Airway Stent/Lung Stent Market by Type (Tracheal, Bronchial, Laryngeal Stent), Product (Non-Expandable, Self-Expandable Stents), Material (Metal (Nitinol, Stainless Steel), Silicone, Hybrid), End User (Hospitals, ASCs) - Global Forecasts to 2024

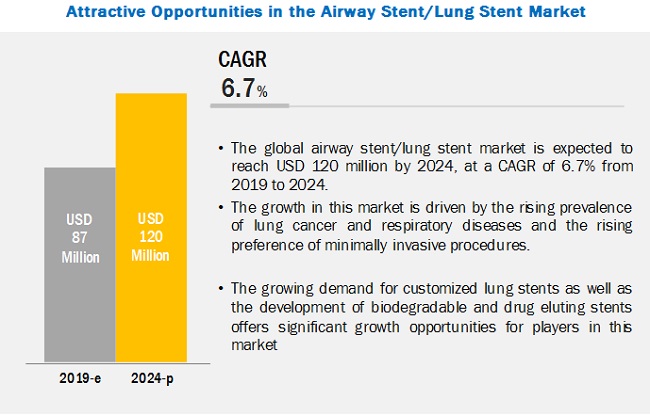

The lung stent market is projected to reach USD 120 million by 2024, at a CAGR of 6.7%. The increase in the prevalence of lung cancer & chronic respiratory disorders globally, combined with the increasing preference for minimally invasive procedures are some of the factors contributing to the growth of this market. However, the associated complication of using these stents and an increase in the availability of alternative treatments might hamper the growth of the airway/lung stents market.

The market is segmented based on the type, material, product, end user, and region. Based on the type, the tracheobronchial segment accounted for the largest share of the airway stent/lung stent market in 2018. The large share of this segment can be attributed to the higher adoption trends seen in the tracheal and bronchial stents for use in the treatments of respiratory disorders.

Based on material, the airway stent/lung stent market is divided into metal, silicone, and hybrid stents. In 2018, metal stents accounted for the largest share in the airway stent/lung stent market. The advantages associated with metal stents, such as ease of insertion, thinner walls as compared to silicone lung stents, a lower risk of dislodgment or migration, and ability to adapt to the twisted airway are driving the growth of this segment.

By product, the airway stent/lung stent market is segmented into expandable and non-expandable stents. The expandable stents segment is expected to hold the largest share in 2019. The large share of this segment can be attributed to the higher preference of these stents by surgeons owing to advantages such as easy insertion in bronchoscopy procedures, lower risks of stent-induced complications, and small size.

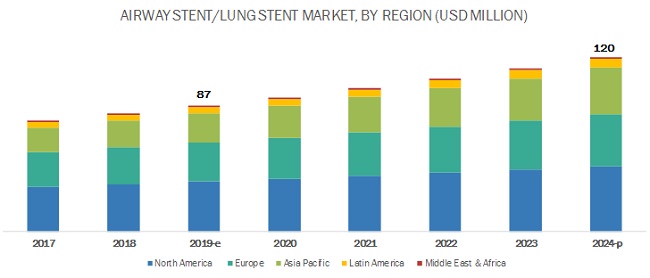

Geographically, the global airway stent/lung stent market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is expected to hold the largest share of this market in 2019. The dominant share of North America can mainly be attributed to the presence of several large hospitals, robust healthcare infrastructure, rising prevalence of diseases, growing geriatric population, and rising healthcare expenditure.

Lung Stent Market Key Players

The major players operating in the airway stent/lung stent market include Boston Scientific Corporation (US), Taewoong Medical Co., Ltd. (South Korea), Micro-Tech (Nanjing) Co., Ltd. (China), Novatech SA (France), Boston Medical Products, Inc. (US), E. Benson Hood Laboratories, Inc. (US), Merit Medical Systems, Inc. (US), Cook Group (US), EFER ENDOSCOPY (France), ENDO-FLEX GmbH (Germany), Standard Sci. Tech Inc. (South Korea), and Stening SRL (Argentina), among others.

Boston Scientific Corporation (US) and Novatech SA (France) dominated the airway/lung stents market in 2018. Boston’s dominance can be attributed to its extensive geographical presence and broad portfolio, combined with the company’s focus on expansion into emerging markets through the development of distribution channels. Similarly, Novatech’s stringent compliances to regulatory requirements to ensure the delivery of high-quality products and continuously striving to develop innovative and patient-centric products have played a significant role in leveraging its leading position in this market.

Lung Stent Market Scope

|

Report Metric |

Details |

|

Market Size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast Unit |

Value (USD Million) |

|

Segments covered |

Type, Material, Product, End User |

|

Geographies covered |

|

|

Companies covered |

Boston Scientific Corporation (US), Taewoong Medical Co., Ltd. (South Korea), Micro-Tech (Nanjing) Co., Ltd. (China), Novatech SA (France), Boston Medical Products, Inc. (US), E. Benson Hood Laboratories, Inc. (US), Merit Medical Systems, Inc. (US), Cook Group (US), EFER ENDOSCOPY (France), ENDO-FLEX GmbH (Germany), Standard Sci. Tech Inc. (South Korea), and Stening SRL (Argentina), |

The research report categorizes the airway stent/lung stent market into the following segments and subsegments:

By Type

- Tracheobronchial Stents

- Laryngeal Stents

By Material

-

Metal Stents

- Nitinol Stents

- Stainless Steel Stents

- Other Metal Stents*

- Silicone Stents

- Hybrid Stents

- *Others include stents made from cobalt, chromium, platinum, and tantalum.

By Product

- Self-expandable Stents

- Non-expandable Stents

By End User

- Hospitals

- Ambulatory Surgical Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- The Middle East and Africa

Recent Developments:

- In June 2018, Taewoong Medical (South Korea) partnered with Cook Medical (US) to distribute Taewoong’s product portfolio in the US market.

- In May 2018, Merit Medical Systems, Inc. (US) held a worldwide distribution agreement with NinePoint Medical, Inc (US) to market Merit’s gastrointestinal and pulmonary medical devices.

- In July 2015, Micro-Tech (Nanjing) Co., Ltd. inaugurated a wholly-owned subsidiary in the US, Micro-Tech USA, Inc.

Key Questions Addressed in the Report:

- Who are the top 10 players operating in the airway stent/lung stent market?

- What are the drivers, restraints, opportunities, and challenges in the airway stent/lung stent market?

- What are the reimbursement policies for airway stent procedures?

- What are the industry trends as well as the current scenario in the airway stent/lung stent market?

- Comment on the regulatory scenario for airway/lung stents in various geographies.

- What are the growth trends in the airway stent/lung stent market at the segmental and overall market levels?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Sources

2.1.2 Some of the Key Secondary Sources Referred for This Study Include:

2.1.2.1 Key Data From Secondary Sources

2.1.3 Primary Sources

2.1.3.1 Key Data From Primary Sources

2.1.3.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Lung Stents Market: Market Overview

4.2 Asia Pacific: Lung Stents Market, 2018

4.3 Lung Stents Market: Geographic Growth Opportunities

4.4 Lung Stents Market: Geographic Mix

4.5 Lung Stents Market: Developing vs Developed Countries/Regions

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics: Impact Analysis

5.3 Market Drivers

5.3.1 Rising Prevalence of Lung Cancer and Respiratory Diseases

5.3.2 Increasing Preference for Minimally Invasive Procedures

5.3.3 Continuous Growth in the Healthcare Industry

5.3.3.1 Increasing Life Expectancy

5.3.3.2 Rising Healthcare Expenditure

5.3.3.3 Growing Geriatric Population

5.4 Market Restraints

5.4.1 Decreasing Prevalence of Tobacco Smoking

5.4.2 Availability of Alternative Treatments

5.4.3 Complications Associated With Stents

5.5 Market Opportunities

5.5.1 Need for Customized Lung Stents

5.5.2 Development of Biodegradable and Drug-Eluting Lung Stents

5.5.3 3D Printing of Lung Stents

6 Industry Insights (Page No. - 46)

6.1 Reimbursement Scenario for Airway Stenting Procedures

6.2 Regulatory Analysis

6.2.1 North America

6.2.1.1 US

6.2.1.2 Canada

6.2.2 Europe

6.2.3 Asia Pacific

6.2.3.1 Japan

6.2.3.2 China

6.2.3.3 India

6.2.4 Latin America

6.2.4.1 Brazil

6.2.4.2 Mexico

7 Lung Stents Market, By Type (Page No. - 56)

7.1 Introduction

7.2 Tracheobronchial Stents

7.2.1 Tracheobronchial Stents Dominate the Airway/Lung Stents Market

7.3 Laryngeal Stents

7.3.1 Rising Prevalence of Laryngeal Stenosis & Laryngeal Web & Atresia Will Drive the Market for Laryngeal Stents

8 Lung Stents Market, By Material (Page No. - 64)

8.1 Introduction

8.2 Metal Stents

8.2.1 Nitinol Stents

8.2.1.1 Nitinol Stents Segment Dominates the Metal Airway/Lung Stents Market

8.2.2 Stainless Steel Stents

8.2.2.1 Stainless Steel Airway/Lung Stents Can Be Inserted Via Rigid Or Flexible Bronchoscopy

8.2.3 Other Metal Stents

8.3 Silicone Stents

8.3.1 Silicone Stents Cause Less Local Inflammatory Response, Resulting in Reduced Tissue Granulation

8.4 Hybrid Stents

8.4.1 Hybrid Airway/Lung Stents are More Expensive as Compared to Metal and Silicone Airway/Lung Stents

9 Lung Stents Market, By Product (Page No. - 76)

9.1 Introduction

9.2 Self-Expandable Stents

9.2.1 Self-Expandable Stents Do Not Require Surgical Implantation

9.3 Non-Expandable Stents

9.3.1 Non-Expandable Stents are Used in the Treatment of Tracheobronchial Tumors & Tracheal Stenosis With Scarring

10 Lung Stents Market, By End User (Page No. - 81)

10.1 Introduction

10.2 Hospitals

10.2.1 Rising Number of Bronchoscopy Surgical Procedures Performed in Hospitals to Drive Market Growth

10.3 Ambulatory Surgery Centers

10.3.1 Increasing Number of Outpatient Surgeries Performed at ASCs is Expected to Drive the Demand for Airway/Lung Stents at ASCs

11 Lung Stents Market, By Region (Page No. - 86)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 The US is the Largest Regional Market for Airway/Lung Stents

11.2.2 Canada

11.2.2.1 Canada is Estimated to Grow at A Relatively Lower Rate Than the US

11.3 Europe

11.3.1 Germany

11.3.1.1 Germany Holds the Largest Share in the European Market

11.3.2 UK

11.3.2.1 Increasing Incidence of Chronic Respiratory Diseases and Rising Number of Tobacco Smokers, Will Drive the UK Market

11.3.3 France

11.3.3.1 High Healthcare Expenditure Will Ensure Continued Market Growth in France

11.3.4 Italy

11.3.4.1 The Italian Healthcare Market is Expected Witness Low Growth Owing to the Ongoing Economic Crisis in the Country

11.3.5 Spain

11.3.5.1 Large Debts and Slow Growth of the Healthcare System Will Challenge Market Growth in Spain

11.3.6 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 China Will Grow at the Highest Rate in the APAC Market

11.4.2 Japan

11.4.2.1 Availability of Universal Healthcare Reimbursement Policy in Japan Supports the Adoption for Airway Stent Products

11.4.3 India

11.4.3.1 India has Captured A Notable Share of the APAC Airway/Lung Stents Market

11.4.4 Rest of Asia Pacific

11.5 Latin America

11.6 Middle East & Africa

12 Competitive Landscape (Page No. - 131)

12.1 Introduction

12.2 Product Portfolio Matrix

12.3 Geographical Assessment of Key Players in the Airway/Lung Stents Market (2018)

12.4 Competitive Leadership Mapping

12.4.1 Visionary Leaders

12.4.2 Innovators

12.4.3 Dynamic Differentiators

12.4.4 Emerging Companies

12.5 Airway/Lung Stents Market Leadership Analysis (2018)

12.6 Competitive Situations and Trends

12.6.1 Partnerships (2016 – 2019)

12.6.2 Distribution Agreement (2016-2019)

12.6.3 Expansions (2018 – 2019)

13 Company Profiles (Page No. - 137)

(Business Overview, Products Offered, Recent Developments, MnM View)*

13.1 Boston Scientific Corporation

13.2 Taewoong Medical Co., Ltd.

13.3 Micro-Tech (Nanjing) Co., Ltd.

13.4 Bess Aktiengesellschaft (Bess AG)

13.5 E. Benson Hood Laboratories, Inc.

13.6 Merit Medical Systems, Inc.

13.7 Cook Group

13.8 Efer Endoscopy

13.9 Endo-Flex GmbH

13.10 Standard Sci. Tech Inc.

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 Appendix (Page No. - 152)

14.1 Insights of Industry Experts

14.2 Market Sizing & Validation Approach

14.3 Discussion Guide

14.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (137 Tables)

Table 1 Prevalence of Cancer, By Country

Table 2 Decrease in Age-Standardized Global Prevalence of Tobacco Smoking Among People Aged ≥ 15 Years, By Region & Sex, 2000–2025

Table 3 Medicare National Average Payment, By Physician Type, 2018-2019 (USD)

Table 4 Medicare National Average Payment, By Type of Facility, 2018-2019 (USD)

Table 5 Indicative List of Regulatory Authorities Governing Medical Devices

Table 6 US Fda: Medical Devices Classification

Table 7 Regulatory Process for Medical Devices in the Us

Table 8 Classification of Medical Devices and the Reviewing Body in Japan

Table 9 China: Medical Device Classification

Table 10 Brazil: Medical Device Classification

Table 11 Mexico: Medical Device Classification

Table 12 Lung Stents Market, By Type, 2017-2024 (USD Million)

Table 13 Lung Stents Market, By Country, 2017-2024 (USD Million)

Table 14 Key Brands of Tracheobronchial Stents Available in the Market

Table 15 Tracheobronchial Stents Market, By Country, 2017-2024 (USD Million)

Table 16 Key Brands of Laryngeal Stents Available in the Market

Table 17 Laryngeal Stents Market, By Country, 2017-2024 (USD Million)

Table 18 Lung Stents Market, By Material, 2017–2024 (USD Million)

Table 19 Lung Stents Market, By Material, 2017-2024 (Thousand Units)

Table 20 Major Brands of Metal Airway/Lung Stents

Table 21 Metal Lung Stents Market, By Type, 2017–2024 (USD Million)

Table 22 Metal Lung Stents Market, By Country, 2017–2024 (USD Million)

Table 23 Metal Lung Stents Market, By Region, 2017-2024 (Thousand Units)

Table 24 Nitinol Lung Stents Market, By Country, 2017–2024 (USD Million)

Table 25 Stainless Steel Lung Stents Market, By Country, 2017–2024 (USD Million)

Table 26 Other Metal Lung Stents Market, By Country, 2017–2024 (USD Million)

Table 27 Major Brands of Silicone Airway/Lung Stents

Table 28 Silicone Lung Stents Market, By Country, 2017–2024 (USD Million)

Table 29 Silicone Lung Stents Market, By Region, 2017-2024 (Thousand Units)

Table 30 Hybrid Lung Stents Market, By Country, 2017–2024 (USD Million)

Table 31 Hybrid Lung Stents Market, By Region, 2017-2024 (Thousand Units)

Table 32 Lung Stents Market, By Product, 2017–2024 (USD Million)

Table 33 Self-Expandable Lung Stents Market, By Country, 2017–2024 (USD Million)

Table 34 Non-Expandable Lung Stents Market, By Country, 2017–2024 (USD Million)

Table 35 Lung Stents Market, By End User, 2017–2024 (USD Million)

Table 36 Lung Stents Market for Hospitals, By Country, 2017–2024 (USD Million)

Table 37 Lung Stents Market for Ambulatory Surgery Centers, By Country, 2017–2024 (USD Million)

Table 38 Lung Stents Market, By Region, 2017-2024 (USD Million)

Table 39 Prevalence of Cancer, By Country, 2010-2017

Table 40 Age-Standardized Prevalence of Tobacco Smoking Among People Aged 15 Years and Older (%), By Country, 2015

Table 41 North America: Lung Stents Market, By Country, 2017–2024 (USD Million)

Table 42 North America: Lung Stents Market, By Type, 2017–2024 (USD Million)

Table 43 North America: Lung Stents Market, By Product, 2017–2024 (USD Million)

Table 44 North America: Lung Stents Market, By Material, 2017-2024 (USD Million)

Table 45 North America: Lung Stents Market, By Material, 2017-2024 (Thousand Units)

Table 46 North America: Metal Airway Stents Market, By Type, 2017–2024 (USD Million)

Table 47 North America: Airway Stents Market, By End User, 2017–2024 (USD Million)

Table 48 US: Airway Stents Market, By Type, 2017–2024 (USD Million)

Table 49 US: Airway Stents Market, By Product, 2017–2024 (USD Million)

Table 50 US: Airway Stents Market, By Material, 2017-2024 (USD Million)

Table 51 US: Metal Airway Stents Market, By Type, 2017–2024 (USD Million)

Table 52 US: Airway Stents Market, By End User, 2017–2024 (USD Million)

Table 53 Canada: Airway Stents Market, By Type, 2017–2024 (USD Million)

Table 54 Canada: Airway Stents Market, By Product, 2017–2024 (USD Million)

Table 55 Canada: Airway Stents Market, By Material, 2017-2024 (USD Million)

Table 56 Canada: Metal Airway Stents Market, By Type, 2017–2024 (USD Million)

Table 57 Canada: Airway Stents Market, By End User, 2017–2024 (USD Million)

Table 58 Europe: Airway Stents Market, By Country, 2017–2024 (USD Million)

Table 59 Europe: Airway Stents Market, By Type, 2017–2024 (USD Million)

Table 60 Europe: Airway Stents Market, By Product, 2017–2024 (USD Million)

Table 61 Europe: Airway Stents Market, By Material, 2017-2024 (USD Million)

Table 62 Europe: Airway Stents Market, By Material, 2017-2024 (Thousand Units)

Table 63 Europe: Metal Airway Stents Market, By Type, 2017–2024 (USD Million)

Table 64 Europe: Airway Stents Market, By End User, 2017–2024 (USD Million)

Table 65 Germany: Airway Stents Market, By Type, 2017–2024 (USD Million)

Table 66 Germany: Airway Stents Market, By Product, 2017–2024 (USD Million)

Table 67 Germany: Airway Stents Market, By Material, 2017-2024 (USD Million)

Table 68 Germany: Metal Airway/Lung Stents Market, By Type, 2017–2024 (USD Million)

Table 69 Germany: Airway/Lung Stent Market, By End User, 2017–2024 (USD Million)

Table 70 UK: Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 71 UK: Airway/Lung Stent Market, By Product, 2017–2024 (USD Million)

Table 72 UK: Airway/Lung Stent Market, By Material, 2017-2024 (USD Million)

Table 73 UK: Metal Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 74 UK: Airway/Lung Stent Market, By End User, 2017–2024 (USD Million)

Table 75 France: Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 76 France: Airway/Lung Stent Market, By Product, 2017–2024 (USD Million)

Table 77 France: Airway/Lung Stent Market, By Material, 2017-2024 (USD Million)

Table 78 France: Metal Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 79 France: Airway/Lung Stent Market, By End User, 2017–2024 (USD Million)

Table 80 Italy: Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 81 Italy: Airway/Lung Stent Market, By Product, 2017–2024 (USD Million)

Table 82 Italy: Airway/Lung Stent Market, By Material, 2017-2024 (USD Million)

Table 83 Italy: Metal Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 84 Italy: Airway/Lung Stent Market, By End User, 2017–2024 (USD Million)

Table 85 Spain: Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 86 Spain: Airway/Lung Stent Market, By Product, 2017–2024 (USD Million)

Table 87 Spain: Airway/Lung Stent Market, By Material, 2017-2024 (USD Million)

Table 88 Spain: Metal Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 89 Spain: Airway/Lung Stent Market, By End User, 2017–2024 (USD Million)

Table 90 RoE: Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 91 RoE: Airway/Lung Stent Market, By Product, 2017–2024 (USD Million)

Table 92 RoE: Airway/Lung Stent Market, By Material, 2017-2024 (USD Million)

Table 93 RoE: Metal Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 94 RoE: Airway/Lung Stent Market, By End User, 2017–2024 (USD Million)

Table 95 Asia Pacific: Airway/Lung Stent Market, By Country/Region, 2017–2024 (USD Million)

Table 96 Asia Pacific: Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 97 Asia Pacific: Airway/Lung Stent Market, By Product, 2017–2024 (USD Million)

Table 98 Asia Pacific: Airway/Lung Stent Market, By Material, 2017-2024 (USD Million)

Table 99 Asia Pacific: Airway/Lung Stent Market, By Material, 2017-2024 (Thousand Units)

Table 100 Asia Pacific: Metal Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 101 Asia Pacific: Airway/Lung Stents Market, By End User, 2017–2024 (USD Million)

Table 102 China: Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 103 China: Airway/Lung Stent Market, By Product, 2017–2024 (USD Million)

Table 104 China: Airway/Lung Stent Market, By Material, 2017-2024 (USD Million)

Table 105 China: Metal Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 106 China: Airway/Lung Stent Market, By End User, 2017–2024 (USD Million)

Table 107 Japan: Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 108 Japan: Airway/Lung Stent Market, By Product, 2017–2024 (USD Million)

Table 109 Japan: Airway/Lung Stent Market, By Material, 2017-2024 (USD Million)

Table 110 Japan: Metal Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 111 Japan: Airway/Lung Stent Market, By End User, 2017–2024 (USD Million)

Table 112 India: Airway/Lung Stent Market, By Type, 2017–2024 (USD Million)

Table 113 India: Airway/Lung Stent Market, By Product, 2017–2024 (USD Million)

Table 114 India: Airway/Lung Stent Market, By Material, 2017-2024 (USD Million)

Table 115 India: Metal Lung Stents Market, By Type, 2017–2024 (USD Million)

Table 116 India: Airway/Lung Stents Market, By End User, 2017–2024 (USD Million)

Table 117 RoAPAC: Market, By Type, 2017–2024 (USD Million)

Table 118 RoAPAC: Market, By Product, 2017–2024 (USD Million)

Table 119 RoAPAC: Market, By Material, 2017-2024 (USD Million)

Table 120 RoAPAC: Metal Lung Stents Market, By Type, 2017–2024 (USD Million)

Table 121 RoAPAC: Market, By End User, 2017–2024 (USD Million)

Table 122 Latin America: Market, By Type, 2017–2024 (USD Million)

Table 123 Latin America: Market, By Product, 2017–2024 (USD Million)

Table 124 Latin America: Market, By Material, 2017-2024 (USD Million)

Table 125 Latin America: Market, By Material, 2017-2024 (Thousand Units)

Table 126 Latin America: Metal Lung Stents Market, By Type, 2017–2024 (USD Million)

Table 127 Latin America: Market, By End User, 2017–2024 (USD Million)

Table 128 MEA: Market, By Type, 2017–2024 (USD Million)

Table 129 MEA: Market, By Product, 2017–2024 (USD Million)

Table 130 MEA: Market, By Material, 2017-2024 (USD Million)

Table 131 MEA: Market, By Material, 2017-2024 (Thousand Units)

Table 132 MEA: Metal Lung Stents Market, By Type, 2017–2024 (USD Million)

Table 133 MEA: Airway/Lung Stents Market, By End User, 2017–2024 (USD Million)

Table 134 Market Leadership Analysis (2018)

Table 135 Partnerships (2016-2019)

Table 136 Distribution Agreement (2016-2019)

Table 137 Expansions (2018-2019)

List of Figures (34 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Bottom-Up Approach

Figure 4 Top Down Approach

Figure 5 Airway/Lung Stents Market, By Type, 2019 vs 2024 (USD Million)

Figure 6 Airway/Lung Stents Market, By Material, 2019 vs 2024 (USD Million)

Figure 7 Airway/Lung Stents Market, By Product, 2019 vs 2024 (USD Million)

Figure 8 Airway/Lung Stents Market, By End User, 2019 vs 2024 (USD Million)

Figure 9 Geographic Snapshot: Airway/Lung Stents Market

Figure 10 Rising Preference of Minimally Invasive Procedures to Drive Market Growth During the Forecast Period

Figure 11 China Held the Largest Share of the Asia Pacific Airway/Lung Stents Market in 2018

Figure 12 China and India to Grow at the Highest Rate During the Forecast Period

Figure 13 North America Will Continue to Dominate the Airway/Lung Stents Market By 2024

Figure 14 Developing Markets to Register the Highest Growth During the Forecast Period

Figure 15 Deaths Caused By Household and Ambient Air Pollution, By Disease, 2018

Figure 16 Increase in Life Expectancy, 2010 vs 2016

Figure 17 Healthcare Expenditure, 2010 vs 2016

Figure 18 Growth in Geriatric Population, By Region, 2015-2050

Figure 19 Premarket Notification: 510(K) Approval for Medical Devices

Figure 20 Canadian Medical Device License (MDL) Process

Figure 21 CE Approval Process for Airway/Lung Stents

Figure 22 Brazil: Medical Device Premarket Approval Process

Figure 23 Mexico: Medical Device Premarket Approval Process

Figure 24 Tracheobronchial Stents Will Continue to Dominate the Airway/Lung Stents Market By 2024

Figure 25 Hybrid Stents to Witness the Highest Growth in the Airway/Lung Stents Market During the Forecast Period

Figure 26 Self-Expandable Stents Will Continue to Dominate the Airway/Lung Stents Market in 2024

Figure 27 Hospitals are the Largest End Users of the Airway/Lung Stents Market

Figure 28 Geographical Snapshot (2018): Asian Countries to Show Highest Growth in the Market

Figure 29 North America: Airway/Lung Stents Market

Figure 30 Europe: Airway/Lung Stents Market

Figure 31 Asia Pacific: Airway/Lung Stents Market

Figure 32 Airway/Lung Stents Market: Competitive Leadership Mapping (2018)

Figure 33 Boston Scientific Corporation: Company Snapshot (2018)

Figure 34 Merit Medical Systems, Inc.: Company Snapshot (2018)

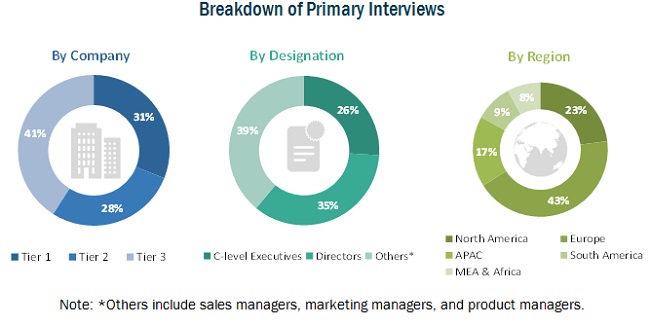

This study involved 4 major activities in estimating the current market size for The airway stent/lung stent market. Exhaustive secondary research was done to collect information on the market and peer market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. Thereafter, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global digital oilfield market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The airway stent/lung stent market comprises several stakeholders.The demand side of this market is characterized by increasing preference for minimally invasive procedures. The supply side is characterized by advancements in new technology. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as following—

To know about the assumptions considered for the study, download the pdf brochure

Objectives of the study

- To define, describe, and forecast the airway stent/lung stent market by type, product, material, end user, and region

- To provide detailed information about factors influencing market growth (drivers, opportunities, and restraints)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape of key players

- To forecast the size of the market in five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as joint ventures, alliances, mergers, acquisitions, product/technology developments, and research & development activities of the leading players in the airway/lung stents market

Research Methodology

Top-down and bottom-up approaches were used to validate the size of the airway stent/lung stent market and to estimate the size of other dependent submarkets. Various secondary sources such as World Health Organization (WHO), International Society for Respiratory Diseases, American Journal of Respiratory and Critical Care Medicine, Canadian Journal of Respiratory Therapy (CJRT), European Association of Bronchology and Interventional Pulmonology (EAPIB) among others, as well as the Annual Reports/SEC Filings, Investor Presentations of various companies, and the press releases of key players (white papers; journals/magazines; and news articles) were considered. Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess dynamics of this market.

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- A further breakdown of the Rest of European airway stent/lung stent market into the Netherlands, Belgium, Switzerland, and other countries

- A further breakdown of the RoAPAC airway stent/lung stent market into South Korea, Australia, New Zealand, and other countries

- A further breakdown of the Latin American airway stent/lung stent market into Brazil, Mexico, and other countries

Company Information

Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Airway Stent/Lung Stent Market