Aerostructures Market by Component (Fuselages, Empennages, Flight Control Surfaces, Wings, Noses, Nacelles & Pylons, Doors & Skids), Material (Composites, Alloys & Superalloys, Metals), End User Aircraft Type and Region – Global Forecast to 2028

Update: 11/22/2024

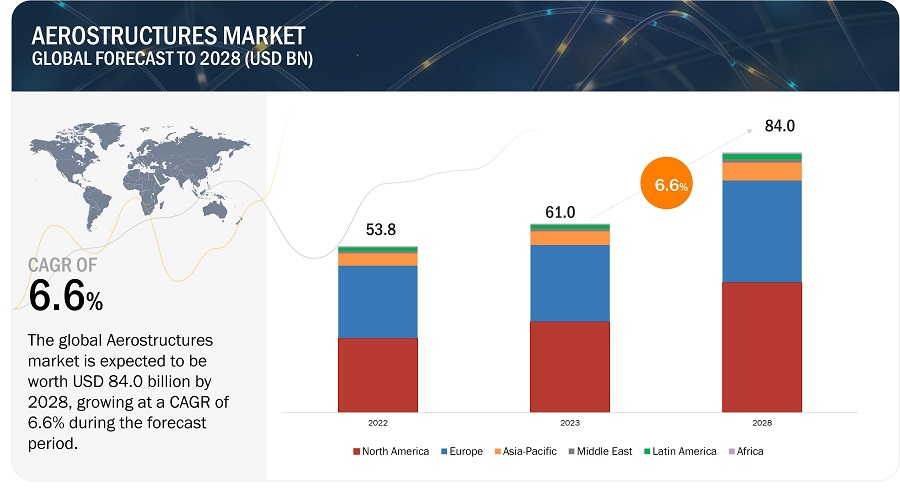

The Global Aerostructures Market Size was valued at USD 61.0 billion in 2023 and is estimated to reach USD 84.0 billion by 2028, growing at a CAGR of 6.6% during the forecast period. The Aerostructures Industry is driven by factors such as technological advancements in aerostructures, expansion of MRO services and decline in cost of composite materials.

Aerostructures Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Aerostructures Market Dynamics

Drivers: Preference for efficient and sustainable aerostructures

In the aerostructures business, efficiency and sustainability are two significant forces influencing design, production, operation, and maintenance. Efficient aerostructures lower the weight of the aircraft and reduce fuel consumption, thereby enhancing the performance of the aircraft. These sturdy and lightweight structures, which can endure the stresses of flight using less fuel, are made with cutting-edge materials and technologies. Aerostructures with improved aerodynamics lower drag, further reducing emissions. Due to increased environmental concerns related to air travel among airlines and passengers, sustainability is becoming pivotal to the aerostructures business. In addition to lowering carbon emissions, sustainable aerostructures are meeting the need for eco-friendly goods and services. Consequently, eco-friendly products, production techniques, and propulsion systems are being created, such as composites made of recycled materials or biofuels that emit less carbon. Airlines are also enhancing their environmental profile by investing in sustainable aerostructures.

The production and maintenance of aerostructures is also influenced by efficiency and sustainability. Automation and digitalization assist in streamlining industrial processes, cutting waste, and improving efficiency. Robotics and machine learning are being used to produce aerostructures with higher quality, fewer mistakes, and lower costs. Digital tools are used to track the performance of aerostructures, providing real-time information on fuel consumption, wear and tear, and other metrics that can help airlines run more efficiently and economically.

Restraints: Obstacles associated with recycling composite materials

Compared with single material-made wastes, composite wastes are more challenging to recycle, mechanically or chemically, due to inconsistencies in chemical compositions and material properties. Considering their innate properties of lightweight, durability, and longevity, composite materials contribute to the development of sustainable solutions for assemblies and structures across industries. However, stricter environmental policy and legislation, increased restrictions and costs for landfill disposal, and the transition to a circular economy are some factors to be considered for creating recycling solutions for composites. Increased use of lifecycle assessments as part of the materials selection process across many sectors is also scrutinizing composites’ end-of-life waste management. Furthermore, there are nearly 11,000 tonnes of E-glass fiber waste from earlier stages of the supply chain. It is also estimated that around 1,600 tonnes of carbon fiber/carbon-fiber-reinforced plastic (CFRP) production waste may be generated annually. While there is relatively little carbon fiber end-of-life waste at present, significant volumes are expected to join the waste stream soon. Therefore, due to the recyclability issues of composite materials, the manufacturing of aerostructures is restrained.

Opportunities: High demand for UAVs

The unmanned aerial vehicle (UAV) demand has opened up enormous possibilities for the aerostructures market. Drones, often known as UAVs, have a variety of uses in the consumer, business, and military sectors. Due to their numerous uses in surveillance, agriculture, transportation, and delivery services, UAVs are anticipated to expand rapidly over the next several years. In order to enhance their flying performance and increase their range and endurance, innovative aerostructures made of lightweight composite materials are being developed in response to the growing demand for UAVs.

Players in the aerostructures market are investing in the development of new technologies and materials to assist the production of UAVs as consumer demand for them rises. This creates more chances for producers of aerostructures to increase their capabilities and domain knowledge in aerodynamics, materials science, and innovative production techniques. Businesses are also looking into novel business models to offer a variety of services, including design, prototyping, and testing, to aid in the development of UAVs.

Furthermore, the growth of autonomous UAVs gives aerostructure businesses a chance to provide fresh services such as maintenance, repair, and overhaul (MRO). Companies will need to provide new MRO services to support their operations as the use of autonomous UAVs increases, which will call for knowledge of modern aerostructures. The growing demand for UAVs presents tremendous potential for the aerostructures market to establish new business models and services and extend its capabilities.

Challenges: Supply chain constraints and high shipping costs

One of the challenges that aerostructure manufacturers need to overcome is the high cost of transportation and hurdles in the supply chain. High transportation costs are driving supply chain strategies. The changes in transport costs have an impact not just on transportation budgets but also on the broader supply chain and financial performance.

Reasons for high-cost transportation:

- High freight rates

- Outdated warehouse network

- Out-of-area shipping

- Poor compliance with prescribed routings

- Split shipments

A conjunction of factors and economic developments lies behind the rising transportation costs. Freight movement in most modes largely depends on increasingly expensive and finite fossil fuels, primarily diesel fuel. According to the US Energy Information Administration, the price of crude oil is the dominant factor influencing changes in diesel prices. Another equally influential factor in transportation costs is the demand-supply imbalance of freight transport services, a repercussion of trade growth that has outpaced the availability of transport services to such an extent that it has led to severe issues of congestion and capacity constraint in the US. According to a report presented in September 2021 at the Council of Supply Chain Management Professionals (CSCMP) annual conference, overall logistics costs in the US fell by 4% to USD 1.56 trillion. The drop was primarily driven by a 15% decrease in inventory carrying costs. The report stated that transportation costs increased by 0.8%, driven by a 24.3% increase in the parcel and last-mile segment from e-commerce and home delivery growth. Also, airfreight costs increased by 9%, the motor was down 0.6%, the ocean was down 28.6%, and rail was down 11%. Costs continued to fluctuate throughout 2021 and are currently trending up. Thus, the increase in transportation costs and hurdles in the supply chain will have an adverse effect on the aerostructures market.

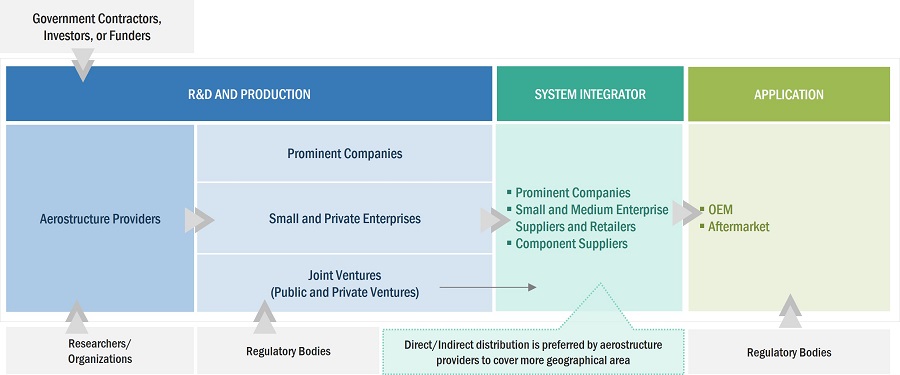

Aerostructures Market Ecosystem

Based on end user, the aftermarket segment of the market is projected to grow at the second highest CAGR from 2023 to 2028.

Based on end user, the aerostructures market has been segmented into OEM and aftermarket. The increasing maintenance, repair and replacement activities is driving the aftermarket segment. Aging od aircraft fleet, Increasing utilization of aircraft, increasing upgrades and retrofits is also influencing the growth of this segment.

Based on material, the alloys & superalloys segment of the market is projected to grow at the second highest CAGR from 2023 to 2028.

Based on material, the aerostructures market has been segmented into composites, alloys & superalloys, and metals. The need to withstand high temperatures, high resistance to fatigue and high strength is driving the growth of this segment. The increased research on developing new alloys & superalloys with improved properties such as reduced weight, enhanced resistance and increased strength also is influencing the growth of this segment.

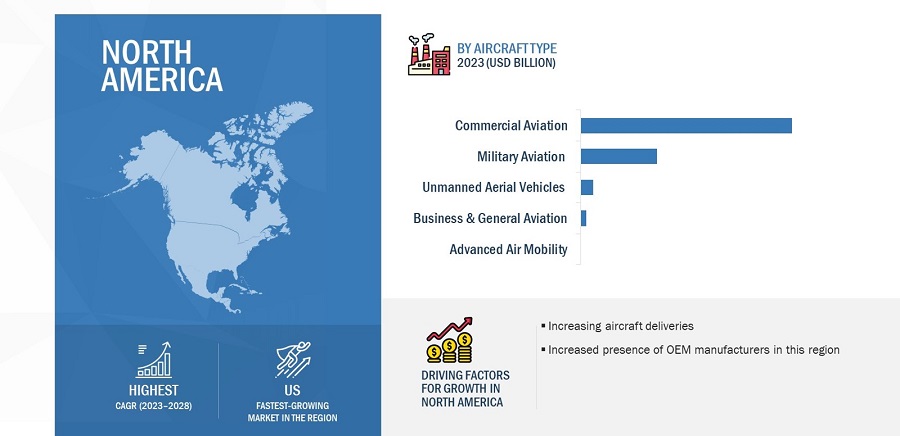

Based on aircraft type, the UAVs segment of the market is projected to grow at the second highest CAGR from 2023 to 2028.

Based on aircraft type, the aerostructures market has been segmented into commercial aviation, military aviation, business & general aviation, unmanned aerial vehicles (UAVs) and advanced air mobility (AAM). The demand for UAVs is due to its increasing applications of UAVs for military and commercial use. The demand for lightweight design and customized designs are also driving the UAVs segment in the aerostructures market.

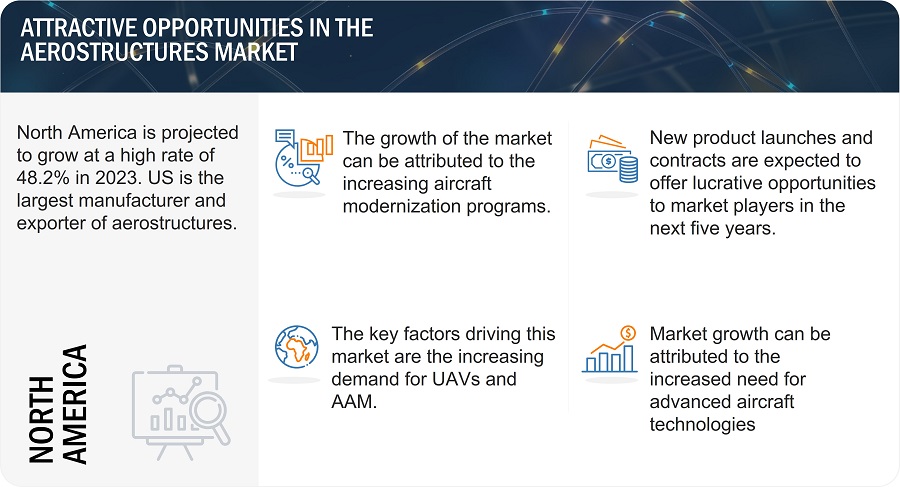

North America is expected to account for the highest CAGR in the forecasted period.

North America is estimated to account for the highest CAGR in the forecasted period. The increasing demand for commercial aircrafts is majorly driving this growth of the market. US and Canada are the countries studied under this region. The presence of leading aerostructure manufacturers and increasing R & D investments is influencing growth in this segment

Aerostructures Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Players such as Airbus SE (Netherlands), FACC AG (Austria), Elbit System Ltd. (Israel), ST Engineering (Singapore) and Ruag Holding AG (Switzerland). The report covers various industry trends and new technological innovations in the Aerostructures Companies for the period 2020-2028.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate |

6.6% |

|

Estimated Market Size in 2023 |

USD 61.0 Billion |

|

Projected Market Size in 2028 |

USD 84.0 Billion |

|

Market size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Component, By Material, By Aircraft Type, By End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Companies covered |

Airbus SE (Netherlands), Spirit AeroSystems Inc. (US), GKN plc (UK), Saab AB (Sweden), Leonardo S.P.A (Italy) and Raytheon Technologies Corporation (US) |

Aerostructures Market Highlights

The study categorizes aerostructures based on component, material, aircraft type, end user, and region.

|

Segment |

Subsegment |

|

By Component |

|

|

By Material |

|

|

By Aircraft Type |

|

|

By End Use |

|

|

By Region |

|

Recent Developments

- In March 2023, Spirit AeroSystems Inc. and Joramco have signed an agreement to be a spirit-authorized maintenance, repair, and overhaul (MRO) center. Under this agreement, they will first provide nacelle services to selective players and their products.

- In December 2022, Airbus SE announced the extension of its contract with Axiscades Technologies Ltd. to provide engineering services for the design and development of Airbus aircraft programs. The contract will provide engineering services and product development for fuselage and wings at different locations.

- In September 2022, Spirit AeroSystems Inc. received a contract from The Boeing Company to provide horizontal stabilizers for its KC-135R Stratotankers used by US Airforce.

- In October 2022, Air Force Research Laboratory has awarded a contract to Collins Aerospace to design and build an advanced impact resistant F-16 ventral fin using thermoplastic welding technology. The contract is for three years, under which the company will make component design, application of welding process, and fabrication of F-16 fin.

- In January 2022, GKN plc signed an agreement with Gulfstream for major workshare, including G800 empennage, G800 floorboards, G800 fuselage panels, G400 rudder, and G400 machined wing skins.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Aerostructures market?

Response: The increasing demand for UAVs and increasing aircraft modernization programs are few growth prospects of aerostructures market.

What are the key sustainability strategies adopted by leading players operating in the Aerostructures market?

Response: Major players in the aerostructure industry have introduced various organic and inorganic strategies to make their presence in the market. The key players include Airbus SE (Netherlands), GKN plc (UK), Spirit AeroSystems Inc. (US), Leonardo S.p.A (Italy) and Raytheon Technologies Corporation (US). These players have adopted many sustainable strategies, such as new product launches, acquisitions, partnerships & agreements, and contracts to strengthen their position in the market.

What are the new emerging technologies and use cases disrupting the Aerostructures market?

Response: The emerging technologies in the aerostructure market are Artificial intelligence, Internet of things, additive manufacturing, morphing technology for wings, 4D printing and Industry 4.0.

What is the current size of the aerostructure market?

Response: The aerostructure market is expected to grow from an estimated USD 61.0 billion in 2023 to USD 84.0 billion by 2028 at a CAGR of 6.6% from 2023 to 2028.

What are some of the opportunities of the aerostructures market?

Response: Expansion of MRO services, high demand for UAVs, decline in cost of composite materials are few of the opportunities of the aerostructures market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Preference for efficient and sustainable aerostructures- Technological advancements associated with aerostructures- Increased adoption of composite materialsRESTRAINTS- Obstacles associated with recycling composite materials- High capital investmentOPPORTUNITIES- Expansion of MRO services- High demand for UAVs- Decline in cost of composite materialsCHALLENGES- Supply chain constraints and high shipping costs- Regulatory compliance- Lack of skilled labor- Increased competition in aerostructures market

- 5.3 ROADMAP OF AEROSTRUCTURES MARKET, 2010–2022

- 5.4 RECESSION IMPACT ANALYSIS

-

5.5 VALUE CHAIN ANALYSISRAW MATERIALSR&DCOMPONENT MANUFACTURINGOEMSEND USERS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR AEROSTRUCTURES MARKET

-

5.7 AEROSTRUCTURES MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.9 PRICING ANALYSIS

- 5.10 VOLUME DATA, BY COMPONENT

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.12 TRADE ANALYSIS

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.15 TECHNOLOGY ANALYSISKEY TECHNOLOGY- Development of robotsSUPPORTING TECHNOLOGY- Use of computational fluid dynamics (CFD)

-

5.16 USE CASE ANALYSISUSE CASE 1: USE OF SMART STRUCTURES BY COLLINS AEROSPACEUSE CASE 2: USE OF ADVANCED MATERIALS IN AEROSTRUCTURESUSE CASE 3: USE OF ADDITIVE MANUFACTURING

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSAUTOMATIONADDITIVE MANUFACTURINGINTERNET OF THINGS (IOT)MORPHING TECHNOLOGY FOR WINGS4D PRINTING

-

6.3 IMPACT OF MEGATRENDSADVANCED COMPOSITE MATERIALSINDUSTRY 4.0

-

6.4 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 FUSELAGESENSURE SAFE AND EFFECTIVE TRANSPORTATION OF GOODS

-

7.3 EMPENNAGESENSURE STABILITY AND MANEUVERABILITY DURING FLIGHT

-

7.4 FLIGHT CONTROL SURFACESENSURE OPTIMIZED AIRCRAFT PERFORMANCE AND SAFETY

-

7.5 WINGSENSURE REDUCED FUEL CONSUMPTION

-

7.6 NOSESENSURE ENHANCED AIRCRAFT PERFORMANCE

-

7.7 NACELLES & PYLONSPLAY VITAL ROLE IN ENSURING AIRCRAFT SAFETY

-

7.8 DOORS & SKIDSENSURE BETTER STABILITY AND EASY ACCESS

- 8.1 INTRODUCTION

-

8.2 OEMPIVOTAL IN DESIGN AND DEVELOPMENT OF AIRCRAFT COMPONENTS AND SYSTEMS

-

8.3 AFTERMARKETASSISTS IN MAINTENANCE AND REPAIR OF AIRCRAFT

- 9.1 INTRODUCTION

-

9.2 COMMERCIAL AVIATIONNARROW-BODY AIRCRAFT- Aerostructures influence performance of narrow-body aircraftWIDE-BODY AIRCRAFT- Pivotal in long-haul commercial aviationREGIONAL JETS- Used in connecting regional communitiesCOMMERCIAL HELICOPTERS- Advancements in aerostructures technology

-

9.3 BUSINESS & GENERAL AVIATIONBUSINESS JETS- Innovative aerostructures to enhance comfort and safetyULTRALIGHT & LIGHT AIRCRAFT- Lightweight aerostructures to optimize efficiency

-

9.4 MILITARY AVIATIONFIGHTER AIRCRAFT- Use of advanced composite materials in fighter aircraft aerostructuresTRANSPORT AIRCRAFT- Need to carry heavy loads over long distancesSPECIAL MISSION AIRCRAFT- Multi-mission capabilities of special mission aircraftMILITARY HELICOPTERS- Need for combat helicopters

-

9.5 UNMANNED AERIAL VEHICLESMILITARY- Wide-scale use of UAVs in military applicationsGOVERNMENT & LAW- Increased government investmentsCOMMERCIAL- Lucrative opportunities for UAVs in commercial sector

-

9.6 ADVANCED AIR MOBILITYAIR TAXIS- Increased adoption of air taxis to cope with rapidly expanding megacitiesAIR SHUTTLES & AIR METROS- Need for rapid transportationPERSONAL AERIAL VEHICLES- Private air transport vehicles offer convenience, speed, and routing efficiencyCARGO AIR VEHICLES- Increased developments by key eVTOL aircraft manufacturersAIR AMBULANCES & MEDICAL EMERGENCY VEHICLES- Advances in eVTOL aircraft facilitate organ transportLAST-MILE DELIVERY VEHICLES- Rising adoption of autonomous vehicles

- 10.1 INTRODUCTION

-

10.2 COMPOSITESOFFER LONGEVITY TO AEROSTRUCTURES

-

10.3 ALLOYS & SUPERALLOYSOFFER DURABILITY TO AEROSTRUCTURES

-

10.4 METALSOFFER STRENGTH AND STIFFNESS TO AEROSTRUCTURES

- 11.1 INTRODUCTION

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

-

11.3 NORTH AMERICARECESSION IMPACT ANALYSIS: NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Presence of leading domestic playersCANADA- Increased R&D activities

-

11.4 EUROPERECESSION IMPACT ANALYSIS: EUROPEPESTLE ANALYSIS: EUROPEUK- Technological advancements in UAVs and UAMFRANCE- Presence of several aircraft OEMsGERMANY- Advancements in air transportITALY- Increasing number of unmanned aircraftRUSSIA- Need for military aircraftREST OF EUROPE- Growing focus on timely maintenance and replacement of aircraft parts

-

11.5 ASIA PACIFICRECESSION IMPACT ANALYSIS: ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Growing demand for UAVs in militaryINDIA- Improved domestic OEM capabilitiesJAPAN- Diversification of commercial operationsAUSTRALIA- Use of advanced technology in air transportSOUTH KOREA- Rise in defense spendingREST OF ASIA PACIFIC- Strong manufacturing expertise with composites and metals

-

11.6 LATIN AMERICARECESSION IMPACT ANALYSIS: LATIN AMERICAPESTLE ANALYSIS: LATIN AMERICABRAZIL- Significant presence of OEMs and carriersMEXICO- Expanding composites industryREST OF LATIN AMERICA- Rising demand for aircraft

-

11.7 MIDDLE EASTRECESSION IMPACT ANALYSIS: MIDDLE EASTPESTLE ANALYSIS: MIDDLE EASTISRAEL- Increased investments in UAV R&DUAE- Preference for locally produced goodsSAUDI ARABIA- Increased demand for aerostructure components and repair stationsTURKEY- Localization of contemporary aircraft platforms and componentsREST OF MIDDLE EAST- Rise in number of aircraft repair stations

-

11.8 AFRICARECESSION IMPACT ANALYSIS: AFRICAPESTLE ANALYSIS: AFRICASOUTH AFRICA- Growing demand for replacement aircraft partsNIGERIA- Rise in domestic demand for aircraftREST OF AFRICA- Accessibility of affordable materials

- 12.1 INTRODUCTION

- 12.2 MARKET RANKING ANALYSIS

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

-

12.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 12.7 COMPANY FOOTPRINT ANALYSIS

- 12.8 COMPETITIVE BENCHMARKING OF KEY PLAYERS

-

12.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSAIRBUS SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSPIRIT AEROSYSTEMS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLEONARDO S.P.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGKN PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAFRAN SA- Business overview- Products/Solutions/Services offered- Recent developmentsSAAB AB- Business overview- Products/Solutions/Services offered- Recent developmentsFACC AG- Business overview- Products/Solutions/Services offered- Recent developmentsKAWASAKI HEAVY INDUSTRIES LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsST ENGINEERING- Business overview- Products/Solutions/Services offered- Recent developmentsKAMAN CORPORATION- Business overview- Products/Solutions/Services offeredRUAG INTERNATIONAL HOLDING LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsLATÉCOÈRE- Business overview- Products/Solutions/Services offered- Recent developmentsELBIT SYSTEMS LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsTRIUMPH GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsKOREA AEROSPACE INDUSTRIES LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsISRAEL AEROSPACE INDUSTRIES LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsMITSUBISHI HEAVY INDUSTRIES LTD.- Business overview- Products/Solutions/Services offeredAAR CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsAEROSPACE INDUSTRIAL DEVELOPMENT CORPORATION (AIDC)- Business overview- Products/Solutions/Services offered

-

13.3 OTHER PLAYERSSONACA GROUPAERNNOVA AEROSPACE S.AAERO VODOCHODYTURKISH AEROSPACE INDUSTRIES, INC.SABCA NVDAHERTHE NORDAM GROUP LLCPRECISION CASTPARTS CORPORATIONCOMPOSITES TECHNOLOGY RESEARCH MALAYSIA SDN BHD (CTRM)MECACHROME GROUP

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 AEROSTRUCTURES MARKET ECOSYSTEM

- TABLE 4 PORTER’S FIVE FORCE ANALYSIS

- TABLE 5 AVERAGE PRICE ANALYSIS FOR AEROSTRUCTURE COMPONENTS, BY AIRCRAFT TYPE

- TABLE 6 AEROSTRUCTURE OEM MARKET, BY COMPONENT (UNITS)

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 9 COUNTRY-WISE IMPORT, 2018–2021 (USD THOUSAND)

- TABLE 10 COUNTRY-WISE EXPORTS, 2018–2021 (USD THOUSAND)

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING AEROSTRUCTURES, BY COMPONENT (%)

- TABLE 12 KEY BUYING CRITERIA FOR AEROSTRUCTURES, BY COMPONENT

- TABLE 13 CONFERENCES AND EVENTS

- TABLE 14 MAJOR PATENTS FOR AEROSTRUCTURES

- TABLE 15 AEROSTRUCTURES MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 16 AEROSTRUCTURES MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 17 FUSELAGES: AEROSTRUCTURES MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 18 FUSELAGES: AEROSTRUCTURES MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 19 EMPENNAGES: AEROSTRUCTURES MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 20 EMPENNAGES: AEROSTRUCTURES MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 21 FLIGHT CONTROL SURFACES: AEROSTRUCTURES MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 22 FLIGHT CONTROL SURFACES: AEROSTRUCTURES MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 23 WINGS: AEROSTRUCTURES MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 24 WINGS: AEROSTRUCTURES MARKET, BY MATERIAL 2023–2028 (USD MILLION)

- TABLE 25 NOSES: AEROSTRUCTURES MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 26 NOSES: AEROSTRUCTURES MARKET, BY MATERIAL 2023–2028 (USD MILLION)

- TABLE 27 NACELLES & PYLONS: AEROSTRUCTURES MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 28 NACELLES & PYLONS: AEROSTRUCTURES MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 29 DOORS & SKIDS: AEROSTRUCTURES MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 30 DOORS & SKIDS: AEROSTRUCTURES MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 31 AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 32 AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 33 COMMERCIAL AVIATION: AEROSTRUCTURES OEM MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 34 COMMERCIAL AVIATION: AEROSTRUCTURES OEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 35 BUSINESS & GENERAL AVIATION: AEROSTRUCTURES OEM MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 36 BUSINESS & GENERAL AVIATION: AEROSTRUCTURES OEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 MILITARY AVIATION: AEROSTRUCTURES OEM MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 38 MILITARY AVIATION: AEROSTRUCTURES OEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 39 UNMANNED AERIAL VEHICLES: AEROSTRUCTURES OEM MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 40 UNMANNED AERIAL VEHICLES: AEROSTRUCTURES OEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 41 ADVANCED AIR MOBILITY: AEROSTRUCTURES OEM MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 42 ADVANCED AIR MOBILITY: AEROSTRUCTURES OEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 COMMERCIAL AVIATION: AEROSTRUCTURES AFTERMARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 44 COMMERCIAL AVIATION: AEROSTRUCTURES AFTERMARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 45 BUSINESS & GENERAL AVIATION: AEROSTRUCTURES AFTERMARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 46 BUSINESS & GENERAL AVIATION: AEROSTRUCTURES AFTERMARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 MILITARY AVIATION: AEROSTRUCTURES AFTERMARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 48 MILITARY AVIATION: AEROSTRUCTURES AFTERMARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 49 AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 50 AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 51 COMMERCIAL AVIATION: AEROSTRUCTURES MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 52 COMMERCIAL AVIATION: AEROSTRUCTURES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 53 BUSINESS & GENERAL AVIATION: AEROSTRUCTURES MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 54 BUSINESS & GENERAL AVIATION: AEROSTRUCTURES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 MILITARY AVIATION: AEROSTRUCTURES MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 56 MILITARY AVIATION: AEROSTRUCTURES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 57 UNMANNED AERIAL VEHICLES: AEROSTRUCTURES MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 58 UNMANNED AERIAL VEHICLES: AEROSTRUCTURES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 ADVANCED AIR MOBILITY: AEROSTRUCTURES MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 60 ADVANCED AIR MOBILITY: AEROSTRUCTURES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 61 AEROSTRUCTURES MARKET, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 62 AEROSTRUCTURES MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 63 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 64 AEROSTRUCTURES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 65 AEROSTRUCTURES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: AEROSTRUCTURES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: AEROSTRUCTURES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 72 US: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 73 US: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 74 US: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 75 US: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 76 CANADA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 77 CANADA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 78 CANADA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 79 CANADA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: AEROSTRUCTURES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 81 EUROPE: AEROSTRUCTURES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 83 EUROPE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 85 EUROPE: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 86 UK: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 87 UK: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 88 UK: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 89 UK: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 90 FRANCE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 91 FRANCE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 92 FRANCE: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 93 FRANCE: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 94 GERMANY: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 95 GERMANY: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 96 GERMANY: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 97 GERMANY: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 98 ITALY: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 99 ITALY: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 100 ITALY: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 101 ITALY: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 102 RUSSIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 103 RUSSIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 104 RUSSIA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 105 RUSSIA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 106 REST OF EUROPE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 107 REST OF EUROPE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 109 REST OF EUROPE: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AEROSTRUCTURES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AEROSTRUCTURES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 116 CHINA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 117 CHINA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 118 CHINA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 119 CHINA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 120 INDIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 121 INDIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 122 INDIA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 123 INDIA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 124 JAPAN: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 125 JAPAN: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 126 JAPAN: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 127 JAPAN: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 128 AUSTRALIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 129 AUSTRALIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 130 AUSTRALIA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 131 AUSTRALIA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 132 SOUTH KOREA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 133 SOUTH KOREA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 134 SOUTH KOREA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 135 SOUTH KOREA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 140 LATIN AMERICA: AEROSTRUCTURES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 141 LATIN AMERICA: AEROSTRUCTURES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 142 LATIN AMERICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 143 LATIN AMERICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 144 LATIN AMERICA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 145 LATIN AMERICA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 146 BRAZIL: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 147 BRAZIL: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 148 BRAZIL: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 149 BRAZIL: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 150 MEXICO: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 151 MEXICO: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 152 MEXICO: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 153 MEXICO: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 154 REST OF LATIN AMERICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 155 REST OF LATIN AMERICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 156 REST OF LATIN AMERICA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 157 REST OF LATIN AMERICA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST: AEROSTRUCTURES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 159 MIDDLE EAST: AEROSTRUCTURES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 161 MIDDLE EAST: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 163 MIDDLE EAST: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 164 ISRAEL: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 165 ISRAEL: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 166 ISRAEL: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 167 ISRAEL: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 168 UAE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 169 UAE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 170 UAE: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 171 UAE: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 172 SAUDI ARABIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 173 SAUDI ARABIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 174 SAUDI ARABIA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 175 SAUDI ARABIA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 176 TURKEY: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 177 TURKEY: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 178 TURKEY: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 179 TURKEY: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 180 REST OF MIDDLE EAST: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 184 AFRICA: AEROSTRUCTURES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 185 AFRICA: AEROSTRUCTURES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 186 AFRICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 187 AFRICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 188 AFRICA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 189 AFRICA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 190 SOUTH AFRICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 191 SOUTH AFRICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 192 SOUTH AFRICA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 193 SOUTH AFRICA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 194 NIGERIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 195 NIGERIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 196 NIGERIA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 197 NIGERIA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 198 REST OF AFRICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 199 REST OF AFRICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 200 REST OF AFRICA: AEROSTRUCTURES MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 201 REST OF AFRICA: AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 202 KEY DEVELOPMENTS BY LEADING PLAYERS IN AEROSTRUCTURES MARKET, 2022–2023

- TABLE 203 AEROSTRUCTURES MARKET: DEGREE OF COMPETITION

- TABLE 204 AEROSTRUCTURES MARKET: KEY STARTUPS/SMES

- TABLE 205 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 206 COMPANY FOOTPRINT

- TABLE 207 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 208 AEROSTRUCTURES MARKET: PRODUCT LAUNCHES, JANUARY 2020–DECEMBER 2023

- TABLE 209 AEROSTRUCTURES MARKET: DEALS, JANUARY 2020–DECEMBER 2023

- TABLE 210 AIRBUS SE: BUSINESS OVERVIEW

- TABLE 211 AIRBUS SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 AIRBUS SE: DEALS

- TABLE 213 SPIRIT AEROSYSTEMS INC.: BUSINESS OVERVIEW

- TABLE 214 SPIRIT AEROSYSTEMS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 SPRITS AEROSYSTEMS HOLDINGS, INC.: DEALS

- TABLE 216 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 217 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 219 LEONARDO S.P.A.: BUSINESS OVERVIEW

- TABLE 220 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 LEONARDO S.P.A.: DEALS

- TABLE 222 GKN PLC: BUSINESS OVERVIEW

- TABLE 223 GKN PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 GKN PLC: PRODUCT DEVELOPMENTS

- TABLE 225 GKN PLC: DEALS

- TABLE 226 SAFRAN SA: BUSINESS OVERVIEW

- TABLE 227 SAFRAN SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 SAFRAN SA: DEALS

- TABLE 229 SAAB AB: BUSINESS OVERVIEW

- TABLE 230 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 SAAB AB: DEALS

- TABLE 232 SAAB AB: OTHERS

- TABLE 233 FACC AG: BUSINESS OVERVIEW

- TABLE 234 FACC AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 FACC AG: DEALS

- TABLE 236 KAWASAKI HEAVY INDUSTRIES LTD.: BUSINESS OVERVIEW

- TABLE 237 KAWASAKI HEAVY INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 KAWASAKI HEAVY INDUSTRIES LTD.: DEALS

- TABLE 239 ST ENGINEERING: BUSINESS OVERVIEW

- TABLE 240 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 ST ENGINEERING: DEALS

- TABLE 242 KAMAN CORPORATION: BUSINESS OVERVIEW

- TABLE 243 KAMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 RUAG INTERNATIONAL HOLDING LTD.: BUSINESS OVERVIEW

- TABLE 245 RUAG INTERNATIONAL HOLDING LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 RUAG INTERNATIONAL HOLDING LTD.: DEALS

- TABLE 247 LATÉCOÈRE: BUSINESS OVERVIEW

- TABLE 248 LATÉCOÈRE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 LATÉCOÈRE: DEALS

- TABLE 250 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 251 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 ELBIT SYSTEMS LTD.: DEALS

- TABLE 253 TRIUMPH GROUP: BUSINESS OVERVIEW

- TABLE 254 TRIUMPH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 TRIUMPH GROUP: DEALS

- TABLE 256 KOREA AEROSPACE INDUSTRIES LTD.: BUSINESS OVERVIEW

- TABLE 257 KOREA AEROSPACE INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 KOREA AEROSPACE INDUSTRIES LTD.: DEALS

- TABLE 259 ISRAEL AEROSPACE INDUSTRIES LTD.: BUSINESS OVERVIEW

- TABLE 260 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

- TABLE 262 MITSUBISHI HEAVY INDUSTRIES LTD.: BUSINESS OVERVIEW

- TABLE 263 MITSUBISHI HEAVY INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 AAR CORPORATION: BUSINESS OVERVIEW

- TABLE 265 AAR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 AAR CORPORATION: DEALS

- TABLE 267 AEROSPACE INDUSTRIAL DEVELOPMENT CORPORATION (AIDC): BUSINESS OVERVIEW

- TABLE 268 AEROSPACE INDUSTRIAL DEVELOPMENT CORPORATION (AIDC): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 SONACA GROUP: COMPANY OVERVIEW

- TABLE 270 AERNNOVA AEROSPACE S.A: COMPANY OVERVIEW

- TABLE 271 AERO VODOCHODY: COMPANY OVERVIEW

- TABLE 272 TURKISH AEROSPACE INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 273 SABCA NV: COMPANY OVERVIEW

- TABLE 274 DAHER: COMPANY OVERVIEW

- TABLE 275 THE NORDAM GROUP LLC: COMPANY OVERVIEW

- TABLE 276 PRECISION CASTPARTS CORPORATION: COMPANY OVERVIEW

- TABLE 277 COMPOSITES TECHNOLOGY RESEARCH MALAYSIA SDN BHD: COMPANY OVERVIEW

- TABLE 278 MECACHROME GROUP: BUSINESS OVERVIEW

- FIGURE 1 AEROSTRUCTURES MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY ON AEROSTRUCTURES MARKET

- FIGURE 8 FUSELAGES SEGMENT TO DOMINATE AEROSTRUCTURES MARKET IN 2023

- FIGURE 9 COMPOSITES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 10 COMMERCIAL AVIATION TO SURPASS OTHER SEGMENTS IN 2023

- FIGURE 11 NORTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 INCREASED DEMAND FOR ADVANCED AIR MOBILITY AND INTRODUCTION TO LIGHTWEIGHT AIRCRAFT MATERIALS

- FIGURE 13 FUSELAGES TO SECURE LEADING MARKET POSITION FROM 2023 TO 2028

- FIGURE 14 OEM TO ACQUIRE MAXIMUM MARKET SHARE BY 2028

- FIGURE 15 UAE TO BE FASTEST-GROWING COUNTRY DURING FORECAST PERIOD

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR AEROSTRUCTURES MARKET

- FIGURE 17 VALUE CHAIN ANALYSIS

- FIGURE 18 REVENUE SHIFT CURVE

- FIGURE 19 AEROSTRUCTURES MARKET ECOSYSTEM MAP

- FIGURE 20 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING AEROSTRUCTURES, BY COMPONENT

- FIGURE 22 KEY BUYING CRITERIA FOR AEROSTRUCTURES, BY COMPONENT

- FIGURE 23 MORPHING WINGS TECHNOLOGY

- FIGURE 24 4D PRINTING TECHNOLOGY

- FIGURE 25 AEROSTRUCTURES MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- FIGURE 26 AEROSTRUCTURES MARKET, BY END USER, 2023–2028 (USD MILLION)

- FIGURE 27 AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- FIGURE 28 AEROSTRUCTURES MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- FIGURE 29 AEROSTRUCTURES MARKET, BY REGION, 2023–2028

- FIGURE 30 NORTH AMERICA: AEROSTRUCTURES MARKET SNAPSHOT

- FIGURE 31 EUROPE: AEROSTRUCTURES MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: AEROSTRUCTURES MARKET SNAPSHOT

- FIGURE 33 LATIN AMERICA: AEROSTRUCTURES MARKET SNAPSHOT

- FIGURE 34 MIDDLE EAST: AEROSTRUCTURES MARKET SNAPSHOT

- FIGURE 35 AFRICA: AEROSTRUCTURES MARKET SNAPSHOT

- FIGURE 36 MARKET RANKING OF TOP FIVE PLAYERS, 2022

- FIGURE 37 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2022 (USD BILLION)

- FIGURE 38 MARKET SHARE OF TOP FIVE PLAYERS, 2022

- FIGURE 39 AEROSTRUCTURES MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 40 AEROSTRUCTURES MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 41 AIRBUS SE: COMPANY SNAPSHOT

- FIGURE 42 SPIRIT AEROSYSTEMS INC.

- FIGURE 43 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 45 COMPANY SNAPSHOT: GKN PLC

- FIGURE 46 SAFRAN SA: COMPANY SNAPSHOT

- FIGURE 47 SAAB AB: COMPANY SNAPSHOT

- FIGURE 48 FACC AG: COMPANY SNAPSHOT

- FIGURE 49 KAWASAKI HEAVY INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 50 ST ENGINEERING: COMPANY SNAPSHOT

- FIGURE 51 COMPANY SNAPSHOT: KAMAN CORPORATION

- FIGURE 52 COMPANY SNAPSHOT: RUAG INTERNATIONAL HOLDING LTD.

- FIGURE 53 LATÉCOÈRE: COMPANY SNAPSHOT

- FIGURE 54 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 55 TRIUMPH GROUP: COMPANY SNAPSHOT

- FIGURE 56 COMPANY SNAPSHOT: KOREA AEROSPACE INDUSTRIES LTD.

- FIGURE 57 COMPANY SNAPSHOT: ISRAEL AEROSPACE INDUSTRIES LTD.

- FIGURE 58 COMPANY SNAPSHOT: MITSUBISHI HEAVY INDUSTRIES LTD.

- FIGURE 59 COMPANY SNAPSHOT: AAR CORPORATION

- FIGURE 60 COMPANY SNAPSHOT: AEROSPACE INDUSTRIAL DEVELOPMENT CORPORATION (AIDC)

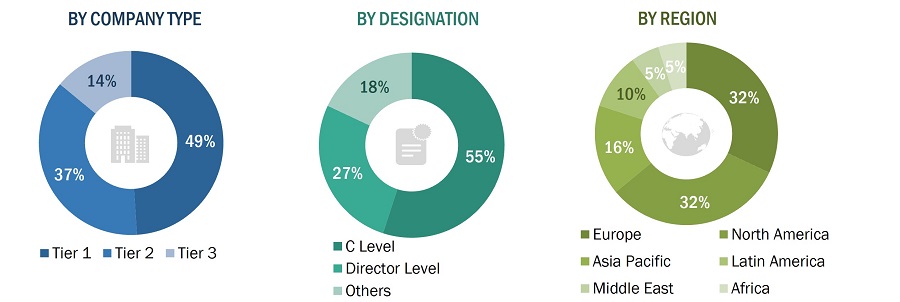

This research study on the aerostructures market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva, to identify and collect information relevant to the market. Primary sources included industry experts as well as manufacturers, system providers, technology developers, alliances, and organizations related to the segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market and assess its growth prospects.

Secondary Research

Secondary sources referred to for this research study included financial statements of companies offering aerostructures for all types of applications, such as commercial, military, business & general aviation, unmanned aerial vehicles and advanced air mobility, along with various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents. The ranking analysis of companies in the aerostructures market was determined using secondary data from paid and unpaid sources and by analyzing product portfolios and service offerings of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the aerostructures market through secondary research. Several primary interviews were conducted with market experts from both demand and supply sides across North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. This primary data was collected through questionnaires, emails, and telephonic interviews. Primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), directors from business development, marketing, and product development/innovation teams, related key executives from aerostructure vendors, independent aviation consultants, importers, and distributors.

Interviews were conducted to gather insights such as market statistics, data on revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand trends related to material, component, end user, aircraft type, and region. Stakeholders from the demand side, such as CXOs, production managers, engineers, and installation teams of end users of aerostructures, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and future outlook of their business, which could affect the aerostructures market.

To know about the assumptions considered for the study, download the pdf brochure

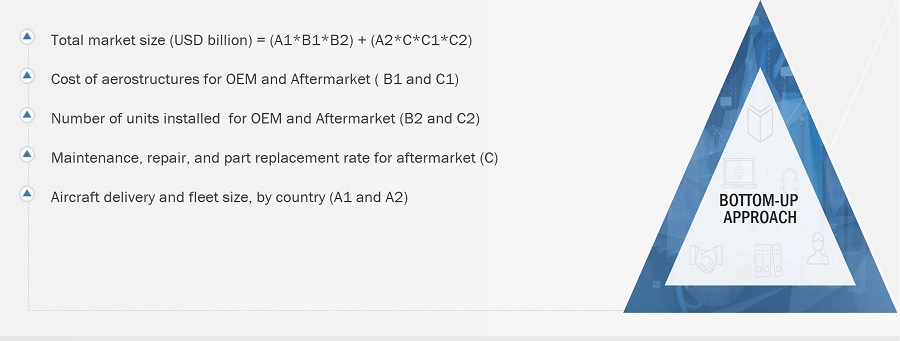

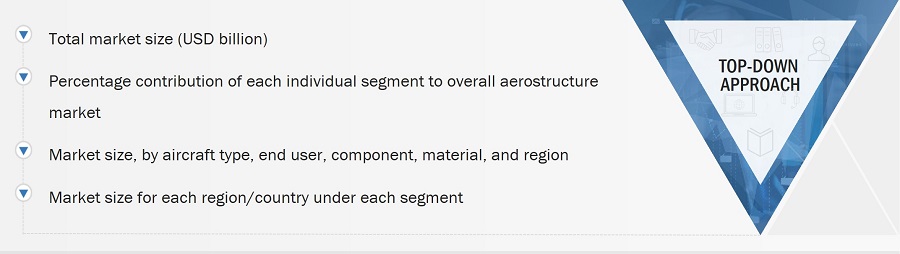

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aerostructures market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Bottom-Up Approach

Top Down Approach

Market Definition

An aerostructure is an aircraft component that helps it fly and maintain its position in changing aerodynamic conditions. It is designed to withstand challenging weather and structural fatigue caused by extreme loading cycles. An aerostructure is part of the airframe and includes fuselages, wings, flight control surfaces, nacelles, and other components. It is manufactured using composites, alloys & superalloys, and metals to keep it lightweight.

Key Stakeholders

- Aerostructure Manufacturers

- Aerostructure Distributors

- System Integrators

- Technology Support Providers

- Subcomponent Manufacturers

- Raw Material Suppliers

- Aircraft Manufacturers

Objectives of the Report

- To define, describe, and forecast the size of the aerostructures market based on component, material, aircraft type, end user, and region

- To forecast the market size of segments across North America, Europe, Asia Pacific, Latin America, Middle East, and Africa, along with major countries in these regions

- To analyze the demand- and supply-side indicators of the aerostructures market and provide a factor analysis for the same

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aerostructures market

- To identify the current industry, market, and technology trends in the aerostructures market

- To strategically analyze micromarkets1 with respect to individual technological trends and prospects

- To analyze the degree of competition in the aerostructures market by identifying key market players

- To analyze competitive developments such as joint ventures, mergers & acquisitions, and product launches/developments undertaken by key market players

- To identify the financial position, key products, and major developments of leading market players

- To strategically profile key market players and comprehensively analyze their market share and core competencies2

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aerostructures market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the aerostructures market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aerostructures Market

I will be using this in my not for profit research paper.

Interested in, Aerostructure part ; machining, sheet metal and assembly for detail part, composite, hard metal(titanium)

First hand info about the growth in the aerostructures field

I just want to know the figures of market share and market size of the world aerostructure business (as suppliers), in the past, today (2019), and for the next 10 years.

Interested to develop our aerostructure parts unit to study a possible location in the US as we already have one in Spain.