Apoptosis Assays Market by Product (Caspase, Annexin V, DNA Fragmentation, Mitochondrial Assay), Detection Technology (Flow Cytometry, Florescence microscopy), Application (Stem Cell, Discovery & Development, Clinical Research) & Region - Global Forecasts to 2023

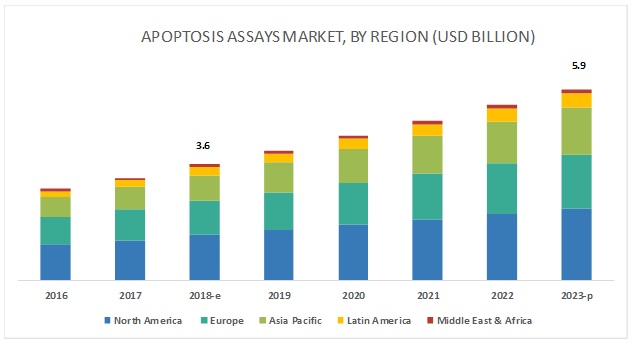

The global apoptosis assays market is projected to reach USD 5.9 billion by 2023, at a CAGR of 10.5%. Factors contributing to the growth of this market include the rising incidence and prevalence of chronic and infectious diseases, growing funding for cancer research, growing cell-based research, and development of apoptosis-modulating drugs.

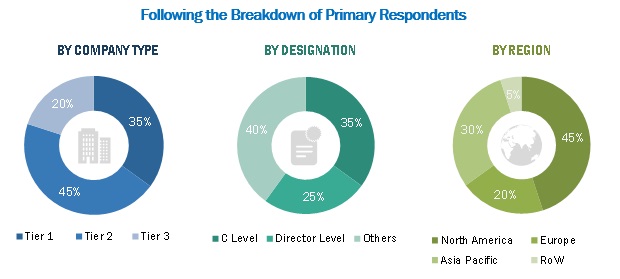

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

Secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the apoptosis assays market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, industry experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Industry experts from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, technology and innovation directors of companies manufacturing apoptosis assay products, key opinion leaders, and suppliers and distributors, whereas, the Industry experts from the demand side include researchers, biotechnologists, R&D heads, and related key personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by product, application, detection technology, end user, and region).

Data Triangulation

After arriving at the market size, the total apoptosis assays market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast of the global apoptosis assays industry by product, application, detection technology, end user, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the apoptosis assays market in five main regions (along with major countries)—North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To profile key players in the global apoptosis assays market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as mergers and acquisitions; new product/technology launches; expansions; collaborations and agreements; and R&D activities of the leading players in the global apoptosis assays market

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Products, Detection Technology, Application, End User, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and Middle East & Africa |

|

Companies covered |

Merck KGaA (Germany), Thermo Fisher Scientific (US), Becton, Dickinson and Company (US), Bio-Rad Laboratories (US), GE Healthcare (US), Sartorius AG (Germany), Danaher Corporation (US), Geno Technology (US), GeneCopoeia, Inc. (US), Bio-Techne Corporation(US), BioTek Instruments (US), PerkinElmer (US), Promega Corporation (US), Biotium (US), Abcam plc (UK), and Creative Bioarray (US). |

The research report categorizes the market into the following segments and subsegments:

Apoptosis Assays Market, By Product

-

Assay Kits

- Caspase Assays

- Annexin V and Cell Permeability Assays

- DNA Fragmentation Assays

- Mitochondrial Assays

- Reagents

- Microplates

- Instruments

Apoptosis Assays Market, By Detection Technology

- Flow Cytometry

- Cell Imaging & Analysis Systems

- Spectrophotometry

- Other Detection Technologies

Apoptosis Assays Market, By Application

- Drug Discovery & Development

- Clinical & Diagnostic Applications

- Basic Research

- Stem Cell Research

Apoptosis Assays Market, By End User

- Pharmaceutical and Biotechnology Companies

- Hospital and Diagnostic Laboratories

- Academic and Research Institutes

Apoptosis Assays Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific apoptosis assays market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Latin American apoptosis assays market into Brazil, Mexico, and others.

The cell imaging & microscopy segment is expected to grow at the highest CAGR during the forecast period

Based on detection technology, the cell imaging and microscopy is expected to grow at the fastest growth rate during the forecast period. The cell imaging and microscopy segment is expected to witness the highest CAGR due to its increasing adoption of cell imaging and microscopy in diagnostic laboratories, drug discovery applications, and basic research.

Assay kits segment to witness the highest growth during the forecast period

On the basis of product, the assay kits segment is expected to account for the largest share of the market in 2018. The large share can be attributed to the repeated consumption of assays in various apoptosis procedures. On the other hand, among all the detection technology, the flow cytometry is most widely used for apoptosis process.

APAC region is expected to grow at the highest CAGR during the forecast period

The apoptosis assays market in APAC is expected to grow at the highest CAGR during the forecast period. The highest CAGR is due to the increasing prevalence of chronic and infectious diseases in this region, large patient population, increasing healthcare spending, and growing interest of key players in APAC countries. Also, owing to the high growth opportunities in the APAC region, many manufacturers are expanding their global manufacturing bases to this region. With their low-cost manufacturing advantage, China and India are regarded as the most profitable manufacturing and R&D locations by manufacturers. However, the presence of a large number of local players in this region has led to intense price competition among global players operating in the APAC.

The prominent players in the global apoptosis assays market are Merck KGaA (Germany), Thermo Fisher Scientific (US), Bio-Rad Laboratories (US), GE Healthcare (US), Danaher Corporation (US), Becton, Dickinson and Company (US),Sartorius AG (Germany), Geno Technology (US), GeneCopoeia, Inc. (US), Bio-Techne Corporation(US), BioTek Instruments (US), PerkinElmer (US), Promega Corporation (US), Biotium (US), Abcam plc (UK), Canvax (Spain), Abnova (Taiwan), and Creative Bioarray (US).

Recent Developments

- In 2015, Merck acquired Sigma Aldrich Corporation (US). This acquisition strengthened Merck’s Life Science segment. Sigma-Aldrich’s SAFC Commercial business is now a part of Merck’s Life Science segment.

- In 2018, Thermo Fisher Scientific launched Multiskan Sky Microplate Spectrophotometer.

- In 2017, Becton, Dickinson and Company acquired C.R Bard (US). This acquisition advanced BD’s product offerings and global reach.

- In 2018, GE Healthcare Life Sciences opened a new production facility in Pasching, Austria. The newly built manufacturing site will help to strengthen product supply for biopharmaceutical companies in Europe.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the major end users of apoptosis assays?

- What are the application areas of the apoptosis assays?

- Which are the major apoptosis assays kits?

- Which are the detection technologies used for the apoptosis process?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Break Down of Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Apoptosis Assays Market Overview

4.2 Apoptosis Assays Market: Geographic Overview (2017)

4.3 Regional Mix: Apoptosis Assays Market (2018–2023)

4.4 Asia Pacific: Apoptosis Assays Market, By End User & Country (2017)

4.5 Apoptosis Assays Market: Developed vs Developing Markets

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Incidence and Prevalence of Chronic and Infectious Diseases

5.2.1.2 Growing Funding for Cancer Research

5.2.1.3 Growing Cell-Based Research

5.2.1.4 Development of Apoptosis-Modulating Drugs

5.2.2 Restraints

5.2.2.1 High Investments Required for Research and Development

5.2.3 Opportunities

5.2.3.1 Emerging Markets

6 Industry Insights (Page No. - 46)

6.1 Introduction

6.2 Industry Trends

6.2.1 Increasing Adoption of Apoptosis-Targeting Therapy in Cancer Treatment

6.2.2 Technological Advancements

6.2.2.1 Label-Free Detection and Imaging of Apoptosis

6.2.2.2 Microfluidic Devices for the Analysis of Apoptosis

6.3 Unmet Need

6.3.1 Unavailability of 3D Apoptosis Assays

7 Apoptosis Assays Market, By Product (Page No. - 49)

7.1 Introduction

7.1.1 Assay Kits

7.1.1.1 Caspase assays

7.1.1.1.1 Caspase Assays to Dominate the Assay Kits Market During the Forecast Period

7.1.1.2 Annexin V and Cell Permeability Assays

7.1.1.2.1 Annexin V & Cell Permeability Assays are Among the Most Commonly Used Apoptosis Assays Due to Their Ability to Bind to Phosphatidylserine

7.1.1.3 DNA Fragmentation Assays

7.1.1.3.1 Ability to Detect Nuclear Changes to Drive the Demand for DNA Fragmentation Assay Kits

7.1.1.4 Mitochondrial Assays

7.1.1.4.1 Merck, Thermo Fisher, Bio-Rad, and BD are Among the Key Players in the Mitochondrial Assays Segment

7.1.2 Reagents

7.1.3 Instruments

7.1.4 Microplates

8 Apoptosis Assays Market, By Detection Technology (Page No. - 63)

8.1 Introduction

8.1.1 Flow Cytometry

8.1.1.1 Flow Cytometry is the Most Popular Apoptosis Detection Technology Owing to Its Ability to Provide Quantitative Multi-Parametric Analysis

8.1.2 Cell Imaging and Microscopy

8.1.2.1 Ability to Monitor Cell Physiology and Examine Complex Cellular Processes to Drive the Demand for Cell Imaging and Microscopy Technologies

8.1.3 Spectrophotometry

8.1.3.1 Lower Instrument Cost as Compared to Flow Cytometers Drives Greater Adoption of Spectrophotometers in Academic Settings

8.1.4 Other Detection Technologies

9 Apoptosis Assays Market, By Application (Page No. - 70)

9.1 Introduction

9.2 Drug Discovery and Development

9.2.1 Drug Discovery and Development Forms the Largest Application Market for Apoptosis Assays

9.3 Clinical and Diagnostic Applications

9.3.1 Rising Prevalence of Cancer, Blood-Related Disorders, & Infectious Diseases Driving the Demand for Apoptosis Assays for Clinical & Diagnostics Applications

9.4 Basic Research

9.4.1 Growing Research Funding for Academic Institutions Likely to Support the Demand for Apoptosis Assays in Basic Research

9.5 Stem Cell Research

9.5.1 Rapidly Growing Interest in Regenerative Therapies Driving the Demand for Apoptosis Assays in Stem Cell Research

10 Apoptosis Assays Market, By End User (Page No. - 78)

10.1 Introduction

10.2 Pharmaceutical & Biotechnology Companies

10.2.1 Rising R&D Activities & Interest Towards Development of Apoptosis Targeted Therapies Likely to Drive the Market Growth Among Pharmaceutical & Biotechnology Companies

10.3 Hospital & Diagnostic Laboratories

10.3.1 Increasing Number of Hospitals & High Prevalence of Chronic Diseases to Drive the Market Growth Among Hospital & Diagnostic Laboratories

10.4 Academic & Research Institutes

10.4.1 Growing Drug Discovery Research in Academic Institutions to Propel the Demand for Apoptosis Assays

11 Apoptosis Assays Market, By Region (Page No. - 85)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Increasing Demand for Early and Effective Disease Diagnosis and Treatment to Drive the Growth of the Apoptosis Assays Market in the Us

11.2.2 Canada

11.2.2.1 Number of Government Initiatives to Support Life Sciences Research to Drive the Apoptosis Assays Market in Canada

11.3 Europe

11.3.1 Germany

11.3.1.1 Well-Established R&D Infrastructure & Large Number of Academic Research Institutes Account for Large Share of Germany in European Apoptosis Assays Market

11.3.2 France

11.3.2.1 Support From Government and Private Investors for Promoting Research in Cell Therapy to Drive the Growth of the Apoptosis Assays Market in France

11.3.3 UK

11.3.3.1 Growing Prevalence of Cancer and Neurological Disorders & Increasing R&D Investments to Drive the Demand for Apoptosis Assays in the UK

11.3.4 Italy

11.3.4.1 Increasing Prevalence of Target Diseases Driving the Demand for Apoptosis Assays in Italy

11.3.5 Spain

11.3.5.1 Increasing Private and Public Funding for Cell-Based Research to Drive the Growth of the Apoptosis Assays Market in Spain

11.3.6 Rest of Europe

11.4 Asia Pacific

11.4.1 Japan

11.4.1.1 High Prevalence of Cancer and Expansion of Cancer Research to Drive the Growth of the Apoptosis Assays Market in Japan

11.4.2 China

11.4.2.1 Increasing Prevalence of Chronic Diseases and Expanding Biopharmaceutical Research Propelling the Growth of the Apoptosis Assays Market in China

11.4.3 India

11.4.3.1 Geographic Expansion of Pharmaceutical Companies and Increasing Cell-Based Research Expected to Drive the Demand for Apoptosis Assays in India

11.4.4 Rest of Asia Pacific

11.5 Latin America

11.5.1 Increasing Funding for Life Sciences Research to Drive the Demand for Apoptosis Assays in Latin America

11.6 Middle East & Africa

11.6.1 Increasing Number of Partnerships in the Research Sector Driving the Market Growth in the Middle East & Africa

12 Competitive Landscape (Page No. - 144)

12.1 Overview

12.2 Market Share Analysis

12.2.1 Market Share Analysis: Apoptosis Assay Kits Market

12.3 Competitive Situation and Trends

12.3.1 Product Launches

12.3.2 Expansions

12.3.3 Acquisitions

12.3.4 Other Strategies

13 Company Profiles (Page No. - 150)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

13.1 Merck KGaA

13.2 Thermo Fisher Scientific Inc.

13.3 Becton, Dickinson and Company

13.4 Bio-Rad Laboratories

13.5 Promega Corporation

13.6 Abcam PLC

13.7 Bio-Techne Corporation

13.8 Sartorius AG

13.9 Biotium

13.10 Creative Bioarray (A Part of Creative Dynamics Inc.)

13.11 Geno Technology, Inc.

13.12 GeneCopoeia, Inc.

13.13 Danaher Corporation

13.14 GE Healthcare

13.15 Biotek Instruments

13.16 PerkinElmer

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 197)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (125 Tables)

Table 1 Apoptosis Assays Market: Impact Analysis of Drivers, Restraints, and Opportunities

Table 2 Global Cancer Incidence

Table 3 Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 4 Apoptosis Assays Market, By Country, 2016–2023 (USD Million)

Table 5 Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 6 Apoptosis Assay Kits Market, By Country, 2016–2023 (USD Million)

Table 7 List of Some of the Caspase Assay Kits Offered By Prominent Players

Table 8 Caspase Assay Kits Market, By Country, 2016–2023 (USD Million)

Table 9 List of Some of the Annexin Assay Kits Offered By Prominent Players

Table 10 Annexin V and Cell Permeability Assay Kits Market, By Country, 2016–2023 (USD Million)

Table 11 List of Some of the DNA Fragmentation Assay Kits Offered By Prominent Players

Table 12 DNA Fragmentation Assay Kits Market, By Country, 2016–2023 (USD Million)

Table 13 List of Some of the Mitochondrial Assay Kits Offered By Prominent Players

Table 14 Mitochondrial Assay Kits Market, By Country, 2016–2023 (USD Million)

Table 15 Apoptosis Reagents Market, By Country, 2016–2023 (USD Million)

Table 16 Apoptosis Instruments Market, By Country, 2016–2023 (USD Million)

Table 17 Apoptosis Microplates Market, By Country, 2016–2023 (USD Million)

Table 18 Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 19 Flow Cytometry Market for Apoptosis Detection, By Country, 2016–2023 (USD Million)

Table 20 Cell Imaging and Microscopy Market for Apoptosis Detection, By Country, 2016–2023 (USD Million)

Table 21 Spectrophotometry Market for Apoptosis Detection, By Country, 2016–2023 (USD Million)

Table 22 Other Detection Technologies Market for Apoptosis Detection, By Country, 2016–2023 (USD Million)

Table 23 Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 24 Apoptosis Assays Market for Drug Discovery and Development, By Country, 2016–2023 (USD Million)

Table 25 Apoptosis Assays Market for Clinical and Diagnostic Applications, By Country, 2016–2023 (USD Million)

Table 26 Apoptosis Assays Market for Basic Research, By Country, 2016–2023 (USD Million)

Table 27 Apoptosis Assays Market for Stem Cell Research, By Country, 2016–2023 (USD Million)

Table 28 Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 29 Apoptosis Assays Market for Pharmaceutical & Biotechnology Companies, By Country, 2016–2023 (USD Million)

Table 30 Apoptosis Assays Market for Hospital & Diagnostic Laboratories, By Country, 2016–2023 (USD Million)

Table 31 Apoptosis Assays Market for Academic & Research Institutes, By Country, 2016–2023 (USD Million)

Table 32 Apoptosis Assays Market, By Region, 2016–2023 (USD Million)

Table 33 North America: Apoptosis Assays Market, By Country, 2016–2023 (USD Million)

Table 34 North America: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 35 North America: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 36 North America: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 37 North America: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 38 North America: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 39 US: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 40 US: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 41 US: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 42 US: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 43 US: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 44 Canada: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 45 Canada: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 46 Canada: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 47 Canada: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 48 Canada: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 49 Europe: Apoptosis Assays Market, By Country, 2016–2023 (USD Million)

Table 50 Europe: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 51 Europe: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 52 Europe: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 53 Europe: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 54 Europe: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 55 Germany: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 56 Germany: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 57 Germany: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 58 Germany: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 59 Germany: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 60 France: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 61 France: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 62 France: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 63 France: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 64 France: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 65 UK: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 66 UK: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 67 UK: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 68 UK: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 69 UK: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 70 Italy: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 71 Italy: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 72 Italy: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 73 Italy: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 74 Italy: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 75 Spain: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 76 Spain: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 77 Spain: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 78 Spain: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 79 Spain: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 80 RoE: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 81 RoE: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 82 RoE: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 83 RoE: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 84 RoE: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 85 Asia Pacific: Apoptosis Assays Market, By Country, 2016–2023 (USD Million)

Table 86 Asia Pacific: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 87 Asia Pacific: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 88 Asia Pacific: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 89 Asia Pacific: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 90 Asia Pacific: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 91 Japan: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 92 Japan: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 93 Japan: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 94 Japan: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 95 Japan: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 96 China: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 97 China: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 98 China: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 99 China: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 100 China: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 101 India: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 102 India: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 103 India: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 104 India: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 105 India: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 106 RoAPAC: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 107 RoAPAC: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 108 RoAPAC: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 109 RoAPAC: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 110 RoAPAC: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 111 Latin America: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 112 Latin America: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 113 Latin America: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 114 Latin America: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 115 Latin America: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 116 Middle East & Africa: Apoptosis Assays Market, By Product, 2016–2023 (USD Million)

Table 117 Middle East & Africa: Apoptosis Assay Kits Market, By Type, 2016–2023 (USD Million)

Table 118 Middle East & Africa: Apoptosis Assays Market, By Detection Technology, 2016–2023 (USD Million)

Table 119 Middle East & Africa: Apoptosis Assays Market, By Application, 2016–2023 (USD Million)

Table 120 Middle East & Africa: Apoptosis Assays Market, By End User, 2016–2023 (USD Million)

Table 121 Growth Strategy Matrix (2015–2018)

Table 122 Product Launches, 2015–2018

Table 123 Expansions, 2015–2018

Table 124 Acquisitions, 2015–2018

Table 125 Other Strategies, 2015–2018

List of Figures (37 Figures)

Figure 1 Research Design

Figure 2 Primary Sources

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Apoptosis Assays Market, By Product, 2018 vs 2023 (USD Million)

Figure 8 Apoptosis Detection Technology Market, By Type, 2018 vs 2023 (USD Million)

Figure 9 Apoptosis Assays Market, By Application, 2018 vs 2023 (USD Million)

Figure 10 Apoptosis Assays Market, By End User, 2018 vs 2023 (USD Million)

Figure 11 Geographical Snapshot of the Apoptosis Assays Market

Figure 12 Rising Incidence and Prevalence of Chronic and Infectious Diseases is Expected to Drive Market Growth

Figure 13 the US Dominated the Apoptosis Assays Market in 2017

Figure 14 APAC to Register the Highest Growth Rate During the Forecast Period (2018–2023)

Figure 15 China Accounted for the Largest Share of the APAC Apoptosis Assays Market in 2017

Figure 16 Developing Markets to Register A Higher Growth Rate During the Forecast Period

Figure 17 Drivers, Restraints, and Opportunities: Apoptosis Assays Market

Figure 18 Assay Kits Segment to Dominate the Apoptosis Assays Market, By Product, During the Forecast Period

Figure 19 Flow Cytometry to Dominate the Apoptosis Assays Market During the Forecast Period

Figure 20 Drug Discovery and Development Estimated to Be the Largest Application Segment in the Apoptosis Assays Market in 2018

Figure 21 Apoptosis Assays Market, By End User, 2018 vs 2023 (USD Million)

Figure 22 Apoptosis Assays Market: Geographical Snapshot (2017)

Figure 23 North America to Dominate the Apoptosis Assays Market During the Forecast Period

Figure 24 North America: Apoptosis Assays Market Snapshot

Figure 25 Asia Pacific: Apoptosis Assays Market Snapshot

Figure 26 Product Launches—Key Growth Strategy Adopted By Market Players From 2015 to May 2018

Figure 27 Apoptosis Assays Kits Market, By Key Player, 2017

Figure 28 Merck KGaA: Company Snapshot (2017)

Figure 29 Thermo Fisher Scientific: Company Snapshot (2017)

Figure 30 Becton, Dickinson and Company: Company Snapshot (2017)

Figure 31 Bio-Rad Laboratories: Company Snapshot (2017)

Figure 32 Abcam PLC: Company Snapshot (2017)

Figure 33 Bio-Techne: Company Snapshot (2018)

Figure 34 Sartorius AG : Company Snapshot (2017)

Figure 35 Danaher Corporation: Company Snapshot (2017)

Figure 36 GE Healthcare: Company Snapshot (2017)

Figure 37 PerkinElmer: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Apoptosis Assays Market