGMENT TO HOLD LARGER MARKET SIZE IN 2022

FIGURE 17 CONSUMER ELECTRONICS SEGMENT TO GROW AT HIGHEST CAGR IN 2022

FIGURE 18 ASIA PACIFIC TO BE EMERGING DOMINANT REGION IN TERMS OF MARKET SIZE IN 2022

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 AUTOMATIC CONTENT RECOGNITION MARKET OVERVIEW

FIGURE 19 RISING USE OF SMART DEVICES AND CONTENT STREAMING SERVICES TO BOOST MARKET GROWTH

4.2 MARKET: TOP THREE VERTICALS

FIGURE 20 MEDIA & ENTERTAINMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 21 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4.4 NORTH AMERICA: MARKET, BY APPLICATION AND VERTICAL

FIGURE 22 AUDIENCE SEGMENTATION & MEASUREMENT SEGMENT AND MEDIA & ENTERTAINMENT VERTICAL TO ACCOUNT FOR THE HIGHEST SHARES IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: AUTOMATIC CONTENT RECOGNITION MARKET

5.2.1 DRIVERS

5.2.1.1 Rising use of smart devices and content streaming services

5.2.1.2 Increase in deployment of automatic content recognition technologies by media & entertainment companies for audience measurement and broadcast monitoring

5.2.1.3 Increasing penetration of speech and voice recognition technology in smart appliances

5.2.1.4 Need to understand consumer behavior and the growing number of hosted automatic content recognition solution providers

5.2.2 RESTRAINTS

5.2.2.1 Huge investment in technology development keeps out small players

5.2.2.2 Data security concerns

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in adoption of AI, ML, and NLP technologies

5.2.3.2 Evolving concept of contextual advertising, contextual commerce, enhanced contextual experiences, and spoiler-proof social feeds

5.2.4 CHALLENGES

5.2.4.1 Overcoming loopholes in automatic content recognition technologies

5.2.4.2 Technological challenges and complexity of devising content recognition algorithms

5.2.4.3 Ownership and privacy of collected data

5.2.4.4 Lack of skilled workforce

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 AUTOMATIC CONTENT RECOGNITION: EVOLUTION

FIGURE 24 EVOLUTION OF AUTOMATIC CONTENT RECOGNITION

5.4 CASE STUDY ANALYSIS

5.4.1 MEDIA & ENTERTAINMENT

5.4.1.1 Case study 1: Sony TV used Zapr to engage with 2,000,000+ smartphone users

5.4.1.2 Case study 2: Endeavour Media enhanced their customer experience with Digimarc

5.4.2 IT & TELECOMMUNICATION

5.4.2.1 Case study 1: Avantive Solutions deployed VoiceBase Enterprise Accelerator to help clients automatically identify overall agent performance

5.4.3 RETAIL & ECOMMERCE

5.4.3.1 Case study 1: Britannia opted Zapr to reach out to the wider audience and generate a powerful brand impression

5.4.3.2 Case study 2: Datalogic S.p.A reduced bar code scanning time with Digimarc Solution

5.4.4 AUTOMOTIVE

5.4.4.1 Case study 1: CarDekho solved the duplication problem and reached the right audiences cost-effectively with Zapr

5.4.5 EDUCATION

5.4.5.1 Case study 1: Crafton Hills College (CHC) enhanced live captioning with Verbit to deliver quality education for disabled beings

5.4.5.2 Case study 2: University of Pittsburgh enhanced live captioning with Verbit for commencement ceremonies across 35 countries

5.4.6 HEALTHCARE & LIFE SCIENCES

5.4.6.1 Case study 1: Delta Dental selected Voice Base’s Enterprise Accelerator to streamline its call center operations

5.4.7 CONSUMER ELECTRONICS

5.4.7.1 Case Study 1: Dell bridged Offline TV with targeted engagement among young audiences

5.4.8 GOVERNMENT & DEFENSE

5.4.8.1 Case study 1: Groundwork Ohio provided accessible content to its community with Verbit’s transcription

5.5 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 25 SUPPLY/VALUE CHAIN ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.6.1 AI AND AUTOMATIC CONTENT RECOGNITION

5.6.2 MACHINE LEARNING AND AUTOMATIC CONTENT RECOGNITION

5.6.3 INTERNET OF THINGS AND AUTOMATIC CONTENT RECOGNITION

5.6.4 AUTOMATIC CONTENT RECOGNITION AND NATURAL LANGUAGE PROCESSING

5.7 PATENT ANALYSIS

5.7.1 METHODOLOGY

5.7.2 DOCUMENT TYPE

TABLE 7 PATENTS FILED, 2019–2022

5.7.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 26 ANNUAL NUMBER OF PATENTS GRANTED, 2018–2022

5.7.3.1 Top applicants

FIGURE 27 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2020–2022

5.8 AUTOMATIC CONTENT RECOGNITION ECOSYSTEM

TABLE 8 AUTOMATIC CONTENT RECOGNITION MARKET: ECOSYSTEM

5.9 PRICING MODEL ANALYSIS

TABLE 9 PRICING MODEL

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 28 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 10 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 REGULATORY IMPLICATIONS

5.11.1 GENERAL DATA PROTECTION REGULATION

5.11.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.11.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.11.4 SARBANES-OXLEY ACT OF 2002

5.11.5 SOC 2 TYPE II COMPLIANCE

5.11.6 ISO/IEC 27001

5.11.7 THE GRAMM–LEACH–BLILEY ACT

5.12 AUTOMATIC CONTENT RECOGNITION MARKET: COVID-19 IMPACT

5.13 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 11 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 TARIFF AND REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 NORTH AMERICA: TARIFFS AND REGULATIONS

5.14.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

5.14.2.2 Gramm-Leach-Bliley (GLB) Act

5.14.2.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

5.14.2.4 Federal Information Security Management Act (FISMA)

5.14.2.5 Federal Information Processing Standards (FIPS)

5.14.2.6 California Consumer Privacy Act (CSPA)

5.14.3 EUROPE: TARIFFS AND REGULATIONS

5.14.3.1 GDPR 2016/679 is a regulation in the EU

5.14.3.2 General Data Protection Regulation

5.14.3.3 European Committee for Standardization (CEN)

5.14.3.4 European Technical Standards Institute (ETSI)

5.15 KEY STAKEHOLDERS & BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE TECHNOLOGIES (%)

5.15.2 BUYING CRITERIA

TABLE 18 KEY BUYING CRITERIA FOR TOP THREE TECHNOLOGIES

6 AUTOMATIC CONTENT RECOGNITION MARKET, BY COMPONENT (Page No. - 89)

6.1 INTRODUCTION

6.1.1 COVID-19 IMPACT ON MARKET, BY COMPONENT

FIGURE 29 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 19 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 20 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.1.2 COMPONENT: MARKET DRIVERS

6.2 SOLUTION

TABLE 21 SOLUTION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 22 SOLUTION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

TABLE 23 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 SERVICES: AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1 Consulting

6.3.2.2 Deployment & integration

6.3.2.3 Support & maintenance

7 AUTOMATIC CONTENT RECOGNITION MARKET, BY TECHNOLOGY (Page No. - 96)

7.1 INTRODUCTION

7.1.1 COVID-19 IMPACT ON MARKET, BY TECHNOLOGY

FIGURE 30 AUDIO & VIDEO FINGERPRINTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 25 MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 26 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

7.1.2 TECHNOLOGY: MARKET DRIVERS

7.2 AUDIO & VIDEO FINGERPRINTING

TABLE 27 AUDIO & VIDEO FINGERPRINTING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 28 AUDIO & VIDEO FINGERPRINTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 AUDIO & VIDEO WATERMARKING

TABLE 29 AUDIO & VIDEO WATERMARKING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 30 AUDIO & VIDEO WATERMARKING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 SPEECH RECOGNITION

TABLE 31 SPEECH RECOGNITION: AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 SPEECH RECOGNITION: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 OPTICAL CHARACTER RECOGNITION

TABLE 33 OPTICAL CHARACTER RECOGNITION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 OPTICAL CHARACTER RECOGNITION: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 OTHER TECHNOLOGIES

TABLE 35 OTHER TECHNOLOGIES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 OTHER TECHNOLOGIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 AUTOMATIC CONTENT RECOGNITION MARKET, BY APPLICATION (Page No. - 105)

8.1 INTRODUCTION

8.1.1 COVID-19 IMPACT ON MARKET, BY APPLICATION

FIGURE 31 CONTENT FILTERING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 37 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 38 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.1.2 APPLICATION: MARKET DRIVERS

8.2 AUDIENCE SEGMENTATION & MEASUREMENT

TABLE 39 AUDIENCE SEGMENTATION & MEASUREMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 AUDIENCE SEGMENTATION & MEASUREMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 BROADCAST MONITORING

TABLE 41 BROADCAST MONITERING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 BROADCAST MONITERING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 ADVERTISEMENT TARGETING & PRICING

TABLE 43 ADVERTISEMENT TARGETING & PRICING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 44 ADVERTISEMENT TARGETING & PRICING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 CONTENT FILTERING

TABLE 45 CONTENT FILTERING: AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 CONTENT FILTERING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 OTHER APPLICATIONS

TABLE 47 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 AUTOMATIC CONTENT RECOGNITION MARKET, BY CONTENT (Page No. - 115)

9.1 INTRODUCTION

9.1.1 COVID-19 IMPACT ON MARKET, BY CONTENT

FIGURE 32 IMAGE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 49 MARKET, BY CONTENT, 2016–2021 (USD MILLION)

TABLE 50 MARKET, BY CONTENT, 2022–2027 (USD MILLION)

9.1.2 CONTENT: MARKET DRIVERS

9.2 AUDIO

TABLE 51 AUDIO: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 AUDIO: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 VIDEO

TABLE 53 VIDEO: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 VIDEO: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 TEXT

TABLE 55 TEXT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 56 TEXT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 IMAGE

TABLE 57 IMAGE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 IMAGE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 AUTOMATIC CONTENT RECOGNITION MARKET, BY DEPLOYMENT MODE (Page No. - 122)

10.1 INTRODUCTION

10.1.1 COVID-19 IMPACT ON MARKET, BY DEPLOYMENT MODE

FIGURE 33 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 59 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 60 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

10.1.2 DEPLOYMENT MODE: MARKET DRIVERS

10.2 ON-PREMISES

TABLE 61 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 62 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 CLOUD

TABLE 63 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 64 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 AUTOMATIC CONTENT RECOGNITION MARKET, BY ORGANIZATION SIZE (Page No. - 127)

11.1 INTRODUCTION

11.1.1 COVID-19 IMPACT ON MARKET, BY ORGANIZATION SIZE

FIGURE 34 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 65 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 66 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

11.1.2 ORGANIZATIONS SIZE: MARKET DRIVERS

11.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 67 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 68 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 LARGE ENTERPRISES

TABLE 69 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 70 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 AUTOMATIC CONTENT RECOGNITION MARKET, BY PLATFORM (Page No. - 133)

12.1 INTRODUCTION

12.1.1 COVID-19 IMPACT ON MARKET, BY PLATFORM

FIGURE 35 OTT APPLICATIONS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 71 MARKET, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 72 MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.1.2 PLATFORM: MARKET DRIVERS

12.2 LINEAR TV

TABLE 73 LINEAR TV: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 74 LINEAR TV: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 CONNECTED TV

TABLE 75 CONNECTED TV: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 76 CONNECTED TV: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.4 OTT APPLICATIONS

TABLE 77 OTT APPLICATIONS: AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 78 OTT APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.5 OTHER PLATFORMS

TABLE 79 OTHER PLATFORMS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 80 OTHER PLATFORMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

13 AUTOMATIC CONTENT RECOGNITION MARKET, BY VERTICAL (Page No. - 140)

13.1 INTRODUCTION

13.1.1 COVID-19 IMPACT ON MARKET, BY INDUSTRY VERTICAL

FIGURE 36 CONSUMER ELECTRONICS INDUSTRY VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 81 MARKET, BY INDUSTRY VERTICAL, 2016–2021 (USD MILLION)

TABLE 82 MARKET, BY INDUSTRY VERTICAL, 2022–2027 (USD MILLION)

13.1.2 VERTICAL: MARKET DRIVERS

13.2 MEDIA & ENTERTAINMENT

TABLE 83 MEDIA & ENTERTAINMENT: USE CASES

TABLE 84 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 85 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 CONSUMER ELECTRONICS

TABLE 86 CONSUMER ELECTRONICS: USE CASES

TABLE 87 CONSUMER ELECTRONICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 88 CONSUMER ELECTRONICS: AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

13.4 RETAIL & ECOMMERCE

TABLE 89 RETAIL & ECOMMERCE: USE CASES

TABLE 90 RETAIL & ECOMMERCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 91 RETAIL & ECOMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

13.5 EDUCATION

TABLE 92 EDUCATION: USE CASES

TABLE 93 EDUCATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 94 EDUCATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

13.6 AUTOMOTIVE

TABLE 95 AUTOMOTIVE: USE CASES

TABLE 96 AUTOMOTIVE: AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 97 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

13.7 IT & TELECOMMUNICATION

TABLE 98 IT & TELECOMMUNICATION: USE CASES

TABLE 99 IT & TELECOMMUNICATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 100 IT & TELECOMMUNICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

13.8 HEALTHCARE & LIFE SCIENCES

TABLE 101 HEALTHCARE & LIFESCIENCES: USE CASES

TABLE 102 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 103 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

13.9 GOVERNMENT & DEFENSE

TABLE 104 GOVERNMENT & DEFENSE: USE CASES

TABLE 105 GOVERNMENT & DEFENSE: AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 106 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

13.10 AVIONICS

TABLE 107 AVIONICS: USE CASES

TABLE 108 AVIONICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 109 AVIONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

13.11 OTHER VERTICALS

TABLE 110 OTHER INDUSTRY VERTICALS: USE CASES

TABLE 111 OTHER INDUSTRY VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 112 OTHER INDUSTRY VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

14 AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION (Page No. - 158)

14.1 INTRODUCTION

FIGURE 37 CHINA TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 38 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

14.1.1 COVID-19 IMPACT ON MARKET, BY REGION

TABLE 113 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 114 MARKET, BY REGION, 2022–2027 (USD MILLION)

14.2 NORTH AMERICA

14.2.1 NORTH AMERICA: AUTOMATIC CONTENT RECOGNITION MARKET DRIVERS

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

TABLE 115 NORTH AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET, BY CONTENT, 2016–2021 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET, BY CONTENT, 2022–2027 (USD MILLION)

TABLE 123 NORTH AMERICA: AUTOMATIC CONTENT RECOGNITION MARKET, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 124 NORTH AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 127 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 128 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 130 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 131 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 132 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.2.2 UNITED STATES

14.2.2.1 Presence of tech giants and increased use of the internet to drive market growth

14.2.3 CANADA

14.2.3.1 Startup ecosystem and transformation into data-driven organizations to drive market growth

14.3 EUROPE

14.3.1 EUROPE: AUTOMATIC CONTENT RECOGNITION MARKET DRIVERS

TABLE 133 EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 134 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 135 EUROPE: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 136 EUROPE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 137 EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 138 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 139 EUROPE: MARKET, BY CONTENT, 2016–2021 (USD MILLION)

TABLE 140 EUROPE: MARKET, BY CONTENT, 2022–2027 (USD MILLION)

TABLE 141 EUROPE: AUTOMATIC CONTENT RECOGNITION MARKET, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 142 EUROPE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 143 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 144 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 145 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 146 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 147 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 148 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 149 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 150 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.3.2 UNITED KINGDOM

14.3.2.1 Advanced IT infrastructure and continued transition toward intelligence services to drive market growth

14.3.3 GERMANY

14.3.3.1 Government initiatives for technological developments in the manufacturing vertical to drive solutions’ growth

14.3.4 FRANCE

14.3.4.1 Heavy R&D investments, digitalization, and stronghold of retail and manufacturing verticals to drive market growth

14.3.5 REST OF EUROPE

14.4 ASIA PACIFIC

14.4.1 ASIA PACIFIC: AUTOMATIC CONTENT RECOGNITION MARKET DRIVERS

FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 151 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY CONTENT, 2016–2021 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY CONTENT, 2022–2027 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 160 ASIA PACIFIC: AUTOMATIC CONTENT RECOGNITION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.4.2 CHINA

14.4.2.1 Automatic content recognition services for driving policy support and technological investments to fuel market growth

14.4.3 JAPAN

14.4.3.1 Rise of innovative technologies and collaboration between governments and businesses to boost market growth

14.4.4 INDIA

14.4.4.1 Local entrepreneurs with shift in technologies to provide support to Indian companies in the automatic content recognition market

14.4.5 REST OF ASIA PACIFIC

14.5 MIDDLE EAST & AFRICA

14.5.1 MIDDLE EAST & AFRICA: AUTOMATIC CONTENT RECOGNITION MARKET DRIVERS

TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY CONTENT, 2016–2021 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY CONTENT, 2022–2027 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 179 MIDDLE EAST & AFRICA: AUTOMATIC CONTENT RECOGNITION MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.5.2 UNITED ARAB EMIRATES

14.5.2.1 New investments, strategies, and products to drive automatic content recognition solutions’ adoption

14.5.3 KINGDOM OF SAUDI ARABIA

14.5.3.1 Growing need for delivering actionable insights to boost the growth of the automatic content recognition market

14.5.4 SOUTH AFRICA

14.5.4.1 Growing digitalization in countries to offer opportunities for deploying automatic content recognition

14.5.5 REST OF MIDDLE EAST & AFRICA

14.5.5.1 Increase in globalization to offer opportunities to deploy automatic content recognition solutions in the rest of the Middle East & Africa

14.6 LATIN AMERICA

14.6.1 LATIN AMERICA: AUTOMATIC CONTENT RECOGNITION MARKET DRIVERS

TABLE 187 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY CONTENT, 2016–2021 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY CONTENT, 2022–2027 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 198 LATIN AMERICA: AUTOMATIC CONTENT RECOGNITION MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.6.2 BRAZIL

14.6.2.1 Increased use of internet, technologies, and government organizations to increase demand in Brazil

14.6.3 MEXICO

14.6.3.1 Increasing trade, rising customer base, and government initiatives to fuel the growth of automatic content recognition

14.6.4 REST OF LATIN AMERICA

15 COMPETITIVE LANDSCAPE (Page No. - 209)

15.1 OVERVIEW

15.2 KEY PLAYER STRATEGIES

TABLE 205 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN AUTOMATIC CONTENT RECOGNITION MARKET

15.3 REVENUE ANALYSIS

FIGURE 41 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST FIVE YEARS

15.4 MARKET SHARE ANALYSIS

FIGURE 42 MARKET SHARE ANALYSIS

TABLE 206 MARKET: DEGREE OF COMPETITION

15.5 COMPANY EVALUATION QUADRANT

15.5.1 STARS

15.5.2 EMERGING LEADERS

15.5.3 PERVASIVE PLAYERS

15.5.4 PARTICIPANTS

FIGURE 43 KEY AUTOMATIC CONTENT RECOGNITION MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

TABLE 207 COMPANY COMPONENT FOOTPRINT

TABLE 208 COMPANY REGION FOOTPRINT

15.6 STARTUP/SME EVALUATION QUADRANT

15.6.1 PROGRESSIVE COMPANIES

15.6.2 RESPONSIVE COMPANIES

15.6.3 DYNAMIC COMPANIES

15.6.4 STARTING BLOCKS

FIGURE 44 STARTUP/SMES: AUTOMATIC CONTENT RECOGNITION MARKET EVALUATION MATRIX, 2021

15.7 COMPETITIVE BENCHMARKING

TABLE 209 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 210 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

15.8 COMPETITIVE SCENARIO

15.8.1 PRODUCT LAUNCHES

TABLE 211 PRODUCT LAUNCHES, MAY 2018–NOVEMBER 2021

15.8.2 DEALS

TABLE 212 DEALS, JULY 2018-FEBRUARY 2022

16 COMPANY PROFILES (Page No. - 225)

16.1 INTRODUCTION

(Business Overview, Products, Solutions & Services, Recent Developments, MnM View)*

16.2 MAJOR PLAYERS

16.2.1 IBM

TABLE 213 IBM: BUSINESS OVERVIEW

FIGURE 45 IBM: COMPANY SNAPSHOT

TABLE 214 IBM: PRODUCTS OFFERED

TABLE 215 IBM: SERVICES OFFERED

TABLE 216 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 217 IBM: DEALS

16.2.2 DIGIMARC

TABLE 218 DIGIMARC: BUSINESS OVERVIEW

FIGURE 46 DIGIMARC: COMPANY SNAPSHOT

TABLE 219 DIGIMARC: PRODUCTS OFFERED

TABLE 220 DIGIMARC: SERVICES OFFERED

TABLE 221 DIGIMARC: DEALS

16.2.3 GOOGLE

TABLE 222 GOOGLE: BUSINESS OVERVIEW

FIGURE 47 GOOGLE: COMPANY SNAPSHOT

TABLE 223 GOOGLE: PRODUCTS OFFERED

TABLE 224 GOOGLE: SERVICES OFFERED

TABLE 225 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 226 GOOGLE: DEALS

16.2.4 MICROSOFT

TABLE 227 MICROSOFT: BUSINESS OVERVIEW

FIGURE 48 MICROSOFT: COMPANY SNAPSHOT

TABLE 228 MICROSOFT: PRODUCTS OFFERED

TABLE 229 MICROSOFT: SERVICES OFFERED

TABLE 230 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 231 MICROSOFT: DEALS

16.2.5 APPLE

TABLE 232 APPLE: BUSINESS OVERVIEW

FIGURE 49 APPLE: COMPANY SNAPSHOT

TABLE 233 APPLE: PRODUCTS OFFERED

TABLE 234 APPLE: DEALS

16.3 OTHER PLAYERS

16.3.1 NUANCE COMMUNICATIONS

TABLE 235 NUANCE COMMUNICATIONS: BUSINESS OVERVIEW

TABLE 236 NUANCE COMMUNICATIONS: PRODUCTS OFFERED

TABLE 237 NUANCE COMMUNICATIONS: SERVICES OFFERED

TABLE 238 NUANCE COMMUNICATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 239 NUANCE COMMUNICATIONS: DEALS

16.3.2 ARCSOFT

TABLE 240 ARCSOFT: BUSINESS OVERVIEW

TABLE 241 ARCSOFT: PRODUCTS OFFERED

TABLE 242 ARCSOFT: DEALS

16.3.3 AUDIBLE MAGIC

TABLE 243 AUDIBLE MAGIC: BUSINESS OVERVIEW

TABLE 244 AUDIBLE MAGIC: PRODUCTS OFFERED

TABLE 245 AUDIBLE MAGIC: SERVICES OFFERED

TABLE 246 AUDIBLE MAGIC: DEALS

16.3.4 ACRCLOUD

TABLE 247 ACRCLOUD: BUSINESS OVERVIEW

TABLE 248 ACRCLOUD: SERVICES OFFERED

TABLE 249 ACRCLOUD: DEALS

16.3.5 KT CORPORATION

TABLE 250 KT CORPORATION: BUSINESS OVERVIEW

TABLE 251 KT CORPORATION: SERVICES OFFERED

TABLE 252 KT CORPORATION: DEALS

16.3.6 KUDELSKI GROUP

TABLE 253 KUDELSKI GROUP: BUSINESS OVERVIEW

TABLE 254 KUDELSKI GROUP: PRODUCTS OFFERED

TABLE 255 KUDELSKI GROUP: SERVICES OFFERED

TABLE 256 KUDELSKI GROUP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 257 KUDELSKI GROUP: DEALS

16.3.7 GRACENOTE

TABLE 258 GRACENOTE: BUSINESS OVERVIEW

TABLE 259 GRACENOTE: PRODUCTS OFFERED

TABLE 260 GRACENOTE: SERVICES OFFERED

TABLE 261 GRACENOTE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 262 GRACENOTE: DEALS

16.3.8 VOICEINTERACTION

TABLE 263 VOICEINTERACTION: BUSINESS OVERVIEW

TABLE 264 VOICEINTERACTION: PRODUCTS OFFERED

TABLE 265 VOICEINTERACTION: SERVICES OFFERED

TABLE 266 VOICEINTERACTION: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 267 VOICEINTERACTION: DEALS

16.3.9 VOBILE

TABLE 268 VOBILE: BUSINESS OVERVIEW

TABLE 269 VOBILE: PRODUCTS OFFERED

TABLE 270 VOBILE: SERVICES OFFERED

TABLE 271 VOBILE: DEALS

16.3.10 VOICEBASE

TABLE 272 VOICEBASE: BUSINESS OVERVIEW

TABLE 273 VOICEBASE: PRODUCTS OFFERED

TABLE 274 VOICEBASE: SERVICES OFFERED

TABLE 275 VOICEBASE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 276 VOICEBASE: DEALS

16.3.11 MUFIN GMBH

TABLE 277 MUFIN GMBH: BUSINESS OVERVIEW

TABLE 278 MUFIN GMBH: PRODUCTS OFFERED

TABLE 279 MUFIN GMBH: SERVICES OFFERED

*Details on Business Overview, Products, Solutions & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

16.4 SMES AND STARTUPS

16.4.1 BEATGRID MEDIA B.V.

16.4.2 CLARIFAI

16.4.3 DATASCOUTING

16.4.4 IVITEC

16.4.5 VISCOVERY PTE LTD

16.4.6 ZAPR MEDIA LABS

16.4.7 VALOSSA

16.4.8 SENSETIME

16.4.9 VERBIT

16.4.10 MEGVII

16.4.11 SAMBATV

17 ADJACENT AND RELATED MARKETS (Page No. - 287)

17.1 INTRODUCTION

17.2 NATURAL LANGUAGE PROCESSING MARKET— GLOBAL FORECAST TO 2026

17.2.1 MARKET DEFINITION

17.2.2 MARKET OVERVIEW

17.2.3 NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT

TABLE 280 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 281 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

17.2.4 NATURAL LANGUAGE PROCESSING MARKET, BY SOLUTION TYPE

TABLE 282 SOLUTIONS: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY SOLUTION TYPE, 2015–2019 (USD MILLION)

TABLE 283 SOLUTIONS: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY SOLUTION TYPE, 2019–2026 (USD MILLION)

17.2.5 NATURAL LANGUAGE PROCESSING MARKET, BY DEPLOYMENT MODE

TABLE 284 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 285 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

17.2.6 NATURAL LANGUAGE PROCESSING MARKET, BY ORGANIZATION SIZE

TABLE 286 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 287 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

17.2.7 NATURAL LANGUAGE PROCESSING MARKET, BY TYPE

TABLE 288 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 289 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

17.2.8 NATURAL LANGUAGE PROCESSING MARKET, BY APPLICATION

TABLE 290 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 291 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

17.2.9 NATURAL LANGUAGE PROCESSING MARKET, BY VERTICAL

TABLE 292 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 293 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

17.2.10 NATURAL LANGUAGE PROCESSING MARKET, BY REGION

TABLE 294 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 295 NATURAL LANGUAGE PROCESSING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 296 NORTH AMERICA: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 297 NORTH AMERICA: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 298 EUROPE: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 299 EUROPE: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 300 ASIA PACIFIC: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 301 ASIA PACIFIC: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 302 MIDDLE EAST AND AFRICA: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 303 MIDDLE EAST AND AFRICA: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 304 LATIN AMERICA: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 305 LATIN AMERICA: NATURAL LANGUAGE PROCESSING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

17.3 ENTERPRISE CONTENT MANAGEMENT MARKET - GLOBAL FORECAST TO 2025

17.3.1 MARKET DEFINITION

17.3.2 MARKET OVERVIEW

TABLE 306 GLOBAL ENTERPRISE CONTENT MANAGEMENT MARKET SIZE AND GROWTH RATE, 2018–2025 (USD MILLION, Y-O-Y%)

17.3.3 ENTERPRISE CONTENT MANAGEMENT MARKET, BY COMPONENT

TABLE 307 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

17.3.4 ENTERPRISE CONTENT MANAGEMENT MARKET, BY DEPLOYMENT MODE

TABLE 308 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

17.3.5 ENTERPRISE CONTENT MANAGEMENT MARKET, BY ORGANIZATION SIZE

TABLE 309 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

17.3.6 ENTERPRISE CONTENT MANAGEMENT MARKET, BY BUSINESS FUNCTION

TABLE 310 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

17.3.7 ENTERPRISE CONTENT MANAGEMENT MARKET, BY VERTICAL

TABLE 311 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

17.3.8 ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION

TABLE 312 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

18 APPENDIX (Page No. - 304)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATIONS

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

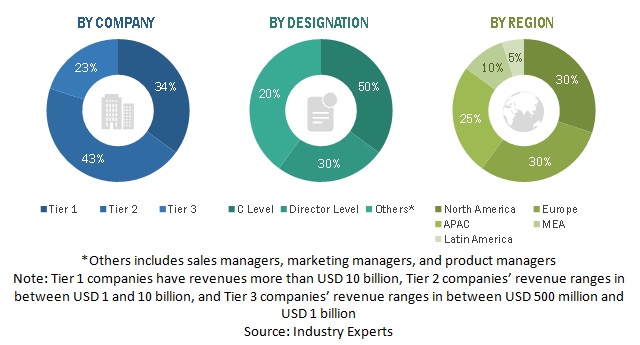

The research study for the Automatic content recognition report involved the use of extensive secondary sources, directories, as well as several journals and magazines, to identify and collect information that is useful for this technical and market-oriented study. During the production cycle of the report, in-depth interviews were conducted with various primary respondents, including key opinion leaders, subject-matter experts, high-level executives of various companies offering Automatic content recognition and services, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of Automatic content recognition vendors; white papers, certified publications, and articles from recognized industry associations; statistics bureaus; and government publishing sources. The secondary research was carried out to obtain key information about the industry’s value and supply chain, the total pool of key players, market classifications, and segmentations from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the Automatic content recognition ecosystem were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives of various vendors providing Automatic content recognition, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global Automatic content recognition and estimate the size of various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players in the market were identified through secondary research and their revenue contributions in the respective regions were determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data was consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the automatic content recognition market by component, technology, application, content, platform, deployment mode, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the automatic content recognition market

- To forecast the market size of five main regions: namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the automatic content recognition market

- To profile the key market players and provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as acquisitions; expansions; new product launches and product enhancements; agreements, collaborations, and partnerships; and R&D activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automatic Content Recognition Market

Understand the market dynamics of the mACR market of TVs in North America.