Aircraft DC-DC Converter Market by Application, Aircraft Type (Fixed Wing, Rotary Wing, Unmanned Aerial Vehicles, Air Taxis), Form Factor, Input Voltage, Output Voltage, Output Power, Output Number, Type, and Region (2021-2030)

Updated on : Oct 22, 2024

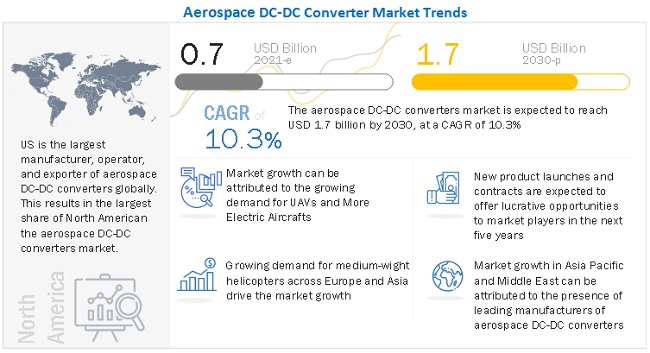

The global aircraft DC-DC converter market size is projected to grow from USD 0.7 billion in 2021 to USD 1.7 billion by 2030, at a CAGR of 10.3% from 2021 to 2030. The market is driven by factors such as development of More Electric Aircrafts (MEAs) and Drone Taxis, growing demand for commercial aircrafts and advancements in interior systems of Business Jets and helicopters.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Aircraft DC-DC converter System Market

The aircraft DC-DC converter market includes major players TDK Lambda Corporation (Japan), Murata Manufacturing Co. Ltd. (Japan), Texas Instruments Incorporated (US), Vicor Corporation (US), and Advanced Energy (US). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, Africa, and Latin America. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 has affected the power converter production and services for aerospace and defense sector globally in 2020.

Because of COVID-19 outbreak, the orders and deliveries of aircraft DC-dc converters experienced a sudden dip. As a result, the negative impact is expected on the aircraft DC-DC converters market which recovers slowly in 1st quarter of 2021.

Aircraft DC-DC Converter Market Dynamics

Driver: introduction to new programs in business jets

Business jet manufacturers are focusing on improvements in the passenger experience. Upgrading avionics, cabin interiors, and aircraft systems are some of the areas of focus. The Praetor 500 and the Praetor 600 launched by Embraer and Global 5500 and Global 6500 by Bombardier in 2018 are some of the business jets launched with such upgraded infrastructures. This has resulted in the introduction of new aircraft programs. New aircraft programs demand the replacement of existing aircrafts and attract new buyers. The sales of older designs slow down with the introduction of new aircrafts with advanced features and designs. This leads to the growth of the business jet market. The demand for electrical components such as DC-DC converters in newly designed aircrafts is higher, owing to which the aircraft DC-DC converters market will also witness growth.

Opportunity: Rising demand for business jets from emerging markets

The emerging economies of the world contribute majorly to the growth of the business jets market. Countries such as India, China, Australia, Saudi Arabia, and Nigeria are the growing markets for business jets manufacturers. Since 2014, these countries have regained their economy after the recession of 2009 at a stable pace, which encourages manufacturers to grow their business for business jets. Enhancements in the interior of the business jets also attract new customers. This leads to a huge demand for DC-DC converters used in the aerospace sector, which are used in several cockpit and other luxury equipment of business jets.

Challenges: Restrictions in the commercial use of drones

The drone industry is facing one major problem, which would be the regulations imposed by government agencies on the use of drones for civil and commercial applications. For example, across Europe, the operation of drones is regulated by the European Aviation Safety Agency (EASA). To operate the drone, these certifications are mandatory. This restricts innovative ideas such as drone taxis to operate in a full-fledged manner. DC-DC converters are used in various sections of the controller as well as the drone for providing continuous, uninterrupted DC supply. As a result, there is uncertainty over the demand for DC-DC converters used in such systems.

Demand for non-isolated product type aircraft DC-DC converter system will drive the demand for product type segment

The non-isolated aircraft DC-DC converters is expected to grow the largest by value. In non-isolated DC-DC converters, the current can flow between input and output pins. Non-isolated DC-DC converters can easily be fitted into small-size applications. When parameters such as size and cost are considered, non-isolated converters are preferred over isolated DC-DC converters. Based on performance characteristics, DC-DC converters are buck, boost, and buck-boost DC-DC converters. Non-isolated DC-DC converters in aircraft are used in several sub-systems of UAVs and aircraft, such as cockpit lighting.

In the aerospace and defense industry, 10 to 20 Amp rated non-isolated DC-DC converters are used. These converters can operate in wide temperatures from -40°C to 85°C. All DC-DC converters used in the aerospace and defense industry are of military standard. Texas Instruments’ LM5161 is one such non-isolated aircraft DC-DC converter used in UAVs.

The UAV sector is projected to witness a higher CAGR during the forecast period

The Unmanned Aerial Vehicles (UAVs) sector seems to have had the least impact because of the COVID-19 outbreak. The COVID-19 pandemic has created new opportunities for the UAVs market. The revenue generated by the commercial drones market, which recorded USD 1,121 million in 2021, is expected to grow up to USD 2,407 million in 2026 with CAGR of 16.5%.

30-99W output power aircraft DC-DC converter projected to witness highest CAGR during the forecast period

Aircraft DC-DC converters market with output power in the range 30 to 99 watts is expected to grow 247 Million USD in 2021 to 651 Million USD in 2030 with CAGR of 11.3%. Aircraft DC-DC converters working in the range of power output of 30-99W usually have a very wide input range. They can be used to power equipment that require to work under fluctuating input voltages. They work efficiently under interrupted power supply and are designed to work under rugged environmental conditions. Such converters in the aerospace industry are used for critical applications such as environmental control systems. HR120 from Crane Co. is one such DC-DC converter used in the aviation industry.

The 15V output voltage DC-DC converter is projected to witness the highest CAGR during the forecast period

The 15v output voltage segment is projected to grow at the highest CAGR rate for the aircraft DC-DC converter market during the forecast period. One of the applications where 15 volts DC supply is required is in the Electric Engine Controller (EEC). These 15 volts DC-DC converters are isolated converters. Infineon’s Electronic Power Conditioner (EPC) is one such product designed to provide 15 volts regulated DC output for aircrafts.

The Brick form type aircraft DC-DC converter is projected to witness the highest CAGR during the forecast period

The Brick type aircraft DC-DC converter is projected to grow at the highest CAGR for the aircraft DC-DC converter market during the forecast period. Brick type DC-DC converters are known for their high-power density with lower operational noise. These converters also provide advanced power processing and a very compact package. They provide a wide range of input and output voltage and have higher operational efficiency. Brick DC-DC converters offer products in different sizes, fulfilling the need for a compact DC-DC converter. These can be further categorized into full brick, half brick, quarter brick, eighth brick, and sixteenth brick.

The Multiple output number aircraft DC-DC converter is projected to witness the highest CAGR during the forecast period

The multiple output DC-DC converters are projected to grow at the highest CAGR rate for the DC-DC converter market during the forecast period. Multiple output DC-DC converters in the aviation industry are used in avionics systems in cockpits, where the same voltage level is required for driving many sub-systems. One such sub-system is the cockpit lighting system in aircrafts. They work for input voltage ranges from 18 volts to 32 volts DC and are capable of providing output DC voltage in the range of 3.3 to 18 volts. These converters have an operating efficiency of as high as 98%. RECOM Power’s MD200 provides one 5Vdc output and two 12Vdc outputs.

The Flight control system application is projected to require the highest number of aircraft DC-DC converters during the forecast period

The market for aircraft DC-DC converters used in flight control systems is expected to grow at the highest CAGR. Flight control systems refer to the system that controls all the functionalities of the aircraft that are helpful in take-off, landing, changing the direction, etc. Flight control systems allow the pilot to operate all the mentioned operations from the cockpit by using switches. These switches send the control signals to the systems, and the systems then work accordingly. The control signals are to be modified by direction in fly-by-wire flight control systems as per the specific systems requirement, which is achieved by DC-DC converters. DC-DC converters also provide isolation which prevents any harm in the cockpit due to an electrical current or voltage surge in the reverse direction in fly-by-wire flight control systems.

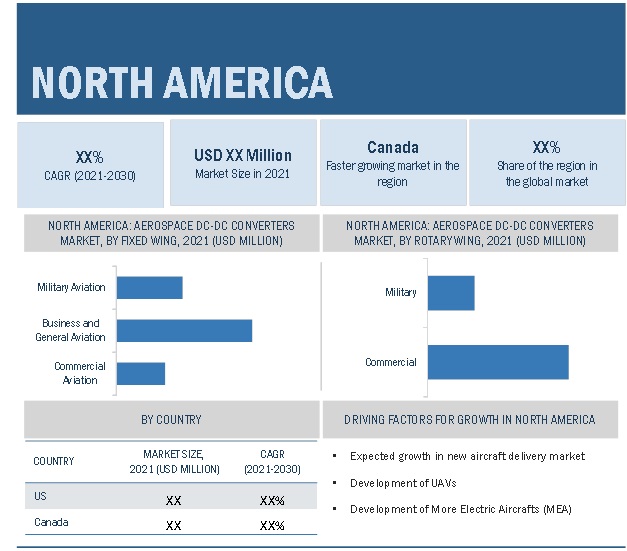

The North America market is projected to contribute the largest share from 2021 to 2030

North America is projected to be the largest regional share of the global DC-DC converter market during the forecast period. In the North America section, the aircraft DC-DC converters market is majorly divided into two countries: US and Canada. The US is one of the leaders in the aircraft DC-DC converters industry. Major companies such as Advanced Energy, Vicor Corp., Texas Instruments, Crane Co., XP Power, Bel Fuse Inc., and Astronics, and small-scale private companies such as Pico Electronics, Abbott Tech, VPT, Martek Power, KGS Electronics, SYNQOR, and AJ’s Power Source have their headquarters in the US. The above-mentioned major players continuously invest in the R&D of new & improved designs of aerospace and defense-standard DC-DC converters.

The progress of aerospace and defense standard DC-DC converters in North America is growing because of the steady demand in the aerospace sector and the development of new and advanced UAVs. Also, the development of More Electric Aircraft (MEA) demands new and improved aerospace and military-standard DC-DC converters.

Key Market Players:

The aircraft DC-DC converter market is dominated by a few globally established players such as TDK Lambda Corporation (Japan), Texas Instruments Incorporated (US), Vicor Corp. (US), MURATA (Japan) and Infineon Tecnologies AG (Germany)

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017–2030 |

|

Base year considered |

2021 |

|

Forecast period |

2021-2030 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Aircraft Type, By Form Factor, By Input Voltage, By Output Voltage, By Output Power, By Output Number, By Type, By Application, By Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, and Rest of the World |

|

Companies covered |

TDK Lambda Corporation (Japan), Advanced Energy Industries Inc. (US), Murata Manufacturing Co. Ltd. (Japan), Infineon Technologies AG (Germany), and Vicor Corporation (US) |

The study categorizes the DC-DC converter market based on Aircraft Type, Form Factor, Input Voltage, Output Voltage, Output Power, Output Number, Type, Application, and Region.

By Aircraft Type

- Fixed Wing

- Rotary Wing

- Unmanned Aerial Vehicles

- Air Taxis

By Form Factor

- Chassis Mount

- Encapsulated

- Brick

- Others

By Input Voltage

- <28V

- 28-75V

- 75-270V

- 270-800V

- >800V

By Output Voltage

- <5V

- 12V

- 15V

- 24V

- 48V

- >48V

By Output Power

- <10W

- 10-29W

- 30-99W

- 100-250W

- 250-500W

- 500-1,000W

- >1,000W

By Output Number

- Single Output

- Dual Output

- Multiple Output

By Type

- Isolated

- Non-Isolated

By Application

- Avionics

- Flight Control System

- Surveillance System

- Environmental Control System

- Energy Storage System

- Others

By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Rest of the World

Recent Developments

- In April 2021, Texas Instruments launched new synchronous DC/DC buck controllers called LM25149 and LM25149-Q1. These products enable engineers to shrink the size of the power-supply solution and lower its electromagnetic interference (EMI). LM25149 converters will be used in a wide range of applications, including drones.

- In March 2021, Crane Aerospace developed a new 4 kW high voltage, wide input, to 28V output regulated DC-DC power converter that can be used in multiple platforms such as aviation, eVTOL, and military ground vehicles.

- In March 2021, Cincon introduced the latest DC/DC CHASSIS MOUNT CFB750-300S-CMFD Series. With a high input range of 200~425VDC input range (300V nominal), this new product is a chassis-mountable DC-DC converter that offers 750 watts of output power at single output voltages of 12, 15, 24, 28, 36, and 48VDC, with 3000Vac isolation. The product is built with MIL-STD-217F, which is suitable for defense applications as well.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the aircraft DC-DC converter market?

The aircraft DC-DC converter market is expected to grow substantially owing to the technological development in designing of the new models of aircrafts and drones.

What are the key sustainability strategies adopted by leading players operating in the aircraft DC-DC converter market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft DC-DC converter market. The major players include TDK Lambda Corporation (Japan), Texas Instruments Incorporated (US), Vicor corp. (US), Advanced Energy (US) and Infineon Technologies AG (Germany), these players have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the aircraft DC-DC converter market?

Some of the major emerging technologies and use cases disrupting the market include Compact size, low power and low noise DC-DC converters

Who are the key players and innovators in the ecosystem of the aircraft DC-DC converter market?

The key players in the aircraft DC-DC converter market include TDK Lambda Corporation (Japan), Texas Instruments Incorporated (US), Vicor corp. (US), MURATA (JApan) and Infineon Tecnologies AG (Germany).

Which region is expected to hold the highest market share in the aircraft DC-DC converter market?

DC-DC converter market in North America is projected to hold the highest market share during the forecast period. . The key factor responsible for North America, leading the aircraft DC-DC converter market owing to the rapid growth of the More Electric Aircrafts (MEAs) and advancements of Drones in the region. The increasing demand for aircraft DC-DC converter and the presence of some of the leading players operating in the market, such as TDK Lambda Corporation, Murata Manufacturing Co. Ltd, FDK Corporation, are expected to drive the aircraft DC-DC converter market in North America. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 50)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AEROSPACE DC-DC CONVERTERS MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN THE AEROSPACE DC-DC CONVERTERS MARKET

1.5 CURRENCY & PRICING

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 54)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET DEFINITION & SCOPE

2.2.2 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.2 AEROSPACE DC-DC CONVERTERS MARKET FOR VERTICALS

FIGURE 4 MARKET SIZE CALCULATION FOR VERTICALS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.3 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 TRIANGULATION & VALIDATION

FIGURE 7 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 ASSUMPTIONS FOR THE RESEARCH STUDY

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 64)

FIGURE 8 AVIONICS SEGMENT TO ACCOUNT FOR THE LARGEST SHARE OF THE AEROSPACE DC-DC CONVERTERS MARKET IN 2021

FIGURE 9 AEROSPACE DC-DC CONVERTERS MARKET, BY TYPE, 2021

FIGURE 10 BRICK TO DOMINATE THE AEROSPACE DC-DC CONVERTERS MARKET IN 2021

FIGURE 11 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 67)

4.1 BRIEF OVERVIEW OF THE AEROSPACE DC-DC CONVERTERS MARKET

FIGURE 12 RISING DEMAND FOR UAVS EXPECTED TO DRIVE THE MARKET

4.2 AEROSPACE DC-DC CONVERTERS MARKET, BY AIRCRAFT TYPE

FIGURE 13 UAV SEGMENT PROJECTED TO LEAD THE MARKET

4.3 AEROSPACE DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER

FIGURE 14 MULTIPLE SEGMENT TO DOMINATE THE MARKET

4.4 AEROSPACE DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE

FIGURE 15 28-75V SEGMENT TO DOMINATE FROM 2021 TO 2026

4.5 AEROSPACE DC-DC CONVERTERS MARKET, BY COUNTRY

FIGURE 16 AUSTRALIA PROJECTED TO BE THE FASTEST-GROWING MARKET DURING 2021–2030

5 MARKET OVERVIEW (Page No. - 70)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 AEROSPACE DC-DC CONVERTERS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Introduction to new programs in business jets

5.2.1.2 Rise in aircraft renewals and deliveries

FIGURE 18 AIRCRAFTS DELIVERED BY BOEING AND AIRBUS, BY YEAR

5.2.1.3 Growing demand for unmanned aerial vehicles

FIGURE 19 COMMERCIAL DRONE MARKET PREDICTION

5.2.1.4 Increasing demand for military helicopters

TABLE 2 INCREASING MILITARY EXPENDITURE BY EMERGING ECONOMIES, 2011-2018 (USD BILLION)

5.2.2 RESTRAINTS

5.2.2.1 Limited Adoption of drones due to political, economic, social, technological, and legal factors

5.2.2.2 Lengthy period of product certification from aviation authorities

5.2.2.3 Defense budget reductions in developed nations

TABLE 3 DECREASING MILITARY EXPENDITURE BY DEVELOPED ECONOMIES, 2011-2018 (USD BILLION)

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing environmental concerns

5.2.3.2 Rising demand for business jets from emerging markets

5.2.4 CHALLENGES

5.2.4.1 Restrictions in the commercial use of drones

5.3 COVID-19 IMPACT SCENARIOS

5.4 IMPACT OF COVID-19 ON THE AEROSPACE DC-DC CONVERTERS MARKET

TABLE 4 COVID-19 IMPACT ON PASSENGER NUMBERS AND PASSENGER REVENUE

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR THE AEROSPACE DC-DC CONVERTERS MARKET

FIGURE 20 REVENUE SHIFT IN THE AEROSPACE DC-DC CONVERTERS MARKET

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 21 AEROSPACE DC-DC CONVERTERS ECOSYSTEM

TABLE 5 AEROSPACE DC-DC CONVERTERS MARKET ECOSYSTEM

5.7 VOLUME DATA

TABLE 6 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING AND ROTARY WING AIRCRAFT TYPE (UNITS)

5.8 TARIFF REGULATORY LANDSCAPE FOR THE POWER ELECTRONICS INDUSTRY

5.9 TRADE DATA

5.10 PORTER’S FIVE FORCES MODEL

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 COMPETITION IN THE INDUSTRY

5.11 TECHNOLOGY ANALYSIS

5.11.1 DEVELOPMENT OF MORE ELECTRIC AIRCRAFTS

5.11.2 REDUCTION IN THE SIZE OF MILITARY STANDARD CONVERTERS

5.12 USE CASES

5.12.1 DC-DC CONVERTERS FOR MORE ELECTRIC AIRCRAFT (MEA)

5.12.2 POWERING DRONES WITH WIDE VIN DC-DC CONVERTERS

5.13 OPERATIONAL DATA

TABLE 7 NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION, 2019-2038

6 INDUSTRY TRENDS (Page No. - 85)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN ANALYSIS

6.2.1 MAJOR COMPANIES

6.2.2 SMALL AND MEDIUM ENTERPRISES

6.2.3 END USERS/CUSTOMERS

6.3 EMERGING INDUSTRY TRENDS

6.3.1 REDUCTION IN SIZE

6.3.2 HIGHLY PRECISE TESTING PROCESS

6.3.3 HVDC TO LVDC POWER CONVERSION

6.3.4 DC-DC CONVERTER FOR ELECTRONIC ENGINE CONTROLLER (EEC)

6.4 INNOVATIONS AND PATENTS REGISTRATIONS, 2012-2021

6.5 IMPACT OF MEGATRENDS

7 AEROSPACE DC-DC CONVERTERS MARKET, BY AIRCRAFT TYPE (Page No. - 90)

7.1 INTRODUCTION

FIGURE 23 UAV SEGMENT TO COMMAND THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 8 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 9 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

7.1.1 IMPACT OF COVID-19 ON AIRCRAFT TYPES

7.1.1.1 Most impacted segment

FIGURE 24 AIRCRAFTS DELIVERED BY BOEING AND AIRBUS FROM 2016 TO 2021

7.1.1.2 Least impacted segment

7.2 FIXED

7.2.1 COMMERCIAL AVIATION

TABLE 10 FIXED WING: COMMERCIAL AVIATION DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 11 FIXED WING: COMMERCIAL AVIATION DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

7.2.1.1 Narrow body aircraft

7.2.1.1.1 narrow body aircrafts available, which are mostly manufactured by Airbus and Boeing

FIGURE 25 NARROW BODY AIRCRAFT DELIVERIES, BY YEAR

7.2.1.2 Wide body aircraft

7.2.1.2.1 DC-DC converters in wide body aircraft are used in APU and cabin lighting sub-systems as well

FIGURE 26 WIDE BODY AIRCRAFT DELIVERIES, 2019 TO 2021 (Q1)

7.2.1.3 Regional transport

7.2.1.3.1 Regional transport jets are smaller jets that ideally carry 80 to 100 passengers for shorter flights

7.2.2 BUSINESS JETS & GENERAL AVIATION

TABLE 12 FIXED WING: BUSINESS JETS & GENERAL AVIATION DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 13 FIXED WING: BUSINESS JETS & GENERAL AVIATION DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

7.2.2.1 Light aircraft

7.2.2.1.1 Light aircrafts are used for person or freight transportation, sightseeing

7.2.2.2 Business jets

7.2.2.2.1 The business jets market is experiencing growth

7.2.3 MILITARY AVIATION

TABLE 14 FIXED WING: MILITARY AVIATION DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 15 FIXED WING: MILITARY AVIATION DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

7.2.3.1 Fighter & combat aircraft

7.2.3.1.1 Fighter and combat aircrafts are small aircrafts with high speed and a tough interior

7.2.3.2 Transport aircraft

7.2.3.2.1 Military transport aircrafts are large aircrafts that carry military goods and other supplies

7.2.3.3 Special mission aircraft

7.2.3.3.1 Special mission aircrafts are used in air to ground, air to air, and maritime naval attacks worldwide

7.3 ROTARY WING

TABLE 16 ROTARY WING DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 17 ROTARY WING DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

7.3.1 CIVIL HELICOPTERS

7.3.1.1 Civil helicopters use DC-DC converters for down-conversion of voltage from 270Vdc generated

7.3.2 MILITARY HELICOPTERS

7.3.2.1 Military-standard DC-DC converters are used in helicopters for providing 12v, 15v, 24v, 28v

FIGURE 27 ESTIMATED REVENUE GENERATION BY THE MILITARY HELICOPTERS MARKET, 2019 TO 2025

7.4 UNMANNED AERIAL VEHICLES

TABLE 18 UAV DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 19 UAV DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

7.4.1 COMMERCIAL UAVS

FIGURE 28 COMMERCIAL DRONE MARKET PREDICTION

TABLE 20 COMMERCIAL UAV DC-DC CONVERTERS MARKET SIZE, BY PROPULSION TYPE, 2017–2020 (USD MILLION)

TABLE 21 COMMERCIAL UAV DC-DC CONVERTERS MARKET SIZE, BY PROPULSION TYPE, 2021–2030 (USD MILLION)

7.4.1.1 Electric propulsion

7.4.1.1.1 Electric propulsion drones make use of batteries that power the propellers

7.4.1.2 Non-electric Propulsion

7.4.1.2.1 Larger UAVs conventionally use propulsion, which is non-electric

7.4.2 MILITARY UAVS

7.4.2.1 UAVs are used for several applications such as surveillance, navigation

7.5 AIR TAXIS

TABLE 22 AIR TAXI DC-DC CONVERTERS MARKET SIZE, BY AUTONOMOUS TYPE, 2021–2030 (USD MILLION)

7.5.1 MANNED

7.5.1.1 Air taxi ambulance and air taxi transport will help this market witness a significant surge

7.5.2 UNMANNED

7.5.2.1 Unmanned air taxis are used for the transportation of goods

8 AEROSPACE DC-DC CONVERTERS MARKET, BY FORM FACTOR (Page No. - 103)

8.1 INTRODUCTION

FIGURE 29 THE BRICK SEGMENT TO COMMAND THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 23 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FORM FACTOR, 2017–2020 (USD MILLION)

TABLE 24 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FORM FACTOR, 2021–2030 (USD MILLION)

8.2 CHASSIS MOUNT

8.2.1 A CHASSIS MOUNT DC-DC CONVERTER IS DESIGNED TO OPERATE AT HIGHER TEMPERATURE RANGES

8.3 ENCAPSULATED

8.3.1 ENCAPSULATED DC-DC CONVERTERS CAN PROVIDE UP TO 10:1 INPUT RANGE, MAKING THEM RELIABLE

8.4 BRICK

8.4.1 FULL BRICK

8.4.1.1 Full brick DC-DC converters have a wide range of input voltage and a higher power density

8.4.2 HALF BRICK

8.4.2.1 Half brick converters are capable of operating in a wide input voltage range

8.4.3 QUARTER BRICK

8.4.3.1 These converters have an operational efficiency of about 85-90%.

8.4.4 EIGHTH BRICK

8.4.4.1 Eighth brick DC-DC converters in the aerospace and defense industry cater to distributed power architecture applications

8.4.5 SIXTEENTH BRICK

8.4.5.1 sixteenth brick converters provide high efficiencies and power densities

8.5 OTHERS

9 AEROSPACE DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE (Page No. - 107)

9.1 INTRODUCTION

FIGURE 30 THE 28-75V SEGMENT TO COMMAND THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 25 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY INPUT VOLTAGE, 2017–2020 (USD MILLION)

TABLE 26 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY INPUT VOLTAGE, 2021–2030 (USD MILLION)

9.2 <28V

9.2.1 DC-DC CONVERTERS WORK ON INPUT VOLTAGES BELOW 28 VOLTS; THESE ARE COMPACT AND PROVIDE SINGLE OUTPUT

9.3 28-75V

9.3.1 28-75V CONVERTERS ARE USED TO POWER AIRCRAFT SEATS

9.4 75-270V

9.4.1 75-270V CONVERTERS ARE DUAL OR MULTI-OUTPUT AND ARE ISOLATE

9.5 270-800V

9.5.1 DC-DC CONVERTERS WITH 270 TO 800 VOLTS DC INPUT VOLTAGE ARE MAJORLY USED IN CONVENTIONAL AIRCRAFTS

9.6 >800V

9.6.1 48 VOLTS DC IS NEEDED TO DRIVE FEW SYSTEMS IN MORE ELECTRIC AIRCRAFTS

10 AEROSPACE DC-DC CONVERTERS MARKET, BY OUTPUT VOLTAGE (Page No. - 111)

10.1 INTRODUCTION

FIGURE 31 THE 24V SEGMENT TO COMMAND THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 27 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY OUTPUT VOLTAGE, 2017–2020 (USD MILLION)

TABLE 28 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY OUTPUT VOLTAGE, 2021–2030 (USD MILLION)

10.2 5V

10.2.1 MICROCONTROLLERS USED IN DRONES WHICH REQUIRES 3.3 VOLTS INPUT

10.3 12V

10.3.1 DC-DC CONVERTERS OF 12 VOLTS OUTPUT ARE MOSTLY USED IN AVIONICS SYSTEMS

10.4 15V

10.4.1 15 VOLTS DC SUPPLY IS REQUIRED IS IN THE ELECTRIC ENGINE CONTROLLER (EEC)

10.5 24V

10.5.1 24 VOLTS DC SUPPLY IS REQUIRED TO GIVE POWER TO THE DC SUPPLY LINE IN AIRCRAFTS

10.6 48V

10.6.1 8 VOLTS DC IS NEEDED TO DRIVE FEW SYSTEMS IN MORE ELECTRIC AIRCRAFT

10.7 >48V

10.7.1 DC-DC CONVERTERS PROVIDING GREATER THAN 48 VOLTS DC ARE USED IN NEWER DESIGNS

11 AEROSPACE DC-DC CONVERTERS MARKET, BY OUTPUT POWER (Page No. - 115)

11.1 INTRODUCTION

FIGURE 32 THE 30-99W SEGMENT TO COMMAND THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 29 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY OUTPUT POWER, 2017–2020 (USD MILLION)

TABLE 30 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY OUTPUT POWER, 2021–2030 (USD MILLION)

11.2 <10W

11.2.1 DC-DC CONVERTERS ARE VERY SMALL IN SIZE AND ARE SUITABLE FOR CONVERTING POWER IN COMPACT BOARD SPACE

11.3 10-29W

11.3.1 AEROSPACE DC-DC CONVERTERS WORKING IN THIS RANGE OF 310-29W OUTPUT POWER IS IN THE POWER DISTRIBUTION OF SMALL UAVS

11.4 30-99W

11.4.1 DC-DC CONVERTERS WORKING IN THE RANGE OF POWER OUTPUT OF 30-99W USUALLY HAVE A VERY WIDE INPUT RANGE

11.5 100-250W

11.5.1 THESE DC-DC CONVERTERS ALSO HAVE ECOEFFICIENCY FROM 80% TO UP TO 90%.

11.6 250-500W

11.6.1 THESE HIGHLY RELIABLE AND RUGGED DC-DC CONVERTERS ARE USED IN A WIDE RANGE OF AEROSPACE APPLICATIONS

11.7 500-1000W

11.7.1 DEFENSE IS THE MAJOR APPLICATION COVERED BY DC-DC CONVERTERS WORKING UNDER THIS RANGE OF POWER OUTPUT

11.8 >1000W

11.8.1 DC-DC CONVERTERS WITH SUCH HIGH-POWER OUTPUT PROVIDE PRECISELY REGULATED OUTPUT AT VARIED VOLTAGES

12 AEROSPACE DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER (Page No. - 119)

12.1 INTRODUCTION

FIGURE 33 THE MULTIPLE SEGMENT TO COMMAND THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 31 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY OUTPUT NUMBER, 2017–2020 (USD MILLION)

TABLE 32 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY OUTPUT NUMBER, 2021–2030 (USD MILLION)

12.2 SINGLE OUTPUT

12.2.1 SINGLE OUTPUT DC-DC CONVERTERS ARE ONE OF THE MOST WIDELY USED IN THE AEROSPACE

12.3 DUAL OUTPUT

12.3.1 DUAL OUTPUT DC-DC CONVERTERS ARE MAINLY USED IN POWER DISTRIBUTION UNITS OF AIRCRAFTS AND LARGE UAVS

12.4 MULTIPLE OUTPUT

12.4.1 MULTIPLE OUTPUT DC-DC CONVERTERS IN THE AEROSPACE INDUSTRY ARE USED IN AVIONICS SYSTEMS IN COCKPITS

13 AEROSPACE DC-DC CONVERTERS MARKET, BY TYPE (Page No. - 122)

13.1 INTRODUCTION

FIGURE 34 THE NON-ISOLATED SEGMENT TO COMMAND THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 33 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 34 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY TYPE, 2021–2030(USD MILLION)

13.2 ISOLATED DC-DC CONVERTERS

13.2.1 ISOLATED DC-DC CONVERTERS PROVIDE ISOLATION BETWEEN THE INPUT AND OUTPUT SECTIONS OF THE DEVICE

13.3 NON-ISOLATED DC-DC CONVERTERS

13.3.1 NON-ISOLATED DC-DC CONVERTERS CAN EASILY BE FITTED INTO SMALL-SIZE APPLICATIONS.

14 AEROSPACE DC-DC CONVERTERS MARKET, BY APPLICATION (Page No. - 125)

14.1 INTRODUCTION

FIGURE 35 THE FLIGHT CONTROL SYSTEM SEGMENT TO COMMAND THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 35 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 36 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY APPLICATION, 2021–2030 (USD MILLION)

FIGURE 36 MARKET ESTIMATION FOR DRONES (USD BILLION)

14.2 AVIONICS

14.2.1 AEROSPACE DC-DC CONVERTERS ARE USED IN SEVERAL AVIONICS THAT ARE USED IN CIVIL AND MILITARY AIRCRAFTS

14.3 POWER DISTRIBUTION SYSTEMS

14.3.1 ALL THE AVIONICS FROM AIRCRAFTS GET POWER FROM THIS 28VDC NETWORK

14.4 FLIGHT CONTROL SYSTEMS

14.4.1 FLIGHT CONTROL SYSTEMS REFER TO THE SYSTEM THAT CONTROLS ALL THE FUNCTIONALITIES OF THE AIRCRAFT

14.5 SURVEILLANCE SYSTEMS

14.5.1 SURVEILLANCE SYSTEMS IN AVIATION ARE USED TO DETECT AIRCRAFTS AND SEND THE INFORMATION TO THE ATC

14.6 ENVIRONMENTAL CONTROL SYSTEMS

14.6.1 AN ENVIRONMENTAL CONTROL SYSTEM IS USED TO MAINTAIN AN APPROPRIATE TEMPERATURE IN THE COCKPIT

14.7 ENERGY STORAGE SYSTEMS

14.7.1 AN ENERGY STORAGE SYSTEM INCLUDES BATTERIES THAT STORE THE POWER AND SUPPLY IT TO THE NETWORK

14.8 OTHER SYSTEMS

15 AEROSPACE DC-DC CONVERTERS MARKET, BY REGION (Page No. - 130)

15.1 INTRODUCTION

FIGURE 37 AEROSPACE DC-DC CONVERTER MARKET: REGIONAL SNAPSHOT

15.2 IMPACT OF COVID-19

FIGURE 38 IMPACT OF COVID-19 ON AEROSPACE DC-DC CONVERTER MARKET

TABLE 37 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY REGION, 2021–2030 (USD MILLION)

15.3 NORTH AMERICA

FIGURE 39 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SNAPSHOT

TABLE 39 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 40 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COUNTRY, 2021–2030 (USD MILLION)

TABLE 41 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 42 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 43 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 44 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 45 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 46 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 47 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 48 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 49 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 50 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 51 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 52 NORTH AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.3.1 PESTLE ANALYSIS: NORTH AMERICA

15.3.2 US

15.3.2.1 Growing UAVs market to drive the aerospace DC-DC converters market

15.3.2.2 Development of More Electric Aircraft (MEA)

TABLE 53 US: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 54 US: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 55 US: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 56 US: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 57 US: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 58 US: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 59 US: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 60 US: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 61 US: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 62 US: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 63 US: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 64 US: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.3.3 CANADA

15.3.3.1 Investments made in the development of air taxis to drive the Canadian market

TABLE 65 CANADA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 66 CANADA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 67 CANADA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 68 CANADA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 69 CANADA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 70 CANADA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 71 CANADA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 72 CANADA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 73 CANADA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 74 CANADA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 75 CANADA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 76 CANADA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.4 EUROPE

FIGURE 40 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SNAPSHOT

TABLE 77 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 78 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COUNTRY, 2021–2030 (USD MILLION)

TABLE 79 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 80 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 81 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 82 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 83 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 84 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 85 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 86 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 87 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 88 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 89 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 90 EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.4.1 PESTLE ANALYSIS: EUROPE

15.4.2 GERMANY

TABLE 91 GERMANY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 92 GERMANY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 93 GERMANY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 94 GERMANY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 95 GERMANY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 96 GERMANY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 97 GERMANY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 98 GERMANY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 99 GERMANY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 100 GERMANY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 101 GERMANY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 102 GERMANY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.4.3 RUSSIA

TABLE 103 RUSSIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 104 RUSSIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 105 RUSSIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 106 RUSSIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 107 RUSSIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 108 RUSSIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 109 RUSSIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 110 RUSSIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 111 RUSSIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 112 RUSSIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 113 RUSSIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 114 RUSSIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.4.4 NORWAY

TABLE 115 NORWAY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 116 NORWAY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 117 NORWAY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 118 NORWAY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 119 NORWAY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 120 NORWAY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 121 NORWAY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 122 NORWAY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 123 NORWAY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 124 NORWAY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 125 NORWAY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 126 NORWAY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.4.5 ITALY

TABLE 127 ITALY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 128 ITALY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 129 ITALY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 130 ITALY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 131 ITALY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 132 ITALY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 133 ITALY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 134 ITALY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 135 ITALY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 136 ITALY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 137 ITALY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 138 ITALY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.4.6 FRANCE

15.4.6.1 Growing aerospace sector will drive the DC-DC converters market

TABLE 139 FRANCE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 140 FRANCE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 141 FRANCE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 142 FRANCE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 143 FRANCE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 144 FRANCE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 145 FRANCE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 146 FRANCE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 147 FRANCE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 148 FRANCE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 149 FRANCE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 150 FRANCE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.4.7 REST OF EUROPE

TABLE 151 REST OF EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 152 REST OF EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 153 REST OF EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 154 REST OF EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 155 REST OF EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 156 REST OF EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 157 REST OF EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 158 REST OF EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 159 REST OF EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 160 REST OF EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 161 REST OF EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 162 REST OF EUROPE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.5 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SNAPSHOT

TABLE 163 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 164 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COUNTRY, 2021–2030 (USD MILLION)

TABLE 165 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 166 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 167 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 168 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 169 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 170 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 171 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 172 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 173 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 174 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 175 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 176 ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.5.1 PESTLE ANALYSIS: ASIA PACIFIC

15.5.2 CHINA

TABLE 177 CHINA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 178 CHINA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 179 CHINA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 180 CHINA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 181 CHINA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 182 CHINA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 183 CHINA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 184 CHINA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 185 CHINA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 186 CHINA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 187 CHINA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 188 CHINA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.5.3 TAIWAN

TABLE 189 TAIWAN: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 190 TAIWAN: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 191 TAIWAN: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 192 TAIWAN: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 193 TAIWAN: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 194 TAIWAN: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 195 TAIWAN: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 196 TAIWAN: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 197 TAIWAN: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 198 TAIWAN: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 199 TAIWAN: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 200 TAIWAN: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.5.4 INDIA

TABLE 201 INDIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 202 INDIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 203 INDIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 204 INDIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 205 INDIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 206 INDIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 207 INDIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 208 INDIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 209 INDIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 210 INDIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 211 INDIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 212 INDIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.5.5 AUSTRALIA

TABLE 213 AUSTRALIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 214 AUSTRALIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 215 AUSTRALIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 216 AUSTRALIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 217 AUSTRALIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 218 AUSTRALIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 219 AUSTRALIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 220 AUSTRALIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 221 AUSTRALIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 222 AUSTRALIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 223 AUSTRALIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 224 AUSTRALIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.5.6 SINGAPORE

TABLE 225 SINGAPORE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 226 SINGAPORE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 227 SINGAPORE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 228 SINGAPORE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 229 SINGAPORE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 230 SINGAPORE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 231 SINGAPORE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 232 SINGAPORE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 233 SINGAPORE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 234 SINGAPORE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 235 SINGAPORE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 236 SINGAPORE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.5.7 REST OF ASIA PACIFIC

TABLE 237 REST OF ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 238 REST OF ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 239 REST OF ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 240 REST OF ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 241 REST OF ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 242 REST OF ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 243 REST OF ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 244 REST OF ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 245 REST OF ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 246 REST OF ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 247 REST OF ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 248 REST OF ASIA PACIFIC: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.6 MIDDLE EAST

TABLE 249 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 250 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COUNTRY, 2021–2030 (USD MILLION)

TABLE 251 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 252 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 253 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 254 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 255 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 256 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 257 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 258 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 259 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 260 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 261 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 262 MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.6.1 PESTLE ANALYSIS: MIDDLE EAST

15.6.2 UAE

15.6.2.1 Rising commercial aviation sector to drive the aerospace industry

TABLE 263 UAE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 264 UAE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 265 UAE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 266 UAE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 267 UAE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 268 UAE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 269 UAE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 270 UAE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 271 UAE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 272 UAE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 273 UAE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 274 UAE: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.6.3 SAUDI ARABIA

15.6.3.1 Aerospace and defense industry to drive the demand

TABLE 275 SAUDI ARABIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 276 SAUDI ARABIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 277 SAUDI ARABIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 278 SAUDI ARABIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 279 SAUDI ARABIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 280 SAUDI ARABIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 281 SAUDI ARABIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 282 SAUDI ARABIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 283 SAUDI ARABIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 284 SAUDI ARABIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 285 SAUDI ARABIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 286 SAUDI ARABIA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.6.4 TURKEY

15.6.4.1 Growing drone industry will drive the aerospace DC-DC converters market

TABLE 287 TURKEY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 288 TURKEY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 289 TURKEY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 290 TURKEY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 291 TURKEY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 292 TURKEY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 293 TURKEY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 294 TURKEY: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.6.5 REST OF MIDDLE EAST

15.6.5.1 Rising defense and commercial aviation industries will drive the demand

TABLE 295 REST OF MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 296 REST OF MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 297 REST OF MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 298 REST OF MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 299 REST OF MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 300 REST OF MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 301 REST OF MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 302 REST OF MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 303 REST OF MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 304 REST OF MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 305 REST OF MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 306 REST OF MIDDLE EAST: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.7 REST OF THE WORLD

TABLE 307 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 308 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY REGION, 2021–2030 (USD MILLION)

TABLE 309 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 310 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 311 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 312 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 313 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 314 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 315 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 316 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 317 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 318 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 319 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 320 REST OF THE WORLD: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.7.1 PESTLE ANALYSIS

15.7.2 LATIN AMERICA

15.7.2.1 Growing investment in alternative sources of energy along the aerospace industry will drive the DC-DC converters market

TABLE 321 LATIN AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 322 LATIN AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 323 LATIN AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 324 LATIN AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 325 LATIN AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 326 LATIN AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 327 LATIN AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 328 LATIN AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 329 LATIN AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 330 LATIN AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 331 LATIN AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 332 LATIN AMERICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

15.7.3 AFRICA

15.7.3.1 Growing industrial and telecommunication sector will drive the DC-DC converters market

TABLE 333 AFRICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 334 AFRICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY AIRCRAFT TYPE, 2021–2030 (USD MILLION)

TABLE 335 AFRICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2017–2020 (USD MILLION)

TABLE 336 AFRICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY FIXED WING, 2021–2030 (USD MILLION)

TABLE 337 AFRICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2017–2020 (USD MILLION)

TABLE 338 AFRICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY COMMERCIAL AVIATION, 2021–2030 (USD MILLION)

TABLE 339 AFRICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2017–2020 (USD MILLION)

TABLE 340 AFRICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY BUSINESS AND GENERAL AVIATION, 2021–2030 (USD MILLION)

TABLE 341 AFRICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2017–2020 (USD MILLION)

TABLE 342 AFRICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY MILITARY AVIATION, 2021–2030 (USD MILLION)

TABLE 343 AFRICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2017–2020 (USD MILLION)

TABLE 344 AFRICA: AEROSPACE DC-DC CONVERTERS MARKET SIZE, BY ROTARY WING, 2021–2030 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 223)

16.1 INTRODUCTION

16.2 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2020

TABLE 345 DEGREE OF COMPETITION

FIGURE 42 MARKET SHARE OF THE TOP PLAYERS IN THE AEROSPACE DC-DC CONVERTERS MARKET, 2020

16.3 REVENUE ANALYSIS OF THE TOP FIVE MARKET PLAYERS, 2020

16.3.1 COMPANY EVALUATION QUADRANT

16.3.1.1 Star

16.3.1.2 Emerging leader

16.3.1.3 Pervasive

16.3.1.4 Participant

FIGURE 43 AEROSPACE DC-DC CONVERTERS MARKET: COMPANY EVALUATION QUADRANT, 2020

TABLE 346 COMPANY FOOTPRINT

TABLE 347 COMPANY OUTPUT NUMBER FOOTPRINT

TABLE 348 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 349 COMPANY REGION FOOTPRINT

16.4 COMPETITIVE SCENARIO

16.4.1 NEW PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 350 NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2018–2021

16.4.2 DEALS

TABLE 351 DEALS, 2018–2020

17 COMPANY PROFILES (Page No. - 233)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

17.1 KEY PLAYERS

17.1.1 TDK-LAMBDA CORPORATION

TABLE 352 TDK-LAMBDA CORPORATION: BUSINESS OVERVIEW

FIGURE 44 TDK-LAMBDA CORPORATION: COMPANY SNAPSHOT

17.1.2 MURATA MANUFACTURING CO. LTD

TABLE 353 MURATA MANUFACTURING CO. LTD.: BUSINESS OVERVIEW

FIGURE 45 MURATA MANUFACTURING CO. LTD.: COMPANY SNAPSHOT

17.1.3 INFINEON TECHNOLOGIES AG

TABLE 354 INFINEON TECHNOLOGIES AG.: BUSINESS OVERVIEW

FIGURE 46 INFINEON TECHNOLOGIES AG.: COMPANY SNAPSHOT

17.1.4 ADVANCED ENERGY INDUSTRIES INC.

TABLE 355 ADVANCED ENERGY INDUSTRIES INC.: BUSINESS OVERVIEW

FIGURE 47 ADVANCED ENERGY INDUSTRIES INC.: COMPANY SNAPSHOT

17.1.5 VICOR CORPORATION

TABLE 356 VICOR CORPORATION: BUSINESS OVERVIEW

FIGURE 48 VICOR CORPORATION: COMPANY SNAPSHOT

TABLE 357 VICOR CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 358 VICOR CORPORATION: DEALS

17.1.6 PICO ELECTRONICS

TABLE 359 PICO ELECTRONICS: BUSINESS OVERVIEW

17.1.7 ABBOTT TECHNOLOGIES

TABLE 360 ABBOTT TECHNOLOGIES: BUSINESS OVERVIEW

17.1.8 TEXAS INSTRUMENTS INCORPORATED

TABLE 361 TEXAS INSTRUMENTS INCORPORATED: BUSINESS OVERVIEW

FIGURE 49 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

TABLE 362 TEXAS INSTRUMENTS INCORPORATED: NEW PRODUCT DEVELOPMENTS

17.1.9 FDK CORPORATION

TABLE 363 FDK CORPORATION: BUSINESS OVERVIEW

FIGURE 50 FDK CORPORATION: COMPANY SNAPSHOT

17.1.10 RECOM-POWER GMBH

TABLE 364 RECOM-POWER GMBH: BUSINESS OVERVIEW

17.1.11 CRANE CO.

TABLE 365 CRANE CO.: BUSINESS OVERVIEW

FIGURE 51 CRANE CO.: COMPANY SNAPSHOT

TABLE 366 CRANE CO.: NEW PRODUCT DEVELOPMENTS

17.1.12 BRIGHTLOOP CONVERTERS

TABLE 367 BRIGHTLOOP CONVERTERS: BUSINESS OVERVIEW

17.1.13 CINCON ELECTRONICS

TABLE 368 CINCON ELECTRONICS: BUSINESS OVERVIEW

TABLE 369 CINCON ELECTRONICS: NEW PRODUCT DEVELOPMENTS

17.1.14 VPT

TABLE 370 VPT: BUSINESS OVERVIEW

TABLE 371 VPT: NEW PRODUCT DEVELOPMENTS

17.1.15 MARTEK POWER

TABLE 372 MARTEK POWER: BUSINESS OVERVIEW

17.1.16 XP POWER

TABLE 373 XP POWER: BUSINESS OVERVIEW

FIGURE 52 XP POWER: COMPANY SNAPSHOT

17.1.17 VIABLE POWER

TABLE 374 VIABLE POWER: BUSINESS OVERVIEW

17.1.18 THALES

TABLE 375 THALES: BUSINESS OVERVIEW

FIGURE 53 THALES: COMPANY SNAPSHOT

17.1.19 BEL FUSE INC.

TABLE 376 BEL FUSE INC.: BUSINESS OVERVIEW

FIGURE 54 BEL FUSE INC.: COMPANY SNAPSHOT

17.1.20 KGS ELECTRONICS

TABLE 377 KGS ELECTRONICS: BUSINESS OVERVIEW

17.1.21 SYNQOR

TABLE 378 SYNQOR: BUSINESS OVERVIEW

TABLE 379 SYNQOR: NEW PRODUCT DEVELOPMENTS

17.1.22 ASTRONICS CORPORATION

TABLE 380 ASTRONICS CORPORATION: BUSINESS OVERVIEW

FIGURE 55 ASTRONICS CORPORATION: COMPANY SNAPSHOT

TABLE 381 ASTRONICS CORPORATION: NEW PRODUCT DEVELOPMENTS

17.1.23 MEGGITT PLC

TABLE 382 MEGGITT PLC: BUSINESS OVERVIEW

FIGURE 56 MEGGITT: COMPANY SNAPSHOT

17.2 OTHER PLAYERS

17.2.1 TAME POWER

TABLE 383 TAME POWER: BUSINESS OVERVIEW

17.2.2 AJ’S POWER SOURCE

TABLE 384 AJ’S POWER SOURCE: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

18 APPENDIX (Page No. - 277)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATION

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

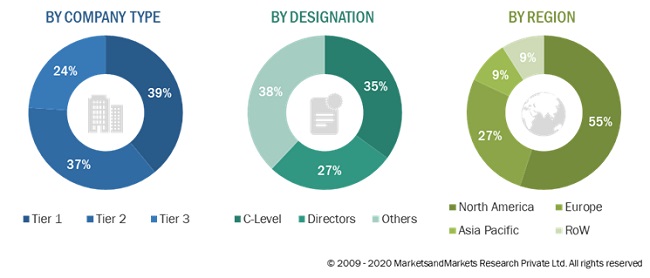

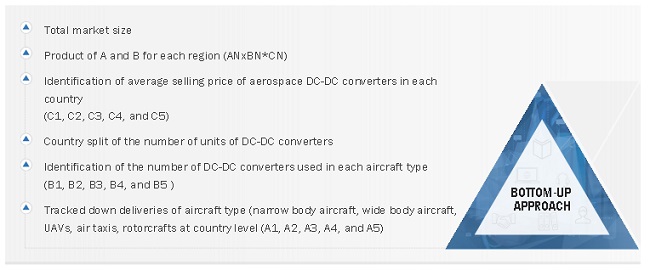

The study involved four major activities in estimating the current size of the aircraft DC-DC converter market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as the International Air Transport Association (IATA); International Civil Aviation Organization (ICAO); Stockholm International Peace Research Institute (SIPRI); corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from aircraft DC-DC converter vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using aircraft DC-DC converter were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of aircraft DC-DC converter and future outlook of their business which will affect the overall market.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

Aerospace DC-DC ConverteRs OEMs |

Others |

|

TDK Lambda Corporation |

Vicor Corporation |

|

Advanced Energy Industries Inc. |

Cincon Electronics |

|

Murata Manufacturing Co. Ltd. |

RECOM-Power |

|

Infineon Technologies AG |

Abbott Technologies |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aerospace DC-DC converter market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Aerospace DC-DC Converter Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the aerospace DC-DC Converter Market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the aerospace DC-DC converter market.

Report Objectives

- To define, describe, segment, and forecast the size of the aerospace DC-DC converter market based on application, aircraft type, input voltage, form factor, output power, output voltage, output number, type, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aerospace DC-DC converter market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets1, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis