Arthroscopy Instruments Market by Type (Implants, Arthroscope, Visualization System, Surgical Shaver, RF Ablation, Fluid Management), Application (Knee, Hip, Shoulder), End User (Hospitals, Ambulatory Surgery Centers & Clinics) - Global Forecast to 2022

The global arthroscopy instruments market is expected to reach USD 5.61 Billion by 2022 from USD 3.89 Billion in 2016, at a CAGR of 6.1% during the forecast period.

- Base Year: 2016

- Forecast Period: 2017–2022

Objectives of the study are:

- To define, describe, and forecast the global market by product, application, end user, and region

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of market segments with respect to the four key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches; agreements, partnerships, and joint ventures; mergers and acquisitions; and research and development activities in the global market

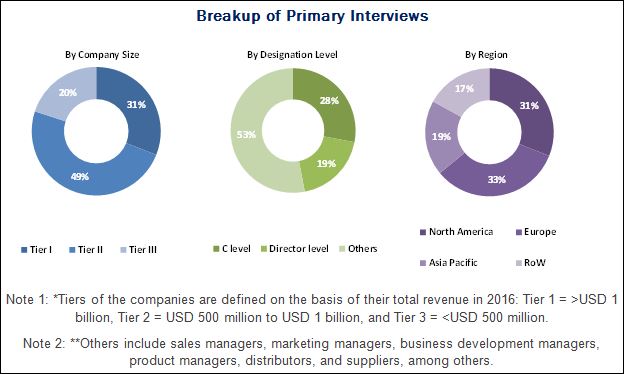

This research study involves the extensive usage of secondary sources, directories, and databases (such as Hoover’s, Bloomberg Business, Factiva, and Avention), to identify and collect information useful for this technical, market-oriented, and financial study of the market. In-depth interviews were conducted with various primary respondents, including subject-matter experts (SMEs), C-level executives of key arthroscopy instruments industry players, and industry consultants to obtain and verify qualitative and quantitative information and to assess market prospects.

To know about the assumptions considered for the study, download the pdf brochure

As of 2016, the global arthroscopy instruments market was dominated by Arthrex (US), Smith & Nephew (UK), DePuy Synthes (US), Stryker (US), and CONMED (US). These companies accounted for a majority share of the global market in 2016. The other players involved in this market include Zimmer Biomet (US), Medtronic (Ireland), Karl Storz (Germany), B. Braun (Germany), Olympus (Japan), Richard Wolf (Germany), MEDICON (Germany), Sklar (US), Millennium (US), and GPC Medical (India).

Stakeholders

- Arthroscopy instruments bags manufacturers

- Third-party arthroscopy instruments product suppliers

- Raw material suppliers

- Market research and consulting firms

- Regulatory bodies

- Venture capitalists

- Hospitals

Arthroscopy Instruments Market Scope

This report categorizes the global arthroscopy instruments market into the following segments and subsegments:

By Product

- Arthroscopy Implants

- Arthroscope

- Visualization Systems

- RF Ablation Systems

- Motorized Shavers

- Fluid Management Systems

By Application

- Knee Arthroscopy

- Shoulder Arthroscopy

- Other Arthroscopy Applications

By End User

- Hospitals

- Ambulatory Surgical Centers & Clinics

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe (RoE)

-

Asia

- Japan

- China

- India

- Rest of Asia (RoA)

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the RoW arthroscopy instruments market into Latin America, the Middle East, and Africa

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global arthroscopy instruments market is projected to reach USD 5.61 Billion by 2022 from USD 4.17 Billion in 2017, at a CAGR of 6.1% during the forecast period. The high incidence of sport-related injuries; technological advancements in arthroscopy products; and efficient reimbursement systems in developed countries are some of the factors driving the growth of the market.

This report broadly segments the global market into type, applications, and end user. On the basis of type, the market is categorized into arthroscopic implants, arthroscope, visualization system, RF ablation system, motorized shavers, and fluid management system. In 2017, arthroscopes segment is expected to grow at the highest growth rate during the forecast period. The significant growth of this segment is mainly attributed to the reduction in the life span of arthroscopes due to the sterilization process used to avoid infection and the launch of single-use arthroscopes.

On the basis of application, the market is segmented into knee arthroscopy, shoulder arthroscopy, and other arthroscopy applications. Other arthroscopy applications include hip, foot, ankle, elbow, and wrist arthroscopy. The other applications segment is estimated to be the fastest growing segment during the study period due to the rising number of hip arthroscopy surgeries and rising focus of manufacturers towards developing new instruments for complex hip arthroscopy surgeries.

Based on end users, arthroscopy instruments market is segmented into hospitals and ambulatory surgery centers & clinics. Hospitals are expected to dominate the global market during the forecast period due to the large number of surgeries that are performed in hospitals.

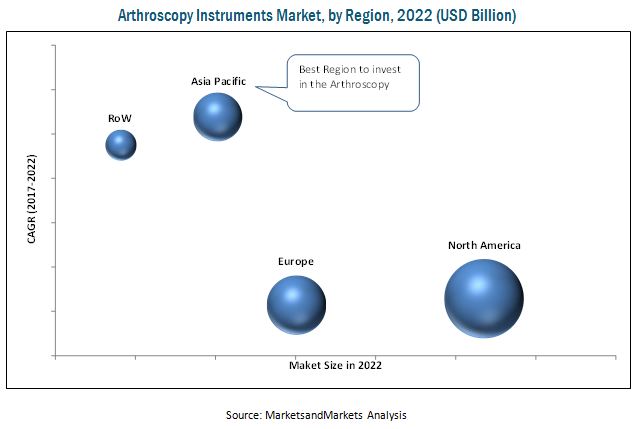

The report covers the arthroscopy instruments market across four major geographies, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America is expected to command the largest share of the market in 2017, however, Asia Pacific is expected to register the highest growth rate during the forecast period. The growth of the Asia Pacific region is attributed to the growing patient pool and on-going positive changes in healthcare infrastructure in that region.

The major players of the market are Arthrex (US), Smith & Nephew (UK), DePuy Synthes (US), Stryker (US), CONMED (US), Zimmer Biomet (US), Medtronic (Ireland), Karl Storz (Germany), B. Braun (Germany), Olympus (Japan), Richard Wolf (Germany), MEDICON (Germany), Sklar (US), Millennium (US), and GPC Medical (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.2 Secondary Research

2.2.1 Key Data From Secondary Sources

2.3 Primary Research

2.3.1 Key Data From Primary Sources

2.3.1.1 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Research Assumptions

2.6.1 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Arthroscopy Instruments Market: Overview

4.2 Geographic Analysis: Arthroscopy Market, By Application, 2017

4.3 Global Market, By End User, 2017 vs 2022

4.4 Global Market, By Product (2017 vs 2022)

4.5 Geographical Snapshot of the global Market

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Geriatric Population and Incidence of Target Conditions

5.2.1.2 Increasing Preference for Mis Procedures

5.2.1.5 Ongoing Technological Advancements

5.2.2 Restraints

5.2.2.1 High Cost of Arthroscopy Instruments

5.2.2.2 Reimbursement Challenges in the Medical Device Industry

5.2.3 Opportunities

5.2.3.1 Expansion & Modernization of Healthcare Infrastructure Across Emerging Countries

5.2.4 Challenges

5.2.4.1 Dearth of Trained Personnel

5.2.4.2 Shift in Decision-Making in Hospitals

6 Arthroscopy Instruments Market, By Product (Page No. - 39)

6.1 Introduction

6.2 Arthroscopic Implants

6.3 Arthroscopes

6.4 Visualization Systems

6.5 Motorized Shavers

6.6 Fluid Management Systems

6.7 Radiofrequency (RF) Ablation Systems

7 Arthroscopy Instruments Market, By Application (Page No. - 46)

7.1 Introduction

7.2 Knee Arthroscopy

7.3 Shoulder Arthroscopy

7.4 Other Arthroscopy Applications

8 Arthroscopy Instruments Market, By End User (Page No. - 51)

8.1 Introduction

8.2 Hospitals

8.3 Ambulatory Surgery Centers & Clinics

9 Arthroscopy Instruments Market, By Region (Page No. - 55)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 Rest of Asia Pacific

9.5 Rest of the World

10 Competitive Landscape (Page No. - 86)

10.1 Introduction

10.2 Arthroscopy Instruments Market Share Analysis, 2016

10.2.1 Key Players in Global Market

10.3 Competitive Scenario

10.3.1 Product Launches & Enhancements

10.3.2 Expansions

10.3.3 Agreements, Partnerships, and Collaborations

10.3.4 Acquisitions

11 Company Profiles (Page No. - 91)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 Arthrex

11.2 Smith & Nephew

11.3 Depuy Synthes Companies (A Johnson & Johnson Company)

11.4 Stryker

11.5 Karl Storz

11.6 B. Braun Melsungen AG

11.7 Richard Wolf GmbH

11.8 Medtronic

11.9 Conmed

11.10 Zimmer Biomet

11.11 Olympus

11.12 Medicon

11.13 Sklar

11.14 Millennium Surgical

11.15 GPC Medical

*Details on Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 128)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (67 Tables)

Table 1 Arthroscopy Instruments Market, By Product, 2015–2022 (USD Million)

Table 2 Arthroscopic Implants Market, By Region, 2015–2022 (USD Million)

Table 3 Arthroscopes Market, By Region, 2015–2022 (USD Million)

Table 4 Arthroscopy Visualization Systems Market, By Region, 2015–2022 (USD Million)

Table 5 Motorized Shavers Market, By Region, 2015–2022 (USD Million)

Table 6 Fluid Management Systems Market, By Region, 2015–2022 (USD Million)

Table 7 Rf Ablation Systems Market, By Region, 2015–2022 (USD Million)

Table 8 Arthroscopy Instruments Market, By Application, 2015–2022 (USD Million)

Table 9 Knee Arthroscopy Market, By Region, 2015–2022 (USD Million)

Table 10 Shoulder Arthroscopy Market, By Region, 2015–2022 (USD Million)

Table 11 Other Arthroscopy Applications Market, By Region, 2015–2022 (USD Million)

Table 12 Global Market, By End User (2015–2022) (USD Million)

Table 13 Global Market for Hospitals, By Region (2015–2022) (USD Million)

Table 14 Number of Medicare-Certified Ascs in the US (2000–2014)

Table 15 Global Market for Ambulatory Surgery Centers & Clinics, By Region (2015–2022) (USD Million)

Table 16 Global Market, By Region, 2015–2022 (USD Million)

Table 17 North America: Arthroscopy Instruments Market, By Country, 2015–2022 (USD Million)

Table 18 North America: Market, By Product, 2015–2022 (USD Million)

Table 19 North America: Market, By Application, 2015–2022 (USD Million)

Table 20 North America: Market, By End User, 2015–2022 (USD Million)

Table 21 US: Market Arthroscopy Instruments, By Product, 2015–2022 (USD Million)

Table 22 US: Market, By Application, 2015–2022 (USD Million)

Table 23 US: Market, By End User, 2015–2022 (USD Million)

Table 24 Canada: Market Arthroscopy Instruments, By Product, 2015–2022 (USD Million)

Table 25 Canada: Market, By Application, 2015–2022 (USD Million)

Table 26 Canada: Market, By End User, 2015–2022 (USD Million)

Table 27 Europe: Arthroscopy Instruments Market, By Country, 2015–2022 (USD Million)

Table 28 Europe: Market, By Product, 2015–2022 (USD Million)

Table 29 Europe: Market, By Application, 2015–2022 (USD Million)

Table 30 Europe: Market, By End User, 2015–2022 (USD Million)

Table 31 Germany: Market Arthroscopy Instruments, By Product, 2015–2022 (USD Million)

Table 32 Germany: Market, By Application, 2015–2022 (USD Million)

Table 33 Germany: Market, By End User, 2015–2022 (USD Million)

Table 34 UK: Arthroscopy Instruments Market, By Product, 2015–2022 (USD Million)

Table 35 UK: Market, By Application, 2015–2022 (USD Million)

Table 36 UK: Market, By End User, 2015–2022 (USD Million)

Table 37 France: Market Arthroscopy Instruments, By Product, 2015–2022 (USD Million)

Table 38 France: Market, By Application, 2015–2022 (USD Million)

Table 39 France: Market, By End User, 2015–2022 (USD Million)

Table 40 RoE: Arthroscopy Instruments Market, By Product, 2015–2022 (USD Million)

Table 41 RoE: Market, By Application, 2015–2022 (USD Million)

Table 42 RoE: Market, By End User, 2015–2022 (USD Million)

Table 43 Asia Pacific: Market Arthroscopy Instruments, By Country, 2015–2022 (USD Million)

Table 44 Asia Pacific: Market, By Product, 2015–2022 (USD Million)

Table 45 Asia Pacific: Market, By Application, 2015–2022 (USD Million)

Table 46 Asia Pacific: Market, By End User, 2015–2022 (USD Million)

Table 47 Japan: Arthroscopy Instruments Market, By Product, 2015–2022 (USD Million)

Table 48 Japan: Market, By Application, 2015–2022 (USD Million)

Table 49 Japan: Market, By End User, 2015–2022 (USD Million)

Table 50 China: Market, By Product, 2015–2022 (USD Million)

Table 51 China: Market, By Application, 2015–2022 (USD Million)

Table 52 China: Market, By End User, 2015–2022 (USD Million)

Table 53 Indicative List of Government-Initiated New Hospital Projects in India (2013–2016)

Table 54 India: Arthroscopy Instruments Market, By Product, 2015–2022 (USD Million)

Table 55 India: Market, By Application, 2015–2022 (USD Million)

Table 56 India: Market, By End User, 2015–2022 (USD Million)

Table 57 RoAPAC: Market Arthroscopy Instruments, By Product, 2015–2022 (USD Million)

Table 58 RoAPAC: Market, By Application, 2015–2022 (USD Million)

Table 59 RoAPAC: Market, By End User, 2015–2022 (USD Million)

Table 60 New Hospital Projects in Africa (2014 to 2016)

Table 61 RoW: Arthroscopy Instruments Market, By Product, 2015–2022 (USD Million)

Table 62 RoW: Market, By Application, 2015–2022 (USD Million)

Table 63 RoW: Market, By End User, 2015–2022 (USD Million)

Table 64 Product Launches & Enhancements, 2015-2017

Table 65 Expansions, 2015-2017

Table 66 Agreement, Partnership, Collaboration, and Alliance, (2015-2017)

Table 67 Acquisition, 2015-2017

List of Figures (22 Figures)

Figure 1 Arthroscopy Instruments Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 3 Global Market, By Product, 2017 vs 2022 (USD Million)

Figure 4 Global Market, By Application, 2017 vs 2022 (USD Million)

Figure 5 Global Market, By End User, 2017 vs 2022 (USD Million)

Figure 6 Global Market, By Region

Figure 7 Arthroscopy Instruments Market: Drivers, Restraints, Opportunities, and Restrains

Figure 8 North America: Market Snapshot

Figure 9 Europe: Market Snapshot

Figure 10 Asia Pacific: Market Snapshot

Figure 11 RoW: Market Snapshot

Figure 12 Key Developments By Leading Market Players in the Arthroscopy Instruments Market, 2015–2017

Figure 13 Global Market Share, By Key Players, (2016)

Figure 14 Product Launches & Enhancements, the Most Widely Adopted Growth Strategy Between 2015 to 2017

Figure 15 Company Snapshot: Smith & Nephew (2016)

Figure 16 Company Snapshot: Johnson & Johnson (2016)

Figure 17 Company Snapshot: Stryker (2016)

Figure 18 Company Snapshot: B. Braun(2016)

Figure 19 Company Snapshot: Medtronic (2016)

Figure 20 Company Snapshot: Conmed (2016)

Figure 21 Company Snapshot: Zimmer Biomet (2016)

Figure 22 Company Snapshot: Olympus (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Arthroscopy Instruments Market