Antimicrobial Powder Coatings Market by Additive Type (Silver, Zinc, Copper & Others), End-use Industry (Medical & Healthcare, Appliances, HVAC, Food Equipment, General Industry, Transportation, Fitness Equipment), & Region - Global Forecast to 2025

Updated on : March 27, 2023

Antimicrobial Powder Coatings Market

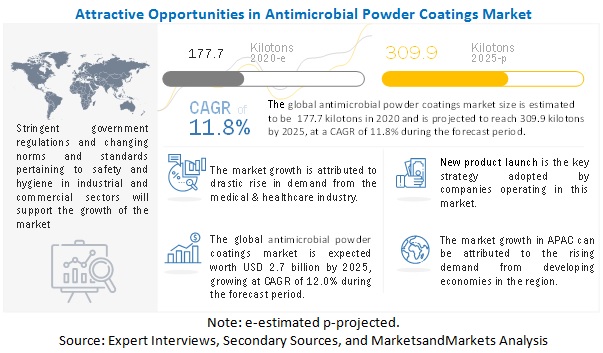

The global antimicrobial powder coatings market was valued at USD 1.5 billion in 2020 and is projected to reach USD 2.7 billion by 2025, growing at a cagr 12.0% from 2020 to 2025. Due to the COVID-19 pandemic, the demand for antimicrobial powder coatings has been increasing in the medical & healthcare industry. Antimicrobial powder coatings have gained significant attention and were applied in the several temporary and existing healthcare facilities during the pandemic.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Antimicrobial Powder Coatings Market

There has been a significant increase in the patient pool across the globe due to the COVID-19 pandemic. For the treatment of these patients, temporary hospitals and facilities were established in several countries, wherein the utmost care was taken to avoid the spread and growth of the COVID-19 virus and other bacteria on the surfaces. Also, several temporary and existing healthcare facilities are applying antimicrobial powder coatings on the surfaces, such as door handles, trails, beds, healthcare instruments, and medical devices used for the treatment. Antimicrobial powder coatings have thus emerged as an effective weapon to fight against the COVID-19 pandemic in the medical & healthcare industry.

Antimicrobial Powder Coatings Market Dynamics

Driver: Increase in demand for HVAC systems

Significant growth in the demand for the HVAC systems in residential, commercial, institutional, and industrial sectors has been witnessed in developed regions, such as the US, EU-5, and BENELUX. Moreover, government regulations and policies, such as tax benefits and incentives for energy conservation, had prompted the demand for HVAC systems.

Mold formation in the HVAC system is a major concern for air quality. During air circulation, the mold spores from the external environment enter into the HVAC system and then get distributed throughout the ductwork and ultimately in the buildings, which leads to the formation of new mold colonies. According to the World Health Organization (WHO), more than 80% of indoor air quality and allergies-related problems are caused due to mold. Several government authorities, such as EPA, WHO, and others, have levied regulations and norms on the indoor air quality at residential, commercial, and institutional buildings. As a preventive measure, the HVAC system manufacturers are applying a layer of antimicrobial powder coatings on the system part, which not only prevents the growth of molds and other bacteria but also reduces the maintenance cost.

Government’s acrpss th globe have also changed the norms and regulations pertaining to indoor air quality due to the COVID-19 pandemic. This, in turn, has resulted in significant growth in demand for the antimicrobial coated HVAC systems in commercial and institutional sectors. Consequently, with the growing awareness and increasing installation and replacement of HVAC systems across the globe, the demand for antimicrobial powder coatings is expected to increase over the forecast period.

Restraint: Stringent governmental regulations

In developed countries, antimicrobial products have to comply with the guidelines and norms levied by the local government authority. In the US, antimicrobial powder coatings must fulfill the criteria imposed by the Environmental Protection Agency (EPA). Before approval, risk assessment of each antimicrobial powder coating product is carried out by independent scientific bodies, as well as governmental agencies, which include EPA, FDA, and regulatory authorities, whose approval has been accepted globally. This risk assessment is intended to estimate the impact of antimicrobial powder coatings on human health & safety. Also, depending upon the application areas, the manufacturer has to take approval from the government authorities. For instance, in the food & beverage industry, FDA approval is mandatory.

Opportunity: Rising usage in novel applications

With the recent COVID-19 pandemic, significant growth in demand for antimicrobial powder coatings is witnessed from several applications, such as appliances, consumer goods, and electronic products. Currently, many established companies and start-ups are developing products to fight against COVID-19. For instance, in June 2020, Berger Paints India offered antimicrobial powder coatings for treatment in the medical industry to limit the spread of the disease. Furthermore, with the growing concern and rising awareness about safety and hygiene across the globe, several manufacturers, such as consumer goods and electronics manufacturers, are focusing on the development of antimicrobial products. It will help to comply with changing consumer preferences and market demand. In January 2020, ZAGG Inc. (US) entered into a partnership with the Irish start-up company, Kastus, to incorporate the next-generation antimicrobial technology on touch screen devices.

Challenge: Growing concerns about the toxicity of nanoparticles

The toxic nature of metal nanoparticles has resulted in concerns about its applications, particularly in the medical industry. The properties of metal nanoparticles are significantly different from their bulk form; they differ in terms of their toxic and biological activity. Even long-term exposure to silver and copper coatings might risk human health by inducing skin diseases and breathing issues if it gets mixed into dust. Also, these particles can cause adverse effects on tissues and organs at cellular levels.

Silver to be the fastest-growing additive type segment of the antimicrobial powder coatings market during the forecast period.

Silver is expected to be the largest segment, by additive type, during the forecast period. Silver ion is widely known for its antifungal, antibacterial, and antiviral effects and also for low toxicity for human beings. The technology advancement and efforts made by coating manufacturers to incorporate silver-based antimicrobial powder coatings onto medical devices, such as surgical instruments and implants, have supported the growth of the product.

The medical & healthcare segment is estimated to be the fastest-growing end-use industry of the antimicrobial powder coatings market during the forecast period.

Based on end-use industry, the medical & healthcare segment is estimated to account for the largest share of the antimicrobial powder coatings market during the forecast period. Antimicrobial powder coatings promote a safe and hygienic environment. These coatings are often used by hospitals, surgical facilities, and dental offices to create a protective coating on equipment. Because powder coatings can be applied to a variety of materials, including galvanized steel and aluminum, they are often used for hospital beds, wheelchairs, handrails, lifts, trolleys, and other metal equipment that comes in contact with patients and is susceptible to bacteria and viruses

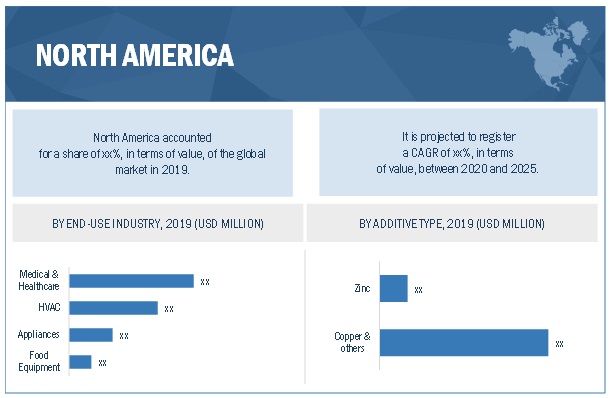

North America to account for the largest share of the global antimicrobial powder coatings market during the forecast period.

The North America antimicrobial powder coatings market is expected to witness strong growth in the next five years. The North American antimicrobial coatings market is driven by the rising demand from the medical & healthcare sector to inhibit the growth of bacteria and microbes causing HAIs. Also, due to the stringent regulations pertaining to the indoor air quality, the HVAC system manufacturers are incorporating antimicrobial coatings on surfaces to ensure the required air quality by inhibiting the growth of mold and bacteria.

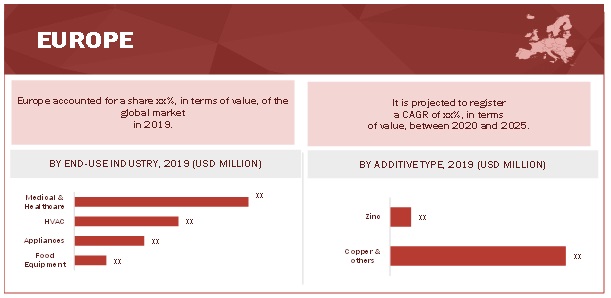

Europe to account for the second largest share of the global antimicrobial powder coatings during the forecast period.

Europe was the second-largest market for antimicrobial powder coatings in 2019. The key contributors to the growth of the European antimicrobial powder coatings market are Germany, the UK, France, Spain, Italy, and Russia. The growth is mainly attributed to the rising demand from the medical & healthcare industry and the growing awareness about the safety and hygiene of food & beverage products and indoor air quality. A strong emphasis has been given on the safety of the hospital staff and patients at hospital facilities, especially now in the global pandemic situation, from the HAIs and transmission of the virus. Also, the demand for furniture, such as hospital beds, has increased drastically. Owing to this, the demand for antimicrobial powder coatings has increased significantly.

Antimicrobial Powder Coatings Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million) and Volume (Kiloton) |

|

Segments |

Additive Type and End-Use Industry |

|

Regions |

APAC, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

PPG Industries, Inc. (US), Sherwin-Williams Company (US), AkzoNobel N.V. (Netherlands), Axalta Coating Systems LLC (US), and Berger Paints India Ltd (India) |

This research report categorizes the antimicrobial powder coatings market based on additive type, end-use industry, and region.

Based on additive type, the antimicrobial powder coatings market has been segmented as follows:

- Silver

- Zinc

- Copper & others (Polymer compounds and quaternary ammonium compounds)

Based on end-use industries, the antimicrobial powder coatings market has been segmented as follows:

- Medical & Healthcare

- HVAC

- Appliances

- Food Equipment

- General Industry

- Transportation

- Fitness Equipment

- Steel Furniture

- Others (Water treatment plants & equipment, water coolers, ice-making equipment, and sporting goods)

Based on the region, the antimicrobial powder coatings market has been segmented as follows:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Antimicrobial Powder Coatings Market Players

PPG Industries, Inc. (US), Sherwin-Williams Company (US), AkzoNobel N.V. (Netherlands), Axalta Coating Systems LLC (US), Berger Paints India Ltd (India), are some of the players operating in the global market.

Recent Developments

- In May 2020, Akzonobel N.V. added antimicrobial properties to its Interpon D1000 and 2000 range of architectural powder coatings. This was done to meet the increased demand for products that can improve hygiene owing to the widespread coronavirus pandemic.

- In March 2020, PPG acquired Alpha Coating Technologies, LLC, a manufacturer of powder coatings for light industrial applications and heat-sensitive substrates. The acquisition was made with the intention to help PPG expand and strengthen its powder coatings product portfolio.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET INCLUSIONS AND EXCLUSIONS

1.3.1 MARKET INCLUSIONS, BY ADDITIVE TYPE

1.3.2 MARKET INCLUSIONS, BY END-USE INDUSTRY

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION: ANTIMICROBIAL POWDER COATINGS

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED FOR STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION APPROACH

2.2.1 BASED ON THE SILVER NANOPARTICLES CONSUMPTION IN PAINTS & COATINGS APPLICATION

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 32)

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ANTIMICROBIAL POWDER COATINGS MARKET

4.2 ANTIMICROBIAL POWDER COATINGS MARKET, BY ADDITIVE TYPE

4.3 ANTIMICROBIAL POWDER COATINGS MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

4.4 ANTIMICROBIAL POWDER COATINGS MARKET IN APAC, BY END-USE INDUSTRY AND COUNTRY

4.5 ANTIMICROBIAL POWDER COATINGS MARKET, BY KEY COUNTRIES

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Healthcare industry to drive the market growth during and post-COVID-19 pandemic

5.2.1.2 Increase in demand for HVAC systems

5.2.1.3 Growing awareness to increase the demand from the food & beverage industry

5.2.2 RESTRAINTS

5.2.2.1 Costly in comparison to other coating products

5.2.2.2 Stringent governmental regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Rising usage in novel applications

5.2.4 CHALLENGES

5.2.4.1 Growing concerns about the toxicity of nanoparticles

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ANTIMICROBIAL PRODUCTS ECOSYSTEM

5.5 VALUE CHAIN OVERVIEW

5.5.1 DISRUPTION IN VALUE CHAIN DUE TO COVID–19

5.5.1.1 Action plan against such vulnerability

5.6 PRICING ANALYSIS

5.7 YC AND YCC SHIFT

5.7.1 YC SHIFT

5.7.2 YCC SHIFT

5.8 FORECASTING FACTORS AND COVID-19 PANDEMIC IMPACT

5.8.1 PRODUCT SELECTION CRITERIA

5.9 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.9.1 INTRODUCTION

5.9.2 TRENDS AND FORECAST OF GDP

5.9.3 TRENDS AND FORECAST OF GLOBAL AUTOMOTIVE INDUSTRY

5.1 COVID-19 IMPACT

5.11 COVID-19 ECONOMIC ASSESSMENT

5.11.1 COVID-19 ECONOMIC IMPACT – SCENARIO ASSESSMENT

6 ANTIMICROBIAL POWDER COATINGS MARKET, BY ADDITIVE TYPE (Page No. - 67)

6.1 INTRODUCTION

6.2 SILVER

6.2.1 MARKET DRIVEN BY DEMAND FROM MEDICAL DEVICES, SUCH AS SURGICAL INSTRUMENTS

6.3 ZINC

6.3.1 ZINC IS WIDELY USED IN BUILDING & CONSTRUCTION COATINGS DUE TO ITS ABILITY TO ABSORB UV RAYS

6.4 COPPER & OTHERS

6.4.1 MEDICAL & HEALTHCARE, BUILDING & CONSTRUCTION, AND HVAC SYSTEMS ARE DRIVING THE DEMAND

7 ANTIMICROBIAL POWDER COATINGS MARKET, BY END-USE INDUSTRY (Page No. - 73)

7.1 INTRODUCTION

7.1.1 DISRUPTION DUE TO COVID-19

7.2 MEDICAL & HEALTHCARE

7.2.1 GROWING CONCERNS REGARDING HOSPITAL-ACQUIRED INFECTIONS ARE DRIVING THE MARKET

7.2.2 COVID-19 IMPACT ON THE MEDICAL & HEALTHCARE INDUSTRY

7.2.3 LIST OF POTENTIAL CUSTOMERS

7.2.3.1 Medical Device Manufacturers

7.2.3.2 Medical Beds & Patient Handling Equipment Manufacturers

7.3 HVAC

7.3.1 HEAVY INVESTMENTS BY GOVERNMENTS FOR THE CONSTRUCTION OF COMMERCIAL SPACES IMPACTING MARKET GROWTH

7.3.2 COVID-19 IMPACT ON THE HVAC INDUSTRY

7.3.3 LIST OF POTENTIAL CUSTOMERS

7.4 APPLIANCES

7.4.1 ENERGY-EFFICIENCY AND ADVANCED FEATURES HAVE PROMOTED THE GROWTH OF APPLIANCES

7.4.2 COVID-19 IMPACT ON THE APPLIANCES INDUSTRY

7.4.3 LIST OF POTENTIAL CUSTOMERS

7.5 FOOD EQUIPMENT

7.5.1 HIGH DURABILITY, STRONG ADHESION, AND MECHANICAL AND THERMAL STABILITY HAVE LED TO INCREASED DEMAND

7.5.2 COVID-19 IMPACT ON THE FOOD EQUIPMENT INDUSTRY

7.5.3 LIST OF POTENTIAL CUSTOMERS

7.6 GENERAL INDUSTRIAL

7.6.1 MANDATORY USE IN BUILDINGS WITH A HIGH INFLUX OF PEOPLE TO DRIVE THE MARKET

7.6.2 COVID-19 IMPACT ON THE GENERAL INDUSTRY

7.6.3 LIST OF POTENTIAL CUSTOMERS

7.7 TRANSPORTATION

7.7.1 GROWING CONCERNS REGARDING THE SAFETY OF PASSENGERS WILL BOOST MARKET GROWTH

7.7.2 COVID-19 IMPACT ON THE TRANSPORTATION INDUSTRY

7.7.3 LIST OF POTENTIAL CUSTOMERS

7.8 FITNESS EQUIPMENT

7.8.1 STABILIZING ECONOMIC PROSPERITY AMONG THE CITIZENS OF APAC COUNTRIES DRIVING THE DEMAND

7.8.2 COVID-19 IMPACT ON THE FITNESS EQUIPMENT INDUSTRY

7.8.3 LIST OF POTENTIAL CUSTOMERS

7.9 STEEL FURNITURE

7.9.1 REOPENING OF COMMERCIAL PLACES SUCH AS SHOPPING MALLS AND SUPERMARKETS WILL BOOST THE DEMAND

7.9.2 COVID-19 IMPACT ON THE STEEL FURNITURE INDUSTRY

7.9.3 LIST OF POTENTIAL CUSTOMERS

7.9.3.1 Steel furniture manufacturers

7.9.3.2 Shopping Cart Manufacturers

7.1 OTHERS

7.10.1 LIST OF POTENTIAL CUSTOMERS

8 ANTIMICROBIAL POWDER COATINGS MARKET, BY REGION (Page No. - 99)

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 COVID-19 IMPACT ON NORTH AMERICA

8.2.2 US

8.2.2.1 The mature US market to witness a steady growth rate

8.2.2.2 COVID-19 Impact on the US

8.2.3 CANADA

8.2.3.1 Increased demand from temporary healthcare facilities and protective clothing manufacturers

8.2.3.2 COVID-19 Impact on Canada

8.2.4 MEXICO

8.2.4.1 Changing monetary and fiscal policies are supporting market growth

8.2.4.2 COVID-19 Impact on Mexico

8.3 EUROPE

8.3.1 COVID-19 IMPACT ON EUROPE

8.3.2 GERMANY

8.3.2.1 Growing demand from the HVAC and food & beverage industries in the country

8.3.2.2 COVID-19 Impact on Germany

8.3.3 FRANCE

8.3.3.1 Construction of temporary healthcare facilities and purchase of medical equipment to boost the market growth

8.3.3.2 COVID-19 Impact on France

8.3.4 RUSSIA

8.3.4.1 Growing concern about safety will support market growth

8.3.4.2 COVID-19 Impact on Russia

8.3.5 UK

8.3.5.1 Robust healthcare infrastructure and facilities in the country provide market growth opportunities

8.3.5.2 COVID-19 Impact on the UK

8.3.6 ITALY

8.3.6.1 Increased use by industries to safeguard products’ quality and maintain workplace hygiene

8.3.6.2 COVID-19 Impact on Italy

8.3.7 SPAIN

8.3.7.1 Focus on safety at public places and development of healthcare infrastructure by the government to drive the demand

8.3.7.2 COVID-19 Impact on Spain

8.3.8 SWEDEN

8.3.8.1 High standards of living, income, well-being, and gender equality, as well as high environmental quality to drive the market

8.3.8.2 COVID-19 Impact on Sweden

8.3.9 TURKEY

8.3.9.1 Rapid urbanization, improving living standards, and rising middle-class population are boosting the demand

8.3.9.2 COVID-19 Impact on Turkey

8.3.10 REST OF EUROPE

8.3.10.1 COVID-19 Impact on Rest of Europe

8.4 APAC

8.4.1 COVID-19 IMPACT ON APAC

8.4.2 CHINA

8.4.2.1 The country is one of the fastest-growing economies

8.4.2.2 COVID-19 Impact on China

8.4.3 INDIA

8.4.3.1 Government policies to support the medical industry driving the market

8.4.3.2 COVID-19 Impact on India

8.4.4 JAPAN

8.4.4.1 Sluggish domestic market and increased competition from neighboring countries have impacted market growth

8.4.4.2 COVID-19 Impact on Japan

8.4.5 SOUTH KOREA

8.4.5.1 Stable economic growth and global integration have helped the country

8.4.5.2 COVID-19 Impact on South Korea

8.4.6 INDONESIA

8.4.6.1 Increased domestic consumption and FDIs have supported the country’s growth

8.4.6.2 COVID-19 Impact on Indonesia

8.4.7 MALAYSIA

8.4.7.1 Openness to trade and investment has helped market growth

8.4.7.2 COVID-19 Impact on Malaysia

8.4.8 AUSTRALIA & NEW ZEALAND

8.4.8.1 Medical & healthcare and HVAC segments driving the demand

8.4.8.2 COVID-19 Impact on Australia & New Zealand

8.4.9 REST OF APAC

8.4.9.1 COVID-19 Impact on Rest of APAC

8.5 SOUTH AMERICA

8.5.1 COVID-19 IMPACT ON SOUTH AMERICA

8.5.2 BRAZIL

8.5.2.1 Industrial sector promotes the use of these coatings in the country

8.5.2.2 COVID-19 Impact on Brazil

8.5.3 ARGENTINA

8.5.3.1 Increase in population and improved economic conditions to fuel the demand

8.5.3.2 COVID-19 Impact on Argentina

8.5.4 REST OF SOUTH AMERICA

8.5.4.1 COVID-19 Impact on Rest of South America

8.6 MIDDLE EAST & AFRICA

8.6.1 COVID-19 IMPACT ON THE MIDDLE EAST & AFRICA

8.6.2 SAUDI ARABIA

8.6.2.1 Medical & healthcare segment will drive the market growth

8.6.2.2 COVID-19 Impact on Saudi Arabia

8.6.3 UAE

8.6.3.1 The upcoming Expo 2020 (to be held in 2021) has led to the launch of various roadway projects

8.6.3.2 COVID-19 Impact on the UAE

8.6.4 SOUTH AFRICA

8.6.4.1 Upcoming development projects across the country are expected to boost the market growth

8.6.4.2 COVID-19 Impact on South Africa

8.6.5 IRAN

8.6.5.1 The market is driven by healthcare and medical spending amidst the COVID-19 pandemic

8.6.5.2 COVID-19 Impact on Iran

8.6.6 REST OF THE MIDDLE EAST & AFRICA

8.6.6.1 COVID-19 Impact on Rest of Middle East & Africa

9 COMPETITIVE LANDSCAPE (Page No. - 160)

9.1 OVERVIEW

9.2 MARKET SHARE ANALYSIS

9.3 COMPANY EVALUATION QUADRANT, 2019

9.3.1 STAR

9.3.2 EMERGING LEADERS

9.3.3 PERVASIVE

9.3.4 EMERGING COMPANIES

9.4 STRENGTH OF PRODUCT PORTFOLIO

9.5 BUSINESS STRATEGY EXCELLENCE

9.6 COMPETITIVE SCENARIO

9.6.1 NEW PRODUCT LAUNCH

9.6.2 MERGER & ACQUISITION

9.6.3 INVESTMENT & EXPANSION

9.6.4 PARTNERSHIP & AGREEMENT

10 COMPANY PROFILES (Page No. - 168)

10.1 PPG INDUSTRIES

10.1.1 BUSINESS OVERVIEW

10.1.1.1 Impact of COVID-19 on business segments

10.1.2 PRODUCTS OFFERED

10.1.3 RECENT DEVELOPMENTS

10.1.4 WINNING IMPERATIVES

10.1.5 STRATEGIC OVERVIEW

10.1.6 THREAT FROM COMPETITION

10.1.7 SWOT ANALYSIS

10.1.8 RIGHT TO WIN

10.2 SHERWIN-WILLIAMS COMPANY

10.2.1 BUSINESS OVERVIEW

10.2.1.1 Impact of COVID-19 on business segments

10.2.2 PRODUCTS OFFERED

10.2.3 WINNING IMPERATIVES

10.2.4 STRATEGIC OVERVIEW

10.2.5 THREAT FROM COMPETITION

10.2.6 SWOT ANALYSIS

10.2.7 RIGHT TO WIN

10.3 AKZONOBEL N.V.

10.3.1 BUSINESS OVERVIEW

10.3.1.1 Impact of COVID-19 on business segments

10.3.2 WINNING IMPERATIVES

10.3.3 STRATEGIC OVERVIEW

10.3.4 THREAT FROM COMPETITION

10.3.5 PRODUCTS OFFERED

10.3.6 RECENT DEVELOPMENTS

10.3.7 SWOT ANALYSIS

10.3.8 MNM VIEW

10.4 AXALTA COATING SYSTEMS LLC

10.4.1 BUSINESS OVERVIEW

10.4.1.1 Impact of COVID-19 on business segments

10.4.2 WINNING IMPERATIVES

10.4.3 STRATEGIC OVERVIEW

10.4.4 THREAT FROM COMPETITION

10.4.5 PRODUCTS OFFERED

10.4.6 RECENT DEVELOPMENTS

10.4.7 SWOT ANALYSIS

10.4.8 MNM VIEW

10.5 BERGER PAINTS INDIA LTD

10.5.1 BUSINESS OVERVIEW

10.5.1.1 Impact of COVID-19 on business segments

10.5.2 WINNING IMPERATIVES

10.5.3 STRATEGIC OVERVIEW

10.5.4 THREAT FROM COMPETITION

10.5.5 PRODUCTS OFFERED

10.5.6 SWOT ANALYSIS

10.5.7 MNM VIEW

10.6 PULVER KIMYA SAN. VE TIC. A.S.

10.6.1 BUSINESS OVERVIEW

10.6.2 PRODUCTS OFFERED

10.7 IGP PULVERTECHNIK AG

10.7.1 BUSINESS OVERVIEW

10.7.2 PRODUCTS OFFERED

10.8 PROTECH-OXYPLAST GROUP

10.8.1 BUSINESS OVERVIEW

10.8.2 PRODUCTS OFFERED

10.9 RAPID COAT POWDER COATINGS

10.9.1 BUSINESS OVERVIEW

10.9.2 PRODUCTS OFFERED

10.10 IFS COATINGS INC.

10.10.1 BUSINESS OVERVIEW

10.10.2 PRODUCTS OFFERED

10.11 DULUX POWDER AND INDUSTRIAL COATINGS

10.11.1 BUSINESS OVERVIEW

10.11.2 PRODUCTS OFFERED

10.12 TULIP PAINTS

10.12.1 BUSINESS OVERVIEW

10.12.2 PRODUCTS OFFERED

10.13 AEROWOOD POWDER COATING LIMITED

10.13.1 BUSINESS OVERVIEW

10.13.2 PRODUCTS OFFERED

10.14 KASTUS TECHNOLOGIES

10.14.1 BUSINESS OVERVIEW

10.14.2 PRODUCTS OFFERED

10.14.3 RECENT DEVELOPMENTS

10.15 TOPO POWDER COATING CO. LTD

10.15.1 BUSINESS OVERVIEW

10.15.2 PRODUCTS OFFERED

11 APPENDIX (Page No. - 196)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

LIST OF TABLES (131 TABLE)

TABLE 1 ANTIMICROBIAL POWDER COATINGS MARKET SNAPSHOT, 2020 VS. 2025

TABLE 2 NATIONAL ACUTE CARE HOSPITAL HAI METRICS, 2020

TABLE 3 TOXICITY OF METAL NANOPARTICLES

TABLE 4 KEY CUSTOMERS WITH RESPECT TO INDUSTRY

TABLE 5 GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2019–2024

TABLE 6 AUTOMOTIVE INDUSTRY PRODUCTION, BY KEY COUNTRY, 2018-2019

TABLE 7 ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 8 ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 9 SILVER ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 10 SILVER ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 ZINC ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 12 ZINC ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 COPPER & OTHER ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 14 COPPER & OTHER ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 16 ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 17 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN MEDICAL & HEALTHCARE, BY REGION, 2018–2025 (KILOTON)

TABLE 18 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN MEDICAL & HEALTHCARE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN HVAC, BY REGION, 2018–2025 (KILOTON)

TABLE 20 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN HVAC, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN APPLIANCES, BY REGION, 2018–2025 (KILOTON)

TABLE 22 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN APPLIANCES, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN FOOD EQUIPMENT, BY REGION, 2018–2025 (KILOTON)

TABLE 24 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN FOOD EQUIPMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN GENERAL INDUSTRIAL, BY REGION, 2018–2025 (KILOTON)

TABLE 26 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN GENERAL INDUSTRIAL, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN TRANSPORTATION, BY REGION, 2018–2025 (KILOTON)

TABLE 28 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN TRANSPORTATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN FITNESS EQUIPMENT, BY REGION, 2018–2025 (KILOTON)

TABLE 30 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN FITNESS EQUIPMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN STEEL FURNITURE, BY REGION, 2018–2025 (KILOTON)

TABLE 32 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN STEEL FURNITURE, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (KILOTON)

TABLE 34 ANTIMICROBIAL POWDER COATINGS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 36 ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 37 ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 38 ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 39 ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 40 ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 41 NORTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 42 NORTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 44 NORTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 46 NORTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 LIST OF TEMPORARY HOSPITALS IN THE US (AS ON MAY 10TH)

TABLE 48 US: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 49 US: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 50 CANADA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 51 CANADA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 52 MEXICO: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 53 MEXICO: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 54 EUROPE: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 55 EUROPE: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 56 EUROPE: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 57 EUROPE: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 58 EUROPE: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 59 EUROPE: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 60 GERMANY: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 61 GERMANY: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 62 FRANCE: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 63 FRANCE: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 64 RUSSIA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 65 RUSSIA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 66 UK: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 67 UK: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 68 ITALY: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 69 ITALY: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 70 SPAIN: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 71 SPAIN: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 72 SWEDEN: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 73 SWEDEN: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 74 TURKEY: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 75 TURKEY: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 76 REST OF EUROPE: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 77 REST OF EUROPE: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 78 APAC: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 79 APAC: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 80 APAC: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 81 APAC: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 82 APAC: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 83 APAC: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 84 CHINA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 85 CHINA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 86 INDIA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 87 INDIA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 88 JAPAN: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 89 JAPAN: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 90 SOUTH KOREA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 91 SOUTH KOREA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 92 INDONESIA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 93 INDONESIA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 94 MALAYSIA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 95 MALAYSIA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 96 AUSTRALIA & NEW ZEALAND: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 97 AUSTRALIA & NEW ZEALAND: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 98 REST OF APAC: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 99 REST OF APAC: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 100 SOUTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 101 SOUTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 102 SOUTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 103 SOUTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 104 SOUTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 105 SOUTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 106 BRAZIL: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 107 BRAZIL: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 108 ARGENTINA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 109 ARGENTINA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 110 REST OF SOUTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 111 REST OF SOUTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 112 MIDDLE EAST & AFRICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 113 MIDDLE EAST & AFRICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 114 MIDDLE EAST & AFRICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 115 MIDDLE EAST & AFRICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 117 MIDDLE EAST & AFRICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 118 SAUDI ARABIA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 119 SAUDI ARABIA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 120 UAE: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 121 UAE: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 122 SOUTH AFRICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 123 SOUTH AFRICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 124 IRAN: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 125 IRAN: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 126 REST OF MIDDLE EAST & AFRICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (KILOTON)

TABLE 127 REST OF MIDDLE EAST & AFRICA: ANTIMICROBIAL POWDER COATINGS MARKET SIZE, BY ADDITIVE TYPE, 2018–2025 (USD MILLION)

TABLE 128 NEW PRODUCT LAUNCH, 2017-2020

TABLE 129 MERGER & ACQUISITION, 2017-2020

TABLE 130 INVESTMENT & EXPANSION, 2017–2020

TABLE 131 PARTNERSHIP & AGREEMENT, 2017–2020

LIST OF FIGURES (41 Figures)

FIGURE 1 ANTIMICROBIAL POWDER COATINGS MARKET: RESEARCH DESIGN

FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 3 ANTIMICROBIAL POWDER COATINGS MARKET: DATA TRIANGULATION

FIGURE 4 SILVER-BASED COATINGS ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

FIGURE 5 MEDICAL & HEALTHCARE IS THE LARGEST MARKET SEGMENT IN 2020

FIGURE 6 NORTH AMERICA ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

FIGURE 7 HIGH DEMAND FROM THE MEDICAL & HEALTHCARE INDUSTRY TO DRIVE THE MARKET

FIGURE 8 SILVER TO REMAIN THE LARGEST ADDITIVE TYPE SEGMENT

FIGURE 9 DEVELOPING COUNTRIES TO GROW FASTER THAN THE DEVELOPED COUNTRIES

FIGURE 10 MEDICAL & HEALTHCARE AND CHINA ACCOUNTED FOR THE LARGEST MARKET SHARES IN APAC IN 2019

FIGURE 11 CHINA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE ANTIMICROBIAL POWDER COATINGS MARKET

FIGURE 13 GLOBAL HVAC SYSTEM MARKET SIZE BETWEEN 2016 AND 2019

FIGURE 14 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 ANTIMICROBIAL PRODUCTS ECOSYSTEM

FIGURE 16 VALUE CHAIN ANALYSIS OF THE ANTIMICROBIAL POWDER COATINGS MARKET

FIGURE 17 AVERAGE PRICE COMPETITIVENESS IN THE GLOBAL MARKET

FIGURE 18 YCC SHIFT

FIGURE 19 IMPACT OF THE END-USE INDUSTRY SEGMENTS ON THE ANTIMICROBIAL POWDER COATINGS MARKET

FIGURE 20 REVISED GDP FORECASTS DUE TO COVID-19 FOR SELECT G20 COUNTRIES IN 2020

FIGURE 21 FACTORS IMPACTING ECONOMY OF SELECT G20 COUNTRIES IN 2020

FIGURE 22 THREE SCENARIOS BASED ANALYSIS OF IMPACT OF COVID-19 ON BUSINESS

FIGURE 23 SILVER TO BE THE LARGEST ADDITIVE TYPE SEGMENT

FIGURE 24 MEDICAL & HEALTHCARE TO BE THE LARGEST END-USE INDUSTRY DURING THE FORECAST PERIOD

FIGURE 25 APAC TO BE THE FASTEST-GROWING REGION IN THE ANTIMICROBIAL POWDER COATINGS MARKET

FIGURE 26 NORTH AMERICA: ANTIMICROBIAL POWDER COATINGS MARKET SNAPSHOT

FIGURE 27 EUROPE: ANTIMICROBIAL POWDER COATINGS MARKET SNAPSHOT

FIGURE 28 THE UK MANUFACTURING OUTPUT: Q4-2019 AND Q1-2020

FIGURE 29 APAC: ANTIMICROBIAL POWDER COATINGS MARKET SNAPSHOT

FIGURE 30 BRAZIL TO BE THE LARGEST ANTIMICROBIAL POWDER COATINGS MARKET

FIGURE 31 SAUDI ARABIA TO BE THE FASTEST-GROWING ANTIMICROBIAL POWDER COATINGS MARKET

FIGURE 32 COMPANIES ADOPTED NEW PRODUCT LAUNCH AS THE KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

FIGURE 33 ANTIMICROBIAL POWDER COATINGS: GLOBAL MARKET SHARE, BY KEY PLAYERS (2019)

FIGURE 34 ANTIMICROBIAL POWDER COATINGS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 35 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE ANTIMICROBIAL POWDER COATINGS MARKET

FIGURE 36 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE ANTIMICROBIAL POWDER COATINGS MARKET

FIGURE 37 PPG INDUSTRIES: COMPANY SNAPSHOT

FIGURE 38 SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

FIGURE 39 AKZONOBEL N.V.: COMPANY SNAPSHOT

FIGURE 40 AXALTA COATING SYSTEMS LLC: COMPANY SNAPSHOT

FIGURE 41 BERGER PAINTS INDIA LTD: COMPANY SNAPSHOT

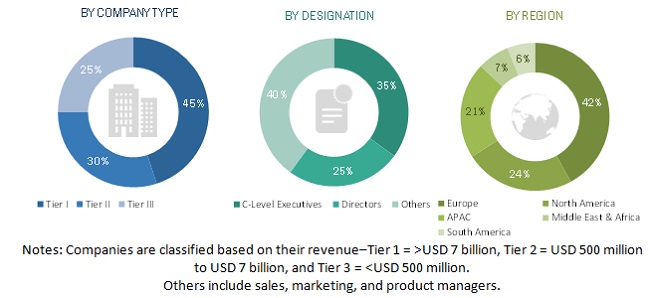

The study involved four major activities in estimating the current market size of antimicrobial powder coatings. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the antimicrobial powder coatings market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The antimicrobial powder coatings market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the medical & healthcare, HVAC, appliances, and other industries. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the antimicrobial powder coatings market. These approaches have also been used extensively to estimate the size of various dependent sub-segments of the market. The research methodology used to estimate the market size includes the following steps:

- The key players have been identified through extensive secondary research.

- The antimicrobial powder coatings industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall size of the antimicrobial powder coatings market from the estimation process explained above, the total market has been split into several segments and sub-segments. The data triangulation and market breakdown procedures have been employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Apart from this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the antimicrobial powder coatings market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market based on additive type and end-use industry

- To analyze and forecast the market based on key regions, such as North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze the micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as new product launch and merger & acquisition

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Antimicrobial Powder Coatings Market