Bioinformatics Services Market by Type (Sequencing, Data Analysis, Discovery, Gene Expression, Database Management), Specialty (Medical, Plant, Forensics), Application (Genomics, Metabolomics), Enduser (Academia, Pharma-biotech) - Global Forecast to 2026

Market Growth Outlook Summary

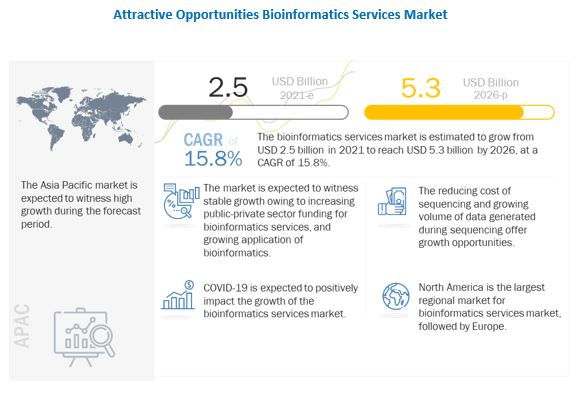

The global bioinformatics services market growth forecasted to transform from $2.5 billion in 2021 to $5.3 billion by 2026, driven by a CAGR of 15.8%. Growing applications of bioinformatics across industries, increasing public-private sector funding for bioinformatics services, and the shortage of skilled bioinformatics professionals (leading to increased outsourcing of bioinformatics projects) are the major factors that are expected to drive the growth of the bioinformatics services market during the forecast period. However, the in-house development of bioinformatics solutions and publicly available bioinformatics tools are expected to limit market are expected to restrain market growth in the coming years.

Bioinformatics Services Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Bioinformatics Services Market Dynamics

Driver: Growing applications of bioinformatics in various industries

Several industries, such as the food, bioremediation, agriculture, forensics, and consumer industries, are also using bioinformatics services to improve the quality of their products and supply chain processes. Bioinformatics services such as data integration, manipulation, lead discovery, data management, in silico analysis, and advanced knowledge discovery are increasingly being adopted by companies across various industries. This growth in the application areas of bioinformatics services is expected to create new revenue pockets for players operating in this market, which in turn will further support the adoption of these services and lead to overall market growth.

Restraint: In-house development of bioinformatics solutions and publicly available bioinformatics tools

With the increasing need for constant input from bioinformatics experts, most biomedical laboratories, biotechnology companies, and pharmaceutical companies are developing in-house bioinformatics expertise. The in-house development of bioinformatics solutions helps companies customize the applications of the developed tools for their specific requirements for research projects. Apart from drug discovery companies, many research institutions are developing freely available bioinformatics tools and advanced bioinformatics concepts. This development of open-source bioinformatics tools and freely accessible information/software is supporting the growth of the overall bioinformatics market but is limiting the growth of the bioinformatics services market.

Opportunity: Reducing cost of sequencing and growing volume of data generated during sequencing

Over the last two decades, there has been a significant reduction in the cost of genome sequencing, primarily due to technological advancements in this field. The availability of advanced, efficient, and accurate systems at low costs, along with the reduced cost of sequencing, has greatly boosted the adoption of the latest sequencing technologies globally.

Challenge: Complexity of data

Owing to the data explosion as a result of the growing number of high-throughput biological experiments (such as sequencing and microarrays), bioinformatics service providers are required to offer a data-driven approach over the conventional hypothesis-driven approach for solving bioinformatics problems such as bioinformatics-based diagnostics and analysis of biological data. To implement this, service providers require advanced tools and computational approaches, along with skilled professionals with interdisciplinary knowledge of life sciences, computer sciences, statistics, mathematics, and engineering. Handling complex data also requires a well-equipped infrastructure for high-dimension data processing capabilities, and its storage, retrieval, and analysis. For instance, the modern systems biology approach requires large-scale integration of data and processes for whole system evaluation. However, the complexity of data, in turn, results in a proportionate increase in the demand for physical storage, correct and rigorous analysis, and suitable software for visualization. Considering these factors, the effective management, processing, and analysis of a large volume of data at lower costs constitute a major challenge in the bioinformatics services market.

In terms Application, the genomics segment is expected to account for the largest share of the bioinformatics services industry in 2020.

Based on application, the bioinformatics services market is segmented into genomics, chemoinformatics and drug design, proteomics, transcriptomics, metabolomics and other applications. Large share is attributed to genomics segment due to increasing use of pharmacogenomic research for the development of precision medicine, favorable funding scenario for genomic research, and partnerships and collaborations between various life sciences and informatics companies for the development of advanced bioinformatics solutions and services.

In terms of type segment, sequencing services segment of the bioinformatics services industry is expected to account for the largest share during the forecast period.

Based on type, the bioinformatics services market is segmented into sequencing services, data analysis, drug discovery services, differential gene expression analysis, database and management services, and other bioinformatics services. Due to reduced cost of sequencing the sequencing services segment enjoy the major share of the market.

In terms of specialty segment, medical biotechnology segment is expected to account for the largest share of the bioinformatics services industry during the forecast period.

Based on specialty, the bioinformatics services market is segmented into medical biotechnology, plant biotechnology, animal biotechnology, environment biotechnology and forensic biotechnology. Medical biotechnology holds the largest share due to the development of new databases for drug discovery, the use of bioinformatics for clinical diagnostics, and increasing funding for the development of bioinformatics solutions for clinical diagnostics.

The academic institutes and research centers segment of the bioinformatics services industry is expected to register the highest CAGR during the forecast period

Based on end-users, the bioinformatics services market has been segmented as —academic institutes and research centers, hospitals and clinics, pharma and biotech companies, CROs and other end users. The large share of academic institutes and research centers segment can be attributed to the growing number of bioinformatics-based research studies, increasing scale of genomics research, rising number of collaborations between academic research institutes and players in the bioinformatics market, and the growing number of government funding programs for genomics research.

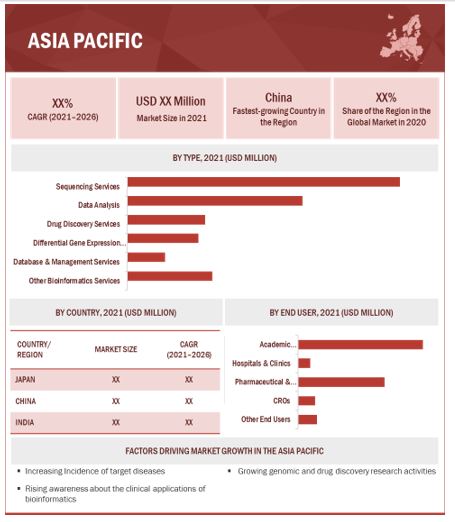

Asia Pacific region of the bioinformatics services industry is expected to grow at the highest CAGR during the forecast period.

The bioinformatics services market covers five key geographies—North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2020, Asia Pacific region offered significant opportunities for the growth of the bioinformatics services market. The market growth in Asia Pacific can be attributed to the increasing incidence of genetic diseases, rising number of bioinformatics-based research studies, and growing demand for bioinformatics services from various end users.

Prominent players in the bioinformatics services market include Illumina (US), Thermo Fisher Scientific (US), Eurofins Scientific (Luxembourg), BGI Group (China), NeoGenomics (US), PerkinElmer (US), CD Genomics (US), Psomagen, Inc. (South Korea), QIAGEN (Germany), GENEWIZ (US), Source BioScience (UK), Microsynth (Switzerland), MedGenome (India), Fios Genomics (UK), and BaseClear (Netherlands), among others.

Scope of the Bioinformatics Services Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$2.5 billion |

|

Projected Revenue Size by 2026 |

$5.3 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 15.8% |

|

Market Driver |

Growing applications of bioinformatics in various industries |

|

Market Opportunity |

Reducing cost of sequencing and growing volume of data generated during sequencing |

This report has segmented the bioinformatics services market to forecast revenue and analyze trends in each of the following submarkets:

By Application

- Genomics

- Chemoinformatics & Drug Design

- Proteomics

- Transcriptomics

- Metabolomics

- Other Applications

By Specialty

- Medical Biotechnology

- Animal Biotechnology

- Plant Biotechnology

- Environmental Biotechnology

- Forensic Biotechnology

By Type

- Sequencing Services

- Data Analysis

- Drug Discovery Services

- Differential Gene Expression Analysis

- Database and Management Services

- Other Bioinformatics Services

By End User

- Academic Institutes & Research Centers

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- CROs

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

- Middle East & Africa

Recent Developments of Bioinformatics Services Industry:

- In November 2020, BaseClear partnered with Leiden University this partnership focused on developing innovative technologies applicable in the field of metagenomics In April 2020, Medline Industries partnered with Yale New Haven for the exclusive supply of medical supplies along with supply chain and logistics solutions

- In January 2020, Charles River Laboratories entered into a strategic partnership with Fios Genomics to gain access to the expertise of Fios Genomics in the field of bioinformatics, statistics, and biology

- In August 2019, Eurofins Genomics acquired Blue Heron Biotech, a company specializing in advanced gene synthesis, and expanded its portfolio of oligonucleotides, sequencing, and synthetic genes

Frequently Asked Questions (FAQs):

What is the size of Bioinformatics Services Market?

The bioinformatics services market is projected to reach USD 5.3 Billion by 2026 from USD 2.5 Billion in 2021, at a CAGR of 15.8%.

What are the major growth factors of Bioinformatics Services Market?

Growing applications of bioinformatics across industries, increasing public-private sector funding for bioinformatics services, and the shortage of skilled bioinformatics professionals (leading to increased outsourcing of bioinformatics projects) are the major factors that are expected to drive the growth of the bioinformatics services market during the forecast period. However, the in-house development of bioinformatics solutions and publicly available bioinformatics tools are expected to limit market are expected to restrain market growth in the coming years.

Who all are the prominent players of Bioinformatics Services Market?

Prominent players in the bioinformatics services market include Illumina (US), Thermo Fisher Scientific (US), Eurofins Scientific (Luxembourg), BGI Group (China), NeoGenomics (US), PerkinElmer (US), CD Genomics (US), Psomagen, Inc. (South Korea), QIAGEN (Germany), GENEWIZ (US), Source BioScience (UK), Microsynth (Switzerland), MedGenome (India), Fios Genomics (UK), and BaseClear (Netherlands), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET SCOPE

1.2.2 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.3 MARKETS COVERED

FIGURE 1 BIOINFORMATICS SERVICES MARKET SEGMENTATION

1.2.4 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

FIGURE 2 BIOINFORMATICS SERVICES MARKET: RESEARCH DESIGN METHODOLOGY

2.2.1 SECONDARY DATA

2.2.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

2.2.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 6 MARKET SIZE ESTIMATION: BIOINFORMATICS SERVICES MARKET (BOTTOM-UP APPROACH)

FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 8 TOP-DOWN APPROACH

2.4 COVID-19 HEALTH ASSESSMENT

2.5 COVID-19 ECONOMIC ASSESSMENT

2.6 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 10 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

2.7 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO IN THE BIOINFORMATICS SERVICES MARKET

2.8 DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION

2.9 RESEARCH ASSUMPTIONS

2.10 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 12 BIOINFORMATICS SERVICES MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 13 BIOINFORMATICS SERVICES MARKET, BY SPECIALTY, 2021 VS. 2026 (USD MILLION)

FIGURE 14 BIOINFORMATICS SERVICES MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 15 BIOINFORMATICS SERVICES MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 16 BIOINFORMATICS SERVICES MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 BIOINFORMATICS SERVICES MARKET OVERVIEW

FIGURE 17 GROWING APPLICATIONS OF BIOINFORMATICS TO DRIVE THE GROWTH OF THIS MARKET DURING THE FORECAST PERIOD

4.2 BIOINFORMATICS SERVICES MARKET, BY TYPE

FIGURE 18 SEQUENCING SERVICES SEGMENT WILL CONTINUE TO DOMINATE THE BIOINFORMATICS SERVICES MARKET BY 2026

4.3 BIOINFORMATICS SERVICES MARKET, BY COUNTRY AND APPLICATION

FIGURE 19 GENOMICS ACCOUNTED FOR THE LARGEST SHARE OF THE APAC BIOINFORMATICS SERVICES MARKET

4.4 BIOINFORMATICS SERVICES MARKET, BY END USER

FIGURE 20 ACADEMIC INSTITUTES AND RESEARCH CENTERS ARE THE LARGEST END USERS OF BIOINFORMATICS SERVICES

4.5 BIOINFORMATICS SERVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 21 CHINA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 MARKET DYNAMICS: DRIVER, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing applications of bioinformatics in various industries

5.2.1.2 Increasing public-private sector funding for bioinformatics services

TABLE 2 PUBLIC-PRIVATE SECTOR FUNDING FOR BIOINFORMATICS AND RELATED FIELDS

5.2.1.3 Shortage of skilled bioinformatics professionals leading to increased outsourcing of bioinformatics projects

5.2.1.4 Increasing pharmaceutical and biotech R&D expenditure

TABLE 3 R&D INVESTMENTS BY PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN THE ASIA PACIFIC REGION

5.2.2 RESTRAINTS

5.2.2.1 In-house development of bioinformatics solutions and publicly available bioinformatics tools

5.2.3 OPPORTUNITIES

5.2.3.1 Reducing cost of sequencing and growing volume of data generated during sequencing

FIGURE 23 COST OF HUMAN WHOLE-GENOME SEQUENCING, 2001–2019

FIGURE 24 DATA PRODUCTION DURING HUMAN WHOLE-GENOME SEQUENCING, 2001–2019

5.2.3.2 Growing focus on outsourcing for the management of large volumes of data

5.2.3.3 Growth potential in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Complexity of data

5.2.4.2 Lack of well-defined standards and interoperability issues for bioinformatics analysis

5.2.4.3 Ethical issues

5.2.5 INDUSTRY TRENDS

5.2.5.1 Partnerships & collaborations for technological advancements in the bioinformatics services market

FIGURE 25 ECOSYSTEM COVERAGE: PARENT MARKET

5.3 REGULATORY ANALYSIS

5.3.1 GLOBAL ALLIANCE FOR GENOMICS AND HEALTH (GA4GH)

5.4 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN: BIOINFORMATICS SERVICES WORKFLOW—ANALYSIS PLAYS A CRUCIAL ROLE AFTER CORE SERVICES

5.5 SUPPLY CHAIN ANALYSIS

TABLE 4 SUPPLY CHAIN ECOSYSTEM

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 BIOINFORMATICS SERVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 COMPETITIVE RIVALRY AMONG EXISTING PLAYERS

5.7 COVID-19 IMPACT

6 BIOINFORMATICS SERVICES MARKET, BY TYPE (Page No. - 74)

6.1 INTRODUCTION

TABLE 6 BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.2 SEQUENCING SERVICES

TABLE 7 BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 8 BIOINFORMATICS SEQUENCING SERVICES MARKET, BY SPECIALTY, 2019–2026 (USD MILLION)

TABLE 9 BIOINFORMATICS SEQUENCING SERVICES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 10 BIOINFORMATICS SEQUENCING SERVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 11 BIOINFORMATICS SEQUENCING SERVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.1 WHOLE-GENOME SEQUENCING AND DE NOVO ASSEMBLY

6.2.1.1 Launch of advanced whole-genome sequencing services to drive market growth

TABLE 12 BIOINFORMATICS SEQUENCING SERVICES MARKET FOR WHOLE-GENOME SEQUENCING AND DE NOVO ASSEMBLY, BY REGION, 2019–2026 (USD MILLION)

6.2.2 EXOME ANALYSIS

6.2.2.1 Rising awareness of exome analysis services to drive market growth

TABLE 13 BIOINFORMATICS SEQUENCING SERVICES MARKET FOR EXOME ANALYSIS, BY REGION, 2019–2026 (USD MILLION)

6.2.3 TRANSCRIPTOME ANALYSIS

6.2.3.1 Application of transcriptomics in diagnostics and cancer research is increasing

TABLE 14 BIOINFORMATICS SEQUENCING SERVICES MARKET FOR TRANSCRIPTOME ANALYSIS, BY REGION, 2019–2026 (USD MILLION)

6.2.4 METAGENOMIC ANALYSIS

6.2.4.1 Application of metagenomics in human microbiome analysis to drive market growth

TABLE 15 BIOINFORMATICS SEQUENCING SERVICES MARKET FOR METAGENOMIC ANALYSIS, BY REGION, 2019–2026 (USD MILLION)

6.2.5 CHIP-SEQ ANALYSIS

6.2.5.1 Increasing awareness about the advantages of ChIP-seq among professionals to drive market growth

TABLE 16 BIOINFORMATICS SEQUENCING SERVICES MARKET FOR CHIP-SEQ ANALYSIS, BY REGION, 2019–2026 (USD MILLION)

6.2.6 OTHER SEQUENCING SERVICES

TABLE 17 BIOINFORMATICS SEQUENCING SERVICES MARKET FOR OTHER SEQUENCING SERVICES, BY REGION, 2019–2026 (USD MILLION)

6.3 DATA ANALYSIS SERVICES

TABLE 18 BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 19 BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY SPECIALTY, 2019–2026 (USD MILLION)

TABLE 20 BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 21 BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 22 BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.1 DATA MINING

6.3.1.1 Development of advanced bioinformatics applications and algorithms based on data mining to drive market growth

TABLE 23 BIOINFORMATICS DATA ANALYSIS SERVICES MARKET FOR DATA MINING, BY REGION, 2019–2026 (USD MILLION)

6.3.2 GENOMIC ANALYSIS

6.3.2.1 Growth in the amount of sequencing data and technological advancements in genomic analysis to drive market growth

TABLE 24 BIOINFORMATICS DATA ANALYSIS SERVICES MARKET FOR GENOMIC ANALYSIS, BY REGION, 2019–2026 (USD MILLION)

6.3.3 PROTEOMIC ANALYSIS

6.3.3.1 Increasing focus on personalized medicine and outsourcing of proteomic studies to drive market growth

TABLE 25 BIOINFORMATICS DATA ANALYSIS SERVICES MARKET FOR PROTEOMIC ANALYSIS, BY REGION, 2019–2026 (USD MILLION)

6.3.4 VARIANT ANNOTATION AND DISCOVERY

6.3.4.1 Increasing research on mutation analysis to drive market growth

TABLE 26 BIOINFORMATICS DATA ANALYSIS SERVICES MARKET FOR VARIANT ANNOTATION AND DISCOVERY, BY REGION, 2019–2026 (USD MILLION)

6.4 DRUG DISCOVERY SERVICES

6.4.1 ADVANCEMENTS IN PHARMACOGENOMICS TO DRIVE MARKET GROWTH

TABLE 27 BIOINFORMATICS DRUG DISCOVERY SERVICES MARKET, BY SPECIALTY, 2019–2026 (USD MILLION)

TABLE 28 BIOINFORMATICS DRUG DISCOVERY SERVICES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 29 BIOINFORMATICS DRUG DISCOVERY SERVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 30 BIOINFORMATICS DRUG DISCOVERY SERVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.5 DIFFERENTIAL GENE EXPRESSION ANALYSIS SERVICES

6.5.1 R&D FOR THE ADVANCEMENT OF SOLUTIONS & SERVICES FOR DIFFERENTIAL GENE EXPRESSION STUDIES IS INCREASING

TABLE 31 BIOINFORMATICS DIFFERENTIAL GENE EXPRESSION ANALYSIS SERVICES MARKET, BY SPECIALTY, 2019–2026 (USD MILLION)

TABLE 32 BIOINFORMATICS DIFFERENTIAL GENE EXPRESSION ANALYSIS SERVICES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 33 BIOINFORMATICS DIFFERENTIAL GENE EXPRESSION ANALYSIS MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 34 BIOINFORMATICS DIFFERENTIAL GENE EXPRESSION ANALYSIS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.6 DATABASE AND MANAGEMENT SERVICES

6.6.1 GOVERNMENT INITIATIVES FOR DATA SHARING WILL DRIVE MARKET GROWTH

TABLE 35 BIOINFORMATICS DATABASE AND MANAGEMENT SERVICES MARKET, BY SPECIALTY, 2019–2026 (USD MILLION)

TABLE 36 BIOINFORMATICS DATABASE AND MANAGEMENT SERVICES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 37 BIOINFORMATICS DATABASE AND MANAGEMENT SERVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 38 BIOINFORMATICS DATABASE AND MANAGEMENT SERVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.7 OTHER BIOINFORMATICS SERVICES

TABLE 39 OTHER BIOINFORMATICS SERVICES MARKET, BY SPECIALTY, 2019–2026 (USD MILLION)

TABLE 40 OTHER BIOINFORMATICS SERVICES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 41 OTHER BIOINFORMATICS SERVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 42 OTHER BIOINFORMATICS SERVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

7 BIOINFORMATICS SERVICES MARKET, BY SPECIALTY (Page No. - 97)

7.1 INTRODUCTION

TABLE 43 BIOINFORMATICS SERVICES MARKET, BY SPECIALTY, 2019–2026 (USD MILLION)

7.2 MEDICAL BIOTECHNOLOGY

7.2.1 USE OF BIOINFORMATICS SERVICES IS INCREASING IN MOLECULAR MEDICINE, DRUG DISCOVERY, AND CLINICAL DIAGNOSTICS

TABLE 44 BIOINFORMATICS SERVICES MARKET FOR MEDICAL BIOTECHNOLOGY, BY REGION, 2019–2026 (USD MILLION)

7.3 ANIMAL BIOTECHNOLOGY

7.3.1 VAST OMICS DATABASES FOR SEQUENCING & ANALYSIS OF ANIMAL GENOMIC DATA ARE DRIVING THE GROWTH OF THIS MARKET SEGMENT

TABLE 45 BIOINFORMATICS SERVICES MARKET FOR ANIMAL BIOTECHNOLOGY, BY REGION, 2019–2026 (USD MILLION)

7.4 PLANT BIOTECHNOLOGY

7.4.1 DECREASING SEQUENCING COST AND ADVANCED BIOINFORMATICS SERVICES TO BOOST MARKET GROWTH

TABLE 46 BIOINFORMATICS SERVICES MARKET FOR PLANT BIOTECHNOLOGY, BY REGION, 2019–2026 (USD MILLION)

7.5 ENVIRONMENTAL BIOTECHNOLOGY

7.5.1 R&D OF BIOINFORMATICS IN ENVIRONMENTAL BIOTECHNOLOGY TO DRIVE MARKET GROWTH

TABLE 47 BIOINFORMATICS SERVICES MARKET FOR ENVIRONMENTAL BIOTECHNOLOGY, BY REGION, 2019–2026 (USD MILLION)

7.6 FORENSIC BIOTECHNOLOGY

7.6.1 IMPROVED USE OF FORENSIC BIOINFORMATICS WILL DRIVE MARKET GROWTH

TABLE 48 BIOINFORMATICS SERVICES MARKET FOR FORENSIC BIOTECHNOLOGY, BY REGION, 2019–2026 (USD MILLION)

8 BIOINFORMATICS SERVICES MARKET, BY APPLICATION (Page No. - 104)

8.1 INTRODUCTION

TABLE 49 BIOINFORMATICS SERVICES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 GENOMICS

8.2.1 GENOMICS IS THE LARGEST APPLICATION SEGMENT IN THE BIOINFORMATICS SERVICES MARKET

TABLE 50 BIOINFORMATICS SERVICES MARKET FOR GENOMICS, BY REGION, 2019–2026 (USD MILLION)

8.3 CHEMOINFORMATICS & DRUG DESIGN

8.3.1 PROACTIVE USE OF CHEMOINFORMATICS IN DRUG DISCOVERY BY PHARMACEUTICAL COMPANIES WILL DRIVE MARKET GROWTH

TABLE 51 BIOINFORMATICS SERVICES MARKET FOR CHEMOINFORMATICS & DRUG DESIGN, BY REGION, 2019–2026 (USD MILLION)

8.4 PROTEOMICS

8.4.1 R&D AND FINANCIAL SUPPORT FROM GOVERNMENT AND PRIVATE FUNDING BODIES IS INCREASING IN THE FIELD OF PROTEOMICS

TABLE 52 BIOINFORMATICS SERVICES MARKET FOR PROTEOMICS, BY REGION, 2019–2026 (USD MILLION)

8.5 TRANSCRIPTOMICS

8.5.1 INCREASING NUMBER OF RESEARCH STUDIES FOR THE TREATMENT OF CANCER USING TRANSCRIPTOMICS WILL SUPPORT MARKET GROWTH

TABLE 53 BIOINFORMATICS SERVICES MARKET FOR TRANSCRIPTOMICS, BY REGION, 2019–2026 (USD MILLION)

8.6 METABOLOMICS

8.6.1 TECHNOLOGICAL ADVANCEMENT IN THE FIELD OF METABOLOMICS AND DATA ANALYSIS TO DRIVE MARKET GROWTH

TABLE 54 BIOINFORMATICS SERVICES MARKET FOR METABOLOMICS, BY REGION, 2019–2026 (USD MILLION)

8.7 OTHER APPLICATIONS

TABLE 55 BIOINFORMATICS SERVICES MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

9 BIOINFORMATICS SERVICES MARKET, BY END USER (Page No. - 110)

9.1 INTRODUCTION

TABLE 56 BIOINFORMATICS SERVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2 ACADEMIC INSTITUTES AND RESEARCH CENTERS

9.2.1 ACADEMIC INSTITUTES AND RESEARCH CENTERS ARE THE LARGEST END USERS OF BIOINFORMATICS SERVICES

TABLE 57 BIOINFORMATICS SERVICES MARKET FOR ACADEMIC INSTITUTES AND RESEARCH CENTERS, BY REGION, 2019–2026 (USD MILLION)

9.3 HOSPITALS AND CLINICS

9.3.1 GROWING NUMBER OF COLLABORATIONS AND AGREEMENTS BETWEEN COMPANIES AND HOSPITALS TO BOOST MARKET GROWTH

TABLE 58 BIOINFORMATICS SERVICES MARKET FOR HOSPITALS AND CLINICS, BY REGION, 2019–2026 (USD MILLION)

9.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

9.4.1 INCREASING FOCUS ON DEVELOPING TARGETED THERAPIES WILL DRIVE THE MARKET GROWTH

TABLE 59 BIOINFORMATICS SERVICES MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY REGION, 2019–2026 (USD MILLION)

9.5 CONTRACT RESEARCH ORGANIZATIONS

9.5.1 INCREASING NUMBER OF CROS WILL ENHANCE THE MARKET GROWTH

TABLE 60 BIOINFORMATICS SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2019–2026 (USD MILLION)

9.6 OTHER END USERS

TABLE 61 BIOINFORMATICS SERVICES MARKET FOR OTHER END USERS, BY REGION, 2019–2026 (USD MILLION)

10 BIOINFORMATICS SERVICES MARKET, BY REGION (Page No. - 117)

10.1 INTRODUCTION

TABLE 62 BIOINFORMATICS SERVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 27 NORTH AMERICA: BIOINFORMATICS SERVICES MARKET SNAPSHOT

TABLE 63 NORTH AMERICA: BIOINFORMATICS SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 65 N0RTH AMERICA: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: BIOINFORMATICS SERVICES MARKET, BY SPECIALTY, 2019–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: BIOINFORMATICS SERVICES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: BIOINFORMATICS SERVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Growing R&D activities in the US to drive market growth

TABLE 70 US: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 US: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 US: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing government initiatives in genomics research will boost the adoption of bioinformatics services

TABLE 73 CANADA: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 CANADA: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 ANADA: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 76 EUROPE: BIOINFORMATICS SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 77 EUROPE: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 EUROPE: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 EUROPE: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 EUROPE: BIOINFORMATICS SERVICES MARKET, BY SPECIALTY, 2019–2026 (USD MILLION)

TABLE 81 EUROPE: BIOINFORMATICS SERVICES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 82 EUROPE: BIOINFORMATICS SERVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Funding initiatives by the government will drive market growth

TABLE 83 GERMANY: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 GERMANY: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 85 GERMANY: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 UK dominates the bioinformatics services market in Europe

TABLE 86 UK: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 UK: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 UK: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Government initiatives to support genomics research—a major factor driving market growth in France

TABLE 89 FRANCE: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 FRANCE: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 FRANCE: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Favorable funding scenario to drive the bioinformatics services market in Italy

TABLE 92 ITALY: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 ITALY: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 ITALY: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Increasing number of conferences focusing on new sequencing technologies and data analysis to support market growth

TABLE 95 SPAIN: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 SPAIN: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 SPAIN: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 98 ROE: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 ROE: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 ROE: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC: BIOINFORMATICS SERVICES MARKET SNAPSHOT

TABLE 101 APAC: BIOINFORMATICS SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 102 APAC: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 APAC: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 APAC: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 105 APAC: BIOINFORMATICS SERVICES MARKET, BY SPECIALTY, 2019–2026 (USD MILLION)

TABLE 106 APAC: BIOINFORMATICS SERVICES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 107 APAC: BIOINFORMATICS SERVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Increasing focus on personalized diagnostics products to drive market growth in Japan

TABLE 108 JAPAN: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 JAPAN: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 JAPAN: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 China is the largest market for bioinformatics services in APAC

TABLE 111 CHINA: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 CHINA: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 CHINA: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Growing prevalence of target diseases in India to support market growth

TABLE 114 INDIA: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 INDIA: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 INDIA: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Increasing use of NGS platforms by academic institutes to propel market growth

TABLE 117 AUSTRALIA: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 AUSTRALIA: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 AUSTRALIA: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.4.5 SOUTH KOREA

10.4.5.1 Supportive government initiatives expected to positively impact market growth

TABLE 120 SOUTH KOREA: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 SOUTH KOREA: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 SOUTH KOREA: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 123 ROAPAC: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 ROAPAC: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 125 ROAPAC: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

TABLE 126 LATAM: BIOINFORMATICS SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 127 LATAM: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 LATAM: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 LATAM: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 130 LATAM: BIOINFORMATICS SERVICES MARKET, BY SPECIALTY, 2019–2026 (USD MILLION)

TABLE 131 LATAM: BIOINFORMATICS SERVICES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 132 LATAM: BIOINFORMATICS SERVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Focus on NGS technologies and NGS data analysis is increasing in Brazil

TABLE 133 BRAZIL: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 BRAZIL: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 BRAZIL: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.5.2 MEXICO

10.5.2.1 Economic growth in Mexico to support the growth of the market

TABLE 136 MEXICO: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 MEXICO: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 MEXICO: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.5.3 REST OF LATIN AMERICA

TABLE 139 ROLA: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 140 ROLA: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 ROLA: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 INCREASING FOCUS ON GENOMICS RESEARCH TO DRIVE MARKET GROWTH IN MEA

TABLE 142 MEA: BIOINFORMATICS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 MEA: BIOINFORMATICS SEQUENCING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 MEA: BIOINFORMATICS DATA ANALYSIS SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 145 MEA: BIOINFORMATICS SERVICES MARKET, BY SPECIALTY, 2019–2026 (USD MILLION)

TABLE 146 MEA: BIOINFORMATICS SERVICES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 147 MEA: BIOINFORMATICS SERVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 169)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.3 OVERVIEW OF STRATEGIES ADOPTED BY KEY BIOINFORMATICS SERVICE PROVIDERS

11.4 REVENUE ANALYSIS

FIGURE 29 REVENUE SHARE ANALYSIS OF THE TOP PLAYERS IN THE BIOINFORMATICS SERVICES MARKET

11.5 MARKET SHARE ANALYSIS

FIGURE 30 THERMO FISHER SCIENTIFIC HELD THE LEADING POSITION IN THE BIOINFORMATICS SERVICES MARKET IN 2020

11.6 COMPANY EVALUATION QUADRANT (MAJOR PLAYERS)

11.7 VENDOR INCLUSION CRITERIA

11.7.1 STARS

11.7.2 PERVASIVE PLAYERS

11.7.3 EMERGING LEADERS

11.7.4 PARTICIPANTS

FIGURE 31 BIOINFORMATICS SERVICES MARKET: GLOBAL COMPANY EVALUATION MATRIX, 2020

11.8 COMPANY EVALUATION QUADRANT (SMES/STRAT-UPS)

11.8.1 PROGRESSIVE COMPANIES

11.8.2 STARTING BLOCKS

11.8.3 RESPONSIVE COMPANIES

11.8.4 DYNAMIC COMPANIES

FIGURE 32 BIOINFORMATICS MARKET: GLOBAL COMPETITIVE LEADERSHIP MAPPING, 2020 (SME/START-UPS)

11.9 COMPETITIVE BENCHMARKING

FIGURE 33 SERVICE AND REGIONAL FOOTPRINT ANALYSIS OF THE TOP PLAYERS IN THE BIOINFORMATICS SERVICES MARKET

TABLE 148 SERVICE FOOTPRINT OF COMPANIES

TABLE 149 REGIONAL FOOTPRINT OF COMPANIES

11.10 COMPETITIVE SCENARIO AND TRENDS

TABLE 150 BIOINFORMATICS SERVICES MARKET: SERVICE LAUNCHES, JANUARY 2017–MAY 2021

TABLE 151 BIOINFORMATICS SERVICES MARKET: EXPANSIONS, JANUARY 2017–MAY 2021

TABLE 152 BIOINFORMATICS SERVICES MARKET: DEALS, JANUARY 2017–MAY 2021

12 COMPANY PROFILES (Page No. - 181)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, MnM View)*

12.1.1 THERMO FISHER SCIENTIFIC

TABLE 153 THERMO FISHER SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 34 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

TABLE 154 THERMO FISHER SCIENTIFIC: SERVICE OFFERINGS

TABLE 155 THERMO FISHER SCIENTIFIC: DEALS

TABLE 156 THERMO FISHER SCIENTIFIC: OTHER DEVELOPMENTS

12.1.2 EUROFINS SCIENTIFIC

TABLE 157 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 35 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

TABLE 158 EUROFINS SCIENTIFIC: SERVICE OFFERINGS

TABLE 159 EUROFINS SCIENTIFIC: SERVICE LAUNCHES

TABLE 160 EUROFINS SCIENTIFIC: DEALS

12.1.3 ILLUMINA

TABLE 161 ILLUMINA: BUSINESS OVERVIEW

FIGURE 36 ILLUMINA: COMPANY SNAPSHOT

TABLE 162 ILLUMINA: SERVICE OFFERINGS

TABLE 163 ILLUMINA: DEALS

TABLE 164 ILLUMINA: OTHER DEVELOPMENTS

12.1.4 PERKINELMER

TABLE 165 PERKINELMER: BUSINESS OVERVIEW

FIGURE 37 PERKINELMER, INC.: COMPANY SNAPSHOT

TABLE 166 PERKINELMER: SERVICE OFFERINGS

TABLE 167 PERKINELMER: SERVICE LAUNCHES

TABLE 168 PERKINELMER: DEALS

12.1.5 NEOGENOMICS

TABLE 169 NEOGENOMICS: BUSINESS OVERVIEW

FIGURE 38 NEOGENOMICS: COMPANY SNAPSHOT

TABLE 170 NEOGENOMICS: SERVICE OFFERINGS

TABLE 171 NEOGENOMICS: OTHER DEVELOPMENTS

12.1.6 BASECLEAR

TABLE 172 BASECLEAR: BUSINESS OVERVIEW

TABLE 173 BASECLEAR: SERVICE OFFERINGS

TABLE 174 BASECLEAR: SERVICE LAUNCHES

TABLE 175 BASECLEAR: DEALS

12.1.7 BGI GROUP

TABLE 176 BGI GROUP: BUSINESS OVERVIEW

TABLE 177 BGI: SERVICE OFFERINGS

TABLE 178 BGI GROUP: DEALS

12.1.8 CD GENOMICS

TABLE 179 CD GENOMICS: BUSINESS OVERVIEW

TABLE 180 CD GENOMICS: SERVICE OFFERINGS

12.1.9 FIOS GENOMICS

TABLE 181 FIOS GENOMICS: BUSINESS OVERVIEW

TABLE 182 FIOS GENOMICS: SERVICE OFFERINGS

TABLE 183 FIOS GENOMICS: DEALS

12.1.10 GENEWIZ (A BROOKS LIFE SCIENCES COMPANY)

TABLE 184 GENEWIZ: BUSINESS OVERVIEW

FIGURE 39 BROOKS AUTOMATION, INC.: COMPANY SNAPSHOT

TABLE 185 GENEWIZ: SERVICE OFFERINGS

TABLE 186 GENEWIZ: SERVICE LAUNCHES

TABLE 187 GENEWIZ: DEALS

TABLE 188 GENEWIZ: OTHER DEVELOPMENTS

12.1.11 PSOMAGEN, INC. (FORMERLY KNOWN AS MACROGEN)

TABLE 189 PSOMAGEN, INC.: BUSINESS OVERVIEW

TABLE 190 PSOMAGEN: SERVICE OFFERINGS

TABLE 191 PSOMAGEN: DEALS

TABLE 192 PSOMAGEN: OTHER DEVELOPMENTS

12.1.12 MEDGENOME LABS

TABLE 193 MEDGENOME: BUSINESS OVERVIEW

TABLE 194 MEDGENOME: SERVICE OFFERINGS

12.1.13 MICROSYNTH

TABLE 195 MICROSYNTH: BUSINESS OVERVIEW

TABLE 196 MICROSYNTH: SERVICE OFFERINGS

TABLE 197 MICROSYNTH: SERVICE LAUNCHES

12.1.14 QIAGEN N.V.

TABLE 198 QIAGEN N.V.: BUSINESS OVERVIEW

FIGURE 40 QIAGEN N.V.: COMPANY SNAPSHOT

TABLE 199 QIAGEN N.V.: SERVICE OFFERINGS

TABLE 200 QIAGEN N.V.: DEALS

TABLE 201 QIAGEN: OTHER DEVELOPMENTS

12.1.15 SOURCE BIOSCIENCE

TABLE 202 SOURCE BIOSCIENCE: BUSINESS OVERVIEW

FIGURE 41 SOURCE BIOSCIENCE: COMPANY SNAPSHOT

TABLE 203 SOURCE BIOSCIENCE: SERVICE OFFERINGS

12.2 OTHER COMPANIES

12.2.1 NXT-DX (A DIAGENODE COMPANY)

12.2.2 NUCLEOME BIOINFORMATICS

12.2.3 1010GENOME

12.2.4 DNANEXUS, INC.

12.2.5 BIONIVID

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 230)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the bioinformatics services market. A database of the key industry leaders was also prepared using secondary research.

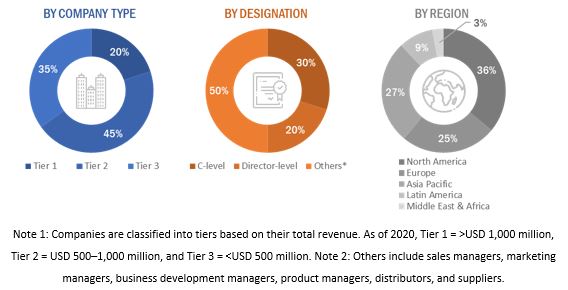

Primary Research

Primary research was conducted after acquiring extensive knowledge about the global bioinformatics services market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as hospitals, research universities, academic institutions, and government institutions, among others) and supply-side respondents (such as presidents, CEOs, vice presidents, directors, general managers, heads of business units, and senior managers) across five major geographies, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East, and Africa. Approximately 30% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 70%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

A detailed market estimation approach was followed to estimate and validate the size of the global bioinformatics services market and other dependent submarkets.

- Key players in the global bioinformatics services market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for detailed insights (both qualitative and quantitative trends) on the bioinformatics services market.

- All percentage shares, splits, and breakdowns for the global bioinformatics services market were determined by using secondary sources and verified through primary sources.

- All the key macro indicators affecting the revenue growth of the market segments and sub-segments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added to detailed inputs, analyzed, and presented in this report.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation:

After arriving at the overall size of the global bioinformatics services market through the above-mentioned methodology, this market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and sub-segments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives:

- To define, describe, and forecast the bioinformatics services market based on type, specialty, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the global bioinformatics services market (such as drivers, restraints, challenges, opportunities, and regulatory landscape, among others)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the global bioinformatics services market

- To analyze the opportunities in the global bioinformatics services market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key global players and comprehensively analyze their market shares and core competencies2

- To provide a five-year forecast for various market segments in terms of revenue with respect to five main regions, namely, North America (includes the US and Canada), Europe (includes Germany, the UK, France, Italy, and Spain), Asia Pacific (includes Japan, China, India, Australia, and South Korea), Latin America (includes Brazil and Mexico), and the Middle East & Africa

- To track and analyze competitive developments such as service launches; agreements, partnerships, collaboration and joint ventures; mergers and acquisitions; and research and development activities in the bioinformatics services market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the global bioinformatics services market report:

Product analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company information

- Detailed analysis and profiling of additional market players (up to five)

Geographic analysis

- Further breakdown of the Rest of Europe bioinformatics services market into Belgium, Austria, Denmark, Greece, Poland, and Russia, among other countries

- Further breakdown of the Rest of Asia Pacific bioinformatics services market into New Zealand, Vietnam, Philippines, Singapore, Malaysia, Thailand, and Indonesia, among other countries

- Further breakdown of the Rest of Latin America bioinformatics services market into Argentina and Colombia, among other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bioinformatics Services Market