Anaerobic Adhesives Market by Product (Thread Locker, Thread Sealants, Retaining Compounds, and Gasket Sealants), Substrate (Metals, Plastics), End-Use Industry (Automotive, Electrical & Electronics, Industrial), and Region - Global Forecast to 2022

[160 Pages Report] Anaerobic Adhesives Market size is projected to grow from USD 407.1 Million in 2016 to USD 564.1 Million by 2022, at a CAGR of 5.60% during the forecast period. In this study, 2016 has been considered as the base year to estimate the size of the anaerobic adhesives market. The report provides the short-term forecast from 2017 to 2022. It aims at estimating the size and future growth potential of the anaerobic adhesives market across different segments such as product, substrate, end-use industry, and region. Factors such as drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the anaerobic adhesives market have also been studied in this report. The report analyzes the opportunities in the anaerobic adhesives market for stakeholders and presents a competitive landscape for market leaders.

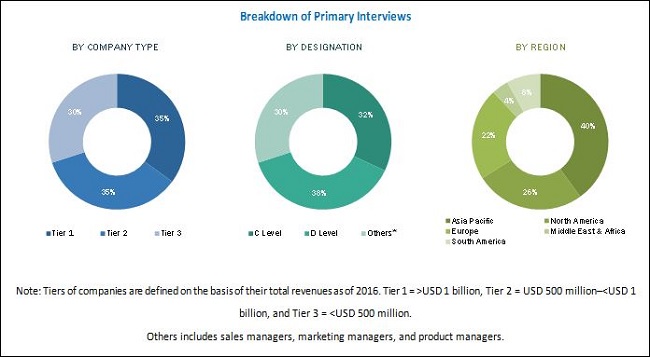

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the anaerobic adhesives market and to estimate the sizes of various other dependent submarkets. This research study involves the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government associations. Moreover, private websites and company websites have also been used to identify and collect information useful for this technical, market-oriented, and commercial study of the anaerobic adhesives market. After arriving at the total market size, the overall market has been split into several segments and subsegments. The figure given below provides a breakdown of the primaries conducted during the research study on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

3M Company (US), Henkel (Germany), H.B.Fuller (US), Illinois Tool Works (US), Three Bond International (Japan), Delta Adhesives (UK), etc., have been profiled in this report.

Key Target Audience:

- Manufacturers of anaerobic adhesives and its raw materials, including resins, solvents, additives, and pigments, and other feedstock chemical manufacturers

- Manufacturers in application industries such as automotive & transportation, electrical & electronics, industrial, and others

- Traders, distributors, and suppliers of anaerobic adhesives

- Regional manufacturers’ associations such as the European General Adhesive & Sealants Association

- Government and regional agencies and research organizations

Scope of the Report:

This research report categorizes the anaerobic adhesives market on the basis of product, substrate, end-use industry, and region.

Anaerobic Adhesives Market, by Product:

- Thread locker

- Thread Sealants

- Retaining Compounds

- Gasket Sealants

Anaerobic Adhesives Market, by Substrate:

- Metals

- Plastics

- Others

Anaerobic Adhesives Market, by End-use Industry:

- Automotive & Transportation

- Electrical & Electronics

- Industrial

- Others

Anaerobic Adhesives Market, by Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

The market is further analyzed for key countries in each of these regions.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the anaerobic adhesives market, by product

- Country-level analysis of the anaerobic adhesives market, by end-use industry

Company Information:

- Detailed analysis and profiles of additional market players

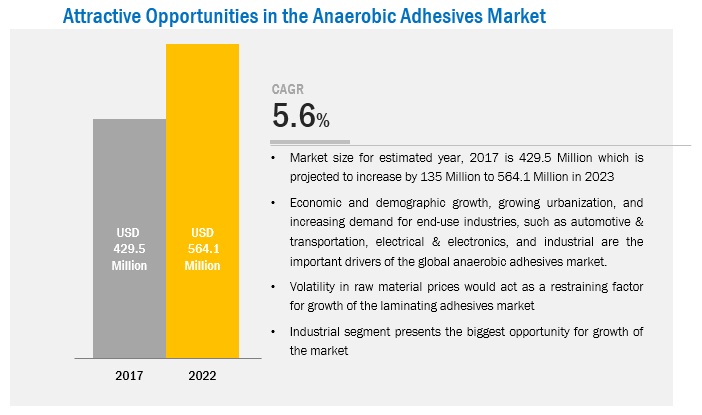

The global anaerobic adhesives market is estimated to be USD 429.5 Million in 2017 and is projected to reach USD 564.1 Million by 2022, at a CAGR of 5.60% from 2017 to 2022. The demand for anaerobic adhesives has been increasing in end-use industries such as automotive & transportation, electrical & electronics, industrial, and others. Several manufacturers of anaerobic adhesives are undertaking R&D activities to develop sustainable adhesives and overcome the limitations of traditional fastening methods.

Based on product, the anaerobic adhesives market has been segmented into thread locker, thread sealants, retaining compounds, and gasket sealants. The thread sealants product segment of the anaerobic adhesives market is projected to witness the highest growth during the forecast period. Thread sealant adhesives provide exceptional bonding strength to metals. Thread sealant adhesives exhibit properties such as high heat resistance, chemical resistance, high performance on passive metals without activator, and instant low-pressure seal.

Based on substrate, the anaerobic adhesives market has been segmented into metals, plastics, and others. The metals segment is projected to witness the highest growth during the forecast period. Metal substrate-based anaerobic adhesives are extra strong. Metals substrates provide anaerobic adhesives remarkable tensile strength and excellent tear resistance.

Based on end-use industry, the anaerobic adhesives market has been segmented into automotive & transportation, electrical & electronics, industrial, and others. The electrical & electronics end-use industry segment of the anaerobic adhesives market is projected to witness the highest growth from 2017 to 2022. Anaerobic adhesives are used for bonding, potting, low-pressure molding, and sealing & encapsulating critical components such as connectors, splice assemblies, and cable closures.

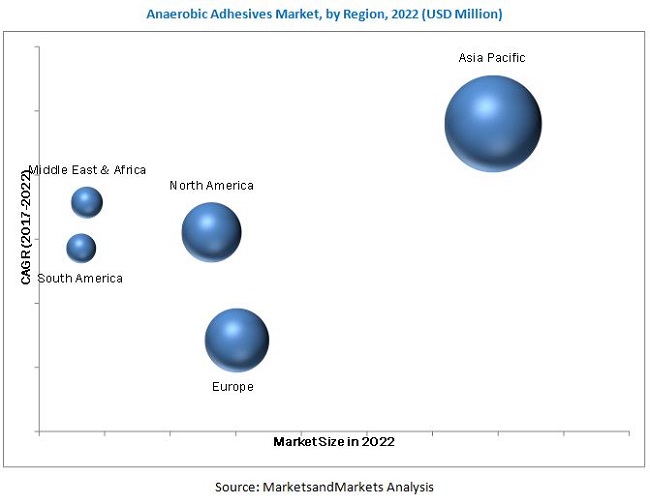

The Asia Pacific (APAC) anaerobic adhesives market is projected to witness the highest growth during the forecast period. The growth of the APAC anaerobic adhesives market can be attributed to the rising demand for anaerobic adhesives from countries such as India, China, South Korea, Thailand, Indonesia, etc.

Stringent environmental regulations in North America and Europe may restrain the growth of the anaerobic adhesives market in the coming years.

Key players operating in the anaerobic adhesives market are 3M Company (US), Henkel (Germany), H.B.Fuller (US), Illinois Tool Works (US), Three Bond International (Japan), and Delta Adhesives (UK).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Covered

1.3.1 Year Considered for the Study

1.4 Currency

1.5 Pacakge Size

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Research Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 30)

4 Market Overview (Page No. - 36)

4.1 Introduction

4.2 Market Dynamics

4.2.1 Drivers

4.2.1.1 Growing Demand From End Use Industries Such as Electrical & Electronics and Building & Construction

4.2.1.2 Rising Ageing Populations

4.2.1.3 Superior Properties of Waterproof Tapes

4.2.2 Restraints

4.2.2.1 Slow Growth in Automotive Production in Countries Such as Russia, Argentina, Brazil, Japan and Taiwan

4.2.3 Opportunities

4.2.3.1 Healthcare Industry in Emerging Market

4.2.4 Challenges

4.2.4.1 Low Scope for Product Differentiation

4.3 Porter’s Five Forces Analysis

4.3.1 Threat of New Entrants

4.3.2 Threat of Substitutes

4.3.3 Bargaining Power of Buyers

4.3.4 Bargaining Power of Suppliers

4.3.5 Intensity of Competitive Rivalry

5 Waterproof Tapes Market, By Adhesive Type (Page No. - 45)

5.1 Introduction

5.2 Acrylic

5.3 Silicone

5.4 Butyl

5.5 Others

6 Waterproof Tapes Market, By Substrate Type (Page No. - 52)

6.1 Introduction

6.2 Plastic

6.3 Metal

6.4 Rubber

6.5 Others

7 Waterproof Tapes Market, By End-Use Industry (Page No. - 60)

7.1 Introduction

7.1.1 Automotive

7.1.2 Healthcare

7.1.3 Building & Construction

7.1.4 Electrical & Electronics

7.1.5 Packaging

7.1.6 Others

8 Waterproof Tapes Market, By Region (Page No. - 73)

8.1 Introduction

8.2 Asia-Pacific

8.2.1 China

8.2.2 Japan

8.2.3 India

8.2.4 South Korea

8.2.5 Indonesia

8.2.6 Taiwan

8.2.7 Vietnam

8.2.8 Rest of Asia-Pacific

8.3 Europe

8.3.1 Germany

8.3.2 Russia

8.3.3 France

8.3.4 U.K.

8.3.5 Italy

8.3.6 Turkey

8.3.7 Spain

8.3.8 Rest of Europe

8.4 North America

8.4.1 U.S.

8.4.2 Canada

8.4.3 Mexico

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.2 U.A.E.

8.5.3 South Africa

8.5.4 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 122)

9.1 Introduction

9.2 Competitive Leadership Mapping

9.3 Competitive Benchmarking

9.3.1 Strength of Product Portfolio

9.3.2 Business Strategy Excellence

9.4 Key Player Ranking

9.4.1 Market Ranking of Key Players (2016)

10 Company Profiles (Page No. - 128)

10.1 3M Company

10.1.1 Business Overview

10.1.2 Product Offerings Scorecard

10.1.3 Business Strategy Scorecard

10.1.4 Recent Developments

10.2 Nitto Denko Corporation

10.2.1 Business Overview

10.2.2 Product Offerings Scorecard

10.2.3 Business Strategy Scorecard

10.3 TESA SE

10.3.1 Business Overview

10.3.2 Product Offerings Scorecard

10.3.3 Business Strategy Scorecard

10.4 Johnson & Johnson

10.4.1 Business Overview

10.4.2 Product Offerings Scorecard

10.4.3 Business Strategy Scorecard

10.5 Henkel AG & Co. KGaA

10.5.1 Business Overview

10.5.2 Product Offerings Scorecard

10.5.3 Business Strategy Scorecard

10.5.4 Recent Developments

10.6 Medline Industries, Inc

10.6.1 Business Overview

10.6.2 Product Offerings Scorecard

10.6.3 Business Strategy Scorecard

10.7 Furukawa Electric Co., Ltd.

10.7.1 Business Overview

10.7.2 Product Offerings Scorecard

10.7.3 Business Strategy Scorecard

10.8 Avery Dennison Corporation

10.8.1 Business Overview

10.8.2 Product Offerings Scorecard

10.8.3 Business Strategy Scorecard

10.8.4 Recent Developments

10.9 Scapa Group PLC

10.9.1 Business Overview

10.9.2 Product Offerings Scorecard

10.9.3 Business Strategy Scorecard

10.9.4 Recent Developments

10.10 Teraoka Seisakusho Co Ltd

10.10.1 Business Overview

10.10.2 Product Offerings Scorecard

10.10.3 Business Strategy Scorecard

10.11 Asian Paints Lmited

10.11.1 Business Overview

10.11.2 Product Offerings Scorecard

10.11.3 Business Strategy Scorecard

11 Additional Companies (Page No. - 152)

11.1 Shurtape Technologies LLC

11.2 A.B.E. Construction Chemicals (Pty) Ltd.

11.3 Tapespec

11.4 Heskins Ltd

11.5 Gebrüder Jaeger GmbH

11.6 Advance Tapes International Ltd

11.7 Dukal Corporation

11.8 Isoltema Spa

11.9 Metalnastri S.R.L

11.10 Chowgule Construction Chemicals Pvt. Ltd.

11.11 Shanghai Richeng Electronic Co., Ltd.

11.12 BTM

11.13 Tejas Cobert

11.14 Permatex

12 Appendix (Page No. - 155)

12.1 Discussion Guide

12.2 Introducing RT: Real-Time Market Intelligence

12.3 Available Customizations

12.4 Related Reports

List of Tables (111 Tables)

Table 1 Waterproof Tapesmarket Snapshot (2017 vs 2022)

Table 2 Silicone Adhesive Dominates the Waterproof Tapes Market

Table 3 Waterproof Tapes Market, By Adhesive Type, 2015–2022 (Million Square Meter)

Table 4 Waterproof Tapes Market, By Adhesive Type, 2015–2022 (USD Million)

Table 5 Acrylic Adhesive-Based Waterproof Tapes Market Size, By Region, 2015–2022 (Million Square Meter)

Table 6 Acrylic Adhesive-Based Waterproof Tapes Market Size, By Region, 2015–2022 (USD Million)

Table 7 Silicone Adhesive-Based Waterproof Tapes Market Size, By Region, 2015–2022 (Million Square Meter)

Table 8 Silicone Adhesive-Based Waterproof Tapes Market Size, By Region, 2015–2022 (USD Million)

Table 9 Butyl Adhesive-Based Waterproof Tapes Market Size, By Region, 2015–2022 (Million Square Meter)

Table 10 Butyl Adhesive-Based Waterproof Tapes Market Size, By Region, 2015–2022 (USD Million)

Table 11 Other Adhesives-Based Waterproof Tapes Market Size, By Region, 2015–2022 (Million Square Meter)

Table 12 Other Adhesives-Based Waterproof Tapes Market Size, By Region, 2015–2022 (USD Million)

Table 13 Plastic Substrate Segment to Dominates the Waterproof Tapes Market , Between 2017 and 2022

Table 14 Waterproof Tapes Market, By Substrate Type, 2015–2022 (Million Square Meter)

Table 15 Waterproof Tapes Market, By Substrate Type, 2015–2022 (USD Million)

Table 16 Plastic Substrate-Based Waterproof Tapes Market Size, By Region, 2015–2022 (Million Square Meter)

Table 17 Plastic Substrate-Based Waterproof Tapes Market Size, By Region, 2015–2022 (USD Million)

Table 18 Metal Substrate-Based Waterproof Tapes Market Size, By Region, 2015–2022 (Million Square Meter)

Table 19 Metal Substrate-Based Waterproof Tapes Market Size, By Region, 2015–2022 (USD Million)

Table 20 Rubber Substrate-Based Waterproof Tapes Market Size, By Region, 2015–2022 (Million Square Meter)

Table 21 Rubber Substrate-Based Waterproof Tapes Market Size, By Region, 2015–2022 (USD Million)

Table 22 Other Substrates-Based Waterproof Tapes Market Size, By Region, 2015–2022 (Million Square Meter)

Table 23 Other Substrates-Based Waterproof Tapes Market Size, By Region, 2015–2022 (USD Million)

Table 24 Anaerobic Adhesives Market Size, By End-Use Industry 2015–2022 (Million Square Meter)

Table 25 Anaerobic Adhesives Market Size, By End-Use Industry 2015–2022 (USD Million)

Table 26 Anaerobic Adhesives Market Size in Automtoive, By Region, 2015–2022 (Million Square Meter)

Table 27 Anaerobic Adhesives Market Size in Automtotive, By Region, 2015–2022 (USD Million)

Table 28 Anaerobic Adhesives Market Size in Healthcare, By Region, 2015–2022 (Million Square Meter)

Table 29 Anaerobic Adhesives Market Size in Healthcare, By Region, 2015–2022 (USD Million)

Table 30 Anaerobic Adhesives Market Size in Building & Construction, By Region, 2015–2022 (Million Square Meter)

Table 31 Anaerobic Adhesives Market Size in Building & Construction, By Region, 2015–2022 (USD Million)

Table 32 Anaerobic Adhesives Market Size in Electrical & Electronics, By Region, 2015–2022 (Million Square Meter)

Table 33 Anaerobic Adhesives Market Size in Electrical & Electronics , By Region, 2015–2022 (USD Million)

Table 34 Anaerobic Adhesives Market Size in Packaging, By Region, 2015–2022 (Million Square Meter)

Table 35 Anaerobic Adhesives Market Size in Packaging, By Region, 2015–2022 (USD Million)

Table 36 Anaerobic Adhesives Market Size in Other Industries, By Region, 2015–2022 (Million Square Meter)

Table 37 Anaerobic Adhesives Market Size in Other Industries, By Region, 2015–2022 (USD Million)

Table 38 Anaerobic Adhesives Market Size, By Region, 2015–2022 (Million Square Meter)

Table 39 Anaerobic Adhesives Market Size, By Region, 2015–2022 (USD Million)

Table 40 Asia-Pacific: Anaerobic Adhesive Market Size, By Country, 2015–2022 (Million Square Meter)

Table 41 Asia-Pacific: Anaerobic Adhesive Market Size, By Country, 2015–2022 (USD Million)

Table 42 Asia-Pacific: Anaerobic Adhesive Market Size, By End-Use Industry 2015–2022 (Million Square Meter)

Table 43 Asia-Pacific: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 44 Chiina: Anaerobic Adhesive Market Size, By End-Use Industry 2015–2022 (Million Square Meter)

Table 45 China : Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 46 Japan: Anaerobic Adhesive Market Size, By End-Use Industry 2015–2022 (Million Square Meter)

Table 47 Japan: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 48 Japan: Anaerobic Adhesive Market Size, By End-Use Industry 2015–2022 (Million Square Meter)

Table 49 India: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 50 South Korea: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (Million Square Meter)

Table 51 South Korea: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 52 Indonesia: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (Million Square Meter)

Table 53 Indonesia: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 54 Taiwan: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (Million Square Meter)

Table 55 Taiwan: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 56 Vietnam: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (Million Square Meter)

Table 57 Vietnam: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 58 Rest of Asia-Pacific: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (Million Square Meter)

Table 59 Rest of Asia-Pacific: Waterproof Tapes Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 60 Europe: Anaerobic Adhesive Market Size, By Country, 2015–2022 (Million Square Meter)

Table 61 Europe: Anaerobic Adhesive Market Size, By Country, 2015–2022 (USD Million)

Table 62 Europe: Anaerobic Adhesive Market Size in End-Use Industry 2015–2022 (Million Square Meter)

Table 63 Europe: Anaerobic Adhesive Market Size in End-Use Industry 2015–2022 (USD Million)

Table 64 Germany: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry 2015–2022 (Million Square Meter)

Table 65 Germany : Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry, 2015–2022 (USD Million)

Table 66 Russia: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry 2015–2022 (Million Square Meter)

Table 67 Russia: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry, 2015–2022 (USD Million)

Table 68 France: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry 2015–2022 (Million Square Meter)

Table 69 France: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry, 2015–2022 (USD Million)

Table 70 U.K.: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry 2015–2022 (Million Square Meter)

Table 71 U.K.: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry, 2015–2022 (USD Million)

Table 72 Italy: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry 2015–2022 (Million Square Meter)

Table 73 Italy: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry, 2015–2022 (USD Million)

Table 74 Turkey: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry 2015–2022 (Million Square Meter)

Table 75 Turkey: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry, 2015–2022 (USD Million)

Table 76 Spain: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry 2015–2022 (Million Square Meter)

Table 77 Spain: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry, 2015–2022 (USD Million)

Table 78 Rest of Europe: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry 2015–2022 (Million Square Meter)

Table 79 Rest of Europe: Anaerobic Adhesive Market Size in End Use Industry, By End-Use Industry, 2015–2022 (USD Million)

Table 80 North America: Anaerobic Adhesive Market Size, By Country, 2015–2022 (Million Square Meter)

Table 81 North America: Anaerobic Adhesive Market Size, By Country, 2015–2022 (USD Million)

Table 82 North America: Anaerobic Adhesive Market , By End-Use Industry 2015–2022 (Million Square Meter)

Table 83 North America: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 84 U.S.: Anaerobic Adhesive Market Size, By End-Use Industry 2015–2022 (Million Square Meter)

Table 85 U.S.: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 86 Canada: By Market Size in End Use Industry, By End-Use Industry 2015–2022 (Million Square Meter)

Table 87 Canada: By Market Size in End Use Industry, By End-Use Industry, 2015–2022 (USD Million)

Table 88 Mexico: By Market Size in End Use Industry, By End-Use Industry 2015–2022 (Million Square Meter)

Table 89 Mexico: By Market Size in End Use Industry, By End-Use Industry, 2015–2022 (USD Million)

Table 90 Middle East & Africa: By Market Size, By Country, 2015–2022 (Million Square Meter)

Table 91 Middle East and Africa: By Market Size, By Country, 2015–2022 (USD Million)

Table 92 Middle East & Africa: By Market Size, By End-Use Industry 2015–2022 (Million Square Meter)

Table 93 Middle East & Africa: By Market Size, By End-Use Industry 2015–2022 (USD Million)

Table 94 Saudi Arabia: By Market Size in End Use Industry, By End-Use Industry 2015–2022 (Million Square Meter)

Table 95 Saudi Arabia : By Market Size in End Use Industry, By End-Use Industry, 2015–2022 (USD Million)

Table 96 U.A.E.: By Market Size, By End-Use Industry 2015–2022 (Million Square Meter)

Table 97 U.A.E. : By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 98 South Africa: By Market Size, By End-Use Industry 2015–2022 (Million Square Meter)

Table 99 South Africa : By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 100 Rest of Middle East & Africa: By Market Size, By End-Use Industry 2015–2022 (Million Square Meter)

Table 101 Rest of Middle East & Africa : By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 102 South America: Anaerobic Adhesive Market Size, By Country, 2015–2022 (Million Square Meter)

Table 103 South America: Anaerobic Adhesive Market Size, By Country, 2015–2022 (USD Million)

Table 104 South America: Anaerobic Adhesive Market Size, By End-Use Industry 2015–2022 (Million Square Meter)

Table 105 South America: Anaerobic Adhesive Market Size , By End-Use Industry 2015–2022 (USD Million)

Table 106 Brazil: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (Million Square Meter)

Table 107 Brazil: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 108 Argentina: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (Million Square Meter)

Table 109 Argentina: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 110 Rest of South America: Anaerobic Adhesive Market Size, By End-Use Industry, 2015–2022 (Million Square Meter)

Table 111 Rest of South America: Waterproof Tapes Market Size, By End-Use Industry, 2015–2022 (USD Million)

List of Figures (28 Figures)

Figure 1 Anaerobic Adhesives : Market Segmentation

Figure 2 Anaerobic Adhesives Market: Research Design

Figure 3 2. 1.2 .1 Key Data From Primary Sources

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Waterproof Tapes Market: Data Triangulation

Figure 7 Asia-Pacific Waterproof Tapes Market to Register Highest CAGR During the Forecast Period

Figure 8 Healthcare to Be the Fastest-Growing End-Use Industry Between 2017 and 2022

Figure 9 Asia-Pacific is the Largest Market for Waterproof Tapes in 2016 (Value)

Figure 10 Drivers, Restrains, Opportunities, and Challenges in the Waterproof Tapes Market

Figure 11 Porter’s Five Forces Analysis

Figure 12 Healthcare End-Use Industry Expected to Register Highest CAGR During Forecast Period

Figure 13 China is the Leading Waterproof Tapes Market in Terms of Value in 2016

Figure 14 Attractiveness of the Waterproof Tapes Market in Asia-Pacific

Figure 15 Europe Market Snapshot: Waterproof Tapes

Figure 16 North America Market Snapshot: Waterproof Tapes

Figure 17 Waterproof Tapes Market: Competitive Leadership Mapping

Figure 18 3M Company: Company Snapshot

Figure 19 Nitto Denko Corporation: Company Snapshot

Figure 20 TESA SE: Company Snapshot

Figure 21 Johnson & Johnson : Company Snapshot

Figure 22 Henkel AG & Co. KGaA: Company Snapshot

Figure 23 Medline Industries Inc.: Company Snapshot

Figure 24 Furukawa Electtric Co., Ltd.: Company Snapshot

Figure 25 Avery Denninson Corporation.: Company Snapshot

Figure 26 Scapa Group PLC: Company Snapshot

Figure 27 Teraoka Seiskusho Co Ltd: Company Snapshot

Figure 28 Asian Paints Limited: Company Snapshot

Growth opportunities and latent adjacency in Anaerobic Adhesives Market