Asia and North Africa Critical Care Equipment Market by Product (Infusion Pumps, Ventilators, & Patient Monitors) - Competitive Analysis & Global Forecasts to 2021

The critical care equipment for asia & north africa market is expected to reach $2.61 billion by 2021 from $1.78 billion in 2016, at a CAGR of 8.0% during the forecast period. Continuous technological advancements in critical care devices, increasing government support, growing private sector investments in the healthcare industry, and increasing patient population base are key factors fuelling the growth of the north africa critical care equipment market in the emerging nations. High replacement rate of critical care devices, growing medical tourism in Asia, and development of multiparameter monitors are some other prime factors offering growth opportunities for players in the critical care equipment market. However, high cost of these devices is restraining the growth of this market.

Asia and the Middle East and North Africa (MENA) region offer high-growth potential for companies engaged in the development and marketing of critical care devices to hospitals and clinics. Growing geriatric population, increasing cases of chronic and respiratory diseases, growing number of local manufacturers, and increasing number of super-speciality hospitals are the key factors propelling the growth of the north africa critical care equipment market in the emerging countries.

A combination of bottom-up and top-down approaches was used to calculate the market sizes and growth rates of the north africa critical care equipment market and its subsegments. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Primary interviews with key opinion leaders were also used to determine the percentage shares of each product in emerging nations. The report provides qualitative insights about growth rates and market drivers for all subsegments. It maps market sizes and growth rates for each subsegment and identifies segments poised for rapid growth in each geographic segment.

Target Audience:

- Critical Care Equipment Dealers and Suppliers

- Critical Care Equipment Service Providers

- Healthcare Institutions (Hospitals, Diagnostic Centers, and Outpatient Clinics)

- Venture Capitalists

- Insurance Providers (Payers)

- Government Bodies

- Consulting Service Providers

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report

This research report categorizes the critical care equipment market for asia & north africa into the following segments:

By Product

-

Ventilators

-

By Type

- Adult Ventilators

- Infant/Neonatal Ventilators

-

By Region

- India

- Asia (Excluding India)

- Middle East and North Africa (MENA)

-

By Type

-

Patient Monitors

-

By Region

- India

- Asia (Excluding India)

- Middle East and North Africa (MENA)

-

By Region

-

Infusion Pumps

-

By Region

- India

- Asia (Excluding India)

- Middle East and North Africa (MENA)

-

By Region

-

Syringe Pumps

-

By Region

- India

- Asia (Excluding India)

- Middle East and North Africa (MENA)

-

By Region

By Region

- India

- Asia (Excluding India)

- Middle East and North Africa (MENA)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of the Middle East and North Africa and Asia market on the basis of price range (covering low, moderate, and high price ranges)

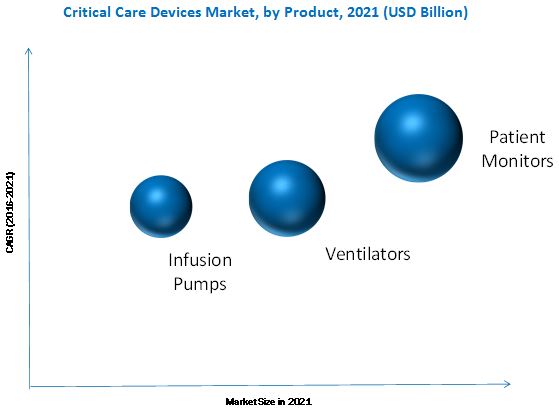

On the basis of products, the asia critical care equipment market is divided into three segments, namely, patient monitors, ventilators, and infusion pumps. The patient monitors segment is expected to grow at the highest CAGR in the next five years, owing to the increasing patient population base and the high adoption of advanced patient monitoring devices by big hospitals and clinics in the emerging nations.

The patient monitors segment holds the largest share of the asia critical care equipment market in emerging nations. The increased private sector investments and expansions, premium cost of devices, high replacement rates, and development of multiparameter monitors are the key factors contributing to the growth of this market segment. Moreover, development of patient monitors with wireless and sensor technology and rising adoption of home-use and remote patient monitoring devices are other factors contributing to the growth of the patient monitors market in emerging nations.

The ventilators market segment is further categorized on the basis of products into adult ventilators and neonatal/infant ventilators. Increasing geriatric population, rising number of ICU patients in India, growing use of home care ventilation devices, and increasing prevalence of respiratory devices are key factors driving the market for adult ventilators in the emerging nations. Whereas, increasing incidence of pre-term births in emerging nations is a key factor driving the adoption of neonatal ventilators in these regions. However, shortage of ICU beds and high adoption of refurbished products are shrinking the revenue growth of this market.

The infusion pumps market, on the other hand, is driven by factors such as rising geriatric and obese population resulting in the growing prevalence of chronic diseases in India, increasing number of hospital beds, and introduction of smart infusion pumps which are propelling the growth of the infusion pumps market in emerging nations. However, high cost of infusion pumps and rising adoption of refurbished infusion pumps are the key factors restraining the growth of this north africa critical care equipment market.

Geographically, the global market is classified into Asia (excluding India), India, and the Middle East and North Africa. In 2016, the critical care equipment market is estimated to be dominated by Asia. Rising demand for remote patient monitoring, high adoption rate of technologically advanced critical care devices, and increasing patient population base are contributing to the large share of the Asian critical care equipment market. The Indian market is expected to grow at the highest CAGR from 2016 to 2021. Factors such as growing government support, increasing private sector investment, rising geriatric population, growing incidence and prevalence of respiratory and chronic diseases, and developing healthcare infrastructure are propelling the growth of the Indian critical care equipment market.

Geographic expansion is the primary growth strategy adopted by major players to increase their presence in the Indian critical care equipment market. Moreover, strategies such as new product launches and product enhancements; partnerships, agreements, and collaborations; and acquisitions were also adopted by a significant number of market players to strengthen their product portfolios and increase their visibility in the critical care equipment market.

Koninklijke Philips N.V. (Netherlands), General Electric Company (U.S.), Medtronic plc (U.S.), Drägerwerk AG & Co. KGaA (Germany), Skanray Technologies Pvt. Ltd. (India), Maquet Holding B.V. & Co. KG. (Germany), BPL Medical Technologies Ltd (India), B. Braun Melsungen AG (Germany), Akas Medical (India), Smiths Medical (U.S.), Nihon Kohden Corporation (Japan), and Fresenius Kabi (Germany) are some of the key players operating in the Indian critical care equipment market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Asia and North Africa Critical Care Equipment Market Definition

1.3 Asia and North Africa Critical Care Equipment Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Methodology Steps

2.2 Secondary and Primary Research Methodology

2.2.1 Secondary Research

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Research

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.2.1 Supply Side

2.2.2.2.2 Demand Side

2.3 Asia and North Africa Critical Care Equipment Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Asia and North Africa Critical Care Equipment Market Breakdown and Data Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 29)

3.1 Introduction

3.2 Current Scenario

3.3 Future Outlook

3.4 Conclusion

4 Premium Insights (Page No. - 32)

4.1 Critical Care Devices Market in Emerging Nations - Overview

4.2 Critical Care Devices Market Size, By Product (2016 vs 2021)

4.3 Indian Critical Care Devices Market, By Product and Price Range, 2016 (USD Million)

4.4 Critical Care Devices Market, By Product and Region, 2016 (USD Million)

5 Business Models (Page No. - 35)

5.1 Introduction

5.2 Indian Infusion Pumps Market

5.2.1 Key Business Models

5.2.2 Key Product Specifications

5.2.3 Key Strategies

5.2.4 Strategic Recommendations

5.3 Indian Patient Monitors Market

5.3.1 Key Business Models

5.3.2 Key Product Specifications

5.3.3 Key Strategies

5.3.4 Strategic Recommendations

5.4 Indian Ventilators Market

5.4.1 Key Business Models

5.4.2 Key Product Specifications

5.4.3 Key Strategies

5.4.4 Strategic Recommendations

6 Market Overview: Critical Care Market (Page No. - 43)

6.1 Patient Monitors

6.1.1 Introduction

6.1.2 Market Dynamics

6.1.2.1 Drivers

6.1.2.1.1 High Replacement Rates

6.1.2.1.2 Increased Private Sector Investments and Expansions

6.1.2.1.3 Development of Multi-Parameter Monitors

6.1.2.1.4 Huge Patient Base in India

6.1.2.2 Restraints

6.1.2.2.1 High Use of Refurbished Patient Monitors

6.1.2.2.2 High Cost of Patient Monitors

6.1.2.3 Opportunities

6.1.2.3.1 Development of Patient Monitors With Wireless and Sensor Technology

6.1.2.3.2 Rising Development of Home-Use and Remote Patient Monitoring Devices

6.1.2.4 Challenges

6.1.2.4.1 Lack of Regulations and High Import Duties

6.1.2.5 Burning Issues

6.1.2.5.1 High Demand for Low-Cost Chinese Patient Monitors

6.2 Ventilators Market

6.2.1 Introduction

6.2.2 Market Dynamics

6.2.2.1 Drivers

6.2.2.1.1 Increasing Number of Preterm Births

6.2.2.1.2 Growing Geriatric Population

6.2.2.1.3 Rising Prevalence of Respiratory Diseases

6.2.2.1.3.1 Growing Level of Atmospheric Pollution Increasing the Prevalence of Chronic Respiratory Disorders

6.2.2.1.4 Rising Number of Surgical Procedures

6.2.2.2 Restraints

6.2.2.2.1 Shortage of Icu Beds

6.2.2.2.2 Low Per Capita Healthcare Expenditure and Lack of Reimbursement

6.2.2.2.3 Availability of Low-Cost Products From Local Manufacturers Shrinking Revenue Growth

6.2.2.3 Opportunities

6.2.2.3.1 Growing Demand for Home Care Ventilators

6.2.2.3.2 Rising Number of Icu Patients

6.2.2.3.3 Emergence of Noninvasive Ventilation Technologies

6.2.2.4 Challenges

6.2.2.4.1 Risks and Complications Associated With Invasive Ventilators

6.2.2.4.1.1 Neonatal Invasive Ventilators

6.2.2.4.1.2 Adult Invasive Ventilators

6.2.2.4.2 Shortage of Medical Staff in Hospitals

6.2.2.5 Burning Issues

6.2.2.5.1 Shortage of Ventilators in Government Hospitals

6.3 Infusion Pumps Market

6.3.1 Introduction

6.3.2 Market Dynamics

6.3.2.1 Drivers

6.3.2.1.1 Rising Prevalence of Chronic Diseases

6.3.2.1.2 Rising Geriatric and Obese Population Resulting in the Growing Prevalence of Chronic Diseases in India

6.3.2.1.3 Increasing Number of Hospital Beds

6.3.2.2 Restraints

6.3.2.2.1 High Cost of Infusion Pumps

6.3.2.2.2 Rise in Import Duty for Medical Devices

6.3.2.3 Opportunities

6.3.2.3.1 Improving Healthcare Infrastructure in India

6.3.2.3.1.1 Increasing Number of Specialty/Super Specialty Hospitals

6.3.2.3.1.2 Increasing Number of Hospitals in Tier Ii and Tier Iii Cities

6.3.2.3.2 Rising Medical Tourism in India

6.3.2.3.3 Introduction of Smart Infusion Pumps

6.3.2.3.3.1 Growing Government Initiatives to Promote Indigenous Manufacturing of Medical Devices – Make in India Initiative

6.3.2.4 Challenges

6.3.2.4.1 Lower Adoption of Insulin Infusion Pumps

6.3.2.4.2 Rising Adoption of Refurbished Infusion Pumps

6.3.2.5 Burning Issues

6.3.2.5.1 High Use of Stacked Pumps for Multiple Drug Delivery

6.3.2.5.2 Increasing Shift to Disposable Ambulatory Infusion Pumps From Basic Gravity Sets

7 Patient Monitors Market in Emerging Nations, By Region (Page No. - 65)

7.1 Introduction

7.2 Asia

7.2.1 Rising Demand for Remote Patient Monitoring

7.2.2 Growing Medical Tourism in the Region

7.2.3 Rising Focus of Players on the Asian Patient Monitors Market

7.2.4 Rising Demand for Low-Cost Patient Monitors Offered By Chinese Manufacturers

7.2.5 High Cost and Growing Use of Refurbished Patient Monitors

7.3 India

7.3.1 Expanding Patient Population Base

7.3.2 Lucrative Market for Key Players

7.3.3 Improving Healthcare Infrastructure in Rural Areas

7.4 Middle East and North Africa (MENA)

7.4.1 Growing Initiatives By Key Market Players for Improving Healthcare Infrastructure

8 Ventilators Market in Emerging Nations, By Region (Page No. - 72)

8.1 Introduction

8.2 Asia

8.2.1 Rising Geriatric Population

8.2.2 Increasing Prevalence of Copd, Asthma, and Obesity in China

8.2.3 Presence of A Well-Developed Healthcare System and Availability of the Universal Healthcare Reimbursement Policy in Japan

8.3 India

8.3.1 Rising Number of Patients With Respiratory Diseases

8.3.2 Growing Initiatives By Key Players

8.3.3 Increasing Number of Super-Specialty Hospitals in India

8.3.4 Growing Number of Local Manufacturers

8.3.5 Low Accessibility of Copd Treatment

8.4 Middle East and North Africa (MENA)

8.4.1 Huge Patient Base for Respiratory Diseases

8.4.2 Improving Healthcare Infrastructure

9 Infusion Pumps Market in Emerging Nations, By Region (Page No. - 79)

9.1 Introduction

9.2 Asia

9.2.1 Large Patient Base

9.2.2 Improving Healthcare Infrastructure in Asian Countries

9.2.3 Rapid Rise in Aging and Diabetic Population

9.2.4 Rising Popularity of Disposable Infusion Pumps in Asian Countries

9.2.5 South Korea, One of the Most Lucrative Markets for Infusion Pumps in Asia

9.2.6 Focus of Market Players on Asia

9.2.7 Limited Access to Modern Healthcare Treatment in Key Asian Countries

9.2.8 Reluctance to Shift From Traditional Medication Delivery Approaches

9.3 India

9.3.1 Need for Technological Differentiation

9.3.2 Rising Middle-Class Population and Growing Prevalence of Target Diseases

9.3.3 “Make in India” Campaign

9.4 Middle East and North Africa (MENA)

9.4.1 Improving Healthcare Expenditure in the MENA

9.4.2 Middle East Countries: New Frontiers in Infusion Pumps Market

9.4.3 Improving Regulatory Scenario in Middle East Countries

9.4.4 Rising Prevalence of Hiv in Africa

10 Ventilators Market in Emerging Nations, By Product (Page No. - 91)

10.1 Introduction

10.2 Adult Ventilators

10.3 Infant/Neonatal Ventilators

11 Competitive Landscape (Page No. - 96)

11.1 Overview

11.2 Asia and North Africa Critical Care Equipment Market Share Analysis

11.2.1 Key Players in the Indian Infusion Pumps Market

11.2.2 Key Players in the Indian Patient Monitors Market

11.2.3 Key Players in the Indian Ventilators Market

11.3 Competitive Situation and Trends

11.3.1 Expansions

11.3.2 Agreements, Partnerships, and Collaborations

11.3.3 New Product Launches and Product Enhancements

11.3.4 Acquisitions

11.3.5 Other Strategies

12 Company Profiles: Critical Care Market (Page No. - 105)

12.1 Patient Monitors

12.1.1 Introduction

12.1.2 Koninklijke Philips N.V.

12.1.2.1 Business Overview

12.1.2.2 Products Offered

12.1.2.3 Recent Developments

12.1.2.4 MnM View

12.1.3 General Electric Company

12.1.3.1 Business Overview

12.1.3.2 Products Offered

12.1.3.3 Recent Developments

12.1.3.4 MnM View

12.1.4 Nihon Kohden Corporation

12.1.4.1 Business Overview

12.1.4.2 Products Offered

12.1.4.3 Recent Developments

12.1.4.4 MnM View

12.1.5 Drägerwerk AG & Co. KGAA

12.1.5.1 Business Overview

12.1.5.2 Products Offered

12.1.5.3 Recent Developments

12.1.6 Skanray Technologies Pvt. Ltd.

12.1.6.1 Business Overview

12.1.6.2 Products Offered

12.1.6.3 Recent Developments

12.2 Ventilators Market

12.2.1 Introduction

12.2.2 Koninklijke Philips N.V.

12.2.2.1 Business Overview

12.2.2.2 Products Offered

12.2.2.3 Recent Developments

12.2.2.4 MnM View

12.2.3 General Electric Company (GE)

12.2.3.1 Business Overview

12.2.3.2 Products Offered

12.2.3.3 Recent Developments

12.2.3.4 MnM View

12.2.4 Drägerwerk AG & Co. KGAA

12.2.4.1 Business Overview

12.2.4.2 Products Offered

12.2.4.3 Recent Developments

12.2.4.4 MnM View

12.2.5 Maquet Holding B.V. & Co. Kg. (A Subsidiary of the Getinge Group)

12.2.5.1 Business Overview

12.2.5.2 Products Offered

12.2.5.3 Recent Developments

12.2.6 Medtronic PLC

12.2.6.1 Business Overview

12.2.6.2 Products Offered

12.2.6.3 Recent Developments

12.3 Infusion Pumps Market

12.3.1 Introduction

12.3.2 B. Braun Melsungen AG

12.3.2.1 Business Overview

12.3.2.2 Products Offered

12.3.2.3 Recent Developments

12.3.2.4 MnM View

12.3.3 Fresenius KABI (A Business Unit of Fresenius SE & Co. KGAA)

12.3.3.1 Business Overview

12.3.3.2 Products Offered

12.3.3.3 Recent Developments

12.3.3.4 MnM View

12.3.4 BPL Medical Technologies Ltd.

12.3.4.1 Business Overview

12.3.4.2 Products Offered

12.3.4.3 Recent Developments

12.3.4.4 MnM View

12.3.5 Smiths Medical (A Division of Smiths Group PLC)

12.3.5.1 Business Overview

12.3.5.2 Products Offered

12.3.5.3 Recent Developments

12.3.5.4 MnM View

12.3.6 Akasmedical

12.3.6.1 Business Overview

12.3.6.2 Products Offered

12.3.6.3 Recent Developments

13 Appendix (Page No. - 152)

13.1 Discussion Guide*

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (19 Tables)

Table 1 Statistics for Geriatric Population, 2015 vs. 2030

Table 2 Impact of Chinese Manufacturers in the Critical Care Market, 2016

Table 3 Impact of Refurbished Devices in the Critical Care Market, 2016

Table 4 Patient Monitors Market Size, By Region, 2014-2021 (USD Million)

Table 5 India: Patient Monitors Market Size, By Price Range,2014-2021 (USD Million)

Table 6 Ventilators Market Size, By Region, 2014-2021 (USD Million)

Table 7 India: Ventilators Market Size, By Price Range, 2014-2021 (USD Million)

Table 8 Infusion Pumps Market Size, By Region, 2014-2021 (USD Million)

Table 9 Syringe Pumps Market Size, By Region, 2014-2021 (USD Million)

Table 10 India: Infusion Pumps Market Size, By Price Range,2014-2021 (USD Million)

Table 11 India: Syringe Pumps Market Size, By Price Range,2014-2021 (USD Million)

Table 12 Ventilators Market Size, By Product, 2014–2021 (USD Million)

Table 13 Adult Ventilators Market Size, By Region, 2014–2021 (USD Million)

Table 14 Infant/Neonatal Ventilators Market Size, By Region,2014–2021 (USD Million)

Table 15 Top 5 Expansions, 2012–2016

Table 16 Top 5 Agreements, Partnerships, and Collaborations, 2012–2016

Table 17 Top 5 New Product Launches and Product Enhancements, 2012–2016

Table 18 Acquisitions, 2012–2016

Table 19 Top 5 Other Strategies, 2012–2016

List of Figures (49 Figures)

Figure 1 Critical Care equipment Market in Emerging Nations: Research Methodology Steps

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Asia Critical Care equipment Market: Bottom-Up Approach

Figure 4 Asia Critical Care equipment Market: Top-Down Approach

Figure 5 Research Design

Figure 6 Critical Care Equipment Market in Emerging Nations, By Product,2016 vs 2021 (USD Million)

Figure 7 Critical Care Equipment Market in Emerging Nations, By Region, (USD Million)

Figure 8 Critical Care Equipment Market is Expected to Witness Lucrative Growth in Emerging Nations

Figure 9 Patient Monitors Market is Estimated to Have the Largest Share in the Critical Care equipment Market

Figure 10 the Indian Critical Care equipment Market is Dominated By Moderate Price Range Products in 2016

Figure 11 Patient Monitors Product Segment to Dominate the Critical Care equipment Market in Emerging Nations in 2016

Figure 12 Patient Monitors Market: Drivers, Restraints, Opportunities, & Challenges

Figure 13 Ventilators Market: Drivers, Restraints, Opportunities, & Challenges

Figure 14 Infusion Pumps Market: Drivers, Restraints, Opportunities, & Challenges

Figure 15 Projected Burden of Diseases in India, By Cause, 2004–2030

Figure 16 Number of Hospital Beds in India has Witnessed Significant Growth (2005–2013)

Figure 17 Joint Commission International Accredited Hospitals in India

Figure 18 Asia is Expected to Dominate the Patient Monitors Market In2016 (USD Million)

Figure 19 Moderate-Priced Patient Monitors to Grow at the Highest Rate in the Forecast Period

Figure 20 Asia is Expected to Dominate the Ventilators Market in 2016

Figure 21 Moderate-Priced Ventilator Devices to Witness Highest Growth During the Forecast Period

Figure 22 Asia is Expected to Dominate the Infusion Pumps Market In2016 (USD Million)

Figure 23 India is Expected to Grow at the Highest Rate in the Syringe Pumps Market in 2016 (USD Million)

Figure 24 Infusion Pumps and Syringe Pumps Market Size in Asia Region,2016 vs 2021

Figure 25 High-Priced Infusion Pumps to Grow at the Highest Rate In2016 (USD Million)

Figure 26 Low-Priced Syringe Pumps to Dominate the Indian Syringe Pumps Market in 2016 (USD Million)

Figure 27 Infusion Pumps and Syringe Pumps Market Size in MENA, 2016 vs 2021

Figure 28 Adult Ventilators are Expected to Dominate the Ventilators Market in 2016 (USD Million)

Figure 29 Asia is Expected to Dominate the Adult Ventilators Market in 2016 (USD Million)

Figure 30 India is Expected to Be the Fastest-Growing Region in the Infant/Neonatal Ventilators Market in 2016 (USD Million)

Figure 31 Indian Infusion Pumps Market Share Analysis, By Key Player, 2014

Figure 32 Indian Patient Monitors Market Share Analysis, By Key Player, 2015

Figure 33 Indian Ventilators Market Share Analysis, By Key Player, 2015

Figure 34 Battle for Market Share: Expansions Was the Key Strategy Pursued By Market Players Between 2012 & 2016

Figure 35 Geographic Revenue Snapshot (2015)

Figure 36 Koninklijke Philips N.V.: Company Snapshot

Figure 37 General Electric Company: Company Snapshot

Figure 38 Nihon Kohden Corporation: Company Snapshot

Figure 39 Drägerwerk AG & Co. KGAA: Company Snapshot

Figure 40 Geographic Revenue Snapshot (2015)

Figure 41 Koninklijke Philips N.V.: Company Snapshot

Figure 42 General Electric Company: Company Snapshot

Figure 43 Drägerwerk AG & Co. KGAA: Company Snapshot

Figure 44 Getinge Group: Company Snapshot

Figure 45 Medtronic PLC: Company Snapshot

Figure 46 Geographic Revenue Snapshot (2014)

Figure 47 B. Braun Melsungen AG: Company Snapshot

Figure 48 Fresenius KABI: Company Snapshot

Figure 49 Smiths Group PLC: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Asia and North Africa Critical Care Equipment Market