APAC Spatial Genomics & Transcriptomics Market by Technique (Spatial Transcriptomics (IHC, ISH), Spatial Genomics (FISH, Sequencing)), Product (Instruments, Consumables, Software), Application (Drug Discovery), End User (Biotech, CROs) - Forecast to 2027

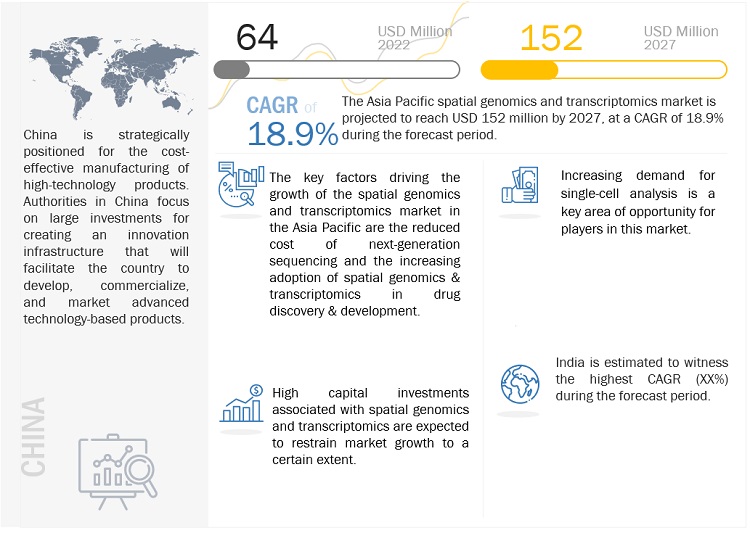

[134 Pages Report] The global APAC spatial genomics & transcriptomics market, stood at US$64 million in 2022 and is projected to advance at a resilient CAGR of 18.9% from 2023 to 2027, culminating in a forecasted valuation of US$152 million by the end of the period. The key factors driving the growth of the spatial genomics and transcriptomics market in the Asia Pacific are the increasing capital investments, rising use of spatial omics for disease diagnosis, and rising rate in the adoption rate of spatial genomics and transcriptomics in drug discovery & development. However, analytical limitation associated with spatial techniques are expected to restrain market growth to a certain extent.

Attractive Opportunities in the Asia Pacific Spatial Genomics & Transcriptomics Market

To know about the assumptions considered for the study, Request for Free Sample Report

Asia Pacific Spatial Genomics & Transcriptomics Market Dynamics

DRIVER: Reduced cost of next-generation sequencing

The cost of next-generation sequencing (NGS) is continuing to decline, with Illumina leading the way in making NGS more affordable and accessible. This is expected to create a robust customer base as laboratories of all sizes are now able to adopt NGS. In October 2022, Illumina launched the NovaSeqX series, a quicker and cheaper genomic sequencing platform, in Thailand. The new platform is a significant improvement over the previous models in terms of speed and cost. The NovaSeqX series is expected to minimize the cost of genome sequencing to just USD 200–300 per sample (this excludes costs associated with processing, interpretation, and counseling), down from USD 600. The new platform delivers more than 20,000 whole genomes of high-resolution optics and ultra-high density flow cells per year, which is 2.5 times greater throughput than the previous model. Such developments are expected to increase the accessibility of NGS across Asia Pacific countries, which would expand its applications in the spatial genomics and transcriptomics market.

CHALLENGES: Analytical limitations associated with spatial techniques

The key analytical limitation associated with spatial genomics and transcriptomics is the limited number of genes that can be analyzed in one go. A variety of methods have been commercialized by market players to visualize mRNA sequences on tissue sections. However, the maximum number of different genes that can be analyzed at a time with such techniques is limited. Customers make use of quantitative and sensitive spatial transcriptomic sequencing methods, but only 3 to 4 genes can be analyzed at once. This creates a challenging environment for customers looking to adopt spatial transcriptomics and genomics techniques.

The Spatial Transcriptomics accounted for the largest share of the technique segments in spatial genomics & transcriptomics market in 2022.

Based on technique, the market is categorized into spatial transcriptomics, and spatial genomics analysis. In 2021, the spatial transcriptomics segment accounted for the largest share of the spatial genomics and transcriptomics market. Increasing demand for and high adoption rate of in situ sequencing techniques is expected to drive the growth of the spatial transcriptomics segment during the forecast period.

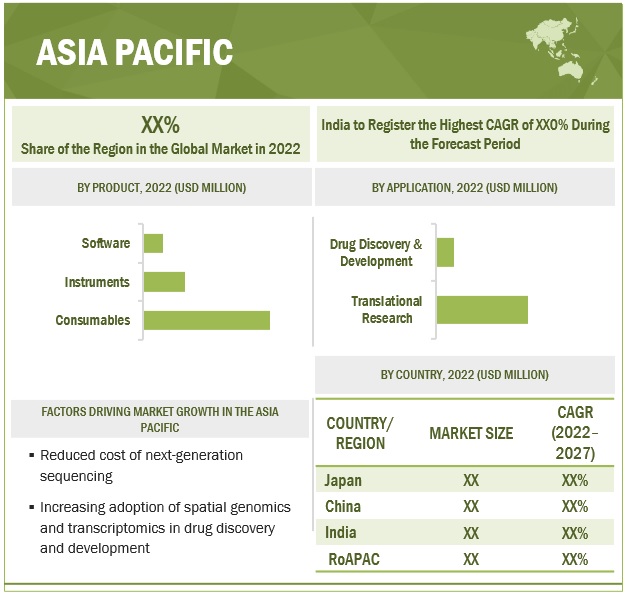

The Consumables segment dominated the product segment in spatial genomics & transcriptomics market in 2021.

Based on the product, the segment is categorized into consumables, instruments and software. In 2021, the consumables segment dominated the product segment with the highest revenue share. Growing use of consumables for various spatial genomics and transcriptomics applications is estimated to drive the market growth.

In 2021, the translational research segment have generated highest revenue in the application segment for spatial genomics & transcriptomics market.

Based on the application, the Asia Pacific Spatial Genomics & Transcriptomics Market is segmented into translational research, and drug discovery & development. In 2022, the translational research have generated highest revenue in the application segment. The large share of the translational research segment can be attributed to the increasing use of spatial genomics and transcriptomics to determine high-throughput data on the organizational structure of cell content from tissue and cell species.

China was the largest market for Asia Pacific Spatial Genomics & Transcriptomics in 2022.

Geographically, the spatial genomics & transcriptomics market is segmented into Japan, China, India and Rest of Asia Pacific. The spatial genomics & transcriptomics market is dominated by China in 2022 and this dominance is anticipated to continue throughout the forecast period. The large share of the segment can be attributed to the rising incidence of chronic diseases and technological advancements and the launch of cell therapies to treat different cancers in the spatial genomics and transcriptomics market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Prominent players in the spatial genomics & transcriptomics market include NanoString Technologies, Inc. (US), 10x Genomics (US), Illumina (US), Bio-Rad Laboratories (US), Bio-Techne Corporation (US), Standard BioTools Inc. (US), Genomic Vision SA (France), Akoya Biosciences, Inc. (US), S2 Genomics (US), Cantata Bio (US), Vizgen Group (US), BGI Group (China), Miltenyi Biotec (Germany), Bruker (US), PerkinElmer Inc. (US), Novogene Co., Ltd. (China).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, Technique, Application, End User, and Country |

|

Geographies covered |

China, India, Japan, and rest of Asia Pacific |

|

Companies covered |

NanoString Technologies, Inc. (US), 10X Genomics (US), Illumina (US), Bio-Rad Laboratories (US), Bio-Techne Corporation (US), Standard BioTools Inc. (US), Akoya Biosciences, Inc. (US), PerkinElmer, Inc. (US), S2 Genomics, Inc. (US), Cantata Bio (US), Vizgen Corporation (US), BGI (China), Miltenyi Biotec (Germany), Bruker (US), PerkinElmer Inc. (US), and Novogene Co., Ltd. (China). |

This report categorizes the Asia Pacific spatial genomics & transcriptomics market into the following segments:

Asia Pacific Spatial Genomics & Transcriptomics Market, by Technique

- Spatial Transcriptomics

- Immunohistochemistry (IHC)

- In Situ Hybridization

- Sequencing Techniques

- Microscopy based RNA imaging

- Other Spatial Transcriptomics Techniques

- Spatial Genomics Analysis

- Immunohistochemistry (IHC)

- In Situ Hybridization

- Sequencing Techniques

- Microscopy based RNA imaging

- Other Spatial Transcriptomics Techniques

Asia Pacific Spatial Genomics & Transcriptomics Market, by Product

- Instruments

- Consumables

- Software

Asia Pacific Spatial Genomics & Transcriptomics Market, by Application

- Translational Research

- Drug Discovery and Development

Asia Pacific Spatial Genomics & Transcriptomics Market, by End User

- Academic and Research Institutes

- Contract Research Organization

- Pharmaceutical and Biotechnology Companies

Asia Pacific Spatial genomics & transcriptomics Market, by Country

-

Asia Pacific (APAC)

- Japan

- India

- China

- Rest of Asia Pacific (RoAPAC)

Recent Developments

- In 2022, NanoString and Abcam announced an agreement to co-market Abcam antibodies for NanoString’s high-plex spatial multiomics solutions.

- In 2022, 10x Genomics announced the first commercial shipments of its Xenium platform for in situ analysis. Xenium is the next generation of targeted spatial profiling of genes and proteins at subcellular resolution.

- In 2022, Illumina and AstraZeneca announced a strategic research collaboration to accelerate drug target discovery by combining their strengths in AI-based genome interpretation and genomic analysis techniques with industry expertise.

Frequently Asked Questions (FAQ):

Who are the key players in the spatial genomics & transcriptomics market?

Key players in the spatial genomics & transcriptomics market include NanoString Technologies, Inc. (US), 10X Genomics (US), Illumina (US), Bio-Rad Laboratories (US), Bio-Techne Corporation (US), Standard BioTools Inc. (US), Genomic Vision SA (France), Akoya Biosciences, Inc. (US), S2 Genomics (US), Cantata Bio (US), Vizgen Group (US), BGI Group (China), Miltenyi Biotec (Germany), Bruker (US), Perkinelmer Inc. (US), and Novogene Co., Ltd. (China).

Which product type segment dominates in the spatial genomics & transcriptomics market?

In 2022, the consumables segment accounted for the largest share of the spatial genomics & transcriptomics market. Growing use of consumables for various spatial genomics and transcriptomics applications are expected to drive the growth of the consumables segment during the forecast period.

Which application segment of the Asia Pacific Spatial Genomics & Transcriptomics Market is expected to witness lucrative growth?

Based on application, the spatial genomics & transcriptomics market is broadly segmented into translational research, and drug discovery & development. The translational research segment accounted for the largest share of the application segment in 2022. The large share of this segment is attributed to the increasing use of spatial genomics and transcriptomics to determine high-throughput data on the organizational structure of cell content from tissue and cell species.

What is the market size for spatial genomics and transcriptomics market?

The Asia Pacific spatial genomics and transcriptomics market is projected to reach USD 152 million by 2027 from USD 64 million in 2022, at a CAGR of 18.9% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Reduced cost of next-generation sequencing- Increasing adoption of spatial genomics and transcriptomics in drug discovery and developmentRESTRAINTS- High capital investmentsOPPORTUNITIES- Increasing demand for single-cell analysisCHALLENGES- Analytical limitations associated with spatial techniques

- 5.3 TECHNOLOGY ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICE TREND

- 5.9 KEY CONFERENCES AND EVENTS (2020–2023)

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA FOR SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET IN ASIA PACIFIC REGION

- 6.1 INTRODUCTION

-

6.2 CONSUMABLESGROWING USE OF CONSUMABLES FOR VARIOUS SPATIAL GENOMICS AND TRANSCRIPTOMICS APPLICATIONS TO DRIVE GROWTH

-

6.3 INSTRUMENTSINTRODUCTION OF NOVEL INSTRUMENTS TO DRIVE MARKET

-

6.4 SOFTWARERISING USE OF SPATIAL OMICS FOR DISEASE DIAGNOSIS TO PROPEL DEMAND FOR SOFTWARE

- 7.1 INTRODUCTION

-

7.2 SPATIAL TRANSCRIPTOMICSIMMUNOHISTOCHEMISTRY- Emergence of mIHC/IF to propel growthIN SITU HYBRIDIZATION- High adoption of MERFISH to drive growthSPATIAL TRANSCRIPTOMIC SEQUENCING- Microdissection-based sequencing- In situ sequencing- Other sequencing technologiesMICROSCOPY-BASED RNA IMAGING- Increasing use of microscopy-based RNA imaging in cancer research and diagnosis to drive growthOTHER SPATIAL TRANSCRIPTOMICS TECHNIQUES

-

7.3 SPATIAL GENOMICS ANALYSISFLUORESCENCE IN SITU HYBRIDIZATION- Emerging potential of spatial genomics analysis in cancer diagnostics to support growthSPATIAL GENOMIC SEQUENCING- Rising adoption of massively parallel sequencing to drive growthOTHER SPATIAL GENOMICS ANALYSIS TECHNIQUES

- 8.1 INTRODUCTION

-

8.2 TRANSLATIONAL RESEARCHDEMAND FOR SPATIAL TRANSCRIPTOMICS IN UNDERSTANDING TUMOR MICROENVIRONMENT TO DRIVE GROWTH

-

8.3 DRUG DISCOVERY AND DEVELOPMENTRISING USE OF RNA-SEQ IN DRUG DISCOVERY TO DRIVE GROWTH

- 9.1 INTRODUCTION

-

9.2 ACADEMIC AND RESEARCH INSTITUTESINCREASING DEMAND FOR SPATIAL GENOMICS AND TRANSCRIPTOMICS IN TRANSLATIONAL RESEARCH TO DRIVE GROWTH

-

9.3 CONTRACT RESEARCH ORGANIZATIONSINCREASING NUMBER OF CROS FORMING STRATEGIC PARTNERSHIPS WITH GENOMICS PROVIDERS TO DRIVE GROWTH

-

9.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIESGROWING IMPORTANCE OF BIOMARKERS TO DRIVE DEMAND FOR SPATIAL GENOMICS AND TRANSCRIPTOMICS SYSTEMS

- 10.1 INTRODUCTION

-

10.2 CHINAINCREASING R&D SPENDING BY GOVERNMENT AND BIOPHARMA COMPANIES TO SUPPORT MARKET GROWTH

-

10.3 JAPANRISING FUNDING IN JAPAN TO BOOST RESEARCH APPLICATIONS

-

10.4 INDIACOLLABORATIONS BETWEEN HOSPITALS AND DIAGNOSTIC CENTERS FOR LABORATORY SERVICES TO BOOST GROWTHSINGAPORE- Active partnerships with key players to boost market growthSOUTH KOREA- Government initiatives and strong R&D expenditure to propel demand for spatial solutionsAUSTRALIA- Increasing adoption of spatial solutions by research institutions to propel growthREST OF ASIA PACIFIC

- 11.1 INTRODUCTION

- 11.2 RIGHT-TO-WIN STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE SHARE ANALYSIS (TOP SIX PLAYERS)

- 11.4 MARKET SHARE ANALYSIS (2021)

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPETITIVE SCENARIO AND TRENDSDEALS- Product launches- Other developments

-

12.1 KEY PLAYERSNANOSTRING- Business overview- Products offered- Recent developments- MnM view10X GENOMICS- Business overview- Products offered- Recent developments- MnM viewILLUMINA- Business overview- Products offered- Recent developments- MnM viewBIO-RAD LABORATORIES, INC.- Business overview- Products offered- Recent developments- MnM viewBIO-TECHNE- Business overview- Products offered- Recent developments- MnM viewSTANDARD BIOTOOLS- Business overview- Products offered- Recent developmentsAKOYA BIOSCIENCES- Business overview- Products offered- Recent developmentsS2 GENOMICS- Business overview- Products offeredCANTATA BIO- Business overview- Products offeredVIZGEN CORP.- Business overview- Products offered

-

12.2 OTHER PLAYERSBGI GROUPMILTENYI BIOTECBRUKERPERKINELMER INC.NOVOGENE CO., LTD.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET: IMPACT ANALYSIS

- TABLE 2 FIVE BENCHMARK COMPUTATIONAL METHODS: COMPARATIVE ANALYSIS

- TABLE 3 INDICATIVE LIST OF DISTRIBUTORS FOR KEY MARKET PLAYERS IN ASIA PACIFIC

- TABLE 4 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 PRODUCT PRICING: KEY MARKET PLAYERS

- TABLE 7 SPATIAL GENOMICS AND TRANSCRIPTOMICS CONFERENCES (2020–2023)

- TABLE 8 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 9 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS CONSUMABLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 10 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 11 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 12 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 13 ASIA PACIFIC: SPATIAL TRANSCRIPTOMICS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 14 ASIA PACIFIC: SPATIAL TRANSCRIPTOMICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 15 ASIA PACIFIC: IMMUNOHISTOCHEMISTRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 16 ASIA PACIFIC: IN SITU HYBRIDIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 17 ASIA PACIFIC: SPATIAL TRANSCRIPTOMIC SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 18 ASIA PACIFIC: MICRODISSECTION-BASED SPATIAL TRANSCRIPTOMIC SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 19 ASIA PACIFIC: IN SITU SPATIAL TRANSCRIPTOMIC SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 20 ASIA PACIFIC: SPATIAL TRANSCRIPTOMIC SEQUENCING MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 21 ASIA PACIFIC: MICROSCOPY-BASED RNA IMAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 22 ASIA PACIFIC: SPATIAL TRANSCRIPTOMICS MARKET FOR OTHER TECHNIQUES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 23 ASIA PACIFIC: SPATIAL GENOMICS ANALYSIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 24 ASIA PACIFIC: SPATIAL GENOMICS ANALYSIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 25 ASIA PACIFIC: FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 26 ASIA PACIFIC: SPATIAL GENOMIC SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 27 ASIA PACIFIC: OTHER SPATIAL GENOMICS ANALYSIS TECHNIQUES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 28 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 29 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET FOR TRANSLATIONAL RESEARCH, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 30 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET FOR DRUG DISCOVERY AND DEVELOPMENT, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 31 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 32 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 33 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 34 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 35 ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 36 CHINA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 37 CHINA: SPATIAL TRANSCRIPTOMICS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 38 CHINA: SPATIAL GENOMICS ANALYSIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 39 CHINA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 40 CHINA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 41 CHINA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 42 JAPAN: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 43 JAPAN: SPATIAL TRANSCRIPTOMICS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 44 JAPAN: SPATIAL GENOMICS ANALYSIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 45 JAPAN: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 46 JAPAN: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 47 JAPAN: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 48 INDIA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 49 INDIA: SPATIAL TRANSCRIPTOMICS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 50 INDIA: SPATIAL GENOMICS ANALYSIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 51 INDIA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 52 INDIA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 53 INDIA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 54 SINGAPORE: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 55 SINGAPORE: SPATIAL TRANSCRIPTOMICS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 56 SINGAPORE: SPATIAL GENOMICS ANALYSIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 57 SINGAPORE: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 58 SINGAPORE: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 59 SINGAPORE: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 60 SOUTH KOREA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 61 SOUTH KOREA: SPATIAL TRANSCRIPTOMICS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 62 SOUTH KOREA: SPATIAL GENOMICS ANALYSIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 63 SOUTH KOREA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 64 SOUTH KOREA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 65 SOUTH KOREA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 66 AUSTRALIA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 67 AUSTRALIA: SPATIAL TRANSCRIPTOMICS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 68 AUSTRALIA: SPATIAL GENOMICS ANALYSIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 69 AUSTRALIA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 70 AUSTRALIA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 71 AUSTRALIA: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 72 REST OF ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: SPATIAL TRANSCRIPTOMICS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: SPATIAL GENOMICS ANALYSIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 76 REST OF ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 78 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET: DEALS

- TABLE 79 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET: PRODUCT LAUNCHES

- TABLE 80 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET: OTHER DEVELOPMENTS

- TABLE 81 NANOSTRING: BUSINESS OVERVIEW

- TABLE 82 10X GENOMICS: BUSINESS OVERVIEW

- TABLE 83 ILLUMINA: BUSINESS OVERVIEW

- TABLE 84 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- TABLE 85 BIO-TECHNE: BUSINESS OVERVIEW

- TABLE 86 STANDARD BIOTOOLS: BUSINESS OVERVIEW

- TABLE 87 AKOYA BIOSCIENCES: BUSINESS OVERVIEW

- TABLE 88 S2 GENOMICS: BUSINESS OVERVIEW

- TABLE 89 CANTATA BIO: BUSINESS OVERVIEW

- TABLE 90 VIZGEN: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARIES: ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET

- FIGURE 3 MARKET SIZE ESTIMATION (COMPANY REVENUE ANALYSIS-BASED ESTIMATION)

- FIGURE 4 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET SIZE (USD MILLION)

- FIGURE 5 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET: FINAL CAGR PROJECTIONS (2022−2027)

- FIGURE 6 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DEMAND-SIDE DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY TECHNIQUE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET SHARE, BY COUNTRY, 2021

- FIGURE 13 REDUCED COST OF NEXT-GENERATION SEQUENCING TO DRIVE MARKET GROWTH

- FIGURE 14 CONSUMABLES SEGMENT DOMINATED MARKET IN JAPAN

- FIGURE 15 TRANSLATIONAL RESEARCH SEGMENT DOMINATED MARKET IN CHINA

- FIGURE 16 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 ASIA PACIFIC SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 20 KEY BUYING CRITERIA FOR END USERS

- FIGURE 21 SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 24 SPATIAL GENOMICS AND TRANSCRIPTOMICS MARKET: COMPANY EVALUATION MATRIX (2021)

- FIGURE 25 NANOSTRING: COMPANY SNAPSHOT (2021)

- FIGURE 26 10X GENOMICS: COMPANY SNAPSHOT (2021)

- FIGURE 27 ILLUMINA: COMPANY SNAPSHOT (2021)

- FIGURE 28 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 29 BIO-TECHNE: COMPANY SNAPSHOT (2021)

- FIGURE 30 STANDARD BIOTOOLS: COMPANY SNAPSHOT (2021)

- FIGURE 31 AKOYA BIOSCIENCES: COMPANY SNAPSHOT (2021)

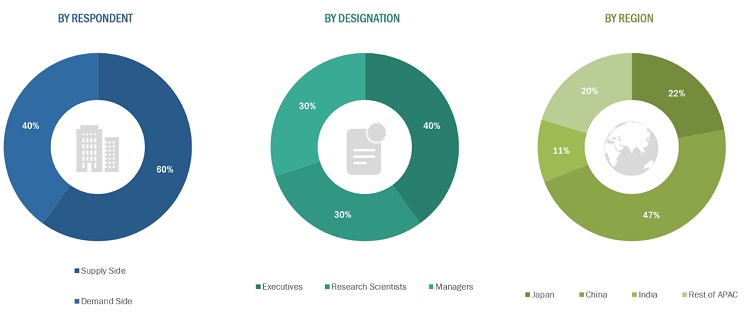

This study involved four major activities in estimating the current size of the Asia Pacific spatial genomics & transcriptomics market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the Asia Pacific spatial genomics & transcriptomics market. The secondary sources used for this study include Some of the key secondary sources referred to for this study include publications from government sources World Health Organization (WHO), National Institutes of Health (NIH), Organisation for Economic Co-operation and Development (OECD), International Agency for Research on Cancer (IARC), Research!America, Genome Canada, GenomeWeb, South African Medical Research Council (SAMRC), Wellcome Sanger Institute, Genome Research Limited, Labiotech.eu, R&D World Magazine, India Brand Equity Foundation (IBEF), Biotechnology Innovation Organization (BIO), National Center for Biotechnology Information (NCBI), BioPharm International, EvaluatePharma, ScienceDirect, Eurostat, Annual Reports, Press Releases, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Asia Pacific spatial genomics & transcriptomics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the spatial genomics & transcriptomics business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the Asia Pacific spatial genomics & transcriptomics market based on product, technique, application, and end user.

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, opportunities, and trends)

- To strategically analyse micromarkets with respect to individual growth trends, future prospects, and contributions to the overall spatial genomics & transcriptomics market

- To analyse opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the spatial genomics & transcriptomics market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in APAC Spatial Genomics & Transcriptomics Market