Middle East and Africa Industrial Valves Market by Closure Type (Quarter Turn, Multi Turn and Others), by Function (Control, Isolation, Check and Others), by Type (Ball, Globe, Plug and Others) and by Application (Oil & Gas, Chemical, Municipal, Power and Mining) - Global Trends & Forecasts to 2019

[160 Pages Report] The increasing demand for valves in oil & gas and power industries is expected to be a major driver for the industrial valves market in Africa. The industrial valves market is projected to reach $10 Billion by 2019, at a healthy growth rate of 5.9% between 2014 and 2019. The market for oil & gas is estimated to be one of the fastest growing markets for industrial valves from 2014 to 2019.

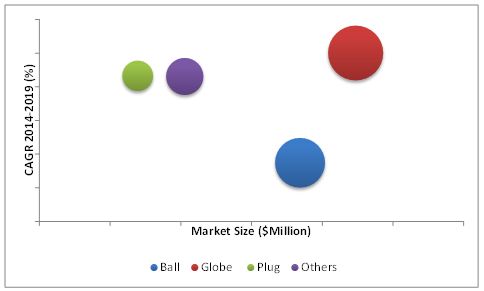

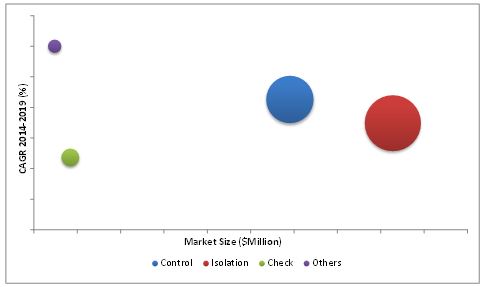

The market was segmented on the basis of function, type, and closure type in terms of value. The market segments by closure type include quarter turn, multi turn, and check. The market segments for valve function include control, isolation, check, and special. The valve type segmentation includes market size of ball valves, globe valves, plug valves, and others.

The report provides a full analysis of key companies and competitive analysis of developments recorded in the industry during the past four years. In the report market drivers, restraints, opportunities, and challenges of the market are discussed in detail. The leading players in the market such as Pentair Ltd. (Switzerland), Flowserve Corporation (U.S.), Emerson Electric (U.S.), and FMC Technologies (U.S.) have been profiled in this report to provide an insight of the competitive scenario in the African valves market. Product development has been one of the key strategies adopted by leading companies to accommodate the fast changing technologies in the end application industries like oil & gas and chemicals. Companies have also adopted expansion and acquisitions to bridge the existing gaps in their product offerings, the end market requirements, and the geographical constraints. These strategies have been adopted by leading companies to ensure retention of considerable market share within the highly fragmented industrial valves market.

African Valves Market Size, by Type, 2014–2019 ($Million)

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

Africa is estimated to be one of the fastest growing markets for industrial valves market. Growing demand of petrochemical products like paints, polymers, plastics, and fuel additives is expected to boost the demand for industrial valves. Growth of alternative energy sources as well as nuclear energy for power generation is also expected to drive the demand for industrial valves market. The key players of industrial valves prefer agreements, contracts, joint ventures, and partnership strategies and product developments to garner a larger share in the market. Leading industrial valve manufacturers are focusing on the emerging countries that are estimated to show potential for industrial development in the near future.

Scope of the Report

This report focuses on the industrial valves market for the African region. The market was segmented on the basis of closure type, function, and valve type and has been listed below.

On the basis of closure type

- Quarter turn

- Multi turn

- Check

On the basis of function

- Control

- Isolation

- Check

- Special

On the basis of type

- Ball valve

- Globe valve

- Plug valves

- Others

Industrial valves are devices used for flow regulation and control in piping systems. Valves are used to regulate, start and stop, or control the direction of a fluid or gas, flowing through the piping system. The market demand for industrial valve in the Middle East and Africa market is estimated to reach $10 Billion by 2019, with a projected CAGR of 5.7% in the next half a decade. The increasing demand in oil & gas, chemical and municipal applications is expected to be the major drivers for the industrial valves market in this region.

The Middle East region is increasingly expected to transform from a raw goods supplier to a refined product provider. This changing trend would be corroborated with the increase in the number of manufacturing and process industries. The industrial valve market is expected to be driven by the demand from these industrial expansions. Growing desalination market is another significant factor that would boost the demand for industrial valves in this region.

The industrial valves market is estimated to grow with the growing oil & gas industry in the northern parts of Africa, as well as the growing nuclear and renewable energy sectors in the African power industry. Other sectors that are estimated to drive the industrial valves market include water and wastewater application in the municipal market and the petrochemical industry in the chemical market.

The study on industrial valves market for Middle East and Africa classifies on the basis of function, type, and closure type in terms of value. The market segments by closure type include quarter turn, multi turn, and check. The market segments for function include control, isolation, check, and special. The valve type segmentation includes market value for ball valves, globe valves, plug valves, and others. On the basis of application, industrial valves market has been categorized into Oil & gas, Chemical, Municipal, Power, and Mining and others.

Middle East and Africa – Industrial Valves Market Size, by Function, 2012 - 2019 ($Million)

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

Africa is estimated to be one of the emerging markets for industrial valves market. The key players of industrial valves prefer agreements, contracts, joint ventures, and partnership strategies and product developments to garner a larger share in the market. Product innovation is one of the most adopted developments by majority of companies in the valve industry. Some of the leading players in the market such as Pentair Ltd. (Switzerland), Flowserve Corporation (U.S.), Emerson Electric (U.S.), and FMC Technologies (U.S.) have been profiled in this report to provide an understanding of the competitive scenario in the Middle East and Africa valves market. These leading industrial valves manufacturers are focusing on the emerging countries that are estimated to show potential for industrial development in the near future.

Table of Contents

1. Introduction

1.1. Objectives of the Study

1.2. Markets Covered

1.3. Stakeholders

1.4. Market Scope

2. Research Methodology

2.1. Market Size Estimation

2.2. Market Crackdown & Data Triangilation

2.3. Market Share Estimation

2.3.1. Key Data From Secondary Sources

2.3.2. Key Data From Primary Sources

2.3.3. Assumptions

3. Executive Summary

4. Premium Insights

4.1. Global Industrial Valves Market

4.2. African Valves Market

4.3. Oil & Gas Industry: the Largest Market Share Holder

4.4. Angola Oil & Gas Valves Market, By Function (2012-2019)

5. Market Overview

5.1. Introduction

5.2. Market Segmentation

5.2.1. African Valves Market By Closure Type

5.2.2. African Valves Market By Type

5.2.3. African Valves Market By Funtion

5.3. Market Dynamics

5.4. Drivers

5.4.1. Growing Chemical Industry

5.4.2. Expanding Oil & Gas Industry

5.4.3. Changing Energy Industry Trends

5.5. Restraints

5.5.1. Mining Industry Slowdown in South Africa

5.6. Oppurtunities

5.6.1. Increasing Foreign Investments

5.7. Challenges

5.7.1. Economic Disparity

6. Industry Trends

6.1. Value-Chain Analysis

6.2. Porter’s Five Forces Analysis

6.2.1. Threat of New Entrants

6.2.2. Threat of Substitutes

6.2.3. Bargaining Power of Suppliers

6.2.4. Bargaining Power of Buyers

6.2.5. Degree of Competition

7. African Valve Market

7.1. Introduction

7.2. African Valve Market, By Closure

7.3. African Valve Market,By Function

7.4. African Valve Market, By Type

7.5. African Valve Market, By Country

7.5.1. Introduction

7.5.2. Angola

7.5.2.1. Introduction

7.5.2.2. Angola Oil & Gas Market, By Type

7.5.2.3. Angola Oil & Gas Market, By Closure Type

7.5.2.4. Angola Oil & Gas Market, By Function

8. Competitive Landscape

8.1. Overview

8.1.1. Company Development Analysis

8.1.2. Competitive Situation & Trends

8.1.3. Agreements, Contracts, Joint Ventures, & Partnerships

8.1.4. Expansions

8.1.5. Mergers and Acquisitions

8.1.6. New Product & Technology Launches

9. Company Profiles

9.1. Pentair Ltd.

9.1.1. Business Overview

9.1.2. Product offerings

9.1.3. Key Strategy

9.1.4. Recent Developments

9.1.5. SWOT Analysis

9.1.6. MNM View

9.2. Flowserve Corporation

9.2.1. Business Overview

9.2.2. Product offerings

9.2.3. Key Strategy

9.2.4. Recent Developments

9.2.5. SWOT Analysis

9.2.6. MNM View

9.3. Emerson Electric

9.3.1. Business Overview

9.3.2. Product offerings

9.3.3. Key Strategy

9.3.4. Recent Developments

9.3.5. SWOT Analysis

9.3.6. MNM View

9.4. Fmc Technologies

9.4.1. Business Overview

9.4.2. Product offerings

9.4.3. Key Strategy

9.4.4. Recent Developments

9.5. Alfa Laval AB

9.5.1. Business Overview

9.5.2. Product offerings

9.5.3. Key Strategy

9.5.4. Recent Developments

9.6. Kira Valves and Engineering

9.6.1. Business Overview

9.6.2. Product offerings

9.6.3. Key Strategy

9.6.4. Recent Developments

9.7. ITT Corporation

9.7.1. Business Overview

9.7.2. Product offerings

9.7.3. Key Strategy

9.7.4. Recent Developments

9.7.5. SWOT Analysis

9.7.6. MNM View

9.8. Weir Group PLC

9.8.1. Business Overview

9.8.2. Product offerings

9.8.3. Key Strategy

9.8.4. Recent Developments

9.9. Circor International Inc.

9.9.1. Business Overview

9.9.2. Product offerings

9.9.3. Key Strategy

9.9.4. Recent Developments

9.10. Kitz Corporation.

9.10.1. Business Overview

9.10.2. Product offerings

9.10.3. Key Strategy

9.10.4. Recent Developments

List of Tables (60 Tables)

Table 1 Growing Demand for Plastics and Petrochemical Products Driving the Valves Market

Table 2 Slowdown in South African Mining Industry Restraining Market Growth

Table 3 Increasing foreign Investments in the African Region Providing Better Oppurtunities for Growth

Table 4 Industrial Valves Market Size, By Geography, 2014-2019 ($Mllion)

Table 5 African Valves Market Size, By Country, 2014-2019 ($Mllion)

Table 6 African Valves Market Size, By Application, 2014-2019 ($Mllion)

Table 7 African Valves Market Size, By Closure Type, 2014-2019 ($Mllion)

Table 8 African Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 9 African Valves Market Size, By Type, 2014-2019 ($Mllion)

Table 10 African Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 11 African Oil & Gas Valves Market Size, By Type, 2014-2019 ($Mllion)

Table 12 African Oil & Gas Valves Market Size, By Closure Type, 2014-2019 ($Mllion)

Table 13 Angola Valves Market Size, By Application, 2014-2019 ($Mllion)

Table 14 Angola Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 15 Angola Oil & Gas Valves Market Size, By Type, 2014-2019 ($Mllion)

Table 16 Angola Oil & Gas Valves Market Size, By Closure Type, 2014-2019 ($Mllion)

Table 17 Angola Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 18 South Africa Valves Market Size, By Application, 2014-2019 ($Mllion)

Table 19 South Africa Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 20 South Africa Oil & Gas Valves Market Size, By Type, 2014-2019 ($Mllion)

Table 21 South Africa Oil & Gas Valves Market Size, By Closure Type, 2014-2019 ($Mllion)

Table 22 South Africa Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 23 Nigeria Valves Market Size, By Application, 2014-2019 ($Mllion)

Table 24 Nigeria Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 25 Nigeria Oil & Gas Valves Market Size, By Type, 2014-2019 ($Mllion)

Table 26 Nigeria Oil & Gas Valves Market Size, By Closure Type, 2014-2019 ($Mllion)

Table 27 Nigeria Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 28 Others Valves Market Size, By Application, 2014-2019 ($Mllion)

Table 29 Others Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 30 Others Oil & Gas Valves Market Size, By Type, 2014-2019 ($Mllion)

Table 31 Others Oil & Gas Valves Market Size, By Closure Type, 2014-2019 ($Mllion)

Table 32 Others Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 33 Middle East Valves Market Size, By Country, 2014-2019 ($Mllion)

Table 34 Middle East Valves Market Size, By Application, 2014-2019 ($Mllion)

Table35 Middle East Valves Market Size, By Closure Type, 2014-2019 ($Mllion)

Table36 Middle East Valves Market Size, By Function, 2014-2019 ($Mllion)

Table37 Middle East Valves Market Size, By Type, 2014-2019 ($Mllion)

Table 38 Middle East Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 39 Middle East Oil & Gas Valves Market Size, By Type, 2014-2019 ($Mllion)

Table 40 Middle East Oil & Gas Valves Market Size, By Closure Type, 2014-2019 ($Mllion)

Table 41 Saudi Arabia Valves Market Size, By Application, 2014-2019 ($Mllion)

Table 42 Saudi Arabia Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 43 Saudi Arabia Oil & Gas Valves Market Size, By Type, 2014-2019 ($Mllion)

Table 44 Saudi Arabia Oil & Gas Valves Market Size, By Closure Type, 2014-2019 ($Mllion)

Table 45 Saudi Arabia Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 46 UAE Valves Market Size, By Application, 2014-2019 ($Mllion)

Table 47 UAE Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 48 UAE Oil & Gas Valves Market Size, By Type, 2014-2019 ($Mllion)

Table 49 UAE Oil & Gas Valves Market Size, By Closure Type, 2014-2019 ($Mllion)

Table 50 UAE Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 51 Kuwait Valves Market Size, By Application, 2014-2019 ($Mllion)

Table 52 Kuwait Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 53 Kuwait Oil & Gas Valves Market Size, By Type, 2014-2019 ($Mllion)

Table 54 Kuwait Oil & Gas Valves Market Size, By Closure Type, 2014-2019 ($Mllion)

Table 55 Kuwait Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 56 Others Valves Market Size, By Application, 2014-2019 ($Mllion)

Table 57 Others Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

Table 58 Others Oil & Gas Valves Market Size, By Type, 2014-2019 ($Mllion)

Table 59 Others Oil & Gas Valves Market Size, By Closure Type, 2014-2019 ($Mllion)

Table 60 Others Oil & Gas Valves Market Size, By Function, 2014-2019 ($Mllion)

List of Figures (19 Figures)

Figure 1 African Valves Market Segmentation

Figure 2 African Valves Market: Research Methodology

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Pentair Ltd: Company Snapshot

Figure 6 Pentair Ltd: SWOT Analysis

Figure 7 Emerson Electric: Company Snapshot

Figure 8 Emerson Electric: SWOT Analysis

Figure 9 Flowserve Corp: Company Snapshot

Figure 10 Flowserve Corp: SWOT Analysis

Figure 11 FMC Technologies Inc.: Company Snapshot

Figure 12 ITT Corp: Company Snapshot

Figure 13 ITT Corp: SWOT Analysis

Figure 14 Kira Valves and Engineering: Company Snapshot

Figure 15 Alfa Laval AB: Company Snapshot

Figure 16 Alfa Laval: SWOT Analysis

Figure 17 Weir Group PLC: Company Snapshot

Figure 18 Circor International Inc.: Company Snapshot

Figure 19 Kitz Corporation: Company Snapshot

Growth opportunities and latent adjacency in Middle East and Africa Industrial Valves Market