Aircraft Hydraulic Systems Market by Type (Closed-center, Open-center), End-user (Line-fit, Retrofit), Platform (Fixed Wing, Rotary Wing, Unmanned Aerial Vehicles), Component, Application and Region - Global Forecast to 2027

Update: 11/28/2024

Aircraft Hydraulic systems Market Size & Growth

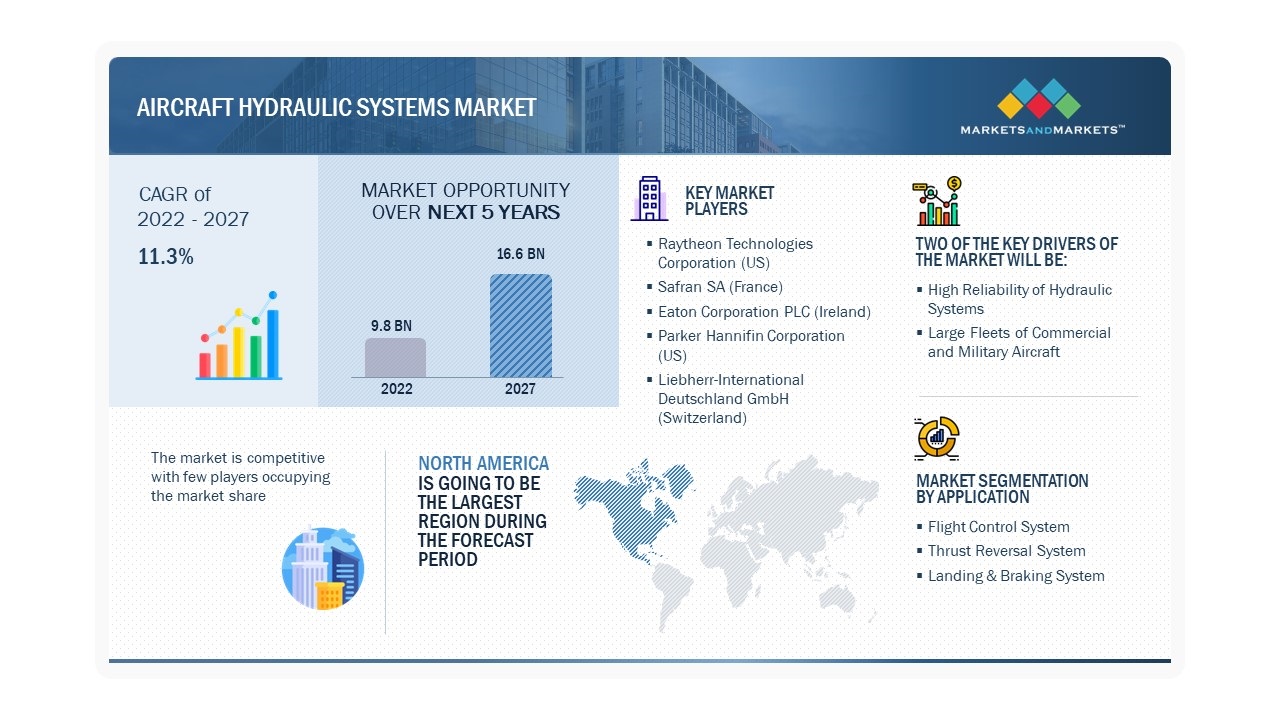

The Global Aircraft Hydraulic System Market Size was valued at USD 9.8 Billion in 2022 and is estimated to reach USD 16.6 Billion by 2027, growing at a CAGR of 11.3% during the forecast period.

The key factor driving the growth of the worldwide Aircraft Hydraulic Systems Industry is the increase in global air traffic and the spike in new aircraft deliveries. Additionally, the demand for advanced aircraft hydraulic systems onboard modern aircraft is driving the adoption of aircraft hydraulic systems, which saves weight and lowers operating and maintenance costs for end users.

Aircraft Hydraulic Systems Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Hydraulic systems Market Trends

Driver: Enhanced Inherent benefits of integrating hydraulic systems

There are certain benefits of integrating hydraulic systems to power the critical systems of an aircraft, such as flight controls. Hydraulic systems can offer a higher power to weight ratio than a mechanical or electrical systems as a piston with a small surface area connected to another with a larger surface area will generate more units of force than its original surface area. Moreover, hydraulic systems generate around 25% less heat than their electrical counterparts, eliminating the need to install bulky cooling mechanism and reducing the overall weight of the system.

Since all the aircraft system are designed for a specific application with a clearly defined load, an overloading scenario may lead to scrapping of the older system and may require installation of a replacement with larger load capacity, incurring added costs. However, a properly designed hydraulic system can be overloaded up to 50% or more and still can operate effectively. In case the load is to be increased, the pump is required to be re-stroked to avoid overloading the motor. This can result in reduction of dynamic performance to handle the larger load. However, at higher load, installation of a larger motor-pump assembly can help increase performance compared to the original. Such operational benefits drive the adoption and integration of hydraulic systems for certain critical systems of the aircraft

Restraint: Design Shortcomings of the hydraulics technology

The high load factor offered by hydraulic systems render them viable to be used in wheel brakes, landing gears, propellers, flight control surfaces, wing flaps, and spoilers. A hydraulic actuator uses a reservoir or electric pump that converts energy into mechanical motion, and are susceptible to fluid leakages, fire risks, and erosion of mechanical components due to hydraulic oil spills. There are other challenges associated with hydraulics. For instance, in case the system exceeds its maximum allowable operating temperature, it must be de-energized. The hydraulic systems are also highly susceptible to hydraulic fluid contamination and can result in the loss of hydraulic system efficiency, fluid leaks, excessive component wear, and premature component failure.

Opportunity: Advancements in hydraulic system components

High reliability, high power to weight ratio, and constant torque provided by hydraulic system have led to manufacturers develop lightweight system that can deliver high power. For instance, Airbus used the 5,000-psi hydraulic system to reduce the weight of the complete system. The system features reduced diameter of tubes and hoses, resulting in significant reduction in weight and efficient power transfer. Advancements in electro-hydraulic components are expected to boost the market, as the use of these system lead to significant weight reduction. Electro-hydraulic actuators have replaced the centralized hydraulic system with more localized system, which are controlled by electrical input, rather than mechanical linkages. These localized, small, and self-contained hydraulic system help reduce the overall weight of the aircraft, increase the efficiency, and reduce emissions. Furthermore, advanced electro-hydraulic components draw power only when in use and maintain pressure throughout, even when the pump is inactive. Hydraulic fluids used in aircraft have evolved to a greater extent. Their capability of being inert and stable at very low temperatures and very high temperatures has improved. However, hydraulic fluid accounts to significant weight of an aircraft. Research activities are being carried on lightweight fluid, which will help reduce the weight to a great extent.

Challenge: Higher weight profile of hydraulic systems

Aircraft hydraulic system consists of hydraulic fluid and all its components, which adds to significant weight of an aircraft. Hydraulic fluid and components such as actuators, pumps, tubes, and hoses add to significant weight of the system. All these components are major part of the system and cannot be eliminated. Thus, reduction in weight is a great challenge for aircraft hydraulic system. Reduced aircraft weight helps in the reduction of fuel consumption as well as emissions. Lightweight and more efficient hydraulic fluid, reduction in the length of tubes and hoses, and reduction in actuators can help reduce weight to a certain extent. However, as compared to electrical system the overall system weight is still greater. Hence, reduction in the weight of aircraft hydraulic system is a major challenge.

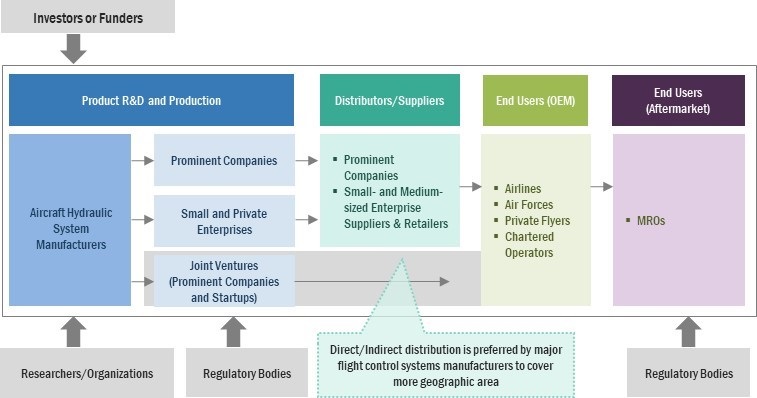

Aircraft Hydraulic Systems Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of aircraft hydraulic systems. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies include Raytheon Technologies Corporation (US), Parker-Hannifin Corporation (US), Safran SA (France), Eaton Corporation Plc (Ireland), Liebherr-International Deutschland GmbH (Switzerland), Woodward, Inc. (US), Triumph Group, Inc. (US), Moog Inc. (US), Arkwin Industries Inc. (US), and Beaver Aerospace & Defense, Inc. (US). Airlines, global air forces, business jet users, private flyers, MROs, and chartered operators are some of the leading consumers of aircraft hydraulic systems.

Aircraft Hydraulic systems Market Segments

Actuators to dominate market share during the forecast period

Based on components, the aircraft hydraulic systems market has been segmented into actuators, pumps, reservoir, valves, accumulator, hoses, pipes & connectors, filters, and hydraulic fluid. One of the primary factors propelling the actuator segment is the increased demand of passengers for air travel. The inherent benefits of employing hydraulic actuators for high-force applications encourage its employment in aircraft.

Closed-Center to lead the market for aircraft hydraulic systems during the forecast period

Based on Type, the aircraft hydraulic systems market has been segmented into closed-center and open-center. The high reliability of closed-center hydraulic systems has resulted in their rapid adoption in a majority of new aircraft. Additionally, the evolving regulations that aim to enhance the safety offered by aircraft and standardize the functionalities offered by certain types of aircraft are anticipated to drive the fleet modernization programs and thereby create demand for closed center hydraulic systems.

Fixed Wing segment to witness higher demand during the forecast period

Based on Platform, the aircraft hydraulic systems market has been classified into fixed wing, rotary wing, and unmanned aerial vehicles. Rapid growth in worldwide passenger traffic is predicted to boost demand for fixed wing aircraft in both commercial and general aviation sectors, creating a parallel need for aircraft hydraulic systems for modern aircraft. Secondly, the manufacturers are developing the advanced aircraft hydraulic system to replacing heavy, traditional aircraft components.

Line fit to acquire the largest market share during the forecast period

Based on End User, the aircraft hydraulic systems market has been classified into line fir and retrofit. The ongoing fleet expansion programs of several end users, such as airlines and military operators, drive the line fit segment of the market. Several airlines are increasing the size of their fleets by investing in aircrafts that are lightweight and fuel-efficient.

Landing & braking system segment to hold major market share during the forecast period

Based on application, the aircraft hydraulic systems market has been classified into flight control system, thrust reversal system and landing & braking system. The increase in the air passenger travel will drive the aviation industry, that will proportionally enhance the market for the aircraft hydraulic systems. Strict restrictions governing passenger and aircraft safety have been implemented. Airlines all around the world are ordering new planes outfitted with cutting-edge technology to improve passenger safety. To meet airline demand, the aircraft industry is developing planes with improved systems and components. As the need for airlines grows, so will the demand for aircraft landing and braking systems.

Aircraft Hydraulic systems Market Regions

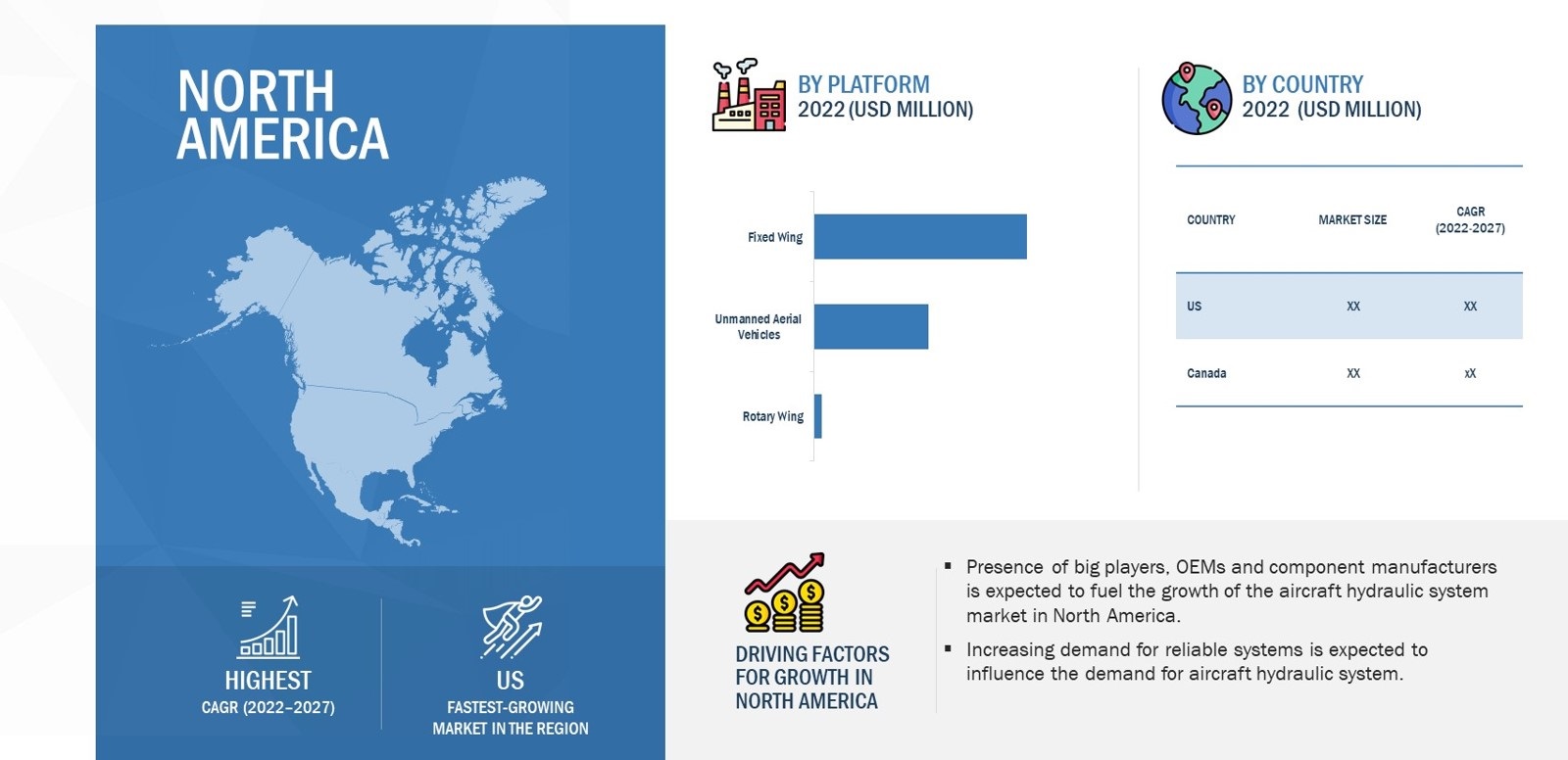

North America is projected to witness the highest market share during the forecast period

North America leads the aircraft hydraulic systems market due Presence of big players, OEMs, and component manufacturers are some of the factors expected to boost the growth of the aircraft hydraulic systems market in North America. These players continuously invest in R&D to develop aircraft hydraulic systems with improved efficiency and reliability. Additionally, the growing demand for lightweight aircraft for civil & commercial applications and their increasing utility in the defense sector for carrying out persistent transport and surveillance activities are additional factors influencing the growth of the North America aircraft hydraulic systems market. North America has a high proportion of consumer spending in the world, leading to increased demand for air travel from the region. Market growth in the North American region is expected to be fueled by the increase in the number of deliveries of wide-body and narrow-body aircraft during the forecast period to fulfill the demand for air travelers. Key manufacturers and suppliers of aircraft hydraulic systems in this region include Raytheon Technologies Corporation (US), Parker Hannifin Corporation (US), Woodward, Inc. (US), Triumph Group, Inc. (US), Moog Inc. (US), Arkwin Industries Inc. (US), and Beaver Aerospace & Defense, Inc. (US).

Aircraft Hydraulic Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Aircraft Hydraulic Systems Companies: Top Key Market Players

The Aircraft Hydraulic Systems Companies is dominated by globally established players such as:

- Raytheon Technologies Corporation (US)

- Parker Hannifin Corporation (US)

- Safran SA (France)

- Eaton Corporation Plc (Ireland)

- Liebherr-International Deutschland GmbH (Switzerland)

- Woodward, Inc. (US)

- Triumph Group, Inc. (US)

- Moog Inc. (US)

- Arkwin Industries Inc. (US)

- Beaver Aerospace & Defense, Inc. (US)

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 9.8 Billion in 2022 |

|

Projected Market Size |

USD 16.6 Billion by 2027 |

|

Growth Rate (CAGR) |

11.3% |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Component, By Type, By End User, By Platform, By Application, By Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies Covered |

Raytheon Technologies Corporation (U.S.), Parker-Hannifin Corporation (U.S.), Safran S.A. (France), Eaton Corporation Plc (Ireland), Liebherr-International Deutschland GmbH (Switzerland), Woodward, Inc. (U.S.), Triumph Group, Inc. (U.S.), Moog Inc. (U.S.), Arkwin Industries Inc. (U.S.), and Beaver Aerospace & Defense, Inc. (U.S.), among others |

Aircraft Hydraulic Systems Market Highlights

This research report categorizes the Aircraft Hydraulic Systems Market based on Component, Type, End User, Platform, Application and Region.

|

Aspect |

Details |

|

Aircraft Hydraulic Systems Market, By Component |

|

|

Aircraft Hydraulic Systems Market, By Type |

|

|

Aircraft Hydraulic Systems Market, By End User |

|

|

Aircraft Hydraulic Systems Market, By Platform |

|

|

Aircraft Hydraulic systems Market, By Application |

|

|

Aircraft Hydraulic systems Market, By Region |

|

Recent Developments

- In 2019, Sichuan Lingfeng Aviation Hydraulic Machinery Co., Ltd. (China) announced the invention of replaceable split hydraulic damper. Particular attention is drawn to a modularized replaceable split hydraulic damper used in a helicopter rotor system.

Frequently Asked Questions (FAQs) Addressed by the Report

What are your views on the growth prospect of the aircraft hydraulic systems market?

The aircraft hydraulic system market is being driven by end-user fleet modernization initiatives, as well as an expanding order book and the delivery of new-generation aircraft.

What are the key sustainability strategies adopted by leading players operating in the aircraft hydraulic systems market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft hydraulic systems market. The major players include Raytheon Technologies Corporation (US), Parker Hannifin Corporation (US), Safran SA (France), Eaton Corporation Plc (Ireland), Liebherr-International Deutschland GmbH (Switzerland), Woodward, Inc. (US), Triumph Group, Inc. (US), Moog Inc. (US), Arkwin Industries Inc. (US), and Beaver Aerospace & Defense, Inc. (US). These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Aircraft hydraulic systems market?

Some of the major emerging technologies and use cases disrupting the market include more electric technology, digital fly-by-wire, and the use of fully electric architecture in aviation applications.

Who are the key players and innovators in the ecosystem of the aircraft hydraulic systems market?

The key players in the Aircraft Hydraulic Systems Market include Raytheon Technologies Corporation (US), Parker Hannifin Corporation (US), Safran SA (France), Eaton Corporation Plc (Ireland), Liebherr-International Deutschland GmbH (Switzerland), Woodward, Inc. (US), Triumph Group, Inc. (US), Moog Inc. (US), Arkwin Industries Inc. (US), and Beaver Aerospace & Defense, Inc. (US).

Which region is expected to hold the highest market share in the aircraft hydraulic systems market?

The aircraft hydraulic systems market in North America is projected to hold the highest market share during the forecast period due to the presence of several large aircraft hydraulic systems manufacturers in the region.

How electro-hydraulic systems will proliferate and eliminate the use of singular hydraulic systems?

The electro-hydraulic system is a self-contained hydraulic system consisting of brushless direct current motor, bi-directional pump, accumulator, control elements, hydraulic actuator, and a controller built on a central manifold. Electro-hydraulic systems provide advantages such as increased efficiency, reduced leakages, and less overall weight as compared to that of the conventional hydraulic system.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

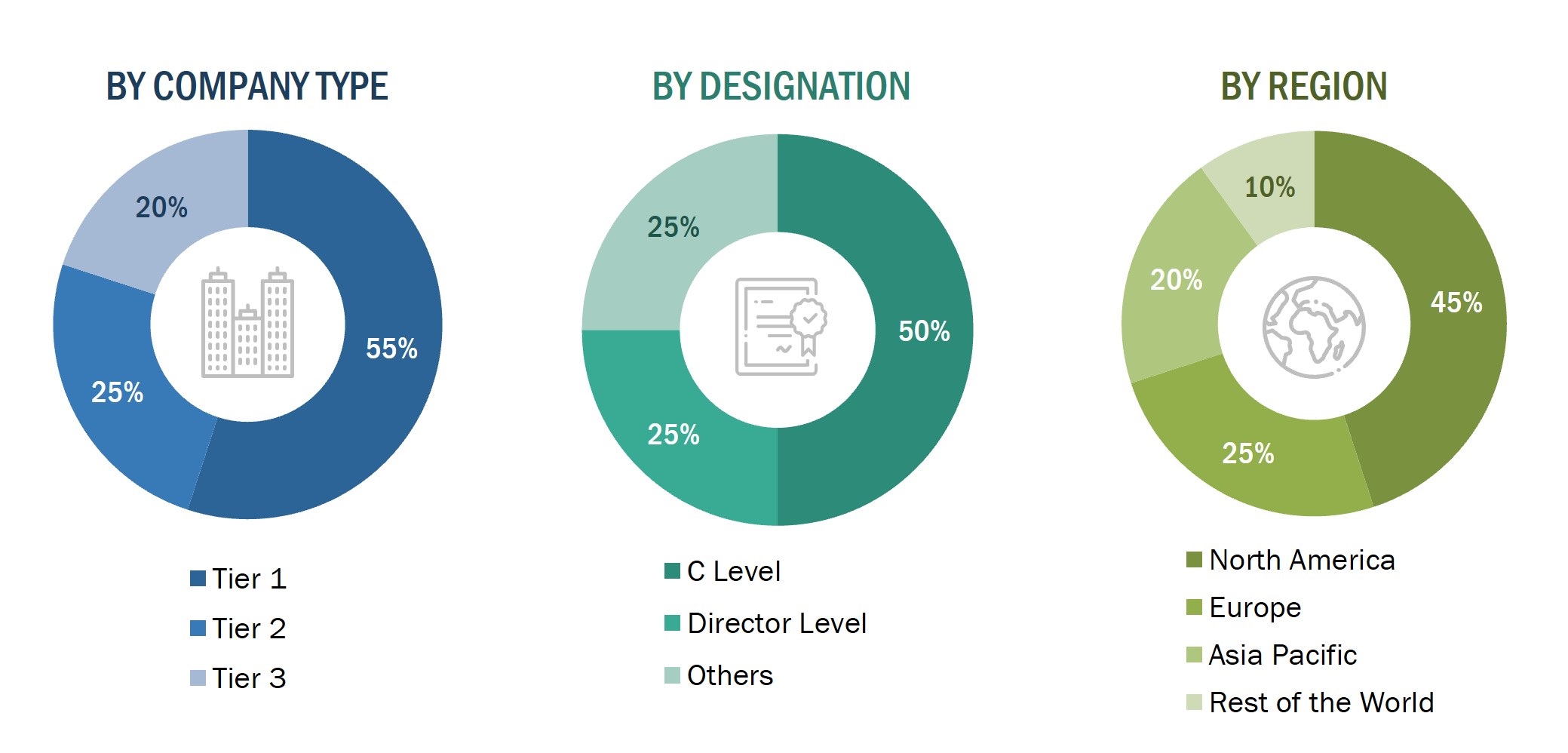

The study involved four major activities in estimating the current market size for the aircraft hydraulic systems market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

The aircraft hydraulic systems market comprises several stakeholders, such as raw material providers, aircraft hydraulic systems manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in actuator technologies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft hydraulic systems market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

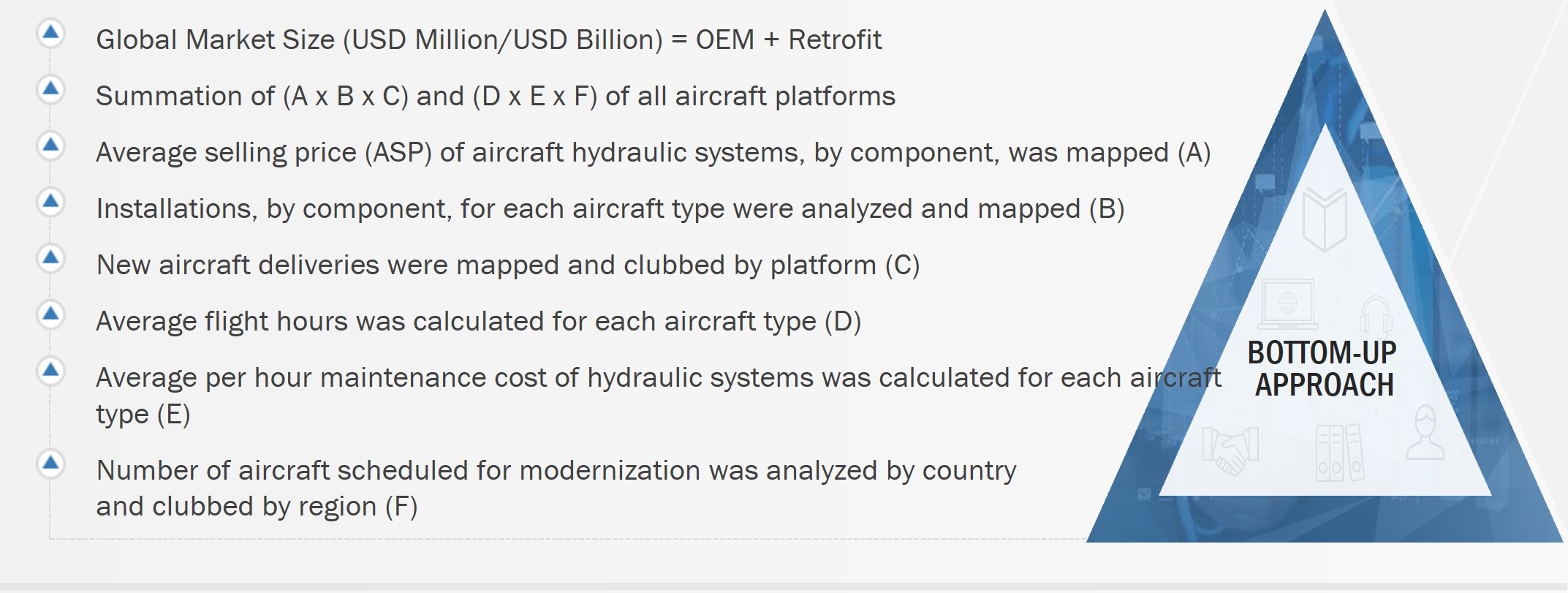

Market size estimation methodology: Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the aircraft hydraulic systems market from the demand for such systems and components by end users in each country, and the average cost of integration for both, line fit and retrofit installation was multiplied by the new aircraft deliveries and MRO fleet, respectively. These calculations led to the estimation of the overall market size.

Market size estimation methodology: Top-down approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

The most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

A market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With data triangulation procedures and validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the aircraft Hydraulic systems market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the aircraft Hydraulic systems market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, and Rest of the World, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Hydraulic Systems Market

I am working on a supply chain task that requires identifying the components/materials that go into an aileron hydraulic actuator for the F-35 jet. Can you help?