Aircraft Switches Market by End-User (OEM, Aftermarket), Application (Cockpit, Cabin, Engine & APU, Aircraft Systems, Avionics), Type (Manual, Automatic), Platform (Fixed Wing, Rotary Wing), and Region - Global Forecast to 2035

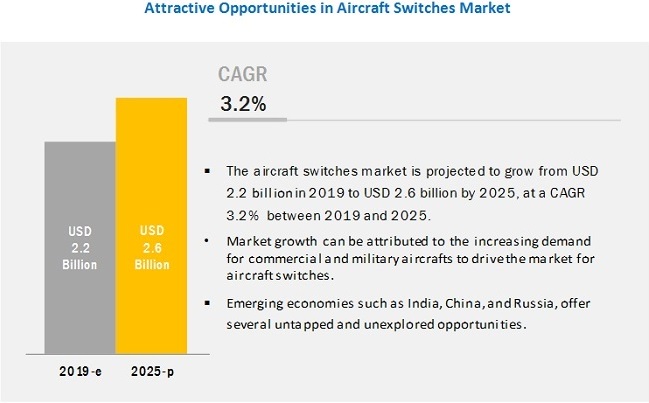

[161 Pages Tables] The aircraft switches market is projected to grow from USD 2.2 billion in 2019 to USD 2.6 billion by 2025, at a CAGR of 3.2% during the forecast period. The growing demand for in-flight entertainment & connectivity (IFEC) is a major factor driving the growth of the aircraft switches market. This demand has led to new and improved IFEC upgrades across many airline fleets. These upgrades involve new systems that are more interactive and contain manual electromechanical switches, as well as touchscreen interfaces. These factors are expected to drive the growth of the aircraft switches market.

See how this study impacted revenues for other players in Aircraft Switches Market

Client’s Problem Statement

Our client, a top security solution provider globally, was keen to understand the market potential for high performance KVM switches in mission critical control centres globally. The client wanted to understand the competitor landscape of companies operating in KVM switches with more than 24 ports across verticals such as media, education, finance, government, healthcare, hospitality, manufacturing, oil and gas, and transportation.

MnM Approach

MnM assisted the client with multiple potential segments such as Wireless extenders, Cloud based KVMs, future of 8K resolution KVM and target markets which they can focus on. Further, MnM helped them identify the potential use cases like Defense Control Rooms, Broadcast/Media, Public Safety, and Traffic Control Rooms for such segments.

Special emphasis was given on Mining application since it is an upcoming market with high degree of innovation and relatively low competition. Both Surface and Underground mining were explored for market potential and evaluated based on multiple macro & micro indicators.

Revenue Impact (RI)

The study helped them discover market potential of $50 Million in existing applications that they are into while $10-15 Million in newer/upcoming applications in 2-3 years.

By platform, the rotary wing segment is expected to be the largest contributor to the aircraft switches market during the forecast period.

The rotary wing witnessed strong growth over the past few years. This growth can be attributed to factors such as increasing air travel, the rise in disposable income of the middle-class population, and growing international trade & tourism across the globe. Strong growth in this sector has resulted in increasing the number of aircraft orders to address the increasing air passenger traffic. Manufacturers are currently focusing on aircraft switches components to develop products that are more reliable, accurate, and efficient. Continuous improvements in software have modified the human-machine interface of aircraft switches.

By application, the cabin segment is projected to lead the aircraft switches market during the forecast period.

Switches in an aircraft differ from aircraft to aircraft based on the type of aircraft. Important functions are performed through a panel of switches present in the cockpit dashboard. Pilots control components and systems such as fuel, engine, APU, lights, radio communication aids, and navigation aids, among others. Pilots perform functions such as starting the engines, controlling the electrical power supply to various systems, lights and switch between radio frequencies, selecting airspeed, control navigation computers, and many more critical functions needed during different flight phases such as take-off, landing, and taxi. Military aircraft contain ammunition control switches for combat purposes. The rising number of aircraft is expected to drive the demand for aircraft switches in cabins over the next few years.

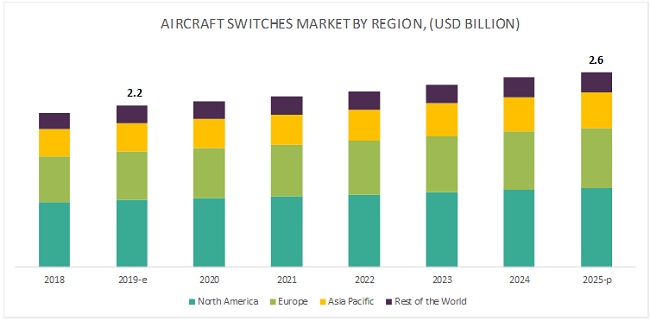

North America is projected to lead the market for aircraft switches during the forecast period.

North America is expected to be the largest market for aircraft switches during the forecast period. The demand for commercial aircraft is continuously increasing, due to which aircraft manufacturers are expanding their product line, thereby creating a significant requirement for aircraft switches. Thus, increasing aircraft orders and supplies is a significant advantage for commercial aircraft switches market in the current scenario. Moreover, the trend of up gradation of existing/older aircraft is rapidly flourishing in the current commercial aircraft industry.

Key Market Players

Major vendors in the aircraft switches market include Safran (France), Curtiss-Wright (US), Esterline Technologies (US), Honeywell (US), Meggitt (UK), and United Technologies Corporation (Collins Aerospace) (US). Honeywell, which specializes in aircraft switches, has developed a limit, toggle, push-button switches for commercial and military aircraft.

United Technologies Corporation (Collins Aerospace) is among the world’s top three suppliers and manufacturers of aerospace switches systems. The company has been working intensively in this field for more than 60 years. Thales provides major innovative aerospace switches solutions to commercial and military aircraft, including the Boeing 787 Dreamliner, Airbus A380, Airbus A350 XWB, and Airbus Military’s A400M military transport.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2025 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

End User, Application, Platform, Type and Region |

|

Regions Covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Safran (France), UTC (Collins Aerospace) (US), Honeywell International Inc. (US), Curtiss-Wright (US), Esterline Technologies (US), and Meggitt (UK), among others |

This research report categorizes the aircraft switches market based on end user, application, platform, type, and region.

On the basis of the end-user, the aircraft switches market has been segmented as follows:

- OEM

- Aftermarket

On the basis of application, the aircraft switches market has been segmented as follows:

- Cockpit

- Cabin

- Engine and APU

- Aircraft Systems

- Avionics

On the basis of type, the aircraft switches market has been segmented as follows:

-

Manual

- Push

- Toggle

- Rocker

- Selector

-

Automatic

- Limit

- Pressure

- Temperature

- Flow

- Network

- Relay

On the basis of the platform, the aircraft switches market has been segmented as follows:

-

Fixed Wing

- Commercial

- General & Business Aviation

- Military

-

Rotary Wing

- Civil and Commercial

- Military

On the basis of region, the aircraft switches market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In July 2018, Honeywell received a contract from Allegiant Air to provide maintenance, repair and overhaul services for its auxiliary power units and select avionics components for Airbus A319 and A320 aircraft.

- In January 2018, Curtiss-Wright received a contract from Air Force Test Center (AFTC) to provide the aerospace instrumentation technology for use on the High-Speed Data Acquisition System (HSDAS) program which includes network switches, recorders, telemetry systems, and ground station systems.

- In July 2017, Safran signed a contract with Kulite Semiconductor Products, Inc. for the development of a new solid state electronic pressure switch (FFCI) to be installed on CFM56-7B aircraft engines.

Key Questions Addressed by the Report

- What will be the revenue pockets for the aircraft switches market in the next five years?

- Who are the leading manufacturers of aircraft switches in the global market? What are the growth prospects of the aircraft switches market?

- What are the major drivers impacting the aircraft switches market?

- What are the latest technological trends in the market?

- Who all are the leading MRO players for the aircraft switches market?

Frequently Asked Questions (FAQ):

Which region is expected to witness significant demand for aircraft switches in the coming years?

The European aviation market is projected to witness significant growth in the next 20 years, with major airlines expected to acquire over 7,500 new aircraft valued at USD 1.1 trillion. According to Boeing Current Market Outlook 2018, single-aisle aircraft will witness the highest number of deliveries, representing a 78% share.

Who are the leading vendors operating in this market?

Major vendors in the aircraft switches market include Safran (France), Curtiss-Wright (US), Esterline Technologies (US), Honeywell (US), Meggitt (UK), and United Technologies Corporation (Collins Aerospace) (US). Honeywell, which specializes in aircraft switches, has developed a limit, toggle, push-button switches for commercial and military aircraft.

Which segment provides the most opportunity for growth?

The automatic switches segment is expected to present the most opportunity in the aircraft switches market. Automatic switches are switches that activate through machine functions, a physical process, or an electric current. This growth is owed to the advancement in automation and the technological sector.

What are the major hindrances to the growth of the aircraft switches market?

Complex wiring, maintenance, and replacement of switches is a challenging task that needs to be carried out with extreme precision since errors in wiring or rewiring of switches can lead to failures.

Which type of technologies will be used widely in the aircraft switches market in the coming future?

Touchscreen display technology has the potential to increase operational efficiency as it not only shows flight information but also enables certain system controls. These displays are aimed at reducing the complexity of a panel that has multiple switches, as well as the overall weight of cockpit controls. Upgrades and replacements can also be carried out easily with software updates.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Years Considered

1.4 Currency & Pricing

1.5 Market Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Definition & Scope

2.3 Segments and Subsegments

2.3.1 Segment Definitions

2.3.1.1 Aircraft Switches Market, By Type

2.3.1.2 Aircraft Switches Market, By Application

2.3.1.3 Aircraft Switches Market, By Platform

2.3.1.4 Aircraft Switches Market, By End Use

2.4 Research Approach & Methodology

2.4.1 Bottom-Up Approach

2.4.1.1 General Approach for Aircraft Switches Market

2.4.1.2 Aircraft Switches Market Approach, By Type, Application

2.4.1.3 Regional Aircraft Switches Market for OEM

2.4.2 Top-Down Approach

2.4.2.1 Regional Aircraft Switches Market for Aftermarket

2.4.3 Pricing Analysis

2.5 Triangulation & Validation

2.5.1 Triangulation Through Secondary

2.5.2 Triangulation Through Primaries

2.6 Market Breakdown and Data Triangulation

2.7 Research Limitations

2.8 Research Assumptions

2.8.1 Market Sizing

2.8.2 Market Forecasting

2.9 Risks

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 39)

4.1 Attractive Opportunities in Aircraft Switches Market, 2019–2025

4.2 Aircraft Switches Market, By Application

4.3 Aircraft Switches Market, By Country

5 Market Overview (Page No. - 41)

5.1 Market Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Use of Electronics in Aircraft Systems

5.2.1.2 Increased Demand for In-Flight Entertainment & Connectivity (IFEC)

5.2.2 Restraints

5.2.2.1 Touch Screen Technology Replacing Manual Switches

5.2.2.1.1 Increasing Use of Touch Screens in Aircraft

5.2.3 Opportunities

5.2.3.1 Use of Switches in Unmanned Aerial Vehicle (UAV) and Space Applications

5.2.4 Challenges

5.2.4.1 Complex Maintenance Procedures

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Technology Trends

6.2.1 Solid-State Technology

6.2.2 Touchscreen Switch Controls

6.2.3 Poke Home Switch Connectors

6.2.4 Reduction in Switch Size

6.2.5 Magnetic Switches

6.2.6 Network Switches

6.2.6.1 Increasing Requirement of Network in the Aerospace Industry Driving the Demand for Aerospace Switches

6.3 Supply Chain

6.3.1 Raw Material Suppliers

6.3.2 Prominent Companies

6.3.3 Small and Medium Enterprises

6.3.4 End Users (System Integrators, Aircraft Manufacturers, and Airlines)

6.4 Key Influencers

7 Aircraft Switches, By Type (Page No. - 51)

7.1 Introduction

7.2 Manual

7.2.1 Increased Aircraft Deliveries Driving the Demand for Manual Switches

7.2.2 Push

7.2.3 Toggle

7.2.4 Rocker

7.2.5 Selector

7.3 Automatic

7.3.1 Aerospace Switches Used for Network and Electronic Automation Driving the Demand for Automatic Switches

7.3.2 Limit

7.3.3 Pressure

7.3.4 Temperature

7.3.5 Flow

7.3.6 Network

7.3.7 Relay

8 Aircraft Switches Market, By Application (Page No. - 57)

8.1 Introduction

8.2 Cockpit

8.2.1 Switches Required for Important Pilot Functions Present in Every Aircraft Cockpit

8.3 Cabin

8.3.1 Increasing Demand for Cabin Switches in Aftermaket

8.4 Engine and Auxiliary Power Unit (APU)

8.4.1 Automatic Switches Including Pressure, Temperature, Limit and Flow Switches

8.5 Aircraft Systems

8.5.1 Fastest Growing Potential Due to Increase in Use of Safety Switches

8.6 Avionics

8.6.1 Aircraft Electrical System and Network Data Handling

9 Aircraft Switches, By End Use (Page No. - 62)

9.1 Introduction

9.2 OEM

9.2.1 Increased Aircraft Demand in the Coming Years to Drive the Demand for OEM Aircraft Switches

9.3 Aftermarket

9.3.1 Large Global Aircraft Fleet in Operation Driving the Aftermarket for Aircraft Switches

10 Aircraft Switches, By Platform (Page No. - 66)

10.1 Introduction

10.2 Fixed Wing

10.2.1 Commercial

10.2.1.1 Increasing Commercial Aircraft Orders Driving the Market of Aircraft Switches for Commercial Fixed Wing Platform

10.2.1.2 Narrow-Body Aircraft (NBA)

10.2.1.3 Wide-Body Aircraft (WBA)

10.2.1.4 Very Large Aircraft (VLA)

10.2.1.5 Regional Transport Aircraft (RTA)

10.2.2 General & Business Aviation

10.2.2.1 Customized In-Flight Entertainment Systems in Business Aviation Driving the Demand for General & Business Aviation Switches for Fixed Wing Platform

10.2.3 Military

10.2.3.1 Increase in Deliveries of Combat Aircraft Leading to Growth of Military Fixed Wing Switches Market

10.2.3.2 Fighter

10.2.3.3 Transport

10.3 Rotary Wing

10.3.1 Civil & Commercial

10.3.1.1 Switches Within Civil, Homeland Security, and Commercial Purpose Helicopter

10.3.2 Military

10.3.2.1 Switches in Military Combat and Transport Helicopters

11 Regional Analysis (Page No. - 75)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Significant Investment in Aircraft Switches

11.2.2 Canada

11.2.2.1 Upgradation, Modernization, and Maintenance of Aircraft Will Lead to Demand for Aircraft Switches

11.3 Europe

11.3.1 France

11.3.1.1 Presence of Significant Aircraft Switch Suppliers

11.3.2 UK

11.3.2.1 Increase in Passenger Traffic Driving the UK Market

11.3.3 Italy

11.3.3.1 Presence of Aircraft Engine Manufacturers Driving the Italy Market

11.3.4 Russia

11.3.4.1 Increase in Aircraft Orders Driving the Russia Market

11.3.5 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Increase in Demand for Automatic Switches Driving the China Market

11.4.2 India

11.4.2.1 Increasing Aircraft Fleet is Resulting in Growth of Aircraft Switches Aftermarket in India

11.4.3 Japan

11.4.3.1 Rise in the Demand for Low-Cost Carriers Drives Market for Aircraft Switches in Japan

11.4.4 Rest of Asia Pacific

11.5 Rest of the World

11.5.1 Africa

11.5.1.1 Increase in Demand for Single-Aisle Aircraft Fueling the Growth of Aircraft Switches Market in Africa

11.5.2 Middle East

11.5.2.1 Aircraft Modernization Projects Driving the Market in the Middle East

11.5.3 Latin America

11.5.3.1 Growth in Trade and Tourism and Increase in the Number of Aircraft Deliveries Driving the Latin America Market

12 Competitive Landscape (Page No. - 114)

12.1 Introduction

12.2 OEM Competitive Leadership Mapping

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

12.3 Ranking of Key Players, 2018

12.4 Competitive Scenario

12.4.1 New Product Launches

12.4.2 Acquisitions

12.4.3 Contracts

12.4.4 Agreements

13 Company Profiles (Page No. - 121)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Safran

13.2 Curtiss-Wright

13.3 Esterline Technologies

13.4 Honeywell

13.5 Meggitt

13.6 United Technologies Corporation (Collins Aerospace)

13.7 Eaton Corporation

13.8 Ametek

13.9 TE Connectivity

13.10 Raytheon

13.11 ITT Aerospace

13.12 Hydra-Electric Company

13.13 C&K

13.14 Baran Advanced Technologies (Barantec)

13.15 Unison Industries

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 155)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (134 Tables)

Table 1 List of Raw Material Suppliers

Table 2 List of Top Aircraft Manufacturers

Table 3 Top Aircraft Mro Service Providers

Table 4 Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 5 Manual Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 6 Manual Aircraft Switches Market Size, By Region, 2017–2025 (USD Million)

Table 7 Automatic Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 8 Automatic Aircraft Switches Market Size, By Region, 2017–2025 (USD Million)

Table 9 Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 10 Aircraft Switches Market Size for Cockpits, By Region, 2017–2025 (USD Million)

Table 11 Aircraft Switches Market Size for Cabins, By Region, 2017–2025 (USD Million)

Table 12 Aircraft Switches Market Size for Engine & APU, By Region, 2017–2025 (USD Million)

Table 13 Aircraft Switches Market Size for Aircraft Systems, By Region, 2017–2025 (USD Million)

Table 14 Aircraft Switches Market Size for Avionics, By Region, 2017–2025 (USD Million)

Table 15 Aircraft Switches Market Size, By End Use, 2017-2025 (USD Million)

Table 16 OEM: Aircraft Switches Market Size, By Region, 2017–2025 (USD Million)

Table 17 Aftermarket: Aircraft Switches Market Size, By Region, 2017–2025 (USD Million)

Table 18 Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 19 Fixed Wing Aircraft Switches Market, By End User, 2017–2025 (USD Million)

Table 20 Fixed Wing Aircraft Switches Market Size, By Region, 2017–2025 (USD Million)

Table 21 Commercial Aircraft Switches Market, By Aircraft Type , 2017–2025 (USD Million)

Table 22 Commercial Aircraft Switches Market Size, By Region, 2017–2025 (USD Million)

Table 23 General & Business Aviation Aircraft Switches Market Size, By Region, 2019-2025 (USD Million)

Table 24 Fixed Wing Military Aircraft Switches Market, By Aircraft Type, 2017–2025 (USD Million)

Table 25 Fixed Wing Military Aircraft Switches Market Size, By Region, 2017–2025 (USD Million)

Table 26 Rotary Wing Aircraft Switches Market, By End User , 2017–2025 (USD Million)

Table 27 Rotary Wing Aircraft Switches Market Size, By Region, 2017–2025 (USD Million)

Table 28 Rotary Wing Civil & Commercial Aircraft Switches Market Size, By Region, 2017–2025 (USD Million)

Table 29 Rotary Wing Military Aircraft Switches Market Size, By Region, 2017–2025 (USD Million)

Table 30 Aircraft Switches Market Size, By Region, 2017–2025 (USD Million)

Table 31 North America: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 32 North America: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 33 North America: Manual Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 34 North America: Automatic Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 35 North America: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 36 North America: Fixed-Wing Aircraft Switches Market Size, By End User, 2017–2025 (USD Million)

Table 37 North America: Commercial Aircraft Switches Market Size, By Aircraft Type, 2017–2025 (USD Million)

Table 38 North America: Military Aircraft Switches Market Size, By Aircraft Type, 2017–2025 (USD Million)

Table 39 North America: Rotary-Wing Aircraft Switches Market Size, By End User, 2017–2025 (USD Million)

Table 40 North America: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 41 North America: Aircraft Switches Market Size, By Country, 2017–2025 (USD Million)

Table 42 US: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 43 US: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 44 US: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 45 US: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 46 Canada: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 47 Canada: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 48 Canada: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 49 Canada: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 50 Europe: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 51 Europe: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 52 Europe: Manual Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 53 Europe: Automatic Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 54 Europe: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 55 Europe: Fixed-Wing Aircraft Switches Market Size, By End User, 2017–2025 (USD Million)

Table 56 Europe: Commercial Aircraft Switches Market Size, By Aircraft Type, 2017–2025 (USD Million)

Table 57 Europe: Military Aircraft Switches Market Size, By Aircraft Type, 2017–2025 (USD Million)

Table 58 Europe: Rotary-Wing Aircraft Switches Market Size, By End User, 2017–2025 (USD Million)

Table 59 Europe: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 60 Europe: Aircraft Switches Size, By Country, 2017–2025 (USD Million)

Table 61 France: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 62 France: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 63 France: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 64 France: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 65 UK: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 66 UK: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 67 UK: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 68 UK: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 69 Italy: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 70 Italy: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 71 Italy: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 72 Italy: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 73 Russia: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 74 Russia: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 75 Russia Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 76 Russia Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 77 Rest of Europe: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 78 Rest of Europe: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 79 Rest of Europe: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 80 Rest of Europe: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 81 Asia Pacific: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 82 Asia Pacific: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 83 Asia Pacific: Manual Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 84 Asia Pacific: Automatic Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 85 Asia Pacific: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 86 Asia Pacific: Fixed-Wing Aircraft Switches Market Size, By End User, 2017–2025 (USD Million)

Table 87 Asia Pacific: Commercial Aircraft Switches Market Size, By Aircraft Type, 2017–2025 (USD Million)

Table 88 Asia Pacific: Military Aircraft Switches Market Size, By Aircraft Type, 2017–2025 (USD Million)

Table 89 Asia Pacific: Rotary-Wing Aircraft Switches Market Size, By End User, 2017–2025 (USD Million)

Table 90 Asia Pacific: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 91 Asia Pacific: Aircraft Switches Size, By Country, 2017–2025 (USD Million)

Table 92 China: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 93 China: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 94 China: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 95 China: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 96 India: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 97 India: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 98 India: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 99 India: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 100 Japan: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 101 Japan: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 102 Japan: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 103 Japan: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 104 Rest of Asia Pacific: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 105 Rest of Asia Pacific: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 106 Rest of Asia Pacific: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 107 Rest of Asia Pacific: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 108 RoW: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 109 RoW: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 110 RoW: Manual Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 111 RoW: Automatic Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 112 RoW: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 113 RoW: Fixed-Wing Aircraft Switches Market Size, By End User, 2017–2025 (USD Million)

Table 114 RoW: Commercial Aircraft Switches Market Size, By Aircraft Type, 2017–2025 (USD Million)

Table 115 RoW: Military Aircraft Switches Market Size, By Aircraft Type, 2017–2025 (USD Million)

Table 116 RoW: Rotary-Wing Aircraft Switches Market Size, By End User, 2017–2025 (USD Million)

Table 117 RoW: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 118 RoW: Aircraft Switches Market Size, By Region, 2017–2025 (USD Million)

Table 119 Africa: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 120 Africa: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 121 Africa: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 122 Africa: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 123 Middle East: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 124 Middle East: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 125 Middle East: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 126 Middle East: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 127 Latin America: Aircraft Switches Market Size, By Application, 2017–2025 (USD Million)

Table 128 Latin America: Aircraft Switches Market Size, By Type, 2017–2025 (USD Million)

Table 129 Latin America: Aircraft Switches Market Size, By Platform, 2017–2025 (USD Million)

Table 130 Latin America: Aircraft Switches Market Size, By End Use, 2017–2025 (USD Million)

Table 131 New Product Launches, 2014–2019

Table 132 Acquisitions, 2014–2019

Table 133 Contracts, 2014–2019

Table 134 Agreements, 2014–2019

List of Figures (46 Figures)

Figure 1 Markets Covered

Figure 2 Research Flow

Figure 3 Research Design: Aircraft Switches Market

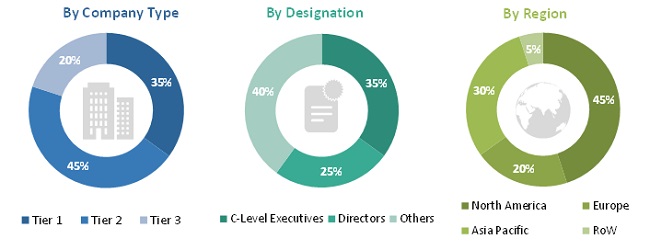

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Assumptions for the Research Study

Figure 9 Cabin Segment Projected to Lead Aircraft Switches Application Market During Forecast Period

Figure 10 Automatic Segment Projected to Dominate Aircraft Switches Type Market During Forecast Period

Figure 11 Aftermarket Segment Projected to Hold Larger Share in Aircraft Switches End Use Market During Forecast Period

Figure 12 Fixed-Wing Segment Projected to Hold Largest Share in Aircraft Switches Platform Market During Forecast Period

Figure 13 North America Projected to Account for Largest Share in Aircraft Switches Market During Forecast Period

Figure 14 Increasing Use of Electronics in Aircraft Systems Drives Growth of Aircraft Switches Market

Figure 15 Cabin Segment Projected to Lead the Aircraft Switches Market During the Forecast Period

Figure 16 Automatic Switches Segment Expected to have the Highest CAGR During the Forecast Period

Figure 17 India Estimated to have the Highest CAGR in the Aircraft Switches Market

Figure 18 Market Dynamics of the Aircraft Switches Market

Figure 19 Supply Chain: Direct Distribution is the Preferred Strategy of Prominent Aircraft Switch Manufacturers

Figure 20 Aircraft Switches Market Size, By Type, 2019–2025 (USD Million)

Figure 21 Aircraft Switches Market Size, By Application, 2019–2025 (USD Million)

Figure 22 Aircraft Switches Market Size, By End Use, 2019-2025 (USD Million)

Figure 23 Aircraft Switches Market, By Platform, 2019–2025 (USD Million)

Figure 24 North America Estimated to Account for the Largest Share of the Aircraft Switches Market in 2019

Figure 25 North America: Aircraft Switches Market Snapshot

Figure 26 Europe: Aircraft Switches Market Snapshot

Figure 27 Asia Pacific: Aircraft Switches Market Snapshot

Figure 28 Key Developments By Leading Players in Aircraft Switches Market Between 2014 and 2019

Figure 29 Aircraft Switches Market OEM Competitive Leadership Mapping, 2018

Figure 30 Ranking of Top Players in Aircraft Switches Market, 2018

Figure 31 Safran: Company Snapshot

Figure 32 Safran: SWOT Analysis

Figure 33 Curtiss-Wright: Company Snapshot

Figure 34 Esterline Technologies: Company Snapshot

Figure 35 Honeywell: Company Snapshot

Figure 36 Honeywell: SWOT Analysis

Figure 37 Meggitt: Company Snapshot

Figure 38 Meggitt: SWOT Analysis

Figure 39 United Technologies Corporation: Company Snapshot

Figure 40 United Technologies Corporation: SWOT Analysis

Figure 41 Eaton Corporation: Company Snapshot

Figure 42 Eaton Corporation: SWOT Analysis

Figure 43 Ametek: Company Snapshot

Figure 44 TE Connectivity: Company Snapshot

Figure 45 TE Connectivity: SWOT Analysis

Figure 46 Raytheon: Company Snapshot

The study considered major activities to estimate the current market size for aircraft switches. Exhaustive secondary research was undertaken to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, and Aerospace Magazine were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The aircraft switches market comprises several stakeholders such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by various end users, such as OEMs and aftermarket players. The supply side is characterized by advancements in aircraft switches component technology and the development of aircraft switches systems. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft switches market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details.

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the aircraft switches market.

Report Objectives

- To define, describe, and forecast the aircraft switches market based on end user, platform, application, type, and region

- To identify and analyze key drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To identify technology trends that are currently prevailing in the market

- To analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To forecast the size of different segments of the with respect to various regions, including North America, Europe, Asia Pacific, and Rest of the World, along with key countries in each of these regions

- To profile leading players in the market on the basis of their product portfolios, financial positions, and key growth strategies

- To analyze the degree of competition in the aircraft switches market by identifying key growth strategies, such as acquisitions, new product launches, contracts, joint ventures, partnerships, collaborations, and agreements adopted by the leading market players

- To provide a detailed competitive landscape of the market, along with a market ranking analysis of key players

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Aircraft Switches Market