AI Sensor Market with Recession Impact by Sensor Type (Motion, Pressure, Temperature, Optical, Position), Application (Automotive, Consumer Electronics, Manufacturing), Type, Technology (NLP, ML, Computer Vision) and Region - Global Forecast to 2028

Updated on : Sep 12, 2024

AI sensor Market Size, Share & Growth

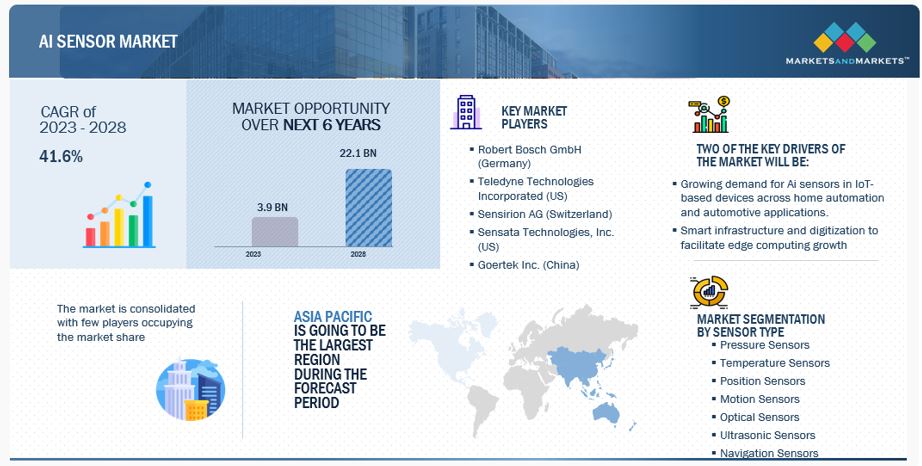

[227 Pages Report] The AI sensor market is projected to reach USD 22.1 billion by 2028, from USD 3.0 billion in 2022, at a CAGR of 41.6%. Factors such as the high installation and maintenance cost, lack of trust and awareness among end users, and complexity in data storage act as restraints for the growth of the market.

AI Sensor Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

AI sensor Market Trends & Dynamics

Smart infrastructure and digitalization to facilitate edge computing growth.

Rapid urbanization and digitalization significantly impact the growth of smart infrastructure. Edge computing is a critical technology increasingly used in smart infrastructure. It enables real-time data processing and analysis from smart sensors and other IoT devices. By processing data near the source, edge computing can reduce latency, increase reliability, and improve overall system performance. Smart infrastructure utilizes data and technology to optimize the performance of buildings, transportation systems, energy networks, and other essential infrastructure. With the help of smart sensors, IoT devices, and other digital tools, smart infrastructure can manage and monitor anything from traffic patterns to energy usage, enabling cities to make more informed decisions and provide better services to their residents.

The increasing urban population and rapid urbanization have increased the demand for more sustainable and efficient infrastructure solutions. Over 50% of the world’s population lives in urban areas. This is expected to grow by 1.5 times by 2045, which means nearly 75% of the global population will live in urban areas. This, in turn, will push the upgradation of manufacturing processes by implementing industry 4.0 norms that require AI sensors for operations. Furthermore, the development of smart cities, smart automotive, smart traffic systems, smart homes, smart factories, and smart transport systems depend on AI and IoT technologies and cannot be attained without AI sensors.

Restraint: High installation and maintenance cost

Cost plays a critical role in determining the growth of the AI sensor market. The huge capital requirement for the deployment and maintenance of integrated AI sensors can pose challenges for market players. Furthermore, additional expenditure on AI sensor software solutions, related software compatibility compliances, and software maintenance services make the deployment of AI sensors costly, limiting the adoption of these sensors. Artificial intelligence is still under development in some sectors as it cannot be applied to specific applications due to technical and implementation constraints. This, along with the high cost of ownership, may limit the growth of this market. End users also tend to be slightly more skeptical about the cost benefits of AI sensors across emerging use cases.

Opportunity: Growing preference for AI-sensor enabled wearables

Wearables based on AI sensors form one of the fastest-growing markets. Smartwatches and ear-worn devices are the leading market segments. This market is projected to account for USD 265.4 billion by 2026, registering a CAGR of 18.0% during the forecast period. Spending on hearables increased by 124% in 2020, and global shipments of wearable technology reached 570 million units in 2021 at a CAGR of 16.6% (Source: MarketsandMarkets). This growing preference for wearables will likely boost the market for AI sensors. The adoption of wearables is growing rapidly as users increasingly focus on improving their overall health and fitness, driving the demand for fitness and medical tracking equipment. This, in turn, drives the demand for AI sensors. These sensors are used in applications such as smart glasses/goggles; ring/fingerworn scanners; footwear such as athletic, fitness, and sports shoes; wristwear such as advanced electronic watches and wristbands; smart textiles; and headbands & neckwear. Bosch Sensortec (Germany) has started actively working on the wearable technology market. Bosch Sensortec has developed a revolutionary self-learning motion sensor, BHI260AP, that adds AI to portable devices. The sensor enables manufacturers of wearable and hearable devices to provide personalized fitness tracking through self-learning AI software in the sensor. This self-learning AI sensor will change how users interact with their fitness devices from a one-way approach to an interactive way of training.

Challenges: Lack of skilled workforce

The AI sensor market is growing rapidly, and there is a significant shortage of trained professionals with the skills and expertise necessary to develop and maintain AI sensor systems. This shortage of skilled workforce is a major challenge for companies operating in this market and can limit their ability to innovate and compete effectively. One of the main reasons for this shortage is the relatively new nature of the field, due to which few educational programs and training opportunities are available for those interested in pursuing careers in AI sensors. Additionally, the complexity of these systems requires a broad range of skills, including expertise in cognitive computing, machine learning, deep learning, image recognition technologies, data analytics, computer vision, and signal processing. Integrating AI solutions into existing systems requires extensive data processing to replicate the behavior of a human brain. Even minor errors can result in system failure or malfunctioning of a solution, affecting outcomes and desired results. This can make it difficult for companies to find individuals with the necessary skillsets to fill these roles.

AI sensor market Map:

Motion sensors in consumer electronics application to account for largest market share during forecast period.

Motion sensors are primarily used across consumer electronics applications. Major use cases for motion sensors lie across wearable electronic devices. Motion sensors, such as accelerometers, gyroscopes, MEMS, and a combination of these sensors, are the most used type of sensors incorporated in wearables. The market for these sensors is expected to grow due to consumers' increased focus on tracking real-time motion-sensing activities, such as step counting and walking distance covered. This generated data analysis provides users with specific results that can be used to define health and fitness goals.

Consumer electronics to account for second-largest market share of the AI sensor market during forecast period.

The consumer electronics segment is expected to hold the second-largest market share during the forecast period. Artificial intelligence has become pivotal in consumer electronics. Mobile devices, smart TVs, speakers, virtual personal assistants, and distributed and wearable sensors are among the many products and services benefiting from AI developments. With rapid urbanization and the rising use of the internet, consumer lifestyles are evolving, leading to changes in preferences. The growing inclination towards smart and intelligent devices has led to consumer electronics market growth at a fast rate. Moreover, the availability of low-cost AI chipsets also boosts the adoption of intelligent devices across the consumer electronics sector.

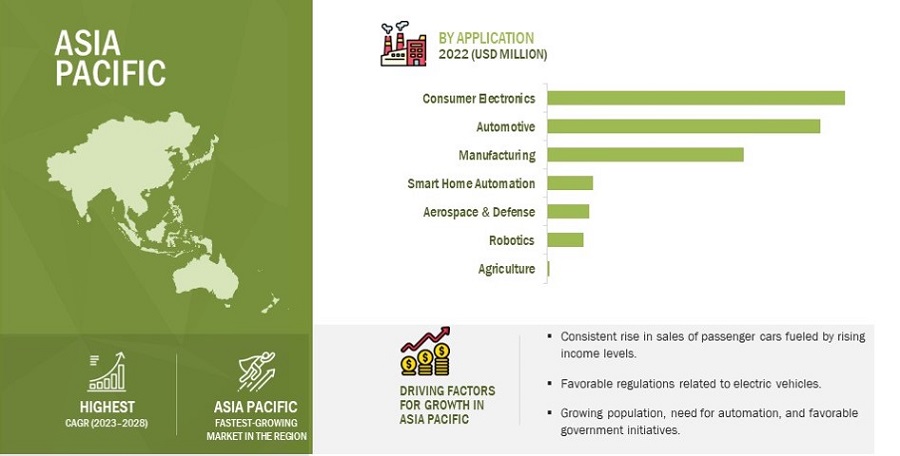

Asia Pacific to have the largest market share in the AI sensor market during the forecast period.

The Asia Pacific region is the market leader for AI sensors in various industries such as consumer electronics, automotive, and manufacturing sectors, with a huge demand coming from countries like China, Japan, and India. China has shown massive growth due to its rapidly expanding industrial sector and increasing adoption of smart home devices.

Japan is also expected to see a high growth in the AI sensor industry, driven by the country's strong focus on AI research and development. The Japanese government has launched several initiatives to promote the adoption of AI technology in various sectors, including healthcare, manufacturing, and transportation.

AI Sensor Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Regional analysis of Artificial Intelligence (AI) sensors Market:

The global AI sensor market is experiencing robust growth across all regions, driven by technological advancements, increasing investments, and supportive government policies. Each region offers unique opportunities and faces specific challenges, influenced by local market dynamics, regulatory environments, and industry needs. Key players are investing heavily in research and development, forming strategic partnerships, and innovating to capitalize on the growing demand for AI sensors in various applications, from healthcare and automotive to industrial automation and smart cities.

North America Artificial Intelligence (AI) sensors Market:

Market Growth Drivers: North America, particularly the United States, leads the global AI sensor market due to the presence of tech giants like Google, IBM, and Microsoft. These companies are heavily investing in AI research and development, driving innovation in AI sensor technologies. The region benefits from a robust infrastructure that supports the rapid adoption of AI across various industries. In healthcare, for example, AI sensors are being used for predictive analytics and patient monitoring, while in the automotive industry, they are integral to the development of autonomous vehicles.

Opportunities: The growth opportunities in North America are substantial, with the increasing implementation of AI in IoT applications and the expansion of smart city initiatives. AI sensors are crucial for smart homes, traffic management, and public safety systems. The burgeoning demand for AI-based automation and robotics in manufacturing also presents significant opportunities for market growth.

Challenges: Despite the promising growth, the market faces challenges such as high initial investment costs and concerns over data privacy and security. The rapid pace of technological advancements requires constant upskilling, but there is a shortage of skilled professionals in the AI field.

Recent Developments: Recent developments include significant advancements in AI sensor technologies for autonomous vehicles and healthcare. Collaborations between tech companies and healthcare providers are leading to the development of AI-driven diagnostic tools. For instance, AI sensors are being used to detect anomalies in medical imaging, enhancing the accuracy and speed of diagnoses.

Top Companies: AI sensor Market

- IBM Corporation

- Google LLC

- Microsoft Corporation

- NVIDIA Corporation

- Intel Corporation

Growth Driving Factors: The strong presence of leading tech companies ensures continuous innovation and development in AI sensors. Government support through funding and favorable policies further accelerates growth. Strategic partnerships and collaborations are also pivotal in driving the market forward.

Artificial Intelligence (AI) sensors Market in United States (USA):

The United States AI sensors market is seeing the highest growth in segments like automotive, healthcare, consumer electronics, industrial automation, and smart cities. These segments are driven by advancements in technology, increasing demand for automation and smart solutions, and substantial investments in AI research and development. With ongoing innovations and the integration of AI in various applications, these segments are expected to lead the market growth in the coming years.

1. Automotive Industry:

Growth Rate:

- Expected CAGR of 25% from 2023 to 2028.

Key Drivers:

- Autonomous Vehicles: The push towards self-driving cars by companies like Tesla, Waymo, and General Motors is a significant driver. AI sensors are essential for navigation, obstacle detection, and real-time decision-making.

- Advanced Driver Assistance Systems (ADAS): Increasing adoption of ADAS in mainstream vehicles to enhance safety and driving experience.

- Electric Vehicles (EVs): AI sensors help in battery management, predictive maintenance, and enhancing the efficiency of EV systems.

Innovations:

- Development of LiDAR, radar, and camera sensors with AI capabilities to improve vehicle perception and safety.

- Integration of AI sensors for vehicle-to-everything (V2X) communication.

2. Healthcare Sector:

Growth Rate:

- Expected CAGR of 22% from 2023 to 2028.

Key Drivers:

- AI-driven Diagnostics: Increasing use of AI sensors in imaging systems for early disease detection and diagnosis.

- Remote Patient Monitoring: Growth in wearable health devices equipped with AI sensors to monitor vital signs and detect health anomalies in real-time.

- Robotic Surgery: Adoption of AI sensors in robotic surgical systems to enhance precision and outcomes.

Innovations:

- Development of AI sensors for continuous glucose monitoring and heart rate variability analysis.

- Use of AI in sensors for non-invasive health monitoring devices.

3. Consumer Electronics:

Growth Rate:

- Expected CAGR of 20% from 2023 to 2028.

Key Drivers:

- Smartphones and Wearables: High demand for AI-enhanced sensors in smartphones for features like facial recognition, augmented reality (AR), and health tracking.

- Smart Home Devices: Growing adoption of AI sensors in smart speakers, security systems, and home automation products.

- Gaming and AR/VR: Use of AI sensors to enhance user experience in gaming consoles and AR/VR devices.

Innovations:

- Introduction of edge AI sensors that process data locally on the device, improving performance and reducing latency.

- AI-powered biometric sensors for advanced security features in consumer electronics.

4. Industrial Automation:

Growth Rate:

- Expected CAGR of 18% from 2023 to 2028.

Key Drivers:

- Industry 4.0: Increasing adoption of AI sensors in smart factories for predictive maintenance, quality control, and process optimization.

- Robotics: Use of AI sensors in industrial robots to improve their efficiency and accuracy in tasks such as assembly, packaging, and inspection.

- Supply Chain Optimization: Implementation of AI sensors in logistics and warehousing for inventory management and real-time tracking.

Innovations:

- Development of AI sensors with machine learning capabilities for adaptive manufacturing processes.

- Integration of AI sensors in collaborative robots (cobots) to work alongside human workers safely and efficiently.

5. Smart Cities:

Growth Rate:

- Expected CAGR of 21% from 2023 to 2028.

Key Drivers:

- Traffic Management: Use of AI sensors in smart traffic lights and systems to optimize traffic flow and reduce congestion.

- Public Safety: Deployment of AI-enhanced surveillance cameras and sensors for crime detection and prevention.

- Environmental Monitoring: Implementation of AI sensors for monitoring air quality, noise levels, and other environmental parameters.

Innovations:

- Development of AI sensors for smart lighting systems that adjust based on real-time data.

- AI-based waste management sensors to optimize collection routes and reduce operational costs.

Artificial Intelligence (AI) Sensors Market in Canada:

The Canada AI sensors market is driven by government support, a strong research base, increasing demand for smart technologies, advancements in healthcare, automotive innovation, industrial automation, a growing AI ecosystem, and rising awareness and adoption across industries. These drivers collectively create a favorable environment for the growth and expansion of the AI sensors market in Canada, positioning it for significant advancements in the coming years.

Key Market Growth Drivers in the Canada Artificial Intelligence (AI) Sensors Market

1. Government Initiatives and Support:

Description:

- The Canadian government has been proactive in promoting AI and related technologies through various initiatives and funding programs.

- AI Superclusters: Canada's Innovation Superclusters Initiative includes the SCALE.AI supercluster, focusing on AI and supply chains, fostering collaboration between industry, academia, and government.

- Funding and Grants: Significant investments in AI research and development, including federal and provincial grants, are encouraging innovation and the adoption of AI sensors across various sectors.

Impact:

- These initiatives provide financial support and create an ecosystem conducive to AI advancements, accelerating the development and deployment of AI sensors.

2. Strong Research and Academic Base:

Description:

- Canada is home to several leading AI research institutions and universities, such as the Vector Institute, the Montreal Institute for Learning Algorithms (MILA), and the Alberta Machine Intelligence Institute (Amii).

- Collaborations: Partnerships between academia and industry facilitate the translation of cutting-edge research into practical AI sensor applications.

Impact:

- The robust research environment fosters innovation in AI sensor technologies, leading to new products and solutions that drive market growth.

3. Rising Demand for Smart Technologies:

Description:

- Increasing consumer interest in smart home devices, wearables, and other consumer electronics that incorporate AI sensors.

- Smart Cities: Initiatives aimed at developing smart city infrastructure, including smart lighting, traffic management, and environmental monitoring systems that rely on AI sensors.

Impact:

- The growing adoption of smart technologies in daily life and urban planning boosts the demand for advanced AI sensors, driving market expansion.

4. Advancements in Healthcare:

Description:

- The healthcare sector in Canada is rapidly adopting AI technologies for diagnostics, remote monitoring, and personalized medicine.

- Wearable Health Devices: Increasing use of AI sensors in wearables for continuous health monitoring and early detection of medical conditions.

- Telehealth: Expansion of telehealth services leveraging AI sensors to provide remote patient care, especially in rural and underserved areas.

Impact:

- Advancements in healthcare applications of AI sensors improve patient outcomes and operational efficiency, driving market growth in this sector.

5. Automotive Innovation:

Description:

- Canada is investing in the development of autonomous and connected vehicles, with AI sensors playing a critical role in these technologies.

- ADAS and EVs: Increasing integration of AI sensors in advanced driver assistance systems (ADAS) and electric vehicles (EVs) to enhance safety, efficiency, and user experience.

Impact:

- The automotive sector's focus on innovation and technology integration fuels the demand for sophisticated AI sensors, contributing significantly to market growth.

6. Industrial Automation and Industry 4.0:

Description:

- Adoption of Industry 4.0 practices, including the use of AI sensors for predictive maintenance, quality control, and process optimization in manufacturing.

- Robotics and IoT: Increasing use of AI sensors in industrial robots and IoT devices to improve operational efficiency and productivity.

Impact:

- The shift towards smart manufacturing and industrial automation drives the need for AI sensors, leading to market expansion in this segment.

7. Growing AI Ecosystem:

Description:

- A thriving AI ecosystem with numerous startups and tech companies focusing on AI sensor technologies.

- Incubators and Accelerators: Support from incubators, accelerators, and venture capital firms helps startups develop innovative AI sensor solutions and bring them to market.

Impact:

- The dynamic AI ecosystem fosters competition and innovation, propelling the growth of the AI sensors market in Canada.

8. Increasing Awareness and Adoption:

Description:

- Rising awareness about the benefits of AI sensors in enhancing efficiency, safety, and decision-making across various sectors.

- Adoption Across Industries: Broader adoption of AI sensor technologies in industries such as agriculture, retail, and logistics to optimize operations and improve outcomes.

Impact:

- Greater awareness and adoption of AI sensors across diverse sectors contribute to the overall growth of the market.

Europe Artificial Intelligence (AI) sensors Market:

Market Growth Drivers: Europe's AI sensor market is propelled by supportive government policies and funding dedicated to AI research and development. Countries like Germany, the UK, and France are at the forefront due to their strong industrial base and emphasis on smart manufacturing and Industry 4.0 initiatives. AI sensors are being increasingly adopted in industrial automation to enhance efficiency and productivity.

Opportunities: There are numerous growth opportunities in the region, particularly in smart manufacturing, where AI sensors are used for predictive maintenance and quality control. The security and surveillance sector is also seeing a rising demand for AI-based systems to improve public safety. Additionally, AI in healthcare is gaining traction for applications such as predictive analytics and personalized medicine.

Challenges: Europe faces challenges related to regulatory hurdles and ethical concerns regarding AI deployment. The market is also fragmented due to varying regulations across different countries, which can slow down the adoption of AI technologies.

Recent Developments: Recent developments include the launch of AI-focused innovation hubs and increased investment in AI startups. Advancements in AI sensor technologies are enhancing industrial applications, particularly in manufacturing and logistics.

Top Companies:

- Siemens AG

- SAP SE

- Robert Bosch GmbH

- ABB Ltd.

- Thales Group

Growth Driving Factors: Robust R&D activities and strong government support are major growth drivers. Europe's focus on innovation and product development, coupled with a solid industrial base, positions the region well for continued growth in the AI sensor market.

Top European Countries in the AI Sensors Market

1. Germany AI Sensors Market:

Market Position:

- Germany is a leading player in the European AI sensors market, known for its strong industrial base and technological innovation.

Key Drivers:

- Industry 4.0: Germany's focus on smart manufacturing and industrial automation drives the demand for AI sensors in predictive maintenance, quality control, and process optimization.

- Automotive Industry: Home to major automotive manufacturers like Volkswagen, BMW, and Daimler, Germany is at the forefront of developing AI sensors for autonomous vehicles and advanced driver assistance systems (ADAS).

- Research and Development: Significant investments in AI research and development by both the government and private sector foster innovation in AI sensor technologies.

Top Companies:

- Siemens AG

- Robert Bosch GmbH

- Infineon Technologies AG

- Continental AG

Growth Opportunities:

- Expansion of AI sensor applications in smart factories and connected vehicles.

- Increasing adoption of AI in healthcare for diagnostics and remote monitoring.

2. United Kingdom (UK) AI Sensors Market:

Market Position:

- The UK is a key market for AI sensors in Europe, with a strong focus on AI research, innovation, and implementation across various sectors.

Key Drivers:

- Healthcare Sector: The UK's National Health Service (NHS) is increasingly adopting AI sensors for patient monitoring, diagnostics, and personalized medicine.

- Tech Ecosystem: A vibrant tech ecosystem with numerous AI startups and research institutions driving advancements in AI sensor technologies.

- Government Support: Initiatives such as the AI Sector Deal and funding programs to promote AI adoption and innovation.

Top Companies:

- ARM Holdings

- DeepMind (Google UK)

- Graphcore

- Sensyne Health

Growth Opportunities:

- Development of AI sensors for smart cities and urban infrastructure.

- Increased use of AI sensors in consumer electronics and smart home devices.

3. France AI Sensors Market:

Market Position:

- France is a significant player in the AI sensors market, with a strong emphasis on AI research and collaboration between industry and academia.

Key Drivers:

- Government Initiatives: The French government’s AI strategy, including substantial funding for AI research and development, supports the growth of the AI sensors market.

- Automotive and Aerospace: France's strong automotive and aerospace industries are driving the demand for AI sensors in autonomous vehicles and advanced manufacturing.

- Healthcare Innovations: Growing adoption of AI sensors in healthcare for diagnostics, patient monitoring, and telemedicine.

Top Companies:

- Thales Group

- STMicroelectronics

- Valeo

- Atos

Growth Opportunities:

- Expansion of AI sensor applications in aerospace and defense.

- Increasing implementation of AI sensors in environmental monitoring and smart agriculture.

4. Sweden AI Sensors Market:

Market Position:

- Sweden is emerging as a significant market for AI sensors in Europe, known for its innovation and technological advancements.

Key Drivers:

- Tech Innovation: A strong focus on technology and innovation, supported by a well-established tech ecosystem and startup culture.

- Automotive Industry: Presence of major automotive manufacturers like Volvo and Scania, driving the development and adoption of AI sensors for autonomous and connected vehicles.

- Sustainability Focus: Emphasis on sustainable technologies and smart city initiatives, integrating AI sensors for environmental monitoring and energy management.

Top Companies:

- Ericsson

- Volvo Group

- Fingerprint Cards

- Husqvarna Group

Growth Opportunities:

- Development of AI sensors for sustainable technologies and smart grids.

- Increasing use of AI sensors in healthcare and wearable devices.

5. Netherlands AI Sensors Market:

Market Position:

- The Netherlands is a notable player in the AI sensors market, with a strong focus on innovation and a thriving tech ecosystem.

Key Drivers:

- Innovation Hubs: Presence of innovation hubs and research institutions fostering advancements in AI sensor technologies.

- Smart Cities: Active implementation of smart city projects, utilizing AI sensors for traffic management, public safety, and environmental monitoring.

- Agriculture: Leading in precision agriculture, with AI sensors being used for crop monitoring, soil analysis, and resource optimization.

Top Companies:

- NXP Semiconductors

- Philips

- ASML Holding

- TomTom

Growth Opportunities:

- Expansion of AI sensor applications in precision agriculture and smart farming.

- Increasing adoption of AI sensors in logistics and supply chain optimization.

Asia-Pacific Artificial Intelligence (AI) sensors Market:

Market Growth Drivers: The Asia-Pacific region is experiencing rapid growth in the AI sensor market, driven by technological advancements and large-scale investments in AI and IoT. Countries like China, Japan, and South Korea are leading due to their strong consumer electronics markets and substantial investments in AI research. The region's automotive industry also significantly contributes to the market, with AI sensors being integral to the development of autonomous and connected vehicles.

Opportunities: Opportunities in the region are vast, with the expansion of AI applications in consumer electronics, automotive, and transportation sectors. The development of smart cities is another major growth area, where AI sensors play a critical role in managing infrastructure, traffic, and public safety.

Challenges: High competition among local players and regulatory issues are notable challenges. Additionally, the cost of advanced AI sensors can be prohibitive for smaller companies and startups.

Recent Developments: Significant investments in AI startups and the launch of AI-driven smart city projects are key recent developments. Collaborations between tech giants and automotive companies are driving advancements in AI sensor technologies.

Top Companies:

- Huawei Technologies Co., Ltd.

- Sony Corporation

- Samsung Electronics Co., Ltd.

- Panasonic Corporation

- Alibaba Group

Growth Driving Factors: Government support and strategic initiatives, high consumer demand for advanced technologies, and the presence of major electronics manufacturers are key growth drivers in the Asia-Pacific region.

Top APAC Countries in the AI Sensors Market

1. China AI Sensors Market:

Market Position:

- China is the dominant player in the APAC AI sensors market, driven by its massive investments in AI research and development, strong manufacturing base, and government support.

Key Drivers:

- Government Initiatives: The Chinese government's strategic plans, such as the "Next Generation Artificial Intelligence Development Plan," heavily invest in AI technology, including sensors.

- Tech Giants: Leading technology companies like Alibaba, Baidu, and Tencent are heavily involved in AI development, driving innovation in AI sensors.

- Industrial and Consumer Applications: High demand for AI sensors in industries such as automotive, electronics, healthcare, and smart cities.

Top Companies:

- Huawei Technologies

- Baidu

- Alibaba Group

- Xiaomi

- Hikvision

Growth Opportunities:

- Expansion of AI sensors in autonomous vehicles and smart transportation.

- Growing applications in healthcare for diagnostics and remote patient monitoring.

- Increasing use of AI sensors in smart manufacturing and Industry 4.0.

2. Japan AI Sensors Market:

Market Position:

- Japan is a leading market for AI sensors in the APAC region, known for its advanced technology sector and strong focus on robotics and automation.

Key Drivers:

- Innovation in Robotics: Japan's leadership in robotics and automation drives the demand for AI sensors in industrial robots and consumer electronics.

- Aging Population: Increasing adoption of AI sensors in healthcare to support an aging population, including in-home care and monitoring systems.

- Automotive Industry: Home to major automotive manufacturers like Toyota and Honda, Japan is a pioneer in integrating AI sensors into autonomous vehicles and ADAS.

Top Companies:

- Sony Corporation

- Panasonic Corporation

- Fujitsu Limited

- Toyota Motor Corporation

- Hitachi Ltd.

Growth Opportunities:

- Development of AI sensors for healthcare applications such as eldercare and remote monitoring.

- Expansion in the use of AI sensors in autonomous vehicles and advanced driver assistance systems.

- Increasing implementation of AI sensors in smart manufacturing and industrial automation.

3. South Korea AI Sensors Market:

Market Position:

- South Korea is a significant player in the APAC AI sensors market, with a strong emphasis on technology innovation and government support for AI development.

Key Drivers:

- Government Initiatives: The South Korean government’s AI strategy, including the “AI National Strategy,” aims to advance AI technology and its applications.

- Tech Industry: Leading technology companies like Samsung and LG are driving advancements in AI sensors for consumer electronics, healthcare, and automotive applications.

- Smart Cities: Active implementation of smart city projects that leverage AI sensors for traffic management, public safety, and environmental monitoring.

Top Companies:

- Samsung Electronics

- LG Electronics

- SK Telecom

- Hyundai Motor Company

- Naver Corporation

Growth Opportunities:

- Expansion of AI sensor applications in consumer electronics and smart home devices.

- Increasing use of AI sensors in healthcare for diagnostics and patient monitoring.

- Development of AI sensors for smart city infrastructure and environmental monitoring.

4. India AI Sensors Market:

Market Position:

- India is an emerging market for AI sensors in the APAC region, with rapid growth in technology adoption and government support for AI initiatives.

Key Drivers:

- Government Support: Initiatives such as the “National AI Strategy” and various funding programs support AI research and development.

- Tech Industry: A growing tech industry with numerous startups and established companies investing in AI sensor technologies.

- Diverse Applications: Increasing adoption of AI sensors in sectors such as agriculture, healthcare, automotive, and smart cities.

Top Companies:

- Tata Consultancy Services (TCS)

- Infosys Limited

- Wipro Limited

- HCL Technologies

- Tech Mahindra

Growth Opportunities:

- Development of AI sensors for precision agriculture and smart farming.

- Increasing use of AI sensors in healthcare for remote monitoring and diagnostics.

- Expansion in the automotive sector, particularly in connected and electric vehicles.

5. Singapore AI Sensors Market:

Market Position:

- Singapore is a notable player in the APAC AI sensors market, known for its smart city initiatives and strong focus on technological innovation.

Key Drivers:

- Smart Nation Initiative: The government’s “Smart Nation” initiative aims to transform Singapore into a leading smart city, driving the adoption of AI sensors in urban infrastructure.

- Innovation Hubs: Presence of innovation hubs and research institutions fostering advancements in AI sensor technologies.

- Tech Ecosystem: A vibrant tech ecosystem with numerous startups and multinational tech companies investing in AI.

Top Companies:

- ST Engineering

- Grab Holdings

- A*STAR (Agency for Science, Technology and Research)

- Razer Inc.

- Sea Group (Garena, Shopee)

Growth Opportunities:

- Expansion of AI sensor applications in smart city projects and urban infrastructure.

- Increasing use of AI sensors in healthcare and eldercare solutions.

- Development of AI sensors for transportation and logistics optimization.

Latin America Artificial Intelligence (AI) sensors Market:

Market Growth Drivers: The AI sensor market in Latin America is growing, driven by increasing investments from both public and private sectors. The adoption of AI in agriculture and manufacturing is on the rise, with AI sensors being used for precision farming and industrial automation to enhance productivity and efficiency.

Opportunities: There are significant opportunities for the expansion of AI applications in agriculture, such as precision farming, which can optimize resource use and increase yields. The use of AI for supply chain optimization and the development of AI-driven healthcare solutions also present substantial growth prospects.

Challenges: Limited technological infrastructure, a shortage of skilled professionals, and economic instability are key challenges facing the market in Latin America.

Recent Developments: Government initiatives to promote AI adoption and collaborations between local and international companies are driving market growth. AI-based projects in healthcare and agriculture are gaining traction, showcasing the potential of AI sensors in these sectors.

Top Companies:

- IBM Latin America

- Intel Corporation

- Google Latin America

- Microsoft Latin America

- Siemens Latin America

Growth Driving Factors: Innovation and development, supported by government funding and a growing awareness of AI technologies, are primary growth drivers in the region.

Middle East & Africa Artificial Intelligence (AI) sensors Market:

Market Growth Drivers: The AI sensor market in the Middle East and Africa is growing due to government initiatives promoting AI adoption and increasing investments in smart city projects. The use of AI in security and surveillance is also on the rise, driven by the need for enhanced public safety and security measures.

Opportunities: The region presents opportunities for the expansion of AI applications in the oil & gas industry, where AI sensors can improve operational efficiency and safety. The financial services sector is also seeing increasing adoption of AI for fraud detection and risk management. Additionally, AI-driven healthcare and education solutions are emerging as significant growth areas.

Challenges: Limited technological infrastructure, a lack of skilled professionals, and political and economic instability in some regions pose challenges to market growth.

Recent Developments: National AI strategies and policies have been launched, and collaborations between local and international AI companies are on the rise. AI-driven projects in various sectors, including healthcare and education, are being developed, highlighting the potential of AI sensors.

Top Companies:

- IBM Middle East & Africa

- Microsoft Middle East & Africa

- Google Middle East & Africa

- SAP Middle East & Africa

- Siemens Middle East & Africa

Growth Driving Factors: Government support and strategic initiatives, increasing investments in AI infrastructure, and a growing awareness and adoption of AI technologies are key growth drivers in the Middle East and Africa.

Key Market Players

Robert Bosch GmbH (Germany), Teledyne Technologies Incorporated (US), Sensirion AG (Switzerland), Sensata Technologies, Inc. (US), Goertek Inc. (China), Hokuriku Electric Industry Co., Ltd. (Japan), MEMSIC Semiconductor Co., Ltd. (China), Movella Inc. (US), and Senodia Technologies (Shanghai) Co., Ltd. (China) are some AI sensor companies operating in the market.

Scope of the Report

|

Report Metric |

Details |

| Estimated Market Size | USD 3.0 Billion |

| Projected Market Size | USD 22.1 Billion |

| Growth Rate | 41.6% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Million |

|

Segments covered |

Type, sensor type, technology, application, and Region. |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies covered |

Teledyne Technologies Incorporated (US), Robert Bosch GmbH (Germany), Goertek Inc. (China), Baidu, Inc. (China), Yokogawa Electric Corporation (Japan), Excelitas Technologies Corp. (US) Hokuriku Electric Industry Co., Ltd. (Japan), Sensata Technologies, Inc. (US), (China), Sensirion AG (Switzerland), Sensortek Technology Corporation (Taiwan), Silicon Sensing Systems Limited (UK), Sony Corporation (Japan), MEMSIC Semiconductor Co., Ltd. (China), Movella Inc. (US), Senodia Technologies (Shanghai) Co., Ltd., STMicroelectronics N.V. (Switzerland), Syntiant Corp. (US), TE Connectivity (US), Alif Semiconductor (US), and Augury (US) are among the key players operating in the AI sensor market. |

AI Sensor Market Highlights

This research report categorizes the AI sensor market based on Type, Sensor Type, Technology, Application, and Region

|

Segment |

Subsegment |

|

AI Sensor Market, By Type |

|

|

AI Sensor Market, By Sensor Type |

|

|

AI Sensor Market, By Technology |

|

|

AI Sensor Market, By Application |

|

|

AI Sensor Market, By Region |

|

Recent Developments

- In April 2022, Robert Bosch GmbH acquired Five AI (France), which builds self-driving software components and development platforms to combat the biggest problems in the self-driving car space. This acquisition helped Robert Bosch GmbH boost its presence in the smart mobility solutions and autonomous vehicles markets.

- In May 2022, Sensata Technologies, Inc. partnered with Nanoprecise (Canada) to launch a new asset monitoring solution that enables predictive maintenance for rotary assets. This partnership will deliver actionable insights to plant managers with the help of Nanoprecise’s AI algorithm, which can extract data from the six sensors offered by the Sensata IQ platform.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the AI sensor market?

The product launch, acquisition and collaboration has been and continues to be some of the major strategies adopted by the key players to grow in the AI sensor market.

What region dominates the AI sensor market?

Asia Pacific region will dominate AI sensor market.

What application dominates the AI sensor market?

Automotive applications are expected to dominate the AI sensor market.

Which sensor in by sensor type segment dominates AI sensor market?

Motion sensor is expected to have the largest market size during the forecast period.

Who are the major companies in the AI sensor market?

Robert Bosch GmbH (Germany), Teledyne Technologies Incorporated (US), Sensirion AG (Switzerland), Sensata Technologies, Inc. (US) and Goertek Inc.(China).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for AI sensors in IoT-based devices across home automation and automotive applications- Smart infrastructure and digitalization to facilitate edge computing growth- Increased use of AI sensor-equipped wireless technologiesRESTRAINTS- High installation and maintenance cost- Lack of trust and awareness among end users- Complexity in data storageOPPORTUNITIES- Growing preference for AI sensor-enabled wearables- Advancements in sensor technologies- Increasing adoption of AI sensors in agriculture and robotics- Rapid growth of smart home infrastructureCHALLENGES- Increasing threat of cybersecurity in AI-based devices- Lack of skilled workforce

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

-

5.7 TECHNOLOGY ANALYSISMICRO-ELECTRO-MECHANICAL SYSTEM (MEMS) SENSOR TECHNOLOGYSMART SENSOR TECHNOLOGYAI SENSOR TECHNOLOGY

-

5.8 PATENT ANALYSIS

-

5.9 TRADE AND TARIFF DATATRADE DATA- HS Code 902690TARIFF DATA

- 5.10 KEY CONFERENCES AND EVENTS

-

5.11 REGULATORY LANDSCAPESTANDARDS- IEEE 1451- IEEE C37.118- ISO 19891-1- International Electrotechnical Commission (IEC)- Atmosphere Explosible (ATEX)- Edison Testing Laboratories (ETL)REGULATIONS

-

5.12 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

- 6.2 NEURAL NETWORK

- 6.3 CASE-BASED REASONING

- 6.4 INDUCTIVE LEARNING

- 6.5 AMBIENT INTELLIGENCE

- 7.1 INTRODUCTION

-

7.2 PRESSURE SENSORSABILITY TO DEVELOP HIGH-PERFORMANCE EQUIPMENT AND REDUCE MANUFACTURING TIME

-

7.3 POSITION SENSORSACCURATE MOTION CONTROL AND IMPROVED PROCESS EFFICIENCY AND SAFETY

-

7.4 TEMPERATURE SENSORSWIDE-SCALE USE IN MEASUREMENT CONTROL SYSTEMS AND INSTRUMENTATION

-

7.5 OPTICAL SENSORSUSED IN AEROSPACE & DEFENSE, OIL & GAS, HEALTHCARE, CONSTRUCTION, CONSUMER ELECTRONICS, AND AUTOMOTIVE INDUSTRIES

-

7.6 ULTRASONIC SENSORSDEPLOYMENT IN AUTOMOBILE SELF-PARKING TECHNOLOGY AND ANTI-COLLISION SAFETY SYSTEMS

-

7.7 MOTION SENSORSGROWING USAGE IN CONSUMER ELECTRONICS AND GAMING INDUSTRY

-

7.8 NAVIGATION SENSORSINCREASED ADOPTION IN AUTOMOBILES, AIRCRAFT, SHIPS, SUBMARINES, DEFENSE, AND ROBOTICS

- 8.1 INTRODUCTION

-

8.2 MACHINE LEARNINGDEEP LEARNING- Ability to build hierarchical representationsSUPERVISED LEARNING- Algorithm learns to make predictions or decisions based on labeled training dataUNSUPERVISED LEARNING- Includes clustering methods consisting of algorithms with unlabeled training dataREINFORCEMENT LEARNING- Allows systems and software to determine ideal behavior for maximizing performance of systemsOTHER MACHINE LEARNING TECHNOLOGIES

-

8.3 NATURAL LANGUAGE PROCESSINGREAL-TIME TRANSLATION AND ABILITY TO COMMUNICATE IN NATURAL LANGUAGE WITH SYSTEMS

-

8.4 CONTEXT-AWARE COMPUTINGHIGH DEMAND FOR HARD AND SOFT SENSORS

-

8.5 COMPUTER VISIONDEVELOPING ALGORITHMS AND TECHNIQUES TO ANALYZE, PROCESS, AND INTERPRET DIGITAL IMAGES AND VIDEOS

- 9.1 INTRODUCTION

-

9.2 AUTOMOTIVEPRIMARY ADOPTERS OF AI SENSING TECHNOLOGY

-

9.3 CONSUMER ELECTRONICSGROWING INCLINATION TOWARD SMART DEVICES

-

9.4 MANUFACTURINGAI INCREASES EFFICIENCY AND REDUCES COSTS ACROSS PRODUCT ASSEMBLY LINE

-

9.5 AEROSPACE & DEFENSEADOPTION OF AI SENSORS IN MISSION-CRITICAL TASKS

-

9.6 SMART HOME AUTOMATIONNEED TO IMPROVE HOME SECURITY

-

9.7 ROBOTICSDEMAND FROM HEALTHCARE MONITORING, SPACE AND UNDERWATER EXPLORATION, AND OTHER INDUSTRIES

-

9.8 AGRICULTUREUSE OF AI SENSORS IN CROP AND SOIL ANALYSIS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Prominence of leading AI sensor manufacturersCANADA- Growing automation in automotive and manufacturing sectorsMEXICO- Increasing demand for temperature sensors for medical equipment

-

10.3 EUROPEGERMANY- Government initiatives for promoting implementation of industry 4.0UK- Consumer electronics sector to create new market opportunitiesFRANCE- Prominence of automotive and manufacturing industriesREST OF EUROPE

-

10.4 ASIA PACIFICCHINA- Presence of prominent automotive, aerospace & defense, and electronics companiesJAPAN- Presence of leading sensor manufacturing companiesINDIA- Strong government support for adoption of industrial automationSOUTH KOREA- Increasing demand for advanced sensors from electronics and automotive industriesREST OF ASIA PACIFIC

-

10.5 ROWMIDDLE EAST & AFRICA- Use of AI sensors in oil refining industries for continuous measuring and monitoring applicationsSOUTH AMERICA- Increased technological advancements in automotive, manufacturing, and consumer electronics sectors

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 RANKING ANALYSIS

-

11.6 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 COMPETITIVE BENCHMARKINGCOMPANY FOOTPRINT, BY SENSOR TYPECOMPANY FOOTPRINT, BY APPLICATIONCOMPANY FOOTPRINT, BY REGIONCOMPANY PRODUCT FOOTPRINT

-

11.8 STARTUP/SME EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES/DEVELOPMENTSDEALS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSTELEDYNE TECHNOLOGIES INCORPORATED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewROBERT BOSCH GMBH- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGOERTEK INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSENSATA TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSENSIRION AG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSENSORTEK TECHNOLOGY CORPORATION- Business overview- Products/Services/Solutions offeredHOKURIKU ELECTRIC INDUSTRY CO., LTD.- Business overview- Products/Services/Solutions offeredBAIDU, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsYOKOGAWA ELECTRIC CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsEXCELITAS TECHNOLOGIES CORP.- Business overview- Products/Services/Solutions offered- Recent developments

-

12.3 OTHER PLAYERSSILICON SENSING SYSTEMS LIMITEDSONY CORPORATIONSTMICROELECTRONICS N.V.SYNTIANT CORP.TE CONNECTIVITYALIF SEMICONDUCTORAUGURYKEYENCE CORPORATIONSK HYNIX INC.ELLIPTIC LABORATORIES ASAEMZA VISUAL SENSE LTD.AISTORM, INC.MEMSIC SEMICONDUCTOR CO., LTD.MOVELLA INC.SENODIA TECHNOLOGIES (SHANGHAI) CO., LTD.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 AVERAGE SELLING PRICE OF AI SENSORS, BY SENSOR TYPE, 2022–2028 (USD)

- TABLE 2 AI SENSOR MARKET ECOSYSTEM

- TABLE 3 LEADING PATENT OWNERS IN US IN PAST 10 YEARS

- TABLE 4 MAJOR PATENTS IN AI SENSOR MARKET

- TABLE 5 TARIFF FOR PRODUCTS EXPORTED BY US UNDER HS CODE 902690

- TABLE 6 TARIFF FOR PRODUCTS EXPORTED BY JAPAN UNDER HS CODE 902690

- TABLE 7 TARIFF FOR PRODUCTS EXPORTED BY GERMANY UNDER HS CODE 902690

- TABLE 8 TARIFF FOR PRODUCTS EXPORTED BY CHINA UNDER HS CODE 902690

- TABLE 9 TARIFF FOR PRODUCTS EXPORTED BY SWITZERLAND UNDER HS CODE 902690

- TABLE 10 CONFERENCES AND EVENTS, 2023–2024

- TABLE 11 IMPACT OF PORTER’S FIVE FORCES ON AI SENSOR MARKET

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 14 AI SENSOR MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 15 AI SENSOR MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 16 AI SENSOR MARKET, BY SENSOR TYPE, 2019–2022 (THOUSAND UNITS)

- TABLE 17 AI SENSOR MARKET, BY SENSOR TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 18 PRESSURE SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 19 PRESSURE SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 20 PRESSURE SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 21 PRESSURE SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (THOUSAND UNITS)

- TABLE 22 POSITION SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 23 POSITION SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 24 POSITION SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 25 POSITION SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (THOUSAND UNITS)

- TABLE 26 TEMPERATURE SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 27 TEMPERATURE SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 TEMPERATURE SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 29 TEMPERATURE SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (THOUSAND UNITS)

- TABLE 30 OPTICAL SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 31 OPTICAL SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 32 OPTICAL SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 33 OPTICAL SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (THOUSAND UNITS)

- TABLE 34 ULTRASONIC SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 35 ULTRASONIC SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 36 ULTRASONIC SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 37 ULTRASONIC SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (THOUSAND UNITS)

- TABLE 38 MOTION SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 39 MOTION SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 40 MOTION SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 41 MOTION SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (THOUSAND UNITS)

- TABLE 42 NAVIGATION SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 43 NAVIGATION SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 44 NAVIGATION SENSORS: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 45 NAVIGATION SENSORS: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (THOUSAND UNITS)

- TABLE 46 AI SENSOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 47 AI SENSOR MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 48 AI SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 49 AI SENSOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 AUTOMOTIVE: AI SENSOR MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 51 AUTOMOTIVE: AI SENSOR MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 52 AUTOMOTIVE: AI SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 AUTOMOTIVE: AI SENSOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA AI SENSOR MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 55 NORTH AMERICA AI SENSOR MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 56 EUROPE AI SENSOR MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 57 EUROPE AI SENSOR MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 58 ASIA PACIFIC AI SENSOR MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 59 ASIA PACIFIC AI SENSOR MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 60 ROW AI SENSOR MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 61 ROW AI SENSOR MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 62 CONSUMER ELECTRONICS: AI SENSOR MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 63 CONSUMER ELECTRONICS: AI SENSOR MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 64 CONSUMER ELECTRONICS: AI SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 CONSUMER ELECTRONICS: AI SENSOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA AI SENSOR MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA AI SENSOR MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 68 EUROPE AI SENSOR MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 69 EUROPE AI SENSOR MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC AI SENSOR MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 71 ASIA PACIFIC AI SENSOR MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 72 ROW AI SENSOR MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 73 ROW AI SENSOR MARKET FOR CONSUMER ELECTRONICS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 74 MANUFACTURING: AI SENSOR MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 75 MANUFACTURING: AI SENSOR MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 76 MANUFACTURING: AI SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 MANUFACTURING: AI SENSOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA AI SENSOR MARKET FOR MANUFACTURING, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA AI SENSOR MARKET FOR MANUFACTURING, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE AI SENSOR MARKET FOR MANUFACTURING, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 81 EUROPE AI SENSOR MARKET FOR MANUFACTURING, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC AI SENSOR MARKET FOR MANUFACTURING, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 ASIA PACIFIC AI SENSOR MARKET FOR MANUFACTURING, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 ROW AI SENSOR MARKET FOR MANUFACTURING, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 85 ROW AI SENSOR MARKET FOR MANUFACTURING, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 AEROSPACE & DEFENSE: AI SENSOR MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 87 AEROSPACE & DEFENSE: AI SENSOR MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 88 AEROSPACE & DEFENSE: AI SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 AEROSPACE & DEFENSE: AI SENSOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA AI SENSOR MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA AI SENSOR MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE AI SENSOR MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE AI SENSOR MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC AI SENSOR MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 95 ASIA PACIFIC AI SENSOR MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 96 ROW AI SENSOR MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 97 ROW AI SENSOR MARKET FOR AEROSPACE & DEFENSE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 SMART HOME AUTOMATION: AI SENSOR MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 99 SMART HOME AUTOMATION: AI SENSOR MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 100 SMART HOME AUTOMATION: AI SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 101 SMART HOME AUTOMATION: AI SENSOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 102 NORTH AMERICA AI SENSOR MARKET FOR SMART HOME AUTOMATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 103 NORTH AMERICA AI SENSOR MARKET FOR SMART HOME AUTOMATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE AI SENSOR MARKET FOR SMART HOME AUTOMATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 105 EUROPE AI SENSOR MARKET FOR SMART HOME AUTOMATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC AI SENSOR MARKET FOR SMART HOME AUTOMATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC AI SENSOR MARKET FOR SMART HOME AUTOMATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 108 ROW AI SENSOR MARKET FOR SMART HOME AUTOMATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 109 ROW AI SENSOR MARKET FOR SMART HOME AUTOMATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 110 ROBOTICS: AI SENSOR MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 111 ROBOTICS: AI SENSOR MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 112 ROBOTICS: AI SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 ROBOTICS: AI SENSOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 NORTH AMERICA AI SENSOR MARKET FOR ROBOTICS, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 115 NORTH AMERICA AI SENSOR MARKET FOR ROBOTICS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 EUROPE AI SENSOR MARKET FOR ROBOTICS, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 117 EUROPE AI SENSOR MARKET FOR ROBOTICS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC AI SENSOR MARKET FOR ROBOTICS, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC AI SENSOR MARKET FOR ROBOTICS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 120 ROW AI SENSOR MARKET FOR ROBOTICS, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 121 ROW AI SENSOR MARKET FOR ROBOTICS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 122 AGRICULTURE: AI SENSOR MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 123 AGRICULTURE: AI SENSOR MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 124 AGRICULTURE: AI SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 125 AGRICULTURE: AI SENSOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 126 NORTH AMERICA AI SENSOR MARKET FOR AGRICULTURE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 127 NORTH AMERICA AI SENSOR MARKET FOR AGRICULTURE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 128 EUROPE AI SENSOR MARKET FOR AGRICULTURE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 129 EUROPE AI SENSOR MARKET FOR AGRICULTURE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC AI SENSOR MARKET FOR AGRICULTURE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC AI SENSOR MARKET FOR AGRICULTURE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 132 ROW AI SENSOR MARKET FOR AGRICULTURE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 133 ROW AI SENSOR MARKET FOR AGRICULTURE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 134 AI SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 135 AI SENSOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 NORTH AMERICA AI SENSOR MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 139 NORTH AMERICA AI SENSOR MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 140 EUROPE: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 141 EUROPE: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 142 EUROPE AI SENSOR MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 143 EUROPE AI SENSOR MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: AI SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AI SENSOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC AI SENSOR MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC AI SENSOR MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 148 ROW: AI SENSOR MARKET, BY APPLICATION TYPE, 2019–2022 (USD MILLION)

- TABLE 149 ROW: AI SENSOR MARKET, BY APPLICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 150 ROW AI SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 151 ROW AI SENSOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 152 STRATEGIES ADOPTED BY KEY PLAYERS IN AI SENSOR MARKET

- TABLE 153 AI SENSOR MARKET: DEGREE OF COMPETITION

- TABLE 154 AI SENSOR MARKET: RANKING ANALYSIS

- TABLE 155 STARTUP MATRIX: KEY STARTUP/SMES

- TABLE 156 AI SENSOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- TABLE 157 PRODUCT LAUNCHES/DEVELOPMENTS, 2020–2022

- TABLE 158 DEALS, 2020–2022

- TABLE 159 TELEDYNE TECHNOLOGIES INCORPORATED: BUSINESS OVERVIEW

- TABLE 160 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 161 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

- TABLE 162 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

- TABLE 163 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

- TABLE 164 ROBERT BOSCH GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 165 ROBERT BOSCH GMBH: DEALS

- TABLE 166 GOERTEK INC.: BUSINESS OVERVIEW

- TABLE 167 GOERTEK INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 168 GOERTEK INC.: DEALS

- TABLE 169 SENSATA TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 170 SENSATA TECHNOLOGIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 171 SENSATA TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 172 SENSATA TECHNOLOGIES, INC.: DEALS

- TABLE 173 SENSIRION AG: BUSINESS OVERVIEW

- TABLE 174 SENSIRION AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 175 SENSIRION AG: PRODUCT LAUNCHES

- TABLE 176 SENSIRION AG: DEALS

- TABLE 177 SENSORTEK TECHNOLOGY CORPORATION: BUSINESS OVERVIEW

- TABLE 178 SENSORTEK TECHNOLOGY CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 179 HOKURIKU ELECTRIC INDUSTRY CO., LTD.: BUSINESS OVERVIEW

- TABLE 180 HOKURIKU ELECTRIC INDUSTRY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 181 BAIDU, INC.: BUSINESS OVERVIEW

- TABLE 182 BAIDU, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 183 BAIDU, INC.: PRODUCT LAUNCHES

- TABLE 184 BAIDU, INC.: DEALS

- TABLE 185 YOKOGAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

- TABLE 186 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 187 YOKOGAWA ELECTRIC CORPORATION: DEALS

- TABLE 188 EXCELITAS TECHNOLOGIES CORP.: BUSINESS OVERVIEW

- TABLE 189 EXCELITAS TECHNOLOGIES CORP.: PRODUCT LAUNCHES

- TABLE 190 EXCELITAS TECHNOLOGIES CORP.: DEALS

- TABLE 191 SILICON SENSING SYSTEMS LIMITED: COMPANY OVERVIEW

- TABLE 192 SONY CORPORATION: COMPANY OVERVIEW

- TABLE 193 STMICROELECTRONICS N.V.: COMPANY OVERVIEW

- TABLE 194 SYNTIANT CORP.: COMPANY OVERVIEW

- TABLE 195 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 196 ALIF SEMICONDUCTOR: COMPANY OVERVIEW

- TABLE 197 AUGURY: COMPANY OVERVIEW

- TABLE 198 KEYENCE CORPORATION: COMPANY OVERVIEW

- TABLE 199 SK HYNIX INC.: COMPANY OVERVIEW

- TABLE 200 ELLIPTIC LABORATORIES ASA: COMPANY OVERVIEW

- TABLE 201 EMZA VISUAL SENSE LTD: COMPANY OVERVIEW

- TABLE 202 AISTORM, INC.: COMPANY OVERVIEW

- TABLE 203 MEMSIC SEMICONDUCTOR CO., LTD: COMPANY OVERVIEW

- TABLE 204 MOVELLA INC.: COMPANY OVERVIEW

- TABLE 205 SENODIA TECHNOLOGIES (SHANGHAI) CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 AI SENSOR MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 DEMAND-SIDE ANALYSIS FOR MARKET SIZE ESTIMATION

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 SUPPLY-SIDE ANALYSIS FOR MARKET SIZE ESTIMATION

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 GDP GROWTH PROJECTION FOR MAJOR ECONOMIES, 2021–2023

- FIGURE 10 IMPACT OF RECESSION ON AI SENSOR MARKET, 2019–2028 (USD MILLION)

- FIGURE 11 MACHINE LEARNING TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 MOTION SENSORS TO SURPASS OTHER TYPES OF SENSORS FROM 2023 TO 2028

- FIGURE 13 CONSUMER ELECTRONICS TO GROW AT HIGHER CAGR BY 2028

- FIGURE 14 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 15 GROWING DEMAND FOR AI SENSORS IN IOT-BASED DEVICES ACROSS CONSUMER ELECTRONICS AND AUTOMOTIVE APPLICATIONS

- FIGURE 16 MACHINE LEARNING TO CAPTURE LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 17 CONSUMER ELECTRONICS AND CHINA TO BE LARGEST SHAREHOLDERS IN 2023

- FIGURE 18 OPTICAL SENSORS TO BE FASTEST-GROWING SEGMENT BY 2028

- FIGURE 19 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 AI SENSOR MARKET DYNAMICS

- FIGURE 21 CYBER-ATTACKS PER ORGANIZATION BY INDUSTRY IN 2021

- FIGURE 22 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AI SENSOR MARKET

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 COMPANIES WITH HIGHEST PATENT APPLICATIONS IN PAST 10 YEARS

- FIGURE 25 NUMBER OF PATENTS GRANTED PER YEAR, 2012–2022

- FIGURE 26 IMPORT DATA, BY COUNTRY, 2017−2021 (USD MILLION)

- FIGURE 27 EXPORT DATA, BY COUNTRY, 2017−2021 (USD MILLION)

- FIGURE 28 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 31 AI SESNOR MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- FIGURE 32 AI SENSOR MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- FIGURE 33 AI SENSOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- FIGURE 34 AI SENSOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 35 NORTH AMERICA: AI SENSOR MARKET SNAPSHOT

- FIGURE 36 EUROPE: AI SENSOR MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: AI SENSOR MARKET SNAPSHOT

- FIGURE 38 3-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN AI SENSOR MARKET, 2019–2021

- FIGURE 39 MARKET SHARE ANALYSIS OF KEY PLAYERS IN AI SENSOR MARKET IN 2022

- FIGURE 40 COMPANY EVALUATION QUADRANT, 2022

- FIGURE 41 STARTUP/SME EVALUATION QUADRANT, 2022

- FIGURE 42 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 43 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 44 GOERTEK INC.: COMPANY SNAPSHOT

- FIGURE 45 SENSATA TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 46 SENSIRION AG: COMPANY SNAPSHOT

- FIGURE 47 SENSORTEK TECHNOLOGY CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 HOKURIKU ELECTRIC INDUSTRY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 49 BAIDU, INC.: COMPANY SNAPSHOT

- FIGURE 50 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

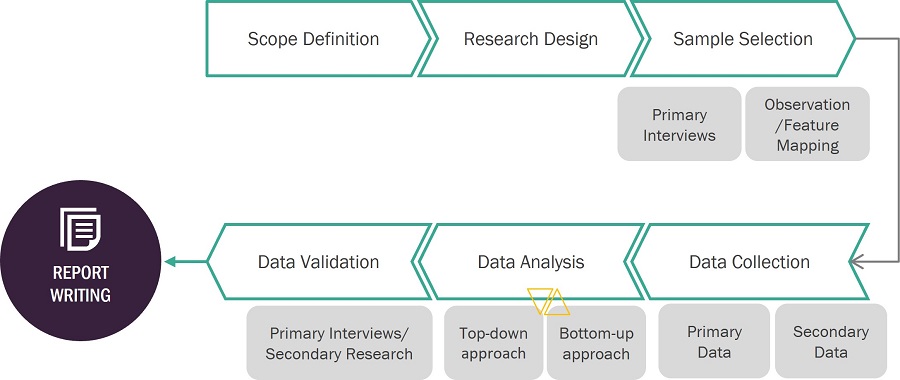

The study involved four major activities in estimating the current size of the AI sensor market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include sensor technology journals and magazines, annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

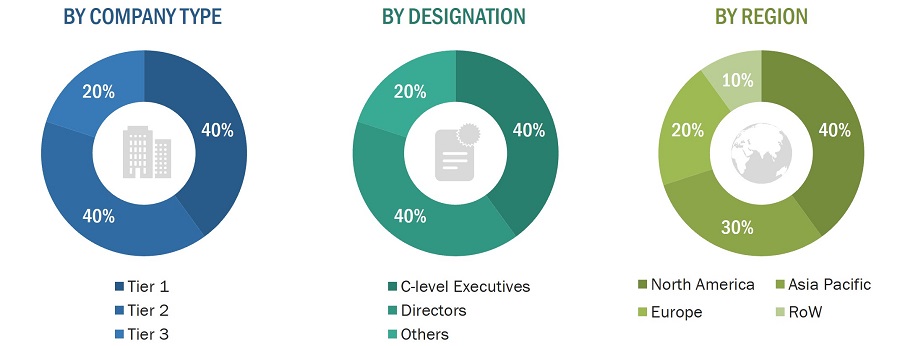

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the AI sensor market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the AI sensor market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Ai Sensor Market: Bottom-Up Approach

Ai Sensor Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides.

Market Definition

An AI sensor is a smart sensor equipped with artificial intelligence capabilities, such as machine learning algorithms or neural networks, to analyze and interpret data in a sophisticated and intelligent way. AI sensors can learn from the data they collect and make decisions based on that learning. This study aims to determine the total addressable market and high-growth opportunities for AI sensors.

Key Stakeholders

- Raw Material Suppliers

- Component Manufacturers and Providers

- Sensor Manufacturers and Providers

- Original Equipment Manufacturers (OEMs)

- Technology Solution Providers

- Application Providers

- System Integrators

- Middleware Providers

- Assembly, Testing, and Packaging Vendors

- Market Research and Consulting Firms

- Associations, Organizations, Forums, and Alliances Related to the Smart Sensor Industry

- Technology Investors

- Governments, Regulatory Bodies, and Financial Institutions

- Venture Capitalists, Private Equity Firms, and Startups

- End Users

Report Objectives

The following are the primary objectives of the study.

- To describe and forecast the size of the AI sensor market, in terms of value, by sensor type, technology, and application

- To describe and forecast the size of the AI sensor market, in terms of volume, by sensor type

- To describe and forecast the size of the AI sensor market across four key regions, namely North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their country-level markets, in terms of value

- To provide information on drivers, restraints, opportunities, and challenges pertaining to the AI sensor market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contribution to the AI sensor market

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To provide a detailed overview of the AI sensor value chain and ecosystem

- To provide information about key technology trends and patents related to the AI sensor market

- To provide information on trade data related to the AI sensor market

- To analyze opportunities for stakeholders by identifying high-growth segments of the AI sensor market

- To benchmark market players using the proprietary company evaluation matrix framework, which analyzes them on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as contracts, acquisitions, product launches, collaborations, and partnerships, along with research and development, in the AI sensor market

- To analyze the impact of the recession on the growth of the AI sensor market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in AI Sensor Market