Africa Cyber Security Market by Solution (IAM, IDS/IPS, Risk & Compliance, Encryption, Antivirus, Firewall, DLP, UTM, SVM, Disaster Recovery & Business Continuity, DDOS Mitigation, Web Filtering), by Service, by Verticals, by Country - Forecast to 2020

[146-Pages Report] The Africa cyber security market is estimated to grow from $0.92 Billion in 2015 to $2.32 Billion by 2020, at a compound annual growth rate (CAGR) of 20.41% from 2015 to 2020.

The protection of valuable intellectual property and business information in digital form, against theft and misuse is a critical need for all businesses. The African countries have identified weak cyber security infrastructure as one of the major concerns. Over the past few years, most of the large organizations in this region, including oil and gas, utilities, and banks, have strengthened their cyber security capabilities. However, the speed at which the companies are deploying security solutions is relatively slow, as compared to other regions.

One of the major factors that have helped the Africa cyber security market to grow is the increasing focus of governments on enhancing the regulations and compliance requirements. Apart from this, factors such as the need for unified cyber solutions, increased internet subscriptions, and data disclosure mandates, enhanced enterprise mobility, and increased spending pattern on security forums are boosting the demand for cyber security solutions. These factors have greatly contributed toward the growth of the market and have emerged the major growth drivers for the market.

The major players include in the Africa cyber security market space include EMC Corporation, Fortinet, IBM, Cisco Systems, Symantec, McAfee, Check Point, and Hewlett-Packard. These players provide innovative cyber security solutions in the form of individual components as well as suites, which get delivered on-premises or via cloud.

The report on the Africa cyber security market provides an in-depth analysis of the global adoption trends, future growth potential and key issues, in the considered market. Furthermore, it provides a comprehensive business case analysis along with the information on the major market drivers, restraints, opportunities, and challenges in the market.

The report also consists of MarketsandMarkets views of the key players and analysts insights on various developments that are taking place in the Africa cyber security market space. The forecast period for market research report is 2015-2020. The research report covers the complete market, categorized into the following segments:

On the basis of sub-segments:

- Network Security

- Endpoint Security

- Content Security

- Application Security

- Industrial Control Systems Security

- Cloud Security

On the basis of solutions:

- Identity and Access Management

- Risk and Compliance Management

- Intrusion Detection System (IDS)/ Intrusion Prevention System (IPS)

- Encryption

- Antivirus and Antimalware

- Firewall

- Data Loss Protection (DLP)

- Unified Threat Management

- Security and Vulnerability Management

- Disaster Recovery and Business Continuity

- DDOS Mitigation

- Others

On the basis of services:

- Consulting

- Design and Integration

- Risk and Threat Assessment

- Managed Security Services

- Training and Education

On the basis of verticals:

- BFSI

- Aerospace, Defense, and Intelligence

- Government (Excluding Defense)

- Energy and Utilities

- Manufacturing

- Retail and Wholesale Distribution

- Telecommunication

- Transportation

- Others

On the basis of countries:

- Kenya

- South Africa

- Nigeria

- Morocco

- Others

With massive projects underway to connect the African continent to the rest of the world, internet penetration is also expected to increase rapidly. Countries such as Nigeria, Morocco, Kenya, and South Africa are leading from the front, setting benchmarks for other countries in the continent. Through cheaper and faster internet, the African continent is particularly becoming more vulnerable to cyber threats. Africa cyber security market is facing severe security risk challenges, intellectual property infringement, and issues with protection of personal data. As the numbers of new internet users are increasing, these challenges are becoming more critical.

Cyber security as a concept is not known to the vast majority. There is little understanding, knowledge and expertise, and mostly a huge lack of awareness about cyber security legal frameworks. Some of the reasons for this are the lack of security awareness, shortage of local cyber security experts, and lack of funds. As a result, the impact of inadequate cyber security is huge. Also, Africa cyber security market has a high number of unauthorized software users, which is aggravating the regions virus and malware miseries. Financial losses due to lack of cyber security controls are rising to more than a billion annually. Some of the African countries such as South Africa and Kenya have realized the importance of cyber security and are actively working on their laws while others are putting their cyber security policy together. Moreover, in June 2014, the African Union (AU) approved a convention on cyber security and data protection that could see many countries enact personal protection laws for the first time.

The growing number of mobile workforce, adoption of cloud-based services, and Advanced Persistent Threats (APTs) present a comprehensive opportunity for cyber vendors in the market space. Apart from these, factors such as the need for strict compliance and data disclosure mandates, risk over maintenance of sensitive data, increased internet penetration, and increasing spending pattern on security forums are boosting up the demand for cyber security solutions. It is expected that the Africa cyber security market will show enormous growth in the coming years.

The notable players in Africa cyber security market such as Cisco, IBM, EMC, CSC, Symantec, McAfee, HP, and Fortinet are expected to develop more advanced and user-friendly solutions to equip organizations with the necessary tools to combat cyber-attacks and thus, create notable market traction during the forecast period.

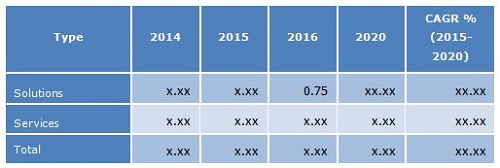

The table given below highlights the market size and year-on-year (Y-O-Y) growth rate by sub-segments. The Africa cyber security market size is expected to grow from $0.92 Billion in 2015 to $2.32 Billion by 2020, at a Compound Annual Growth Rate (CAGR) of 20.41% from 2015 to 2020.

Africa Cyber Security Market Size, by Types 20152020 ($Billion)

Source: MarketsandMarkets Analysis

Table of Content

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.3.1 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities

4.2 Market, By Sub-Segment

4.3 Total Africa Cyber Security Market

4.4 Market Potential

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Evolution of Cyber Security Market

5.3 Market Segmentation

5.3.1 By Sub-Segment

5.3.2 By Solution

5.3.3 By Service

5.3.4 By Vertical

5.3.5 By Country

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Cyber-Attacks Affecting Economic Growth

5.4.1.2 Increasing Focus on Government Regulations and Compliance Requirements

5.4.1.3 Increasing Penetration of Mobile Devices and Internet Subscriptions

5.4.2 Restraints

5.4.2.1 Limitations in the Current Ict Infrastructure

5.4.2.2 Lack of Education, Resources, and Awareness

5.4.3 Opportunities

5.4.3.1 Increasing Cases of Insider Threats

5.4.3.2 Demand Shift Towards Managed It Security Services

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.2 Porters Five Forces

7 Africa Cyber Security Market Analysis, By Sub-Segment (Page No. - 47)

7.1 Introduction

7.2 Network Security

7.3 Endpoint Security

7.4 Content Security

7.5 Application Security

7.6 Industrial Control System Security

7.7 Cloud Security

8 Africa Cyber Security Market Analysis, By Solution (Page No. - 53)

8.1 Introduction

8.2 Identity and Access Management (IAM)

8.3 Risk and Compliance Management

8.4 IDS/IPS

8.5 Encryption

8.6 Antivirus/Antimalware

8.7 Firewall

8.8 Data Loss Protection (DLP)

8.9 UTM

8.10 Security and Vulnerability Management

8.11 Disaster Recovery and Business Continuity

8.12 DDOS Mitigation

8.13 Web Filtering

8.14 Others

9 Africa Cyber Security Market Analysis, By Service (Page No. - 66)

9.1 Introduction

9.2 Consulting

9.3 Design and Integration

9.4 Risk and Threat Assessment

9.5 Managed Security Services

9.6 Training and Education

10 Africa Cyber Security Market Analysis, By Vertical (Page No. - 73)

10.1 Introduction

10.2 BFSI

10.3 Aerospace, Defense, and Intelligence

10.4 Government (Excluding Defense)

10.5 Energy and Utilities

10.6 Manufacturing

10.7 Retail and Wholesale Distribution

10.8 Telecommunication

10.9 Transportation

10.10 Other Verticals

11 Geographic Analysis (Page No. - 83)

11.1 Introduction

11.2 Kenya

11.3 South Africa

11.4 Nigeria

11.5 Morocco

11.6 Others

12 Competitive Landscape (Page No. - 100)

12.1 Overview

12.2 Competitive Situation and Trends

12.2.1 New Product Launches

12.2.2 New Alliances, Contracts, Partnerships, and Agreements

12.2.3 Mergers and Acquisitions

12.2.4 Expansions

13 Company Profiles (Page No. - 110)

13.1 Introduction

13.2 EMC Corporation

13.2.1 Business Overview

13.2.2 Products and Services

13.2.3 Key Strategies

13.2.4 Recent Developments

13.2.5 SWOT Analysis

13.3 Fortinet, Inc.

13.3.1 Business Overview

13.3.2 Products and Services

13.3.3 Key Strategies

13.3.4 Recent Developments

13.3.5 SWOT Analysis

13.4 Cisco Systems

13.4.1 Business Overview

13.4.2 Products and Services

13.4.3 Key Strategies

13.4.4 Recent Developments

13.4.5 SWOT Analysis

13.5 IBM

13.5.1 Business Overview

13.5.2 Products and Services

13.5.3 Key Strategies

13.5.4 Recent Developments

13.5.5 SWOT Analysis

13.6 Symantec Corporation

13.6.1 Business Overview

13.6.2 Products and Services

13.6.3 Key Strategies

13.6.4 Recent Developments

13.6.5 SWOT Analysis

13.7 Check Point Software Technologies Ltd.

13.7.1 Business Overview

13.7.2 Products and Services

13.7.3 Key Strategies

13.7.4 Recent Developments

13.8 Mcafee, Inc.

13.8.1 Business Overview

13.8.2 Products and Services

13.8.3 Key Strategies

13.8.4 Recent Developments

13.9 Hewlett-Packard

13.9.1 Business Overview

13.9.2 Products and Services

13.9.3 Key Strategies

13.9.4 Recent Developments

13.10 Computer Sciences Corp. (CSC)

13.10.1 Business Overview

13.10.2 Products and Services

13.10.3 Key Strategies

13.10.4 Recent Developments

13.11 Trend Micro, Inc.

13.11.1 Business Overview

13.11.2 Products and Services

13.11.3 Key Strategies

13.11.4 Recent Developments

14 Appendix (Page No. - 139)

14.1 Discussion Guide

14.2 Industry Experts

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Related Reports

List of Tables (67 Tables)

Table 1 Africa Cyber Security Market: Assumptions

Table 2 Market Size and Growth, By Sub-Segment, 20142020 ($Billion, Y-O-Y %)

Table 3 Drivers: Impact Analysis

Table 4 Restraints: Impact Analysis

Table 5 Opportunities: Impact Analysis

Table 6 Market Size, By Sub-Segment, 20142020 ($Billion)

Table 7 Network Security: Market Size, By Country, 20132020 ($Million)

Table 8 Endpoint Security: Market Size, By Country, 20132020 ($Million)

Table 9 Content Security: Market Size, By Country, 20142020 ($Million)

Table 10 Application Security: Market Size, By Country, 20142020 ($Billion)

Table 11 Industrial Control System Security: Market Size, By Country, 20142020 ($Billion)

Table 12 Cloud Security: Market Size, By Country, 20142020 ($Billion)

Table 13 Africa Cyber Security Market Size, By Solution, 20142020 ($Billion)

Table 14 IAM: Market Size, By Country, 20142020 ($Million)

Table 15 Risk and Compliance Management: Market Size, By Country, 20142020 ($Million)

Table 16 IDS/IPS: Market Size, By Country, 20142020 ($Million)

Table 17 Encryption: Market Size, By Country, 20142020 ($Million)

Table 18 Antivirus/Antimalware: Market Size, By Country, 20142020 ($Million)

Table 19 Firewall: Africa Cyber Security Market Size, By Country, 20142020 ($Million)

Table 20 DLP: Market Size, By Country, 20142020 ($Million)

Table 21 UTM: Market Size, By Country, 20142020 ($Million)

Table 22 Security and Vulnerability Management: Market Size, By Country, 20142020 ($Million)

Table 23 Disaster Recovery and Business Continuity: Market Size, By Country, 20142020 ($Million)

Table 24 DDOS Mitigation: Market Size, By Country, 20142020 ($Million)

Table 25 Web Filtering: Market Size, By Country, 20142020 ($Million)

Table 26 Others: Africa Cyber Security Market Size, By Country, 20142020 ($Million)

Table 27 Market Size, By Service, 20142020 ($Billion)

Table 28 Consulting: Market Size, By Country, 20142020 ($Million)

Table 29 Design and Integration: Market Size, By Region, 20142020 ($Million)

Table 30 Risk and Threat Assessment: Market Size, By Country, 20142020 ($Million)

Table 31 Managed Security Services: Market Size, By Country, 20142020 ($Million)

Table 32 Training and Education: Market Size, By Country, 20142020 ($Million)

Table 33 Africa Cyber Security Market Size, By Vertical, 20142020 ($Billion)

Table 34 BFSI: Market Size, By Country, 20142020 ($Million)

Table 35 Aerospace, Defense, and Intelligence: Market Size, By Country, 20142020 ($Million)

Table 36 Government: Market Size, By Country, 20142020 ($Million)

Table 37 Energy and Utilities: Market Size, By Country, 20142020 ($Million)

Table 38 Manufacturing: Market Size, By Region, 20142020 ($Million)

Table 39 Retail and Wholesale Distribution: Market Size, By Country, 20142020 ($Million)

Table 40 Telecommunication: Market Size, By Region, 20142020 ($Million)

Table 41 Transportation: Market Size, By Country, 20142020 ($Million)

Table 42 Others Verticals: Market Size, By Country, 20132020 ($Million)

Table 43 Africa Cyber Security Market Size, By Country, 20142020 ($Billion)

Table 44 Kenya: Market Size, By Solution, 20142020 ($Million)

Table 45 Kenya: Market Size, By Service, 20142020 ($Million)

Table 46 Kenya: Market Size, By Sub-Segment, 20142020 ($Million)

Table 47 Kenya: Market Size, By Vertical, 20142020 ($Million)

Table 48 South Africa: Market Size, By Solution, 20142020 ($Million)

Table 49 South Africa: Market Size, By Service, 20142020 ($Million)

Table 50 South Africa: Market Size, By Sub-Segment, 20142020 ($Million)

Table 51 South Africa: Market Size, By Vertical, 20142020 ($Million)

Table 52 Nigeria: Market Size, By Solution, 20142020 ($Million)

Table 53 Nigeria: Market Size, By Service, 20142020 ($Million)

Table 54 Nigeria: Market Size, By Sub-Segment, 20142020 ($Million)

Table 55 Nigeria: Market Size, By Vertical, 20142020 ($Million)

Table 56 Morocco: Africa Cyber Security Market Size, By Solution, 20142020 ($Million)

Table 57 Morocco: Market Size, By Service, 20142020 ($Million)

Table 58 Morocco: Market Size, By Sub-Segment, 20142020 ($Million)

Table 59 Morocco: Market Size, By Vertical, 20132020 ($Million)

Table 60 Others: Market Size, By Solution, 20142020 ($Million)

Table 61 Others: Market Size, By Service, 20142020 ($Million)

Table 62 Others: Market Size, By Sub-Segment, 20142020 ($Million)

Table 63 Others: Market Size, By Vertical, 20142020 ($Million)

Table 64 New Product Launches, 20132015

Table 65 New Alliances, Contracts, Partnerships, and Agreements, 20132015

Table 66 Mergers and Acquisitions, 20132015

Table 67 Expansions, 20132014

List of Figures (45 Figures)

Figure 1 Africa Cyber Security Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Solution Segment is Covering the Maximum Share of Africa Cyber Security Market (2015 vs. 2020)

Figure 7 Antivirus and Antimalware Solution is Expected to Lead the Market (2015 vs. 2020)

Figure 8 Industrial Control System Security is Dominating the Market (2015 vs. 2020)

Figure 9 Energy and Utilities is the Market Leader for the Market, By Vertical (2015 vs. 2020)

Figure 10 Increase in It Spending is Driving the Market

Figure 11 Service Market to Grow at the Highest Rate Among the Segments of the Market in 2020

Figure 12 Antivirus and Antimalware and Energy and Utilities Hold the Maximum Share in the Market (2015)

Figure 13 Morocco Will Grow With the Highest CAGR Between 2015 and 2020

Figure 14 Cyber Security Market: Evolution

Figure 15 Africa Cyber Security Market Segmentation: By Sub-Segment

Figure 16 Market Segmentation: By Solution

Figure 17 Market Segmentation: By Service

Figure 18 Market Segmentation: By Vertical

Figure 19 Market Segmentation: By Country

Figure 20 The Limitations in Existing ICT Infrastructure is Expected to Fuel the Growth in the Market

Figure 21 Value Chain: Cyber Security Market

Figure 22 Market is Dominated By Industrial Control Systems

Figure 23 Antivirus and Antimalware Solution Will Lead the Solution Market

Figure 24 Managed Security Services Accounts for the Maximum Share in the Service Market

Figure 25 Cyber Security Will Witness High Rate of Adoption From the BFSI Sector

Figure 26 South Africa has the Maximum Market Size of the Africa Cyber Security Market

Figure 27 Companies Adopted New Product Launches as the Key Growth Strategy Over the Last 3 Years

Figure 28 Market Evaluation Framework: New Product Launches has Fueled Growth in 20132015

Figure 29 Battle for Market Share: New Product Launches is the Key Strategy

Figure 30 Geographic Revenue Mix of Top 5 Market Players

Figure 31 EMC Corporation: Company Snapshot

Figure 32 EMC Corporation: SWOT Analysis

Figure 33 Fortinet, Inc.: Company Snapshot

Figure 34 Fortinet: SWOT Analysis

Figure 35 Cisco Systems: Company Snapshot

Figure 36 Cisco Systems: SWOT Analysis

Figure 37 IBM: Company Snapshot

Figure 38 IBM: SWOT Analysis

Figure 39 Symantec Corporation: Company Snapshot

Figure 40 Symantec : SWOT Analysis

Figure 41 Check Point: Company Snapshot

Figure 42 MCAFEE, Inc.: Company Snapshot

Figure 43 Hewlett-Packard: Company Snapshot

Figure 44 Computer Science Corp.: Company Snapshot

Figure 45 Trend Micro Inc.: Company Snapshot

Growth opportunities and latent adjacency in Africa Cyber Security Market