Astaxanthin Market by Source (Natural, Synthetic), Form (Dry, Liquid), Method of Production (Microalgae Cultivation, Chemical Synthesis, Fermentation), Application (Dietary Supplements, Food & Beverages, Cosmetics), and Region - Global Forecast to 2026

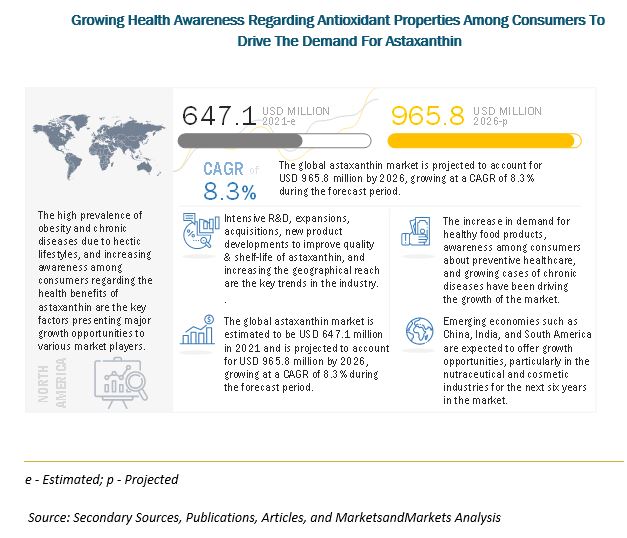

The astaxanthin market was valued at USD 598.9 million in 2020 and it is projected to reach USD 965.8 million by 2026. The astaxanthin market was estimated at $647.1 million in 2021 & it is expected to grow at a CAGR of 8.3% during the forecast period. According to MarketsandMarkets, astaxanthin market in North America is projected to register a fastest growth of CAGR of 9.7% by 2026.

The new research study includes an analysis of industry trends in the market, as well as pricing, patent, and buying behavior analysis, along with an examination of conference and webinar materials and key stakeholders.

Astaxanthin Market Size & Share Analysis

Astaxanthin can be produced naturally or synthetically. Regardless of its abundant presence in natural sources, the traditional method of producing astaxanthin comprises chemical synthesis from petrochemicals. However, due to the recent shift in the global market toward “all-natural ingredients,” natural sources such as algae, yeast, and marine animals are increasingly utilized for the production of astaxanthin. Synthetic astaxanthin dominates the market as the product is economical as compared to naturally derived astaxanthin. However, despite its high cost, the natural astaxanthin market is growing at an exponential rate and is expected to overtake the market of its synthetic counterpart.

To know about the assumptions considered for the study, Request for Free Sample Report

Astaxanthin Market Growth Dynamics

Drivers: Increasing demand for cosmetics products

There has been a significant increase in the global cosmetic industry as a result of the rising spending power of consumers across the globe. This growth is majorly seen in developing countries such as China, India, and Brazil. The demand for skin whitening products and the growing consumption of cosmetics in the rural and semi-urban areas are the major driving factors for the cosmetic industry in these countries. The trend of nutricosmetics and cosmeceuticals is gaining popularity, specifically in developed countries such as the US Canada.

Additionally, consumers across the globe are becoming more aware of nutritional products that contribute to skin health and disease prevention.

Restraints: Lack of R&D activities in under developed countries

The lack of research and development in African countries such as South Africa, Egypt, and Nigeria has led to low adoption of astaxanthin in these regions. European countries such as UK and Spain witness the highest carotenoid consumption. There is an increase in product innovation and exploration of new applications of carotenoids in the region. However, the penetration is significantly low, and no R&D activities are carried out to improvise the techniques for extracting astaxanthin in the underdeveloped countries in Africa. Hence, most astaxanthin manufacturers do not have production facilities in the region.

The standard of living of the people is low in underdeveloped countries such as Bangladesh and Cambodia, which does not enable the people to spend more on healthcare and supplements to improve their health, and the awareness levels regarding the benefits of using astaxanthin are also low in these regions.

Opportunities: Government initiatives to support aquaculture

The aquaculture industry is growing due to various initiatives undertaken by the governments of distinguished countries worldwide. For instance, in India, the Ministry of Agriculture is responsible for the planning, monitoring, and funding of centrally sponsored developmental schemes related to fisheries and aquaculture in all Indian states. It provides an opportunity for the Indian aquaculture industry to focus on enhancing the country’s aquaculture sector. For instance, Pradhan Mantri Matsya Smapada Yojana (PMMSY) aims to upkeep the aquaculture industry and augment production; it also includes an export approach to help double farmers' income. This kind of initiatives provide support and flexibility to manufacturers in the aquafeed industry and provide them the opportunity to further expand globally. Aquaculture is the largest market for astaxanthin, wherein the growth of aquafeed is expected to directly result in the growth of the astaxanthin market.

Challenges: Risks associated with adulteration and clean label requirements

The concern about adulteration in astaxanthin has become a major challenge for the astaxanthin market. Adulterated astaxanthin is extremely dangerous for animals, humans, and the environment. Unlike plants, animals cannot independently synthesize astaxanthin and depend on food for its intake. Not adding proper nutrients to the feed and food products can prove fatal to animals and humans, respectively. The rate of adulteration of astaxanthin, specifically in North America, is increasing. Synthetic astaxanthin sold in the US is made from petrochemicals or genetically mutated yeast, and it is dangerous for human consumption.

Additionally, natural astaxanthin might be very challenging to grow as it is labor-intensive and has a rather expensive process of production from microalgae. Astaxanthin is a high-valued product whose demand is increasing significantly in the region. Due to this, adulterated products are being sold in the market to gain profits. Thus, adulteration poses a significant challenge to the growth of the market. Clean-label requirements are essential in food-grade products, and as astaxanthin is used in combination with other ingredients, it cannot get the clean label, which acts as a setback to its growth in the food and supplements market.

Key features of Astaxanthin Market

- Antioxidant properties: Astaxanthin is a powerful antioxidant that has been shown to have a range of health benefits.

- Versatile applications: Astaxanthin has a wide range of applications, including as a dietary supplement, a cosmetic ingredient, and as a feed additive for aquaculture.

- Natural source: Astaxanthin is a naturally occurring compound that is found in a variety of organisms, including algae, yeast, salmon, trout, krill, shrimp, crayfish, and seaweed.

- Market growth: The astaxanthin market is expected to grow in the coming years due to increased demand for natural and functional ingredients in the food, beverage, and dietary supplement industries.

-

Growing demand: The demand for astaxanthin is growing as consumers become more aware of the health benefits associated with this natural compound.

Astaxanthin Market Segmentation

The delevopment in retail industry is driving the astaxanthin market.

The retail food industry witnessed significant growth among consumers over the past few years globally. The growth in the Asian market is attributed to foreign direct investment, domestic conglomerates, and government investments. According to the India Brand Equity Foundation (IBEF), the Indian retail industry is one of the fastest-growing industries in the world. This market was valued at USD 672 billion in 2017 and is projected to reach USD 1,200 billion in 2021. The relationships between the retail, food processing, and logistics sectors have witnessed significant growth, facilitating the easy availability of a wide range of products to rural towns.

The development of retail channels in the form of supermarkets, hypermarkets, and convenience stores, has encouraged the growth of the astaxanthin market globally. These large food chains are the major outlets for functional food products, which are generally rich in astaxanthin due to the increase in on-the-go consumption. With this, supermarkets are also able to capture their share in the astaxanthin market. This trend is projected to drive the market demand for astaxanthin over the next few years.

Scope of the report

|

Report Metric |

Details |

|

Estimated Market Size in 2020 |

USD 1,721.1 million |

|

Estimated Market Size in 2021 |

USD 647.1 million |

|

Projected Market Size in 2026 |

USD 965.8 million |

|

Market Growth rate |

CAGR of 8.3% from 2021 to 2026 |

|

Market size estimation |

2016 - 2026 |

|

Base year considered |

2020 |

|

Forecast period considered |

2021–2026 |

|

Units considered |

Value (USD) & Volume (Tons) |

|

Segments covered |

Sources, forms, methods of production, applications, and regions. |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Market Growth Drivers |

Increasing demand for cosmetics products and nutritional products owing to increased demand of Astaxanthin |

|

Market Opportunities |

Government initiatives to support aquaculture to provide opportunities in astaxanthin market to further expand globally |

|

Largest Growing Region |

North America |

|

Companies studied / Astaxanthin Manufacturers |

|

Chemically synthesized astaxanthin dominated the market, accounting for a share of 44.0% in 2020

Astaxanthin synthesized chemically as hydroxyl-astaxanthin from petrochemicals. Various strategies are used for synthetic production. However, the oldest and most widely used is the Wittig reaction of two C15-phosphonium salts with a C10-dialdehyde. Synthetic astaxanthin contains the 3S,3S, 3R,3S, and 3R,3R isomers. It is not esterified, while natural astaxanthin mostly occurs in esterified form or a complex with proteins or lipids. Astaxanthin produced by chemical synthesis is the most economical but is not considered fit for human consumption as it liberates toxic greenhouse gases and harmful byproducts, despite the high demand for synthetic astaxanthin for aquaculture and animal consumption.

The fermentation segment, by method of production, is projected to witness a significant CAGR of 8.1% during the forecast period.

The production of astaxanthin on an industrial scale through Phaffia rhodozyma/Xanthophyllomyces dendrorhous (yeast) using the microbial fermentation process is one of the important methods to produce astaxanthin, after microalgae cultivation. A major advantage of this organism is its quick growth and high cell density, which makes the production process fast and economical. Natural astaxanthin produced from the yeast, Phaffia rhodozyma is widely used in the aquaculture of fish and shellfish.

Astaxanthin produced through the fermentation of yeast can be produced efficiently using low-cost raw materials from industrial and agricultural origins, such as sugarcane juice and diluted urea. The use of inexpensive raw materials reduces the cost of production. These raw materials are adopted to get maximum astaxanthin productivity from an industrial perspective.

To know about the assumptions considered for the study, download the pdf brochure

The North America is projected to register a fastest growth of CAGR of 9.7% by 2026.

The North American astaxanthin market is largely driven by the US industry, which accounted for a regional share of nearly 72.9% in terms of value in 2020. The North American market is driven by several factors, such as growth in the industrial application of astaxanthin in the nutraceutical industry for the production of various drugs that help in the treatment of chronic diseases. The use of astaxanthin in medical applications is also gaining popularity in the region on account of rising health benefits offered by the product, such as high protein and calcium and the antioxidant properties present in astaxanthin.

Top Comapines in the Astaxanthin Market

Top astaxanthin manufacturers market include Koninklijke DSM N.V. (the Netherlands), BASF SE (Germany), Cyanotech Corporation (US), Otsuka Holdings Co. Ltd. (Japan), Divi’s Laboratories Ltd. (India), Valensa International (US), Fuji Chemical Industries Co. Ltd. (Japan), Beijing Gingko Group (China), Cardax, Inc. (Denmark), Piveg, Inc (US), Fenchem Biotek Ltd. (China), Algatech Ltd. (Israel), Supreme Biotechnologies (New Zealand), Igene Biotechnology Inc. (US), Algamo (Czech Republic), Biogenic Co. Ltd. (Japan), Astamaz NZ Ltd. (New Zealand), Algalif (Iceland), Algae to Omega (US), and Algae Health Sciences (US).

The astaxanthin market report categorizes into the following segments: sources, forms, methods of production, applications, and regions.

Target Audience

- Astaxanthin manufacturers

- Food ingredient manufacturers

- Astaxanthin importers and exporters

- Raw material suppliers

- Astaxanthin processors

-

Regulatory bodies

- Organizations such as the US Food and Drug Administration (FDA)

- United States Department of Agriculture (USDA)

- European Food Safety Agency (EFSA)

- EUROPA

- Natural Algae Astaxanthin Association

- Codex Alimentarius

- Food Safety Australia and New Zealand (FSANZ)

- Government agencies

- Intermediary suppliers, such as traders, distributors, and suppliers of astaxanthin and end products

- End users

Market By Source

- Natural

- Plants

- Yeast & microbes

- Marine animals

- Synthetic (Petroleum)

Market By Form:

- Dry

- Liquid

Market By Method of Production

- Microalgae cultivation

- Fermentation

- Extraction

- Chemical synthesis

Market By Application

- Feed

- Dietary supplements

- Food & beverages

- Cosmetics

Market By Region

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW) (South America, Middle East & Africa)

Recent Developments in Astaxanthin Market

- In October 2020, Cyanotech Corporation launched a water-dispersible powder form of BioAstin, available in both 1% and 2% concentrations. It is free-flowing and dispersible in either hot or cold water. It is ready to be incorporated into drink powder mixes and ready-to-drink beverages, teas, fruit juices, and carbonated beverages.

- In May 2019, Algatech Ltd. launched a micro-encapsulated natural astaxanthin powder that is formulated for vision and brain health. This would help the company cater to new segments, strengthening its market presence..

- In May 2018, Algatech Ltd. partnered with Sphera to develop innovative functional ingredient formats. This partnership will focus first on the development of new delivery forms of ingredients derived from microalgae.

- In August 2018, BASF Animal Nutrition launched its Lucantin NXT product line in the EU 28 market. This product delivers high homogeneity, outstanding stability, and long-shelf-life while maintaining egg yolk and broiler skin coloring efficacy.

Frequently Asked Questions (FAQ):

What is the projected market value of the global astaxanthin market?

The global astaxanthin market size was valued at $647.1 million in 2021. It is projected to reach $965.8 million by 2026, recording a CAGR of 8.3% during the forecast period.

What is the estimated growth rate (CAGR) of the global astaxanthin market for the next five years?

The global astaxanthin market is expected to grow at a compound annual growth rate (CAGR) of 8.3% from 2021 to 2026.

What are the major revenue pockets in the astaxanthin market currently?

The astaxanthin market in North America is largely influenced by the US industry, which accounted for approximately 72.9% of the regional market value in 2020. Several factors are driving the growth of this market, including the increasing industrial application of astaxanthin in the production of various drugs for the treatment of chronic diseases in the nutraceutical industry. Additionally, the popularity of astaxanthin in medical applications is increasing due to its health benefits, such as its high protein and calcium content, as well as its antioxidant properties.

Which are the astaxanthin manufacturers in the market, and how intense is the competition?

The global market for astaxanthin is dominated by large-scale players, such as BASF SE (Germany), Koninklijke DSM N.V. (The Netherlands), and Fuji Chemical Industries Co., Ltd. (Japan). Other players include Cyanotech Corporation (US), Valensa International (U.S.), Otsuka Holdings Co. Ltd. (Japan), and Algatech Ltd. (Israel). These companies cater to the requirements of the different end-user industries. Moreover, these companies have effective global manufacturing operations and supply chain strategies. Such advantages give these companies an edge over other companies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE ASTAXANTHIN MARKET STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 ASTAXANTHIN MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2016–2020

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 ASTAXANTHIN MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primary interviews

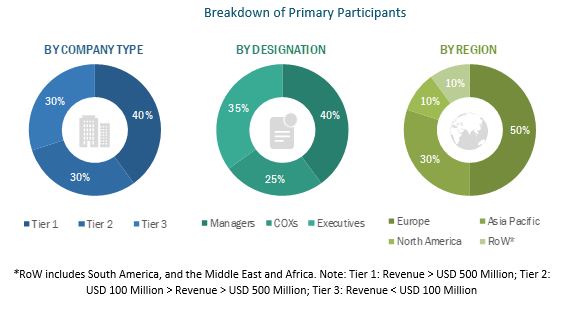

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 ASTAXANTHIN MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION – SUPPLY SIDE (1/2)

FIGURE 5 MARKET SIZE ESTIMATION – SUPPLY SIDE (2/2)

FIGURE 6 MARKET SIZE ESTIMATION – DEMAND SIDE

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 8 ASTAXANTHIN MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 ASTAXANTHIN MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 10 COVID-19: GLOBAL PROPAGATION

FIGURE 11 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 12 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 13 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 14 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 51)

TABLE 2 ASTAXANTHIN MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 15 IMPACT OF COVID-19 ON THE MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 16 MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 17 MARKET SHARE (VALUE), BY FORM, 2021 VS. 2026

FIGURE 18 MARKET SIZE, BY SOURCE, 2021 VS. 2026 (USD MILLION)

FIGURE 19 MARKET SIZE, BY METHOD OF PRODUCTION, 2021 VS. 2026 (USD MILLION)

FIGURE 20 MARKET SHARE (VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL ASTAXANTHIN MARKET

FIGURE 21 GROWING HEALTH AWARENESS REGARDING ANTIOXIDANT PROPERTIES AMONG CONSUMERS TO DRIVE THE DEMAND FOR ASTAXANTHIN

4.2 MARKET, BY KEY COUNTRY

FIGURE 22 US TO BE THE FASTEST-GROWING MARKET DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC: MARKET, BY SOURCE & KEY COUNTRY

FIGURE 23 SYNTHETIC SEGMENT AND CHINA TO ACCOUNT FOR THE LARGEST SHARES OF THE ASIA PACIFIC MARKET IN 2020

4.4 MARKET, BY APPLICATION & REGION

FIGURE 24 FEED APPLICATIONTO DOMINATE THE MARKET ACROSS ASIA PACIFIC IN 2020

4.5 MARKET, BY FORM & REGION

FIGURE 25 LIQUID FORM TO BE THE FASTER-GROWING SEGMENT DURING THE FORECAST PERIOD

4.6 COVID-19 IMPACT ON THE ASTAXANTHIN MARKET

FIGURE 26 CHART OF PRE & POST-COVID SCENARIOS IN THE MARKET

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 DEVELOPMENT IN THE RETAIL INDUSTRY

FIGURE 27 RETAIL MARKET SIZE IN INDIA, 2021 (USD BILLION)

FIGURE 28 AUSTRALIA: RETAIL SALES OF FUNCTIONAL AND FORTIFIED FOOD PRODUCTS, 2018–2022 (USD MILLION)

FIGURE 29 ONLINE RETAIL MARKET SIZE IN INDIA, 2021 (USD BILLION)

5.2.2 RISE IN THE NUMBER OF DUAL-INCOME HOUSEHOLDS

FIGURE 30 US: EMPLOYMENT STATUS OF PARENTS WITH CHILDREN UNDER 18 YEARS, 2020

5.3 MARKET DYNAMICS

FIGURE 31 ASTAXANTHIN MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Rising consumer inclination toward preventive healthcare & nutraceuticals

FIGURE 32 WORLD HEALTH PER CAPITA EXPENDITURE, 2006-2018 (USD THOUSAND)

FIGURE 33 HEALTH EXPENDITURE: US VS. OTHER COUNTRIES, 2006-2018, (AS PERCENTAGE OF GDP)

5.3.1.2 Rapid industrialization of the feed industry

FIGURE 34 FEED CONSUMPTION SHARE (VOLUME), BY LIVESTOCK TYPE, 2018

5.3.1.3 Increasing demand for cosmetic products

FIGURE 35 ANNUAL GROWTH OF THE GLOBAL COSMETIC MARKET (PERCENTAGE), 2010-2019

5.3.2 RESTRAINTS

5.3.2.1 High cost of production of natural astaxanthin

5.3.2.2 Lack of R&D activities in the underdeveloped countries

5.3.3 OPPORTUNITIES

5.3.3.1 Government initiatives to support aquaculture

FIGURE 36 WORLD FISHERIES AND AQUACULTURE PRODUCTION (MILLION TONNES), 2010-2018

5.3.3.2 Growing demand for natural antioxidants

5.3.3.3 Growing demand for astaxanthin in the pharmaceutical industry

5.3.4 CHALLENGES

5.3.4.1 Risks associated with adulteration and clean label requirements

5.3.4.2 Stringent government regulations in developed countries

5.4 IMPACT OF COVID-19 ON THE ASTAXANTHIN MARKET DYNAMICS

5.4.1 COVID-19 BOOSTS THE DEMAND FOR HIGH-QUALITY AND PREMIUM FOOD & BEVERAGES PRODUCTS

5.4.2 COVID-19 IMPACT ON RAW MATERIAL AVAILABILITY AND SUPPLY CHAIN DISRUPTION

5.4.3 COVID-19 TO SHIFT THE DEMAND TOWARD PLANT-SOURCED INGREDIENTS

6 INDUSTRY TRENDS (Page No. - 75)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 37 MARKET: SUPPLY CHAIN ANALYSIS

6.3 ECOSYSTEM

FIGURE 38 ASTAXANTHIN: MARKET MAP

TABLE 3 ASTAXANTHIN MARKET: ECOSYSTEM

6.3.1 UPSTREAM

6.3.2 INGREDIENT MANUFACTURERS

6.3.3 TECHNOLOGY PROVIDERS

6.3.4 END USERS

6.3.4.1 Downstream

6.3.5 REGULATORY BODIES

6.3.6 STARTUPS/EMERGING COMPANIES

6.4 VALUE CHAIN ANALYSIS

FIGURE 39 ASTAXANTHIN MARKET: VALUE CHAIN ANALYSIS

6.5 TECHNOLOGY ANALYSIS

6.5.1 ASTAXANTHIN AND MICROENCAPSULATION

6.5.2 ASTAXANTHIN AND ROBOTS

6.6 PRICING ANALYSIS: MARKET, BY SOURCE

FIGURE 40 PRICING TREND OF THE ASTAXANTHIN, 2016–2020 (USD/TON)

6.7 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

FIGURE 41 YC-YCC: REVENUE SHIFT FOR THE MARKET

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 ASTAXANTHIN MARKET: PORTER’S FIVE FORCES ANALYSIS

6.8.1 INTENSITY OF COMPETITIVE RIVALRY

6.8.2 BARGAINING POWER OF SUPPLIERS

6.8.3 BARGAINING POWER OF BUYERS

6.8.4 THREAT OF NEW ENTRANTS

6.8.5 THREAT OF SUBSTITUTES

6.9 PATENT ANALYSIS

FIGURE 42 PATENT INSIGHTS (2020)

FIGURE 43 LIST OF TOP PATENTS IN THE MARKET FOR THE LAST TEN YEARS

TABLE 5 KEY PATENTS PERTAINING TO ASTAXANTHIN, 2020

6.10 TRADE ANALYSIS

TABLE 6 KEY EXPORTING COUNTRIES WITH EXPORT VALUE OF DIETARY SUPPLEMENTS, 2019 (USD MILLION)

FIGURE 44 IMPORT TARIFF OF KEY COUNTRIES ON DIETARY SUPPLEMENTS, 2019 (%)

6.11 CASE STUDY ANALYSIS

6.11.1 USE CASE 1: TATSEWISE’S AI AND MACHINE LEARNING SOLUTION HELPED MEET THE INCREASING DEMAND

6.11.2 USE CASE 2: MINDRIGHT’S BARS HELPED COMBAT MENTAL HEALTH ISSUES

6.12 REGULATIONS

6.12.1 NORTH AMERICA

6.12.1.1 Canada

6.12.1.2 US

6.12.2 EUROPEAN UNION (EU)

7 ASTAXANTHIN MARKET, BY SOURCE (Page No. - 94)

7.1 INTRODUCTION

FIGURE 45 MARKET SHARE (VALUE), BY SOURCE, 2021 VS. 2026

TABLE 7 MARKET SIZE, BY SOURCE, 2016–2020 (USD MILLION)

TABLE 8 MARKET SIZE, BY SOURCE, 2021–2026(USD MILLION)

TABLE 9 MARKET SIZE, BY SOURCE, 2016–2020 (TON)

TABLE 10 MARKET SIZE, BY SOURCE, 2021–2026(TON)

7.2 NATURAL SOURCE

7.2.1 INCREASED PREFERENCE FOR NATURAL PRODUCTS

TABLE 11 NATURAL: ASTAXANTHIN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 12 NATURAL: MARKET SIZE, BY REGION, 2021–2026(USD MILLION)

TABLE 13 NATURAL: MARKET SIZE, BY REGION, 2016–2020 (TON)

TABLE 14 NATURAL: MARKET SIZE, BY REGION, 2021–2026(TON)

TABLE 15 NATURAL: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 16 NATURAL: MARKET SIZE, BY TYPE, 2021–2026(USD MILLION)

7.2.2 PLANTS

7.2.2.1 Microalgae is a non-conventional source of protein due to its high protein content

7.2.3 YEAST & MICROBES

7.2.3.1 Use of yeast-produced astaxanthin in poultry, fishery, cosmetic, pharmaceutical, and food

7.2.4 MARINE ANIMALS

7.2.4.1 Shrimp, krill, salmon, and crustaceans are the major sources of astaxanthin

7.3 SYNTHETIC (PETROLEUM)

7.3.1 LOWER MANUFACTURING COST OF SYNTHETIC ASTAXANTHIN TO DRIVE THE MARKET GROWTH

TABLE 17 SYNTHETIC: ASTAXANTHIN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 SYNTHETIC: MARKET SIZE, BY REGION, 2021–2026(USD MILLION)

TABLE 19 SYNTHETIC: MARKET SIZE, BY REGION, 2016–2020 (TON)

TABLE 20 SYNTHETIC: MARKET SIZE, BY REGION, 2021–2026(TON)

8 ASTAXANTHIN MARKET, BY FORM (Page No. - 103)

8.1 INTRODUCTION

FIGURE 46 MARKET SHARE (VALUE), BY FORM, 2021 VS. 2026

TABLE 21 MARKET SIZE, BY FORM, 2016–2020 (USD MILLION)

TABLE 22 MARKET SIZE, BY FORM, 2021–2026(USD MILLION)

TABLE 23 MARKET SIZE, BY FORM, 2016–2020 (TON)

TABLE 24 MARKET SIZE, BY FORM, 2021–2026(TON)

8.2 DRY FORM

8.2.1 DRY FORMS ARE MAJORLY USED IN FEED FOOD & BEVERAGES AND COSMETICS

TABLE 25 DRY: ASTAXANTHIN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 26 DRY: MARKET SIZE, BY REGION, 2021–2026(USD MILLION)

TABLE 27 DRY: MARKET SIZE, BY REGION, 2016–2020 (TON)

TABLE 28 DRY: MARKET SIZE, BY REGION, 2021–2026(TON)

8.3 LIQUID FORM

8.3.1 APPLICATION OF LIQUID ASTAXANTHIN IN SYRUPS AND TEXTURING AGENTS

TABLE 29 LIQUID: ASTAXANTHIN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 LIQUID: MARKET SIZE, BY REGION, 2021–2026(USD MILLION)

TABLE 31 LIQUID: MARKET SIZE, BY REGION, 2016–2020 (TON)

TABLE 32 LIQUID: MARKET SIZE, BY REGION, 2021–2026(TON)

9 ASTAXANTHIN MARKET, BY METHOD OF PRODUCTION (Page No. - 109)

9.1 INTRODUCTION

TABLE 33 MARKET SIZE, BY METHOD OF PRODUCTION, 2016–2020 (USD MILLION)

TABLE 34 MARKET SIZE, BY METHOD OF PRODUCTION, 2021–2026(USD MILLION)

FIGURE 47 MARKET SIZE, BY METHOD OF PRODUCTION, 2021 VS. 2026 (USD MILLION)

9.2 CHEMICAL SYNTHESIS

9.2.1 CHEMICAL SYNTHESIS OF ASTAXANTHIN MORE ECONOMICAL THAN NATURAL PRODUCTION

TABLE 35 CHEMICAL SYNTHESIS: ASTAXANTHIN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 CHEMICAL SYNTHESIS: MARKET SIZE, BY REGION, 2021–2026(USD MILLION)

9.3 MICROALGAE CULTIVATION

9.3.1 NATURAL ASTAXANTHIN FROM MICROALGAE IS IN HIGH DEMAND FOR DIETARY SUPPLEMENTS AND FOOD & BEVERAGES

TABLE 37 MICROALGAE CULTIVATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 MICROALGAE CULTIVATION: MARKET SIZE, BY REGION, 2021–2026(USD MILLION)

9.4 FERMENTATION

9.4.1 ASTAXANTHIN PRODUCED THROUGH FERMENTATION IS WIDELY USED IN AQUACULTURE

TABLE 39 FERMENTATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 FERMENTATION: ASTAXANTHIN MARKET SIZE, BY REGION, 2021–2026(USD MILLION)

9.5 EXTRACTION

9.5.1 EXTRACTION OF ASTAXANTHIN FROM SHRIMP WASTE IS HIGHLY ENERGY CONSUMING AND PRODUCE TOXIC BYPRODUCTS

TABLE 41 EXTRACTION: ASTAXANTHIN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 EXTRACTION: MARKET SIZE, BY REGION, 2021–2026(USD MILLION)

10 ASTAXANTHIN MARKET, BY APPLICATION (Page No. - 116)

10.1 INTRODUCTION

FIGURE 48 MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 43 MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 44 MARKET SIZE, BY APPLICATION, 2021–2026(USD MILLION)

10.2 COVID-19 IMPACT ON THE MARKET, BY APPLICATION

10.2.1 OPTIMISTIC SCENARIO

TABLE 45 MARKET SIZE, BY-APPLICATION, 2018–2021 (USD MILLION)

10.2.2 REALISTIC SCENARIO

TABLE 46 ASTAXANTHIN MARKET-SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

10.2.3 PESSIMISTIC SCENARIO

TABLE 47 MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

10.3 FEED

10.3.1 MARKET FOR ANIMAL FEED FOCUSING MAINLY ON THE SYNTHETIC FORM

TABLE 48 FEED: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 49 FEED: MARKET SIZE, BY REGION, 2021–2026(USD MILLION)

10.4 DIETARY SUPPLEMENTS

10.4.1 RISING AWARENESS AMONG CONSUMERS FOR NATURAL HEALTH SUPPLEMENTS FUELING THE MARKET GROWTH

TABLE 50 DIETARY SUPPLEMENTS: ASTAXANTHIN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 51 DIETARY SUPPLEMENTS: MARKET SIZE, BY REGION, 2021–2026(USD MILLION)

10.5 FOOD & BEVERAGES

10.5.1 ASTAXANTHIN AIDS IN REDUCING THE RISK OF HEART ATTACK BY INCREASING THE GOOD HDL CHOLESTEROL

TABLE 52 FOOD & BEVERAGES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 53 FOOD & BEVERAGES: MARKET SIZE, BY REGION, 2021–2026(USD MILLION)

10.6 COSMETICS

10.6.1 ASTAXANTHIN - A POTENT SOURCE OF ANTIOXIDANTS AND VITAMIN A

TABLE 54 COSMETICS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 55 COSMETICS: MARKET SIZE, BY REGION, 2021–2026(USD MILLION)

11 ASTAXANTHIN MARKET, BY REGION (Page No. - 126)

11.1 INTRODUCTION

TABLE 56 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 57 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.2 COVID-19 IMPACT ON THE MARKET, BY REGION

11.2.1 OPTIMISTIC SCENARIO

TABLE 58 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE ASTAXANTHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.2.2 REALISTIC SCENARIO

TABLE 59 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.2.3 PESSIMISTIC SCENARIO

TABLE 60 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET, BY REGION, 2018–2021 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 49 NORTH AMERICAN ASTAXANTHIN MARKET: A SNAPSHOT

TABLE 61 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2016–2020 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2016–2020 (TONS)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2021–2026 (TONS)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY FORM, 2016–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY FORM, 2016–2020 (TON)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY FORM, 2021–2026 (TON)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY METHOD OF PRODUCTION, 2016–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY METHOD OF PRODUCTION, 2021–2026 (USD MILLION)

11.3.1 US

11.3.1.1 Astaxanthin is majorly used for pigmenting salmon, owing to which demand for astaxanthin is high in the US

TABLE 75 US: ASTAXANTHIN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 76 US: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.2 CANADA

11.3.2.1 The Canadian market has increased the natural color market for food applications in the country

TABLE 77 CANADA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 78 CANADA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 Strong presence of the food & beverage industry has driven the nutraceutical market growth

TABLE 79 MEXICO: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 80 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 50 ASIA PACIFIC: ASTAXANTHIN MARKET SNAPSHOT

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2016–2020 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

TABLE 83 AISA PACIFIC: MARKET SIZE, BY SOURCE, 2016–2020 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 85 AISA PACIFIC: MARKET SIZE, BY SOURCE, 2016–2020 (TON)

TABLE 86 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2021–2026 (TON)

TABLE 87 ASIA PACIFIC: MARKET SIZE, BY FORM, 2016–2020 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET SIZE, BY FORM, 2016–2020 (TON)

TABLE 90 ASIA PACIFIC: MARKET SIZE, BY FORM, 2021–2026 (TON)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY METHOD OF PRODUCTION, 2016–2020 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY METHOD OF PRODUCTION, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Increasing purchasing power of consumers led to a rise in demand for high-quality processed foods

TABLE 95 CHINA: ASTAXANTHIN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 96 CHINA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Increasing consumption of poultry meat is leading to a rise in the demand for astaxanthin

TABLE 97 INDIA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 98 INDIA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.3 AUSTRALIA & NEW ZEALAND

11.4.3.1 As the aquaculture industry is growing, synthetic astaxanthin demand as a feed additive is also increasing

TABLE 99 AUSTRALIA & NEW ZEALAND: ASTAXANTHIN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 100 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.4 REST OF ASIA PACIFIC

11.4.4.1 The emerging market for astaxanthin in the Asia Pacific is due to an increase in consumption of functional foods

TABLE 101 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 102 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.5 EUROPE

TABLE 103 EUROPE: ASTAXANTHIN MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY SOURCE, 2016–2020 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY SOURCE, 2016–2020 (TON)

TABLE 108 EUROPE: MARKET SIZE, BY SOURCE, 2021–2026 (TON)

TABLE 109 EUROPE: MARKET SIZE, BY FORM, 2016–2020 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY FORM, 2016–2020 (TON)

TABLE 112 EUROPE: MARKET SIZE, BY FORM, 2021–2026 (TON)

TABLE 113 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY METHOD OF PRODUCTION, 2016–2020 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY METHOD OF PRODUCTION, 2021–2026 (USD MILLION)

11.5.1 GERMAN

11.5.1.1 Dairy and pork feed consumption driving the demand for astaxanthin

TABLE 117 GERMANY: ASTAXANTHIN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 118 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.2 UK

11.5.2.1 Increased focus on the food & beverage industry boosts the market growth

TABLE 119 UK: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 120 UK: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.3 FRANCE

11.5.3.1 France exports high-quality shellfish to US and shrimp to Japan

TABLE 121 FRANCE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 122 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.4 ITALY

11.5.4.1 High industrial applications in the feed and cosmetic industries

TABLE 123 ITALY: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 124 ITALY: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.5 SPAIN

11.5.5.1 Astaxanthin is majorly used as a natural colorant in Spain

TABLE 125 SPAIN: ASTAXANTHIN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 126 SPAIN: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.6 REST OF EUROPE

TABLE 127 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 128 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.6 REST OF THE WORLD (ROW)

TABLE 129 ROW: ASTAXANTHIN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 130 ROW: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 131 ROW: MARKET SIZE, BY SOURCE, 2016–2020 (USD MILLION)

TABLE 132 ROW: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 133 ROW: MARKET SIZE, BY SOURCE, 2016–2020 (TON)

TABLE 134 ROW: MARKET SIZE, BY SOURCE, 2021–2026 (TON)

TABLE 135 ROW: MARKET SIZE, BY FORM, 2016–2020 (USD MILLION)

TABLE 136 ROW: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 137 ROW: MARKET SIZE, BY FORM, 2016–2020 (TON)

TABLE 138 ROW: MARKET SIZE, BY FORM, 2021–2026 (TON)

TABLE 139 ROW: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 140 ROW: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 141 ROW: MARKET SIZE, BY METHOD OF PRODUCTION, 2016–2020 (USD MILLION)

TABLE 142 ROW: MARKET SIZE, BY METHOD OF PRODUCTION, 2021–2026 (USD MILLION)

11.6.1 SOUTH AMERICA

11.6.1.1 Increasing industrialization of the aquafeed industry

TABLE 143 SOUTH AMERICA: ASTAXANTHIN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 144 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.6.2 MIDDLE EAST

11.6.2.1 Growth in the natural astaxanthin production due to the presence of key players in the region

TABLE 145 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 146 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.6.3 AFRICA

11.6.3.1 Large livestock population is driving the market for astaxanthin

TABLE 147 AFRICA: ASTAXANTHIN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 148 AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 165)

12.1 OVERVIEW

12.2 ASTAXANTHIN MARKET SHARE ANALYSIS

TABLE 149 ASTAXANTHIN MARKET: DEGREE OF COMPETITION

12.3 KEY PLAYER STRATEGIES

12.4 HISTORICAL REVENUE ANALYSIS OF ASTAXANTHIN MANUFACTURERS

FIGURE 51 FIVE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2016–2020 (USD BILLION)

12.5 COVID-19-SPECIFIC COMPANY RESPONSE

12.5.1 BASF SE

12.5.2 CYANOTECH CORPORATION

12.5.3 DIVI’S LABORATORIES LTD.

12.5.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.4.1 Stars

12.5.4.2 Emerging leaders

12.5.4.3 Pervasive players

12.5.4.4 Participants

FIGURE 52 ASTAXANTHIN MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

12.5.5 PRODUCT FOOTPRINT

TABLE 150 COMPANY SOURCE FOOTPRINT

TABLE 151 COMPANY APPLICATION FOOTPRINT

TABLE 152 COMPANY REGION FOOTPRINT

TABLE 153 COMPANY PRODUCT FOOTPRINT

12.5.6 COMPETITIVE EVALUATION QUADRANT (OTHER PLAYERS)

12.5.6.1 Progressive companies

12.5.6.2 Starting blocks

12.5.6.3 Responsive companies

12.5.6.4 Dynamic companies

FIGURE 53 ASTAXANTHIN MARKET: COMPANY EVALUATION QUADRANT, 2020 (OTHER PLAYERS)

12.6 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

12.6.1 PRODUCT LAUNCHES

TABLE 154 PRODUCT LAUNCHES, AUGUST 2018–OCTOBER 2020

12.6.2 DEALS

TABLE 155 DEALS, SEPTEMBER 2017–DECEMBER 2020

12.6.3 OTHERS

TABLE 156 EXPANSIONS, APRIL 2017–NOVEMBER 2018

13 COMPANY PROFILES (Page No. - 180)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 ASTAXANTHIN MANUFACTURERS

13.1.1 KONINKLIJKE DSM N.V.

TABLE 157 KONINKLIJKE DSM N.V.: BUSINESS OVERVIEW

FIGURE 54 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

TABLE 158 KONINKLIJKE DSM N.V.: PRODUCTS OFFERED

TABLE 159 ASTAXANTHIN MARKET: DEALS, SEPTEMBER 2017–OCTOBER 2020

TABLE 160 MARKET: OTHERS, APRIL 2017

13.1.2 BASF SE

TABLE 161 BASF SE: BUSINESS OVERVIEW

FIGURE 55 BASF SE: COMPANY SNAPSHOT

TABLE 162 BASF SE: PRODUCTS OFFERED

TABLE 163 ASTAXANTHIN MARKET: PRODUCT LAUNCHES, AUGUST 2018

TABLE 164 MARKET: DEALS, DECEMBER 2020

13.1.3 CYANOTECH CORPORATION

TABLE 165 CYANOTECH CORPORATION: BUSINESS OVERVIEW

FIGURE 56 CYANOTECH CORPORATION: COMPANY SNAPSHOT

TABLE 166 CYANOTECH CORPORATION: PRODUCTS OFFERED

TABLE 167 ASTAXANTHIN MARKET: PRODUCT LAUNCHES, OCTOBER 2020

TABLE 168 MARKET: OTHERS, NOVEMBER 2018

13.1.4 OTSUKA HOLDINGS CO., LTD.

TABLE 169 OTSUKA HOLDINGS CO., LTD.: BUSINESS OVERVIEW

FIGURE 57 OTSUKA HOLDINGS CO., LTD.: COMPANY SNAPSHOT

TABLE 170 OTSUKA HOLDINGS CO., LTD.: PRODUCTS OFFERED

13.1.5 DIVI’S LABORATORIES LTD.

TABLE 171 DIVI’S LABORATORIES LTD.: BUSINESS OVERVIEW

FIGURE 58 DIVI’S LABORATORIES LTD.: COMPANY SNAPSHOT

TABLE 172 DIVI’S LABORATORIES LTD.: PRODUCTS OFFERED

13.1.6 VALENSA INTERNATIONAL

13.1.6.1 Business overview

TABLE 173 VALENSA INTERNATIONAL: BUSINESS OVERVIEW

TABLE 174 VALENSA INTERNATIONAL: PRODUCTS OFFERED

13.1.7 FUJI CHEMICAL INDUSTRIES CO., LTD.

TABLE 175 FUJI CHEMICAL INDUSTRIES CO., LTD.: BUSINESS OVERVIEW

TABLE 176 FUJI CHEMICAL INDUSTRIES CO., LTD.: PRODUCTS OFFERED

13.1.8 BEIJING GINGKO GROUP

TABLE 177 BEIJING GINGKO GROUP: BUSINESS OVERVIEW

TABLE 178 BEIJING GINGKO GROUP: PRODUCTS OFFERED

13.1.9 CARDAX, INC.

TABLE 179 CARDAX, INC.: BUSINESS OVERVIEW

FIGURE 59 CARDAX, INC.: COMPANY SNAPSHOT

TABLE 180 CARDAX, INC.: PRODUCTS OFFERED

TABLE 181 ASTAXANTHIN MARKET: DEALS, FEBRUARY 2018

13.1.10 PIVEG, INC.

TABLE 182 PIVEG, INC.: BUSINESS OVERVIEW

TABLE 183 PIVEG, INC.: PRODUCTS OFFERED

13.2 OTHER PLAYERS

13.2.1 FENCHEM BIOTEK LTD.

TABLE 184 FENCHEM BIOTEK LTD.: BUSINESS OVERVIEW

TABLE 185 FENCHEM BIOTEK LTD.: PRODUCTS OFFERED

13.2.2 ALGATECH LTD.

TABLE 186 ALGATECH LTD.: BUSINESS OVERVIEW

TABLE 187 ALGATECH LTD.: PRODUCTS OFFERED

TABLE 188 ASTAXANTHIN MARKET: PRODUCT LAUNCHES, MAY 2019

TABLE 189 MARKET: DEALS, MAY 2018–MARCH 2019

13.2.3 SUPREME BIOTECHNOLOGIES

TABLE 190 SUPREME BIOTECHNOLOGIES: BUSINESS OVERVIEW

TABLE 191 SUPREME BIOTECHNOLOGIES: PRODUCTS OFFERED

13.2.4 IGENE BIOTECHNOLOGY INC.

TABLE 192 IGENE BIOTECHNOLOGY INC.: BUSINESS OVERVIEW

TABLE 193 IGENE BIOTECHNOLOGY INC.: PRODUCTS OFFERED

13.2.5 ALGAMO

TABLE 194 ALGAMO: BUSINESS OVERVIEW

TABLE 195 ALGAMO: PRODUCTS OFFERED

13.2.6 BIOGENIC CO., LTD.

13.2.7 ASTAMAZ NZ LTD.

13.2.8 ALGALIF

13.2.9 ALGAE TO OMEGA

13.2.10 ALGAE HEALTH SCIENCES, INC.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 215)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 CAROTENOIDS MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 CAROTENOIDS MARKET, BY APPLICATION

TABLE 196 CAROTENOIDS MARKET SIZE, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 197 CAROTENOIDS MARKET SIZE, BY APPLICATION, 2017–2026 (TON)

14.3.4 CAROTENOIDS MARKET, BY REGION

TABLE 198 CAROTENOIDS MARKET SIZE, BY REGION, 2017–2026 (USD MILLION)

TABLE 199 CAROTENOIDS MARKET SIZE, BY REGION, 2017–2026 (TON)

14.4 FEED PIGMENTS MARKET

14.4.1 LIMITATIONS

14.4.2 MARKET DEFINITION

14.4.3 MARKET OVERVIEW

14.4.4 FEED PIGMENTS MARKET, BY TYPE

TABLE 200 FEED PIGMENTS MARKET SIZE, BY TYPE, 2013–2020 (USD MILLION)

TABLE 201 FEED PIGMENTS MARKET SIZE, BY CAROTENOID TYPE, 2013–2020 (USD MILLION)

14.4.5 FEED PIGMENTS MARKET, BY REGION

14.4.5.1 Introduction

TABLE 202 FEED PIGMENTS MARKET SIZE, BY REGION, 2013–2020 (USD MILLION)

TABLE 203 FEED PIGMENTS MARKET SIZE, BY REGION, 2013–2020 (KT)

15 APPENDIX (Page No. - 222)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities in estimating the market size for astaxanthin. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. These sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles from recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The astaxanthin market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the astaxanthin market has the presence of key feed manufacturers, dietary supplement manufacturers, cosmetic, nutraceutical, and food & beverage manufacturers. The supply side has the presence of astaxanthin manufacturers and key technology providers producing astaxanthin. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative & quantitative information. Primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs from the feed, nutraceuticals, food & beverage, and cosmetic industries. Primary sources from the supply side include research institutions involved in R&D to introduce technology, key opinion leaders, distributors, and astaxanthin manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the astaxanthin market. These approaches have also been used extensively to determine the size of the various sub-segments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and market have been identified through extensive secondary research.

- The astaxanthin value chain and market size in terms of both value and volume have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the astaxanthin market were considered while estimating the market size.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the most precise estimations for all segments and sub-segments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the astaxanthin market based on sources, forms, methods of production, and applications

- To describe and forecast the astaxanthin market, in terms of value, by regions—Asia Pacific, Europe, North America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets, with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of astaxanthin

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the astaxanthin ecosystem

- To strategically profile key astaxanthin manufacturers and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches such as acquisitions and divestments; expansions and investments; product launches and approvals; agreements; and collaborations and partnerships in the astaxanthin market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe astaxanthin market into Sweden, Poland, Norway, and Greece

- Further breakdown of the Rest of Asia Pacific astaxanthin market into Malaysia, Indonesia, Japan, and Vietnam

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Astaxanthin Market

Interested in astaxanthin market growth estimates and growth opportunities in North American region.