Coronary Stent Market by Type (BMS, BVS, Drug Eluting), Mode of Delivery (Self, Balloon Expandable), Material (Metal (Stainless Steel, CoCr, PtCr, Nitinol), Polymer, Copolymer), & End User (Hospital, Cardiology Center, ASC) - Global Forecasts to 2021

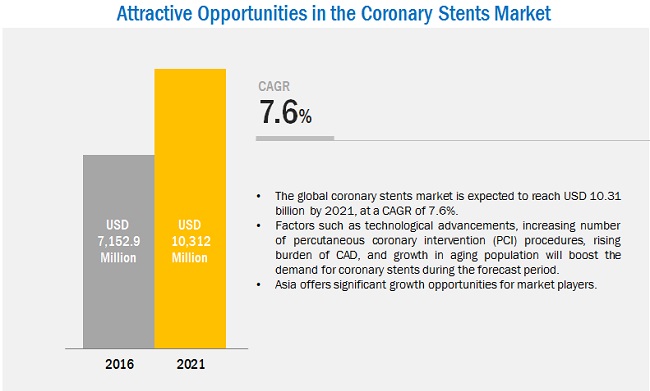

[151 Pages Report] The coronary stent market is expected to reach USD 10.31 billion by 2021 from USD 7.16 billion in 2016, at a CAGR of 7.6% from 2016 to 2021. Major factors driving the growth of this market include technological advancements, increasing number of percutaneous coronary intervention (PCI) procedures, rising burden of CAD, increasing demand for minimally invasive procedures, and rising geriatric population. Moreover, development of bioresorbable vascular scaffold (BVS) and expansion in emerging markets provide significant growth opportunities in the market provide significant growth opportunities in the market. However, alternative treatment methods for CAD, stringent regulations for product approval, and numerous cases of product failure and product recall may hinder the growth of this market during the forecast period.

Market Dynamics

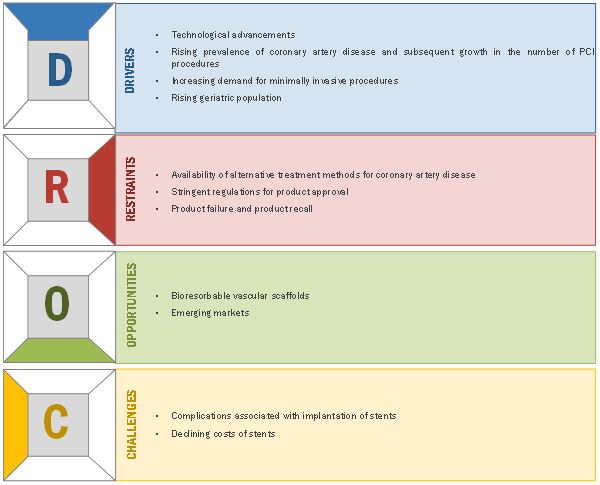

Drivers

- Technological Advancements

- Rising Incidence of Coronary Artery Disease and Subsequent Growth in the Number of PCI Procedures

- Increasing Demand for Minimally Invasive Procedures

- Rising Geriatric Population

Restraints

- Availability of Alternative Treatment Methods for Coronary Artery Disease

- Stringent Regulations for Product Approval

- Product Failure and Product Recalls

Opportunities

- Bioresorbable Vascular Scaffolds

- Emerging Markets

Challenges

- Complications Associated With Implantation of Stents

- Declining Costs of Stents

Technological advancements, increasing demand for minimally invasive procedures and rapid growth in geriatric population are the major drivers for the market.

The coronary stents market is witnessing a new phase of technological developments, with the launch of fully dissolving stents. In July 2016, Abbott (US) received US FDA approval to commercially launch its Absorb bioresorbable heart stent. Absorb is the only fully dissolving stent approved for the treatment of CAD. Moreover, researchers have also developed dual-therapy stents and bioengineered stents for the treatment of CAD. Innovations in stenting technology, in terms of material, construction, and coatings play a major role in increasing the effectiveness of stents and expanding their application areas. Moreover, launching innovative products in the market helps companies gain a competitive advantage and drive the uptake of their products.

Globally, CVD is the leading cause of death. Unlike invasive procedures such as coronary artery bypass surgery (CABS), PCI and coronary angioplasty/stenting are considered as minimally invasive procedures as they do not require any major incisions. The demand for these procedures is increasing mainly due to benefits such as less surgical trauma, reduced scarring, lesser pain, substantially lesser duration of hospital stay, and early return to normal activity. Considering these advantages, an increasing number of patients are opting for minimally invasive procedures. This, in turn, is increasing the demand for products such as catheters, balloons, and stents.

Since age is considered as a major cause for the deterioration of cardiac health, the rising geriatric population across the globe is one of the major factors responsible for the growing prevalence of CVD. According to the WHO, globally, the population of individuals aged 65 years and above was 617 million (8.5% of the total population) in early 2016, and this figure is estimated to reach 1.6 billion (17% of global population) by 2050.

The following are the major objectives of the study

- To define, describe, and forecast the coronary stents market on the basis of type, mode of delivery, material, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

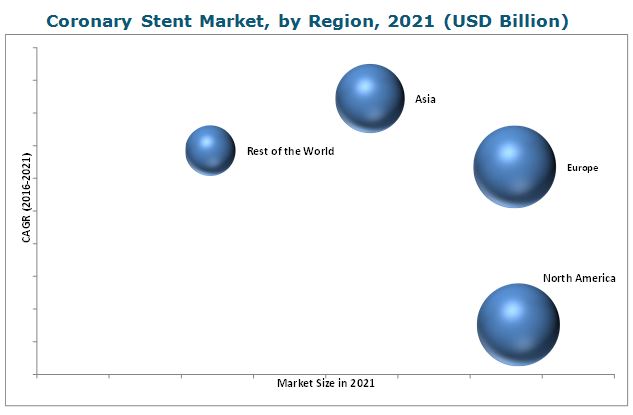

- To forecast the market size of market segments with respect to four main regions, namely, North America, Europe, Asia, and the Rest of the World (RoW)2

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies3

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, new product developments, expansions, and R&D activities in the coronary stents market

During this research study, major players operating in the coronary stents market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The coronary stents market is consolidated in nature. Major players in this market include Medtronic, plc (Ireland), Abbott Laboratories (U.S.), Boston Scientific Corporation (U.S.), Biosensors International Group, Ltd. (Singapore), BIOTRONIK SE & Co. KG (Germany), B. Braun Melsungen AG (Germany), Terumo Corporation (Japan), STENTYS SA (France), MicroPort Scientific Corporation (China), Meril Life Sciences Pvt. Ltd. (India), Vascular Concepts (India), and Translumina GmbH (Germany). Product approvals, launches, and enhancements were the key strategies adopted by players to grow and expand their presence in the coronary stents market.

Major Market Developments:

- In November 2016, Abbott received approval from the Ministry Of Health, Labor And Welfare (MHLW) (Japan) for its Absorb bioresorbable heart stent. This is the only dissolving heart stent used for the treatment of patients with coronary artery disease in Japan. This approval will help the company expand its presence in the Japanese market.

- In January 2016, Abbott acquired St. Jude Medical, Inc. (U.S.), a manufacturer of products for heart failure, atrial fibrillation, and cardiac rhythm management for USD 25 billion. The acquisition helped Abbott to strengthen its coronary intervention product offerings and increase its presence in the cardiovascular devices market

- In May 2016, Boston Scientific collaborated with Mayo Clinic (U.S.) to share intellectual property and speed the development of medical devices. This collaboration focuses on the development of medical technologies in the fields of interventional cardiology, heart rhythm management, endoscopy, neuromodulation, urology and pelvic health. This will help the company to strengthen its product offerings.

Target Audience:

- Coronary Stent Manufacturers

- Healthcare Institutions (Hospitals, Cardiac Centers, and Surgical Centers)

- Coronary Stent Distributors and Suppliers

- Contract Manufacturing Organizations (CMOs)

Scope of the Report

This report categorizes the coronary stent market into the following segments and subsegments.

Coronary Stent Market, by Type

- Bare-metal Stents

- Drug-eluting Stents

- Bioabsorbable Stents

Coronary Stent Market, by Mode of Delivery

- Balloon-expandable Stents

- Self-expanding Stents

Coronary Stent Market, by Material

- Metallic Stents

- Cobalt Chromium

- Platinum Chromium

- Nickel Titanium

- Stainless Steel

- Other Stents

Coronary Stent Market, by End User

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

Coronary Stent Market, by Region

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- RoE (Rest of Europe)

- Asia

- Rest of the World (Pacific countries, LATAM, the Middle East, and Africa)

Critical Questions which the report answers:

- Which are the key players in the market and how intense is the competition?

- What are new type of stents which the coronary stent companies are exploring?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs.

The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Further Split of the Rest of the World Coronary stents Market

- Coronary stents market size and growth rate estimates of Pacific countries, LATAM, Middle East and Africa

Bioabsorbable Stents to grow at the highest CAGR during the forecast period.

Based on type coronary stents are categorized into three major segments—bare-metal stents, drug-eluting stents, and bioabsorbable stents. Bioabsorbable Stents segment is expected to witness the highest growth during the forecast period. Reduction in complications such as thrombosis and inflammation, ability to restore normal vasomotion, and improved abnormal endothelial function are the advantages that are driving the adoption of bioabsorbable stents. However, the high price of bioabsorbable stents is expected to restrain the growth of this market segment in the coming years.

The global coronary stents market is expected to reach USD 10.3 billion by 2021. The growth of this market is mainly driven by rising burden of CAD, increasing demand for minimally invasive procedures, rapid growth in the aging population, and increasing number of PCI procedures. On the other hand, alternative treatment methods for CAD and product failure and product recalls are some of the factors that may hinder the overall growth of the market. As coronary stents are classified under the Class III category (high risk) of medical devices, the regulations for their approval are extremely stringent. This restricts the number of product launches in this segment, thereby affecting the market growth.

Technological advancements, increasing demand for minimally invasive procedures and rapid growth in geriatric population are the major drivers for the market.

The coronary stents market is witnessing a new phase of technological developments, with the launch of fully dissolving stents. In July 2016, Abbott (US) received US FDA approval to commercially launch its Absorb bioresorbable heart stent. Absorb is the only fully dissolving stent approved for the treatment of CAD. Moreover, researchers have also developed dual-therapy stents and bioengineered stents for the treatment of CAD. Innovations in stenting technology, in terms of material, construction, and coatings play a major role in increasing the effectiveness of stents and expanding their application areas. Moreover, launching innovative products in the market helps companies gain a competitive advantage and drive the uptake of their products.

Globally, CVD is the leading cause of death. Unlike invasive procedures such as coronary artery bypass surgery (CABS), PCI and coronary angioplasty/stenting are considered as minimally invasive procedures as they do not require any major incisions. The demand for these procedures is increasing mainly due to benefits such as less surgical trauma, reduced scarring, lesser pain, substantially lesser duration of hospital stay, and early return to normal activity. Considering these advantages, an increasing number of patients are opting for minimally invasive procedures. This, in turn, is increasing the demand for products such as catheters, balloons, and stents.

Since age is considered as a major cause for the deterioration of cardiac health, the rising geriatric population across the globe is one of the major factors responsible for the growing prevalence of CVD. According to the WHO, globally, the population of individuals aged 65 years and above was 617 million (8.5% of the total population) in early 2016, and this figure is estimated to reach 1.6 billion (17% of global population) by 2050.

However, the presence of alternative treatment methods for CAD, stringent regulations for product approval, and negative effects of product failure and product recalls are some of the major factors that are expected to restrain the growth of this market.

Market Dynamics

Hospitals form the fastest growing end user segment.

Hospitals

This segment includes both government and private hospitals that provide treatment to the patients with CAD. The market for this segment is mainly driven by the rising patient pool, growing number of PCI procedures in hospitals, improving healthcare infrastructure, and favorable reimbursement scenario in developed and developing countries. In addition, major players in the coronary stents market are adopting various strategies to enhance the utilization of stents in hospitals.

Cardiac Centers

Cardiac centers include medical centers and heart institutes that specifically focus on cardiovascular treatments. This segment is expected to witness growth due to the increasing prevalence of coronary artery diseases, focus on improving the life expectancy of patients, and reduced cost of post-cardiac surgeries. In addition, the growing incidence of heart attacks and strokes will drive the demand for coronary stents in cardiac centers.

Ambulatory Surgical Centers

Initially, surgeries were conducted only at hospitals. However, the increase in population highlighted several drawbacks of this situation—scheduling delays, slow operating room turnover times, the need for increasing the number of operating rooms, and challenges in obtaining new equipment due to hospital budgets and policies. These factors have driven the establishment of ambulatory surgical centers.

Key questions

- Complications associated with implantation of stents is a major concern in the industry, when will this scenario ease out?

- Emerging countries have immense opportunities for the growth of coronary stents, will this scenario continue?

- Most of the suppliers have opted new product launches, approvals and enhancements as the key strategies as could be seen from the recent developments. Where will it take the industry in the mid to long term?

The coronary stent market is expected to reach USD 10.31 billion by 2021 from USD 7.16 billion in 2016, at a CAGR of 7.6% from 2016 to 2021. The market is mainly driven by factors such as technological advancements, increasing number of percutaneous coronary intervention (PCI) procedures, rising burden of CAD, increasing demand for minimally invasive procedures, and rising geriatric population.

A coronary stent is a small, expandable tube-shaped device placed in the coronary arteries that supply blood to the heart. Coronary stents are used in percutaneous coronary intervention (PCI) procedures to treat patients with coronary artery disease (CAD). They are used for a wide range of indications in CAD, including de novo lesions, small-vessel disease (SVD), bifurcation lesions, and tortuous and narrow lesions.

On the basis of type, the coronary stent market is segmented into bare-metal stents, drug-eluting stents and bioabsorbable stents. The drug-eluting stents segment is expected to account for the largest market share in 2016. This can primarily be attributed to the advantages of drug-eluting stents over bare-metal stents, such as lower risk of restenosis and other related complications.

On the basis of mode of delivery, the market is segmented into balloon expandable stents and self-expanding stents. The balloon expandable stents segment is expected to grow at the highest CAGR during the forecast period due to the increasing research activities to improve this technology, high utilization of these stents, and growing regulatory approvals for balloon-expandable stents.

On the basis of material, the coronary stent market is segmented into metallic stents (cobalt chromium, platinum chromium, nickel titanium, and stainless steel), and other stents. The other stents segment is expected to grow at the highest CAGR during the forecast period. The high growth in this segment is attributed to the growing utilization of polymers and copolymers for the development of bioabsorbable stents.

On the basis of end user, the coronary stent market is segmented into hospitals, cardiac centers and ambulatory surgical centers. The hospitals segment is estimated to dominate the market in 2016. This can primarily be attributed to high utilization of coronary stents in hospitals.

The market is dominated by North America, followed by Europe, Asia, and the Rest of the World. North America is expected to dominate the market in 2016. Asia is expected to grow at a highest CAGR during the forecast period. Factors such as large population base, growing prevalence of cardiac diseases, rising adoption of advanced technologies, and low manufacturing costs in the region are expected to drive market growth in Asia. Moreover, the growing focus of major players in this region is expected to boost the coronary stents market in Asia.

Critical questions the report answers:

- Which of the end user market will dominate in future?

- Emerging countries have immense opportunities for the growth of coronary stents, will this scenario continue?

Coronary angioplasty is the most widely adopted procedure for the treatment of blockages in arteries; however, there are several alternative methods that can be used over stenting in the treatment of CAD. Laser angioplasty, atherectomy, CABG, cardiomyoplasty, heart transplant, and port-access coronary artery bypass are few such alternatives that are considered in some cases. The most widely used surgical alternative for a coronary angioplasty is CABG; it is usually recommended when multiple coronary arteries have become blocked and narrowed. Though coronary angioplasty has fewer risks, the number of people who need further surgery is high because of the use of stents. On the other hand, though CABG has a longer recovery time, only 1 in 10 patients who undergo this procedure require further treatment. Also, CABG is usually a more effective treatment option for people who are over 65 years of age and people with diabetes. In some countries, the cost of both coronary angioplasty and bypass surgery is almost the same. Thus, many patients opt for bypass procedures to avoid the risk of restenosis. These factors are expected to restrain the growth of the coronary stents market in the coming years.

Key players in the Coronary Stent Market include Medtronic plc (Ireland), Abbott Laboratories (U.S.), Boston Scientific Corporation (U.S.), Biosensors International Group, Ltd. (Singapore), BIOTRONIK SE & Co. KG (Germany), B. Braun Melsungen AG (Germany), TERUMO CORPORATION (Japan), STENTYS SA (France), MicroPort Scientific Corporation (China), Meril Life Sciences Pvt. Ltd. (India), Vascular Concepts (India), and Translumina GmbH (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Market Size Estimation

2.2 Market Breakdown and Data Triangulation

2.3 Key Industry Insights

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Coronary Stent: Market Overview

4.2 Coronary Stent Market, By Type

4.3 Market, By Mode of Delivery (2016 vs 2021)

4.4 Coronary Stent Market, By Material (2016 vs 2021)

4.5 Metallic Coronary Stent Market, By Type (2016)

4.6 Market, By End User

4.7 Geographic Snapshot: Coronary Stent Market

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Technological Advancements

5.2.1.2 Rising Incidence of Coronary Artery Disease and Subsequent Growth in the Number of PCI Procedures

5.2.1.3 Increasing Demand for Minimally Invasive Procedures

5.2.1.4 Rising Geriatric Population

5.2.2 Restraints

5.2.2.1 Availability of Alternative Treatment Methods for Coronary Artery Disease

5.2.2.2 Stringent Regulations for Product Approval

5.2.2.3 Product Failure and Product Recalls

5.2.3 Opportunities

5.2.3.1 Bioresorbable Vascular Scaffolds

5.2.3.2 Emerging Markets

5.2.4 Challenges

5.2.4.1 Complications Associated With Implantation of Stents

5.2.4.2 Declining Costs of Stents

5.3 Regulatory Landscape

5.4 Pipeline Products

5.5 Pricing Analysis

6 Coronary Stent Market, By Type (Page No. - 45)

6.1 Introduction

6.2 Bare-Metal Stents

6.3 Drug-Eluting Stents

6.4 Bioabsorbable Stents

7 Coronary Stent Market, By Mode of Delivery (Page No. - 53)

7.1 Introduction

7.2 Balloon-Expandable Stents

7.3 Self-Expanding Stents

8 Coronary Stent Market, By Material (Page No. - 59)

8.1 Introduction

8.2 Metallic Stents

8.2.1 Cobalt Chromium

8.2.2 Platinum Chromium

8.2.3 Nickel Titanium

8.2.4 Stainless Steel

8.3 Other Stents

9 Coronary Stent Market, By End User (Page No. - 69)

9.1 Introduction

9.2 Hospitals

9.3 Cardiac Centers

9.4 Ambulatory Surgical Centers

10 Coronary Stent Market, By Region (Page No. - 76)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Rest of Europe

10.4 Asia

10.5 Rest of the World (RoW)

11 Competitive Landscape (Page No. - 104)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Situation and Trends

11.3.1 Approvals, Product Launches, and Enhancements

11.3.2 Agreements, Collaborations, and Contracts

11.3.3 Expansions

11.3.4 Acquisitions

12 Company Profiles (Page No. - 113)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

12.1 Introduction

12.2 Medtronic PLC

12.3 Abbott Laboratories

12.4 Boston Scientific Corporation

12.5 Biosensors International Group, Ltd.

12.6 Biotronik SE & Co. Kg

12.7 B. Braun Melsungen AG

12.8 Terumo Corporation

12.9 Stentys SA

12.10 Microport Scientific Corporation

12.11 Meril Life Sciences Pvt. Ltd.

12.12 Vascular Concepts Limited

12.13 Translumina GmbH

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 138)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Other Developments

13.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.5 Introducing RT: Real-Time Market Intelligence

13.6 Available Customizations

13.7 Related Reports

13.8 Author Details

List of Tables (103 Tables)

Table 1 Global Coronary Stent Market: Geographic Snapshot

Table 2 Projected Increase in the Global Population Between 2005 and 2030, By Age

Table 3 Medical Device Regulations, By Country

Table 4 Pipeline Products

Table 5 Coronary Stent Market Size, By Type, 2014-2021 (USD Million)

Table 6 Bare-Metal Stents Market Size, By Region, 2014-2021 (USD Million)

Table 7 North America: Bare-Metal Stents Market Size, By Country, 2014-2021 (USD Million)

Table 8 Europe: Bare-Metal Stents Market Size, By Country, 2014-2021 (USD Million)

Table 9 Drug-Eluting Stents Market Size, By Region, 2014-2021 (USD Million)

Table 10 North America: Drug-Eluting Stents Market Size, By Country, 2014-2021 (USD Million)

Table 11 Europe: Drug-Eluting Stents Market Size, By Country, 2014-2021 (USD Million)

Table 12 Bioabsorbable Stents Market Size, By Region, 2014-2021 (USD Million)

Table 13 North America: Bioabsorbable Stents Market Size, By Country, 2014-2021 (USD Million)

Table 14 Europe: Bioabsorbable Stents Market Size, By Country, 2014-2021 (USD Million)

Table 15 Coronary Stent Market Size, By Mode of Delivery, 2014–2021 (USD Million)

Table 16 Commercially Available Balloon-Expandable Coronary Stent

Table 17 Balloon-Expandable Stents Market Size, By Region, 2014–2021 (USD Million)

Table 18 North America: Balloon-Expandable Stents Market Size, By Country, 2014–2021 (USD Million)

Table 19 Europe: Balloon-Expandable Stents Market Size, By Country, 2014–2021 (USD Million)

Table 20 Commercially Available Self-Expanding Coronary Stent

Table 21 Self-Expanding Stents Market Size, By Region, 2014–2021 (USD Million)

Table 22 North America: Self-Expanding Stents Market Size, By Country, 2014–2021 (USD Million)

Table 23 Europe: Self-Expanding Stents Market Size, By Country, 2014–2021 (USD Million)

Table 24 Coronary Stent Market Size, By Material, 2014–2021 (USD Million)

Table 25 Metallic Market Size, By Type, 2014–2021 (USD Million)

Table 26 Metallic Market Size, By Region, 2014–2021 (USD Million)

Table 27 North America: Metallic Coronary Stent Market Size, By Country, 2014–2021 (USD Million)

Table 28 Europe: Metallic Coronary Stent Market Size, By Country, 2014–2021 (USD Million)

Table 29 Commercially Available Cobalt Chromium Coronary Stent

Table 30 Cobalt Chromium Market Size, By Region, 2014–2021 (USD Million)

Table 31 Commercially Available Platinum Chromium Coronary Stent

Table 32 Platinum Chromium Coronary Stent Market Size, By Region, 2014–2021 (USD Million)

Table 33 Commercially Available Nickel Titanium Coronary Stent

Table 34 Nickel Titanium Coronary Stent Market Size, By Region, 2014–2021 (USD Million)

Table 35 Commercially Available Stainless Steel Coronary Stents

Table 36 Stainless Steel Coronary Stent Market Size, By Region, 2014–2021 (USD Million)

Table 37 Commercially Available Bioabsorbable Coronary Stent

Table 38 Other Market Size, By Region, 2014–2021 (USD Million)

Table 39 North America: Other Coronary Stent Market Size, By Country, 2014–2021 (USD Million)

Table 40 Europe: Other Coronary Stent Market Size, By Country, 2014–2021 (USD Million)

Table 41 Coronary Stent Market Size, By End User, 2014-2021 (USD Million)

Table 42 Market Size for Hospitals, By Region, 2014-2021 (USD Million)

Table 43 North America: Coronary Stent Market Size for Hospitals, By Country, 2014-2021 (USD Million)

Table 44 Europe: Coronary Stent Market Size for Hospitals, By Country, 2014-2021 (USD Million)

Table 45 Market Size for Cardiac Centers, By Region, 2014-2021 (USD Million)

Table 46 North America: Coronary Stent Market Size for Cardiac Centers, By Country, 2014-2021 (USD Million)

Table 47 Europe: Coronary Stent Market Size for Cardiac Centers, By Country, 2014-2021 (USD Million)

Table 48 Market Size for Ambulatory Surgical Centers, By Region, 2014-2021 (USD Million)

Table 49 North America: Coronary Stent Market Size for Ambulatory Surgical Centers, By Country, 2014-2021 (USD Million)

Table 50 Europe: Coronary Stent Market Size for Ambulatory Surgical Centers, By Country, 2014-2021 (USD Million)

Table 51 Market Size, By Region, 2014–2021 (USD Million)

Table 52 Market Size, By Region, 2014–2021 (No. of Units)

Table 53 North America: Coronary Stent Market Size, By Country, 2014–2021 (USD Million)

Table 54 North America: Coronary Stent Market Size, By Type, 2014–2021 (USD Million)

Table 55 North America: Coronary Stent Market Size, By Mode of Delivery, 2014–2021 (USD Million)

Table 56 North America: Coronary Stent Market Size, By Material, 2014–2021 (USD Million)

Table 57 North America: Metallic Coronary Stent Market Size, By Type, 2014–2021 (USD Million)

Table 58 North America: Metal Coronary Stent Market Size, By End User, 2014–2021 (USD Million)

Table 59 U.S.: Market Size, By Type, 2014–2021 (USD Million)

Table 60 U.S.: Coronary Stent Market Size, By Mode of Delivery, 2014–2021 (USD Million)

Table 61 U.S.: Market Size, By Material, 2014–2021 (USD Million)

Table 62 U.S.: Metal Coronary Stent Market Size, By End User, 2014–2021 (USD Million)

Table 63 Canada: Coronary Stent Market Size, By Type, 2014–2021 (USD Million)

Table 64 Canada: Market Size, By Mode of Delivery, 2014–2021 (USD Million)

Table 65 Canada: Coronary Stent Market Size, By Material, 2014–2021 (USD Million)

Table 66 Canada: Metal Coronary Stent Market Size, By End User, 2014–2021 (USD Million)

Table 67 Europe: Market Size, By Country, 2014–2021 (USD Million)

Table 68 Europe: Coronary Stent Market Size, By Type, 2014–2021 (USD Million)

Table 69 Europe: Market Size, By Mode of Delivery, 2014–2021 (USD Million)

Table 70 Europe: Coronary Stent Market Size, By Material, 2014–2021 (USD Million)

Table 71 Europe: Metallic Market Size, By Type, 2014–2021 (USD Million)

Table 72 Europe: Metal Coronary Stents Market Size, By End User, 2014–2021 (USD Million)

Table 73 Germany: Coronary Stents Market Size, By Type, 2014–2021 (USD Million)

Table 74 Germany: Coronary Stents Market Size, By Mode of Delivery, 2014–2021 (USD Million)

Table 75 Germany: Coronary Stents Market Size, By Material, 2014–2021 (USD Million)

Table 76 Germany: Metal Coronary Stents Market Size, By End User, 2014–2021 (USD Million)

Table 77 France: Coronary Stents Market Size, By Type, 2014–2021 (USD Million)

Table 78 France: Coronary Stents Market Size, By Mode of Delivery, 2014–2021 (USD Million)

Table 79 France: Coronary Stents Market Size, By Material, 2014–2021 (USD Million)

Table 80 France: Metal Coronary Stents Market Size, By End User, 2014–2021 (USD Million)

Table 81 U.K.: Coronary Stents Market Size, By Type, 2014–2021 (USD Million)

Table 82 U.K.: Coronary Stents Market Size, By Mode of Delivery, 2014–2021 (USD Million)

Table 83 U.K.: Coronary Stents Market Size, By Material, 2014–2021 (USD Million)

Table 84 U.K.: Metal Coronary Stents Market Size, By End User, 2014–2021 (USD Million)

Table 85 RoE: Coronary Stents Market Size, By Type, 2014–2021 (USD Million)

Table 86 RoE: Coronary Stents Market Size, By Mode of Delivery, 2014–2021 (USD Million)

Table 87 RoE: Coronary Stents Market Size, By Material, 2014–2021 (USD Million)

Table 88 RoE: Metal Coronary Stents Market Size, By End User, 2014–2021 (USD Million)

Table 89 Asia: Coronary Stents Market Size, By Type, 2014–2021 (USD Million)

Table 90 Asia: Coronary Stents Market Size, By Mode of Delivery, 2014–2021 (USD Million)

Table 91 Asia: Coronary Stents Market Size, By Material, 2014–2021 (USD Million)

Table 92 Asia: Metallic Coronary Stents Market Size, By Type, 2014–2021 (USD Million)

Table 93 Asia: Metal Coronary Stents Market Size, By End User, 2014–2021 (USD Million)

Table 94 RoW: Coronary Stents Market Size, By Type, 2014–2021 (USD Million)

Table 95 RoW: Coronary Stents Market Size, By Mode of Delivery, 2014–2021 (USD Million)

Table 96 RoW: Coronary Stents Market Size, By Material, 2014–2021 (USD Million)

Table 97 RoW: Metallic Coronary Stents Market Size, By Type, 2014–2021 (USD Million)

Table 98 RoW: Metal Coronary Stents Market Size, By End User, 2014–2021 (USD Million)

Table 99 Approvals, Product Launches, and Enhancements (2014–2017)

Table 100 Agreements, Collaborations, and Contracts (2014–2017)

Table 101 Expansions (2014–2017)

Table 102 Acquisitions (2014–2017)

Table 103 Certifications (2014–2017)

List of Figures (49 Figures)

Figure 1 Global Coronary Stents Market

Figure 2 Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 6 Data Triangulation Methodology

Figure 7 Key Data From Secondary Sources

Figure 8 Key Data From Primary Sources

Figure 9 Drug-Eluting Stents to Dominate the Coronary Stents Market During the Forecast Period

Figure 10 Balloon-Expandable Stents to Register the Highest CAGR From 2016 to 2021

Figure 11 Metallic Stents to Dominate the Coronary Stents Market During the Forecast Period

Figure 12 Hospitals Form Major End Users of Coronary Stents

Figure 13 North America Dominated the Coronary Stents Market in 2016

Figure 14 Technological Advancements and Rising Burden of Coronary Artery Disease are Driving Market Growth

Figure 15 Drug-Eluting Stents to Dominate the Market in 2016

Figure 16 Balloon Expandable Stents Forms the Largest Segment in the Market

Figure 17 Metallic Stents to Dominate the Market During the Forecast Period

Figure 18 Cobalt Chromium Segment to Dominate the Market During the Forecast Period

Figure 19 Hospitals Formed the Largest End Users in 2016

Figure 20 Asia to Register the Highest Growth During the Forecast Period

Figure 21 Coronary Stents Market: Drivers, Restraints, Opportunities, and Challenges

Figure 22 Prevalence of Coronary Heart Disease By Age and Sex (2009–2012)

Figure 23 Pricing Trend (2013-2021)

Figure 24 Bioabsorbable Stents Segment to Grow at the Highest Rate During the Forecast Period

Figure 25 Drug-Eluting Stents Market, By Region: Asia to Grow at the Highest CAGR During the Forecast Period

Figure 26 Balloon-Expandable Stents to Dominate Market From 2016 to 2021

Figure 27 North America Dominates the Balloon-Expandable Stents Market

Figure 28 Other Stents to Witness Highest Growth in the Forecast Period

Figure 29 North America Accounted for the Largest Share of the Metallic Coronary Stents Market in 2016

Figure 30 Hospitals to Dominate the Coronary Stents Market During the Forecast Period

Figure 31 North America to Dominate the Hospitals Market (2016-2021)

Figure 32 North America to Dominate the Coronary Stents Market During the Forecast Period

Figure 33 North America: Coronary Stents Market Snapshot

Figure 34 Europe: Coronary Stents Market Snapshot

Figure 35 Asia: Coronary Stents Market Snapshot

Figure 36 RoW: Coronary Stents Market Snapshot

Figure 37 Key Developments in the Coronary Stents Market, 2014–2017

Figure 38 Market Evolution Framework—Product Approvals, Launches, and Enhancements Fueled Market Growth

Figure 39 Coronary Stents Market Share Analysis, By Key Player, 2015

Figure 40 Battle for Market Share: Approvals, Product Launches, and Enhancements are the Key Strategies Adopted By Market Players

Figure 41 Geographic Revenue Mix of the Top Players in the Coronary Stents Market

Figure 42 Medtronic PLC: Company Snapshot (2016)

Figure 43 Abbott Laboratories: Company Snapshot (2015)

Figure 44 Boston Scientific Corporation: Company Snapshot (2015)

Figure 45 Biosensors International Group Ltd.: Company Snapshot (2015)

Figure 46 B. Braun Melsungen AG: Company Snapshot (2015)

Figure 47 Terumo Corporation: Company Snapshot (2015)

Figure 48 Stentys SA: Company Snapshot (2015)

Figure 49 Microport Scientific Corporation: Company Snapshot (2015)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Coronary Stent Market