Automated Parking System Market by Automation Level (Semi-Automated, Fully-Automated), End-User (Commercial, Residential, Mixed-use), System (Hardware, Software), Platform , Design Model, Parking Level, Region - Global Forecast to 2027

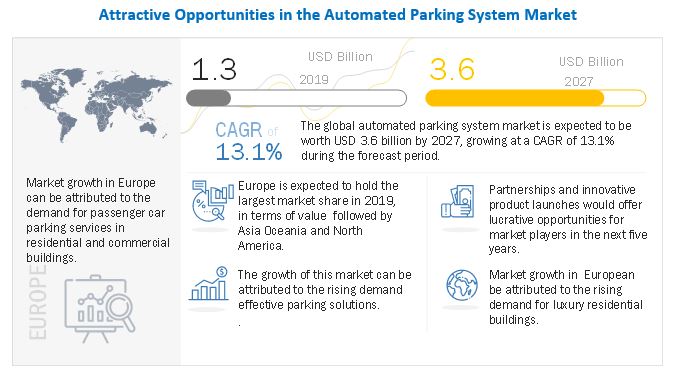

The global automated parking system market was estimated to be worth USD 1.3 billion in 2019 and is projected to reach USD 3.6 billion by 2027, growing at a CAGR of 13.1% from 2019 to 2027. The key drivers for the market are the increasing number of vehicles, scarcity of land for parking, rising urbanization, growing demand for green & sustainable parking solutions, increasing demand for luxury buildings, and smart cities initiatives from the government.

To know about the assumptions considered for the study, Request for Free Sample Report

The COVID 19 pandemic has affected business across industruies, the crisis has long lasting impact on urban mobility. The sales of the car were collapsed in quarantine areas. the car parking industry has been also witnessed the affects by this pandemic . There were sharp decline in the demand of parking systems. There has been reduction commute due to lockdowns as well as fear of spreading the virus. The pandemic has affected all form of transport from public and cars, thus the automated parking market is estimated to witness a dip in 2020.

Driver: Demand for green and sustainable parking solutions

The increasing volume of emission in the automotive industry is one of the key factors responsible for global warming and climate change. Automotive emission contributes a significant share of the total emission in key automotive markets such as China, India, and the US. Many government bodies are taking several initiatives to control automotive emission. For instance, in 2009, the European Union and the G8 nations announced a plan to reduce CO2 emissions by at least 80% by 2050. China and the US gave a joint statement to sign the Paris Climate Agreement on 1st April 2016. The agreement aims to control the global climate change. Hence, the focus of the industry has shifted toward the development of ecofriendly solutions.

The time spent in finding parking space while parking a car results in wastage of fuel and increased emission. According to a report published by the British Parking Association (BPA) in 2017, on an average, the UK citizen spends 90.5 hours searching parking spaces each year. This causes wastage of fuel, time, and increased emission, which can be reduced with the help of an automated parking system. Automated parking helps to reduce emission, energy consumption, and construction footprint. Moreover, the automated parking system increases efficiency and can park more vehicles in less space as compared with a conventional parking system. Solutions such as solar-based automated parking and parking spaces with electric vehicle charging points can help provide green and sustainable solutions.

Restriant : High complexity of the system and issues with quality control

The construction of an automated parking system is complex and requires deliberation of many factors. The automated parking system is built with an amalgamation of hardware and software systems. Failure of any one system can cause the failure of the whole system. In some cases, the wrong car was delivered to the driver from the automated parking system. Along with dependency on software and hardware systems, the availability of space plays a vital role in the construction of an automated parking system. Safety is another key issue in an automated parking system. A car can be damaged while moving from one space to another in an automated parking system. Many companies are focusing on research and development to overcome safety concerns and provide comprehensive software and hardware solutions for automated parking systems.

In the absence of regulations to monitor the working of an automated parking system, the issue of quality control also poses a challenge for manufacturers. Besides, high initial investment is needed for a high-caliber automated parking system. Many construction companies eventually consider automation of the parking system, but they opt for a cheaper low-capacity system rather than a more expensive custom-designed higher capacity system. Hence, authorities must mandate and regulate the quality of the automated parking system.

Opportunity: Initiative of developing ‘Smart Cities’

The initiative of developing smart cities worldwide has influenced the transformation of urban areas. This initiative has resulted in the adoption of IoT-based technology to improve facilities such as transportation and mobility. Among other things, the smart city initiatives adopted by governments across the globe have created business opportunities for smart parking solutions such as automated parking system. Smart cities feature parking management systems that are flexible, easy-to-manage, and space-efficient. Xerox Corporation (US) developed a smart grid for the city of Los Angeles that assists drivers with parking. The Xerox smart grid enables a driver to locate a parking space via a smartphone application. Once parked, the parking sensors installed in the parking bay register the space as occupied. The driver pays for the parking on the parking meter. The time on the parking meter can be further increased and paid for using the same mobile phone application. The parking rates adjust every few months depending on the usage of the parking space. A similar sensor grid for parking has been installed in Oslo, Norway. In Barcelona, there are sensors embedded in the city's streets to alert users about spaces where they can find open parking spots. This system reduces traffic and helps the environment. With fewer cars circling the city's streets, there are lower carbon dioxide emissions. Similarly, SF Park, San Francisco’s system of managing parking program, introduced parking meters that change prices according to the location and reduce the time and fuel wasted by drivers searching for parking.

Challenge: High capital requirement

The automated parking system is comparatively more efficient, sustainable, and eco-friendly vis-a-vis a traditional parking system. However, the initial cost of construction is high. Due to the high cost involved, several companies do not prefer automated parking system and prioritize profits over user experience. Moreover, commercial automated parking facilities can become financially unviable when users park elsewhere on the streets to save parking charges and delay in parking operation. Such cases can be observed in developing countries such as India, Brazil, and Thailand.

The capital requirements for sustainable growth of automated parking system in the industry are high as compared with a conventional parking lot that requires up to 30–40% less cost per parking space. The construction of an underground automated parking system requires around 30% more cost than above the ground automated parking system. However, the cost of an automated parking system per parking space goes down significantly when constructing a large number of parking spaces (more than 200). Such an automated parking system can be developed for private consumers such as luxury residential buildings, hotels, and commercial complexes. However, the hourly parking rates are not yet at a level where the high cost of automation is justified for public use. Hence, for the sustainable use of automated parking system, the company should develop new products and intelligent software solutions to decrease its overall cost and increase its efficiency

To know about the assumptions considered for the study, download the pdf brochure

The fully automated parking system is estimated to account for the largest market size of the automated parking system market in 2019

A fully automated parking system can park and retrieve a car from the parking garage automatically. The high demand for comfort and convenience from consumers, increasing number of luxury projects, and rising adoption of a fully automated parking system by construction companies is driving the fully automated parking system market. The fully automated parking system has increased capacity, high efficiency, reduced emission, and increased safety and convenience.

The non-palleted segment is projected to grow the fastest in automated parking system, by platform type

Non-palleted automated parking system uses lifts, transfer vehicles, and robots to park and retrieve the car in the parking garage. Unlike a palleted system that generally requires two systems to handle the pallet and cars, a non-palleted system requires only one system to handle the car. According to primary insights, a non-palleted automated parking system can reduce cycle time up to 30–35%.

Europe is estimated to be the largest in the automated parking system market

The adoption of an automated parking system is high in the UK, Germany, Denmark, Norway, Switzerland, Spain, and the Netherlands. Rising adoption of automated parking system is expected to enhance parking solutions, save space, and reduce vehicle emission while parking the car. Europe has a state of art technology background and has a presence of leading players of the automated parking solutions. This has further encouraged private and public sectors to adopt automated parking solutions for managing parking problems effectively.

A key factor restraining the growth of the automated parking system are high complexity of the system, issues with quality control, and high capital requirement. The construction of an automated parking system is complex and requires deliberation of many factors. In the absence of regulations to monitor the working of an automated parking system, the issue of quality control also poses a challenge for manufacturers. Besides, the high initial investment is needed for a high-caliber automated parking system. Hence, authorities must mandate and regulate the quality of the automated parking system.

Key market players

The automated parking system market is dominated by a few global players and comprises several regional players. Some of the key manufacturers operating in the market are Wohr (Germany), Klaus Multi Parking (Germany), CityLift (the US), Westfalia (Germany), Robotic Parking Systems Inc. (US), and Unitronics (Israel).

Key Projects

|

Company Name |

Project Location |

Automation Level |

Application Type |

Number of Levels |

No. of Parking Slots |

|

Robotics Parking System Inc. |

Al Jahra Court Complex, Kuwait |

Fully Automated |

Mixed-use |

11 |

2,314 |

|

Robotics Parking System Inc. |

Emirates Financial Towers (EFT), Dubai |

Fully Automated |

Commercial |

9 |

1,200 |

|

Westfalia Parking |

Conrad Hotel & Office Tower, Dubai |

Fully Automated |

Mixed-use |

12 |

1,053 |

|

Robotics Parking System Inc. |

Ibn Battuta Gate, Dubai |

Fully Automated |

Mixed-use |

7 |

768 |

|

Unitronics |

8200 Washington Ave, Houston, Texas, the US |

Fully Automated |

Mixed-use |

11 |

664 |

|

Westfalia Parking |

Leifsgade, Copenhagen, Denmark |

Fully Automated |

Mixed-use |

4 |

408 |

|

Unitronics |

Park+Garden, 1450 Garden St, Hoboken, New Jersey, the US |

Fully Automated |

Mixed-use |

6 |

373 |

|

Unitronics |

1508 Coney Island Ave, Brooklyn, New York, the US |

Fully Automated |

Mixed-use |

2 |

264 |

|

Wohr |

Gran Via48, Madrid, Spain |

Fully Automated |

Commercial |

8 |

320 |

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Value (USD million) and Volume (000’ parking spaces) |

|

Segments covered |

Automation level, system type, end-user type, platform type, design model type, parking level, and region |

|

Geographies covered |

North America, Asia Oceania, Europe, Middle East, and RoW |

|

Companies covered |

Wohr (Germany), Klaus Multiparking (Germany), CityLift (the US), Robotics Parking System Inc. (the US), Westfalia (Germany), and Unitronics (Israel). |

This research report categorizes the automated parking system based on type, technology, vehicle class, dimension type, vehicle type, and region.

Market, By Automation Level

- Semi-automated

- Fully-automated

Market, By System Type

- Hardware

- Software

Market, By End-User

- Commercial

- Residential

- Mixed-use

Market, By Design Model

- Hydraulic

- Electro-mechanical

Market, By Platform Type

- Palleted

- Non-palleted

Market, by Parking Level

- Less than Level 5

- Level 5-Level 10

- More than Level 15

Market, By Region

- Asia Oceania

- Europe

- Middle East

- North America

- Rest of the World

Frequently Asked Questions (FAQ):

How big is the automated parking system market?

The automated parking system market is estimated to be $1.3 billion in 2019 and is projected to reach $3.6 billion by 2027, at a CAGR of 13.1% from 2019 to 2027.

Which regions are considered in the report?

The report includes European countries such as:

- Asia Oceania

- Europe

- Middle East

- North America

- Rest of the World (RoW)

We are interested in regional automated parking market different end use type? Does this report cover market size for commercial use?

Yes, automated parking market for different end use types (commercial, residential, and mixed-use) are covered at regional level.

Does this report contain market size of automated parking solutions for semi-automated and fully automated parking system?

Yes, market size of automated parking is extensively covered in both value and volume across different automation level (semi-automated and fully automated).

Does this report contain market size of automated parking solutions for hardware and software system?

Yes, the report covers market size for hardware and software automated parking system in terms of value. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Automated Parking System Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Top-Down Approach

2.5 Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Automated Parking System Market

4.2 Market, By Region

4.3 Market, By Level of Automation

4.4 Market, By End-User Type

4.5 Market, By Platform Type

4.6 Market, By System Type

5 Automated Parking System Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Demand for Green and Sustainable Parking Solutions

5.2.1.2 Hours Spent Searching for Parking in Germany

5.2.1.3 Growth in Infrastructure Due to Rising Urbanization

5.2.1.4 Global Urban vs. Rural Population, 2018–2050 (%)

5.2.2 Restraint

5.2.2.1 High Complexity of the System and Issues With Quality Control

5.2.3 Opportunities

5.2.3.1 Initiative of Developing ‘Smart Cities’

5.2.3.2 Increasing Demand From Luxury Residential Buildings

5.2.4 Challenges

5.2.4.1 High Capital Requirement

6 Industry Trends (Page No. - 45)

6.1 Value Chain Analysis

6.2 Macro Indicator Analysis

6.2.1 Introduction

6.2.2 Macro Indicators Influencing the Automated Parking System Market for Top 3 Countries

6.2.2.1 US

6.2.2.2 Germany

6.2.2.3 China

6.3 Porter’s 5 Forces Analysis

6.4 Ev Charging Points in Automated Parking System

6.5 Case Study: Financial Risk Associated With Market

7 Automated Parking System Market, By Automation Level (Page No. - 53)

7.1 Introduction

7.2 Research Methodology

7.3 Fully Automated

7.3.1 Growing Acceptance of Fully Automated Parking System in Europe to Boost the Market in the Region

7.4 Semi-Automated

7.4.1 Lower Cost Than A Fully Automated Parking System and Higher Efficiency Than Conventional Parking System Would Drive the Market for Semi-Automated Parking System

7.5 Key Industry Insights

8 Automated Parking System Market, By Platform Type (Page No. - 59)

8.1 Introduction

8.2 Research Methodology

8.3 Palleted

8.3.1 Asia Oceania is Projeted to Be the Fastest Growing Market

8.4 Non-Palleted

8.4.1 Europe is Estimated to Be the Largest Market

8.5 Key Industry Insights

9 Automated Parking System Market, By End-User Type (Page No. - 64)

9.1 Introduction

9.2 Research Methodology

9.3 Residential

9.3.1 Growing Number of High-Rise and Luxury Residential Buildings to Drive the Asia Oceania Market

9.4 Commercial

9.4.1 Government Support to Drive the European Market

9.5 Mixed-Use

9.5.1 Growing Number of Mixed-Use Facilities Across the Globe to Drive the Market

9.6 Key Industry Insights

10 Automated Parking System Market, By Design Model Type (Page No. - 70)

10.1 Introduction

10.2 Research Methodology

10.3 Hydraulic

10.4 Electro-Mechanical

10.5 Key Industry Insights

11 Automated Parking System Market, By System Type (Page No. - 73)

11.1 Introduction

11.2 Research Methodology

11.3 Hardware

11.3.1 Europe is Estimated to Lead the Market

11.4 Software

11.4.1 Demand for Parking Management System Safety and Security to Drive the Software Market

11.5 Key Indsutry Insights

12 Automated Parking System Market, By Parking Level (Page No. - 78)

12.1 Introduction

12.2 Research Methodology

12.3 Less Than Level 5

12.4 Level 5–Level 10

12.5 More Than Level 10

12.6 Key Industry Insights

13 Automated Parking System Market, By Structure Type (Page No. - 82)

13.1 Introduction

13.2 AGV System

13.3 Silo System

13.4 Tower System

13.5 Rail Guided Cart (RGC) System

13.6 Puzzle System

13.7 Shuttle System

14 Automated Parking System Market, By Region (Page No. - 84)

14.1 Introduction

14.2 Asia Oceania

14.2.1 China

14.2.2 Japan

14.2.3 India

14.2.4 South Korea

14.3 Europe

14.3.1 Germany

14.3.2 Spain

14.3.3 Switzerland

14.3.4 UK

14.3.5 Norway

14.3.6 The Netherlands

14.3.7 Denmark

14.4 Middle East

14.4.1 Kuwait

14.4.2 Israel

14.4.3 UAE

14.5 North America

14.5.1 US

14.5.2 Mexico

14.5.3 Canada

14.6 RoW

14.6.1 Brazil

14.6.2 South Africa

15 Competitive Landscape (Page No. - 104)

15.1 Overview

15.2 Details of Key Automated Parking Projects

15.3 Competitive Leadership Mapping

15.3.1 Visionary Leaders

15.3.2 Innovators

15.3.3 Dynamic Differentiators

15.3.4 Emerging Companies

15.4 Strength of Product Portfolio

15.5 Business Strategy Excellence

16 Company Profiles (Page No. - 109)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

16.1 Skyline Parking

16.2 Westfalia Parking

16.3 Unitronics Corporation

16.4 Klaus Multiparking Systems

16.5 Robotic Parking Systems, Inc.

16.6 Fata Automation

16.7 Citylift

16.8 Parkplus

16.9 Wohr

16.10 Parkmatic

16.11 Eito&Global Inc.

16.12 Automotion Parking Systems

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

16.13 Other Key Players

16.13.1 Asia Pacific

16.13.1.1 IHI Parking Systems

16.13.1.2 Pari

16.13.1.3 Shandong Tada Auto Parking

16.13.1.4 Simmatec International Corporation

16.13.1.5 Nissei Build Kogyo

16.13.2 North America

16.13.2.1 Romax Parking Solutions

16.13.2.2 Watry Design Inc.

16.13.3 Europe

16.13.3.1 5by2

16.13.3.2 Katopark

16.13.3.3 Swiss-Park

16.13.3.4 Designa

17 Appendix (Page No. - 133)

17.1 Insights of Industry Experts

17.2 Discussion Guide

17.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

17.4 Available Customizations

17.4.1 Additional Company Profiles

17.4.1.1 Business Overview

17.4.1.2 SWOT Analysis

17.4.1.3 Recent Developments

17.4.1.4 MnM View

17.4.2 Detailed Analysis of the Automated Parking System Market, By Technology Type

17.4.3 Country Level Detailed Analysis of the Market

17.5 Related Reports

17.6 Author Details

List of Tables (57 Tables)

Table 1 Currency Exchange Rate (Per 1 USD)

Table 2 Impact of Market Dynamics

Table 3 Automated Parking System Market, By Automation Level, 2017–2027 (‘000 Parking Spaces)

Table 4 Market, By Automation Level, 2017–2027 (USD Million)

Table 5 Fully Automated: Market, By Region, 2017–2027 (‘000 Parking Spaces)

Table 6 Fully Automated: Market, By Region, 2017–2027 (USD Million)

Table 7 Semi-Automated: Market, By Region, 2017–2027 (‘000 Parking Spaces)

Table 8 Semi-Automated: Market, By Region, 2017–2027 (USD Million)

Table 9 Market, By Platform Type, 2017–2027 (USD Million)

Table 10 Palleted: Market, By Region, 2017–2027 (USD Million)

Table 11 Non-Palleted: Market, By Region, 2017–2027 (USD Million)

Table 12 Market, By End-User Type, 2017–2027 (USD Million)

Table 13 Residential: Market, By Region, 2017–2027 (USD Million)

Table 14 Commercial: Market, By Region, 2017–2027 (USD Million)

Table 15 Mixed-Use: Market, By Region, 2017–2027 (USD Million)

Table 16 Market, By Design Model Type, 2017–2027 (‘000 Parking Spaces)

Table 17 Market, By System Type, 2017–2027 (USD Million)

Table 18 Hardware: Market, By Region, 2017–2027 (USD Million)

Table 19 Software: Market, By Region, 2017–2027 (USD Million)

Table 20 Market, By Parking Level, 2017–2027 (‘000 Parking Spaces)

Table 21 Market, By Region, 2017–2027 (‘000 Parking Spaces)

Table 22 Market, By Region, 2017–2027 (USD Million)

Table 23 Asia Oceania: Market, By Automation Level, 2017–2027 (‘000 Parking Spaces)

Table 24 Asia Oceania: Market, By Automation Level, 2017–2027 (USD Million)

Table 25 Europe: Market, By Automation Level, 2017–2027 (‘000 Parking Spaces)

Table 26 Europe: Market, By Automation Level, 2017–2027 (USD Million)

Table 27 Germany: Key Automated Pariking Projects

Table 28 Spain: Key Automated Pariking Projects

Table 29 Switzerland: Key Automated Pariking Projects

Table 30 UK: Key Automated Pariking Projects

Table 31 Norway: Key Automated Pariking Projects

Table 32 The Netherlands: Key Automated Pariking Projects

Table 33 Denmark: Key Automated Pariking Projects

Table 34 Middle East: Market, By Automation Level, 2017–2027 (‘000 Parking Spaces)

Table 35 Middle East: Market, By Automation Level, 2017–2027 (USD Million)

Table 36 Kuwait: Key Automated Pariking Projects

Table 37 Israel: Key Automated Pariking Projects

Table 38 UAE: Key Automated Pariking Projects

Table 39 North America: Market, By Automation Level, 2017–2027 (‘000 Parking Spaces)

Table 40 North America: Market, By Automation Level, 2017–2027 (USD Million)

Table 41 US: Key Automated Pariking Projects

Table 42 Mexico: Key Automated Pariking Projects

Table 43 Canada: Key Automated Pariking Projects

Table 44 RoW: Market, By Automation Level, 2017–2027 (‘000 Parking Spaces)

Table 45 RoW: Market, By Automation Level, 2017–2027 (USD Million)

Table 46 Company Projects: Skyline Parking

Table 47 Company Projects: Westfalia Parking

Table 48 Company Projects: Unitronics Corporation

Table 49 Company Projects: Klaus Multiparking Systems

Table 50 Company Projects: Robotic Parking Systems, Inc.

Table 51 Company Projects: Fata Automation

Table 52 Company Projects: Citylift

Table 53 Company Projects: Parkplus

Table 54 Company Projects: Wohr

Table 55 Company Projects: Parkmatic

Table 56 Company Projects: Eito&Global

Table 57 Company Projects: Automotion Parking Systems

List of Figures (42 Figures)

Figure 1 Automated Parking System Market: Research Design

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology for the Market: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market Overview

Figure 7 Market: Market Dynamics

Figure 8 Europe Holds the Largest Share of Market in 2019

Figure 9 Fully Automated Parking System Holds the Largest Market Share in 2019

Figure 10 Commercial Segment of Automated Parking System is Estimated to Be the Largest Market in 2019

Figure 11 Hardware System Holds the Largest Market Share in 2019

Figure 12 Rapid Urbanization and Demand for Green and Sustainable Parking Solutions are Expected to Boost the Growth of Market From 2019 to 2027

Figure 13 Asia Oceania is Projected to Be the Fastest Growing Market

Figure 14 Fully Automated Parking System and Europe Account for the Largest Share in the Global Market for Automated Parking System in 2019

Figure 15 Commercial Segment is Expected to Dominate the Market

Figure 16 Non-Palleted Automated Parking System is Projected to Grow at the Fastest Rate

Figure 17 Software System Segment of Market is Projected to Grow at the Fastest Rate

Figure 18 Market: Market Dynamics

Figure 19 Most Value-Added in the Assembly & Manufacturing Stage in the Automated Parking Solutions Market

Figure 20 Rising Gni Per Capita and Increased Consumer Spending are Expected to Have A Positive Impact on the Market

Figure 21 Increasing Per Capita Income Would Drive the Market

Figure 22 Growing Number of Vehicles is the Key Driver for Growth of Automated Parking System in China

Figure 23 Low Threat From New Entrants in the Market Due to High Cost of Entry

Figure 24 Market, By Automation Level, 2019 vs. 2027 (USD Million)

Figure 25 Market, By Platform Type, 2019 vs. 2027 (USD Million)

Figure 26 Market, By End-User Type, 2019 vs. 2027 (USD Million)

Figure 27 Market, By Design Model Type, 2019 vs. 2027 (‘000 Parking Spaces)

Figure 28 Market, By System Type, 2019 vs. 2027 (USD Million)

Figure 29 Market, By Parking Level, 2019 vs. 2027 (‘000 Parking Spaces)

Figure 30 Europe is Estimated to Dominate the Market

Figure 31 Asia Oceania: Market Snapshot

Figure 32 Europe: Market Snapshot

Figure 33 Middle East: Market, By Automation Level, 2019 vs. 2027 (USD Million)

Figure 34 North America: Market Snapshot

Figure 35 RoW: Market, By Automation Level, 2019 vs. 2027 (USD Million)

Figure 36 Automated Parking System Market (Global): Competitive Leadership Mapping, 2019

Figure 37 Skyline Parking: SWOT Analysis

Figure 38 Unitronics: Company Snapshot

Figure 39 Unitronics: SWOT Analysis

Figure 40 Klaus Multiparking Systems: SWOT Analysis

Figure 41 Robotic Parking Systems, Inc: SWOT Analysis

Figure 42 Wohr: SWOT Analysis

The study involved four major activities in estimating the current market size of the automated parking system market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. Top-down approach was employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include automotive industry organizations such as the National and Regional Parking Associations, Organisation Internationale des Constructeurs d'Automobiles (OICA); corporate filings (annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been validated further through primary research.

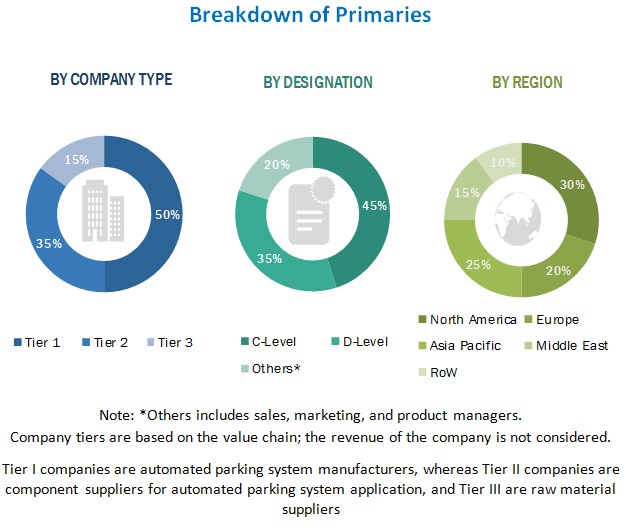

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automated parking system market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across five major regions, namely, North America, Europe, Asia Oceania, Middle East and Rest of the World. Approximately 40% and 60% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert’s opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down approaches were used to estimate and validate the total size of the automated parking system market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-sides.

Report Objectives

- To define, describe, and project (2019–2027) the automated parking system market by volume (000’ parking spaces) and value (USD million)

- To comprehensively analyze the major factors, such as drivers, restraints, opportunities, and industry-specific challenges, which influence the growth of the market

- To analyze and forecast the market for automated parking system and forecast the market size, by volume and value, based on automation level (fully automated and semi-automated)

- To analyze and forecast the market for automated parking system and forecast the market size, by value, based on end-user (residential, commercial, and mixed-use)

- To analyze and forecast the market for automated parking system and forecast the market size, by value, based on system type (software and hardware)

- To analyze and forecast the market for automated parking system and forecast the market size, by value, based on platform type (palleted and non-palleted)

- To analyze and forecast the market for automated parking system and forecast the market size, by value, based on building level (less than level 5, level 5–level 10, and more than level 10)

- To forecast the market size, by volume and value, of the market with respect to five major regions, namely, North America, Europe, Asia Oceania, Middle East, and the Rest of the World (RoW)

- To analyze the opportunities in the market for stakeholders and provide a critical commentary on the competitive landscape for market leaders

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and expansions in the automated parking system market

Available Customizations

- Additional company profiles

- Detailed Analysis of the market, by technology type (RFID, Mobile, and Sensor)

- country-level Detailed Analysis of the market

Growth opportunities and latent adjacency in Automated Parking System Market