Aerospace Fasteners Market by Product (Rivets, Screws, Nuts & Bolts), Application (Interior, Fuselage, Control Surface), Aircraft Type (NBA, WBA, VLA, RTA, Business Jets, Fighter Jets), End User, Material Type and Region - Global Forecast to 2021

The aerospace fasteners market is projected to grow from 5.49 Billion in 2016 to USD 7.73 Billion by 2021, at a CAGR of 7.08%. The base year considered for the report is 2015, and the forecast period is 2016 to 2021.

Objective of the Study:

The report forecasts the aerospace fasteners market for the next five years. It also identifies and analyzes evolving technologies, recent developments, and high potential geographic regions and countries. The aerospace fasteners market has been analyzed on the basis of product type, application, aircraft type, end user, and region. The report provides a competitive landscape of key players in the market with explicit focus on their product offerings, key financials, and growth strategies adopted by them to sustain their market position.

The aerospace fasteners market is projected to grow from USD 5.49 Billion in 2016 to USD 7.73 Billion by 2021, at a CAGR of 7.08% between 2016 and 2021. Factors influencing the growth of aerospace fasteners market include increasing aircraft orders along with the increasing passenger traffic across the globe. The number of aircraft has increased due to rise in air traffic. The aerospace fasteners market is highly dependent on the number of aircraft manufactured and the ability of fasteners to minimize limitations of weight, maintenance requirements, and vulnerability of security risks. This has further resulted in procurement of high strength and low weight fasteners.

In this report, the aerospace fasteners market has been categorized into five key segments, namely, aircraft type, end user, material type, product type, and application. The product type segment has been further categorized into rivets, screws, nuts & bolts, and others (hi-locks, collar, and so on). Based on application, the market is segmented into cabin interiors, fuselage, and control surfaces.

The aircraft type segment includes narrow body aircraft, wide body aircraft, very large aircraft, regional transport aircraft and business jets. Among these, the wide body aircraft segment is projected to grow at the highest CAGR during the forecast period. The demand for wide body aircraft is increasing globally due to its efficiency, rise in passenger traffic, and increased connectivity between important geographical locations of developing and developed regions.

On the basis of end user, the aerospace fasteners market is segmented into commercial aviation and defense. The commercial aviation segment is expected to grow at the highest CAGR during the forecast period. Increasing orders for commercial aircraft from developing regions have generated demand for aerospace fasteners from the commercial aviation segment.

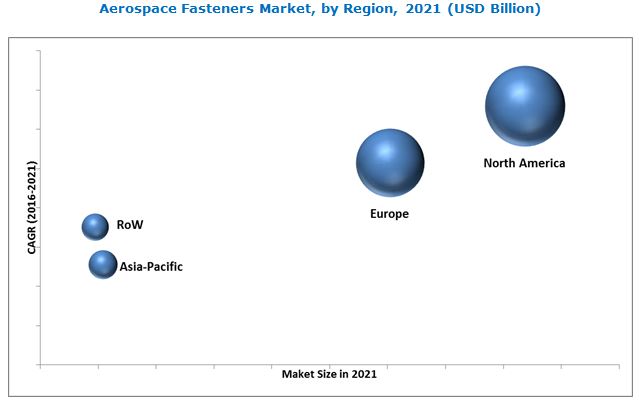

On the basis of region, the market has been classified into North America, Europe, Asia-Pacific, and RoW (Rest of the World). Europe is the most dominant region in the aerospace fastener market, as of 2016, followed by North America. The aerospace fastener market in Asia-Pacific is projected to grow at the highest CAGR during the forecast period. Factors driving the growth of aerospace fasteners market include low oil prices, expansionary fiscal & monetary policies, deleveraging private sector, and steady labor market.

Factors such as introduction of composite materials to aircraft manufacturing, cost and availability of raw materials, and underdeveloped logistics and supply chain are restraining the growth of aerospace fasteners market.

Key players operating in the aerospace fasteners market are Alcoa Fastening Systems & Rings (U.S.), LISI Aerospace (U.S.), Precision Castparts Corp. (U.S.), and Stanley Black & Decker Inc. (U.S.), among others. Partnerships, collaborations, agreements, and contracts are the major growth strategies adopted by the players to strengthen their position and enhance their product offerings.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Introduction

2.2 Research Data

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

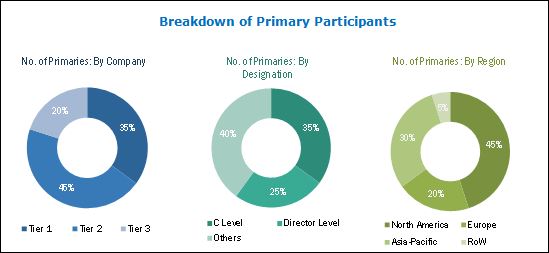

2.2.2.2 Breakdown of Primaries

2.3 Factor Analysis

2.3.1 Introduction

2.3.2 Demand-Side Analysis

2.3.2.1 Rise in Aircraft Orders

2.3.3 Supply-Side Analysis

2.3.3.1 Increase in Production Capacity

2.4 Market Size Estimation

2.4.1.1 Bottom-Up Approach

2.4.1.2 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in Aerospace Fasteners Market

4.2 Aerospace Fasteners Market, By Aircraft Type

4.3 Aerospace Fasteners Market, By Application

4.4 Aerospace Fasteners Market, By Product

4.5 Aerospace Fasteners Market Share Analysis, By Region

4.6 Aerospace Fasteners Market, By End User

4.7 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Aircraft Type

5.2.2 By Application

5.2.3 By End User

5.2.4 By Material Type

5.2.5 By Product

5.2.6 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Aircraft Orders

5.3.2 Restraints

5.3.2.1 Application of Composite Materials

5.3.2.2 Raw Materials Management

5.3.3 Opportunities

5.3.3.1 High Growth in Emerging Markets

5.3.3.2 Innovations in Research and Development

5.3.4 Challenges

5.3.4.1 Quality Accreditations

6 Industry Trends (Page No. - 49)

6.1 Introduction

6.2 Emerging Trends

6.2.1 Key Influencers

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Aerospace Fasteners Market, By Product (Page No. - 52)

7.1 Introduction

7.2 Nuts & Bolts

7.3 Rivets

7.4 Screws

7.5 Others

8 Aerospace Fasteners Market, By Material Type (Page No. - 55)

8.1 Introduction

8.2 Aluminum

8.3 Alloy Steel

8.4 Titanium

8.5 Others

9 Aerospace Fasteners Market, By Application (Page No. - 58)

9.1 Introduction

9.2 Fuselage

9.3 Control Surfaces

9.4 Interior

10 Aerospacer Fasteners Market, By End User (Page No. - 61)

10.1 Introduction

10.2 Commercial

10.3 Defense

11 Aerospace Fasteners Marekt- By Aircraft Type (Page No. - 64)

11.1 Introduction

11.2 Narrow Body Aircraft

11.3 Wide Body Aircraft

11.4 Very Large Aircraft

11.5 Regional Transport Aircraft

11.6 Business Jet

11.7 Fighter Jet

12 Regional Analysis (Page No. - 68)

12.1 Introduction

12.2 North America

12.2.1 By Type

12.2.2 By Material Type

12.2.3 By Application

12.2.4 By End User

12.2.5 By Aircraft Type

12.2.6 By Country

12.2.6.1 U.S.

12.2.6.1.1 By Material Type

12.2.6.1.2 By Application

12.2.6.1.3 By End User

12.2.6.2 Canada

12.2.6.2.1 By Material Type

12.2.6.2.2 By Application

12.2.6.2.3 By End User

12.3 Europe

12.3.1 By Type

12.3.2 By Material Type

12.3.3 By Application

12.3.4 By End User

12.3.5 By Aircraft Type

12.3.6 By Country

12.3.6.1 France

12.3.6.1.1 By Material Type

12.3.6.1.2 By Application

12.3.6.1.3 By End User

12.3.6.2 Germany

12.3.6.2.1 By Material Type

12.3.6.2.2 By Application

12.3.6.2.3 By End User

12.3.6.3 U.K.

12.3.6.3.1 By Material Type

12.3.6.3.2 By Application

12.3.6.3.3 By End User

12.3.6.4 Spain

12.3.6.4.1 By Material Type

12.3.6.4.2 By Application

12.3.6.4.3 By End User

12.3.6.5 Italy

12.3.6.5.1 By Material Type

12.3.6.5.2 By Application

12.3.6.5.3 By End User

12.3.6.6 Rest of Europe

12.3.6.6.1 By Material Type

12.3.6.6.2 By Application

12.3.6.6.3 By End User

12.4 Asia-Pacific

12.4.1 By Fasteners Type

12.4.2 By Material Type

12.4.3 By Application

12.4.4 By End User

12.4.5 By Aircraft Type

12.4.6 By Country

12.4.6.1 Russia

12.4.6.1.1 By Material Type

12.4.6.1.2 By Application

12.4.6.1.3 By End User

12.4.6.2 China

12.4.6.2.1 By Material Type

12.4.6.2.2 By Application

12.4.6.2.3 By End User

12.4.6.3 Japan

12.4.6.3.1 By Material Type

12.4.6.3.2 By Application

12.4.6.3.3 By End User

12.4.6.4 Rest of Asia-Pacific

12.4.6.4.1 By Material Type

12.4.6.4.2 By Application

12.4.6.4.3 By End User

12.5 Rest of the World

12.5.1 By Fasteners Type

12.5.2 By Material Type

12.5.3 By Application

12.5.4 By End User

12.5.5 By Aircraft Type

12.5.6 By Country

12.5.6.1 Brazil

12.5.6.1.1 By Material Type

12.5.6.1.2 By Application

12.5.6.1.3 By End User

12.5.6.2 Others

12.5.6.2.1 By Material Type

12.5.6.2.2 By Application

12.5.6.2.3 By End User

13 Competitive Landscape (Page No. - 123)

13.1 Introduction

13.2 Brand Analysis

13.3 Market Rank Analysis of Aerospace Fastener Market

13.4 Competitive Situations & Trends

13.4.1 Mergers & Acquisitions

13.4.2 Contracts & Agreements

13.4.3 Expansions

14 Company Profile (Page No. - 129)

14.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

14.2 Financial Highlight

14.3 Alcoa Fastening Systems & Rings

14.4 Stanley Black & Decker Inc.

14.5 Precision Castparts Corp

14.6 LISI Aerospace

14.7 Trimas Corporation

14.8 National Aerospace Fasteners Corp.

14.9 B&B Specialties, Inc.

14.10 3V Fasteners Company Inc.

14.11 TFI Aerospace Corp.

14.12 Ho-Ho-Kus Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 152)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Available Customizations

15.4 Related Reports

List of Tables (90 Tables)

Table 1 Aerospace Fasteners Market Size, By Product , 2014-2021 (USD Million)

Table 2 Market Size, By Material Type, 2016-2021 (USD Million)

Table 3 Market Size, By Application, 2014-2021 (USD Million)

Table 4 Market Size, By End User, 2014-2021 (USD Million)

Table 5 Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 6 Market Size, By Region, 2016–2021 (USD Million)

Table 7 North America: Aerospace Fasteners Industry Size, By Type, 2014-2021 (USD Million)

Table 8 North America Aerospace Fasteners Industry Size, By Material Type, 2014-2021 (USD Million)

Table 9 North America: Aerospace Fasteners Industry Size, By Application, 2014-2021 (USD Million)

Table 10 North America: Aerospace Fasteners Industry Size, By End User, 2014-2021 (USD Million)

Table 11 North America: Aerospace Fasteners Industry Size, By Aircraft Type, 2014-2021 (USD Million)

Table 12 North America: Aerospace Fasteners Industry Size, By Country, 2014-2021 (USD Million)

Table 13 U.S. Market Size, By Type, 2014-2021 (USD Million)

Table 14 U.S. Market Size, By Material Type, 2014-2021 (USD Million)

Table 15 U.S. Market Size, By Application, 2014-2021 (USD Million)

Table 16 U.S. Market Size, By End User, 2014-2021 (USD Million)

Table 17 Canada Market Size, By Type, 2014 - 2021 (USD Million)

Table 18 Canada Market Size, By Material Type, 2014-2021 (USD Million)

Table 19 Canada Market Size, By Application, 2014-2021 (USD Million)

Table 20 Canada Market Size, By End User, 2014-2021 (USD Million)

Table 21 Europe Aerospace Fasteners Market Size, By Type, 2014-2021 (USD Million)

Table 22 Europe Market Size, By Material Type, 2014-2021 (USD Million)

Table 23 Europe Market Size, By Application, 2014-2021 (USD Million)

Table 24 Europe Market Size, By End User, 2014-2021 (USD Million)

Table 25 Europe Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 26 Europe Market Size, By Country, 2014 - 2021 (USD Million)

Table 27 France Aerospace Fasteners Market Size, By Type, 2014-2021 (USD Million)

Table 28 France Market Size, By Material Type, 2014-2021 (USD Million)

Table 29 France Market Size, By Application, 2014-2021 (USD Million)

Table 30 France Market Size, By End User, 2014-2021 (USD Million)

Table 31 Germany Market Size, By Type, 2014-2021 (USD Million)

Table 32 Germany Market Size, By Material Type, 2014-2021 (USD Million)

Table 33 Germany Market Size, By Application, 2014-2021 (USD Million)

Table 34 Germany Market Size, By End User, 2014-2021 (USD Million)

Table 35 U.K. Aerospace Fastener Market Size, By Type, 2014-2021 (USD Million)

Table 36 U.K. Market Size, By Material Type, 2014-2021 (USD Million)

Table 37 U.K. Market Size, By Application, 2014-2021 (USD Million)

Table 38 U.K. Market Size, By End User, 2014-2021 (USD Million)

Table 39 Spain Aerospace Fastener Market Size, By Type, 2014-2021 (USD Million)

Table 40 Spain Market Size, By Material Type, 2014-2021 (USD Million)

Table 41 Spain Market Size, By Application, 2014-2021 (USD Million)

Table 42 Spain Market Size, By End User, 2014-2021 (USD Million)

Table 43 Italy Aerospace Fastener Market Size, By Type, 2014-2021 (USD Million)

Table 44 Italy Market Size, By Material Type, 2014-2021 (USD Million)

Table 45 Italy Market Size, By Application, 2014-2021 (USD Million)

Table 46 Italy Market Size, By End User, 2014-2021 (USD Million)

Table 47 Rest of Europe Aerospace Fastener Market Size, By Type, 2014-2021 (USD Million)

Table 48 Rest of Europe Market Size, By Material Type, 2014-2021 (USD Million)

Table 49 Rest of Europe Market Size, By Application, 2014-2021 (USD Million)

Table 50 Rest of Europe Market Size, By End User, 2014-2021 (USD Million)

Table 51 APAC Market Size, By Type, 2014-2021 (USD Million)

Table 52 APAC Market Size, By Material Type, 2014-2021 (USD Million)

Table 53 APAC Market Size, By Application, 2014-2021 (USD Million)

Table 54 APAC Market Size, By End User, 2014-2021 (USD Million)

Table 55 APAC Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 56 APAC Market Size, By Country, 2014-2021 (USD Million)

Table 57 Russia Aerospace Fastener Market Size, By Type, 2014-2021 (USD Million)

Table 58 Russia Market Size, By Material Type, 2014-2021 (USD Million)

Table 59 Russia Market Size, By Application, 2014-2021 (USD Million)

Table 60 Russia Market Size, By End User, 2014-2021 (USD Million)

Table 61 China Aerospace Fastener Market Size, By Type, 2014-2021 (USD Million)

Table 62 China Market Size, By Material Type, 2014-2021 (USD Million)

Table 63 China Market Size, By Application, 2014-2021 (USD Million)

Table 64 China Market Size, By End User, 2014-2021 (USD Million)

Table 65 Japan Aerospace Fastener Market Size, By Type, 2014-2021 (USD Million)

Table 66 Japan Market Size, By Material Type, 2014-2021 (USD Million)

Table 67 Japan Market Size, By Application, 2014-2021 (USD Million)

Table 68 Japan Market Size, By End User, 2014-2021 (USD Million)

Table 69 Rest of Asia-Pacific Aerospace Fastener Market Size, By Type, 2014-2021 (USD Million)

Table 70 Rest of Asia-Pacific Market Size, By Material Type, 2014-2021 (USD Million)

Table 71 Rest of Asia-Pacific Market Size, By Application, 2014-2021 (USD Million)

Table 72 Rest of Asia-Pacific Market Size, By End User, 2014-2021 (USD Million)

Table 73 RoW Market Size, By Type, 2014-2021 (USD Million)

Table 74 RoW Market Size, By Material Type, 2014-2021 (USD Million)

Table 75 RoW Market Size, By Application, 2014-2021 (USD Million)

Table 76 RoW Market Size, By End User, 2014-2021 (USD Million)

Table 77 RoW Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 78 RoW Market Size, By Country, 2014-2021 (USD Million)

Table 79 Brazil Aerospace Fastener Market Size, By Type, 2014-2021 (USD Million)

Table 80 Brazil Market Size, By Material Type, 2014-2021 (USD Million)

Table 81 Brazil Market Size, By Application, 2014-2021 (USD Million)

Table 82 Brazil Market Size, By End User, 2014-2021 (USD Million)

Table 83 Others Aerospace Fastener Market Size, By Fastener Type, 2014-2021 (USD Million)

Table 84 Others Market Size, By Material Type, 2014-2021 (USD Million)

Table 85 Others Market Size, By Application, 2014-2021 (USD Million)

Table 86 Others Market Size, By End User, 2014-2021 (USD Million)

Table 87 Brand Analysis of Aerospace Fastener Market

Table 88 Mergers & Acquisitions,March 2014– January 2016

Table 89 Contracts & Agreements,August 2014–January2016

Table 90 Expansions, September 2015– June 2016

List of Figures (76 Figures)

Figure 1 Aerospace Fasteners Market Segmentation

Figure 2 Study Years

Figure 3 Limitations of the Research Study

Figure 4 Research Design: Aerospace Fasteners

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Market Breakdown and Data Triangulation

Figure 8 Assumptions of the Research Study

Figure 9 Narrow Body Aircraft Segment Projected to Dominate the Market During the Forecast Period

Figure 10 Aerospace Fasteners Market: By Application, Snapshot (2014–2021)

Figure 11 Market: By Product , Snapshot (2014–2021)

Figure 12 Commercial Segment to Grow at A Higher Rate During the Forecast Period

Figure 13 Aerospace Fasteners Market, By Material: Aluminum to Capture the Largest Market Share

Figure 14 Europe Estimated to Account for the Largest Market Share of the Aerospace Fastener Market in 2016

Figure 15 Mergers & Acquisitions is the Key Development Strategy Adopted in the Aerospace Fastener Market

Figure 16 Increasing Demand for Fuel-Efficient and Lightweight Aircraft Will Drive the Market

Figure 17 Wide Body Aircraft Segment to Grow at the Highest CAGR in Aerospace Fastener Market During the Forecast Period

Figure 18 Control Surfaces Estimated to Be the Most Lucrative Segment for Aerospace Fastener Market

Figure 19 Aluminum Material Segment Estimated to Account for the Largest Market Share of the Aerospace Fasteners Market in 2016

Figure 20 Asia-Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 21 Commercial Aviation Segment to Dominate the Aerospace Fasteners Market During the Forecast Period

Figure 22 Asia-Pacific Market to Witness Remarkable Growth in Coming Years

Figure 23 Market Dynamics for Aerospace Fasteners Market

Figure 24 Number of New Aircraft Orders Across the Globe, By Region (2016 – 2035)

Figure 25 Passenger Traffic Across the Globe in Terms of RPKS, By Region (2014 & 2034)

Figure 26 Porter’s Five Forces Analysis: Aerospace Fastener Market

Figure 27 Aerospace Fastener Market Size, By Product, 2016 & 2021 (USD Million)

Figure 28 Market Size, By Material Type, 2016 & 2021 (USD Million)

Figure 29 Market Size, By Application, 2016 & 2021 (USD Million)

Figure 30 Market Size, By End User, 2016 & 2021 (USD Million)

Figure 31 Market Size, By Aircraft Type, 2016 & 2021 (USD Million)

Figure 32 Geographic Snapshot: Asia-Pacific Region Projected to Grow at the Fastest Rate During the Forecast Period in the Aerospace Fasteners Market

Figure 33 North America: Aerospace FastenersMarket Snapshot (2016)

Figure 34 Nuts &Bolts Segment Led the Market in 2016

Figure 35 Titanium Segment Led the Market in 2016

Figure 36 Interiors Segment Projected to Grow at the Highest CAGR in Aerospace Fasteners Market From 2016 to 2021

Figure 37 North America: Commercial Segment Dominated the Aerospace Fastener Market During the Forecast Period

Figure 38 North America: Wide Body Aircraft Led the Aerospace Fastener Market, By Aircraft Type in 2016

Figure 39 U.S. Aerospace Fasteners Market , By Country, 2016 & 2021

Figure 40 Europe: Aerospace Fastener Market Snapshot (2016)

Figure 41 Europe Market Size, By Type, 2016 & 2021

Figure 42 Europe Market Size, By Material Type, 2016 & 2021

Figure 43 Europe Market Size, By Application, 2016 & 2021

Figure 44 Europe Market Size, By End User, 2016 & 2021

Figure 45 Europe Market Size, By Aircraft Type, 2016 & 2021

Figure 46 Europe Market Size, By Country, 2016 & 2021

Figure 47 Asia-Pacific: Aerospace Fastener Market Snapshot (2016)

Figure 48 Asia Pacific Aerospace Fastener Market Size, By Type, 2016 & 2021

Figure 49 APAC Aerospace Fasteners Market Size, By Material Type, 2016 & 2021

Figure 50 APAC Market Size, By Application, 2016 & 2021

Figure 51 APAC Market Size, By End User, 2016 & 2021

Figure 52 APAC Market Size, By Aircraft Type, 2016 & 2021

Figure 53 APAC Market Size, By Country, 2016 & 2021

Figure 54 RoW Aerospace Fastener Market Size, By Type, 2016 & 2021

Figure 55 RoW Market Size, By Material Type, 2016 & 2021

Figure 56 RoW Market Size, By Application, 2016 & 2021

Figure 57 RoW Market Size, By End User, 2016 & 2021

Figure 58 RoW Market Size, By Aircraft Type, 2016 & 2021

Figure 59 RoW Market Size, By Country, 2016 & 2021

Figure 60 Companies Adopted Mergers & Acquisitions as the Key Growth Strategy From March 2014 to June 2016

Figure 61 Aerospace Fasteners Market Rank Analysis, By Key Player, 2015

Figure 62 Mergers & Acquisitions was the Key Growth Strategy During March 2014- June 2016

Figure 63 Geographical Revenue Mix of Top Players (2015)

Figure 64 Financial Highlight of Top Players (2015)

Figure 65 Alcoa Fastening Systems & Rings: Company Snapshot

Figure 66 Alcoa Fastening Systems & Rings: SWOT Analysis

Figure 67 Stanley Black & Decker Inc.: Company Snapshot

Figure 68 Stanley Black & Decker Inc.: SWOT Analysis

Figure 69 Precision Castparts Corp: Company Snapshot

Figure 70 Precision Castparts Corp: SWOT Analysis

Figure 71 LISI Aerospace: Company Snapshot

Figure 72 LISI Aerospace: SWOT Analysis

Figure 73 Trimas Corporation: Company Snapshot

Figure 74 Trimas Corp: SWOT Analysis

Figure 75 National Aerospace Fasteners Corp.: Company Snapshot

Figure 76 National Aerospace Fasteners Corp.: SWOT Analysis

Research Methodology:

Key players in the aerospace fasteners market have been identified through secondary research and their market shares have been determined through both primary and secondary research. These include a study of annual and financial reports of top players and extensive interviews with key industry experts. Some of the secondary sources include The Federal Aviation Administration, Aviation Week, NASA.gov, Reuters, Factiva, among others.

All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to procure the final quantitative and qualitative data. This data has been consolidated, added with detailed inputs and analysis by MarketsandMarkets, and presented in this report. The following figure represents the primary interview breakdown undertaken during the course of this study on the aviation actuator systems market:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the aerospace fasteners market comprises raw material suppliers; OEMs (component manufacturers) such as Alcoa Fastening Systems & Rings (U.S.), LISI Aerospace (U.S.), Precision Castparts Corp. (U.S.), Stanley Black & Decker Inc. (U.S.); airplane manufacturers such as Boeing (U.S.), Airbus (France), Bombardier (Canada), Embraer (Brazil), Comac (China), Dassault Systèmes (France), among others; and end users.

Key Target Audience:

- Aircraft Manufacturers (Commercial & Defense)

- Aerospace Fasteners Manufacturers

- Raw Materials Providers or Suppliers

“Furthermore, this study answers several questions for stakeholders, primarily which market segments to focus on prioritizing efforts and investments to be made in this industry over the period of next five years”

Scope of the Report

This research report categorizes the aerospace fasteners market into the following segments and subsegments:

Aerospace Fasteners Market, By Product Type

- Rivets

- Screws

- Nuts & Bolts

- Others

Aerospace Fasteners Market, By Application

- Cabin Interior

- Fuselage

- Control Surfaces

Aerospace Fasteners Market, By Aircraft Type

- Narrow Body Aircraft

- Wide Body Aircraft

- Very Large Aircraft

- Regional Transport Aircraft

- Business Jets

- Fighter Jets

Aerospace Fasteners Market, By End User

- Commercial Aviation

- Defense

Aerospace Fasteners Market, By Region

- North America

- Europe

- Asia-Pacific

- RoW

Customizations available for the report:

With the given market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for the report:

Aerospace Fasteners Market, By Aircraft Manufacturer

- Airbus

- Boeing

- Others

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Aerospace Fasteners Market, By Country

- Mexico

- Australia

- Turkey

Growth opportunities and latent adjacency in Aerospace Fasteners Market

I am assembling a report as an overview of the global aerospace fasteners market/industry with a particular view on the American and European history, growth, and development.

Projected market for aerospace market was 7.73 Billion US $. Now we are in 2020 and in Covid times. Is the figure for 2020 will be still be real?